0% found this document useful (0 votes)

1K views41 pagesGeneral Annuity

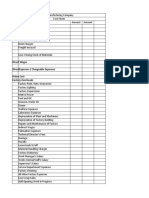

The document provides an overview of general annuities, which differ from simple annuities in that the compounding period is not the same as the payment interval. It defines key terms and concepts for general annuities and outlines the steps to solve for the future value and present value of a general annuity. Examples are provided to illustrate applying the concepts and calculation steps to solve real-world problems involving general annuities. The objectives are to differentiate general annuities from simple annuities and correctly solve related problems.

Uploaded by

jhonedcelllauderesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views41 pagesGeneral Annuity

The document provides an overview of general annuities, which differ from simple annuities in that the compounding period is not the same as the payment interval. It defines key terms and concepts for general annuities and outlines the steps to solve for the future value and present value of a general annuity. Examples are provided to illustrate applying the concepts and calculation steps to solve real-world problems involving general annuities. The objectives are to differentiate general annuities from simple annuities and correctly solve related problems.

Uploaded by

jhonedcelllauderesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd