Professional Documents

Culture Documents

The Indian Performing Right Society Limited: Page 1 of 1

Uploaded by

mayurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Indian Performing Right Society Limited: Page 1 of 1

Uploaded by

mayurCopyright:

Available Formats

THE INDIAN PERFORMING RIGHT SOCIETY LIMITED

TARIFF: - SNC: MUSIC IN COMMERCIALS/ ADVERTISEMENTS/ PROMOS/

CORPORATE VIDEOS/AUDIOS

1. SCOPE OF TARIFF

This Tariff applies to utilization of musical works and literary works in Commercials,

Advertisements, Promos, & Corporate Videos/Audios by way of Synchronization on

Television, Radio, Internet/Website or any other medium.

2. GENERAL CONDITIONS

This Tariff is subject to the Society’s General Conditions applicable to Tariffs and

Licenses.

3. ROYALTY/ LICENSE FEE RATES

The following Royalty/License Fee Rates shall apply for Broadcast/ Communication to the

Public/ the Performance of Music by way of Synchronization on different medium per

language in-

a. Television Commercials (TVC)/ Advertisements (Ads)/ Promo, shall be

₹45,000/- per 30 second for all the TV Channels/ Satellite Channels, per annum

b. Radio Jingles/ Radio Advertisement shall be ₹25,000/- per 30 second for all

FM/AIR Radio Stations, per annum

c. Advertisement on Internet/website shall be ₹30,000/- per 30 second, per annum.

d. Commercials/Advertisement in digital Out of Home (OOH) shall be ₹20,000/- per

30 second, per city, per segment, per annum.

e. Corporate Videos/Audio (for corporate communications, training initiatives and

educational videos/audios), the Royalty/License Fee shall be ₹20,000/- per 30

second, per annum

f. The Minimum Royalty/License Fee under this tariff shall be ₹20,000/-.

4. SPECIFIC CONDITIONS

This tariff is subject to the Licensee’s obtaining the “Synchronization License” with

regards the work and/or sound recordings from the copyright holders.

5. APPLICABILITY OF TARIFF

a. This Tariff comes into force from the 01-April-2018 and applies to all

Royalties/License fee falling due on or after that date.

b. Non-Compliant Licensees who seek to regularize past infringements / violations /

breach of Society’s rights and licenses (including non-compliance with agreements,

usage without license, vexatious litigation, etc.), a penalty of 30% over the existing

tariff shall be applied at the discretion of Society.

c. Royalty/License Fee rate shall be adjusted to reflect the increase, if any, in the general

price level (inflation), as measured by the Consumer Price Index. Such adjustment in

royalty/license fee rate can be yearly or cumulative over a period of time.

d. All Royalties/License fee are exclusive of all applicable GST/ taxes / levies.

Page 1 of 1

You might also like

- Tariff Intr-17 Internet Interactive BroadcastDocument1 pageTariff Intr-17 Internet Interactive BroadcastravinderpathakNo ratings yet

- Royalty PaymentsDocument3 pagesRoyalty Paymentsabdul samadNo ratings yet

- DTH Operators Association of IndiaDocument7 pagesDTH Operators Association of Indiacnugoud2011No ratings yet

- Revised Criteria & Tariff For Grant of Landing Rights Permission To Satellite TV ChannelsDocument6 pagesRevised Criteria & Tariff For Grant of Landing Rights Permission To Satellite TV ChannelsAli MemonNo ratings yet

- Government Advertising Guidelines in IndiaDocument6 pagesGovernment Advertising Guidelines in IndiaMridul PantNo ratings yet

- Assignment For LicensingDocument6 pagesAssignment For Licensingm tvlNo ratings yet

- Zosa TosDocument3 pagesZosa TosErika De VelazquezNo ratings yet

- CM Media LicenseDocument5 pagesCM Media LicenseJiseNo ratings yet

- CBDT Circular 5 of 2016 - 29.02.2016 - No TDS Ad Agency PaymentsDocument1 pageCBDT Circular 5 of 2016 - 29.02.2016 - No TDS Ad Agency PaymentsSubramanyam SettyNo ratings yet

- Bharti Airtel's response to TRAI's draft tariff order on STB rental plansDocument8 pagesBharti Airtel's response to TRAI's draft tariff order on STB rental plansAashish ChhajedNo ratings yet

- Satellite Channels CP 22112011Document8 pagesSatellite Channels CP 22112011maddy449No ratings yet

- Prasar Bharati: Doordarshan Commercial ServiceDocument115 pagesPrasar Bharati: Doordarshan Commercial ServiceMMjagpreetNo ratings yet

- Coson TariffsDocument31 pagesCoson TariffsborexdaneNo ratings yet

- 1 Sync LicenseDocument6 pages1 Sync LicenseLélege Rhodes AgíadasNo ratings yet

- Terms and Conditions The Wall: Page 1 of 12Document12 pagesTerms and Conditions The Wall: Page 1 of 12Ajith RNo ratings yet

- Terms and Conditions The Wall: Page 1 of 12Document12 pagesTerms and Conditions The Wall: Page 1 of 12Shahin Kauser ZiaudeenNo ratings yet

- 37th GSTC MeetingDocument3 pages37th GSTC MeetingKalpeshh G BhavsarNo ratings yet

- October 11 Statement From AMPTP - Voz MediaDocument2 pagesOctober 11 Statement From AMPTP - Voz MediaVozMediaNo ratings yet

- Code of Practice: What Does The Code Apply To?Document2 pagesCode of Practice: What Does The Code Apply To?Chloe RotherhamNo ratings yet

- Make-Up and Hair Artist AgreementDocument6 pagesMake-Up and Hair Artist AgreementabishekburnerNo ratings yet

- Short Film Agreement 1 13Document11 pagesShort Film Agreement 1 13Christopher A. WrightNo ratings yet

- Bundled ONT - NEW - Monthlyplan - 20062023Document2 pagesBundled ONT - NEW - Monthlyplan - 20062023Al KhanNo ratings yet

- VitrifiedDocument14 pagesVitrifiedmanugeorgeNo ratings yet

- Summary of Off-Broadway Contract Negotiations 2009Document6 pagesSummary of Off-Broadway Contract Negotiations 2009tizzler07No ratings yet

- Entrepreneur Subsidy in AssamDocument2 pagesEntrepreneur Subsidy in AssamGaurav SokhiNo ratings yet

- Supply GSTDocument16 pagesSupply GSTMehak Kaushikk100% (1)

- Bharti Airtel Response to TRAI draft order on DTH tariffsDocument9 pagesBharti Airtel Response to TRAI draft order on DTH tariffsSuresh MeenaNo ratings yet

- Isp Licence Guidelines DraftDocument9 pagesIsp Licence Guidelines DraftSonet SahaNo ratings yet

- Advertisement Pricing BTV 2014Document4 pagesAdvertisement Pricing BTV 2014Arafat HussainNo ratings yet

- Issues Related To New Regulatory Framework For Media IndustryDocument5 pagesIssues Related To New Regulatory Framework For Media IndustrySameer VatsNo ratings yet

- KBP TV CodeDocument45 pagesKBP TV CodeKimberly Joy FerrerNo ratings yet

- Short Take License AgreementDocument3 pagesShort Take License AgreementCasting CallNo ratings yet

- TRAI CP Paper Answers by TEMA IndiaDocument4 pagesTRAI CP Paper Answers by TEMA IndiadeeepkaNo ratings yet

- Request To Issuing A Clarification Economic Advisor-010210Document2 pagesRequest To Issuing A Clarification Economic Advisor-010210Rayudu VVSNo ratings yet

- Tax PresentationDocument21 pagesTax PresentationVarshini AgarwallaNo ratings yet

- A Customer CentricDocument12 pagesA Customer CentricArshad ShaikhNo ratings yet

- 2004 BIR - Ruling - DA 509 04 - 20210505 13 1jx55dpDocument3 pages2004 BIR - Ruling - DA 509 04 - 20210505 13 1jx55dpFirenze PHNo ratings yet

- Northwestern (2021) (00396211xC146B)Document3 pagesNorthwestern (2021) (00396211xC146B)Matt BrownNo ratings yet

- Amptpsag-Aftra ChartDocument23 pagesAmptpsag-Aftra ChartTHR100% (1)

- Mygov 168052351rcularDocument3 pagesMygov 168052351rcularkshitij_sharmaNo ratings yet

- Vasool VettaiDocument14 pagesVasool VettaiSankari NarayaniNo ratings yet

- Fringe Benefit Tax (FBT)Document35 pagesFringe Benefit Tax (FBT)SanjayNo ratings yet

- Recommendations Made On GST Rate Changes On Services by The 25th GST Council MeetingDocument6 pagesRecommendations Made On GST Rate Changes On Services by The 25th GST Council MeetinganiNo ratings yet

- SEBI Consultation PaperDocument1 pageSEBI Consultation Papersmc.universalNo ratings yet

- Sag Short Film Agreement 2011Document10 pagesSag Short Film Agreement 2011kvaniceNo ratings yet

- GST Notes Semester 6Document39 pagesGST Notes Semester 6Bhanu DangNo ratings yet

- Proposal DD PDFDocument14 pagesProposal DD PDFmanugeorgeNo ratings yet

- TAXATION – DEFINITIONDocument147 pagesTAXATION – DEFINITIONGGT InteriorsNo ratings yet

- Guidelines For Obtaining License For Providing Direct-To-Home (DTH) Broadcasting Service in IndiaDocument26 pagesGuidelines For Obtaining License For Providing Direct-To-Home (DTH) Broadcasting Service in IndiaTanveer ShaikhNo ratings yet

- Guidelines For Empanelment of CRS With BocDocument2 pagesGuidelines For Empanelment of CRS With BocSathesh KrishnasamyNo ratings yet

- DA AgreementDocument6 pagesDA AgreementabishekburnerNo ratings yet

- Closed Captioning Required for TV BroadcastsDocument2 pagesClosed Captioning Required for TV BroadcastsMiles Delos ReyesNo ratings yet

- Agreement On Subsidies and Countervailing Measures 16022011Document32 pagesAgreement On Subsidies and Countervailing Measures 16022011Raja Chako Malhotra100% (1)

- Terms & Conditions For Unifi Home Fibre: Page #Document32 pagesTerms & Conditions For Unifi Home Fibre: Page #Paula MartinNo ratings yet

- Nelson Y. NG For Petitioner. The City Legal Officer For Respondents City Mayor and City TreasurerDocument7 pagesNelson Y. NG For Petitioner. The City Legal Officer For Respondents City Mayor and City TreasurerLeslie LernerNo ratings yet

- Limited Tender For Advt - AgenciesDocument9 pagesLimited Tender For Advt - AgenciesRam KumarNo ratings yet

- 3M PhilippinesDocument2 pages3M PhilippinesKarl Vincent Raso100% (1)

- Sample Distribution AgreementDocument9 pagesSample Distribution AgreementJan Eidrienne De Luis100% (1)

- Pune Order 1-04-2021Document26 pagesPune Order 1-04-2021mayurNo ratings yet

- Schedule of The PropertyDocument1 pageSchedule of The PropertymayurNo ratings yet

- Adobe Scan Aug 31, 2021Document1 pageAdobe Scan Aug 31, 2021mayurNo ratings yet

- Wipo Schedule of Webinar On CopyrightDocument4 pagesWipo Schedule of Webinar On CopyrightmayurNo ratings yet

- Letter of AttornmentDocument1 pageLetter of Attornmentmayur100% (6)

- WIPO Global Brand DatabaseDocument14 pagesWIPO Global Brand DatabasemayurNo ratings yet

- Saikat Mukherjee Legal Expertise ProfileDocument4 pagesSaikat Mukherjee Legal Expertise ProfilemayurNo ratings yet

- Saikat Mukherjee Legal Expertise ProfileDocument4 pagesSaikat Mukherjee Legal Expertise ProfilemayurNo ratings yet

- Request to use vacant land as playgroundDocument1 pageRequest to use vacant land as playgroundmayurNo ratings yet

- Cce-Pdpu HTTP://WWW - Pdpu.Ac - In/ Venkatakrishnan Source: LaxmikanthDocument12 pagesCce-Pdpu HTTP://WWW - Pdpu.Ac - In/ Venkatakrishnan Source: LaxmikanthmayurNo ratings yet

- Advertisement of Recruitment NotificationDocument2 pagesAdvertisement of Recruitment NotificationmayurNo ratings yet

- Dainik Aikya 16junDocument8 pagesDainik Aikya 16junmayurNo ratings yet

- mRNA COVID Vaccine Patent LandscapeDocument3 pagesmRNA COVID Vaccine Patent LandscapemayurNo ratings yet

- ShowdocumentDocument2 pagesShowdocumentmayurNo ratings yet

- Admission For MNLUA LL.D. ProgrammeDocument3 pagesAdmission For MNLUA LL.D. ProgrammemayurNo ratings yet

- The Evolutionary Dynamics of Endemic Human Coronaviruses: Wendy K. Jo, Christian Drosten, and Jan Felix DrexlerDocument12 pagesThe Evolutionary Dynamics of Endemic Human Coronaviruses: Wendy K. Jo, Christian Drosten, and Jan Felix DrexlermayurNo ratings yet

- Icfaeam PDFDocument211 pagesIcfaeam PDFmayur100% (1)

- e-BILL Details - Customer Id: 578632, Date: 2021-08-24Document1 pagee-BILL Details - Customer Id: 578632, Date: 2021-08-24mayurNo ratings yet

- Trip 28may21 eDocument1 pageTrip 28may21 emayurNo ratings yet

- CCRAS - Guideline of Drug Development PDFDocument112 pagesCCRAS - Guideline of Drug Development PDFAbhayNo ratings yet

- पुणे जिल्हा कोर्ट सफाईगार जाहिरात २०२१Document9 pagesपुणे जिल्हा कोर्ट सफाईगार जाहिरात २०२१mayurNo ratings yet

- User Manual Digital Signature Certificate (DSC) (Controller General of Patents, Designs & Trademarks)Document4 pagesUser Manual Digital Signature Certificate (DSC) (Controller General of Patents, Designs & Trademarks)Aditya NagNo ratings yet

- Trademark Rights Under The Plain Packaging Regime and The New Tobacco Products DirectiveDocument77 pagesTrademark Rights Under The Plain Packaging Regime and The New Tobacco Products DirectivemayurNo ratings yet

- Coconut Oil: What Do We Really Know About It So Far?: ReviewDocument12 pagesCoconut Oil: What Do We Really Know About It So Far?: ReviewmayurNo ratings yet

- Intellectual Property HandbookDocument13 pagesIntellectual Property HandbookmayurNo ratings yet

- Well Known Trademaks UpdatedDocument6 pagesWell Known Trademaks UpdatedJeswin RoshiniNo ratings yet

- National IPR Policy2016 14october2020Document36 pagesNational IPR Policy2016 14october2020mayurNo ratings yet

- FSSAI News ETM LatestLY 18 07 2018 PDFDocument2 pagesFSSAI News ETM LatestLY 18 07 2018 PDFmayurNo ratings yet

- Compendium of Order Milk Products PDFDocument3 pagesCompendium of Order Milk Products PDFmayurNo ratings yet

- Literature @jun-2020 MODIFIEDDocument26 pagesLiterature @jun-2020 MODIFIEDEng-Mukhtaar CatooshNo ratings yet

- Snap Inc FinalDocument35 pagesSnap Inc Finalapi-461693941No ratings yet

- Keith Dawson (Author) - The Call Center Handbook-CRC Press (2007)Document283 pagesKeith Dawson (Author) - The Call Center Handbook-CRC Press (2007)aaati100% (1)

- MIS Procter & Gamble Q2 AndQ3 by WatieDocument7 pagesMIS Procter & Gamble Q2 AndQ3 by WatieAtielia De SamsNo ratings yet

- Big Data AnalyticsDocument31 pagesBig Data AnalyticsTushar SawantNo ratings yet

- Payal Pharma SolutionDocument1 pagePayal Pharma SolutionAkhil NarangNo ratings yet

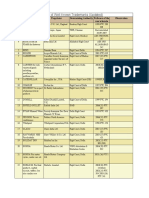

- Resolution Amendingthe Applicable SOLRRateDocument3 pagesResolution Amendingthe Applicable SOLRRateAbbi PerezNo ratings yet

- Short Selling Comes Under Fire - AgainDocument1 pageShort Selling Comes Under Fire - AgainSUNLINo ratings yet

- Human Resource Management - Mind Map On Traditional Functions of HRMDocument14 pagesHuman Resource Management - Mind Map On Traditional Functions of HRMZamzam Abdelazim100% (1)

- MR - Economic and Financial Analysis of Planning The Menu in Aqua Caffe and Food RestaurantDocument100 pagesMR - Economic and Financial Analysis of Planning The Menu in Aqua Caffe and Food RestaurantAdhemar C. Rosas (adechoes1112)No ratings yet

- Project Report ON Initiation of The Process To Attain Rspo Certification in Tsoilfed'S Oil Palm Plantations in Telangana StateDocument78 pagesProject Report ON Initiation of The Process To Attain Rspo Certification in Tsoilfed'S Oil Palm Plantations in Telangana StatePriyam TalukdarNo ratings yet

- JD 0001 - General ManagerDocument2 pagesJD 0001 - General ManagerAigene PinedaNo ratings yet

- King County Metro Budget 2021-2022 BriefDocument3 pagesKing County Metro Budget 2021-2022 BriefThe UrbanistNo ratings yet

- Sales and Marketing Channel Management (M3) : Course ObjectiveDocument37 pagesSales and Marketing Channel Management (M3) : Course ObjectiveDhanek NathNo ratings yet

- Merchandising - Journal EntriesDocument3 pagesMerchandising - Journal EntriesBhea Ballesteros CabasanNo ratings yet

- The Central Park Apartment Owners Association - Memorandum of AssociationDocument7 pagesThe Central Park Apartment Owners Association - Memorandum of Associationkjacobgeorge124288% (8)

- US Navy Foundry Manual 1958Document264 pagesUS Navy Foundry Manual 1958Pop Adrian100% (8)

- Collection Development PDFDocument3 pagesCollection Development PDFolalekan jimohNo ratings yet

- UAS Report Laundry - inDocument13 pagesUAS Report Laundry - inJody RanklyNo ratings yet

- GTP&DWG of - Earthing Pipe& Earth RodDocument6 pagesGTP&DWG of - Earthing Pipe& Earth RodabhishekNo ratings yet

- TECHNOLOGY1 Answer-1Document6 pagesTECHNOLOGY1 Answer-1JlkKumarNo ratings yet

- Training on Outdoor Firefighting SystemDocument18 pagesTraining on Outdoor Firefighting SystemSiduzzaman Khan SourovNo ratings yet

- Transactions: The Barclays Bank A/C 20-77-85 43223280Document2 pagesTransactions: The Barclays Bank A/C 20-77-85 43223280Doris Zhao100% (2)

- Module 1 - Administrative Office ProcedureDocument17 pagesModule 1 - Administrative Office ProcedureShayne Candace QuizonNo ratings yet

- Godrej Appliances - Case PDFDocument22 pagesGodrej Appliances - Case PDFAbhijit Kumar100% (1)

- Project Report On Brand Loyalty and It S EffectDocument13 pagesProject Report On Brand Loyalty and It S EffectNeeraj KhanwaniNo ratings yet

- 1000 Stocks - 7b48eDocument3 pages1000 Stocks - 7b48eAshok DewanganNo ratings yet

- Ashwini A. AcharyaDocument10 pagesAshwini A. AcharyaDesh Vikas JournalNo ratings yet

- Contact Information Passenger Information Flight Ticket NumbersDocument1 pageContact Information Passenger Information Flight Ticket Numbersصالح قشوطNo ratings yet

- Chemical Composition, Mechanical, Physical and Environmental Properties of SAE 1536, Steel Grades, Carbon SteelDocument1 pageChemical Composition, Mechanical, Physical and Environmental Properties of SAE 1536, Steel Grades, Carbon SteelKuldeep SinghNo ratings yet