Professional Documents

Culture Documents

DT Part 2 - 18233359 - 2024 - 01 - 23 - 08 - 53

DT Part 2 - 18233359 - 2024 - 01 - 23 - 08 - 53

Uploaded by

Yasu RawteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DT Part 2 - 18233359 - 2024 - 01 - 23 - 08 - 53

DT Part 2 - 18233359 - 2024 - 01 - 23 - 08 - 53

Uploaded by

Yasu RawteCopyright:

Available Formats

CS Vikas Vohra CA CS Harish A.

Mathariya

CS Vikas Vohra CA CS Harish A. Mathariya

Founders

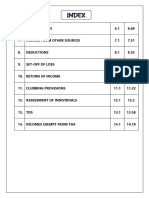

INDEX

DIRECT TAX (PART - 2)

SN Chapter Name No of No of Page No

Illustrations Mcq’s

7 Capital Gain 9 112 7.1 - 7.63

8 Income from Other Source 7 76 8.1 – 8.32

9 Clubbing of Income 7 43 9.1 – 9.19

10 Set Off and Carry Forward of Losses - 48 10.1 – 10.21

11 Permissible Deduction from Total 9 129 11.1 - 11.67

Income

12 TDS And TCS 2 85 12.1 – 12.54

13 Advance Tax - 16 13.1 – 13.05

14 Regulatory Framework - 12 14.1 – 14.14

15 Assessment Procedure 7 96 15.1 – 15.63

16 Computation of Total Income 2 53 16.1 - 16.29

17 Appeal, Revision, Penalty and - 19 17.1 – 17.30

Prosecution

18 Collection and Recovery of Tax - 8 18.1 – 18.08

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

CHAPTER 7 CAPITAL GAIN

MEANING & BASIS OF CHARGE [SEC. 45]

Meaning As per section 45(1) profits or gain arising on transfer of a capital asset shall be

chargeable under the head capital gains.

Conditions

1 There should be capital Asset

2 The Capital Assets is Transferred By the Assessee

3 Such transfer takes place during the previous year

4 Such gain is not exempt u/s. 54.

CONDITION 1: THERE SHOULD BE CAPITAL ASSET [SEC. 2(14)]

(a) Property of any kind held by an assessee, whether or not connected with his business or

profession

(b) Any securities held by a Foreign Institutional investor which has invested in such securities

in accordance with the SEBI regulations.

(c) Any unit linked insurance policy (ULIP) issued on or after 1/2/2021 to which exemption

under section 10(10D) does not apply on account of – [Amendments Fin Act 2021]

i Premium payable exceeding ₹ 2,50,000 for any of the previous years during the term

of such policy; or

ii The aggregate amount of premium exceeding ₹ 2,50,000 in any of the previous years

during the term of any such ULIP(s), in a case where premium is payable by a person

for more than one ULIP issued on or after 1/2/2021.

1 Any stock-in-trade, consumable stores or raw material held for the purposes of business

or profession.

2 Personal effect means any movable property held for personal use of the assessee or for

any dependent member of his family but excludes.

a Jewellery

b Archaeological Collection

c Drawings.

d Paintings

e Sculptures

f Any work of art.

Note: House Property is immovable property hence shall not be treated as personal effect.

Explanation:

For the purpose of this sub-clause, “jewellery” includes –

YES ACADEMY FOR CS 8888 235 235 7.1

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

a Ornaments made of gold, silver, platinum or any other precious metal or any alloy

containing one or more of such precious metals, whether or not containing any precious

or semi-precious stone, and whether or not worked or sewn into any wearing apparel;

b Precious and semi-precious stones, whether or not set in any furniture, utensil or other

articles or worked or sewn into any wearing apparel;

3 Rural agriculture land in India i.e., agricultural land in India which is not situated in any

specified area. As per definition, only rural agricultural lands in India are excluded from

the purview of the term ‘capital asset;. Hence urban agricultural lands constitute capital

assets.

4 6.5% gold bonds, 1977, 7% gold bonds, 1980 or National defence gold bonds, 1980 issued

by central government.

5 Special bearer bonds 1991 issued by central government.

6 Gold deposit bonds issued under the gold deposit scheme 1999.

Explanations: For the removal of doubts, it is hereby clarified that “property” includes and shall

be deemed to have always included any rights in or in relation to an Indian company, including

rights of management or control or any other rights whatsoever;

Examples of Capital Asset:

Asset Whether Reason

Capital

Asset?

Throne, made up of gold, Diamonds, Ruby YES It is Jewellery

& other precious stones

Gold Watch NO Personal effect

Gold Pen NO Personal effect

Mobile Phone NO Personal effect

House Property used for Personal YES Personal effect does not include

purpose immovable properties.

Shirt of Vipul Shah NO Personal effect

Shirt with Diamond buttons sewn into it. YES Jewellery

B.M.W bike used by brother, dependent NO Personal effect include assets used

by members of family dependent

upon him

Painting of M. F. Hussain YES Personal effect exclude painting

Agricultural land situated in urban area YES Not situated in rural area

Non-agricultural land in rural area YES Not an agricultural area

Agricultural land in rural area, used for YES Not used for agricultural purpose

non-agricultural purposes, permanently.

YES ACADEMY FOR CS 8888 235 235 7.2

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

Agricultural land in rural area, used for NO Specifically excluded

agricultural purposes

House property sold by a Builder NO It is Stock in Trade

Shares, debentures, bonds etc. YES Except Gold Deposit Bonds.

Capital Indexed Bonds YES Not exclude in 2(14)

Goodwill YES Capital assets include intangible

assets.

MY NOTES

Important judicial pronouncement

Held that – the land is an independent and identifiable capital asset and it continues to remains

as an identifiable capital asset even after construction of building. In this case capital gain

calculation separately for land and building after splitting up the sale consideration for the land

and building.

TYPES OF CAPITAL ASSET & POH

1. This distinguishment depends upon the period of holding (POH) of the asset, as

summarized below –

No. Nature of asset STCA LTCA

1. A security (other than unit) listed in a recognized stock

exchange in India,

POH <= 12 POH <= 12

2. Units of UTI or Equity oriented Mutual Fund specified u/s

months months

10(23D),

3. Zero coupon bond

4. Unlisted shares Immovable property being land or building POH <= 24 POH > 24

or both months months

5. • Unit of debt oriented fund

POH <= 36 POH > 36

• Unlisted securities other than shares

months months

• Other capital assets

2. Period of holding applicable to different assets

Shares (equity or preference) or Debentures or bonds listed in RSE in India 12 months

Shares (equity or preference) or Debentures or bonds listed in SE outside 36 months

India

Unlisted Shares (equity or preference) 24 months

Units of UTI 12 months

Units of equity oriented MF 12 months

Units of Debts fund or money market mutual fund 36 months

YES ACADEMY FOR CS 8888 235 235 7.3

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

Zero coupon Bonds 12 months

Land or Building or both 24 months

Debenture or bond 36 months

Any other Asset 36 months

3 Period of holding

It means the period for which the asset is held by the assessee. It starts from the day

following the date of acquisition and ends on the date of transfer

Day following the date

Period of holding Date of transfer

of acquisition

1. Illustration

State whether the following assets are short-term capital assets or long-term capital assets:

No. Particulars Nature

of Asset

1 Jewellery purchased on 1/7/2018 and sold on 7/3/2024

2 Shares in Walnut Ltd (unlisted) purchased on 7/7/2021 and sold on 14/9/2023.

3 Personal car purchased on 18/8/1997 and sold on 17/8/2023

4 A residential house used for own occupation constructed on 17/7/1992 & sold

on 15/04/23.

5 Units of UTI purchased on 14/5/2023 and sold on 1/1/2024.

6 Zero coupon bonds purchased on 6/6/2022 and sold on 11/11/2023.

7 Drawings purchased on 1/1/2016 and sold on 12/12/2024.

8 Shares purchased (listed) on 1/4/21 and sold on 15/09/23.

CONDITION B: THE CAPITAL ASSETS IS TRANSFERRED BY THE ASSESSEE

Transfer u/s. 2(47) means

a The Sale, exchange or relinquishment (to withdraw) of the asset.

b The compulsory acquisition of asset under any law.

c Conversion of asset into stock-in-trade.

d Redemption of Zero coupon bonds.

e Possession of property under part performance of contract of the nature referred in section

53A of the transfer of property Act 1882.

f Any transaction by which has the effect of transferring of any immovable property.

YES ACADEMY FOR CS 8888 235 235 7.4

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

SALE

1. The term sale has not defined in the income tax act, as per its meaning can be applied as:

In case of movable property As per sale of Goods act, 1930

In case of Immovable property As per Transfer of property Act, 1992.

2. Sale

Sale means voluntary conveyance of ‘property’ in the goods by one person to another for

consideration in ‘money’

3. Exchange

Exchange means voluntary conveyance of Property in the goods by one person to another for

consideration in kind.

Transfer of loose diamonds

Mr. A Mr. B

Transfer of shares

Key Point: The sale consideration shall be the FMV of the thing received in kind.

4. Relinquishment: to give up

It means Voluntary conveyance of property in the goods without consideration. For example

gift, will or appointing a trust, etc.

5. Extinguishment: involuntary transfer of rights by one person to another

To extinguish means to put a total end to something. It indicates a complete wipe out,

destruction or annihilation of contract, rights, title, interest or a debt or other obligation

whether the effect is produced by the act of God, or by operation of law or by the act of

party.

Key Points:

1. There should be destruction or extinction of Rights and not Capital asset. (exception

45(1A))

2. If any asset is destroyed by any of the following reasons, destruction shall be deemed

to be transfer. Sec 45(1A):

a. Natural calamity,

b. Riot and civil disturbance,

c. Action taken by enemy or combating an enemy (with or without declaration of war),

d. Accident fire or war

3. In such cases, insurance compensation is deemed to be sale consideration,

4. Accident, Theft not covered by sec 45(1A) & hence insurance claim not be treated as

sale consideration,

5. Voluntary act of extinguishment of rights is not a transfer

6. Compulsory Acquisition under any Law

To be discussed later when we study section 45(5)

YES ACADEMY FOR CS 8888 235 235 7.5

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

7. Conversion of capital asset into stock in trade

To be discussed later.

8. Part performance of contract

Any transaction involving the allowing of the possession of any immovable property to be

taken or retained in part performance of a contract of the nature referred on in section

53A of the Transfer of Property Act, 1882 subject to fulfilment of the following conditions:

• There should be a valid contract of sale

• Transfer should be of an immovable property

• Buyer must have paid the consideration or shall be ready to pay the same

• Seller has transferred the possession to the buyer.

9. Asset allotted by co – op society

Any transaction (whether by way of becoming a member of, or acquiring shares in a co-

operative society, company or other association of persons or by way of any agreement or

any agreement or in any other manner whatsoever.) which has the effect of transferring, or

enabling the enjoyment of any immovable property.

Key Points

1. The shareholder/ members are deemed owners

2. The legal owner is the co-operative society or company

3. There should be a transfer of right to use & enjoyment of any immovable property.

10. The maturity or redemption of Zero coupon bonds

Note: There is no interest payable on such bonds. Benefits are receivable only at the

time of maturity or redemption.

COMPUTATION OF CAPITAL GAIN [SECTION 48]

1. Computation of Short term Capital Gain

Particulars Rs.

Full value of consideration XXX

(-) Expenditure on transfer XXX

= Net sale consideration XXX

(-) Cost of acquisition XXX

(-) Cost of improvement XXX

= Short term capital gain XXX

(-) Exemption u/s. 54 XXX

= Taxable STCG XXX

2. Computation of Long term Capital Gain

Particulars Rs.

Full value of consideration XXX

(-) Expenditure on transfer XXX

YES ACADEMY FOR CS 8888 235 235 7.6

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

= Net sale consideration XXX

(-) Indexed Cost of acquisition XXX

(-) Indexed Cost of improvement XXX

= Long term capital gain XXX

(-) Ded. u/s. 54 XXX

KEY NOTE

No deduction will be allowed in respect payment of securities transaction tax in computing

income under the head “Capital Gain”.

WHAT IS A FULL VALUE OF CONSIDERATION

a It is a full value of consideration received or receivable by the transferor.

b If consideration received in kind them fair market value of asset is considered as full value

of consideration.

c Even if a consideration received in instalments in different years full value of consideration

is important.

EXPENSES ON TRANSFER

Expenses on transfer include any expenditure incurred whether directly or indirectly for the

purpose of transfer like advertisement expenses, brokerage, and stamp duty. Registration fees,

legal expenses etc. However any expenses which have been claimed as a deduction under any

other provision of the act cannot be claimed as a deduction under this clause.

COST OF ACQUISITION [SEC. 55(2)]

COST OF ACQUISITION

Purchase Price of Asset +

Deemed cost of Indexed cost of

Expenditure incurred to

acquisition acquisition

purchase an asset

Inflation adjusted cost of

Cost to previous owner

asset

YES ACADEMY FOR CS 8888 235 235 7.7

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

Cost of acquisition of an asset is the value for which it was acquired by the assessee.

Following points should be considered.

1 Cost of acquisition includes expenses incurred in acquiring the assets or completing the title.

2 Interest on money borrowed for acquiring capital asset will form part of cost of asset. But

after acquisition it will be treated as revenue expenditure.

3 Interest paid by firm to its partner capital contribution for the purchase of capital asset

cannot be treated as part of acquisition.

4 Deemed Cost of Acquisition [Section 49(1)]:

a On the distribution of the assets on total / partial partition of Hindu Undivided Family.

b Under a gift or will.

c By succession, inheritance or devolution;

d On any distribution of assets on the liquidation of a company;

e Under a transfer to a revocable or irrevocable trust;

f On a transfer by a wholly owned Indian subsidiary company to its holding company or vice

versa;

g On any transfer in a scheme of amalgamation of two Indian companies subject to certain

conditions u/s. 47(vi)

h On any transfer in a scheme of amalgamation of two foreign companies subject to certain

conditions.

i On any transfer of a capital asset by the banking company to the banking institution in a

scheme of amalgamation of a banking company with a banking institution;

j On conversion of self-acquired property of a member of a Hindu Undivided Family to the

joint family property.

INDEXED COST OF ACQUISITION (EXPLANATION (III) TO SECTION 48)

Cost inflation index for any year such index as the Central Government may specify after

considering 75% of the average rise in the consumer price index for urban non – manual employee

it will be computed on the basis of Consumer Price Index (Urban)) for the immediately preceding

previous year to such previous year by notification in the Official Gazette.

KEY NOTES

Indexed cost of acquisition has to be ascertained with reference to the date of acquisition and

not with reference to the date when such asset became a capital asset.

Cost Inflation Index for different financial years is as follows:

Financial year Index Financial year index

2001 – 02 100 2012 – 13 200

2002 – 03 105 2013 – 14 220

2003 – 04 109 2014 – 15 240

YES ACADEMY FOR CS 8888 235 235 7.8

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

2004 – 05 113 2015 – 16 254

2005 – 06 117 2016 – 17 264

2006 – 07 122 2017 - 18 272

2007 – 08 129 2018 – 19 280

2008 – 09 137 2019 - 20 289

2009 – 10 148 2020 – 21 301

2010 – 11 167 2021 – 22 317

2011 – 12 184 2022 - 23 331

COST OF ACQUISITION OF ASSETS ACQUIRED BEFORE 1-4-2001 [SECTION 55(2) (B)]

Acquired by Cost of acquisition

Assessee himself Cost of acquisition or fair market value as on 01-04-2001

whichever is more

Acquired under section 49(1) Cost of acquisition to previous owner or fair market value

mentioned above. as on 01-04-2001 whichever is more.

[Finance Act 2020]

The above provision has been modified with effect from the Assessment Year 2021 – 22. The

modified version provides that in case of a capital asset (being land or building or both), the fair

market value of such an asset on April 1, 2001 shall not exceed the stamp duty value of such

asset as on April 1, 2001 where such stamp duty value is available.

KEY NOTES

The option in the above case is not available for depreciable assets.

COST OF ACQUISITION OF ASSETS ACQUIRED BEFORE 1-4-2001 [SECTION 55(2) (B)]

The cost of acquisition in relation to the long-term capital assets being

• Equity shares in a company on which STT is paid both at the time of purchase and transfer

or

• Unit of equity oriented fund or unit of business trust on which STT is paid at the time of

transfer.

Acquired before 1st February, 2018 shall be the higher of

i Cost of acquisition of such asset; and

ii Lower of

a The fair market value of such asset; and

b The full value of consideration received or accruing as a result of the transfer of the

capital asset.

YES ACADEMY FOR CS 8888 235 235 7.9

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

• Benefit of Indexation not available

• Indexation not available

Notes

• Deduction u/s 80C to 80U is not available

• Rebate u/s 87A is not available

Meaning of fair market value

S N Circumstance Fair Market Value

1 In a case where the capital asset is If there is trading in such asset on such

listed on any recognized stock exchange on 31/01/2018

exchange as on 31/01/2018 The highest price of the capital asset quoted on

such exchange on the said date

If there is no trading in such asset on such

exchange on 31/01/2018

The highest price of such asset on such exchange

on a date immediately preceding 31/01/2018

when such asset was traded on such exchange

2 In a case where the capital asset is a The net asset value of such unit as on the said

unit which is not listed in any date

recognized stock exchange as on

31/01/2018

3 In a case where the capital asset is an An amount which bears to the cost of acquisition

equity share in a company which is the same proportion as CII for the financial year

• Not listed on a recognized stock 2017 – 18 bears to the CII for the first year in

exchange as on 31/01/2018 but which the asset was held by the assesse or on

listed on such exchange on the 01/04/2001, whichever is later.

date of transfer

• Listed on a recognized stock

exchange on the date of transfer

and which became the property of

the assesse in consideration of

share which is not listed on such

exchange as on 31/01/2018 by way

of transaction not regarded as

transfer under section 47

2. Illustration

Consider the following situations (1,000 shares are transacted by Bombay Stock Exchange but

value of 1 equity shares is given below) –

Particulars Situation Situation Situation Situation 4 Situation

1 Rs. 2 Rs. 3 Rs. Rs. 5 Rs.

YES ACADEMY FOR CS 8888 235 235 7.10

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

Cost of acquisition on Sep. a 410 710 900 800 30

20, 2019

Fair market value as per b 730 780 300 1000 100

highest quotation on January

31, 2020

Sale consideration on march c 760 650 910 825 400

15, 2024

Fair market value for the purpose of calculating tax liability under section 112A shall be calculated

as follows-

Situation Situation Situation Situation Situation Situation

1 2 3 4 5 6

Rs. Rs. Rs. Rs. Rs. Rs.

Step 1 - Cost of (a) 410 710 900 800 30

acquisition on September

20, 2019

Step 2 - Fair market value

as per highest quotation on (b) 730 780 300 1,000 100

January 31, 2020

- Selling price on 15-03- (c) 760 650 910 825 400

2024

- [Lower of (b) or (c)] (d) 730 650 300 825 100

Cost of acquisition for the

purpose of section 112A [(a) (e) 730 710 900 825 100

or (d), whichever is higher]

Long – term capital gain u/s 30 (-) 60 10 Nil 300

112A [(c) – (e)]

The above mode of determining cost of acquisition is applicable only if shares/ units are acquired

prior to February 1, 2020. Suppose in Situation 1, the date of acquisition is February 10, 2020 (no

other change). “Cost of acquisition” will be taken as Rs. 410 (above rules are not applicable).

COST OF IMPROVEMENT [SEC. 55(1)]

Cost of improvement means expenditure incurred to increase the productive quality of the asset.

It includes all expenditure of a capital nature incurred in making any additions or alteration to

the capital asset.

YES ACADEMY FOR CS 8888 235 235 7.11

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

INDEXED COST OF IMPROVEMENT

COST OF IMPROVEMENT

Capital Expenditure

Deemed cost of Indexed cost of

incurred by an assessee

improvement acquisition

in making any addition to

capital asset

Cost to Previous owner Inflation Adjusted Cost

YES ACADEMY FOR CS 8888 235 235 7.12

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

Index cost of acquisition

It is an amount, which bears to the cost of improvement the same proportion as cost inflation

index for the year in which the asset is transferred bears to the cost inflation index for the

year in which the improvement to the asset book place.

• Cost of improvement does not include any expenditure which is deductible in

computing the income chargeable under the head income from house property.

KEY NOTES

‘Profits and gains of business or profession”, or “income from other sources”. Only

capital expenditure is considered as a cost of improvement Routine expenses on

repairs and maintenance do not form part of cost of improvement.

• Improvement cost incurred by previous owner & assessee before 1.4.2001 shall

be ignored.

HOW TO CLACULATE INDEXED COST OF ACQUISITION & IMPROVEMENT

Indexed cost of acquisition [Explanation (iii) to Section 48)

Cost of acquisition X Cost inflation index for the year in which the asset is transferred

Cost inflation index for the PY in which the asset was 1st held by the assessee

Indexed cost of improvement [Explanation (iv) to Section 48)

Cost of improvement X Cost inflation index for the year in which the asset is transferred

Cost inflation index for the year in which the improvement to the asset took place

NOTES

Indexation benefit in case of gifted assets shall be allowed from the date when

KEY

gifted asset is acquired by the previous owner. [CIT vs Manjula J Shah (Bom)]

INDEXATION OF COST NOT ALLOWED IN CERTAIN CASES

In the following cases, indexation of cost & improvement shall not be allowed for the assets

specified therein.

1 Transfer of bonds and debentures other than

• Capital indexed bonds issued by the Government.

• Indexation benefit shall be available in case of LTCG arising of transfer of Sovereign

Gold Bond.

2 Transfer of an undertaking or division in a slump sale.

3 Certain transaction by non-resident.

4 Transfer of global deposit receipts.

YES ACADEMY FOR CS 8888 235 235 7.13

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

In case of depreciable assets, there is no question of any indexation as capital

NOTE

KEY

gain arising from the transfer of depreciable asset shall always be short-term

capital gain.

3. Illustration

1) Where a house property has been purchased by Vadapav on 1-1-1996 for Rs. 30,000 and the

fair market value of the house as on 1-4-2001 is Rs. 1,20,000, the assessee at to adopt Rs. 1,

20,000 as the cost of acquisition.

2) Where certain shares of a company were purchased by Vadapav on 1-1-1996 at the rate of Rs.

200 per share and the market value of the shares as on 31-01-2001 is Rs. 120 per share the

assessee may not opt for market value and adopt Rs. 200 per share as the cost of acquisition.

4. Illustration

Flop Imran purchased Land on 4-01-1998 for Rs. 60,000. This land was sold by him on 02-09-2023

for Rs. 18,00,000. The market value of the land as on 01-04-2001 was Rs. 1, 20,000. Expenses on

transfer were 2% of Sale price. Compute the capital gain for PY 23-24.

Solution

Period of holding

Nature of Capital Gain

Particulars WN RS

Sales consideration 18,00,000

(-) Expenses on transfer 36,000

= Net sales consideration 17,64,000

(-) Indexed cost of acquisition 1 397200

(-) Indexed cost of improvement - 0

Long term capital gain 1366800

Working Note 1: Index cost of acquisition

Cost of acquisition or FMV as on 1-4-2001

Whichever is higher

× Index of transfer

Base index

1,20,000

= × 331 = 397200

100

YES ACADEMY FOR CS 8888 235 235 7.14

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

5. Illustration

Anna Hajare sells the following capital assets during the previous year 22 - 23

Particulars Non-Listed Shares House Property

Rs. Rs.

Sale consideration 34,00,000 18,00,000

Year of acquisition 03-04 06-07

Cost of acquisition 2,90,000 18,000

Cost of improvement incurred in 09-10 70,000

Compute Capital Gain for AY 23 - 24

Solution

Period of holding

Nature of Capital Gain

Particular WN Non-listed shares House property

Rs Rs

Sales consideration 3400000 1800000

(-) Expenses of transfer 0 0

= Net sale consideration 3400000 1800000

(-) Indexed cost of acquisition 1&2 880642 48836

(- ) Indexed of improvement 3 0 156554

Long term capital gain 2519358 1594610

Working Notes:

1) Non-listed shares

COA

× Index of the year of transfer

Index of acquisition

2,90,000

× 331 = 880642

109

2) House property

COA

Index of acquisition

× Index of the year of transfer

18,000

× 331 = 48836

122

3) Cost of improvement – House property

COI

× Index of the Year transfer

Index of improvement

70,000

× 331 = 156554

148

YES ACADEMY FOR CS 8888 235 235 7.15

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

6. Illustration

Mr. Power acquired a land in 1998-99 for Rs. 2, 00,000 & gifted it to his major son Karamati on

16-01-2000, When the market value of the land was Rs. 2, 50,000. The FMV of land on 01-04-

2001 was Rs. 4, 00,000. Karamati sold the land on 14-09-2022 for Rs. 48,00,000. Compute the

capital gain for PY 22-23 assuming that the expenses on transfer were Rs. 1,00,000.

Solution

Period of holding

Nature of Capital Gain

Particular WN Rs

Sales consideration 4800000

(-) Expenses on transfer 100000

= Net sales consideration 4700000

(-) indexed cost of acquisition 1 1324000

(-) indexed cost of improvement - 0

Long term capital gain 3376000

Working Note 1

COA to previous owner or FMV on 1 − 4 − 01 whichever is higher

× Index of the year of transfer

index of acquisition of previous owner

4,00,000

× 331 = 1324000

100

7. Illustration

Lalu acquired a house property in 1997-98 for Rs. 2, 00,000 & gifted it to his major son kalu on

16-01-2011, When the market value of the land was Rs. 2,50,000. The FMV of land as on 01-04-

2002 was Rs. 4, 00,000. Mr. Lalu incurred following improvement expenditures:

a) Extension of first floor in June 1999 Rs. 55,000

b) Extension of second floor in June 2006 Rs. 65,000,

Mr. Kalu incurred following improvement expenditures.

c) Extension of Third – floor in June 2012 Rs. 75,000.

d) Extension of Fourth-floor in June 2022 Rs. 65,000, Mr. Kalu sold the land on 14-09-2022 for

Rs. 19,00,000. Compute the capital gain for AY 23-24 assuming that the expenses on transfer

were Rs. 1,00,000.

Solution

Assessee: Mr Kalu

Period of holding

Nature of Capital Gain

Particular WN Rs

YES ACADEMY FOR CS 8888 235 235 7.16

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

Sales consideration 1900000

(-) Expense on transfer 100000

= Net sale consideration 1800000

(-) Indexed cost of acquisition 1 1324000

(-) Indexed cost of improvement 2 0

(-) Indexed cost of improvement 3 183889

(-) Indexed cost of improvement 4 148653

(-) Indexed cost of improvement 5 65,000

Long term Capital Gain 78458

WN 1:

COA to the previous owner or

FMV on 1 − 4 − 01 whichever is higher

× Index of the year of transfer

indexed on which acquisition

of previous owner

4,00,000

× 331 = 1324000

100

COST OF IMPROVEMENT

COI

× Index of transfer

Index of improvement year took place

WN 2: Improvement expenditure incurred before 1-4-2002 ignored

WN 3

65,000

× 331 = 183889

117

WN 4:

75,000

× 331 = 148653

167

WN 5:

65,000

× 331 = 65000

331

8. Illustration

Motabhai acquired the property in the PY 03-04 for Rs. 5,00,000 & paid Rs. 18,000 as registration

charges. Motabhai died on 14-09-06 & the property was transferred to his son Chotabhai through

inheritance. The market value of property as on 14-09-06 is Rs. 21,00,000. During PY 22 – 23 sold

this property for Rs. 65, 00,000. Compute the capital gain for AY 23 - 24

Solution

Period of holding

Nature of Capital Gain

YES ACADEMY FOR CS 8888 235 235 7.17

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

Particular WN Rs

Sales consideration 6500000

(-) Expenditure on transfer 0

= Net sales consideration 6500000

(-) Indexed cost of acquisition 1 1573009

(-) Indexed cost of improvement 0

= Long term capital gain 4926991

Working Note 1

COA to the previous owner

× Index of the year of transfer

Indexed of acquisition to the previous owner

[5, 00,000 + 18,000]

5,18,000

× 331 = 1573009

109

9. Illustration

Mr. Shahrukh Joshi sold following assets during PY 22 - 23

Particulars HP Jewellery Debentures

Date of Purchase 01/07/14 04/01/10 11/07/98

Date of Sale 31/03/23 31/03/23 31/03/23

Purchase Price 1,14,000 2,00,000 95,000

Sale Price 7,00,000 10,00,000 6,00,000

Compute capital gain for AY 23-24.

Solution

Period of holding

Nature of Capital Gain

Particular W N HP Jewellery Debenture

Sales consideration 700000 1000000 600000

(-) Exp. On transfer 0 0 0

= Net sales consideration 700000 1000000 600000

(-) Indexed cost of acquisition 1 171518 483212 95000

(-) indexed cost of improvement 0 0 0

= Long term capital gain 528482 516788 505000

Working Notes:

1) Indexed cost of acquisition for HP

1,14,000

× 331 = 171518

220

2) Indexed cost of acquisition for Jewellery

YES ACADEMY FOR CS 8888 235 235 7.18

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

2,00,000

× 331 = 483212

137

Note: Benefit of indexation is not available for the debentures.

COMPUTATION OF CAPITAL GAIN IN CERTAIN CASES

CAPITAL GAIN IN CASE OF INSURANCE CLAIM RECEIVED ON DAMAGE OR

DESTRUCTION OF CAPITAL ASSET [SEC. 45(1A)]

INSURANCE CLAIMS

Before A.Y. 2000-2001 • Destruction should After A.Y. 2000-01

happen by way of

Flood, Typhoon,

CIT Vs. Vania silk Mills Hurricane Cyclone, Any compensation received

Pvt. Ltd. Earth quake or from an insurance company

other convulsion of for the specified damages is

nature treated as transfer.

• Riot or civil

disturbance

• Accidental fire

explosion

• Action by enemy or

action taken in

combating an

enemy

1 Conditions: As per provision of this section, any compensation received from an insurance

company for the specified damage is treated as transfer. Such transfers are liable to

capital gain in the year of the receipt.

Here specified damages mean flood, cyclone, earthquake, riot, civil disturbance,

accidental fire, enemy action etc.

2 Computation of Capital Gain

Condition Treatment

Sale consideration Compensation received or if it is received in

kind then FMV as on the date of the receipt.

Cost of acquisition / cost of improvement / As usual

expenses on transfer

Indexation benefit Available till the year of destruction

Taxable In the year of receipt of compensation.

YES ACADEMY FOR CS 8888 235 235 7.19

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

• Compensation received for any damages to capital asset shall be treated as capital

receipt and shall not be taxable.

• Compensation received for any damages to non-capital asset may be chargeable u/s

KEY NOTES

28 or 56. E.g. Compensation received on theft of stock in trade shall be treated as

business income.

• Destruction of asset without insurance: where an asset is destroyed and there is no

insurance or insurance compensation is not received then it shall not be treated as

transfer. Cost of such asset is not allowed as deduction under Income tax Act.

UNIT LINKED INSURANCE POLICY RECEIPTS [SECTION 45(1B)]

[Amendments Fin Act 2021]

Where any person receives, at any time during any previous year, any amount, under a ULIP

issued on or after 1.2.2021, to which exemption under section 10(10D) does not apply on account

of –

a Premium payable exceeding ₹ 2,50,000 for any of the previous years during the term of such

policy; or

b The aggregate amount of premium exceeding ₹2,50,000 in any of the previous years during

the term of any such ULIP(s), in a case where premium is payable by a person for more than

one ULIP issued on or after 1.2.2021.

Then, any profits or gains arising from receipt of such amount by such person shall be chargeable

to income-tax under the head “Capital Gains” and shall be deemed to be the income of the such

person for the previous year in which such amount was received. The income taxable shall be

calculated in such manner as may be prescribed.

CONVERSION OF CAPITAL ASSET INTO STOCK IN TRADE [SECTION 45(2)]

Computation of Capital gain:

Conditions Treatment

Sale consideration FMV on the date of conversion

Cost of acquisition / cost of improvement / expenses on As usual

transfer

Indexation benefit Available till the year of conversion

Taxable In the year in which asset is sold

Difference between actual sale value & Fair value as on the Treated as business income.

date of conversion.

YES ACADEMY FOR CS 8888 235 235 7.20

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

TRANSFER OF SECURITIES BY DEPOSITORY [SECTION 45(2A)]

Computation of capital gain

CONDITIONS TREATMENT

Sale consideration Value at which shares sold

Cost of acquisition Cost of acquisition & period of holding of any securities, shall be

determined on the basis of the FIFO method. This method is

applicable to dematerialized form. Securities held in physical forms

shall be dealt separately.

Indexation benefit As usual

Taxable In the year in which asset is sold

Expenses on transfer As usual

CAPITAL GAIN ON TRANSFER OF CAPITAL ASSET BY A PARTNER/MEMBER TO

A FIRM/AOP/BOI AS CAPITAL CONTRIBUTION [SECTION 45(3)]

Conditions Treatment

Sale consideration The amount recorded in the books of accounts of the

Firm/AOP/BOI as value of such assets.

Cost of acquisition / cost of As usual

improvement / expenses on

transfer

Indexation benefit As usual

Taxable In the year in which asset is transfer.

FMV of such asset is irrelevant to decide sale consideration.

CAPITAL GAIN ON TRANSFER OF CAPITAL ASSET ON ITS DISSOLUTION OF FIRM/AOP/BOI [SECTION 45(4)]

Computation of capital gain:

Conditions Treatment

Sale consideration FMV on the date of dissolution

Cost of acquisition / cost of improvement / expenses As usual

on transfer

Indexation benefit As usual

Taxable In the year in which asset is sold.

YES ACADEMY FOR CS 8888 235 235 7.21

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

COMPULSORY ACQUISITION OF ASSET [SECTION 45(5)]

1 Where a capital asset has been compulsorily acquired (other than urban agricultural land)

under any law, it will be treated as a transfer of the previous year in which the asset is

compulsorily acquired, Indexation, if required, will be done till the previous year of

compulsory acquisition. However, the capital gain will be taxable in the previous year in which

the compensation is received.

2 Initial compensation / consideration:

Computation of capital gain when initial compensation received

Conditions Treatment

Sale consideration Total compensation received or receivable

Cost of acquisition / cost of improvement / As usual

expenses on transfer

Indexation benefit Till the year of acquisition

Taxable In the year in which initial compensation is

received.

Computation of Capital gain when enhanced compensation received

Conditions Treatment

Sale consideration Total enhanced compensation received.

Cost of acquisition / cost of improvement NIL

Indexation benefit NIL

Taxable In the year in which the compensation is

received & treated as STCG OR LTCG

depending upon original gain.

Interest on enhanced compensation Income from other source

Expenditure on transfer Litigation expenses incurred for receiving

enhanced compensation.

It is possible that the person may die before the enhanced compensation / consideration is

received and the enhanced compensation / consideration are received by his legal heirs.

Such enhanced compensation / consideration will be taxable in the hands of the person who

receives the same.

YES ACADEMY FOR CS 8888 235 235 7.22

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

W.E.F. ASSESSMENT YEAR 2005 – 06 SECTION 10(37) HAS BEEN INSERTED, WHICH PROVIDES AS UNDER

• Applicable: An individual or an HUF.

• Conditions:

1 Assessee has transferred urban agricultural land (being a capital asset).

2 Such land was used for agricultural purposes by such HUF or individual or his parents

during the period of 2 years immediately preceding the date of transfer.

3 Such land is transferred:

a By way of compulsory acquisition under any law, or

b For a consideration to be determined or approved by the Central Government or

the RBI.

4 The compensation or consideration for such transfer is received by such assessee on

or after 1.1.04.

• Treatment: Income on such transfer shall be exempted.

SEC. 45(5A): CAPITAL GAIN ON TRANSFER OF LAND OR BUILDING OR BOTH, UNDER DEVELOPMENT AGREEMENT

1. Assessee

Individual or HUF,

2. Asset Transferred

Land or building or both, under a specified agreement

3. “Specified agreement”

means a registered agreement in which a person owning land or building or both, agrees to

allow another person to develop a real estate project on such land or building or both, in

consideration of a share, being land or building or both in such project, whether with or

without payment of part of the consideration in cash

4. PY of taxability

PY in which the certificate of completion for the whole or part of the project is issued by

the competent authority;

5. Full value of consideration

The stamp duty value, on the date of issue of completion certificate, of his share, being land

or building or both in the project, as increased by the consideration received in cash, if any.

6. Exception

provisions of this sub-section shall not apply where the assessee transfers his share in the

project on or before the date of issue of said certificate of completion, and the capital gains

shall be deemed to be the income of the previous year in which such transfer takes place

and the provisions of this Act, other than the provisions of this sub-section, shall apply for

the purpose of determination of full value of consideration received or accruing as a result

of such transfer.

YES ACADEMY FOR CS 8888 235 235 7.23

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

7. Explanation

For the purpose of this sub-section, the expression –

i “Competent Authority” means the authority empowered to approve the building plan by

or under any law for the time being in force;

ii “Stamp Duty Value” means the value adopted or assessed or assessable by any authority

of Government for the purpose of payment of stamp duty in respect of an immovable

property being land or building or both.

BUY BACK OF SHARES [SEC.46A]

1. Transfer

Where a shareholder receives any consideration from the company for purchase of its own

shares Or other specified securities, it is a transfer chargeable under the head Capital

Gains.

2. Year of taxability

Such Capital Gain is chargeable to tax in the previous year in which the shares or securities

are purchased by the Company.

3. Capital Gains

Value of consideration received Less Cost of Acquisition or Indexed cost of Acquisition.

4. No Deemed Dividend

In case of buyback of shares, there is no question of Deemed dividend u/s 2(22) (d).

5. In case of shares (whether listed or unlisted)

In case of buyback of shares (whether listed or unlisted) by domestic companies, additional

income-tax @20% (plus surcharge @12% and cess @4%) is leviable in the hands of the

company.

6. Sec 115QA

Consequently, the income arising to the shareholders in respect of such buyback of shares

by the domestic company would be exempt under section 10(34A), since the domestic

company is liable to pay additional income-tax on the buy back of shares.

Taxation provisions in respect of buyback

(1) (2) (3) (4)

Taxability in the Buyback of shares by Buyback of shares by Buyback of specified

hands of domestic companies a company other than securities by any

a domestic company company

Company Subject to additional Not subject to tax in Not subject to tax in

income-tax the hands of the the hands of the

@23.296%. company. company.

Shareholder/holder Income arising to Income arising to Income arising to

of specified shareholders exempt shareholder taxable holder of specified

securities securities taxable as

YES ACADEMY FOR CS 8888 235 235 7.24

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

under section as capital gains u/s capital gains u/s

10(34A) 46A. 46A.

CAPITAL GAINS IN THE CASE OF SLUMP SALE [SECTION 50B]

1 Meaning

Slump sale means the transfer of one or more undertakings for a lump sum consideration

without assigning values to the individual assets and liabilities in such sales.

Undertaking shall include any part of an undertaking or a unit or division of an undertaking

or a business activity taken as a whole but does not include individual assets or liabilities

or any combination thereof not constituting a business activity.

2 Tax treatment

Sale consideration As usual

Cost of Acquisition or improvement Net worth of the undertaking

Indexation Benefit Not available

Nature of gain whether short term or long If undertaking is owned and held by the

term. assessee for not more than 36 months, then

capital gain shall be deemed to be short-

term capital gain otherwise long-term capital

gain.

Note: Where an undertaking is owned and

held by an assessee for more than 36 months

immediately preceding the date of its

transfer, then it shall be treated as a long-

term capital asset. It makes no difference

that few of the assets of the undertaking

are newly acquired (i.e. for less than 36

months)

Net worth shall be the:

Aggregate value of total assets of the Xxxx

undertaking

Less: Value of liabilities of such undertaking Xxxx

as appearing in the books of account.

Net worth Xxxx

1. Effect of revaluation

If any change has been made in the value of assets on account of revaluation of assets etc.

then such change in value shall be ignored.

YES ACADEMY FOR CS 8888 235 235 7.25

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

2. The aggregate value of total assets [Amendment Fin Act 21]

In case of

• The written down value of block of assets determined in accordance with the provisions

contained in sub-item (c) of section 43(6)(c)(i) in the case of depreciable assets;

• Nil in the case of capital assets in respect of which the whole of the expenditure has

been allowed or is allowable as a deduction under section 35AD;

• Nil in the case of goodwill of a business or profession (not acquired by the assesse by

purchase from a previous owner); and

• The book value for all other assets.

Moreover, fair market value of the capital assets as on the date of transfer (calculated

in the prescribes manner), shall be deemed to be the full value of the consideration

received/accruing as a result of the transfer of such capital asset.

3. Treatment of stock

In case of slump sale, no profit under the head ‘Profit & gains of business or profession’

shall arise even if the stock of the said undertaking is transferred along with other assets.

4. Carry-forward of losses

In case of slump sale, benefit of unabsorbed losses and depreciation of the undertaking

transferred shall be available to the transferor company and not to the transferee

company.

• Report of an Accountant The assessee is required to furnish along with the return of

income, a report of a chartered accountant in Form 3CEA

indicating the computation of the undertaking or division has

been correctly arrived at in accordance with the provisions

of this section.

VALUATION OF CONSIDERATION IN CASE OF LAND OR BUILDING OR BOTH [SECTION 50C]

In case of transfer of immovable capital asset being land or building or both, sale

consideration shall be higher of the following

1 Actual consideration received or accrued on such transfer; or

2 110% of the value adopted or assessed or assessable# by any authority of a State

Government (i.e. Stamp Valuation authority) for the purpose of payment of stamp duty.

3 Where date of agreement and date of registration are not same

Where the date of an agreement fixing the value of consideration and the date of

registration of immovable property are not same then the stamp duty value may be taken

as on date of the Agreement for transfer and not as on date of registration for such

transfer only if the amount of consideration or a part thereof has been received by way of

an account payee cheque or draft or by use of ECS to a bank account on or before the date

of agreement for transfer.

YES ACADEMY FOR CS 8888 235 235 7.26

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

4 In order to promote digital transactions, the payments or receipts through other notified

electronic modes. Have been proposed to be included in the list of acceptable mode of

payment.

REFERENCE TO VALUATION OFFICER

1 The assesse may claim before any Assessing Officer that the stamp value exceeds the FMV

of the property as on the date of transfer provided the stamp value has not been dispute

in any appeal or revision or reference before any other authority, court or the High Court.

2 In such case the AO may refer the valuation of the capital asset to a VO.

Case Result

If the value determined by the Valuation Value adopted or assessed or assessable for

Officer exceeds the value adopted or the purpose of stamp duty shall be taken as

assessed or assessable for the purpose of full value of consideration.

stamp duty.

If the value determined by the Valuation Value determined by the Valuation Officer

Officer does not exceed the value adopted shall be taken as full value of consideration.

or assessed or assessable for the purpose of

stamp duty.

TREATMENT OF ADVANCE MONEY RECEIVED & FORFIETED [SECTION 51]

1 Where any capital asset, was on any previous occasion, the subject of negotiations transfer,

any advance or other money received and retained by the assessee in respect of such

negotiations, shall be deducted from the cost for which the asset was acquired or the

written down value or the fair market value, as the case may be, in computing the cost of

acquisition.

• Any advance money received and forfeited shall be treated as Income from other source

and hence shall not be deducted from the cost of asset.

• If advance money is received before 31-3-14 then it is to be reduced from the cost of

acquisition and if it is received on or after 1-4-14 then it shall be taxable as income from

other source.

Advance money received by:

Current owner Subtracted from the cost of acquisition

Previous owner Not to be subtracted

Advance money received & forfeited before 31- Subtracted from the cost of acquisition.

03-14

YES ACADEMY FOR CS 8888 235 235 7.27

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

• In case, advance money received exceeds cost of acquisition, the excess will be a

NOTES capital receipt, hence not taxable.

KEY

• Forfeiture of advance money by the transferor due to default of transferee is not

allowed as capital loss in the hands of transferee.

EXEMPTIONS UNDER CAPITAL GAIN

CAPITAL GAIN ARISING FROM THE TRANSFER OF RESIDENTIAL HOUSE PROPERTY [SEC. 54]

1. Who can claim exemption

An individual or a HUF

2. Which asset is qualified for exemption?

Residential house property (SO & LO)

3. Which capital asset is eligible for exemption?

Long Term

4. Which asset should be purchased to claim exemption?

Only one / two [ FA 2019] RHP (Purchased or constructed, old or new) in India

Condition for Purchase of two RHP

1. LTCG does not exceeds 2 cr which means if LTCG exceeds 2cr then assessee can buy

only 1 RHP and not 2.

2. Above option of purchase of 2 RHP is available once in a lifetime which means in

subsequent years assesses can buy only 1 RHP irrespective of amount of Capital gain

5. What is the time limit for acquiring the new asset?

a. For purchase: 1 year backward or 2 year forward from the date of transfer of old

property.

b. For construction: 3 years from the date of transfer.

6. What is capital gain scheme?

a. If the new asset is not acquired up to the date of submission of return of income, then

taxpayer will have to deposit the money in “capital gain deposit account” with a

nationalized bank. If amount is not deposited then capital gain will be taxed in that

particulars year.

b. Even if amount deposited in the scheme, period of acquiring the new asset will be

applicable as above.

c. If amount deposited in scheme is not utilized within the 2/3 years from the date of

transfer of asset then unutilized amount at the end of specified period shall be treated

as LTCG

7. How much is exempt?

Amount invested or capital gains whichever is lower.

8. When exemption will be taken back?

YES ACADEMY FOR CS 8888 235 235 7.28

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

If new asset is transferred within 3 years from the date of its acquisition.

9. What will be tax treatment if exemption is taken back?

In such case, the capital gain on transfer of the new residential property will be calculated

as follows:

Sale consideration of new HP

Less: Original Cost of acquisition minus exemption claimed U/s 54 earlier

= Short/ long term capital gain.

Notes

1 The utilized deposit amount in the Capital Gains Account Scheme, 1988 in the case of an

individual who dies before the expiry of the stipulated period cannot be taxed in the hands

of the deceased. This amount is not taxable in the hands of legal heirs also as the unutilised

portion of the deposit does not partake The character of income in their hands but is only a

part of the estate devolving upon them. [Circular No. 743, dated 06/05/1996]

2 The cost of the land is an integral part of the cost of the residential house, whether

purchased or built.

CAPITAL GAIN ARISING FROM THE TRANSFER OF LAND USED FOR AGRICULTURAL

PURPOSE [SEC. 54B]

1. Who can claim exemption?

An Individual

2. Which asset is qualified for exemption?

Agricultural land

3. Which capital asset is eligible for exemption?

Lon-g term as well as short term

Provided the agricultural land was used by the tax payer or his parents, for agricultural

purposes for a period of two years immediately preceding the date of transfer.

4. Which asset should be purchased to claim exemption?

Agricultural land (rural or urban)

5. What is the time limit for acquiring the new asset?

2 years from the date of transfer of agricultural land.

6. What is capital gain scheme?

Applicable

7. How much is exempt?

Amount invested or capital gains whichever is lower.

8. When exemption will be taken back?

If new asset is transferred within 3 years from the date of its acquisition.

9. What will be tax treatment if exemption is taken back?

YES ACADEMY FOR CS 8888 235 235 7.29

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

In such case, the capital gain on transfer of the new agricultural land will be calculated as

follows.

Sale consideration of new HP

Less: Original Cost of acquisition minus exemption claimed U/s 54B earlier

= Short/ long term capital gain.

CAPITAL GAINS ON COMPULSORY ACQUISITION OF LAND AND BUILDING FORMING PART OF

INDUSTRIAL UNDERTAKING [SEC. 54D]

1. Who can claim exemption?

Any assesse

2. Which asset is qualified for exemption?

Land & Building forming part of industrial undertaking.

3. Which capital asset is eligible for exemption?

Long term as well as short term provided industrial undertaking which was compulsory

acquired by the government was used by the taxpayer for industrial purposes for a period

of two years immediately preceding the date of acquisition.

4. Which asset should be purchased to claim exemption?

Land or Building for industrial purpose.

5. What is the time limit for acquiring the new asset?

3 year from the date of receiving initial compensation.

6. What is capital gain scheme?

Applicable

7. How much is exempt?

Amount invested or capital gains whichever is lower.

8. When exemption will be taken back?

If new asset is transferred within 3 years from the date of its acquisition.

9. What will be tax treatment if exemption is taken back?

In such case, the capital gain on transfer of the new land and building will be calculated as

follows.

Sale consideration of new HP

Less: Original Cost of acquisition minus exemption claimed U/s 54D earlier

= Short/ long term capital gain.

CAPITAL GAINS ON TRANSFER OF ASSETS IN CASES OF SHIFTING OF INDUSTRIAL

UNDERTAKING [SECTION 54G]

1. Who can claim exemption?

Any person

2. Which asset is qualified for exemption?

YES ACADEMY FOR CS 8888 235 235 7.30

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

Land, Building, plant or machinery in order to shift an industrial undertaking from urban

area to rural area.

3. Which capital asset is eligible for exemption?

Short term / Long term

4. Which asset should be purchased to claim exemption?

Land, Building, plant or machinery in order to shift an industrial undertaking to rural area.

5. What is the time limit for acquiring the new asset?

For purchase: 1 year backward or 3 year forward from the date of transfer

What is capital gain scheme?

a If the new asset is not acquired up to the date of submission of return of income, then

taxpayer will have to deposit the money in “capital gain deposit account” with a

nationalized bank. If amount is not deposited then capital gain will be taxed in that

particulars year.

b Even if amount deposited in the scheme, period of acquiring the new asset will be

applicable as above.

c If amount deposited in scheme is not utilized within 3 years from the date of transfer

of asset then unutilized amount at the end of specified period shall be treated as

STCG/LTCG depending upon original gain.

6. How much is exempt?

Amount invested or capital gains whichever is lower.

7. When exemption will be taken back?

If new asset is transferred within 3 years from the date of its acquisition.

8. What will be tax treatment if exemption is taken back?

In such case, the capital gain on transfer of the new agricultural land will be calculated as

follows.

Sale consideration of new HP

Less: Original Cost of acquisition minus exemption claimed U/s 54G earlier

= Short/ long term capital gain.

CAPITAL GAINS ON TRANSFER OF ASSETS IN CASES OF SHIFTING OF INDUSTRIAL

UNDERTAKING FROM URBAN AREA TO ANY SEZ [SEC. 54GA]

1. Who can claim exemption?

Any person

2. Which asset is qualified for exemption?

Land, Building, plant or machinery in order to shift an industrial undertaking from urban

area to SEZ.

3. Which capital asset is eligible for exemption?

Short term / Long term

4. Which asset should be purchased to claim exemption?

YES ACADEMY FOR CS 8888 235 235 7.31

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

Land, Building, plant or machinery in order to shift an industrial undertaking to SEZ.

5. What is the time limit for acquiring the new asset?

For purchase: 1 year backward or 3 year forward from the date of transfer.

6. What is capital gain scheme?

a If the new asset is not acquired up to the date of submission of return of income, then

taxpayer will have to deposit the money in “capital gain deposit account” with a

nationalized bank. If amount is not deposited then capital gain will be taxed in that

particulars year.

b Even if amount deposited in the scheme, period of acquiring the new asset will be

applicable as above.

c If amount deposited in scheme is not utilized within 3 years from the date of transfer

of asset then unutilized amount at the end of specified period shall be treated as

STCG/LTCG depending upon original gain.

7. How much is exempt?

Amount invested or capital gains whichever is lower.

8. When exemption will be taken back?

If new asset is transferred within 3 years from the date of its acquisition.

9. What will be tax treatment if exemption is taken back?

In such case, the capital gain on transfer of the new agricultural land will be calculated as

follows Sale consideration of new land.

CAPITAL GAINS NOT TO BE CHARGED ON INVESTMENT IN CERTAIN BONDS [SEC. 54EC]

1. Who can claim exemption?

Any assesse

2. Which asset is qualified for exemption?

There should be transfer of a long-term capital asset being Land or building or both.

3. Which asset should be purchased to claim exemption?

Long term capital asset means specified bonds, redeemable after 5 years, issued on or

after 01/04/2018 by the national Highways Authority of India (NHAI) or the Rural

Electrification Limited (RECL) or any other notified by the Central Government in this

behalf.

Note: The investment made in the long term specified asset noted above by any assessee

during any financial year in which the original assets are transferred and in the subsequent

FY cannot exceed Rs. 50 lakhs.

4. What is the time limit for acquiring the new asset?

6 months from the date of transfer of long term asset.

5. What is capital gain scheme?

Not applicable.

YES ACADEMY FOR CS 8888 235 235 7.32

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

6. How much is exempt?

Amount invested or capital gains whichever is lower.

7. When exemption will be taken back?

If new asset is transferred or converted into money within 5 years from the date of its

acquisition.

8. What will be tax treatment if exemption is taken back?

In such case, the capital gain arising on transfer of original asset which was not charged

to tax, will be treated of long term capital gain of the respective year.

Note: Taking any loan or Advance on the security of the Specified Asset, is deemed to be

transfer of specified asset on the date on which such loan or advance taken.

EX EMPTIONS FROM CAPITAL GAINS ON INVESTMENT IN UNITS OF A SPECIFIED FUND [SEC. 54EE]

1. Applicability

All Assessee

2. Asset Transferred

Transfer of Long Term Capital Asset (Called Original Asset)

3. New Asset to be acquired

Long – Term Specified Asset, (notified by Central Government).

4. What is capital gain scheme?

Not applicable.

5. Time Limit for Investment

6 months from the date of original transfer

6. Limit on Investment Amount in New Asset

• Investment made in the Long –Term Specified Asset by an Assessee during any

financial year does not exceed Rs. 50 Lakhs.

• Investment made by an assessee in the Long-Term Specified Asset, from Capital Gains

arising from the transfer of one or more Original Assets, during the financial year in

which the Original Asset or Assets are transferred and in the subsequent financial

year does not exceed Rs. 50 Lakhs.

7. Amount of Exemption

Amount invested or capital gain whichever is less

8. Holding Period of New Asset

Three Years from the date of its acquisition.

9. Sale of New Asset within holding period

Long Term Capital Gain exempted u/s 54EE shall be deemed to be Income (as LTCG) of the

previous year in which Long Term Specified Asset is transferred.

Note: Taking any loan or Advance on the security of the Specified Asset, is deemed to be

transfer of specified asset on the date on which such loan or advance taken.

YES ACADEMY FOR CS 8888 235 235 7.33

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

CAPITAL GAINS ON TRANSFER OF A LONG TERM CAPITAL ASSET OTHER THAN

A HOUSE PROPERTY [SEC. 54F]

1. Who can claim exemption?

An Individual or HUF

2. Which asset is qualified for exemption?

Any long term capital asset other than a residential house property provided on the date

of transfer the taxpayer does not own more than one residential house property.

3. Which capital asset is eligible for exemption?

Long term.

4. Which asset should be purchased to claim exemption?

One Residential house property (purchased or constructed, (old or new) in India.

5. What is the time limit for acquiring the new asset?

A For purchase, 1 year backward or 2 year forward from the date of transfer of old

property.

B For construction: 3 years from the date of transfer.

C In case compulsory acquisition above period will start from the date of receiving initial

compensation.

6. What is capital gain scheme?

A If the new asset is not acquired up to the date of submission of return of income, then

taxpayer will have to deposit the money in “capital gain deposit account” with a

nationalized bank. If amount is not deposited then capital gain will be taxed in that

particulars year.

B Even if amount deposited in the scheme period of acquiring the new asset will be

applicable as above.

C If amount deposited in scheme is not utilized within 2 years from the date of transfer

of asset then unutilized amount at the end of specified period shall be treated as LTCG

which will be calculated as under

Unutilised amount X Amount of original Capital gain

Net sale consideration

7. How much is exempt?

Cost of new house X Capital gains

Net Sale Consideration

8. When exemption will be taken back?

Case 1 If new asset is transferred within 3 years from the date of its acquisition or

construction.

Case 2 If the assessee purchases, within a period of two years of the transfer of original

asset or constructs within a period of three years of the transfer of such asset,

a residential house other than new house.

9. What will be tax treatment if exemption is taken back?

YES ACADEMY FOR CS 8888 235 235 7.34

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

Case 1 Capital gains which arise on the transfer of the new house will be taken as LTCG/

STCG & exemption which was allowed earlier shall be treated as LTCG of the year

in which the new asset is transferred.

Case 2 Exemption which was allowed earlier shall be treated as LTCG of the year in which

the new asset is purchased or constructed.

which LTCG such deduction should be claimed

DEDUCTION FROM CAPITAL GAIN ON TRANSFER OF RESIDENTIAL PROPERTY FOR INVESTMENT

IN ELIGIBLE COMPANY [SEC. 54GB]

1. Who can claim?

Individual & HUF

2. Which specified asset is Transfer

1. Assessee must have transferred a long-term eligible for exemption capital asset being

residential property (i.e. a house or a plot of land)

2. Such transfer should take place during 01-04-2013 and 31 03-2022. [Finance Act

2021]

3. Which asset should be purchased to claim exemption?

Equity shares of Eligible company.

4. What is the time limit to acquire new asset

a. Assessee must subscribe in the equity shares of an eligible company within the due date

of furnishing income tax return for the relevant assessment year.

b. The company should purchase new asset within 1 year from the date of subscription

in equity shares by the assessee.

c. Capital Gain Deposit Scheme

The amount of the net consideration, which has been received by the company for issue

of shares to the assessee to the extent it is not utilized by the company for the

purchase of the new asset before the due date of furnishing of the return of income by

the assessee u/s. 139, shall be deposited by the company, before the said due date in

the Capital Gain Deposit Scheme.

5. How much is exempt

Minimum of the following:

Investment in the new asset by the

Eligible company

× 𝐶apital Gain

Net sale consideration

6. Is it possible to revoke the exemption

1 If the newly acquired asset is transferred by the eligible company within 5 years from

the date of its acquisition, benefit availed earlier shall be revoked.

2 If the equity shares of the eligible company is transferred by the assess within 5 years

& 3 years in case of computer or computer software by an eligible start up [ FA

2019] from the date of its acquisition, benefit availed earlier shall be revoked.

YES ACADEMY FOR CS 8888 235 235 7.35

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

3 If the amount held in Capital Gains, Deposit Account Scheme (1988), is unutilized,

benefit availed earlier shall be revoked.

7. Treatment of revoked income

• Revocation due to case 1 & 2 above:

Such revoked income (exemption or proportionate thereof) shall be taxable in the hands

of the assessee (i.e., the person who has transferred residential property) as long-term

capital gain in the year of revocation of condition.

Note:

It is to be noted that capital gains, arising on transfer of shares or of the new asset, in

the hands of the assessee or the company, as the case may be is also taxable separately.

• Revocation due to case 3 above.

Chargeable amount in hands of the assessee (i.e. the person who has transferred

residential property) is:- (Unutilised amount for which benefit under section 54GB is

availed X Original capital gain) (Net sale consideration)

Taxation as long term capital gain of the previous year in which 1

year from the date of the subscription in equity shares by the assessee expires.

1. Meaning of Eligible Company:

a It is an Indian company:

The company should be incorporated during the period from the 1st day of April of the

previous year relevant to the assessment year in which the capital gain arises to the due

date of furnishing of return of income u/s. 139(1) by the assessee.

E.g. : If Mr. X has transferred his residential property as on 10/8/2020, then company

should be incorporated between 01/04/2020 and due date of furnishing return u/s.

139(1) by Mr. X (i.e. 31/07/2022 assuming his accounts are not liable for tax audit).

b The company is engaged in the business of manufacture of an article or a thing.

c It is a company in which the assessee has more than 25% share capital or more than

25% voting rights after the subscription in shares by the assessee; and

d It is a company which equalities to be a small or medium enterprise (i.e. SME) under the

Micro. Small and Medium Enterprises Act, 2006 (i.e. investment in plant and machinery

is more than Rs. 25 lakhs but does not exceed Rs. 10 crore). or is an eligible start up

New asset means new plant and machinery but does not include:

a Any machinery or plant which before its installation by the assessee, was used either

within or outside India by any other person (Second hand machine),

b Any machinery or plant installed in any office premises or any residential accommodation,

including accommodation in the nature of a guest-house.

c Any office appliances including computers or computer software;

Note: W.e.f. 1/4./2016, New Asset includes Computers or Computer Software in the

case of an Eligible Start-Up, being a technology driven Start-Up so certified by the

Inter-Ministerial Board of Certification notified by the Central Government.

YES ACADEMY FOR CS 8888 235 235 7.36

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

d Any vehicle; or

e Any machinery or plant for which 100% deduction is allowed (whether by way of

depreciation or otherwise) in computing the income chargeable under the head “profits

and gains of business or profession” of any previous year.

2. What is eligible start up or eligible business

Eligible business means a business which involves innovation, development, deployment, or

commercialized of new products processes or service driven by technology or intellectual

property.

Eligible start-ups means a company engaged in eligible business and satisfies he following

conditions:

a It is incorporated during 1/4/2016 – 31/3/2022

b Total turnover of its business does not exceed Rs. 100 crore in any of the PY during

1/4/2016 to 31/3/2022

c It holds a certificate of eligible business from the enter – Ministerial Board of

certification notified by the CG]

EXEMPTION UNDER MORE THAN ONE PROVISION

An assessee can claim exemption under more than one section (from section 54 to 54GB) if

conditions of the respective sections are fulfilled. E.g. an assessee deriving long term capital

gain on sale of a residential house can claim benefit under section 54 by investing a part of the

capital gain in acquisition of a new residential house property and as well as claim benefit u/s

54E by investing remaining part of the capital gain in acquisition of specified securities.

EXTENSION OF TIME FOR ACQUIRING NEW ASSET OR DEPOSITING OR

INVESTING AMOUNT OF CAPITAL GAIN (SECTION 54H)

1. Applicability

• Where the transfer of the original asset is by way of compulsory acquisition under any

law, and

• Amount of compensation awarded for such acquisition is not received by the assessee on

the date of such transfer.

2. Treatment

The period for acquiring the new asset or the period available to the assessee for depositing

the amount of capital gain in relation to such compensation as is not received on the date of

the transfer, shall be reckoned from the date of receipt of such compensation.

YES ACADEMY FOR CS 8888 235 235 7.37

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

KEY NOTE a It is irrespective of anything contained in section 54, 54B, 54D, 54EC and 54F.

Enhanced compensation: In case of enhanced compensation, the period for acquiring

b

the new asset shall commence from the date of receipt of such enhanced

compensation.

REFERENCE TO VALUATION OFFICER (SECTION 55A)

With a view to ascertaining the fair market value of a capital asset for the purpose of this

chapter (e.g. section 45(1A), 45(2), 45(4), 55 and 2(47)) the Assessing Officer may refer the

valuation of capital asset to a valuation officer. Cases where reference to valuation officer can

be made:

1. Where the value of the asset as claimed by the assessee is in accordance with the

estimate made by a registered value.

If the Assessing Officer is of opinion that the value so claimed is at variance with its fair

market value.

2. In any other case

If the Assessing Officer is of the opinion:

1 That the fair market value of the asset exceeds the value of the asset as claimed by

the assessee by more than

• 15% of the value of the asset as so claimed; or

• By more than Rs.25,000 whichever is less

2 That having regard to the nature of the asset and other relevant circumstances, it is

necessary to do so.

YES ACADEMY FOR CS 8888 235 235 7.38

CMA VIPUL SHAH CS EXECUTIVE – JUNE/ DEC 23 CAPITAL GAIN

SUMMARY OF SECTION 54

Time limit

Applicabl Deposit Revocation of

Sec. Nature New Asset for Exemption

e scheme benefit

investment

54 Long term Individual A Within 1 Capital gains Yes If new asset

Residentia or HUF Residential year before or amount is sold within

l House House in or 2 years invested, 3 years, then

India after the whichever is benefit

( 1 or 2) date of less availed earlier

transfer in will be

case of revoked and

purchase, or shall be

within 3 reduced from

years after cost of new

the date of asset.

transfer, in

case of new