Professional Documents

Culture Documents

Dolat Capital Axis Bank Company Update

Uploaded by

cerohad333Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dolat Capital Axis Bank Company Update

Uploaded by

cerohad333Copyright:

Available Formats

Axis Bank

BUY

Axis Bank to acquire CitiBank’s India Consumer Business CMP Rs 750

Axis Bank today announced the signing of an agreement for acquisition Target / Upside Rs 970 / 29%

of CitiBank’s (India) consumer business including credit cards, retail NIFTY 17,498

banking, wealth management, consumer loans, and Citicorp’s (Citi’s

NBFC) CV/CE and PL portfolios. The transaction, expected to be closed in Scrip Details

the next 9-12 months, will also include transfer of ~3,600 Citi employees Equity / FV Rs 6,128mn / Rs 2

supporting the consumer businesses to Axis Bank. The deal adds ~3mn Market Cap Rs 2,299bn

customers to the Bank, largely complimentary to its existing base. The

acquisition gives strategic thrust to Axis in closing gap with peers and aids USD 30.3bn

long-term return ratios (starting FY25) as synergies accrue. 52-week High/Low Rs 867/ 627

Contours of the Deal Avg. Volume (no) 11,979,200

As per the deal, Axis would pay an all-cash consideration of Rs123bn on Bloom Code AXSB IN

closing of the transaction and incur additional Rs15bn worth integration

costs over the next 2 years. Liabilities acquired under the deal (deposits Price Performance 1M 3M 12M

worth Rs502bn) would be fully matched by advances (Rs274bn) and cash. Absolute (%) 1 12 8

On the liabilities side, Citibank’s relatively small but CASA heavy portfolio Rel to NIFTY (%) (3) 11 (9)

Company Update

(CASA ratio of ~81%) would lead to ~200bps improvement in Axis’ CASA

ratio. On the assets side, CitiBank’s credit card portfolio (worth Rs89bn), Shareholding Pattern

also a part of the deal, is largely comprised of affluent/super affluent Jun'21 Sep'21 Dec'21

customers and is complementary to Axis’ existing portfolio. There is

protection (repricing mechanism) built in for Axis in case business Promoters 11.7 11.6 9.7

parameters deteriorate during the transition period, ensuring that both Citi MF/Banks/FIs 24.3 25.3 30.2

and Axis have skin in the game. FIIs 52.5 51.4 47.4

Synergies to accrue from FY25E Public / Others 11.5 11.7 12.6

Axis has paid for the Citi franchise- customer relationships, Citi phone

banking and experienced team- which the bank would have taken a long Axis Bank Relative to SENSEX

time to put up together on its own. Over the longer term, there will be 120

synergies from strong cross sell opportunity given the breadth of services

Axis can offer to Citi’s loan and wealth customers, with miniscule additional

110

cost of global support centres leading to cost benefits. Axis expects cost

savings of 30-40% after 2 years of transaction closure. Consequently, the

business is expected to turn RoE accretive by CY24. 100

A synergistic acquisition; Benefits will take time to accrue

90

Valued at 18x trailing P/E after factoring in estimated equity requirement,

we find the valuations fair. The consolidated franchise will be able to

generate healthy RoAs at 1.7-1.8% in our view (~1.6% for standalone Axis) 80

given the business synergies. This is however has a long gestation given the

near term addition opex costs Axis needs to incur. We value the bank at 70

Jul-21

Jun-21

Aug-21

Sep-21

Mar-21

Apr-21

Oct-21

Nov-21

Dec-21

Jan-22

Feb-22

May-21

2.3x Mar-24E P/ABV, and raise TP to Rs970 (from Rs930 earlier). RoEs for

FY25/26E at ~18% benefits from rise in leverage and will be impacted by

additional capital raise.

AXSB SENSEX

.

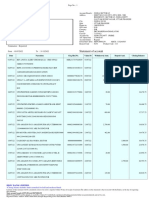

FINANCIALS (Rs Mn) VP - Research: Mona Khetan

Particulars FY20A FY21A FY22E FY23E FY24E Tel: +91 22 40969762

Net Interest Income 252,062 292,391 331,486 401,531 458,160 E-mail: monak@dolatcapital.com

Growth(%) 16.1 16.0 13.4 21.1 14.1 Associate: Arjun Bagga

PPOP 234,382 257,021 243,882 307,477 373,352 Tel: +9122 40969766

PAT 16,273 65,885 122,827 173,310 210,168 E-mail: arjunb@dolatcapital.com

EPS (Rs) 5.8 21.5 40.1 56.6 68.6

ABV (Rs) 267.4 308.4 344.2 354.7 416.1 Associate: Akshay Gupta

ROA (%) 0.2 0.7 1.2 1.4 1.5

Tel: +9122 40969714

E-mail: akshayg@dolatcapital.com

ROE(%) 2.1 7.1 11.5 15.3 16.9

PER(x) 130.1 34.9 18.7 13.3 10.9

P/ABV (x) 2.8 2.4 2.2 2.1 1.8

March 30, 2022

Transition expected to be completed by H1FY25

Source: DART, Company

Premium Credit Card portfolio to lead to higher spends per card

Source: DART, Company

Axis’ CASA ratio to improve due given high CASA % for CitiBank

Source: DART, Company

March 30, 2022 2 Axis Bank

Advances Mix for CitiBank

Mortgage Credit Cards

36% 33%

Personal Loans &

Ready Credit

8%

Asset Backed Small Business

Finance Lending

19% 4%

Source: DART, Company

Change in normalized metrics for standalone and merged bank

Y/E Mar (%) Axis Axis (merged,

(standalone) FY25E)

NII / Assets 3.2 3.3

Other Income / Assets 1.4 1.6

Net Operating Income / Assets 4.7 5.0

Total Opex / Assets 2.0 2.0

Operating Profits / Assets 2.7 2.9

Op Profit ex Except Items / Assets 2.7 2.9

Provisions / Assets 0.6 0.7

Profit Before Tax / Assets 2.0 2.2

Tax Expenses / Assets 0.5 0.6

RoA 1.5 1.7

Leverage (x) 9.9 10.5

RoE 15.2 17.9

Source: Company, DART

March 30, 2022 3 Axis Bank

Key Financials post acquisition

Y/E March FY20 FY21 FY22E FY23E FY24E FY25E FY26E

Loan & Advances 5,714,242 6,237,202 7,048,038 8,246,205 9,483,135 10,905,606 12,541,446

Net Interest Income 252,062 292,391 331,486 401,531 458,160 517,342 587,116

PPP ex Except. Items 234,382 257,021 243,882 307,477 373,352 455,069 542,067

Reported Profits 16,273 65,885 122,827 173,310 210,168 262,709 313,681

Earnings Per Share (Rs) 5.8 21.5 40.1 56.6 68.6 85.7 102.4

P/E (x) 78.9 21.2 11.3 8.0 6.6 5.3 4.4

Adj. BV (Rs) 267.4 308.4 344.2 354.7 416.1 494.1 587.9

P/ABV (x) 1.7 1.5 1.3 1.3 1.1 0.9 0.8

Gross NPAs Ratio (%) 4.9 3.7 3.0 2.4 2.2 2.0 1.9

Adj. RoA 0.2 0.7 1.16 1.44 1.53 1.68 1.77

Adj. RoE 2.1 7.1 11.5 15.3 16.9 17.9 18.1

Source: Company, DART

Du pont analysis for the merged entity

Y/E Mar (%) FY20 FY21 FY22E FY23E FY24E FY25E FY26E

NII / Assets 2.9 3.1 3.1 3.3 3.3 3.3 3.3

Other Income / Assets 1.8 1.6 1.4 1.6 1.6 1.6 1.7

Net Operating Income / Assets 4.7 4.6 4.5 4.9 4.9 5.0 5.0

Employee Exp. / Assets 0.6 0.6 0.7 0.8 0.7 0.7 0.7

Other Opex/ Assets 1.4 1.3 1.5 1.6 1.5 1.3 1.3

Total Opex / Assets 2.0 1.9 2.24 2.35 2.21 2.04 1.94

Operating Profits / Assets 2.7 2.7 2.3 2.5 2.7 2.9 3.1

Exceptional Items / Assets - - - - - - -

Op Profit ex Except Items / Assets 2.7 2.7 2.3 2.5 2.7 2.9 3.1

Provisions / Assets 2.2 1.8 0.8 0.6 0.7 0.7 0.7

Profit Before Tax / Assets 0.6 0.9 1.5 1.9 2.0 2.2 2.4

Tax Expenses / Assets 0.4 0.2 0.4 0.5 0.5 0.6 0.6

RoA 0.2 0.7 1.2 1.4 1.5 1.7 1.8

Leverage (x) 10.8 9.8 10.0 11.2 10.9 10.5 10.1

RoE 2.1 7.1 11.5 15.3 16.9 17.9 18.1

Source: Company, DART

Contours of the deal and expectations

Source: Company, DART

March 30, 2022 4 Axis Bank

1 yr forward P/ABV chart

(x)

1-yr FWD P/ABV

3.5

3.0

2.5

2.0

1.5

1.0

0.5

Jul-15

Jul-20

Mar-12

Aug-12

Apr-14

Sep-14

Feb-15

May-16

Oct-16

Mar-17

Aug-17

Apr-19

Sep-19

Feb-20

May-21

Oct-21

Mar-22

Jan-13

Jun-13

Nov-13

Dec-15

Jan-18

Jun-18

Nov-18

Dec-20

P/ABV Mean +1 STD -1 STD +2 STD -2 STD

Source: Company, DART

Concall Highlights

Deal Dynamics

Funding of the deal would be done through internal accruals. The balance

sheet is strong enough to fund the transaction and growth capital would be

raised when required.

The bank will incur integration costs of Rs15bn (over two year period) post

completion of transaction. This includes Rs12bn to Citi for the services it will

provide to the bank during transition and balance Rs3bn at bank’s end for

integration.

Non-compete agreements are also a part of the deal for the

portfolios/services being purchased. While Citi may retain the corporate

relationships, all associated individual accounts will be transferred to Axis.

Axis needs to take customer consent which will be done over the next 9-12

months. Inputs like customer openness to Axis were taken in consideration

while arriving at bid price.

Axis has paid for the Citi franchise- customer relationships, Citi phone

banking and experienced team- which the bank would have taken a long

time to put up together on its own. Key synergies include strong cross sell

opportunity given the breadth of services Axis can offer and miniscule

additional cost of global support centres.

The assets and liabilities have held up well in Q3FY22 compared to the

reference balance sheet (of Q1FY22). There is protection (repricing

mechanism) built in for Axis in case business parameters deteriorate during

the transition period. Guidance of RoE accretion by CY24 includes possible

attrition and expected portfolio growth.

Axis will find solutions to ensure that Citi’s employee continue with Axis

Bank. Overlap of incoming Citi employees will be taken care of by growth in

the portfolio and attrition. Salary differences between Axis and Citi are not

as high as perceived.

While Axis didn’t have detailed customer data, surveys indicated low

overlaps with Bank’s own portfolio.

March 30, 2022 5 Axis Bank

Portfolio characteristics

Axis’ SA rates are higher than Citi’s SA rates.

Excluding mortgages, average tenure for the portfolio is ~28months. For PL

the average tenure is 6 months. And for ABF it is 20-25 months.

The two CC portfolios are largely complementary with Citi’s strength being

top 8 markets, affluent/super affluent customers, while Axis is spread across,

with mass affluent customer category.

Customer attrition over the last few months has not been alarming.

High C/I ratio for Citi provides an opportunity for optimisation.

March 30, 2022 6 Axis Bank

Profit and Loss Account (Rs Mn)

Particulars FY21A FY22E FY23E FY24E

Interest Income 636,453 698,286 823,797 951,446

Interest expenses 344,062 366,800 422,266 493,286

Net interest income 292,391 331,486 401,531 458,160

Other incomes 148,382 150,022 189,557 219,456

Total expenses 183,752 237,627 283,611 304,264

- Employee cost 61,640 77,050 90,919 100,011

- Other 122,111 160,576 192,692 204,253

Pre provisioning profit 257,021 243,882 307,477 373,352

Provisions 168,963 79,741 75,872 92,491

Profit before taxes 88,058 164,141 231,606 280,861

Tax provision 22,173 41,314 58,295 70,693

Profit after tax 65,885 122,827 173,310 210,168

Adjusted profit 65,885 122,827 173,310 210,168

Balance Sheet (Rs Mn)

Particulars FY21A FY22E FY23E FY24E

Sources of Funds

Equity Capital 6,128 6,128 6,128 6,128

Reserves & Surplus 1,009,903 1,114,133 1,145,096 1,336,667

Minority Interest - 0 0 0

Net worth 1,016,030 1,120,260 1,151,224 1,342,795

Borrowings 1,428,732 1,541,685 1,396,615 1,773,054

- Deposits 7,073,061 8,093,844 9,776,308 10,891,615

- Other interest bearing liabilities 0 0 0 0

Current liabilities & provisions 443,362 488,745 585,003 601,313

Total Liabilities 9,961,184 11,244,534 12,909,151 14,608,776

Application of Funds

Cash and balances with RBI 617,298 760,931 927,663 989,891

Investments 2,261,196 2,463,601 2,667,473 2,890,503

Advances 6,237,202 7,048,038 8,246,205 9,483,135

Fixed assets 42,450 48,471 51,968 56,711

Other current assets, loans and advances 803,038 923,493 1,015,843 1,188,536

Total Assets 9,961,184 11,244,534 12,909,151 14,608,776

E – Estimates

March 30, 2022 7 Axis Bank

Important Ratios

Particulars FY21A FY22E FY23E FY24E

(A) Margins (%)

Yield on advances 8.0 7.8 8.1 8.2

Yields on interest earning assets 7.3 7.2 7.5 7.5

Yield on investments 6.8 6.6 6.6 6.7

Costs of funds 4.2 4.0 4.1 4.1

Cost of deposits 4.9 4.0 3.8 3.8

NIMs 3.4 3.4 3.6 3.6

(B) Asset quality and capital ratios (%)

GNPA 3.7 3.0 2.4 2.2

NNPA 1.1 0.9 0.8 0.7

PCR 72.4 72.0 72.0 72.0

Slippages 3.0 3.2 2.3 2.2

NNPA to NW 6.9 5.9 5.6 5.1

CASA 45.1 45.0 47.0 47.0

CAR 19.1 19.1 16.2 16.5

Tier 1 16.5 16.0 13.5 13.8

Credit - Deposit 88.2 87.1 84.3 87.1

(C) Dupont as a percentage of average assets

Interest income 6.7 6.6 6.8 6.9

Interest expenses 3.6 3.5 3.5 3.6

Net interest income 3.1 3.1 3.3 3.3

Non interest Income 1.6 1.4 1.6 1.6

Total expenses 1.9 2.2 2.3 2.2

- cost to income 41.7 49.4 48.0 44.9

Provisions 1.8 0.8 0.6 0.7

Tax 0.2 0.4 0.5 0.5

RoA 0.7 1.2 1.4 1.5

Leverage 9.8 10.0 11.2 10.9

RoE 7.1 11.5 15.3 16.9

RoRwa 0.3 1.0 1.7 2.0

(D) Measures of Investments

EPS - adjusted 21.5 40.1 56.6 68.6

BV 331.6 365.6 375.8 438.3

ABV 308.4 344.2 354.7 416.1

DPS 5.0 5.0 5.0 5.0

Dividend payout ratio 0.0 0.0 0.0 0.0

(E) Growth Ratios (%)

Net interest income 16.0 13.4 21.1 14.1

PPoP 9.7 (5.1) 26.1 21.4

Adj PAT 304.9 86.4 41.1 21.3

Advances 9.2 13.0 17.0 15.0

Total borrowings (3.4) 7.9 (9.4) 27.0

Total assets 8.8 12.9 14.8 13.2

(F) Valuation Ratios

Market Cap (Rs. mn) 2,299,191 2,299,191 2,299,191 2,299,191

CMP (Rs.) 750 750 750 750

P/E (x) 34.9 18.7 13.3 10.9

P/BV (x) 2.3 2.1 2.0 1.7

P/ABV (x) 2.4 2.2 2.1 1.8

Div Yield (%) 0.7 0.7 0.7 0.7

E – Estimates

March 30, 2022 8 Axis Bank

DART RATING MATRIX

Total Return Expectation (12 Months)

Buy > 20%

Accumulate 10 to 20%

Reduce 0 to 10%

Sell < 0%

Rating and Target Price History

Month Rating TP (Rs.) Price (Rs.)

(Rs) AXSB Target Price Apr-21 BUY 875 700

950 Oct-21 BUY 930 788

880 Jan-22 BUY 930 705

*Price as on recommendation date

810

740

670

600

Apr-21

May-21

Jun-21

Jan-22

Oct-21

Nov-21

Dec-21

Mar-21

Jul-21

Aug-21

Sep-21

Feb-22

DART Team

Purvag Shah Managing Director purvag@dolatcapital.com +9122 4096 9747

Amit Khurana, CFA Head of Equities amit@dolatcapital.com +9122 4096 9745

CONTACT DETAILS

Equity Sales Designation E-mail Direct Lines

Dinesh Bajaj VP - Equity Sales dineshb@dolatcapital.com +9122 4096 9709

Kapil Yadav VP - Equity Sales kapil@dolatcapital.com +9122 4096 9735

Jubbin Shah VP - Equity Sales jubbins@dolatcapital.com +9122 4096 9779

Yomika Agarwal VP - Equity Sales yomika@dolatcapital.com +9122 4096 9772

Anjana Jhaveri VP - FII Sales anjanaj@dolatcapital.com +9122 4096 9758

Lekha Nahar AVP - Equity Sales lekhan@dolatcapital.com +9122 4096 9740

Equity Trading Designation E-mail

P. Sridhar SVP and Head of Sales Trading sridhar@dolatcapital.com +9122 4096 9728

Chandrakant Ware VP - Sales Trading chandrakant@dolatcapital.com +9122 4096 9707

Shirish Thakkar VP - Head Domestic Derivatives Sales Trading shirisht@dolatcapital.com +9122 4096 9702

Kartik Mehta Asia Head Derivatives kartikm@dolatcapital.com +9122 4096 9715

Dinesh Mehta Co - Head Asia Derivatives dinesh.mehta@dolatcapital.com +9122 4096 9765

Bhavin Mehta VP - Derivatives Strategist bhavinm@dolatcapital.com +9122 4096 9705

Dolat Capital Market Private Limited.

Sunshine Tower, 28th Floor, Senapati Bapat Marg, Dadar (West), Mumbai 400013

Analyst(s) Certification

The research analyst(s), with respect to each issuer and its securities covered by them in this research report, certify that: All of the views expressed in

this research report accurately reflect his or her or their personal views about all of the issuers and their securities; and No part of his or her or their

compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this research report.

I. Analyst(s) and Associate (S) holding in the Stock(s): (Nil)

II. Disclaimer:

This research report has been prepared by Dolat Capital Market Private Limited. to provide information about the company(ies) and sector(s), if any,

covered in the report and may be distributed by it and/or its affiliated company(ies) solely for the purpose of information of the select recipient of this

report. This report and/or any part thereof, may not be duplicated in any form and/or reproduced or redistributed without the prior written consent of

Dolat Capital Market Private Limited. This report has been prepared independent of the companies covered herein. Dolat Capital Market Private Limited.

and its affiliated companies are part of a multi-service, integrated investment banking, brokerage and financing group. Dolat Capital Market Private

Limited. and/or its affiliated company(ies) might have provided or may provide services in respect of managing offerings of securities, corporate finance,

investment banking, mergers & acquisitions, financing or any other advisory services to the company(ies) covered herein. Dolat Capital Market Private

Limited. and/or its affiliated company(ies) might have received or may receive compensation from the company(ies) mentioned in this report for

rendering any of the above services. Research analysts and sales persons of Dolat Capital Market Private Limited. may provide important inputs to its

affiliated company(ies) associated with it. While reasonable care has been taken in the preparation of this report, it does not purport to be a complete

description of the securities, markets or developments referred to herein, and Dolat Capital Market Private Limited. does not warrant its accuracy or

completeness. Dolat Capital Market Private Limited. may not be in any way responsible for any loss or damage that may arise to any person from any

inadvertent error in the information contained in this report. This report is provided for information only and is not an investment advice and must not

alone be taken as the basis for an investment decision. The investment discussed or views expressed herein may not be suitable for all investors. The user

assumes the entire risk of any use made of this information. The information contained herein may be changed without notice and Dolat Capital Market

Private Limited. reserves the right to make modifications and alterations to this statement as they may deem fit from time to time. Dolat Capital Market

Private Limited. and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell

the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other

compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such

company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions. This

report is neither an offer nor solicitation of an offer to buy and/or sell any securities mentioned herein and/or not an official confirmation of any

transaction. This report is not directed or intended for distribution to, or use by any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would

subject Dolat Capital Market Private Limited. and/or its affiliated company(ies) to any registration or licensing requirement within such jurisdiction. The

securities described herein may or may not be eligible for sale in all jurisdictions or to a certain category of investors. Persons in whose possession this

report may come, are required to inform themselves of and to observe such restrictions.

For U.S. Entity/ persons only: “This Report is considered independent third-party research and was prepared by Dolat Capital Market Private Limited,

with headquarters in India. The distribution of this Research is provided pursuant to the exemption under Rule 15a-6(a) (2) and is only intended for an

audience of Major U.S. Institutional Investors (MUSIIs) as defined by Rule 15a-6(b)(4). This research is not a product of StoneX Financial Inc. Dolat Capital

Market Private Limited has sole control over the contents of this research report. StoneX Financial Inc. does not exercise any control over the contents

of, or the views expressed in, any research reports prepared by Dolat Capital Market Private Limited and under Rule 15a-6(a) (3), any U.S. recipient of this

research report wishing to affect any transaction to buy or sell securities or related financial instruments based on the information provided in this

research report should do so only through StoneX Financial Inc. Please contact Gene Turok at +1 (212) 379-5463 or email gene.turok@stonex.com and/or

Igor Chernomorskiy at +1 (212)379-5463 or email Igor.Chernomorskiy@stonex.com. Under no circumstances should any U.S. recipient of this research

report effect any transaction to buy or sell securities or related financial instruments through the Dolat Capital Market Private Limited.”

Dolat Capital Market Private Limited.

Corporate Identity Number: U65990DD1993PTC009797

Member: BSE Limited and National Stock Exchange of India Limited.

SEBI Registration No: BSE - INZ000274132, NSE - INZ000274132, Research: INH000000685

Registered office: Unit no PO6-02A - PO6-02D, Tower A, WTC, Block 51, Zone-5, Road 5E, Gift City, Gandhinagar, Gujarat – 382355

Board: +9122 40969700 | Fax: +9122 22651278 | Email: research@dolatcapital.com | www.dolatresearch.com

Our Research reports are also available on Reuters, Thomson Publishers, DowJones and Bloomberg (DCML <GO>)

You might also like

- Screenshot 2022-12-21 at 6.08.50 PMDocument3 pagesScreenshot 2022-12-21 at 6.08.50 PMjoe costantinoNo ratings yet

- ICICI Securities SFB Sector ThematicDocument149 pagesICICI Securities SFB Sector ThematicYerrolla MadhuravaniNo ratings yet

- City Union ResearchDocument38 pagesCity Union ResearchamitNo ratings yet

- Indian Banking - Sector Report - 15-07-2021 - SystematixDocument153 pagesIndian Banking - Sector Report - 15-07-2021 - SystematixDebjit AdakNo ratings yet

- Private Equity - Investment Banks - United Arab Emirates - Draft 1Document8 pagesPrivate Equity - Investment Banks - United Arab Emirates - Draft 1hdanandNo ratings yet

- Promotion Study Material For BanksDocument2 pagesPromotion Study Material For Bankspunj2463% (19)

- Interview Question and AnswersDocument7 pagesInterview Question and AnswersDvd NitinNo ratings yet

- Tax Invoice For: Your Telstra BillDocument8 pagesTax Invoice For: Your Telstra BillmaryannemooreNo ratings yet

- Amortization & Sinking FundDocument27 pagesAmortization & Sinking FundkimNo ratings yet

- Cheque Clearing - An OverviewDocument20 pagesCheque Clearing - An OverviewGiridhaaran.VNo ratings yet

- Problem 9-1, 2 & 3Document3 pagesProblem 9-1, 2 & 3Micah April SabularseNo ratings yet

- FY22 Q4 - Update Note - Citi AcquisitionDocument8 pagesFY22 Q4 - Update Note - Citi Acquisitioncerohad333No ratings yet

- AU Small Finance Bank - IC - HDFC Sec-201710030810174398816Document30 pagesAU Small Finance Bank - IC - HDFC Sec-201710030810174398816Anonymous y3hYf50mTNo ratings yet

- Ujjivan Small Finance Bank LTD - Company Update - 120623 (1) - 12-06-2023 - 09Document10 pagesUjjivan Small Finance Bank LTD - Company Update - 120623 (1) - 12-06-2023 - 09Sanjeedeep Mishra , 315No ratings yet

- Axis Bank: Completes Acquisition of Citi India's Consumer BusinessDocument10 pagesAxis Bank: Completes Acquisition of Citi India's Consumer Businesscerohad333No ratings yet

- Axis Bank - 2QFY18 Result Update - 181017Document10 pagesAxis Bank - 2QFY18 Result Update - 181017johnmecNo ratings yet

- Morning 15oct20.15 10 2020 - 01 39 12Document8 pagesMorning 15oct20.15 10 2020 - 01 39 12fathur abrarNo ratings yet

- Union Bank of India: CMP: INR109Document8 pagesUnion Bank of India: CMP: INR1090003tzNo ratings yet

- Dolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatDocument22 pagesDolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatsaran21No ratings yet

- ICICI BANK - ResearchDocument1 pageICICI BANK - ResearchankitNo ratings yet

- ICICI Securities Suryoday SFB Initiating CoverageDocument34 pagesICICI Securities Suryoday SFB Initiating CoverageDivy JainNo ratings yet

- Voltas PL PDFDocument5 pagesVoltas PL PDFADNo ratings yet

- Voltas: Building On StrengthsDocument5 pagesVoltas: Building On StrengthsADNo ratings yet

- Sbi Banking and Financial Services Fund Factsheet (August-2021-415-1)Document1 pageSbi Banking and Financial Services Fund Factsheet (August-2021-415-1)charan ThakurNo ratings yet

- 05the Economic Times WealthDocument5 pages05the Economic Times WealthvivoposNo ratings yet

- Au SFB - Mosl - 130324 - EbrDocument26 pagesAu SFB - Mosl - 130324 - EbrDivy JainNo ratings yet

- INDIAN HOTELS - Initiating CoverageDocument30 pagesINDIAN HOTELS - Initiating CoverageTejesh GoudNo ratings yet

- Idfc First Bank: IndiaDocument35 pagesIdfc First Bank: IndiaPraveen PNo ratings yet

- Ashoka Buildcon: Business Risks Increasing Valuations CompleteDocument10 pagesAshoka Buildcon: Business Risks Increasing Valuations CompleteSajid FlexwalaNo ratings yet

- Cochin Shipyard LTD - : A Robust Play On India DefenceDocument14 pagesCochin Shipyard LTD - : A Robust Play On India DefencepremNo ratings yet

- AGS Transact Technologies - Jan 2021Document10 pagesAGS Transact Technologies - Jan 2021SaranNo ratings yet

- BLSTR Q4FY20 ResultsDocument6 pagesBLSTR Q4FY20 ResultsAnkush AgrawalNo ratings yet

- V.S. Industry 20230620 HLIBDocument3 pagesV.S. Industry 20230620 HLIBkim heeNo ratings yet

- AU SFB - Centrum - 190324 - EBRDocument11 pagesAU SFB - Centrum - 190324 - EBRDivy JainNo ratings yet

- Free Press Mumbai Edition 30 Jun 2021 Page 1Document1 pageFree Press Mumbai Edition 30 Jun 2021 Page 1handheld01No ratings yet

- Strategist Speaks - NBFC & InsuranceDocument9 pagesStrategist Speaks - NBFC & Insurancemeemansa BagariaNo ratings yet

- Research On CAMS by HDFC Securities - Nov 2020Document22 pagesResearch On CAMS by HDFC Securities - Nov 2020Sanjeet SahooNo ratings yet

- JM IciciDocument18 pagesJM IciciSanjay PatelNo ratings yet

- Zacks Small-Cap Research: Corecivic, IncDocument8 pagesZacks Small-Cap Research: Corecivic, IncKarim LahrichiNo ratings yet

- Ace Hardware IndonesiaDocument6 pagesAce Hardware IndonesiaPutri CandraNo ratings yet

- Ki Aces 20231108Document6 pagesKi Aces 20231108Cindy MartinNo ratings yet

- Axis Bank - HSL - 06122021Document14 pagesAxis Bank - HSL - 06122021GaganNo ratings yet

- India As Nbfcs 20180711 Mosl Su Pg030Document30 pagesIndia As Nbfcs 20180711 Mosl Su Pg030anurag70No ratings yet

- HDFCBank InitiatingCoverage29042020 - 30 04 2020 - 11Document15 pagesHDFCBank InitiatingCoverage29042020 - 30 04 2020 - 11ramkrishna mahatoNo ratings yet

- Au Small Finance BankDocument24 pagesAu Small Finance BankDivy JainNo ratings yet

- Mirae Asset Sekuritas Indonesia ACES August SSSG 10c7c19cd3Document11 pagesMirae Asset Sekuritas Indonesia ACES August SSSG 10c7c19cd3Cindy MartinNo ratings yet

- Motilal Oswal Financial ServicesDocument27 pagesMotilal Oswal Financial ServicesanupamNo ratings yet

- Multi Commodity Exchange of IndiaDocument4 pagesMulti Commodity Exchange of IndiashahavNo ratings yet

- Axis Bank - 03 - 03 - 2023 - Khan030323Document7 pagesAxis Bank - 03 - 03 - 2023 - Khan030323Ranjan SharmaNo ratings yet

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Document10 pagesSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoNo ratings yet

- Affordable Housing Finance Companies - Thematic - Centrum - 260923Document75 pagesAffordable Housing Finance Companies - Thematic - Centrum - 260923Sudeep PattnaikNo ratings yet

- Edelweiss Housing Finance LimitedDocument7 pagesEdelweiss Housing Finance LimitedDr. Ashwin Raja MBBS MSNo ratings yet

- LEH-AggresSIV Plan To Save ABCP MarketDocument7 pagesLEH-AggresSIV Plan To Save ABCP MarketNuggets MusicNo ratings yet

- Oracle Financial Services Software: Management Strategy and Key Highlights of FY20Document13 pagesOracle Financial Services Software: Management Strategy and Key Highlights of FY20Jeet SinghNo ratings yet

- Aptus Value Housing - IC - Axis SecuritiesDocument23 pagesAptus Value Housing - IC - Axis Securitieskumar somyaNo ratings yet

- Icici Bank: CMP: INR502 Operating Performance Resilient Technology Remains Key Growth DriverDocument14 pagesIcici Bank: CMP: INR502 Operating Performance Resilient Technology Remains Key Growth DriverRajat GroverNo ratings yet

- Bank Mandiri: Equity ResearchDocument5 pagesBank Mandiri: Equity ResearchAhmad SantosoNo ratings yet

- PNC Infratech 26 09 2023.Document8 pagesPNC Infratech 26 09 2023.Anonymous brpVlaVBNo ratings yet

- Allcargo Global Logistics Motilal Oswal Religare PLDocument27 pagesAllcargo Global Logistics Motilal Oswal Religare PLarif420_999No ratings yet

- App18a PDFDocument5 pagesApp18a PDFWalter CostaNo ratings yet

- BLS Inter Initial (B&K Sec)Document11 pagesBLS Inter Initial (B&K Sec)beza manojNo ratings yet

- CFAP 4 Summer 2023Document13 pagesCFAP 4 Summer 2023momalrajput3No ratings yet

- IDirect NCC ConvictionIdeaDocument8 pagesIDirect NCC ConvictionIdeaVivek GuptaNo ratings yet

- IDirect SanseraEngg StockTalesDocument13 pagesIDirect SanseraEngg StockTalesbradburywillsNo ratings yet

- O/W: "You Only Sell The Dresses You Have ": City Chic Collective (CCX)Document5 pagesO/W: "You Only Sell The Dresses You Have ": City Chic Collective (CCX)Muhammad ImranNo ratings yet

- Gateway Distriparks: Making The Right Moves, Retain BuyDocument3 pagesGateway Distriparks: Making The Right Moves, Retain BuydarshanmadeNo ratings yet

- Ujjivan SFB - About The BusinessDocument5 pagesUjjivan SFB - About The BusinessDevi YesodharanNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)From EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)No ratings yet

- Fintech in Asia Pacific: Digital Payment Platforms: October 2019Document42 pagesFintech in Asia Pacific: Digital Payment Platforms: October 2019VaishnaviRaviNo ratings yet

- AsdasdasdsadDocument4 pagesAsdasdasdsadWinston Mark KahidNo ratings yet

- Invoice: Ace Global Service Co.,Ltd. 2-12-15-312 Fujimi-Cho, Tachikawa-Shi Tokyo 190-0013 Tel/Fax: +81-42-5221814Document2 pagesInvoice: Ace Global Service Co.,Ltd. 2-12-15-312 Fujimi-Cho, Tachikawa-Shi Tokyo 190-0013 Tel/Fax: +81-42-5221814Hendra Widjaja - Golden Nusa Travel ServicesNo ratings yet

- Raguram Rajan's ThesisDocument14 pagesRaguram Rajan's Thesissum786No ratings yet

- Loan SharkDocument18 pagesLoan SharkPhara MustaphaNo ratings yet

- Retail 2Document32 pagesRetail 2Pravali SaraswatNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceanupsharma2522_98756No ratings yet

- Chapter 5 - Time Value of MoneyDocument7 pagesChapter 5 - Time Value of MoneyParth GargNo ratings yet

- Swot Analysis: Submitted By:-Rohit Gorde. ROLL NO: - 6210Document6 pagesSwot Analysis: Submitted By:-Rohit Gorde. ROLL NO: - 6210rohit gordeNo ratings yet

- Client Code: 01S ICICI BankDocument1 pageClient Code: 01S ICICI BankKushNo ratings yet

- Making Suspense Payments: Consider The Following ExampleDocument2 pagesMaking Suspense Payments: Consider The Following Exampleanoop kumarNo ratings yet

- Chapter 5Document88 pagesChapter 5Dashania GregoryNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVARIKUTI RAJASEKHARNo ratings yet

- Account StatementDocument12 pagesAccount StatementSaurav RaiNo ratings yet

- New BankDocument13 pagesNew BankVelayudhan SunkaraNo ratings yet

- Refuse Payment Saying Goods Not To Satisfaction or (Ii) Cheat or (Iii) Become InsolventDocument2 pagesRefuse Payment Saying Goods Not To Satisfaction or (Ii) Cheat or (Iii) Become Insolventcương trươngNo ratings yet

- ACH Written Statement OF Unauthorized Debit 03 13 14 PDFDocument1 pageACH Written Statement OF Unauthorized Debit 03 13 14 PDFwilliam mcinnisNo ratings yet

- Internship Report On UBLDocument75 pagesInternship Report On UBLBashir Ahmad0% (2)

- 28x VenmoDocument1 page28x Venmorckmvp6c8qNo ratings yet

- The Industrial Credit and Investment Corporation of India LimitedDocument24 pagesThe Industrial Credit and Investment Corporation of India LimitedDevan KumaranNo ratings yet

- ECO531 Chapter 2 Mind MapDocument6 pagesECO531 Chapter 2 Mind MapASMA HANANI BINTI ANUAR100% (1)

- Project On Various Credit Schemes of SBI Back PDFDocument46 pagesProject On Various Credit Schemes of SBI Back PDFAbhinaw KumarNo ratings yet