Professional Documents

Culture Documents

Ast (Long Term)

Uploaded by

For PurposeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ast (Long Term)

Uploaded by

For PurposeCopyright:

Available Formats

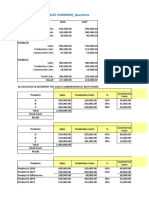

item units cost total cost estimated sales price

cosst of sell nrv

a 1,000 120 120000 180 30 150

b 1,500 110 165000 140 20 120

c 1,200 150 180000 170 30 140

d 1,800 140 252000 190 30 160

e 1,700 130 221000 200 40 160

AST LONG TERM CONSTRUCTION CONTRACT

Percentage of completion method

estimated gross profit % of completion RGP Cost incurred CIP

laguna 600000 0.67 402000 2400000 2802000

bulacan -200000 0.13 -26000 2800000 2774000

428000 5576000

Zero profit Method

estimated gross profit % of completion RGP Cost incurred CIP

laguna 600000 0.67 0 2400000 2400000

bulacan -200000 0.13 0 2800000 2800000

5200000

problem 1

pecentage of completion = total cost incurred- to date / total estimated cost to complete

total cost incurred

Cumulative cost incurred 2,400,000 2800000

total estimated cost to complete

3,600,000 3200000

percentage completion 0.67 0.88

contract price 4,200,000 3000000

total estimated cost to c 3,600,000 3200000

600,000 -200000

percentage completion 0.6667 0.8750

400,000 -175,000 225,000 percentage completion method

contract price 4,200,000 3000000

total estimated cost 3,600,000 3200000

600,000 -200000

percentage completion 0.00

gross profit 0 -200,000 -200,000 percentage completion method

based muna sa nrv and cost

then kung ano mas mababa

yun ang imumultiply mo sa unit

5576000 5200000

3200000 3200000

net progres 2376000 2000000

TOTAL ESTIMATED COST TO COMPLETE

cost incurred - cuurent year

PLUS: Cost incurred - Prioryear

Total Cost incurred to date

PLUS:Estimated cost to complete

CONTRACT PRICE

LESS: TOTAL ESTIMATED COST TO COMPLETE

cost incurred - cuurent year

PLUS: Cost incurred - Prioryear

Total Cost incurred to date

ge completion method PLUS:Estimated cost to complete

ESTIMATED GROSS PROFIT

x % of completion

Realized Gross Profit - to date

Less: Realized Gross Profit - Prior Year

Realiazed Gross Profit - Current Year

ge completion method

You might also like

- Fin MathDocument3 pagesFin MathSk. Alifur RahmanNo ratings yet

- LTCC FormulaDocument2 pagesLTCC FormulaReginald ValenciaNo ratings yet

- Ia T18 AnsDocument3 pagesIa T18 Ansckwai0603No ratings yet

- AST LTCC ComputationDocument9 pagesAST LTCC ComputationeiraNo ratings yet

- Assignment 5 EVDocument4 pagesAssignment 5 EVLekhanath PaudelNo ratings yet

- ANSWERKEYDocument25 pagesANSWERKEYIryne Kim PalatanNo ratings yet

- Problems Long Term Const ContractsDocument17 pagesProblems Long Term Const ContractsJane DizonNo ratings yet

- Assignment Submitted By: Neeraj Dani Section A-MBA General Management FMS-MBA-2020-22-008 Assignment 1Document3 pagesAssignment Submitted By: Neeraj Dani Section A-MBA General Management FMS-MBA-2020-22-008 Assignment 1Neeraj DaniNo ratings yet

- Pembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 2019Document64 pagesPembahasan: A. Membuat Analisis Kontrak Dan Estimasi Gross Profit Setiap Tahun 2018 201917HARISA SETYA HANDININo ratings yet

- Illustration On Projects AppraisalDocument6 pagesIllustration On Projects AppraisalAsmerom MosinehNo ratings yet

- CMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionDocument5 pagesCMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionEi HmmmNo ratings yet

- CMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionDocument4 pagesCMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionAlinah AquinoNo ratings yet

- Day8 (My)Document9 pagesDay8 (My)Jhilmil JeswaniNo ratings yet

- CH 3 Problem SolutionsDocument9 pagesCH 3 Problem SolutionsFrancisco PradoNo ratings yet

- AFAR04. Long Term Construction ContractsDocument4 pagesAFAR04. Long Term Construction ContractsJohn Kenneth BacanNo ratings yet

- Answer Key Chapter 7 LTCC RevisedDocument12 pagesAnswer Key Chapter 7 LTCC Revisedkaren perrerasNo ratings yet

- 3420 - Group Assignment - Week 9Document8 pages3420 - Group Assignment - Week 9samsamNo ratings yet

- 7-28 7-29 The Direct MethodDocument5 pages7-28 7-29 The Direct MethodJohn Carlo AquinoNo ratings yet

- Advacc 6.1Document17 pagesAdvacc 6.1Lorifel Antonette Laoreno TejeroNo ratings yet

- Investment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Document7 pagesInvestment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Sneha DasNo ratings yet

- CH 15Document6 pagesCH 15palashNo ratings yet

- Day 4 - Class ExerciseDocument10 pagesDay 4 - Class Exerciseum23328No ratings yet

- Accounts - FIFO and WA For FinalDocument11 pagesAccounts - FIFO and WA For FinalRohan SinghNo ratings yet

- Project Comparision Using NPVDocument5 pagesProject Comparision Using NPVSamar PratapNo ratings yet

- Solutions To Assign. - Prob 4 Construction ContractsDocument8 pagesSolutions To Assign. - Prob 4 Construction ContractsmhikeedelantarNo ratings yet

- Financial Analysis For Project One: Created By: I Putu Gede Geo R B NIM: E1700869Document6 pagesFinancial Analysis For Project One: Created By: I Putu Gede Geo R B NIM: E1700869candra brataNo ratings yet

- Osjdioahfnlk, MNLKJLDocument10 pagesOsjdioahfnlk, MNLKJLAlex NievaNo ratings yet

- Case Study Invetment DecisionDocument8 pagesCase Study Invetment DecisionKelsy NguyenNo ratings yet

- Solution For Construction AccountingDocument2 pagesSolution For Construction AccountingAliah CyrilNo ratings yet

- Pangibitan, Geojanni R. - Activity 3 - A5Document4 pagesPangibitan, Geojanni R. - Activity 3 - A5Geojanni PangibitanNo ratings yet

- PRACTICAL CASES - 30 - 32 - TemplatesDocument8 pagesPRACTICAL CASES - 30 - 32 - TemplatesloliNo ratings yet

- SFAD Week 1Document4 pagesSFAD Week 1Talha SiddiquiNo ratings yet

- De Gyzman, Kyla Cost Act. 2 & 3Document4 pagesDe Gyzman, Kyla Cost Act. 2 & 3kyla deguzmanNo ratings yet

- Midterm Quiz - Answer KeyDocument17 pagesMidterm Quiz - Answer KeyCatherine Joy VasayaNo ratings yet

- Exercise 16Document10 pagesExercise 16vanessaNo ratings yet

- AfarDocument29 pagesAfarGONZALES, MICA ANGEL A.No ratings yet

- Sensitivity Scenario Analysis 1711549320367Document18 pagesSensitivity Scenario Analysis 1711549320367pre.meh21No ratings yet

- HahahahaDocument4 pagesHahahahaKyla de SilvaNo ratings yet

- Audit Answers SheetDocument6 pagesAudit Answers Sheetcarl fuerzasNo ratings yet

- Week 3 SolutionDocument5 pagesWeek 3 SolutionI190006 Taimoor JanNo ratings yet

- Agregate Planning Methods - 2 (Con.)Document10 pagesAgregate Planning Methods - 2 (Con.)Kl OteenNo ratings yet

- Break-Even Point (BEP) Waktu Balik ModalDocument2 pagesBreak-Even Point (BEP) Waktu Balik ModalDodik ArviantoNo ratings yet

- VC and IPO NumericalDocument16 pagesVC and IPO Numericaluse lnctNo ratings yet

- Expressway Project Finance Task 4A (Avinash Singh)Document9 pagesExpressway Project Finance Task 4A (Avinash Singh)avinash singh100% (2)

- PC Ch. 11 Techniques of Capital BudgetingDocument22 pagesPC Ch. 11 Techniques of Capital BudgetingVinod Mathews100% (2)

- CfrprepDocument30 pagesCfrprepAhmedNo ratings yet

- Ash Fly Project Case SolutionDocument6 pagesAsh Fly Project Case SolutionSaad ArainNo ratings yet

- Uas Metode KuantitifDocument12 pagesUas Metode Kuantitifariyanto wibowoNo ratings yet

- Usp FinalDocument54 pagesUsp Finalsubhamoypatra949No ratings yet

- % Completed Wip Beg FT Sip FT Total Goods To Be Accounted ForDocument17 pages% Completed Wip Beg FT Sip FT Total Goods To Be Accounted ForJc AdanNo ratings yet

- Application of Economic Concepts-Activity 1Document3 pagesApplication of Economic Concepts-Activity 1Katrina Amore VinaraoNo ratings yet

- Actual Cost Vs Plan Projection: Your Company NameDocument25 pagesActual Cost Vs Plan Projection: Your Company NameShamsNo ratings yet

- Assignment 3 Feb MBA 1Document17 pagesAssignment 3 Feb MBA 1shahzad aliNo ratings yet

- Profit (Sales-Cost of Sales) 110,000.00Document4 pagesProfit (Sales-Cost of Sales) 110,000.00Rajshri SaranNo ratings yet

- Application - of - Economic - Concepts-Activity - 1 - Katrina Amore VinaraoDocument3 pagesApplication - of - Economic - Concepts-Activity - 1 - Katrina Amore VinaraoKatrina Amore VinaraoNo ratings yet

- CH 13Document6 pagesCH 13Agung PrabowoNo ratings yet

- Note On Tax Rebate On Takaful Contribution 2019 20 Other Than SalariedDocument1 pageNote On Tax Rebate On Takaful Contribution 2019 20 Other Than Salariedsyed aamir shahNo ratings yet

- Question 2Document14 pagesQuestion 2Leo NguyễnNo ratings yet

- Note On Tax Rebate On Takaful Contribution 2019 20 SalariedDocument1 pageNote On Tax Rebate On Takaful Contribution 2019 20 SalariedRoy Estate (Sajila Roy)No ratings yet

- Hedge FundDocument42 pagesHedge FundAmolNo ratings yet

- 2014 GregoryDocument26 pages2014 GregoryKiều Lê Nhật ĐôngNo ratings yet

- Rad 2022100Document90 pagesRad 2022100poretic617No ratings yet

- Final Project Presentation: Amazon - Echo DotDocument9 pagesFinal Project Presentation: Amazon - Echo DotSamyak BNo ratings yet

- FHBM1124 Marketing Chapter 6-Segmentation Targeting PositioningDocument55 pagesFHBM1124 Marketing Chapter 6-Segmentation Targeting PositioningBenkingcyeoh50% (2)

- Prebo Digital - Business ProfileDocument14 pagesPrebo Digital - Business ProfilePrebodigital Digital Marketing Agency100% (1)

- FIN220 - Time Value of Money Practice QuestionsDocument2 pagesFIN220 - Time Value of Money Practice QuestionsMatt ZaheadNo ratings yet

- Chapter 5Document11 pagesChapter 5Jamie Catherine Go67% (9)

- Activity Based Costing Questions and NotesDocument11 pagesActivity Based Costing Questions and Notesviettuan9167% (3)

- FIDP Entrep LlasosDocument12 pagesFIDP Entrep LlasosRoselyn CalangNo ratings yet

- GENERAL ACCOUNTING RevisedDocument43 pagesGENERAL ACCOUNTING RevisedAkendombi EmmanuelNo ratings yet

- Canada GooseDocument7 pagesCanada GooseMohammed Omer Elgindi100% (1)

- Chapter 1 - What Is Marketing?: Knowledge ObjectivesDocument9 pagesChapter 1 - What Is Marketing?: Knowledge ObjectivesJenmark JacolbeNo ratings yet

- Leadership and Management in The Workplace LMDocument7 pagesLeadership and Management in The Workplace LMJ.J priyaNo ratings yet

- Document Incorporated by Reference Financial Information Annual Report - 2020 12 31Document21 pagesDocument Incorporated by Reference Financial Information Annual Report - 2020 12 31Patrick LegaspiNo ratings yet

- Blue Ocean Strategy - GharParDocument11 pagesBlue Ocean Strategy - GharParAreeba JavedNo ratings yet

- (2013 Pattern) : Text Book: A Pathway To Success Edited By: Ashok Chaskar Anand Kulkarni Vijay MadgeDocument119 pages(2013 Pattern) : Text Book: A Pathway To Success Edited By: Ashok Chaskar Anand Kulkarni Vijay MadgeDev SuranaNo ratings yet

- Week 2-Basic Cost ManagementDocument21 pagesWeek 2-Basic Cost ManagementRichard Oliver CortezNo ratings yet

- ICT3642 - Assignment 4 - 2022Document8 pagesICT3642 - Assignment 4 - 2022Sibusiso NgwenyaNo ratings yet

- Ias 1 SummaryDocument11 pagesIas 1 Summarynur iman qurrataini abdul rahmanNo ratings yet

- What Is The Difference Between Yield To Maturity and The Coupon Rate?Document3 pagesWhat Is The Difference Between Yield To Maturity and The Coupon Rate?khushimaharwalNo ratings yet

- A Case Study On PranDocument79 pagesA Case Study On PranCrimson Hasan67% (3)

- Chapter 3 Lecture Notes STUDENTS SEPT 2023Document20 pagesChapter 3 Lecture Notes STUDENTS SEPT 2023evelyngoveaNo ratings yet

- Finall Thesis KuuriyaDocument56 pagesFinall Thesis KuuriyaMohammed YonisNo ratings yet

- Global Marketing - Marketing MixDocument75 pagesGlobal Marketing - Marketing Mix張習芸No ratings yet

- Direct Marketing in ActionDocument233 pagesDirect Marketing in ActionSangram100% (4)

- CRC Ace Mas First PBDocument10 pagesCRC Ace Mas First PBJohn Philip Castro100% (2)

- Chapter 7 InventoriesDocument25 pagesChapter 7 InventoriesAna Leah DelfinNo ratings yet

- Approaches To IR ModelsDocument3 pagesApproaches To IR ModelsFayez AmanNo ratings yet