Professional Documents

Culture Documents

CH 4

Uploaded by

Mohammed Fouad0 ratings0% found this document useful (0 votes)

4 views26 pagesAudit

Original Title

Ch4

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAudit

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views26 pagesCH 4

Uploaded by

Mohammed FouadAudit

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 26

PROFESSIONAL

ETHICS

CHAPTER 4

Copyright ©2017 Pearson Education, Inc. 4-1

CHAPTER 4 LEARNING OBJECTIVES

4-1 Distinguish ethical from unethical behavior in personal and

professional contexts.

4-2 Resolve ethical dilemmas using an ethical framework.

4-3 Explain the importance of ethical conduct for the accounting

profession.

4-4 Describe the purpose and content of the AICPA Code of

Professional Conduct.

4-5 Apply the AICPA Code rules and interpretations on

independence and explain their importance.

Copyright © 2017 Pearson Education, Inc. 4-2

OBJECTIVE 4-1

Distinguish ethical from unethical behavior in

personal and professional contexts.

Copyright © 2017 Pearson Education, Inc. 4-3

WHAT ARE ETHICS?

Ethics can be defined broadly as a set of moral

principles or values. One set of ethical principles is

detailed in Figure 4-1.

Ethical behavior is necessary for a society to

function in an orderly manner.

The need for ethics in society is sufficiently

important that many commonly held values are

incorporated into laws.

Copyright © 2017 Pearson Education, Inc. 4-4

Copyright ©2017 Pearson Education, Inc. 4-6

WHAT ARE ETHICS? (CONT.)

Why People Act Unethically

Most people define unethical behavior as conduct that differs from

what they believe is inappropriate given the circumstances.

There are two primary reasons why people act unethically:

• The person’s ethical standards differ from general society’s

• The person chooses to act selfishly

A considerable portion of unethical behavior results from selfish

behavior.

Copyright © 2017 Pearson Education, Inc. 4-7

OBJECTIVE 4-2

Resolve ethical dilemmas using an ethical

framework.

Copyright © 2017 Pearson Education, Inc. 4-7

ETHICAL DILEMMAS

An ethical dilemma is a situation a person faces in

which a decision must be made about appropriate

behavior.

Auditors, accountants, and other businesspeople

face many ethical dilemmas in their business

careers.

Copyright © 2017 Pearson Education, Inc. 4-8

ETHICAL DILEMMAS (CONT.)

Rationalizing Unethical Behavior

The following are rationalization methods commonly employed

that can result in unethical behavior:

• Everybody does it.

• If it’s legal, it’s ethical.

• Likelihood of discovery and consequences.

Copyright © 2017 Pearson Education, Inc. 4-10

ETHICAL DILEMMAS (CONT.)

Resolving Ethical Dilemmas

The following six-step approach is one method for resolving ethical

dilemmas:

1. Obtain the relevant facts.

2. Identify the ethical issues from the facts.

3. Determine who is affected by the outcome of the dilemma and how each

person or group is affected.

4. Identify the alternatives available to the person who must resolve the

dilemma.

5. Identify the likely consequence of each alternative.

6. Decide the appropriate action.

Copyright © 2017 Pearson Education, Inc. 4-11

OBJECTIVE 4-3

Explain the importance of ethical conduct for the

accounting profession.

Copyright © 2017 Pearson Education, Inc. 4-11

SPECIAL NEED FOR ETHICAL CONDUCT IN

PROFESSIONS

Our society has attached a special meaning to the term

professional.

The term professional means a responsibility for conduct

that extends beyond satisfying individual responsibilities

and beyond the requirements of our society’s laws and

regulations.

A CPA, as a professional, recognizes a responsibility to the

public, to the client, and to fellow practitioners, including

honorable behavior, even if that means personal sacrifice.

Copyright © 2017 Pearson Education, Inc. 4-12

SPECIAL NEED FOR ETHICAL CONDUCT IN PROFESSIONS

(CONT.)

CPA firms have a different relationship with users of financial

statements than most professionals have with their customers.

Most clients pay professionals for services and the professional’s

primary responsibility is to the client.

CPA firms are engaged by management or the audit committee and

paid by the company, but the CPA firm’s primary responsibility is to

the users of the financial statements.

It is essential that users of the financial statements regard CPA

firms as competent and unbiased. This is contingent on CPA firms

conducting themselves at a high professional level.

Copyright © 2017 Pearson Education, Inc. 4-14

Copyright ©2017 Pearson Education, Inc. 4-14

OBJECTIVE 4-4

Describe the purpose and content of the AICPA

Code of Professional Conduct.

Copyright © 2017 Pearson Education, Inc. 4-15

CODE OF PROFESSIONAL CONDUCT

Members of the AICPA agree to follow the Code of

Professional Conduct.

The Code consists of principles and rules, in addition

to interpretations.

Only members in public practice can audit financial

statements, which is addressed in Part 1.

The organization of the Code is detailed in Table 4-1.

Copyright © 2017 Pearson Education, Inc. 4-16

Copyright ©2017 Pearson Education, Inc. 4-18

CODE OF PROFESSIONAL CONDUCT (CONT.)

Principles of Professional Conduct are detailed below in Table 4-2.

Copyright © 2017 Pearson Education, Inc. 4-19

CODE OF PROFESSIONAL CONDUCT (CONT.)

Conceptual Framework for Rules of Conduct

The Code offers the following for members to evaluate threats to

compliance with the Code:

1. Identify threats. Threats fall into seven broad categories that are

detailed in Table 4-3.

2. Evaluate the significance of the threat.

3. Identify and apply safeguards. Safeguards fall into three broad

categories:

• Safeguards created by the profession, legislation, or regulation.

• Safeguards implemented by the client.

• Safeguards implemented by the firm.

Copyright © 2017 Pearson Education, Inc. 4-20

Copyright ©2017 Pearson Education, Inc. 4-21

OBJECTIVE 4-5

Apply the AICPA Code rules and interpretations

on independence and explain their importance.

Copyright © 2017 Pearson Education, Inc. 4-21

INDEPENDENCE RULE

• The value of auditing is dependent on the public’s perception of

the independence of auditors.

• Independence consists of two components:

• Independence of mind (also referred to as independence in fact)

• Independence in appearance

Copyright © 2017 Pearson Education, Inc. 4-22

INDEPENDENCE RULE (CONT.)

The most significant interpretations involving

independence include:

• Financial interests

• Related financial interest issues

• Consulting, bookkeeping, and other nonattest services

• Litigation between CPA firm and client

• Unpaid fees

• Network of firms

Copyright © 2017 Pearson Education, Inc. 4-25

INDEPENDENCE RULE (CONT.)

Financial Interests—The Code prohibits covered members

from owning any stock or other direct investment in audit

clients.

Covered Members—Any person who is in a position to influence an

attest engagement.

The prohibition of direct ownership also applies to the covered

member’s immediate family, which includes spouse, spousal equivalent,

and dependents.

A Direct versus Indirect Financial Interest—Ownership of stock by a

covered member or immediate family is direct financial interest. A

close, but not direct, ownership interest is an indirect financial interest.

Copyright © 2017 Pearson Education, Inc. 4-26

INDEPENDENCE RULE (CONT.)

Financial Interests (Cont.)

Material or Immaterial—Any direct ownership interest is prohibited,

regardless of materiality. Materiality affects only whether ownership is a

violation of independence for indirect ownership.

Financial Interests of Close Relatives—Close relatives are defined as

parent, sibling, or nondependent child. Ownership by a close relative is

usually not a violation of independence unless the ownership is material

to the relative, or enables the relative to exericise significant influence

over the attest client.

Copyright © 2017 Pearson Education, Inc. 4-27

INDEPENDENCE RULE (CONT.)

Related Financial Interest Issues

Any of these relationships between a CPA and the client could

affect independence:

• Loans, other than normal lending procedures

• Employment of immediate and close family members

• Joint closely held investments with clients

• Director, officer, management, or employee of a company

Copyright © 2017 Pearson Education, Inc. 4-28

You might also like

- Arens Aud16 Inppt04Document40 pagesArens Aud16 Inppt04Zaidoon AlhatabatNo ratings yet

- Developing A Business Mindset: Business in Action 8e Bovée/ThillDocument33 pagesDeveloping A Business Mindset: Business in Action 8e Bovée/ThillTehreem AhmedNo ratings yet

- Fund 04Document14 pagesFund 04emreNo ratings yet

- Ethics and The Audit ProfessionDocument54 pagesEthics and The Audit Professionulfa mariyahNo ratings yet

- Ethics/Social Responsibility/ SustainabilityDocument21 pagesEthics/Social Responsibility/ SustainabilityNur AmirahNo ratings yet

- Ethics/Social Responsibility/ Sustainability: Chapter ThreeDocument21 pagesEthics/Social Responsibility/ Sustainability: Chapter ThreeCahaya Muslimah SejatiNo ratings yet

- Strategic Management & Business Policy: 12 EditionDocument21 pagesStrategic Management & Business Policy: 12 EditionSabri SyahrrawwyNo ratings yet

- Managing Social Responsibility and EthicsDocument37 pagesManaging Social Responsibility and EthicsBrandon LowNo ratings yet

- Ebert 8CE ch03Document31 pagesEbert 8CE ch03SelinaNo ratings yet

- Acknowledgement: Sesi 03-04 Outside-Usa Strategic Palnning Semester: Genap 2019/2020Document23 pagesAcknowledgement: Sesi 03-04 Outside-Usa Strategic Palnning Semester: Genap 2019/2020Cornelita Tesalonika R. K.No ratings yet

- David SMCC16ge ppt03Document22 pagesDavid SMCC16ge ppt03Lê Quỳnh ChiNo ratings yet

- Strategic Management Chapter 3Document22 pagesStrategic Management Chapter 3NutmegNo ratings yet

- Ethics/Social Responsibility/ Sustainability: Chapter ThreeDocument22 pagesEthics/Social Responsibility/ Sustainability: Chapter Threetian chuNo ratings yet

- Business Ethics, Social Responsibility, and Environmental SustainabilityDocument22 pagesBusiness Ethics, Social Responsibility, and Environmental SustainabilitySteph GonzagaNo ratings yet

- Solution Manual For Business Essentials 11th Edition by Ebert and Griffin ISBN 0134129962 9780134129969Document36 pagesSolution Manual For Business Essentials 11th Edition by Ebert and Griffin ISBN 0134129962 9780134129969sarahryanqnidzywbkg100% (26)

- Chapter Four: Ethics and Social ResponsibilityDocument40 pagesChapter Four: Ethics and Social ResponsibilityusawhneyNo ratings yet

- An Introduction To The Foundations of Financial ManagementDocument32 pagesAn Introduction To The Foundations of Financial ManagementErlanggaNo ratings yet

- Seitel ppr13 ppt06Document25 pagesSeitel ppr13 ppt06f79xhpn7d8No ratings yet

- Human Resource Management: Fifteenth EditionDocument22 pagesHuman Resource Management: Fifteenth Editionsuraj lamaNo ratings yet

- Human Resource Management 13 Edition Business Ethics and Corporate Social ResponsibilityDocument28 pagesHuman Resource Management 13 Edition Business Ethics and Corporate Social ResponsibilitydadingafgiNo ratings yet

- Business Ethics, Social Responsibility, and Environmental SustainabilityDocument26 pagesBusiness Ethics, Social Responsibility, and Environmental SustainabilityNora AnisaNo ratings yet

- Ethics in International BusinessDocument23 pagesEthics in International BusinessJayalakshmi Institute of TechnologyNo ratings yet

- Corporate ResponsibilityDocument18 pagesCorporate ResponsibilityNguyen Yen MyNo ratings yet

- Business and Society Stakeholders Ethics Public Policy 15Th Edition Lawrence Solutions Manual Full Chapter PDFDocument41 pagesBusiness and Society Stakeholders Ethics Public Policy 15Th Edition Lawrence Solutions Manual Full Chapter PDFjaniceglover2puc6100% (11)

- Managing Social Responsibility and EthicsDocument25 pagesManaging Social Responsibility and EthicsMeika RahayuNo ratings yet

- Ethics and Ethical Reasoning: Mcgraw-Hill/IrwinDocument21 pagesEthics and Ethical Reasoning: Mcgraw-Hill/IrwinAzyan NajNo ratings yet

- CH 6 Managing Social Responsibility & EthicsDocument35 pagesCH 6 Managing Social Responsibility & EthicsCali CaliNo ratings yet

- Study On Inter-Relationship Between Business Ethics and Corporate GovernanceDocument10 pagesStudy On Inter-Relationship Between Business Ethics and Corporate GovernanceNandini SinghNo ratings yet

- Unit Two The Auditing ProfessionDocument26 pagesUnit Two The Auditing ProfessionHussen AbdulkadirNo ratings yet

- Business Ethics: Most Respectfully SubmitDocument16 pagesBusiness Ethics: Most Respectfully SubmitAnanay ChopraNo ratings yet

- Course Learning OutcomesDocument20 pagesCourse Learning OutcomesYung TianNo ratings yet

- Chapt2 0Document34 pagesChapt2 0Mohamed HashiNo ratings yet

- CH 04Document24 pagesCH 04sheetal gangradeNo ratings yet

- Chapter 4 SlideDocument45 pagesChapter 4 Slidekhanhly2k41107No ratings yet

- Arens Aas17 PPT 25Document45 pagesArens Aas17 PPT 25Loo Bee YeokNo ratings yet

- Chapt 6Document38 pagesChapt 6justiceclaiborne10No ratings yet

- Business Essentials: Understanding Business Ethics and Social ResponsibilityDocument42 pagesBusiness Essentials: Understanding Business Ethics and Social ResponsibilityDee IsmailNo ratings yet

- Developing Positive Employee RelationsDocument26 pagesDeveloping Positive Employee RelationstysinjohnNo ratings yet

- Chapter Four: Ethics and Social ResponsibilityDocument40 pagesChapter Four: Ethics and Social ResponsibilityHananie NanieNo ratings yet

- Johns Org-Behaviour 10e PPT ch08Document118 pagesJohns Org-Behaviour 10e PPT ch08Mohamed HassanNo ratings yet

- SSRN Id1751657Document23 pagesSSRN Id1751657Kamran LakhaniNo ratings yet

- Arens14e Ch05 PPT GeDocument51 pagesArens14e Ch05 PPT GeChristianto TanerNo ratings yet

- Chapter 2Document28 pagesChapter 2Erik NavarroNo ratings yet

- Business Ethics Notes & Study Material PDFDocument4 pagesBusiness Ethics Notes & Study Material PDFJyoti Singh67% (3)

- Introduction To Ethics and Professionalism: A Guide To Sound Ethical and Professional PracticeDocument51 pagesIntroduction To Ethics and Professionalism: A Guide To Sound Ethical and Professional PracticeRobert HamiltonNo ratings yet

- Chapter 25 EditedDocument59 pagesChapter 25 Editedahmed.alaradi88No ratings yet

- Introduction To Business Ethics and Social ResponsibilityDocument31 pagesIntroduction To Business Ethics and Social ResponsibilityAllan Angeles Orbita0% (1)

- Explain The Concept of Business Ethics With Context of An Organization of Your ChoiceDocument15 pagesExplain The Concept of Business Ethics With Context of An Organization of Your ChoiceKhushi ChadhaNo ratings yet

- Human Resource Management 11 Edition Business Ethics and Corporate Social ResponsibilityDocument44 pagesHuman Resource Management 11 Edition Business Ethics and Corporate Social ResponsibilityLiliana Rosemary Aponte PérezNo ratings yet

- Demanding Ethical and Socially Responsible BehaviorDocument23 pagesDemanding Ethical and Socially Responsible BehaviorEndriyani Rahayu100% (1)

- A Framework of Rules Management Accountability The Ethical Environment Ethics in Organisations Accountants and EthicsDocument12 pagesA Framework of Rules Management Accountability The Ethical Environment Ethics in Organisations Accountants and EthicsUmar FarooqNo ratings yet

- Ethics and Ethical ReasoningDocument21 pagesEthics and Ethical ReasoningThao TrungNo ratings yet

- Chapter 4Document42 pagesChapter 4Baby KhorNo ratings yet

- AUD23 - Lec3 HandoutDocument31 pagesAUD23 - Lec3 HandoutKiều TrangNo ratings yet

- CSR and Ethics2017Document21 pagesCSR and Ethics2017Adi Prima RizkiNo ratings yet

- The Ethical and Social Responsibilities of The Entrepreneur: Prepared By: Ana Merly F. de Los ReyesDocument24 pagesThe Ethical and Social Responsibilities of The Entrepreneur: Prepared By: Ana Merly F. de Los ReyesJayrick NatividadNo ratings yet

- BAcc 6 Prelim ExamDocument16 pagesBAcc 6 Prelim ExamJudil Banastao100% (2)

- CH4: Professional EthicsDocument9 pagesCH4: Professional EthicsAhmed HakimNo ratings yet

- Ethics in International Business: Mcgraw-Hill/IrwinDocument22 pagesEthics in International Business: Mcgraw-Hill/IrwinFauzan UsmanNo ratings yet

- Business Ethics For The Modern Man: Understanding How Ethics Fits Into The Business PlaceFrom EverandBusiness Ethics For The Modern Man: Understanding How Ethics Fits Into The Business PlaceRating: 5 out of 5 stars5/5 (1)

- AMA Lecture 6Document33 pagesAMA Lecture 6Mohammed FouadNo ratings yet

- AMA Lecture 7Document46 pagesAMA Lecture 7Mohammed FouadNo ratings yet

- ch05 Real Estate TaxDocument16 pagesch05 Real Estate TaxMohammed FouadNo ratings yet

- AMA Lecture 9Document23 pagesAMA Lecture 9Mohammed FouadNo ratings yet

- All CVP EquationsDocument5 pagesAll CVP EquationsMohammed FouadNo ratings yet

- AMA Lecture 2Document54 pagesAMA Lecture 2Mohammed FouadNo ratings yet

- Chapter 2 The Business Vision and Mission - DR - AbdulkarempptDocument42 pagesChapter 2 The Business Vision and Mission - DR - AbdulkarempptMohammed FouadNo ratings yet

- Topic: Grammatical Issues: What Are Parts of Speech?Document122 pagesTopic: Grammatical Issues: What Are Parts of Speech?AK AKASHNo ratings yet

- Sensitivity of Rapid Diagnostic Test and Microscopy in Malaria Diagnosis in Iva-Valley Suburb, EnuguDocument4 pagesSensitivity of Rapid Diagnostic Test and Microscopy in Malaria Diagnosis in Iva-Valley Suburb, EnuguSMA N 1 TOROHNo ratings yet

- Rankine-Froude Model: Blade Element Momentum Theory Is A Theory That Combines BothDocument111 pagesRankine-Froude Model: Blade Element Momentum Theory Is A Theory That Combines BothphysicsNo ratings yet

- BECED S4 Motivational Techniques PDFDocument11 pagesBECED S4 Motivational Techniques PDFAmeil OrindayNo ratings yet

- Abnt NBR 16868 1 Alvenaria Estrutural ProjetoDocument77 pagesAbnt NBR 16868 1 Alvenaria Estrutural ProjetoGIOVANNI BRUNO COELHO DE PAULANo ratings yet

- CycleMax IntroDocument13 pagesCycleMax IntroIslam AtefNo ratings yet

- I. Choose The Best Option (From A, B, C or D) To Complete Each Sentence: (3.0pts)Document5 pagesI. Choose The Best Option (From A, B, C or D) To Complete Each Sentence: (3.0pts)thmeiz.17sNo ratings yet

- TIA Guidelines SingaporeDocument24 pagesTIA Guidelines SingaporeTahmidSaanidNo ratings yet

- Government Hazi Muhammad Mohsin College Chattogram: Admission FormDocument1 pageGovernment Hazi Muhammad Mohsin College Chattogram: Admission FormThe Helper SoulNo ratings yet

- Installation 59TP6A 08SIDocument92 pagesInstallation 59TP6A 08SIHenry SmithNo ratings yet

- Sony x300 ManualDocument8 pagesSony x300 ManualMarcosCanforaNo ratings yet

- Dec 2-7 Week 4 Physics DLLDocument3 pagesDec 2-7 Week 4 Physics DLLRicardo Acosta Subad100% (1)

- Pitch DeckDocument21 pagesPitch DeckIANo ratings yet

- Poster-Shading PaperDocument1 pagePoster-Shading PaperOsama AljenabiNo ratings yet

- FINAL SMAC Compressor Control Philosophy Rev4Document6 pagesFINAL SMAC Compressor Control Philosophy Rev4AhmedNo ratings yet

- Scrum Exam SampleDocument8 pagesScrum Exam SampleUdhayaNo ratings yet

- Does Adding Salt To Water Makes It Boil FasterDocument1 pageDoes Adding Salt To Water Makes It Boil Fasterfelixcouture2007No ratings yet

- FIR FliterDocument10 pagesFIR FliterasfsfsafsafasNo ratings yet

- 11-Rubber & PlasticsDocument48 pages11-Rubber & PlasticsJack NgNo ratings yet

- RSW - F - 01 " ": Building UtilitiesDocument4 pagesRSW - F - 01 " ": Building Utilities62296bucoNo ratings yet

- 5620 SAM Rel 14 License Point Configuration ToolDocument416 pages5620 SAM Rel 14 License Point Configuration Toolluis100% (1)

- School Based Management Contextualized Self Assessment and Validation Tool Region 3Document29 pagesSchool Based Management Contextualized Self Assessment and Validation Tool Region 3Felisa AndamonNo ratings yet

- Management PriniciplesDocument87 pagesManagement Priniciplesbusyboy_spNo ratings yet

- Digital Systems Project: IITB CPUDocument7 pagesDigital Systems Project: IITB CPUAnoushka DeyNo ratings yet

- Chapter 2 HydrateDocument38 pagesChapter 2 HydrateTaha Azab MouridNo ratings yet

- Arudha PDFDocument17 pagesArudha PDFRakesh Singh100% (1)

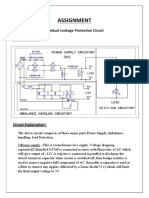

- Assignment: Residual Leakage Protection Circuit Circuit DiagramDocument2 pagesAssignment: Residual Leakage Protection Circuit Circuit DiagramShivam ShrivastavaNo ratings yet

- Structural Design Basis ReportDocument31 pagesStructural Design Basis ReportRajaram100% (1)

- Raiders of SuluDocument1 pageRaiders of SuluBlexx LagrimasNo ratings yet

- Chapter 01 What Is Statistics?Document18 pagesChapter 01 What Is Statistics?windyuriNo ratings yet