Professional Documents

Culture Documents

Topic 8 Derivatives

Topic 8 Derivatives

Uploaded by

pepemanila101Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 8 Derivatives

Topic 8 Derivatives

Uploaded by

pepemanila101Copyright:

Available Formats

Universidad Carlos III de Madrid 9/2/2010

Topic 8 Derivative Products

Table of contents:

8.1 Introduction

Topic 8- 8.2 Types of Derivatives

Derivative Products •Forward

•Future

•Options

Copyright of Spanish version from María Gutiérrez,

David Moreno and Luis Teijeiro

Translation into English by Francisco Romero

Universidad Carlos III 8.3 Pricing Principles

Financial Economics •Forward Price

•Put-Call Parity

Topic 8 Derivative products

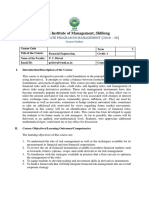

Objectives: 8.1 Introduction

Derivative: investment whose value depends on the value

of another asset (the underlying asset).

1. To be familiar with the different types of derivatives.

e.g.: forward contracts, future contracts, options and

2. To understand how to use them for risk

other contracts/bets linked to the value of assets.

management.

3. To understand how the derivatives market works.

4. To compute the payoffs of the buyer/seller of such How are they valued or priced?

products. Two main principles: replicating portfolio and arbitrage.

5. To understand the principles for pricing derivatives: The main studies, dated back to 1973 were made by

portfolio replication and arbitrage. Black and Scholes.

6. To be able to value a forward contract. This enabled the development of the derivatives market,

as investors were willing to assume counterparty risk.

3 4

(c) David Moreno y María Gutiérrez 1

Universidad Carlos III de Madrid 9/2/2010

8.1 Introduction 8.1 Introduction

What are they used for? Why do they get such bad press?

To speculate and to manage risks of individuals, corporations and

investment funds.

While risk management implies reducing risks,

As we know, there are two types of risk: speculation amplifies them. The former is not relevant

Market risk, which individuals can hardly eliminate but corporations

for the media.

can manage using derivatives.

(e.g.: macroeconomic risks like interest rates or exchange rates related risks) Derivative pricing is complicated.

Specific risk, which is easily diversifiable for an individual investor, but

cannot easily be managed with derivatives, even if in some cases

insurance can be used.

(e.g.: fire, theft)

Risk management (hedging) has expanded due to:

Increased competition and globalization. why?

The development of derivative markets.

5 6

8.2 Types of derivatives: FORWARD CONTRACT 3.2 Types of derivatives: FORWARD

Example: a vineyard owner agrees with a

FORWARD CONTRACT: agreement between two parties which implies that:

wholesaler to sell his harvest in a year

The buyer is obliged to purchase an asset on a future date and at a pre- from now at €0.5/kilo.

determined price.

One year later, the price is €0.75:

The seller is obliged to sell the asset on this future date and at such pre- The owner does not earn this extra €0.25/

Precio del suLargo

0

0.1

-0.5

-0.4

Corto

0.5

0.4

k= 0.5

Payments at settlement

determined price. 0.2 -0.3 date

0.3

kilo. 0.3

0,6 -0.2 0.2

0.4 -0.1 0.1

It is the wholesaler who earns it. 0,4

0.5 0 0

• The buyer (seller) is long (short) in the forward contract. One year later, the price is €0.40:

0.6

0,2 0.1 -0.1

Paymets

0.7 0.2 -0.2 Largo

0

0.8 0.3 -0.3

• The asset of reference is called underlying asset (St) The owner earns €0.1/kilo. -0,2

0.9

1

-0,4

0 0,1 0,2 0,3 0,4 0,5 0,6 0,7 0,8 0,9

0.4

0.5

-0.4

-0.5

Corto

• The future date of the operation is the settlement/maturity or The wholesaler does not earn this extra -0,6

Underlying price at settlement date

delivery date (T) €0.1/kilo.

• The pre-determined price is the forward price (K). In any case:

The owner has a guarantee to receive a

• Value of forward contract at time t (Ft)

€0.5/kilo income (cost for the wholesaler).

Their positions move in opposite

directions.

7 8

(c) David Moreno y María Gutiérrez 2

Universidad Carlos III de Madrid 9/2/2010

8.2 Types of derivatives: FUTURE CONTRACT 8.2 Types of derivatives: FUTURE CONTRACT

FUTURE: it is a special type of forward contract that is negotiated in The future contracts have the following characteristics as opposed

organized exchanges. to forward contracts:

• Only for certain assets (oil, oranges, IBEX35, Treasury Bonds,

currencies...), with specific amounts and maturities.

a) The contracts are traded on an

• Types of Futures according to the underlying asset: organized exchange (like the CBOT) Due to a) and b) a high number of

buyers and sellers will participate

Agriculture Futures (Soft Commodities)

Commodities) These contracts are very LIQUID

COMMODITIES

High competition between market

FUTURES

Metal Futures b) The contracts are standardized: participants to lower prices

By specifying size, underlying asset quality, Contracts can be cancelled before

delivery date… maturity

Energy Futures

Interest Rate Futures

c) There is a clearing house and a daily

Insolvency and counterparty

Currency Futures

settlement system.

FINANCIAL risks of forward contracts at

maturity are eliminated

FUTURES

Shares and Index Futures

9 10

8.2 Types of derivatives: FUTURE 8.2 Types of derivatives: OPTIONS

MEFF (Futures and Options Spanish official market) EUROPEAN OPTIONS:

http://www.meff.es/ing/indexi.htm An European call option gives the buyer the right (not the obligation)

to buy an underlying asset for a certain price (strike) at a specific date

in the future.

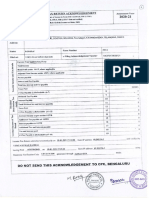

10/07/2009 10:26 Spot Futures • What happens to the seller of the call option?

Underlying asset last +/- % Maturity Last +/- % Contracts An European put option gives the buyer the right (not the obligation)

Contrato s/ IBEX-35 9.420,5 -0,24 17 Jul 9.415,0 -0,2 2972 to sell an underlying asset for a certain price (strike) at a specific time

ACERINOX 12,43 0,57 - in the future.

B. POPULAR 5,76 -0,43 18 Sep 5,60 -3,28 5 • What happens to the seller of the put option?

BBVA 8,77 0,11 18 Sep 8,75 -0,23 22

BME 20,37 -0,73 - • Call (Ct) and Put (Pt) prices

GAS NATURAL 12,10 0,17 - • Underlying asset price (St)

IBERDROLA 5,34 0,47 18 Sep 5,31 -0,19 10

• Strike or exercise price (E)

INDITEX 33,48 -0,03 -

REPSOL YPF 15,15 -0,03 18 Sep 15,20 0,13 73

• Expiration date (T)

SANTANDER 8,28 0,36 18 Sep 8,11 -0,25 368

TELEFONICA 15,70 -0,66 18 Sep 15,67 -1,01 4

11 12

(c) David Moreno y María Gutiérrez 3

Universidad Carlos III de Madrid 9/2/2010

8.2 Types of derivatives: OPTIONS 8.2 Types of derivatives: OPTIONS

Example: Call Option

Peter thinks oil price will spike next year. Price within Peter's

Peter's Bank's earnings Peter's Final Bank's Final

earnings in one in one option in result for one result for one Peter's total Bank's total

He buys 100 European call options on barrels of Brent oil for $45 each and a year

35

36

decision

do not exercise

do not exercise

option in a year

0

0

a year

0

0

option

-6

-6

option

6

6

result

-600

-600

result

600

600

expiration date in one year 37 do not exercise 0 0 -6 6 -600 600

The option price charged by the seller (a bank) is $6 38

39

do not exercise

do not exercise

0

0

0

0

-6

-6

6

6

-600

-600

600

600

How much do they earn if the barrel price rises to $55? To $50? To $40? 40

41

42

do not exercise

do not exercise

do not exercise

0

0

0

0

0

0

-6

-6

-6

6

6

6

-600

-600

-600

600

600

600

43 do not exercise 0 0 -6 6 -600 600

44 do not exercise 0 0 -6 6 -600 600

45 exercise 0 0 -6 6 -600 600

46 exercise 1 -1 -5 5 -500 500

47 exercise 2 -2 -4 4 -400 400

48 exercise 3 -3 -3 3 -300 300

49 exercise 4 -4 -2 2 -200 200

50 exercise 5 -5 -1 1 -100 100

51 exercise 6 -6 0 0 0 0

52 exercise 7 -7 1 -1 100 -100

53 exercise 8 -8 2 -2 200 -200

54 exercise 9 -9 3 -3 300 -300

55 exercise 10 -10 4 -4 400 -400

56 exercise 11 -11 5 -5 500 -500

57 exercise 12 -12 6 -6 600 -600

58 exercise 13 -13 7 -7 700 -700

59 exercise 14 -14 8 -8 800 -800

60 exercise 15 -15 9 -9 900 -900

13 14

8.2 Types of derivatives: OPTIONS 8.2 Types of derivatives: OPTIONS

Call payments at T (long) Call Total Result at T (long)

10 10

Example: Put Option

A farmer thinks that the price of wheat will tumble next year.

8 8

6 6

4 4

He buys a Put option with strike price of €500/ton and expiration date in a

2

2

year.

0

-2

35 40 45 50 55 60

0

-2

35 40 45 50 55 60 Each put option costs €40

-4 -4 How much would the farmer earn if the price of wheat/ton reaches €580

-6 -6 within a year? And what if it’s $485? And $400?

-8 Underlying price at T (ST) -8 Underlying price at T (ST)

Call payments at T (short) Call Total result at T (short)

10 10

8 8

6 6

4 4

2 2

0 0

35 40 45 50 55 60 35 40 45 50 55 60

-2 -2

-4 -4

-6 -6

-8 Underlying price at T (ST) -8 Underlying price at T (ST)

15 16

(c) David Moreno y María Gutiérrez 4

Universidad Carlos III de Madrid 9/2/2010

8.2 Types of derivatives: OPTIONS 8.2 Types of derivatives: OPTIONS

MEFF

We need to take into account that the farmer will sell his crop in the market, Market session: 10/07/2009

and that he is using options to hedge his position. It is therefore interesting to TELEFÓNICA

see the total result (put + production sold) 11:43

SPOT

The price in a year is €580, he sells the crop for €580. Last C hange %Change Open High Low Liquidity Yesterday

Net result 580-40=540 15,65 -0,15 -0,95 15,71 15,75 15,64 - 15,80

The price in a year is €485, he sells the crop for €485.

FUTURE 58

Net result 485-25=460 TEF CC PC PV CV Last Total High Lo w Yesterday

18-sep-09 10 15,63 15,68 75 15,65 58 15,68 15,65 15,83

The price in a year is €400, he sells the crop for €400.

18 Dic 09 1 15,39 15,59 100 - - - - 15,38

Net result 400+60=460

11:43

107 CALL OPTIONS PUT 300

To tal Last CC PC PV CV T EF CC PC PV CV Last Total

Net Result with Purchased (long) Put

Ago 09

Net Result per 5 0,17 200 0,12 0,19 200 16,50 200 0,96 1,06 200 - -

800 op tion

Sep 09

600

- - 200 0,42 0,52 210 16,00 200 0,75 0,83 200 0,79 100

400

200

Paymen ts for

Wheat sold Mar 10

0 100 1,15 100 1,16 1,29 210 15,50 300 1,32 1,48 210 1,34 200

-200 350 400 450 500 550 600 Net Result Mar 10

Wheat delivery price 2 0,30 100 0,18 0,38 100 18,00 100 2,83 3,23 100 - -

17 18

8.2 Types of derivatives: OPTIONS 8.2 Types of derivatives: OPTIONS

Between the date it is issued and the expiration date, the option will be:

A. Pagos Opción de Compra en T (largo) Payoff of put at expiration (long position)

• In the money (ITM): the value of the underlying asset is such that an

Payoff

option eventually exercised at this moment would produce earnings

Valor

Opción

• At the money (ATM): the value of the underlying asset=exercise price

Zona de no

ejercicio

Exercise

No exercise

region

• Out of the money (OTM): the value of the underlying asset is such that an

Zona de

ejercicio 0

region

ST

option eventually exercised at this moment would produce losses

E

0

E ST

Example(Telefónica): Classify the options quoted at 11:43 July 10th 2009

when the value of the underlying asset is 15.65, as ITM, ATM or OTM.

D. Payoff of put at expiration (short position)

C. Payoff of call at expiration (short position)

Payoff Payoff

0

0

No exercise E Exercise ST Exercise

No exercise ST

region region region E

region

19 20

(c) David Moreno y María Gutiérrez 5

Universidad Carlos III de Madrid 9/2/2010

8.3 Pricing Principles

8.2 Types of derivatives: OPTIONS

American options: Derivatives are priced according to two main principles:

• An American call option gives the buyer the right to buy the • Portfolio Replication using the underlying asset and the risk-free rate, and

underlying asset at a pre-determined price (strike price) and can be possibly short selling operations.

exercised at anytime before expiration. • No arbitrage opportunities between both portfolios.

• What happens to the seller of the American Call?

In order to be able to follow the ideas above we need to use these concepts:

• An American put option gives the buyer the right to sell the • What is short selling? Chapter 1

underlying asset at a pre-determined price (strike price) and can be • What is arbitrage? Chapter 1

exercised at anytime before expiration. • What is a replication portfolio?

• What happens to the seller of the American put?

If we have two diversified portfolios (no specific risk) with the same market risk

• Example: we own an American put option on BBVA shares at €17 strike we can say that these portfolios replicate each other.

price and expiration in 6 months. If today’s BBVA share price is €18, our

option is ITM. Should we exercise it? If these portfolios have different prices, there is an arbitrage opportunity: buy

the cheaper portfolio and short sell the expensive one.

21 22

8.3 Pricing Principles 8.3 Pricing Principles

Forward pricing: • Example 1: Suppose that today is January 1st 2020 and you have the obligation to buy

t=0 is the moment when the contract is signed. Compute the value at t of a one share from a company called X in two years for €48 because you bought a forward

contract three years ago. If today’s 2-year risk free interest rate is 5% and the share

forward contract to buy one share (underlying asset) at T of a firm that does price is €59. What price would you sell your forward contract for?

not pay dividends if the forward price is K, the risk-free rate for T − t periods

is rf and the share price is st.

• Forward:

Value at T: ST − K

Cost today: Ft?

• Replicating: zero coupon treasury bonds with face value K are sold short

at t, to fund the purchase of the underlying asset. The securities need to be

repurchased in T in order to close out the short position.

Value at T: ST − K • Example 2: Suppose that today is January 1st 2019 and there is a negotiation to buy a

forward that obliges the holder to buy shares from company X in three years. Today’s 3-

Cost today: st − K(1+rf )-(T−t) = Ft. No arbitrage value of the forward

year risk free rate is 7% and today’s share price is €39.19 euros. Compute the fprward

price.

At the moment of signing the forward contract, the cost is 0

0 = s0 −K(1 + rf )-T

K = s0(1 + rf )T

23 24

(c) David Moreno y María Gutiérrez 6

Universidad Carlos III de Madrid 9/2/2010

8.3 Pricing Principles 8.3 Pricing Principles

The payoff profiles of a forward contract is a linear function of the Put-call parity

underlying asset.

This makes the forward’s replicating portfolio simple and stable.

• The pricing principle covered so far can also be applied to options;

another useful tool is the the put-call parity (Stoll 1969) for

When the function is not linear (as with swaps or options) a dynamic European options that do not pay dividends.

strategy is needed (the replicating portfolio changes over the time);

in addition, the replicating portfolio will only be an approximation.

There will be a ’’tracking error’’

• The put-call parity defines an equilibrium relationship between the

price of call and a put option when both options have the same

underlying asset, exercise price and expiration date.

In those cases the Binomial valuation model and its continuous-

time version known as Black-Scholes model (1973) will be used

• In equilibrium, the price of a put option plus the price of the

underlying asset (obligation to sell the underlying asset which we

hold today) is equal to the price of a call option plus the present

value of the exercise price (hold the present value of the exercise

price to be able to exercise the call).

25 26

8.3 Pricing Principles 8.3 Pricing Principles

• Example: Suppose there is a call and a put option on a share whose value today is

11€. The 1-year risk-free interest rate is 5%, E = 10€, and expiration is in one year.

• The value at expiration (T) of both portfolios needs to be equal: The prices of the options are:

• C = 3€

• Portfolio A: European call option + present value of exercise price • P = 2€

• Does the put-call parity hold in this example?

• The value of the portfolio at T: max (ST – E, 0) + E = max (ST , E)

• Portfolio B: European put option + underlying asset

• The value of the portfolio at T: max (E – ST, 0) + ST = max (E , ST)

• By no arbitrage:

Ct + E(1 + rf )−(T-t) = Pt + St

or:

Ct − Pt = St −E(1 + rf )−(T-t)

27 28

(c) David Moreno y María Gutiérrez 7

Universidad Carlos III de Madrid 9/2/2010

8.3 Pricing Principles 8.3 Principios de valoración

• If the put-call parity does not hold. How can you benefit from this?

• From the put-call parity it can be shown that we can also replicate a

forward contract with forward price K and maturity at T by creating a

portfolio of a long European call and a short European put, both of

them with the same strike price (E=K), same maturity and with the

same underlying asset as the forward.

• See graph

29 30

8.3 Princing Principles 8.3 Pricing Principles

K= 10

Put-call parity results:

T=

rf=

3

0.05

Forward and replicating portfolio

payments at T

• 1. The value of an American call on a share that does not pay

S(T)

0

F(T)

-10

C(T)

0

-P(T)

-10

Bono

10

20

dividends is equal to the value of a European call, because it is

15

1

2

-9

-8

0

0

-9

-8

10

10

not worth to exercise the American call before it expires.

10

3

4

-7

-6

0

0

-7

-6

10

10 5

CAt ≥ CEt≥ St −E(1 + rf )−(T-t) > St − E

5 -5 0 -5 10 S

0 (

6 -4 0 -4 10 T

0 5 10 15 20 25

7 -3 0 -3 10

8

9

-2

-1

0

0

-2

-1

10

10

-5

-10

• 2. We can immunize a portfolio of shares creating a “floor”

10 0 0 0 10

-15

(minimum value) by buying a put. The option (its E) will have to

11 1 1 0 10 ST

12 2 2 0 10 be chosen carefully in order to minimize the immunization cost.

13 3 3 0 10

14

15

4

5

4

5

0

0

10

10

20

Long Call and short Put payments at

T St+Pt = Ct +E(1 + rf )−(T-t) ≥ E(1 + rf )−T

16 6 6 0 10 15

17 7 7 0 10

18 8 8 0 10 10

19 9 9 0 10

20 10 10 0 10 5

21 11 11 0 10

0 C

22 12 12 0 10 (

23 13 13 0 10 0 5 10 15 20 25

-5

24 14 14 0 10

25 15 15 0 10 -10

-15

ST

31 32

(c) David Moreno y María Gutiérrez 8

Universidad Carlos III de Madrid 9/2/2010

8.3 Pricing Principles Useful Websites

K= 10

T= 3

Payments at T (underlying asset + long

MEFF

rf= 0.05 put)

S(T) F(T) C(T) -P(T) Bono P(T) Cartera 20

Mercado Oficial de Futuros y Opciones Financieros en

0 -10 0 -10 10 10 10

1 -9 0 -9 10 9 10

15

España.

2 -8 0 -8 10 8 10 10

3

4

-7

-6

0

0

-7

-6

10

10

7

6

10

10 5 http://www.meff.com/index2.html

5 -5 0 -5 10 5 10 S(T)

LIFF

0 P(T)

6 -4 0 -4 10 4 10 0 5 10 15 20 25 Cartera

7 -3 0 -3 10 3 10 -5

8 -2 0 -2 10 2 10

9 -1 0 -1 10 1 10 -10 London International Financial Futures

10 0 0 0 10 0 10

11

12

1

2

1

2

0

0

10

10

0

0

11

12

-15

ST

http:// www.liffe-commodities.com

13 3 3 0 10 0 13

14

15

4

5

4

5

0

0

10

10

0

0

14

15

Payments at T (long Call + Rf security)

Chicago Mercantile Exchange

http:// www.cmegroup.com/market-data/delayed-

16 6 6 0 10 0 16 20

17 7 7 0 10 0 17

15

18 8 8 0 10 0 18

19

20

9

10

9

10

0

0

10

10

0

0

19

20

10 quotes/commodities.html

5

21 11 11 0 10 0 21 C(T)

22 12 12 0 10 0 22 0 Bono

Cartera

23 13 13 0 10 0 23 0 5 10 15 20 25

-5

24 14 14 0 10 0 24

25 15 15 0 10 0 25 -10

-15

ST

33 34

READINGS

Brealey, R.A., Myers, S.C. and Allen (2006). Principles of Corporate

Finance. McGraw Hill, 8th edition

Chapters 20 and 27

Grinblatt, M. and Titman, S. (2003). Financial Markets and

Corporate Strategy. McGraw Hill

Chapters 7 and 8.

35

(c) David Moreno y María Gutiérrez 9

You might also like

- KFC Marketing Plan For PakistanDocument7 pagesKFC Marketing Plan For PakistanAli SalahuddinNo ratings yet

- Bac 309Document63 pagesBac 309WINFRED KYALONo ratings yet

- BNEO LGA Pre-ActivityDocument1 pageBNEO LGA Pre-ActivityMike Guerzon100% (1)

- Reading 7 - DerivativesDocument2 pagesReading 7 - DerivativesMuhammad AlkahfiNo ratings yet

- Econ F354 - Fin F311 - DRMDocument5 pagesEcon F354 - Fin F311 - DRMf20220292No ratings yet

- M01 Financial Risk Management 01 XXXX PDFDocument18 pagesM01 Financial Risk Management 01 XXXX PDFMayank ChaturvediNo ratings yet

- CRM Proof PDFDocument404 pagesCRM Proof PDFtonicors_806375834No ratings yet

- Financial Derivatives and Their Application in Enterprises: Wanying Huang Xinrun YaoDocument6 pagesFinancial Derivatives and Their Application in Enterprises: Wanying Huang Xinrun YaoANKITA CHOWDHURYNo ratings yet

- Introduction To Derivative Instruments Part1Document49 pagesIntroduction To Derivative Instruments Part1Marco PoloNo ratings yet

- Overview PDFDocument6 pagesOverview PDFcclemNo ratings yet

- Trading StrategyDocument17 pagesTrading StrategyxrashexNo ratings yet

- Derivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorDocument90 pagesDerivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorChandan Srivastava100% (1)

- DBA 5035 - Financial Derivatives ManagementDocument277 pagesDBA 5035 - Financial Derivatives ManagementShrividhyaNo ratings yet

- A Study of Derivative Market in IndiaDocument6 pagesA Study of Derivative Market in IndiaEditor IJTSRDNo ratings yet

- An Analysis of Data Mining Applications For Fraud Detection in Securities MarketDocument7 pagesAn Analysis of Data Mining Applications For Fraud Detection in Securities MarketIIR indiaNo ratings yet

- Financial Derivatives 260214Document347 pagesFinancial Derivatives 260214akshay mourya100% (1)

- IJREAMV05I0452086745Document4 pagesIJREAMV05I0452086745yash wankhadeNo ratings yet

- Portfolio Theory Part1 and 2 DR - ToukabriDocument51 pagesPortfolio Theory Part1 and 2 DR - ToukabriNermine LimemeNo ratings yet

- Possibility To Use Derivatives in MongoliaDocument28 pagesPossibility To Use Derivatives in MongoliaZolboo NiisleldamiranNo ratings yet

- Working Paper Series: Center For Entrepreneurial and Financial StudiesDocument38 pagesWorking Paper Series: Center For Entrepreneurial and Financial StudiesRohit AggarwalNo ratings yet

- Shylaja.b SynobsisDocument28 pagesShylaja.b SynobsisBala SudhakarNo ratings yet

- Synopsis On Financial DerivativesDocument28 pagesSynopsis On Financial DerivativesbalasudhakarNo ratings yet

- Portfolio Management NotesDocument146 pagesPortfolio Management Notespriyarp5075No ratings yet

- 2013 JBR RVALETTEDEBARNIERMicrovsMacrobrandPersonalityDocument8 pages2013 JBR RVALETTEDEBARNIERMicrovsMacrobrandPersonalityjoaodiogoNo ratings yet

- Chapter 1 070804 - 2Document5 pagesChapter 1 070804 - 2Muhammad Zahid FaridNo ratings yet

- Hedgefund and Punto ComDocument44 pagesHedgefund and Punto ComDavidNo ratings yet

- 2014 12 Mercer Risk Premia Investing From The Traditional To Alternatives PDFDocument20 pages2014 12 Mercer Risk Premia Investing From The Traditional To Alternatives PDFArnaud AmatoNo ratings yet

- Economic Industry AnalysisDocument26 pagesEconomic Industry Analysisahmed salama abd elhakimNo ratings yet

- DerivativesDocument9 pagesDerivativesrududu duduNo ratings yet

- Derivatives and Risk ManagementDocument5 pagesDerivatives and Risk ManagementPuneet GargNo ratings yet

- Capital Markets 2020-30Document6 pagesCapital Markets 2020-30Andres Saavedra CameranoNo ratings yet

- The Investment Portfolio Selection Using Fuzzy Logic and PDFDocument6 pagesThe Investment Portfolio Selection Using Fuzzy Logic and PDFtatioliveira01No ratings yet

- 11 Chapter2Document33 pages11 Chapter2POOJA MODI 1829221No ratings yet

- Environmental Analysis: Increase in Gross Domestic SavingsDocument5 pagesEnvironmental Analysis: Increase in Gross Domestic Savingsangelsweety33No ratings yet

- 10 1108 - Ijbm 02 2020 0058Document19 pages10 1108 - Ijbm 02 2020 0058nora lizaNo ratings yet

- Print SlidesDocument12 pagesPrint Slidessustainablerewards8No ratings yet

- FRM Syllabus of AUDocument9 pagesFRM Syllabus of AUMeer Mazhar AliNo ratings yet

- Art 10Document21 pagesArt 10Karla LobatoNo ratings yet

- FIN F311 - Derivative and Risk Management (2) - CMSDocument6 pagesFIN F311 - Derivative and Risk Management (2) - CMSSaksham GoyalNo ratings yet

- TLC Investment PrintedDocument6 pagesTLC Investment PrintedDewi RenitasariNo ratings yet

- Fixed Income Markets - Term-V - Prof. Vivek RajvanshiDocument5 pagesFixed Income Markets - Term-V - Prof. Vivek RajvanshiAcademic Management SystemNo ratings yet

- fm4 1 PDFDocument15 pagesfm4 1 PDFMansoor SheikhNo ratings yet

- CSC CH13Document8 pagesCSC CH13Xuchen ZhuNo ratings yet

- ITA - Module2 (Week 2 and 3) PDFDocument8 pagesITA - Module2 (Week 2 and 3) PDFYeon KimNo ratings yet

- PPM123Document4 pagesPPM123sneha bhongadeNo ratings yet

- Present Scenario of Derivative Market in India An AnalysisDocument7 pagesPresent Scenario of Derivative Market in India An AnalysisGaurav KumarNo ratings yet

- International & Cultural Issues in ERM An Emerging Market PerspectiveDocument30 pagesInternational & Cultural Issues in ERM An Emerging Market PerspectiveHimanshu BhattNo ratings yet

- DerivativesDocument241 pagesDerivativesSomnath Rath (M20MS059)No ratings yet

- A Fundamental Study On Derivatives in India: Kuvempu UniversityDocument68 pagesA Fundamental Study On Derivatives in India: Kuvempu UniversityRakesh SettyNo ratings yet

- 2022 ICM Part 4Document58 pages2022 ICM Part 4amkamo99No ratings yet

- Hybrid Forex Prediction Model Using Multiple Regression, Simulated Annealing, Reinforcement Learning and Technical AnalysisDocument20 pagesHybrid Forex Prediction Model Using Multiple Regression, Simulated Annealing, Reinforcement Learning and Technical AnalysisIAES IJAINo ratings yet

- Analysis Part of The ReportDocument12 pagesAnalysis Part of The ReportSPORTS CITYNo ratings yet

- Birla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR DivisionDocument6 pagesBirla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR DivisionArchak SinghNo ratings yet

- Finance Elective Syllabus Tri-IV Batch 2021-23Document9 pagesFinance Elective Syllabus Tri-IV Batch 2021-23sanket patilNo ratings yet

- FIN 440. Syllabus - Investment AnalysisDocument3 pagesFIN 440. Syllabus - Investment AnalysisHuyen Linh NguyenNo ratings yet

- Study of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementDocument45 pagesStudy of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementmaheshNo ratings yet

- Copy Trading: Apesteguia, Jose Oechssler, Jörg Weidenholzer, SimonDocument32 pagesCopy Trading: Apesteguia, Jose Oechssler, Jörg Weidenholzer, SimonGeatanNo ratings yet

- CASE STUDY David Pyott 1Document9 pagesCASE STUDY David Pyott 1Jamie Rose AragonesNo ratings yet

- Eri WP Predicting Decomposing Risk Data Driven Portfolios 0 PDFDocument46 pagesEri WP Predicting Decomposing Risk Data Driven Portfolios 0 PDFdemetraNo ratings yet

- Financial Engineering - P C BiswalDocument5 pagesFinancial Engineering - P C BiswalRupaliVajpayeeNo ratings yet

- Derivativesin Risk ManagementDocument7 pagesDerivativesin Risk Managementdavid56565No ratings yet

- Topic 2 Financial MathematicsDocument7 pagesTopic 2 Financial Mathematicspepemanila101No ratings yet

- Topic 1 IntroductionDocument5 pagesTopic 1 Introductionpepemanila101No ratings yet

- Topic 3 NPVDocument7 pagesTopic 3 NPVpepemanila101No ratings yet

- Topic 5 Portfolio TheoryDocument8 pagesTopic 5 Portfolio Theorypepemanila101No ratings yet

- Questions For Final Exam CP 2021 1 GradedDocument5 pagesQuestions For Final Exam CP 2021 1 Gradedpepemanila101No ratings yet

- Examen Final CP Ejemplo ResueltoDocument6 pagesExamen Final CP Ejemplo Resueltopepemanila101No ratings yet

- M-550 Power Service Manual: Model No: 3399 Drawring No: Customer: Model No: M-550 Power Rev, DateDocument65 pagesM-550 Power Service Manual: Model No: 3399 Drawring No: Customer: Model No: M-550 Power Rev, Datealbinopu2liuNo ratings yet

- Intermediate Accouting Sample ProblemsDocument24 pagesIntermediate Accouting Sample ProblemstrishaNo ratings yet

- National Competency-Based Teacher StandardsDocument21 pagesNational Competency-Based Teacher StandardsLau BeruinNo ratings yet

- Competition - Good or Bad, Cetorrelli 2001Document11 pagesCompetition - Good or Bad, Cetorrelli 2001Ramm PknnNo ratings yet

- COMS222 Diagram 1Document6 pagesCOMS222 Diagram 1Deanne FernandezNo ratings yet

- Latihan 2 - Soal Pas Bing SMP Kelas 9Document8 pagesLatihan 2 - Soal Pas Bing SMP Kelas 9farahdillahrahma95No ratings yet

- Legally Required Benefits in Context of PakistanDocument16 pagesLegally Required Benefits in Context of Pakistanasim javedNo ratings yet

- Speaking 2 B12Document5 pagesSpeaking 2 B12miltonNo ratings yet

- Past Life Returner - 01!1!150Document150 pagesPast Life Returner - 01!1!150Edgar Estebam Soto EstrellaNo ratings yet

- PHD Thesis Samuel Coenen PDFDocument172 pagesPHD Thesis Samuel Coenen PDFsamuel_coenenNo ratings yet

- Tscyayfd 1 WDocument9 pagesTscyayfd 1 Wapi-350642766No ratings yet

- G H H H - C S: R H I C P A C Hicpac/Shea/Apic/Idsa H H T FDocument39 pagesG H H H - C S: R H I C P A C Hicpac/Shea/Apic/Idsa H H T FAbidi HichemNo ratings yet

- Voting PatternsDocument31 pagesVoting Patternsstefania0912No ratings yet

- Dos My HouseDocument3 pagesDos My HouseKristine TorresNo ratings yet

- 1 Avila V TapucarDocument1 page1 Avila V TapucarAnonymous isdp4VNo ratings yet

- Ong Kim SengDocument2 pagesOng Kim SengDrSunanda MitraNo ratings yet

- TaylorDocument6 pagesTaylorsal27adamNo ratings yet

- ECA 2 LAb REPORT 6Document13 pagesECA 2 LAb REPORT 6Atyia JavedNo ratings yet

- CasesDocument164 pagesCasesgleeNo ratings yet

- Atlantic International University - Bachelor, Master, Doctoral Degree Programs by Distance Learning PDFDocument7 pagesAtlantic International University - Bachelor, Master, Doctoral Degree Programs by Distance Learning PDFEd Phénix le PrinceNo ratings yet

- The Crusades - Final Assignment (Answer Key)Document3 pagesThe Crusades - Final Assignment (Answer Key)api-284208938No ratings yet

- ACTIVITY SHEET 1 q3Document2 pagesACTIVITY SHEET 1 q3Tired LupinNo ratings yet

- Hammer - Sand Drains 2003Document14 pagesHammer - Sand Drains 2003ועדת איכות הסביבה חייםNo ratings yet

- Social Project ManagementDocument9 pagesSocial Project ManagementLê Anh VũNo ratings yet

- Q2 18 19Document4 pagesQ2 18 19Surya SudheerNo ratings yet

- Progress Report: Design Considerations of Go KartDocument6 pagesProgress Report: Design Considerations of Go KartINNOVIZ 19No ratings yet

- GSF Financials - CompressedDocument19 pagesGSF Financials - CompressedHari GSFNo ratings yet

- Cardiac Surgeries PPT FinalDocument55 pagesCardiac Surgeries PPT FinalDumora FatmaNo ratings yet