Professional Documents

Culture Documents

Leveraged Buyouts (Digital)

Uploaded by

Emperor OverwatchOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Leveraged Buyouts (Digital)

Uploaded by

Emperor OverwatchCopyright:

Available Formats

Leveraged Buyouts

DIGITAL FACT SHEET

Printing permitted for personal use only. Redistribution prohibited.

What Makes a Company a Good LBO Target?

Undervalued Potential for increased operational Low CapEx (Capital

profitability (i.e. margin improvement Expenditure) and OWC

Stable cash flows by cost rationalization) (Operating Working

Capital) requirements

Exit opportunities Strong management team

s

Exit Pros Cons

ch

Usually full exit; Typically less support

LBO Exit Strategies

Sale to Third Party Strategic Buyer

buyer will pay for synergies from management

Distributions to Shareholders (Special Allows partial liquidity to Subject to market

Dividends and Recapitalizations) equity holders conditions

Another LBO

Sa Full liquidity Less potential for

operational improvement

IPO Wider pool of potential Usually only a partial exit;

investors IPO “discount”

an

Internal Rate of Return (IRR) = ((Exit equity ÷ Entry equity)(1 )− 1

÷ Years)

dm

Max Entry Equity for given IRR = Exit equity ÷ (1 + IRR) Years

Value Creation

ol

Entry Valuation Exit Valuation Value Created

G

DECOMPOSED

EV increases from EBITDA increase and multiple expansion

Debt decreases from paying down of debt

+ Debt Repayments 100

Total value created is equal to the increase in equity

Net debt remaining EBITDA multiple

at exit 8 = Entry debt − Exit debt

300

× + EBITDA Improvement 140

EBITDA multiple

7 = (Exit EBITDA − Entry EBITDA) × Entry multiple

Net debt at entry

EBITDA

400

× 120

EBITDA

+ Multiple Expansion 120

100 Equity

= (Exit multiple − Entry multiple) × Exit EBITDA

660

Enterprise value Equity Enterprise value = Value Created 360

700 300 960

= Exit equity − Entry equity

© 2020 Financial Edge Training www.fe.training

Leveraged Buyouts

DIGITAL FACT SHEET

Printing permitted for personal use only. Redistribution prohibited.

Sample Valuation

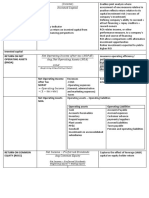

Year 0 1 2 3 Entry Exit

EBITDA 200 203 207 210 Entry EBITDA multiple 8x Exit EBITDA multiple 8x

EBIT 183 187 188 Entry EBITDA 200 Exit EBITDA 210

Tax rate 35% 35% 35%

Acquisition enterprise value 1600 Exit enterprise value 1680

(8 × 200) (8 × 210)

NOPAT 119 121 122 Max debt/EBITDA multiple 5x Sum of free cash flows 356

(117 + 119 + 120)

Depreciation 20 20 22

s

Capex (21) (21) (23) Acquisition debt 1000 Debt remaining at exit 644

(5 × 200) (1000 − 356)

ch

(Inc) Dec in OWC (1) (1) (1)

Entry equity 600 Equity at exit 1036

Free cash flow 117 119 120 (1600 − 1000) (1680 − 644)

Equity Valuation to Achieve 20% IRR = Exit equity ÷ (1 + Target IRR)Years 600 = 1036 ÷ (1 + 0.2)3

Sa

+ EBITDA Credit Ratios

+ Acquisition equity value − Cash taxes

Total debt* ÷ EBITDA

+ Refinance existing net debt +/− Changes in OWC

an

+/− Change in other long-term assets and liabilities Total debt* ÷ (EBITDA − Capex)

+ Debt financing fees

+ Advisory fees − Capex EBITDA ÷ Cash interest

= Total uses of funds = Cash available for debt service (EBITDA − Capex) ÷ Cash Interest

− Total debt raised − Total net cash interest expense*

FCF ÷ Total debt

dm

= Equity Financing Required = Cash Flow Available for Debt Repayment * Total debt excludes preference shares

* Note mezzanine (Payment In Kind, PIK) is a non-cash charge

Percentage of Equity to Total Consideration = Equity financing required ÷ Total sources of funds

ol

SENIOR SECURED DEBT (BANK LOANS) SENIOR UNSECURED DEBT

Available to the public, these notes are a junior

Revolver Revolving credit facility from bank used

High Yield source of debt financing and as such command

to finance short term working capital

G

Notes higher interest rates to compensate holders for

their increased risk.

Term A Amortizing repayment SUBORDINATE DEBT

Term B Bullet repayment

LBO Term Structure

Structured as a loan – usually with a fixed interest

Term C Bullet repayment Mezzanine rate, plus the benefit of warrants on the common

equity. Interest is usually Paid In Kind

Paid after first lien / senior debt OTHER DEBT

Second Lien structured as a bullet repayment,

usually priced with a fixed interest rate. Shareholder Equity-like risk but can be more tax efficient

Loans since interest is tax deductible

Used in medium / smaller transactions where

Unitranche a single debt tranche is faster and simpler to SPONSOR AND MANAGEMENT EQUITY

arrange with a small group of lenders.

Preferred Provided by the financial sponsors. Fixed dividend

A short-term loan to bridge the time period Equity rate usually Paid In Kind

between completion and a refinancing such

as a bond issue or sale and leaseback of Provided by the financial sponsors, management,

Bridge Loan

assets. Will normally last up to a year and Common and sponsor executives. Generally, no dividends

have increased interest or dilutive Equity are paid. Management equity is a key component

implications if not repaid in time to keep them incentivized.

© 2020 Financial Edge Training www.fe.training

You might also like

- Comprehensive Finance Cheat Sheet Collection 1698244606Document52 pagesComprehensive Finance Cheat Sheet Collection 1698244606muratgreywolf100% (1)

- US CMA Gleim Part 2Document258 pagesUS CMA Gleim Part 2Joy Krishna Das100% (1)

- Inancing Ecisions Everages: Learning OutcomesDocument35 pagesInancing Ecisions Everages: Learning OutcomesBhai LangurNo ratings yet

- WST Cash Flow MetricsDocument2 pagesWST Cash Flow MetricsGabriel La MottaNo ratings yet

- R.A. # 11232: Revised Corporation Code of The Philippines Transactions Vote Percentage For Stock CorporationsDocument6 pagesR.A. # 11232: Revised Corporation Code of The Philippines Transactions Vote Percentage For Stock CorporationsMohammad Nowaiser MaruhomNo ratings yet

- Distress PDFDocument65 pagesDistress PDFKhushal UpraityNo ratings yet

- Ratio Analysis Cheat SheetDocument1 pageRatio Analysis Cheat SheetAtharva Gore100% (1)

- Mastering Mergers AcquisitionsDocument6 pagesMastering Mergers AcquisitionsSarfaraz Khan0% (1)

- Lecture 33 Credit+Analysis+-+Corporate+Credit+Analysis+ (Ratios)Document33 pagesLecture 33 Credit+Analysis+-+Corporate+Credit+Analysis+ (Ratios)Taan100% (1)

- Financial Statement Analysis FIN658Document1 pageFinancial Statement Analysis FIN658azwan ayop50% (2)

- Raport Kroll II OcrDocument154 pagesRaport Kroll II OcrSergiu BadanNo ratings yet

- 3SM With Iterations Model 1 Model IntroDocument5 pages3SM With Iterations Model 1 Model IntroEmperor OverwatchNo ratings yet

- Financial Analysis Final (Autosaved)Document159 pagesFinancial Analysis Final (Autosaved)sourav khandelwalNo ratings yet

- Analysis of Financial StatementsDocument46 pagesAnalysis of Financial StatementsSwaroop Ranjan Baghar25% (4)

- Liquidity: Financial Statements (FS) Analysis Tools and TechniqueDocument6 pagesLiquidity: Financial Statements (FS) Analysis Tools and TechniqueDondie ArchetaNo ratings yet

- Brealey MyersDocument27 pagesBrealey MyersHachikuroba100% (3)

- Chapter 2: The Conceptual FrameworkDocument36 pagesChapter 2: The Conceptual FrameworkMuzammil RehmanNo ratings yet

- Midterms I Answer KeyDocument5 pagesMidterms I Answer Keyaldric taclanNo ratings yet

- Financial Statements Model: 1 Income Statement 2 Balance Sheet 3 Cash Flow Statement 4 Scenarios 5 Supporting SchedulesDocument20 pagesFinancial Statements Model: 1 Income Statement 2 Balance Sheet 3 Cash Flow Statement 4 Scenarios 5 Supporting SchedulesEmperor OverwatchNo ratings yet

- Dominos+Pizza+Financial+Model+v1 TemplateDocument5 pagesDominos+Pizza+Financial+Model+v1 TemplateEmperor OverwatchNo ratings yet

- FINC00002Document3 pagesFINC00002Nageshwar SinghNo ratings yet

- Capital Budgeting Project Evaluation TechniquesDocument16 pagesCapital Budgeting Project Evaluation Techniquessamuel kebedeNo ratings yet

- Use The Following Information To Answer Items 1 To 4Document4 pagesUse The Following Information To Answer Items 1 To 4Chris Jay LatibanNo ratings yet

- Masterclass On EBITDADocument15 pagesMasterclass On EBITDArdttecNo ratings yet

- Financial Statement Analysis RatiosDocument4 pagesFinancial Statement Analysis RatiosAmelieNo ratings yet

- 2257 SheetDocument2 pages2257 Sheetev.smith850No ratings yet

- Vertical Analysis Exercise: Strictly ConfidentialDocument2 pagesVertical Analysis Exercise: Strictly ConfidentialPRANAV BHARARANo ratings yet

- Dokumen 2Document2 pagesDokumen 2Dian HaniifahNo ratings yet

- Amity Global Business School Amity Global Business School: Valuation ConceptsDocument36 pagesAmity Global Business School Amity Global Business School: Valuation ConceptssachinremaNo ratings yet

- Compilation of Formulas For RatioDocument2 pagesCompilation of Formulas For RatiojozetteypilNo ratings yet

- UEU Penilaian Asset Bisnis Pertemuan 14Document67 pagesUEU Penilaian Asset Bisnis Pertemuan 14Saputra SanjayaNo ratings yet

- Women in Banking 15m (Empty)Document296 pagesWomen in Banking 15m (Empty)El rincón de las 5 EL RINCÓN DE LAS 5No ratings yet

- Company Valuation - Course NotesDocument10 pagesCompany Valuation - Course NotesAfonsoNo ratings yet

- Financial Statement Analysis Template: Ratio Formula RatioDocument1 pageFinancial Statement Analysis Template: Ratio Formula RatioMetilda MorasNo ratings yet

- EBITDA Example EBITDA (Video) - Stocks and Bonds EBITDA - Stocks and Bonds - Finance & Capital Markets - Khan AcademyDocument1 pageEBITDA Example EBITDA (Video) - Stocks and Bonds EBITDA - Stocks and Bonds - Finance & Capital Markets - Khan AcademyterserahgueNo ratings yet

- Adjusting Entries / Jurnal PenyesuaianDocument4 pagesAdjusting Entries / Jurnal PenyesuaianRatu ShaviraNo ratings yet

- Cheating Sheet IFMDocument2 pagesCheating Sheet IFManggittutpinilihNo ratings yet

- M4. Designing A Buyout Case XYZ Handout 1Document60 pagesM4. Designing A Buyout Case XYZ Handout 1spps140899No ratings yet

- Project Cost Management April 2021Document189 pagesProject Cost Management April 2021bharathiNo ratings yet

- IFRS 3 Business CombinationDocument5 pagesIFRS 3 Business CombinationImraz IqbalNo ratings yet

- Sustainable Growth RateDocument6 pagesSustainable Growth RateadhishcaNo ratings yet

- ROE and ROA Ratios For Accounting SummaryDocument3 pagesROE and ROA Ratios For Accounting SummarymyzevelNo ratings yet

- Accounting: IncomeDocument7 pagesAccounting: IncomeAyesha AliNo ratings yet

- Roce Fast Track Routing: Shines To WinDocument2 pagesRoce Fast Track Routing: Shines To WinEvery day GuyNo ratings yet

- Company ValuationDocument10 pagesCompany ValuationJia MakhijaNo ratings yet

- Acc 1Document45 pagesAcc 1wengkeii07No ratings yet

- Mergers Acquisitions Fact Sheet (Digital)Document2 pagesMergers Acquisitions Fact Sheet (Digital)Emperor OverwatchNo ratings yet

- Ratio Analysis ch-6Document11 pagesRatio Analysis ch-6IP MAXNo ratings yet

- FM SethDocument30 pagesFM SethUtsav MehtaNo ratings yet

- Ratios and InterpretationDocument6 pagesRatios and Interpretationjohngay1987No ratings yet

- Leverage and Excess Risk Acivity Based Costing: BusinessDocument1 pageLeverage and Excess Risk Acivity Based Costing: Businessjavier apodacaNo ratings yet

- Review Session - NUS ACC1002 2020 SpringDocument50 pagesReview Session - NUS ACC1002 2020 SpringZenyuiNo ratings yet

- Ratios IpapaprintDocument2 pagesRatios IpapaprintcoleenNo ratings yet

- Leverage 01Document22 pagesLeverage 01savani margeshNo ratings yet

- Financial Statements Cheat SheetDocument1 pageFinancial Statements Cheat SheetjmbaezfNo ratings yet

- Finance Loop Cards: Opening Balance in JuneDocument1 pageFinance Loop Cards: Opening Balance in JunedollyNo ratings yet

- Leverage Analysis (Autosaved)Document33 pagesLeverage Analysis (Autosaved)Prashant SharmaNo ratings yet

- UAS ANALISIS LAP KEUANGAN DARIUS ULIMPATY-dikonversiDocument8 pagesUAS ANALISIS LAP KEUANGAN DARIUS ULIMPATY-dikonversiIyah LyaNo ratings yet

- EBITDA Misunderstood and MisusedDocument3 pagesEBITDA Misunderstood and Misusedangela mesiasNo ratings yet

- 4 Summary of Commonly Used Ratios (AS & A Level)Document3 pages4 Summary of Commonly Used Ratios (AS & A Level)Musthari KhanNo ratings yet

- Fcffginzu - Xls Using The Valuation SpreadsheetDocument13 pagesFcffginzu - Xls Using The Valuation SpreadsheetMuhammad Zeeshan SaleemNo ratings yet

- 72823cajournal Feb2023 20Document7 pages72823cajournal Feb2023 20S M SHEKARNo ratings yet

- Formula Sheet: Pay Back PeriodDocument3 pagesFormula Sheet: Pay Back PeriodtejaswiNo ratings yet

- 111 - Notes RatiosDocument4 pages111 - Notes RatiosCharlotteNo ratings yet

- Notes For L3Document11 pagesNotes For L3yuyin.gohyyNo ratings yet

- Liv PDFDocument24 pagesLiv PDFravi sharmaNo ratings yet

- Working Capital Management: 30 July 2016Document44 pagesWorking Capital Management: 30 July 2016Nguyễn Ngọc KhánhNo ratings yet

- International Financial Management: Presented To: Prof - ParshuramanDocument27 pagesInternational Financial Management: Presented To: Prof - ParshuramanNiveet SrivastavaNo ratings yet

- Dupont AnalysisDocument6 pagesDupont Analysissoumya_2688No ratings yet

- Discussion NotesDocument3 pagesDiscussion NotesyennieNo ratings yet

- Demo LeverageDocument18 pagesDemo LeverageIftikhar baigNo ratings yet

- AFAR Last Minute by HerculesDocument8 pagesAFAR Last Minute by Herculesjanjan3256No ratings yet

- Simple DCF Workout EmptyDocument3 pagesSimple DCF Workout EmptyEmperor OverwatchNo ratings yet

- Mergers Acquisitions Fact Sheet (Digital)Document2 pagesMergers Acquisitions Fact Sheet (Digital)Emperor OverwatchNo ratings yet

- Open Source Deal Memo Template - Point Nine CapitalDocument2 pagesOpen Source Deal Memo Template - Point Nine CapitalEmperor OverwatchNo ratings yet

- Accounting and Financial Analysis: 565005511.xlsx WelcomeDocument4 pagesAccounting and Financial Analysis: 565005511.xlsx WelcomeEmperor OverwatchNo ratings yet

- Monetary Systems SummaryDocument8 pagesMonetary Systems SummaryEmperor OverwatchNo ratings yet

- 3 Statement Modeling With Iterations SummaryDocument7 pages3 Statement Modeling With Iterations SummaryEmperor OverwatchNo ratings yet

- Hit Scripts Is A Service Type Enterprise in The Entertainment FieldDocument1 pageHit Scripts Is A Service Type Enterprise in The Entertainment Fieldtrilocksp SinghNo ratings yet

- T.y.baf F.A - VLDocument5 pagesT.y.baf F.A - VLStar NxtNo ratings yet

- Corporate LawDocument5 pagesCorporate LawKim HuatNo ratings yet

- Financial Management MCQsDocument27 pagesFinancial Management MCQsYogesh KamraNo ratings yet

- NITL Annual ReportDocument1 pageNITL Annual ReportKristi DuranNo ratings yet

- Revised-application-for-CoR For HFCDocument28 pagesRevised-application-for-CoR For HFCmuskanNo ratings yet

- Payment Details: Email: Investor - Relations@pidilite - Co.inDocument2 pagesPayment Details: Email: Investor - Relations@pidilite - Co.inOpenText DataNo ratings yet

- Extract From The Minutes of The Board of DirectorsDocument2 pagesExtract From The Minutes of The Board of DirectorsJBS RINo ratings yet

- Afar December 2021Document19 pagesAfar December 2021T-306 Caturla FairyzenNo ratings yet

- BibliographyDocument5 pagesBibliographyKen PimenteroNo ratings yet

- Corporate Taxation: Formation, Reorganization, and LiquidationDocument33 pagesCorporate Taxation: Formation, Reorganization, and LiquidationMo ZhuNo ratings yet

- Course Week Section Udemy: Course Introduction & How To Take This Course Decide What Financial Analyst Role InterestDocument4 pagesCourse Week Section Udemy: Course Introduction & How To Take This Course Decide What Financial Analyst Role InterestmaniiscribdNo ratings yet

- Arif Hidayatulloh (221124592)Document64 pagesArif Hidayatulloh (221124592)Verro CasparoNo ratings yet

- ITC Analysis FMDocument19 pagesITC Analysis FMNeel ThobhaniNo ratings yet

- Maintenance Charge Summary: Billing Period: Up To MarDocument5 pagesMaintenance Charge Summary: Billing Period: Up To MarSadman SayadNo ratings yet

- Balance Sheet of FinanceDocument17 pagesBalance Sheet of FinanceManish TayadeNo ratings yet

- International Capital StructureDocument7 pagesInternational Capital StructureRahul SomanNo ratings yet

- Bank Capital RefresherDocument16 pagesBank Capital RefresherrouphaelrNo ratings yet

- JPM Brazilian Education 2023-01-12 4293165 PDFDocument15 pagesJPM Brazilian Education 2023-01-12 4293165 PDFSamantha LacerdaNo ratings yet

- Accounts PracticalDocument22 pagesAccounts PracticalDivija MalhotraNo ratings yet