Professional Documents

Culture Documents

Business Travel Expenses Policy

Uploaded by

ArifOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Travel Expenses Policy

Uploaded by

ArifCopyright:

Available Formats

BUSINESS TRAVEL & EXPENSES POLICY

BUSINESS TRAVEL & EXPENSES POLICY

When employees are required to travel on business, the HR Travel Desk will make

the necessary arrangements to ensure travel requirements are met. Employees are

to submit all documents and approvals to the Travel Desk before travel is arranged.

Travel Desk will thereafter make arrangements for the purchasing of airline tickets,

making hotel bookings and arranging transportation where required.

Reimbursements for reasonable sundry travel expenses and costs incurred as a

consequence of business travel will be reimbursed to the Employee by RA providing

the conditions in Article 4 are met.

Business related travel must have a recurring benefit to the company (e.g., business

development meetings with potential clients or attendance at mandatory site visits)

or be a strategic necessity for the company (e.g., registering a company in a new

jurisdiction).

1. Purpose

The purpose of this Policy is to provide efficient, reasonable, and accountable

guidelines for dealing with business travel expenses, to identify the mandatory

submissions of reports after business travel and the benefit of such travel to the

company; to delineate those expenses that are eligible for reimbursement and

specify any financial limits applicable to such expenses; and to explain the

procedures and responsibilities for dealing with business travel expenses.

2. Principles

The means of travel must be cost-effective and commensurate with Employee’s

position within the company as indicated in Articles 4.1 and 4.2. Business Travel must

be justified, approved and followed by an Expense Claim Form. All travel expense

claim forms are to be submitted to the Travel Representative or the HR

representative in operational areas.

3. Scope

This Policy applies to all Directors, Management, and Staff expected to travel locally

and abroad for business purposes.

4. Expense Definitions

Eligible Expenses are normally those deemed reasonable and prudent e.g.,

transportation (taxis, airport buses, car rentals, parking charges, public

transportation), accommodation, meal allowances, telephone calls, immigration

registration, and other business-related expenditures.

Non-Eligible Expenses are usually those deemed personal, e.g., personal

entertainment, sightseeing, side travels, ‘tips’ and expenses for a spouse or other

individual accompanying the Employee.

Reasonable Expenses are expenses accrued that may be justifiably expected in the

normal course of business and that have not necessarily been accounted for in any

HRM-0006-POL [R00] Jul-2022

1/7

BUSINESS TRAVEL & EXPENSES POLICY

budgeted requirement and/or not specifically detailed in this Policy.

4.1 FLIGHTS

The Travel Desks will always ensure that business travel is arranged by the most

economically available flights. Directors, in view of their business preparation and

planning requirements, are entitled to business class travel.

4.1.1 Prior to making a travel arrangement, each employee whose position

requires business travel must obtain approval from their Line Manager

and complete a Business Travel Request Form. Upon receiving a

request for Business Travel, the Travel Desk will coordinate with

company approved travel agencies to arrange the travel itinerary.

4.1.2 In some cases, the Requestor of the Travel can be different from the

Traveller but should be well documented in relation to the reason for

travel.

4.1.3 The Requester should provide the purpose of the Travel as per the

below categories:

• Operations (General): this Category will be covering normal

business operations and cost will be charged to his respective

department.

• Operations (Specific): where the purpose of Travel is for a specific

Project, the Requestor should specify the related Project Name after

confirming with the Director of Projects as the cost will be charged

to that specified Project.

• Training

• Selling (General): this category should be approved by Business

Development Director.

• Selling (Specific): this category should be approved by Business

Development Director.

• PLC: This is specific to UK related travels and should be approved

by the CFO.

4.1.4 Requests for Business Travel should be made as far in advance

(preferably one month in advance of the Travel) to secure the best

discounts and availability. All airline tickets will normally be issued as

e-tickets. It is the responsibility of the Employee to review the tickets

and itinerary and ensure they meet the scheduled requirements of

Travel.

4.1.5 Airfares change constantly and there are certain airline rules

associated with special fares and air carriers. The non-refundable rules

with relation to air tickets require that changes to a ticket must be

made prior to the original date and time of travel. Some carriers are

more lenient allowing changes to be made up until the last minute.

Failure to follow the time restrictions on ticket changes will result in

forfeiture of the full ticket value which will be charged to the Employee

HRM-0006-POL [R00] Jul-2022

2/7

BUSINESS TRAVEL & EXPENSES POLICY

if no justifiable reason for the change exists. Missing flights, unless

through extraneous circumstances, will result in the full ticket fare

being recovered from the Employee concerned.

4.1.6 Changes resulting from frequent flyer upgrades are the responsibility

of the Employee and will not be reimbursed. Employees are

responsible for processing their own upgrades. Deliberately causing

the company to pay more than the lowest available airfare for the

purpose of obtaining personal gratuities (e.g., frequent flyer awards,

first/business class upgrades) is strictly prohibited. Under no

circumstances may an employee deviate from the standards set in this

Policy in order to accumulate travel bonuses.

4.2 ACCOMMODATION

4.2.1 In the event that the Travel Desk has not made the arrangements for

accommodation, employees have to seek approval from the Travel

desk if they need to book own accommodation and travel desk can

work on a benchmark to be reimbursed. Reimbursement for hotels and

other lodging will be limited to reasonable amounts and should not

exceed the single occupancy rate. Employees should give due

consideration to location and economy prior to making arrangements

for accommodation.

4.2.2 Employees on long term business travel, which is defined as any stay

above two (02) weeks, is required to verify accommodation with Head

of Human Resources.

4.2.3 Employees on Business Travel are required to stay in hotels unless RA

has specific accommodation in the country visited, or when the

Employee has made private arrangements to stay with family or

friends. Eligibility for accommodation when on business travel will be

arranged to the following guidelines:

Type of Accommodation:

5 Star (down to 4 Star when non-availability of standard or at

Directors:

discretion of RA)

3 Star (Up to 4 Star when non-availability of standard or at

Management:

discretion of RA)

2 Star (Up to 3 Star when non-availability of standard or at

Staff:

discretion of RA)

4.3 DAILY ALLOWANCE

4.3.1 A maximum daily allowance is sanctioned as follows when on short

stay Business Travels up to a maximum stay of two (02) weeks:

Role Max Allowance Breakfast Lunch Evening Meal

Directors $80 $10 $30 $40

Managers $65 $10 $25 $30

Staff $55 $10 $20 $25

HRM-0006-POL [R00] Jul-2022

3/7

BUSINESS TRAVEL & EXPENSES POLICY

4.3.2 If hotel stay is inclusive of breakfast, allowance for breakfast will not

be provided.

4.3.3 This allowance is allocated on a per day meal basis depending on the

portion of the day the Employee is actually travelling on behalf of the

company. Additionally, this allowance supports other living costs and

is payable in advance or retrospectively and does not need to be

supported by receipts. Transportation TO and FROM airports, entry

and exit visas or inoculations are not included within this allowance

and may be claimed separately providing receipts are provided.

4.3.4 Long stay Business Travels are those travels that are beyond two (02)

weeks where the Employee or Travel Desk will need to verify the daily

allowance with the Head of Human Resources.

4.3.5 Laundry charges are also not included in this allowance but are

payable only where hotel stay, or travel time exceeds three (03) days.

4.3.6 The daily allowance is not payable when employees are hosted in

operational areas where RA operates and provides facilities such as

food, transport, and accommodation.

4.4 ENTERTAINMENT EXPENSES

Directors who incur business-related entertainment expenses, must include full

details of these expenses on their Expense Claim Form, and must fill up Record of

Gifts & Hospitality Form as per Appendix A of Gifts and Hospitality Policy, and will

be required to complete a business meal/entertainment statement upon their return

when requested by the Head of Human Resources. Expense Claim Form must include

justification of this expense and must be clearly within the parameters of Article 7.4

set forth in the Anti-Bribery & Corruption Policy and Gifts and Hospitality Policy.

4.5 TRAVEL ADVANCE

Employees can request a Travel Advance based on the approximate forecasted

expense during the Travel. The travel advance that an Employee can receive is based

on the length of the Travel. Travel Advance is applicable to staff and managers and

submitted to the Travel Desk one (01) week in advance.

5. Procedures for Approval and Reimbursement

To ensure all staff follow the required procedures for approval and subsequent

reimbursement of expenses incurred as a consequence of a Business Travel, a

Expense Claim Form must be completed.

5.1 BUSINESS TRAVEL REQUEST FORM

5.1.1 Obtain prior approval of each Travel from the relevant signing

authorities. It is not acceptable for an Employee to approve his/her

request, or that of his/her supervisor.

5.1.2 When the form is completed and the relevant approvals obtained, the

original is to be submitted to the Travel Desk for release of the Travel

HRM-0006-POL [R00] Jul-2022

4/7

BUSINESS TRAVEL & EXPENSES POLICY

Advance if required (the Employee is required to keep a copy).

5.1.3 When no cash advance is required the form functions only as an

approval for Business Travel.

5.2 EXPENSE CLAIM FORM FOR BUSINESS TRAVEL

The following steps should be completed within 10 working days of returning from

Business Travel:

5.2.1 Complete Expense Claim Form for expenses incurred outside of the

daily allowance. Include information on the purpose of the Travel and

the destination. Attach original receipts and where original receipts

are not possible then scanned copies of receipts are to be submitted

for approval by the Line Manager.

5.2.2 The employee should be specific on the amount of the advance

required in the correct currency (if required).

5.2.3 Once approved, submit the form along with original receipts to HR to

be included in payroll.

Reimbursement will be paid through payroll within the same month of

travel if the Expense Claim Form is submitted by the 15th of the month.

If submitted after the 15th of the month, reimbursement will be made

in the following month payroll.

Note: The finance department may request further information from

the Employee submitting the Expense Claim Form, or that of his/her

Line Manager/Supervisor in relation to any expense claim.

5.3 MISSING RECEIPTS

Employees submitting an Expense Claim Form without original receipts for expenses

incurred outside of the daily allowance must provide a written statement explaining

why the receipts are missing, which must be approved by the signing authority.

6. Staff Expenses and Entitlements

It is recognized that a variety of expenses may be incurred by Employee who may

be representing the best interests of RA, which are not necessarily covered in the

Business Travel elements above. In those instances, all claims by an Employee must

be authorized by their Head of Department or an authorized signatory, the signatory

must have the appropriate managerial responsibility. The certification by the

manager or authorized signatory (who should not be junior to the claimant) shall be

taken to mean that:

• The Travels were authorized.

• The expenses were properly and necessarily incurred.

• The allowances are properly payable by RA.

• The expense should be within the boundaries of all RA compliance policies

(No Bribes, No Gift offered to RA Customers/Client unless permitted as per

Article 7.4 of Anti-Bribery and Corruption Policy, and documented as per

Appendix A of Gifts & Hospitality Policy).

HRM-0006-POL [R00] Jul-2022

5/7

BUSINESS TRAVEL & EXPENSES POLICY

6.1 TRAVELLING EXPENSES

All employees with RA do so in full knowledge of our business location.

Transportation to and from the business location is the responsibility of the

Employee unless agreed otherwise. Public transport costs, when company transport

is not provided relating to RA business, will be reimbursed in full. All travel expense

claims must be supported by receipts/tickets.

Use of a personal vehicle in Dubai, Somalia, CAR, Mozambique, Nairobi, Uganda, or

any other location where the company has business interests for commuting TO and

FROM the office is not a reimbursable expense (e.g., parking & mileage). However, if

a personal vehicle is used to travel to a destination other than the office in Dubai,

Somalia, CAR, Mozambique, or Nairobi for business purposes, then the expenses are

reimbursable at the rates stated below:

Country Measure Value

UAE FILS/KM 60

Kenya SHILLING/KM 40

UK PENCE/MILE 45

7. International Travel

To ensure the highest level of safety while on international assignments, employees

should ensure they have available the name and telephone number of the in-country

business contact prior to departure. When travelling, employees are always required

to provide Head of Department and the HR Department with an itinerary and contact

numbers. When travelling, employees are encouraged to keep additional copies of

their itinerary and passport pages containing vital information in a safe luggage

compartment, separate from the actual documents. These measures will facilitate

speedier replacement procedures in case original documents are lost or stolen.

An entry and exit visa may be required for international business travels. Employees

should ensure timely arrangements to apply for any required visa prior to departure

date. It is advisable that passport sized photographs are carried/kept should they be

required.

7.1 EXCESS BAGGAGE

Employees are advised that airline baggage restrictions and load limits must be

adhered to. Excess baggage over and above the permitted restriction is a personal

expense and is not reimbursable from RA. Operating area personnel, who have been

relocated by RA to an area outside of their allocated operating area, may claim up

to 20kg excess baggage over the airline limit if approved by their Line Manager.

7.2 PASSPORTS

Renewal of passports is the responsibility of the employee and not a reimbursable

expense. Employees who represent the interests of RA abroad or in operational

areas on a regular basis (more than 10 times per year) may have renewed and/or

second passports funded at company expense in accordance with relevant clause in

their employee contract or with approval from a Director.

HRM-0006-POL [R00] Jul-2022

6/7

BUSINESS TRAVEL & EXPENSES POLICY

7.3 INOCULATIONS

RA will normally make arrangements for inoculations for employees travelling on

business to various areas of the world, on behalf of RA. Inoculations approved will

be in accordance with the World Health Organization (WHO) Immunization

Recommended Vaccine List. Employees are advised to check this list and any

inoculations they have not received should be brought to the attention of the HR

Department. Inoculations on the WHO list will be funded by RA.

7.4 RA EMPLOYEE RESPONSIBILITIES

7.4.1 Exercise good judgment with respect to expenses.

7.4.2 Some countries we operate in require the appropriate inoculations.

Ensure you are covered.

7.4.3 Security is paramount. Adhere to country requirements at all times.

7.4.4 Visa applications can be a lengthy process. Plan accordingly.

7.4.5 Ensure validity of passport and that it remains in date for the duration

of stay.

7.4.6 Spend the company’s money as carefully and judiciously as you would

your own.

7.4.7 Report all expense promptly and accurately with the required

documentation.

7.4.8 Claim reimbursement for business expenditures only. If a Business

Travel includes both business and personal expenditures, only the

business expenditures will be reimbursed.

7.4.9 Ensure all planned Business Travels are discussed with the HR

Department.

8. Summary

RA is a business, and as such will reimburse employees for expenses incurred as a

result of representing our interests. We will not repay employees for expenses that

have not been incurred in the best interests of the company or are outside the remit

of this Policy. The HR Department will monitor this Policy continually to ensure it

remains current.

Policy

Next Policy Review

Implementation/

Date

Review Date

Judy Cunningham

July-2022 October-2024

Head of Human Resources

HRM-0006-POL [R00] Jul-2022

7/7

You might also like

- Corporate Travel PolicyDocument3 pagesCorporate Travel Policyuchman01No ratings yet

- Travel Policy V2.0Document12 pagesTravel Policy V2.0Mahesh “mani”100% (1)

- Employee Hand BookDocument48 pagesEmployee Hand BookSheraz S. AwanNo ratings yet

- International Travel Policy..Document5 pagesInternational Travel Policy..saamrockstarNo ratings yet

- Business Travel Policy PDFDocument4 pagesBusiness Travel Policy PDFSunny Billava67% (3)

- Onsite Travel Policy - V 2.1Document15 pagesOnsite Travel Policy - V 2.1Harsh GuptaNo ratings yet

- Travel and Expense PolicyDocument6 pagesTravel and Expense PolicyLee Cogburn100% (1)

- Finance MannualDocument228 pagesFinance Mannualadithyaiyer009No ratings yet

- KOEL Business Travel PolicyDocument13 pagesKOEL Business Travel PolicyHarish SamavedamNo ratings yet

- Travelling PolicyDocument12 pagesTravelling Policyhr_nishNo ratings yet

- Employee Reimbursement Policy - 09Document25 pagesEmployee Reimbursement Policy - 09ksankar_2005100% (1)

- LYITBusiness Travel Expenses PolicyDocument12 pagesLYITBusiness Travel Expenses PolicyLiezl RSBGCNo ratings yet

- WWIL Travel PolicyDocument9 pagesWWIL Travel PolicyYo Yo Moyal RajNo ratings yet

- Policy - Business TravelDocument5 pagesPolicy - Business TravelBell LờNo ratings yet

- Travel Policy - India W IDC PDFDocument30 pagesTravel Policy - India W IDC PDFmahakagrawal3No ratings yet

- Travel Policy by NitinDocument23 pagesTravel Policy by NitinNitin RathoreNo ratings yet

- Staff Travel Expense Policy PDFDocument20 pagesStaff Travel Expense Policy PDFRishi KumarNo ratings yet

- HRP-06 - Business Travel PolicyV4Document11 pagesHRP-06 - Business Travel PolicyV4rajeev_snehaNo ratings yet

- Travel Policy V 1.3 (3) NEW OCT2021Document8 pagesTravel Policy V 1.3 (3) NEW OCT2021Sudhakar Hr0% (1)

- Swift India Travel Expense PolicyDocument7 pagesSwift India Travel Expense PolicyNari KNo ratings yet

- Travel Policy, Expense Claim & ReimbusementDocument4 pagesTravel Policy, Expense Claim & ReimbusementTinsuNo ratings yet

- Travel and Expense: PolicyDocument12 pagesTravel and Expense: PolicyJuliana SantosNo ratings yet

- TravelPolicy RevDocument8 pagesTravelPolicy RevSamidha PadhiNo ratings yet

- Travel PolicyDocument4 pagesTravel PolicyArvind ElleNo ratings yet

- A Guide To The Automation Body of Knowledge, 2nd EditionDocument8 pagesA Guide To The Automation Body of Knowledge, 2nd EditionTito Livio0% (9)

- CF34-10E LM June 09 Print PDFDocument301 pagesCF34-10E LM June 09 Print PDFPiipe780% (5)

- Suite Popular Brasileira: 5. Shorinho Heitor Villa-LobosDocument4 pagesSuite Popular Brasileira: 5. Shorinho Heitor Villa-Loboshuong trinhNo ratings yet

- Chapter 4 Operation of Travel AgentDocument26 pagesChapter 4 Operation of Travel AgentJanella LlamasNo ratings yet

- SM 6Document116 pagesSM 6陳偉泓No ratings yet

- Financial Policy For Travel and Meal Expense Reimbursement PolicyDocument7 pagesFinancial Policy For Travel and Meal Expense Reimbursement PolicyJonahNo ratings yet

- Handling and Working With Analytical StandardsDocument6 pagesHandling and Working With Analytical StandardsPreuz100% (1)

- Stanley Diamond Toward A Marxist AnthropologyDocument504 pagesStanley Diamond Toward A Marxist AnthropologyZachNo ratings yet

- Comart Travel PolicyDocument7 pagesComart Travel PolicySandeepNo ratings yet

- G1 - Introduction Generator ProtectionDocument21 pagesG1 - Introduction Generator ProtectionOoi Ban JuanNo ratings yet

- Travel & Expense PolicyDocument5 pagesTravel & Expense PolicyShwetaNo ratings yet

- Overseas Travel & Living Expense Allowance: 1. ObjectiveDocument3 pagesOverseas Travel & Living Expense Allowance: 1. ObjectiveThy NguyenNo ratings yet

- Domestic Travel PolicyDocument14 pagesDomestic Travel PolicySavita matNo ratings yet

- 16 Travel Policy Original 2007 2008 FinalDocument9 pages16 Travel Policy Original 2007 2008 Finalai ikhsan2No ratings yet

- Policy No Policy OnDocument8 pagesPolicy No Policy OnSudhakar RNo ratings yet

- N51 the Amendment of Regulation of Business Travel in JC Airlines 英文Document3 pagesN51 the Amendment of Regulation of Business Travel in JC Airlines 英文KINGDOEMSELYNo ratings yet

- International GUIDELINESDocument17 pagesInternational GUIDELINESSavita matNo ratings yet

- 1 Uc 4 Ae 4520 PWXJZF 3 C 5 X 3 y 555163599388142991329015327Document3 pages1 Uc 4 Ae 4520 PWXJZF 3 C 5 X 3 y 555163599388142991329015327Sanjeev SharmaNo ratings yet

- 5.6 Travel Arrangements, Meals & Miscellaneous Expenses: 5.6.1 POLICYDocument4 pages5.6 Travel Arrangements, Meals & Miscellaneous Expenses: 5.6.1 POLICYJewel PeñarandaNo ratings yet

- Corporate Travel & Expense Policy LayoutDocument9 pagesCorporate Travel & Expense Policy Layoutsagar sharmaNo ratings yet

- AmantyaTech-International Travel Policy V1Document6 pagesAmantyaTech-International Travel Policy V1Jaiho PubgNo ratings yet

- Travel Policy v1.0Document12 pagesTravel Policy v1.0sagar_maxNo ratings yet

- Total Safety Travel and Business Expense ReimbursementDocument8 pagesTotal Safety Travel and Business Expense ReimbursementOscar BustillosNo ratings yet

- Politica Co MuterDocument29 pagesPolitica Co MuterYlver J. Estrada CarmonaNo ratings yet

- Travel Expense Claim: P R o C e D U R eDocument13 pagesTravel Expense Claim: P R o C e D U R eB singhNo ratings yet

- Travel Expense Claim: P R o C e D U R eDocument13 pagesTravel Expense Claim: P R o C e D U R eB singhNo ratings yet

- India Travel PolicyDocument3 pagesIndia Travel PolicypranamkNo ratings yet

- Travel & Expense Policy Dealer Solutions North America IncDocument22 pagesTravel & Expense Policy Dealer Solutions North America IncMila ChisholmNo ratings yet

- Domestic TravelDocument4 pagesDomestic Travelsivakumar.tNo ratings yet

- OnsiteDocument2 pagesOnsiteКциԁди КцмдяNo ratings yet

- Employee Reimbursement Policy - vFINALDocument10 pagesEmployee Reimbursement Policy - vFINALRaka BusinessNo ratings yet

- NEW Tour Travel Policy 22 Jan 2018Document6 pagesNEW Tour Travel Policy 22 Jan 2018Indrajeet GiriNo ratings yet

- Travel & Expenses Policy v3 Jan22Document13 pagesTravel & Expenses Policy v3 Jan22hr onxhomesNo ratings yet

- Company Travel Policy TemplateDocument15 pagesCompany Travel Policy TemplateChaitanya SharmaNo ratings yet

- SOP WLUexpensehandbook - Dec - 2011 - Final - v2Document17 pagesSOP WLUexpensehandbook - Dec - 2011 - Final - v2Jeger BaekNo ratings yet

- Travel and Expense Policy: PurposeDocument9 pagesTravel and Expense Policy: Purposeabel_kayelNo ratings yet

- What Are The Requirements To Be A Five-Star Hotel?: ServiceDocument4 pagesWhat Are The Requirements To Be A Five-Star Hotel?: ServiceGopal KrishnanNo ratings yet

- FinRegs StaffChecklistDocument2 pagesFinRegs StaffChecklistlisaconnollyNo ratings yet

- Crazy Deal With Flight - Arena Beach Resort: HighlightsDocument10 pagesCrazy Deal With Flight - Arena Beach Resort: HighlightsajithNo ratings yet

- 5 TravelandConveyancePolicyDocument5 pages5 TravelandConveyancePolicyOmextitech EnterpriseNo ratings yet

- Travel Policies FormsDocument7 pagesTravel Policies FormsmissaveneNo ratings yet

- Harvest Gold Industries PVT - LTD: Travel PolicyDocument7 pagesHarvest Gold Industries PVT - LTD: Travel PolicyAnuragNo ratings yet

- The Certified Hospitality ProfessionalFrom EverandThe Certified Hospitality ProfessionalRating: 5 out of 5 stars5/5 (1)

- 2019 Book TheEBMTHandbookDocument688 pages2019 Book TheEBMTHandbook88tk6rccsmNo ratings yet

- Carbon Fiber 395GPA Structural Ansys ReportDocument13 pagesCarbon Fiber 395GPA Structural Ansys ReportKrish KrishnaNo ratings yet

- CIMB-Financial Statement 2014 PDFDocument413 pagesCIMB-Financial Statement 2014 PDFEsplanadeNo ratings yet

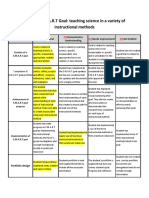

- Smart Goals Rubric 2Document2 pagesSmart Goals Rubric 2api-338549230100% (2)

- Mulberry VarietiesDocument24 pagesMulberry VarietiesKUNTAMALLA SUJATHANo ratings yet

- IoscanDocument3 pagesIoscanTimNo ratings yet

- RESEARCH TEMPLATE 2023 1 AutoRecoveredDocument14 pagesRESEARCH TEMPLATE 2023 1 AutoRecoveredMark Lexter A. PinzonNo ratings yet

- User Access Guide PDFDocument3 pagesUser Access Guide PDFbaldo yellow4No ratings yet

- Carreño Araujo Cesar - Capturas Calculadora Sesion 02Document17 pagesCarreño Araujo Cesar - Capturas Calculadora Sesion 02CESAR JHORCHS EDUARDO CARREÑO ARAUJONo ratings yet

- Inception Report - Performance Management and Measurement Including Monitoring & EvaluationDocument16 pagesInception Report - Performance Management and Measurement Including Monitoring & EvaluationDepartment of Political Affairs, African Union CommissionNo ratings yet

- Creating A New Silk UI ApplicationDocument2 pagesCreating A New Silk UI Applicationtsultim bhutiaNo ratings yet

- Order ID 4148791009Document1 pageOrder ID 4148791009SHUBHAM KUMARNo ratings yet

- Communication Systems Engineering Solutions Manual PDFDocument2 pagesCommunication Systems Engineering Solutions Manual PDFKristin0% (2)

- Volatility Index 75 Macfibonacci Trading PDFDocument3 pagesVolatility Index 75 Macfibonacci Trading PDFSidibe MoctarNo ratings yet

- Marathi Typing 30 WPM Passage PDF For Practice Arathi Typing 30 WPM Passage PDF For PracticeDocument1 pageMarathi Typing 30 WPM Passage PDF For Practice Arathi Typing 30 WPM Passage PDF For Practiceshankar jonwalNo ratings yet

- Analog Circuits - IDocument127 pagesAnalog Circuits - IdeepakpeethambaranNo ratings yet

- Ansoff Matrix of TescoDocument2 pagesAnsoff Matrix of TescoMy GardenNo ratings yet

- UNIT V WearableDocument102 pagesUNIT V WearableajithaNo ratings yet

- Satyam GargDocument2 pagesSatyam GargSatyam GargNo ratings yet

- Building ProcessDocument25 pagesBuilding Processweston chegeNo ratings yet

- Dialux BRP391 40W DM CT Cabinet SystemDocument20 pagesDialux BRP391 40W DM CT Cabinet SystemRahmat mulyanaNo ratings yet

- Class 10th IMO 5 Years EbookDocument71 pagesClass 10th IMO 5 Years EbookAdarsh Agrawal100% (1)

- Ijrcm 2 Cvol 2 Issue 9Document181 pagesIjrcm 2 Cvol 2 Issue 9com-itNo ratings yet