Professional Documents

Culture Documents

46-Article Text-164-1-10-20221210

Uploaded by

Uchiha SasukeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

46-Article Text-164-1-10-20221210

Uploaded by

Uchiha SasukeCopyright:

Available Formats

Implementation Of Profit Sharing System In Murabahah

Financing At Kspps BMT Nurul Jannah Gresik

Farid Ardyansyah, S.E.,M.M.,CIQnR¹, Nely Agustin²

1Trunojoyo Madura University

2Trunojoyo Madura University

Abstract

This study aims to determine the application of the Murabaha financing profit-

sharing system at KSPPS BMT Nurul Jannah Gresik. This type of research is

qualitative research that uses a descriptive approach, which was carried out at KSPPS

BMT Nurul Jannah Gresik. Data collection techniques in this study are interviews,

observations, and literature studies. The data analysis used is descriptive, namely by

knowing how to apply the profit-sharing system in Murabaha financing at KSPPS BMT

Nurul Jannah Gresik.

The results of this study show that the profit-sharing calculation system in

Murabaha financing at KSPPS BMT Nurul Jannah Gresik applies the Revenue

Sharing profit sharing system. The profit-sharing system in KSPPS BMT Nurul Jannah

Gresik is by Islamic law with the absence of usury or taking many advantages of this

Murabaha financing. KSPPS BMT Nurul Jannah Gresik does not take much

advantage instead, KSPPS BMT Nurul Jannah Gresik sets a very low-profit sharing

percentage unlike other bank and non-bank financial institutions that set a relatively

high-profit sharing and prioritize profits. KSPPS BMT Nurul Jannah Gresik also

benefits from corporate financing.

Keywords: Revenue Sharing System. Murabahah Financing, KSPPS

INTRODUCTION

Bank and non-bank financial institutions have a fairly rapid development

because the more developed bank and non-bank financial institutions are, the more

products or services are offered to the public. Especially in Indonesia, where the

majority of the population is Muslim, bank and non-bank financial institutions with

sharia principles can be an alternative for people who do not have an element of usury

in their transactions. The prohibition of usury in Islam makes people confused and

difficult to take financing at banks or savings and loan cooperatives, so that bank and

158

IJEBIR, Volume 01 Issue 01, 2022

Copyright at authors some right reserved this work is licensed under

a Creative Commons Attribution-ShareAlike 4.0 International License.

non-bank financial institutions with sharia principles can help the community and

Micro, Small, and Medium Enterprises in Indonesia. In addition to being free from the

element of usury, savings and loans in the bank and non-bank financial institutions

with sharia principles do not focus on profit, but rather on distributing funds for the

economic empowerment of the people.

KSPPS BMT Nurul Jannah Gresik is a non-bank financial institution that has

been established for approximately 25 years and has approximately ten thousand

customers. KSPPS BMT Nurul Jannah Gresik is a sharia-based cooperative that

distributes its internal funds to the Nurul Jannah Mosque, Nurul Jannah Orphanage,

as well as the distribution of funds in the form of financing to employees of PT.

Petrokimia Gresik and its subsidiaries only, which then begins to open up opportunities

for customers who are not employees such as traders, teachers, and other private

employees. In the sharia system, there is no usury or interest, but there is a profit-

sharing system that has certainly been agreed upon by both parties. The profit sharing

for financing with sharia principles is quite small, and there is a profit-sharing ratio of

70%: 30%. The first party, namely customers, gets a 70% share, while financial

institutions get 30% of the profits from financing, of course, from the profit funds are

reallocated to community financing or Micro, Small, and Medium Enterprises that need

an injection of funds or additional capital. KSPPS BMT Nurul Jannah Gresik is different

from other savings and loan cooperatives whose percentage of profit sharing is higher

than KSPPS BMT Nurul Jannah Gresik, although other cooperatives are sharia-based

as well, such as the employee cooperative PT. Gresik Petrochemicals in addition to

KSPPS BMT Nurul Jannah Gresik whose profit-sharing ratio is 60%: 40%. The first

party, namely the customer, gets a 60% share, while the financial institution gets 40%

of the profit from financing.

The application of profit sharing in the bank and non-bank financial institutions

in each institution is usually different, but KSPPS BMT Nurul Jannah Gresik can

provide a low percentage of profit sharing and has even been operating for decades,

which of course is proof that the sharia-based KSPPS BMT Nurul Jannah Gresik can

compete with the bank and non-bank financial institutions even though the profit-

sharing set is very small. So with this, the author is interested in taking the title

"Application of the Profit Sharing System in Murabahah Financing at KSPPS BMT

Nurul Jannah Gresik", so that the author and readers can better understand and know

how the profit sharing system in KSPPS BMT Nurul Jannah Gresik and how it is

calculated.

159

IJEBIR, Volume 01 Issue 01, 2022

Copyright at authors some right reserved this work is licensed under

a Creative Commons Attribution-ShareAlike 4.0 International License.

RESEARCH METHODS

This research was conducted at KSPPS BMT Nurul Jannah Gresik Jl. General

Ahmad Yani No. 07 Gresik Petrochemical Housing. This type of research is qualitative

research that uses a descriptive approach, which was carried out at KSPPS BMT

Nurul Jannah Gresik. Data collection techniques in this study are interviews,

observations, and literature studies. The data analysis used is descriptive, namely by

knowing how to apply the profit-sharing system in murabaha financing at KSPPS BMT

Nurul Jannah Gresik.

LITERATURE REVIEW

Murabahah Financing

Murabahah financing is one of the financing agreements that is widely applied

in the bank and non-bank financial institutions. A large number of applications of

Murabaha contracts in the bank and non-bank financial institutions is due to the ease

of calculating the profit-sharing ratio for customers or members as well as with bank

and non-bank financial institutions. Akad Murabahah is an activity of buying and selling

in Islam where both parties feel willing, the first party receives objects or goods, and

the other party benefits from the sale and purchase transaction by the agreement or

contract that has been agreed. (Hamzah, 1992)

The Murabaha contract at KSPPS BMT Nurul Jannah Gresik is financing for

business capital specifically for customers or members who are employees of PT.

Petrochemical Gresik and its subsidiaries, can also be for general customers who are

not employees or members. However, Murabaha financing at KSPPS BMT Nurul

Jannah Gresik, does not have the concept that KSPPS BMT Nurul Jannah Gresik will

buy goods that are then sold to customers, but rather towards debt receivables.

Sharia Savings and Loans and Financing Cooperatives

Baitul Maal wat Tamwil (BMT) gave birth to the Sharia Savings and Loans and

Financing Cooperative (KSPPS), which was previously called the Islamic Financial

Services Cooperative (KJKS). KSPPS carries out social tasks, such as collecting,

managing, and distributing ZISWAF funds, in addition to its position as a business

institution (Tamwil). The ZIS funds that have been collected can be collected and used

for charity (Maal), although some KSPPS channel more and use them for

empowerment, especially for micro-entrepreneurs. (Sukmayadi, 2020)

Revenue Sharing

Profit Sharing is the sharing of the results of business operations between

customers and Islamic financial institutions, which are parties to the contract. If there

160

IJEBIR, Volume 01 Issue 01, 2022

Copyright at authors some right reserved this work is licensed under

a Creative Commons Attribution-ShareAlike 4.0 International License.

are two parties to a business agreement, the profits from the transaction entered into

by both parties or only one of the parties will be divided according to the percentage

of each party to the agreement. Using a ratio, Islamic banking determines how a

company's results are distributed. (Ismail, 2011)

DISCUSSION

The application of profit sharing on Murabaha financing at KSPPS BMT Nurul

Jannah Gresik is by Islamic law where the implementation of the profit-sharing system

KSPPS BMT Nurul Jannah Gresik determines and obtains a fairly small profit share

from the financing distributed to employees PT. Petrochemical Gresik Group or not

employees or general customers from various circles. The following is a brief

explanation, Murabaha financing scheme and profit-sharing system at KSPPS BMT

Nurul Jannah Gresik:

1. Murabahah Financing at BMT Nurul Jannah Gresik

Murabahah financing is one of the financing agreements that is widely

applied in the bank and non-bank financial institutions. A large number of

applications of Murabaha contracts in the bank and non-bank financial

institutions is due to the ease of calculating the profit-sharing ratio for

customers or members as well as with bank and non-bank financial

institutions. Akad Murabahah is an activity of buying and selling in Islam where

both parties feel willing, the first party receives objects or goods, and the other

party benefits from the sale and purchase transaction by the agreement or

contract that has been agreed. (Hamzah, 1992)

KSPPS BMT Nurul Jannah Gresik provides Murabaha financing using

the principle of buying and selling in the form of funds or business capital. The

implementation of Murabaha financing at KSPPS BMT Nurul Jannah Gresik

is not like the definition of Murabaha where KSPPS BMT Nurul Jannah Gresik

should buy what the customer needs or wants, then KSPPS BMT Nurul

Jannah Gresik resells to customers whose payment schemes are in

installments. However, in the implementation of Murabaha financing at

KSPPS BMT Nurul Jannah Gresik with the principle of buying and selling this

is like receivable debt, so if there is a customer who finances with a Murabaha

contract, KSPPS BMT Nurul Jannah Gresik will determine the ceiling and how

much profit sharing is obtained from Murabaha financing.

2. Requirements for Applying for Murabahah Financing

In this Murabaha financing, there are 2 categories of customers, namely

employees of PT Petrokimia Gresik and its subsidiaries and general

161

IJEBIR, Volume 01 Issue 01, 2022

Copyright at authors some right reserved this work is licensed under

a Creative Commons Attribution-ShareAlike 4.0 International License.

customers who are traders, teachers, etc. The general conditions that must

be met if you want to apply for Murabaha financing, namely:

a. Photocopy of KTP (Husband and Wife)

b. Photocopy of Family Card

c. Photocopy of Marriage Certificate

d. Salary Slip

e. Photocopy of guarantee (BPKB or Certificate)

f. Photocopy of the latest STNK / Tax

g. Photo of pledged Goods

h. Salary slips authorized by agencies/institutions

i. Physical Check of Motor Vehicles

j. Photos of Business Premises and products sold (Unrelated Parties)

From the conditions listed above, if there are members who cannot meet

these requirements, the application for Murabaha financing at KSPPS BMT

Nurul Jannah Gresik cannot be continued or will not be processed, because

the KSPPS BMT Nurul Jannah Gresik will not accept a large risk if the new

member does not meet the existing requirements.

3. Murabaha Financing Procedures and Mechanisms at KSPPS BMT Nurul

Jannah Gresik

KSPPS BMT Nurul Jannah Gresik is a formal institution in which of

course several stages must be carried out by customers. This Murabaha

financing is divided into 2, productive financing, namely financing that is used

as additional business capital or to start making a business. Then there is

consumptive financing provided to customers to meet the customer's life

needs, and the financing will run out immediately after the customer's needs

are met.

In this regard, some procedures and mechanisms have been set by

KSPPS BMT Nurul Jannah Gresik for the realization of funds or working

capital, namely conditions that are not only administrative but there are also

general provisions that have become provisions in Murabaha financing. The

procedure is that customers come directly to KSPPS BMT Nurul Jannah

Gresik to submit administrative files and fill out the financing application form

to KSPPS BMT Nurul Jannah Gresik, then KSPPS BMT Nurul Jannah Gresik

will process and analyze the complete application files and meet the

requirements, not forgetting to also survey to see the validation of the

submitted files. After the analysis and survey process, KSPPS BMT Nurul

162

IJEBIR, Volume 01 Issue 01, 2022

Copyright at authors some right reserved this work is licensed under

a Creative Commons Attribution-ShareAlike 4.0 International License.

Jannah Gresik can provide a decision regarding the application for Murabaha

financing.

4. Financing Flow Scheme

The financing scheme in financing scheme at KSPPS BMT Nurul Jannah

Gresik has slight differences in installment payments only, the rest of the

administrative requirements and submission procedures remain the same.

The installment payment of the related party uses a salary deduction system

that will be auto-debited every month, while the customer is not related to the

payment directly to the cashier. The salary deduction system for customers of

PT Petrokimia Gresik and its subsidiaries can be done or implemented

because KSPPS BMT Nurul Jannah Gresik already has cooperation with

these companies so it makes it easier for employees to finance at KSPPS

BMT Nurul Jannah Gresik without having to bother to come to KSPPS BMT

Nurul Jannah Gresik to pay the installments.

As for general customers in installment payments, they can directly come

to KSPPS BMT Nurul Jannah Gresik or can ask marketing staff to take general

customer installments at home or in trading places, so that it can make it easier

for general customers who have a trading profession and certainly cannot die.

The following is the financing scheme at KSPPS BMT Nurul Jannah Gresik:

163

IJEBIR, Volume 01 Issue 01, 2022

Copyright at authors some right reserved this work is licensed under

a Creative Commons Attribution-ShareAlike 4.0 International License.

a. General Customers (Related Parties)

Chart 1 General Customers Financing Scheme (Related Party)

1. The customer

completes the

requirements and

fills out the form

5. Payment of 2. Warranty

installments check and

every month analysis

at the cashier

4. Disbursement 3. ACC/Reject

of financing decision

Source: KSPPS BMT Nurul Jannah Gresik Primary Data

b. Employes PT Petrokimia Gresik

Chart 1.Employee Financing Scheme of PT Petrokimia Gresik and its

subsidiaries (Related Parties)

1. The customer completes

the requirements file and fills

out the form and willingness

to take a pay cut

5. Potong Gaji 2. Check and

(Auto Debet) analysis

4. Disbursement 3. ACC/Reject

of financing decision

Source: KSPPS BMT Nurul Jannah Gresik Primary Data

164

IJEBIR, Volume 01 Issue 01, 2022

Copyright at authors some right reserved this work is licensed under

a Creative Commons Attribution-ShareAlike 4.0 International License.

5. Profit Sharing Calculation in Murabaha KSPPS BMT Nurul Jannah Gresik

Financing

In financing Murabahah at KSPPS BMT Nurul Jannah Gresik has flat

financing installments, namely financing by paying installments regularly every

month with a predetermined number of installments. In this flat (monthly)

installment financing, there are 4 payment terms, namely 6 months, 12

months, 18 months and 24 months. There is also a payment system that is

every 3 months, but only PT Petrokimia Gresik customers can pay every 3

months, this is because these customers apply for financing with an outside

salary deduction system which includes Intensiv, BBC, BBP, and Jasop which

are paid every 3 months. In addition, the profit-sharing margin of customers at

KSPPS BMT Nurul Jannah Gresik is different, here is a table of profit-sharing

margins for each group of customers:

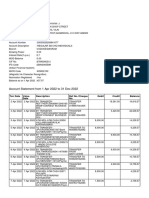

Table 1.Revenue Share Percentage

Employees of PT Petrokimia Gresik 0,66667%

Permanent Anper Employees 0,75%

Contract Anper Employees 1%

General under 2 million unsecured 1%

General above 2 million, below 10 million 0,58%

General above 10 million 1%

Source: KSPPS BMT Nurul Jannah Gresik Primary Data

The method of calculating monthly installments that must be paid is as follows:

How to calculate:

➢ Step 1

Plafond x Revenue share percentage = ....

➢ Step 2

Plafond : Time period =....

➢ Step 3

Step 1 + Step 2 =....

Example:

Mr. Danar, an employee of PT Petrokimia Gresik, applied for Murabahah

financing with a ceiling of Rp.135,000,000; With a period of 36 months

and a margin of 0.66667%, the number of installments in monthly

installments is?

165

IJEBIR, Volume 01 Issue 01, 2022

Copyright at authors some right reserved this work is licensed under

a Creative Commons Attribution-ShareAlike 4.0 International License.

Answer:

Step 1

135.000.000 x 0,66667% = 900.004,5

Step 2

135.000.000 : 36 bulan = 3.750.000

Step 3

900.004,5 + 3.750.000= 4.650.004,5

So, Mr. Danar pays monthly installments of Rp. 4,650,000

By looking at the example of calculations and profit-sharing percentage tables

applied by KSPPS BMT Nurul Jannah Gresik, none of them are above one percent,

so that the profit share obtained by KSPPS BMT Nurul Jannah Gresik is smaller than

other cooperatives, besides that there are several supporting statements from

customers or members of KSPPS BMT Nurul Jannah Gresik who have taken financing

at KSPPS BMT Nurul Jannah Gresik. The following are the results of interviews from

several KSPPS BMT Nurul Jannah Gresik customers.

Table 1.Results of Interviews with Speakers Regarding the Application of a

Profit Sharing System on Financing at KSPPS BMT Nurul Jannah Gresik

No Source Work Information

1 Aldi Bagus Private The profit sharing at KSPPS BMT Nurul

Prakoso sector Jannah Gresik is smaller than that of

(29) employee employee cooperatives and the

installments are fixed or flat in value.

2 Sabikin (37) Private The profit sharing at KSPPS BMT Nurul

sector Jannah Gresik is smaller compared to other

employee bank financial institutions.

3 Alif Nur Private Profit sharing at KSPPS BMT Nurul Jannah

Hidayatullah sector Gresik is small, so that it can help empower

(24) employee or finance for newly started businesses.

4 Rohmatus Honorary The profit sharing at KSPPS BMT Nurul

Izza (22) Teacher Jannah Gresik is smaller compared to other

cooperatives, and the financing scheme is

transparent so that customers know in

detail.

166

IJEBIR, Volume 01 Issue 01, 2022

Copyright at authors some right reserved this work is licensed under

a Creative Commons Attribution-ShareAlike 4.0 International License.

5 Uswatun Krawu The profit sharing at KSPPS BMT Nurul

(43) Rice Jannah Gresik is small, very helpful and

Seller does not impose on customers who have

small micro-businesses whose income is

not much.

Source: Primary Data from Interviews and Author Processing

Based on the table above, it can be concluded that the implementation of the

profit-sharing system at KSPPS BMT Nurul Jannah Gresik is very small and none of

them is above one percent, because indeed the purpose of KSPPS BMT Nurul Jannah

Gresik is to empower the people's economy without attaching importance to profit if

the financing is for employees of PT Petrokimia Gresik and subsidiaries and general

customers, most of whom are traders and teachers. KSPPS BMT Nurul Jannah Gresik

profited from murabaha financing that finances a corporation or finances an agency or

a company, the rest of the KSPPS BMT Nurul Jannah Gresik program, namely

empowering the people's economy and helping small micro-enterprises that need

additional funds to expand or enlarge their business.

CONCLUSION

Based on the discussion that has been presented by the author about the

Application of the Murabahah Financing Profit Sharing System at KSPPS BMT Nurul

Jannah Gresik, the author concludes that the profit sharing system in KSPPS BMT

Nurul Jannah Gresik is by Islamic law with the absence of usury or taking many

benefits from this Murabaha financing. KSPPS BMT Nurul Jannah Gresik does not

take much advantage, instead, KSPPS BMT Nurul Jannah Gresik sets a very low-

profit sharing percentage unlike other bank and non-bank financial institutions that set

a relatively high-profit sharing and prioritize profits. KSPPS BMT Nurul Jannah Gresik

also benefits from corporate financing, namely financing for agencies or companies,

the profits of which are then channeled to UPZ BAZNAS Petrokimia Gresik, Nurul

Jannah Mosque, Nurul Jannah Orphanage, and many others..

REFERENCES

Sudiarti, Sri. 2018. Fiqh Muamalah Kontemporer. Medan: Febi UIN-SU Press.

Ya’kub, Hamzah. 1992. Kode Etik Dagang Menurut Islam (Pola Pembinaan Hidup

Dalam Berekonomi). Bandung: Diponegoro.

Mega Puspitasari, Friska. 2018. Determinan Niat Pengajuan Pembiayaan

Mudharabah Pada BMT Nurul Jannah Gresik. Jurnal Ekonomi Syariah Teori

dan Terapan Volume 5, Nomor 1, Januari.

167

IJEBIR, Volume 01 Issue 01, 2022

Copyright at authors some right reserved this work is licensed under

a Creative Commons Attribution-ShareAlike 4.0 International License.

Mauluddin, Sholeh. 2018. Pembiayaan Murabahah Dalam Perspektif Fatwa DSN-

MUI. Jurnal Qawain, Volume 2, Nomor 1, Januari

Interview with Rukimi, Finance and Cashier of KSPPS BMT Nurul Jannah Gresik,

"Savings Products", on February 23, 2022 at the KSPPS BMT Nurul Jannah

Gresik Office.

Interview with Mohamad Gadhafi, Marketing Office of KSPPS BMT Nurul Jannah

Gresik, "Financing Products", on February 23, 2022 at the KSPPS BMT Nurul

Jannah Gresik Office.

Interview with Aldi Bagus Prakoso, Employee of PT Petrokimia Gresik, on February

24, 2022 at KSPPS BMT Nurul Jannah Gresik.

Interview with Sabikin, an employee of PT Aneka Jasa Gradika, on February 24, 2022

at KSPPS BMT Nurul Jannah Gresik.

Interview with Alif Nur Hidayatullah, Employee of PT Fokus Jasa Mitra, on February

24, 2022 at KSPPS BMT Nurul Jannah Gresik.

Interview with Rohmatus Izza, Honorary Teacher, on February 24, 2022 at KSPPS

BMT Nurul Jannah Gresik. Interview with Uswatun, Krawu Rice Trader, on

February 24, 2022 at KSPPS BMT Nurul Jannah Gresik.

168

IJEBIR, Volume 01 Issue 01, 2022

Copyright at authors some right reserved this work is licensed under

a Creative Commons Attribution-ShareAlike 4.0 International License.

You might also like

- The Functional Microfinance Bank: Strategies for SurvivalFrom EverandThe Functional Microfinance Bank: Strategies for SurvivalNo ratings yet

- Nurul Khasanah, DKK.: Relevansi Fatwa DSN-MUI PadaDocument16 pagesNurul Khasanah, DKK.: Relevansi Fatwa DSN-MUI PadaNailyNo ratings yet

- Tugas IndividuDocument12 pagesTugas IndividuFitriani VyNo ratings yet

- 2701-Article Text-6365-1-10-20220427Document19 pages2701-Article Text-6365-1-10-20220427djaloeNo ratings yet

- 6993-Article Text-21271-1-10-20201203Document11 pages6993-Article Text-21271-1-10-20201203Adrian RonaldNo ratings yet

- Artikel - Widiyah (1908203054)Document16 pagesArtikel - Widiyah (1908203054)Inggih RahayuNo ratings yet

- Notes - Unit 2Document10 pagesNotes - Unit 2ishita sabooNo ratings yet

- Jurnal KharismaDocument14 pagesJurnal Kharismakharismafitrah26No ratings yet

- Prudential Banking Principles in Credit Agreements (Study at BPR Graha Lestari)Document10 pagesPrudential Banking Principles in Credit Agreements (Study at BPR Graha Lestari)Ikang Satrya medyantaraNo ratings yet

- Riantoanugerah, 105-119 Implementasi Pembiayaan Mundhori To Jurnal El-Qist 2020Document16 pagesRiantoanugerah, 105-119 Implementasi Pembiayaan Mundhori To Jurnal El-Qist 2020Khalif AbdilbarrNo ratings yet

- Answer For Case 10 A Micro Finance Bai-Murabaha Model ExampleDocument2 pagesAnswer For Case 10 A Micro Finance Bai-Murabaha Model ExampleFakemailNo ratings yet

- PRADHANA MANTRI MUDRA YOJANA-grp12Document22 pagesPRADHANA MANTRI MUDRA YOJANA-grp12Anaswara C ANo ratings yet

- Naskah Publikasi PDFDocument12 pagesNaskah Publikasi PDFGoso GosoNo ratings yet

- Artikel KP Khikmatul Laeli - 16416262201062Document16 pagesArtikel KP Khikmatul Laeli - 16416262201062August SetyawanNo ratings yet

- Mudharabah MudharabahDocument16 pagesMudharabah MudharabahMery HandayaniNo ratings yet

- Dr. Shakuntala Misra Nationa Rehabilitation: Submitted To: Submitted byDocument14 pagesDr. Shakuntala Misra Nationa Rehabilitation: Submitted To: Submitted byshashi shekhar dixitNo ratings yet

- 456-Article Text-1120-1-10-20201230Document17 pages456-Article Text-1120-1-10-20201230sariNo ratings yet

- Jurnal 2Document13 pagesJurnal 2Isniwana DamayantiNo ratings yet

- Project Appraisal-Financing ProjectsDocument17 pagesProject Appraisal-Financing ProjectsShailendra ChauhanNo ratings yet

- 2265-File Utama Naskah-6996-2-10-20200924Document13 pages2265-File Utama Naskah-6996-2-10-20200924RyansaputraNo ratings yet

- Jurnal Hukum PembaharuanDocument8 pagesJurnal Hukum PembaharuanNasfiahtul Istani DaelyNo ratings yet

- Bank Management FIN 303: Overview of Loan SyndicationDocument4 pagesBank Management FIN 303: Overview of Loan SyndicationTashahudul IslamNo ratings yet

- Sources of FinancingDocument7 pagesSources of FinancingSamuel GirmaNo ratings yet

- Deni Yanuar Dan Siti Ita RositaDocument6 pagesDeni Yanuar Dan Siti Ita RositaRifqi JauhariNo ratings yet

- 407-Article Text-1144-2-10-20201130Document19 pages407-Article Text-1144-2-10-20201130Khoirul ZaqiNo ratings yet

- 46 231 1 PB PDFDocument9 pages46 231 1 PB PDFokta misro'iNo ratings yet

- Analisis Pembiayaan Murabahah Dan Solusi Permasalahannya Pada BMT Rizky Barokah Cabang Talun Magelang Siska YulitaDocument9 pagesAnalisis Pembiayaan Murabahah Dan Solusi Permasalahannya Pada BMT Rizky Barokah Cabang Talun Magelang Siska Yulitaokta misro'iNo ratings yet

- Penerapan Jaminan Fidusia Dalam Akad Murabahah Pembiayaan Oto Pada Bank Syariah Indonesia Cabang CirebonDocument9 pagesPenerapan Jaminan Fidusia Dalam Akad Murabahah Pembiayaan Oto Pada Bank Syariah Indonesia Cabang CirebonWulan CitraNo ratings yet

- Banking: Islamic Banking: Institute of Business Administration (Iba), JuDocument8 pagesBanking: Islamic Banking: Institute of Business Administration (Iba), JuYeasminAkterNo ratings yet

- Impact Assessment of Micro FinanceDocument27 pagesImpact Assessment of Micro Financenisith12No ratings yet

- Loan SyndicationDocument6 pagesLoan SyndicationNaymur RahmanNo ratings yet

- Final Project (Gayatri) PDFDocument52 pagesFinal Project (Gayatri) PDFGayatriThotakura0% (1)

- Resume Jurnal AdelDocument5 pagesResume Jurnal AdelMuhamad SyarifNo ratings yet

- Project Report Microfinance PDFDocument8 pagesProject Report Microfinance PDFkhageshNo ratings yet

- AINUL HIKMAH-jurnal Bagi HasilDocument15 pagesAINUL HIKMAH-jurnal Bagi HasilNur Ayu SayektiNo ratings yet

- 1 PBDocument14 pages1 PBAndi TriyawanNo ratings yet

- Synopsis For Analysis of Microfinance in India: BY Jose T George 092103104Document5 pagesSynopsis For Analysis of Microfinance in India: BY Jose T George 092103104Jose GeorgeNo ratings yet

- Jurnal 15Document12 pagesJurnal 15Isniwana DamayantiNo ratings yet

- Bai Bithaman Ajil BBAModelling by Qardhul HassanDocument7 pagesBai Bithaman Ajil BBAModelling by Qardhul HassanDanial JNo ratings yet

- Tugas Ujian 3Document8 pagesTugas Ujian 3La LiaNo ratings yet

- ID Analisis Implementasi Prinsip Bagi HasilDocument17 pagesID Analisis Implementasi Prinsip Bagi HasilFebrian Surya SaputraNo ratings yet

- Sustainability of MFI's in India After Y.H.Malegam CommitteeDocument18 pagesSustainability of MFI's in India After Y.H.Malegam CommitteeAnup BmNo ratings yet

- 03 Literature ReviewDocument13 pages03 Literature ReviewAmitesh KumarNo ratings yet

- Analysis - Bandhan-Hope For The PoorDocument4 pagesAnalysis - Bandhan-Hope For The PoorNeetesh SinghNo ratings yet

- Chapter 5 CGTMSEDocument17 pagesChapter 5 CGTMSEMikeNo ratings yet

- Finance Decument WPS OfficeDocument5 pagesFinance Decument WPS Officevdav hadhNo ratings yet

- KesesuaianDocument28 pagesKesesuaianhaikalNo ratings yet

- Pengaruh Financing To Deposit Ratio (FDR) Dan Non-Deposito Mudharabah Pada Bank Syariah MandiriDocument16 pagesPengaruh Financing To Deposit Ratio (FDR) Dan Non-Deposito Mudharabah Pada Bank Syariah MandiriHario DaffaNo ratings yet

- Chit FundsDocument10 pagesChit Fundscenajocker100% (1)

- Penerapan Akad Mudharabah Pada Perbankan SyariahDocument18 pagesPenerapan Akad Mudharabah Pada Perbankan SyariahIpmawan Fahri Smith AlfatihNo ratings yet

- Micro FinanceDocument30 pagesMicro FinanceSakshi BhaskarNo ratings yet

- Nurul Khotimah Dosen Fakultas Ekonomi Dan Bisnis Universitas Wijaya PutraDocument13 pagesNurul Khotimah Dosen Fakultas Ekonomi Dan Bisnis Universitas Wijaya PutraSYARIFAH NURMASYITHAH, S. Pd, M. PdNo ratings yet

- Project Report ON: "A Study of Comparative Analyis of Kotak Mahindra Bank With Its Competitor'S"Document63 pagesProject Report ON: "A Study of Comparative Analyis of Kotak Mahindra Bank With Its Competitor'S"Nitesh AgrawalNo ratings yet

- MPRA Paper 24412Document20 pagesMPRA Paper 24412Shiena Dela CruzNo ratings yet

- Case Study On Meezan Bank by Urooj KhursheedDocument40 pagesCase Study On Meezan Bank by Urooj KhursheedUrooj SheikhNo ratings yet

- 53 Microfinance Revolution and The Grameen Bank Experience in Bangladesh20190805-48922-1a68le6-With-Cover-Page-V2Document62 pages53 Microfinance Revolution and The Grameen Bank Experience in Bangladesh20190805-48922-1a68le6-With-Cover-Page-V2Hidayatullah GanieNo ratings yet

- Sistem Perhitungan Bagi Hasil Pembiayaan Mudharabah Pada Pt. Bank Syariah Mandiri Cabang MalangDocument6 pagesSistem Perhitungan Bagi Hasil Pembiayaan Mudharabah Pada Pt. Bank Syariah Mandiri Cabang MalangYudha Alfian HaqqiNo ratings yet

- 07 - Chapter 1 MudraDocument16 pages07 - Chapter 1 Mudrayogesh sharmaNo ratings yet

- Syahrini Back IssueDocument7 pagesSyahrini Back IssueAnnisa SophiaNo ratings yet

- ECS & EFT (Autosaved)Document17 pagesECS & EFT (Autosaved)SRUTHI SNo ratings yet

- Account Details and Transaction History: Sa StatementDocument4 pagesAccount Details and Transaction History: Sa StatementTayana sumathiNo ratings yet

- 1 CashDocument6 pages1 CashMikaella SaduralNo ratings yet

- القروض المصرفية المتعثرة في البنوك الجزائرية وسبل علاجهاmeDocument14 pagesالقروض المصرفية المتعثرة في البنوك الجزائرية وسبل علاجهاmeNada NadaNo ratings yet

- Software Requirement Specification For ATM: 1. Cash DepositDocument10 pagesSoftware Requirement Specification For ATM: 1. Cash DepositRai JiNo ratings yet

- Trade Finance IIBFDocument8 pagesTrade Finance IIBFAmit Kumar0% (2)

- Commercial Bank ReportDocument29 pagesCommercial Bank ReportĐinh HiệpNo ratings yet

- Chapter-1 Introduction PDFDocument78 pagesChapter-1 Introduction PDFRaunak YadavNo ratings yet

- BIG PICTURE A ULOA The-Philippine Banking TodayDocument34 pagesBIG PICTURE A ULOA The-Philippine Banking TodayHime GyuNo ratings yet

- Questions 2 For Case Study 2 ChallengesDocument4 pagesQuestions 2 For Case Study 2 Challengesotaku himeNo ratings yet

- Trade LinesDocument55 pagesTrade LinesKadir Wisdom86% (7)

- Account Statement From 1 Jan 2021 To 12 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 1 Jan 2021 To 12 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUTube தமிழ்No ratings yet

- Banks Offering Basic Deposit AccountsDocument7 pagesBanks Offering Basic Deposit AccountsGeraldine AquinoNo ratings yet

- Question Paper Review - Financial Services - Cpc6aDocument7 pagesQuestion Paper Review - Financial Services - Cpc6ajeganrajrajNo ratings yet

- Account StatementDocument4 pagesAccount Statementnyambeniphindulo42No ratings yet

- BSc3 Financial Intermediation 2020-2021Document12 pagesBSc3 Financial Intermediation 2020-2021AndrewNo ratings yet

- Banking Law& PracticeDocument682 pagesBanking Law& Practicemavado vidukaNo ratings yet

- Mutasi Harian 5Document6 pagesMutasi Harian 5Alfianda RizkonNo ratings yet

- MR - Swapnil Suresh Soni: Mobile BankingDocument2 pagesMR - Swapnil Suresh Soni: Mobile Bankingsappy soniNo ratings yet

- Effect of Electronic Banking On The Economic Growth of Nigeria (2009-2018)Document24 pagesEffect of Electronic Banking On The Economic Growth of Nigeria (2009-2018)The IjbmtNo ratings yet

- 4.2. Loan Requirements: Unit 4: Sources and Uses of Short-Term and Long-Term FundsDocument5 pages4.2. Loan Requirements: Unit 4: Sources and Uses of Short-Term and Long-Term FundsTin CabosNo ratings yet

- Banking Law & Regulation (BBA 8th Sem) PDFDocument115 pagesBanking Law & Regulation (BBA 8th Sem) PDFsuresh pathakNo ratings yet

- Investment Security Contract TemplateDocument45 pagesInvestment Security Contract TemplateFerdee FerdNo ratings yet

- How To Write A Biography Essay ExamplesDocument5 pagesHow To Write A Biography Essay Examplesz1v1mud0z0p2100% (2)

- Online Financial Services3Document1 pageOnline Financial Services3Rebel 8No ratings yet

- Quant Checklist 146 PDF 2022 by Aashish AroraDocument73 pagesQuant Checklist 146 PDF 2022 by Aashish AroraRajnish SharmaNo ratings yet

- This Study Resource Was: Bank Loan Default Prediction ModelDocument9 pagesThis Study Resource Was: Bank Loan Default Prediction ModelAbdelmadjid BouamamaNo ratings yet

- Transaction Procedures TM-WS (2) SpainDocument14 pagesTransaction Procedures TM-WS (2) SpainLeonid SolisNo ratings yet

- KC JBXDLe WU3 I 0 B AhDocument15 pagesKC JBXDLe WU3 I 0 B AhSree Rahavan100% (1)

- 2080bs Financial Performance Analysis of Standard Chartered Bank Nepal LTDDocument51 pages2080bs Financial Performance Analysis of Standard Chartered Bank Nepal LTDBikeshNo ratings yet