Professional Documents

Culture Documents

Book 15 Dec 2023

Book 15 Dec 2023

Uploaded by

manchandavaanyaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Book 15 Dec 2023

Book 15 Dec 2023

Uploaded by

manchandavaanyaCopyright:

Available Formats

Dissolution of a

Partnership Firm

. Accounting Treatment

es tll

e1,~og oan by the firm

As per CBSE Guidelines and Late

st NCEKI' Book

tt1et11ellt of l to a partner (appearing on the

assets side of th bal

foC sC

h )

e ance s . cet :

l, / £,itrJ:

Dr.

}~(114 1nank Alc

eash V

1,oan co Partner NC

'fo . . . b

. d value ofan asset is not. given, 1t 1s. to e presumed that it has not real· d

z. • If realize er has borne and/ or paid the .

realisation expenses, it should be stated 1se any amount.

.If a partll .

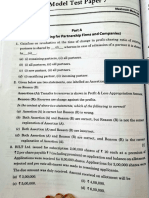

Multiple Choice Questions (MCQs)

the basis of the following data, how muc

h final payment will be made to a part

\. o:capital account of the partner was ner on firm's dissolution? Credit balance

'{S0 ,000. Share of loss on realization amounte

ohim was for fS,000: d to '{10,000. Firm's liability taken over by

(a) f32,000 (b) f48,000

(c) , 4o,ooo . . (d) f52,000

At

2 the time of dissolution of partnership firm, Journal entry for the settlement of loan

• advanced by the firm to a partner would be:

Journal

Date Particulan

(a) Bank Ale

Dr.

LF. Dr. Amt. <') Cr. Amt. <') l

To Loan to Partner Ale

(b) Loan to partner A/c

To Bank Ale Dr.

(c) Realization A/c

To Loan to Partner Ale Dr.

(d) None of these /

3. Retirement or death of a partner will crea

te a situation for the continuing partners

(a) Dissolution of Partnership , which is known as: :

(b) Dissolution of partnership firm

(c) Winding up of business

(d) None of the above

©Rohan, Mohan and Sohan were partners

loan to the firm will be: sharing profits equally. At the time of

dissolution of the partnership firm, Roh

aI

(a) credited to Rohan's Capital Account.

(b) debited to Realisation Account.

(c) .credited to Realisation Account.

5 (d) credited to Bank Account.

• ;'h)ich_of the following does not resu

,a D1ssol • f lt into reconstitution of a firm ?

~) uuon o partnership firm.

(b) Dissolution of partnersh'1p.

c Ilcach of panner.

(d) Change in profit-sharing-ratio of exis

ting partners.

You might also like

- June 2015 p1 (With Answers)Document14 pagesJune 2015 p1 (With Answers)Ashleigh JacksonNo ratings yet

- The Death Penalty in America (Bedau)Document545 pagesThe Death Penalty in America (Bedau)Johnny SinsNo ratings yet

- Tiger GlobalDocument12 pagesTiger GlobalAnsh Lakhmani0% (1)

- Forbes USA - 07 October 2013Document300 pagesForbes USA - 07 October 2013Bramantyo Nugros100% (1)

- 1 - Accounting For Partnership Firms - FundamentalsDocument12 pages1 - Accounting For Partnership Firms - FundamentalsAnkit Roy100% (1)

- Decision From The Western District Court of AppealsDocument7 pagesDecision From The Western District Court of AppealsSt. Louis Business Journal100% (1)

- Chapter 3 Sales Ion - Sales and Distribution ManagementDocument14 pagesChapter 3 Sales Ion - Sales and Distribution ManagementNikhil Chand100% (1)

- This Study Resource Was: Chapter 13 Multiple ChoicesDocument6 pagesThis Study Resource Was: Chapter 13 Multiple ChoicesChris Jay LatibanNo ratings yet

- (DAILY CALLER OBTAINED) - MORU SUP Application Response Letter - SD Dept of Tourism 1.12.23Document4 pages(DAILY CALLER OBTAINED) - MORU SUP Application Response Letter - SD Dept of Tourism 1.12.23Henry RodgersNo ratings yet

- Final Notesgango Alternative Dispute ResolutionDocument50 pagesFinal Notesgango Alternative Dispute ResolutionAngelika GacisNo ratings yet

- CONTRACT OF SERVICES - HaulingDocument2 pagesCONTRACT OF SERVICES - HaulingBernadette Luces Beldad0% (1)

- Reviewer Grade 1 Cont. 5Document2 pagesReviewer Grade 1 Cont. 5Shiela MayNo ratings yet

- NCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 4Document51 pagesNCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 4shivam BahetiNo ratings yet

- Set 1 Test No.1 Answer KeyDocument4 pagesSet 1 Test No.1 Answer KeyJOHAN JOJONo ratings yet

- Sample Paper: Maximum Marks 4Document13 pagesSample Paper: Maximum Marks 4PurvaNo ratings yet

- Change in Profit-Sharing Ratio Among The Existing Partners (Reconstitution of Partnership)Document13 pagesChange in Profit-Sharing Ratio Among The Existing Partners (Reconstitution of Partnership)Yashik JindalNo ratings yet

- Model Test Paper-5Document26 pagesModel Test Paper-5Lavagreat The greatNo ratings yet

- 12CEAccounts SolutionDocument9 pages12CEAccounts SolutionMihir ThakkarNo ratings yet

- 2 - P A R T N e R S H I P A C C o U N T SDocument7 pages2 - P A R T N e R S H I P A C C o U N T SABhranil ChowDhury100% (1)

- Ad Acc As QusDocument196 pagesAd Acc As QusRadhika GargNo ratings yet

- Accounting For Partnership Firms - FundamentalsDocument5 pagesAccounting For Partnership Firms - FundamentalsPainNo ratings yet

- CH - 04 Dissolution of Partnership FirmDocument10 pagesCH - 04 Dissolution of Partnership FirmMahathi AmudhanNo ratings yet

- Accountancy Ms CT Xii Set 1 B 2023Document17 pagesAccountancy Ms CT Xii Set 1 B 2023mendesg4625No ratings yet

- Dissolution SolutionDocument32 pagesDissolution SolutionKomal RastogiNo ratings yet

- Chapter-1 (Additional MCQs and Assertion-Reason Based MCQS)Document6 pagesChapter-1 (Additional MCQs and Assertion-Reason Based MCQS)ranapayal1725No ratings yet

- Dissolution Notes 2Document16 pagesDissolution Notes 2bhosaleparth97No ratings yet

- Retirement or Death of Partner NewDocument5 pagesRetirement or Death of Partner NewAnkit Roy100% (1)

- Ilovepdf MergedDocument10 pagesIlovepdf MergedDivyam RohillaNo ratings yet

- Flow Chart (L-8)Document2 pagesFlow Chart (L-8)Simer preet kaurNo ratings yet

- 12 Accountancy PDFDocument7 pages12 Accountancy PDFGaurang AgarwalNo ratings yet

- Notes To Diss 12Document3 pagesNotes To Diss 12Kartikay UpadhyayNo ratings yet

- Dissolution Notes FullDocument4 pagesDissolution Notes FullVansh BarsaiyanNo ratings yet

- MCQ ISC 2023 Retirement and DeathDocument15 pagesMCQ ISC 2023 Retirement and DeathArnab NaskarNo ratings yet

- Dissolution 1 7Document7 pagesDissolution 1 7ShekarKrishnappaNo ratings yet

- CCP402Document23 pagesCCP402api-3849444No ratings yet

- Partnership Firms - Part5 Guarantee and Past AdjustmentDocument15 pagesPartnership Firms - Part5 Guarantee and Past AdjustmentDeepti BistNo ratings yet

- 588c69bdc763b - Sample Paper Accountancy - 230102 - 185610Document7 pages588c69bdc763b - Sample Paper Accountancy - 230102 - 185610sanchitchaudhary431No ratings yet

- No. Ans - A Ans. B Ans. C Ans. D AnsDocument3 pagesNo. Ans - A Ans. B Ans. C Ans. D AnsHayes MartinNo ratings yet

- Model Sample Paper-2Document8 pagesModel Sample Paper-2arihant jainNo ratings yet

- Dissolution of Partnership FirmDocument17 pagesDissolution of Partnership FirmRenu Bala JainNo ratings yet

- Admission of A PartnerDocument21 pagesAdmission of A PartnerHarmohandeep singhNo ratings yet

- Flow Chart (L-2)Document1 pageFlow Chart (L-2)JazaNo ratings yet

- 2.change in Profit Sharing Ratio, Admission of A PartnerDocument25 pages2.change in Profit Sharing Ratio, Admission of A PartnerTinkuNo ratings yet

- Dissolution of FirmDocument60 pagesDissolution of FirmDj babuNo ratings yet

- 12th Sample Paper 6Document8 pages12th Sample Paper 6Amit ChaudhryNo ratings yet

- Assignment For New 12th ComersDocument3 pagesAssignment For New 12th ComersPrakhar SinghNo ratings yet

- CH-01 FundamenatsDocument3 pagesCH-01 FundamenatsNitin KumarNo ratings yet

- Dissolution of FirmDocument16 pagesDissolution of FirmPrathamNo ratings yet

- Adobe Scan 09 Mar 2023Document20 pagesAdobe Scan 09 Mar 2023Kanishka DixitNo ratings yet

- Partnership Imp QDocument5 pagesPartnership Imp Qa4603488No ratings yet

- Question Paper Accountancy Class 12Document12 pagesQuestion Paper Accountancy Class 12SunitaNo ratings yet

- 12 Accountancy Notes CH06 Dissolution of Partnership 01Document14 pages12 Accountancy Notes CH06 Dissolution of Partnership 01hazeleydenhereNo ratings yet

- B. Com. Sem-1 Fincancial Account (English)Document4 pagesB. Com. Sem-1 Fincancial Account (English)babu20021996No ratings yet

- Annexure D: Report For The - (I/II/III/IV) Quarter Ended - Period Covered by The Report: - (3/6/9/12) MonthsDocument7 pagesAnnexure D: Report For The - (I/II/III/IV) Quarter Ended - Period Covered by The Report: - (3/6/9/12) MonthsNarendra Ku MalikNo ratings yet

- Admission of A PartnerDocument5 pagesAdmission of A PartnerHigreeve SrudhiNo ratings yet

- Xii Mcqs CH - 4 Change in PSRDocument4 pagesXii Mcqs CH - 4 Change in PSRJoanna GarciaNo ratings yet

- Class 12 Pre Board SQP Accountancy 01Document21 pagesClass 12 Pre Board SQP Accountancy 01Mayank SharmaNo ratings yet

- Cbleacpu 01Document10 pagesCbleacpu 01tripatjotkaur757No ratings yet

- CMA Intermediate Paper 5Document16 pagesCMA Intermediate Paper 5ramesh devarajuNo ratings yet

- Unit 5Document6 pagesUnit 5Subha LakshmiNo ratings yet

- Class 12 Term 1 AccountancyDocument7 pagesClass 12 Term 1 AccountancyTûshar ThakúrNo ratings yet

- AccountsDocument12 pagesAccountsSandeep KumarNo ratings yet

- Partnership-Dissolution ExercisesDocument2 pagesPartnership-Dissolution ExercisesLeenNo ratings yet

- Model Test Paper-1Document24 pagesModel Test Paper-1Rupali RoyNo ratings yet

- 12BK Prelims PaperDocument6 pages12BK Prelims Paperpankajgaba64No ratings yet

- CBSE Class 12 Acc Question Bank Admission of A PartnerDocument6 pagesCBSE Class 12 Acc Question Bank Admission of A PartnerJYOTI SoniNo ratings yet

- 1 BK Paper APDocument13 pages1 BK Paper APchhayamurkute1111No ratings yet

- Morpho Detection v. Smiths DetectionDocument6 pagesMorpho Detection v. Smiths DetectionPriorSmartNo ratings yet

- اثر نقص فعالية سياسة الاعفاءات الضريبية في تحقيق التنمية على الاقتصاد الجزائريDocument27 pagesاثر نقص فعالية سياسة الاعفاءات الضريبية في تحقيق التنمية على الاقتصاد الجزائريHamid HathatiNo ratings yet

- DAC88094425Document1 pageDAC88094425Heemel D RigelNo ratings yet

- 9m.2-L.5@i Have A Dream & Literary DevicesDocument2 pages9m.2-L.5@i Have A Dream & Literary DevicesMaria BuizonNo ratings yet

- National Informatics Center: Centrally Managed Mcafee Antivirus Installation ProcedureDocument11 pagesNational Informatics Center: Centrally Managed Mcafee Antivirus Installation ProcedurePRATEEK KUMAR DASNo ratings yet

- IdiomsDocument4 pagesIdiomsElbah ElhouNo ratings yet

- Clarifications On New Standard Fire ProductsDocument2 pagesClarifications On New Standard Fire Productsnia.713303No ratings yet

- 1 - Noblejas V TeehankeeDocument3 pages1 - Noblejas V TeehankeeKaren RonquilloNo ratings yet

- UP Manila DormsDocument10 pagesUP Manila DormsBlack and Gray Kuring100% (1)

- GB PDFDocument359 pagesGB PDFUlaganathanNo ratings yet

- Article On Impeachment of JudgesDocument14 pagesArticle On Impeachment of JudgesshanikaNo ratings yet

- Davao Integrated Port Stevedoring Services vs. AbarquezDocument12 pagesDavao Integrated Port Stevedoring Services vs. AbarquezLorelain ImperialNo ratings yet

- Benin CombatDocument7 pagesBenin Combatapi-239816966No ratings yet

- Chapter 1 2Document203 pagesChapter 1 2Ian Ray PaglinawanNo ratings yet

- Instruction: Department of DefenseDocument45 pagesInstruction: Department of DefenseWilliam A. Kissenberger Jr.No ratings yet

- Amarillo City Commissioner Madison Scott 2008 Ethics FormDocument47 pagesAmarillo City Commissioner Madison Scott 2008 Ethics FormjpeeblesNo ratings yet

- 15 - Chapter 8 Conclusion Parsi Marriage ActDocument23 pages15 - Chapter 8 Conclusion Parsi Marriage ActKalpesh RajgorNo ratings yet

- Gay MarriageDocument24 pagesGay MarriageRA MemijeNo ratings yet

- Final SumsDocument12 pagesFinal SumsMaryNo ratings yet

- Attendance at Mass and Participation in The Liturgy: Fr. Michael SimoulinDocument11 pagesAttendance at Mass and Participation in The Liturgy: Fr. Michael SimoulinIrineuMarquesNo ratings yet

- Affidavit by The Student: (On Rs.10/-STAMP PAPER)Document3 pagesAffidavit by The Student: (On Rs.10/-STAMP PAPER)suvajit mukherjeeNo ratings yet

- EU Directives SummaryDocument2 pagesEU Directives SummaryAndres HidalgoNo ratings yet