Professional Documents

Culture Documents

Q2FY12 - Results Tracker 28.10.11

Uploaded by

Mansukh Investment & Trading SolutionsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q2FY12 - Results Tracker 28.10.11

Uploaded by

Mansukh Investment & Trading SolutionsCopyright:

Available Formats

Results Tracker

Friday, 28 Oct 2011

make more, for sure.

Q2FY12

Results to be Declared on 28th Oct 2011

COMPANIES NAME

7SEAS TECH

Deltron

Manraj Hous

Redington India

Take Solutions

ADINATH BIO

Exelon Infra

Marathwada Refrac

Sankhya Info

Tata Elxsi

Allsoft Corp

Alna Trading

Explicit Fin

Finalysis Cred

Maruti Sec

Minolta Fin

Seamec

Shamken Cotsyn

Tata Sponge

TATAGLOBAL

Alumeco India

Amarjothi Spin

Arsi Cosmetics

Asianlak Cap

First Custodian

Garden Silk

IFB Inds

Indian Hotels

MRO Tek

Nath Seeds

Neelkanth Rock

NEPC Agro

Shamken Multi

Shamken Spin

SPEL Semi

Steel Strp Whls

Velan Hotels

VGuard Inds

VMF Sof Tech

Wendt India

Astra Micro

BEML

Bhagwandas Met

Bharat Elect

Consolid Constr

Indo City Info

Indsil Hydro

Intercorp Inds

Jagan Lamps

Kitex Garments

NEPC India

NEPC Paper

NEPC Textiles

NHPC

Photon Capital

Sundaram Fin

Surana Inds

Swarna Sec

Switching Tech

Syschem India

White Diamond

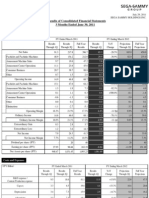

Results Announced on 25th & 26th Oct 2011 (Rs Million)

NTPC

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

156988

6880.7

42024.9

2854.3

39170.6

6582.8

32587.8

8346.6

-1594.6

24241.2

130536.6

23218

39036.9

3684.2

35352.7

5062.8

30289.9

9216.1

2782.8

21073.8

Equity

PBIDTM(%)

82454.6

26.77

82454.6

29.9

% Var

20.26

Year ended

201109

201009

-70.36

7.65

-22.53

10.8

30.02

7.59

-9.43

-157.3

15.03

302230.3

13317.3

80287.6

6234.2

74053.4

12994.1

61059.3

16060.3

-2013

44999

260599.2

28318.5

72350.1

6638.3

65711.8

11890

53821.8

14329.1

3684.1

39492.7

0

-10.48

82454.6

26.57

82454.6

27.76

% Var

15.98

201103

201003

-52.97

10.97

-6.09

12.69

9.29

13.45

12.08

-154.64

13.94

561590.1

30888.3

166843.7

21490.8

145352.9

24856.9

120496

29470.1

3936.9

91025.9

472529.2

19937.3

153444.5

18089.3

135355.2

26500.6

108854.6

21572.6

2091.3

87282

0

-4.32

82454.6

29.71

82454.6

32.47

% Var

18.85

54.93

8.73

18.8

7.39

-6.2

10.69

36.61

88.25

4.29

0

-8.51

A fair growth of 20.26% in the revenue at Rs. 156988.00 millions was reported in the September 2011 quarter as compared to Rs. 130536.60

millions during year-ago period.A slim rise of 15.03% was recorded in the Net profit for the quarter ended September 2011 to Rs. 24241.20

millions From Rs. 21073.80 millions.Operating profit for the quarter ended September 2011 rose to 42024.90 millions as compared to

39036.90 millions of corresponding quarter ended September 2010.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Dr Reddys Lab

Quarter ended

Year to Date

Year ended

Sales

201109

16469.8

201009

12968.8

% Var

27

201109

33439.4

201009

25681.4

% Var

30.21

201103

53044.1

201003

45532

% Var

16.5

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

130.5

2698.5

157.8

2540.7

734

1806.7

421.7

0

1385

523.5

3262.5

1.3

3261.2

613.5

2647.7

445.7

0

2202

-75.07

-17.29

12038.46

-22.09

19.64

-31.76

-5.38

0

-37.1

685.9

9371.5

310.2

9061.3

1423.3

7638

1712.5

0

5925.5

732.7

6627.7

5.9

6621.8

1185.5

5436.3

789.5

0

4646.8

-6.39

41.4

5157.63

36.84

20.06

40.5

116.91

0

27.52

1196

13051.3

53.8

12997.5

2479.4

10518.1

1585

0

8933.1

1714.4

13183.4

110.8

13072.6

2224.3

10848.3

2387.5

0

8460.8

-30.24

-1

-51.44

-0.57

11.47

-3.04

-33.61

0

5.58

Equity

PBIDTM(%)

847.6

16.29

846

24.99

0.19

-34.8

847.6

28.03

846

25.81

0.19

8.59

846.3

24.44

844.2

28.75

0.25

-15

A decent increase of about 27.00% in the sales to Rs. 16469.80 millions was observed for the quarter ended September 2011. The sales

figure stood at Rs. 12968.80 millions during the year-ago period.The Net Profit of the company slipped to Rs. 1385.00 millions from Rs.

2202.00 millions, a decline of -37.10% on QoQ basis.The company reported a degrowth in operating Profit to 2698.50 millions from

3262.50 millions.

Container Corp

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

9945.48

752.88

3381.03

0

3381.03

372.6

3008.43

786.07

45.27

2222.36

9441.84

380.65

2999.36

0

2999.36

364.6

2634.76

567.24

50.46

2067.52

Equity

PBIDTM(%)

1299.83

34

1299.83

31.77

% Var

5.33

Year ended

201109

201009

97.79

12.73

0

12.73

2.19

14.18

38.58

-10.29

7.49

19435.83

1341.32

6566.01

0

6566.01

774.92

5791.08

1227.19

69.15

4563.89

18600.7

739.49

5828.05

0

5828.05

716.81

5111.24

1108.58

84.94

4002.66

0

7.02

1299.83

33.78

1299.83

31.33

% Var

4.49

201103

201003

81.38

12.66

0

12.66

8.11

13.3

10.7

-18.59

14.02

38265.83

1734.44

11960.46

0

11960.46

1436.86

10523.6

2212.51

157

8311.09

37056.76

1800.51

11416.87

0

11416.87

1350.99

10065.87

2203.84

171.39

7862.03

0

7.82

1299.83

31.26

1299.83

30.81

% Var

3.26

-3.67

4.76

0

4.76

6.36

4.55

0.39

-8.4

5.71

0

1.45

The Revenue for the quarter ended September 2011 of Rs. 9945.48 millions grew by 5.33 % from Rs. 9441.84 millions.The Company has

registered profit of Rs. 2222.36 millions for the quarter ended September 2011, a growth of 7.49% over Rs. 2067.52 millions millions

achieved in the corresponding quarter of last year.OP of the company witnessed a marginal growth to 3381.03 millions from 2999.36

millions in the same quarter last year.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Sesa Goa

Quarter ended

201109

Year to Date

201009

Year ended

Sales

7566.6

8144

% Var

-7.09

201109

201009

24550.1

27317.6

% Var

-10.13

201103

201003

75104.6

46603.3

% Var

61.16

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

410.7

533.8

506.9

26.9

194.8

-167.9

-50

0

-117.9

1287.5

3870.5

138.3

3732.2

142.3

3589.9

60

0

3529.9

-68.1

-86.21

266.52

-99.28

36.89

-104.68

-183.33

0

-103.34

1744

11006.4

998.9

10007.5

415.6

9591.9

2980

0

6611.9

2793.8

15914

274

15640

285

15355

1570

0

13785

-37.58

-30.84

264.56

-36.01

45.82

-37.53

89.81

0

-52.04

4978.2

45058.6

369.3

44689.3

831.3

43858

9530

0

34328

4094.5

27662.4

507.7

27154.7

573.8

26580.9

5400

0

21180.9

21.58

62.89

-27.26

64.57

44.88

65

76.48

0

62.07

Equity

PBIDTM(%)

869.1

6.88

859.7

47.53

1.09

-85.52

869.1

44.83

859.7

58.26

1.09

-23.04

869.1

59.49

831

59.36

4.58

0.22

The sales is pegged at Rs. 7566.60 millions for the September 2011 quarter. The mentioned figure indicates decline with the sales recorded

at Rs. 8144.00 millions during the year-ago period.The Net Loss for the quarter ended September 2011 is Rs. -117.90 millions as compared

to Net Profit of Rs. 3529.90 millions of corresponding quarter ended September 2010A decline of 533.80 millions was observed in the OP

in the quarter ended September 2011 from 3870.50 millions on QoQ basis.

BASF India

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

9529.4

0

640.6

9.9

630.7

124.4

506.3

164.4

0

341.9

6586.6

0

783.1

4.1

779

89

690

233.5

0

456.5

Equity

PBIDTM(%)

432.9

6.72

407.7

11.89

% Var

44.68

Year ended

201109

201009

0

-18.2

141.46

-19.04

39.78

-26.62

-29.59

0

-25.1

19692.8

0

1553.8

26.1

1527.7

240.4

1287.3

418.8

0

868.5

13222.7

0

1609.9

6

1603.9

178.4

1425.5

480.4

0

945.1

6.18

-43.46

432.9

7.89

407.7

12.18

% Var

48.93

201103

201003

0

-3.48

335

-4.75

34.75

-9.69

-12.82

0

-8.1

30939.2

0

2065

93.5

1971.5

464

1507.5

329.2

0

1178.3

13941.4

0

1782.9

8.4

1774.5

260.8

1513.7

545.6

0

968.1

6.18

-35.2

432.9

6.67

407.7

12.79

% Var

121.92

0

15.82

1013.1

11.1

77.91

-0.41

-39.66

0

21.71

6.18

-47.81

A decent increase of about 44.68% in the sales to Rs. 9529.40 millions was observed for the quarter ended September 2011. The sales figure

stood at Rs. 6586.60 millions during the year-ago period.Net profit declined -25.10% to Rs. 341.90 millions from Rs. 456.50 millions.The

Operating Profit of the company witnessed a decrease to 640.60 millions from 783.10 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

National Fertilizers

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

17632.8

23.1

464

90.3

373.7

241.8

131.9

40.4

0

91.5

15628.7

32.8

842.3

29.5

812.8

205.7

607.1

176.1

-90.7

431

Equity

PBIDTM(%)

4905.8

2.62

4905.8

5.38

% Var

12.82

Year ended

201109

201009

-29.57

-44.91

206.1

-54.02

17.55

-78.27

-77.06

-100

-78.77

31841.6

51.6

817.2

165.6

651.6

459.5

192.1

40.8

-43.4

151.3

27290.3

74.5

1353.2

44.1

1309.1

436.6

872.5

263.7

-133.8

608.8

0

-51.28

4905.8

2.57

4905.8

4.96

% Var

16.68

201103

201003

-30.74

-39.61

275.51

-50.23

5.25

-77.98

-84.53

-67.56

-75.15

58207.1

164.4

3019.7

91.5

2928.2

889

2039.2

654.2

-342.9

1385

51306.8

183.3

3646.6

109.6

3537

937.5

2599.5

884.4

45.3

1715.1

% Var

13.45

-10.31

-17.19

-16.51

-17.21

-5.17

-21.55

-26.03

-856.95

-19.25

0

-48.24

4905.8

5.18

4905.8

7.1

0

-27.05

The Revenue for the quarter ended September 2011 of Rs. 17632.80 millions grew by 12.82 % from Rs. 15628.70 millions.The company

suffered a huge decline of -78.77% to Rs. 91.50 millions from Rs. 431.00 millions of corresponding previous quarter.The Operating Profit

of the company witnessed a decrease to 464.00 millions from 842.30 millions.

Jay Shree Tea

Quarter ended

Year to Date

201109

201009

Sales

2112

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

28.1

423.2

76.3

346.9

50.7

296.2

0

0

296.2

Equity

PBIDTM(%)

111.7

20.04

Year ended

201109

201009

1403.5

% Var

50.48

201103

201003

2236.7

% Var

35.81

4932.4

4118.8

% Var

19.75

3037.6

148.1

497.3

33.4

463.9

21.5

442.4

0

0

442.4

-81.03

-14.9

128.44

-25.22

135.81

-33.05

0

0

-33.05

41.3

664.7

114.9

549.8

72.4

477.4

0

0

477.4

165.3

650.6

48.9

601.7

41.7

560

0

0

560

-75.02

2.17

134.97

-8.63

73.62

-14.75

0

0

-14.75

93.5

778.8

146.8

632

115.2

516.8

53.7

-35

463.1

132

840.7

75.7

765

78.1

686.9

69.9

15.3

617

-29.17

-7.36

93.92

-17.39

47.5

-24.76

-23.18

-328.76

-24.94

111.7

35.43

0

-43.45

111.7

21.88

111.7

29.09

0

-24.77

111.7

15.79

111.7

20.41

0

-22.64

A decent increase of about 50.48% in the turnover to Rs. 2112.00 millions was observed for the quarter ended September 2011. The

turnover stood at Rs. 1403.50 millions during the similar quarter previous year.Profit after Tax for the quarter ended September 2011 saw

a decline of -33.05% from Rs. 442.40 millions to Rs. 296.20 millions.Operating profit for the quarter ended September 2011 decreased to

423.20 millions as compared to 497.30 millions of corresponding quarter ended September 2010.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Alstom Projects (I)

Quarter ended

Year to Date

Year ended

201109

201009

201009

201003

3134.9

8878.6

6718.6

% Var

32.15

201103

6006.8

% Var

91.61

201109

Sales

18171.6

20648.1

% Var

-11.99

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

100.9

543.6

0

543.6

120.6

423

137.2

0

285.8

86.2

678.1

0

678.1

111.7

566.4

196

0

370.4

17.05

-19.83

0

-19.83

7.97

-25.32

-30

0

-22.84

263.7

758.2

0

758.2

242

516.2

167.4

0

348.8

163.6

1262

0

1262

222.5

1039.5

354

0

685.5

61.19

-39.92

0

-39.92

8.76

-50.34

-52.71

0

-49.12

408.2

3023.6

0

3023.6

482.8

2540.8

851.8

0

1689

180.3

2901.4

1.2

2900.2

417.1

2483.1

810.6

0

1672.5

126.4

4.21

-100

4.25

15.75

2.32

5.08

0

0.99

Equity

PBIDTM(%)

670.2

9.05

670.2

21.63

0

-58.16

670.2

8.54

670.2

18.78

0

-54.54

670.2

16.64

670.2

14.05

0

18.41

The topline for the September 2011 quarter moved up 91.61% to Rs. 6006.80 millions as compared to Rs. 3134.90 millions during the yearago period.The Company's Net profit for the September 2011 quarter have declined marginally to Rs. 285.80 millions as against Rs.

70.40 millions reported during the corresponding quarter ended.The company reported a degrowth in operating Profit to 543.60 millions

from 678.10 millions.

KEC International

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

9574.9

195.5

712.4

327.6

375

88.8

286.2

61.1

0

225.1

9502.7

0

870.3

198.6

586.8

85.4

501.4

188.3

0

313.1

Equity

PBIDTM(%)

514.2

7.26

514.2

8.94

% Var

0.76

Year ended

201109

201009

0

-18.14

64.95

-36.09

3.98

-42.92

-67.55

0

-28.11

17493.9

195.5

1390

608.3

771.9

174.8

597.1

162

0

435.1

17746.2

0

1649.1

462.8

1101.4

168.6

932.8

412.7

0

520.1

0

-18.83

514.2

7.95

514.2

9.29

% Var

-1.42

201103

201003

0

-15.71

31.44

-29.92

3.68

-35.99

-60.75

0

-16.34

39653.2

0

3804.3

986.6

2732.8

344.9

2387.9

917

0

1470.9

38782.3

0

3867.2

865.3

3001.9

262.4

2739.5

1029.6

0

1709.9

0

-14.5

514.2

9.37

514.2

9.86

% Var

2.25

0

-1.63

14.02

-8.96

31.44

-12.83

-10.94

0

-13.98

0

-4.93

With no major difference for the quarter endedSeptember 2011 , the total revenue stood at Rs. 9574.90 millions.The Net Profit of the

company registered a slight decline of -28.11% to Rs. 225.10 millions from Rs. 313.10 millions.Operating profit for the quarter ended

September 2011 decreased to 712.40 millions as compared to 870.30 millions of corresponding quarter ended September 2010.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Engineers India

Quarter ended

Year to Date

201109

201009

Sales

8274.2

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

539.59

2167.34

0

2167.34

28.72

2138.62

672.18

-70.21

1466.44

Equity

PBIDTM(%)

1684.68

26.19

Year ended

201109

201009

5936.13

% Var

39.39

201103

201003

11996.5

% Var

40.13

28232.84

19937.97

% Var

41.6

16810.2

348.64

1815.78

0.02

1815.76

32.86

1782.91

583.5

-89.62

1199.4

54.77

19.36

-100

19.36

-12.6

19.95

15.2

-21.66

22.26

957.33

4382.52

0

4382.52

58.54

4323.98

1376.79

-163.18

2947.19

638.35

3559.07

0.03

3559.04

61.01

3498.05

1153.05

-166.24

2344.99

49.97

23.14

-100

23.14

-4.05

23.61

19.4

-1.84

25.68

1603.66

8002.97

14.67

7988.3

142.97

7845.35

2620.14

-341.16

5225.19

1836.71

6746.74

12.91

6733.83

129.05

6604.78

2249.03

-248.18

4355.75

-12.69

18.62

13.63

18.63

10.79

18.78

16.5

37.46

19.96

1684.68

30.59

0

-14.37

1684.68

26.07

1684.68

29.67

0

-12.12

1684.68

28.35

561.56

33.84

200

-16.23

The sales figure stood at Rs. 8274.20 millions for the September 2011 quarter. The mentioned figure indicates a growth of about 39.39% as

compared to Rs. 5936.13 millions during the year-ago period.A humble growth in net profit of 22.26% reported in the quarter ended

September 2011 to Rs. 1466.44 millions from Rs. 1199.40 millions.The company reported a good operating profit of 2167.34 millions

compared to 1815.78 millions of corresponding previous quarter.

Kotak Mahindra Bank

Quarter ended

201109

Year to Date

201009

% Var

201109

Year ended

201009

% Var

201103

201003

% Var

27944.31

18869.92

48.09

43035.58

32556.25

32.19

Interest Earned

14646.49

9895.76

48.01

Other Income

2124.91

1707.14

24.47

4411.53

3333.37

32.34

6330.37

6282.4

0.76

Interest Expended

8591.9

4771.33

80.07

16211.22

8919.06

81.76

20584.85

13974.76

47.3

Operating Expenses

4379.37

4379.37

22.88

8483.93

6863.26

23.61

15533.2

11893.93

30.6

-23.61

455.08

-105.19

197.24

1016.03

-80.59

1370.88

4858.92

-71.79

1223.64

865.43

2343

1588.87

2499.98

2600.1

1947.04

5120.45

3816.07

47.46

34.18

3695.2

PAT

41.39

33.54

8181.82

5611.06

47.81

45.82

Equity

3693.24

3667.03

3693.24

3667.03

3684.36

3481.42

OPM

25.95

33.02

27.41

34.03

30.78

39.84

Operating Profit

Prov.& Contigencies

Tax

0.71

-21.42

0.71

-19.44

5.83

-22.73

The sales surged to Rs. 14646.49 millions, up 48.01% for the September 2011 quarter as against Rs. 9895.76 millions during the

corresponding quarter previous year.Net Profit recorded in the quarter ended September 2011 rise to 33.54% to Rs. 2600.10 millions

compared to R. 1947.04 millions in corresponding previous quarter.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Data Source : ACE Equity

NAME

DESIGNATION

Varun Gupta

Head - Research

varungupta@moneysukh.com

Pashupati Nath Jha

Research Analyst

pashupatinathjha@moneysukh.com

Vikram Singh

Research Analyst

vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you.

Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and

has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form.

The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or

employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding

any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations.

MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This

information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be

required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be

happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

You might also like

- Land, Building, and MachineryDocument6 pagesLand, Building, and MachineryPaula Rodalyn MateoNo ratings yet

- Financial Modeling of TCS LockDocument62 pagesFinancial Modeling of TCS LocksharadkulloliNo ratings yet

- CEB TowerGroup Reconciliation Applications Market UpdateDocument10 pagesCEB TowerGroup Reconciliation Applications Market UpdatepekassNo ratings yet

- TO Improve Sales at Café Coffee Day PROJECT REPORTDocument85 pagesTO Improve Sales at Café Coffee Day PROJECT REPORTBabasab Patil (Karrisatte)75% (4)

- Asian Paints - Financial Modeling (With Solutions) - CBADocument47 pagesAsian Paints - Financial Modeling (With Solutions) - CBAavinashtiwari201745No ratings yet

- ISA 315 - MGT AssertionsDocument5 pagesISA 315 - MGT AssertionsAwaisQureshiNo ratings yet

- Tendering & ContractingDocument12 pagesTendering & Contractingmearig22267% (3)

- CB Insights Corporate Innovation Labs Finance NurtureDocument47 pagesCB Insights Corporate Innovation Labs Finance Nurturedrestadyumna ChilspiderNo ratings yet

- Clow - Imc8 - Inppt - 09 Final VersionDocument23 pagesClow - Imc8 - Inppt - 09 Final VersionAhmed QNo ratings yet

- Results Tracker: Wednesday, 19 Oct 2011Document6 pagesResults Tracker: Wednesday, 19 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 02 Nov 2011Document8 pagesResults Tracker: Wednesday, 02 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 01 Nov 2011Document13 pagesResults Tracker: Tuesday, 01 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 03 Nov 2011Document6 pagesResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 21 Oct 2011Document8 pagesResults Tracker: Friday, 21 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 25 Oct 2011Document5 pagesResults Tracker: Tuesday, 25 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 20 Oct 2011Document6 pagesResults Tracker: Thursday, 20 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 07 Aug 2012Document7 pagesResults Tracker: Tuesday, 07 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 22.10.11Document14 pagesResults Tracker 22.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Q1FY12 Results Tracker 17th August-Mansukh Investment and TradingDocument5 pagesQ1FY12 Results Tracker 17th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 18 Oct 2011Document4 pagesResults Tracker: Tuesday, 18 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 20 July 2012Document7 pagesResults Tracker: Friday, 20 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 15 Nov 2011Document12 pagesResults Tracker: Tuesday, 15 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 02 Aug 2012Document7 pagesResults Tracker: Thursday, 02 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 26 July 2012Document7 pagesResults Tracker: Thursday, 26 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 04 Aug 2012Document7 pagesResults Tracker: Saturday, 04 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 21 July 2012Document10 pagesResults Tracker: Saturday, 21 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 08 Aug 2012Document4 pagesResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 24 July 2012Document7 pagesResults Tracker: Tuesday, 24 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 16 Aug 2012Document8 pagesResults Tracker: Thursday, 16 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 Results Tracker 14.10.11Document3 pagesQ2FY12 Results Tracker 14.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Q1FY12 Results Tracker 13th August-Mansukh Investment and TradingDocument16 pagesQ1FY12 Results Tracker 13th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 14 July 2012Document4 pagesResults Tracker: Saturday, 14 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 21.04.12Document3 pagesResults Tracker 21.04.12Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 Results Tracker 13.10.11Document2 pagesQ2FY12 Results Tracker 13.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 18 August 2011Document3 pagesResults Tracker 18 August 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 Results Tracker 09 November 2011 - Mansukh Investment and Trading SolutionDocument5 pagesQ2FY12 Results Tracker 09 November 2011 - Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 28 July 2012Document13 pagesResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Hosoku e FinalDocument6 pagesHosoku e FinalSaberSama620No ratings yet

- Weekly Market Outlook 08.10.11Document5 pagesWeekly Market Outlook 08.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 03 Feb 2012Document7 pagesResults Tracker: Friday, 03 Feb 2012Mansukh Investment & Trading SolutionsNo ratings yet

- FY 2069-70 Ten Month14Document5 pagesFY 2069-70 Ten Month14Roshan ManandharNo ratings yet

- Pulau PinangDocument14 pagesPulau PinangNoelle LeeNo ratings yet

- Report AttockDocument33 pagesReport AttockChaudhary BilalNo ratings yet

- WEEKLY MARKET OUTLOOK For 30 July CAUTIOUSLY OPTIMISTIC..Document6 pagesWEEKLY MARKET OUTLOOK For 30 July CAUTIOUSLY OPTIMISTIC..Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 04.11.11Document8 pagesResults Tracker 04.11.11Mansukh Investment & Trading SolutionsNo ratings yet

- KSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutDocument2 pagesKSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutInam Ul Haq MinhasNo ratings yet

- SR DM 05Document42 pagesSR DM 05Sumit SumanNo ratings yet

- Bajaj Bal SheetDocument3 pagesBajaj Bal SheetSukshith ShettyNo ratings yet

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Document1 pageUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaNo ratings yet

- Economic Indicators (IFS)Document2 pagesEconomic Indicators (IFS)Sunil NagpalNo ratings yet

- Johor q1 2012Document14 pagesJohor q1 2012johnNo ratings yet

- Asok 06 08Document1 pageAsok 06 08rahulbalujaNo ratings yet

- Financial Highlights 2010Document2 pagesFinancial Highlights 2010adityahrcNo ratings yet

- Working Capital RatioDocument11 pagesWorking Capital RatiovmktptNo ratings yet

- AKFEN GYO Monthly Report - March 2012Document5 pagesAKFEN GYO Monthly Report - March 2012Akfen Gayrimenkul Yatırım OrtaklığıNo ratings yet

- EV CalcDocument11 pagesEV CalcDeepak KapoorNo ratings yet

- Lakh RS, Y/e June FY09 FY08 FY07Document10 pagesLakh RS, Y/e June FY09 FY08 FY07gaurav910No ratings yet

- Atlas Honda LimitedDocument10 pagesAtlas Honda LimitedUnza TabassumNo ratings yet

- FR 11 66 ValuationOfAnIndianTelcomCompanyDocument23 pagesFR 11 66 ValuationOfAnIndianTelcomCompanyAlen MinjNo ratings yet

- AKFEN GYO Monthly Report - February 2012Document6 pagesAKFEN GYO Monthly Report - February 2012Akfen Gayrimenkul Yatırım OrtaklığıNo ratings yet

- Pantaloon Retail Shoppers Stop 84.51% - 65.31% - 5.32% 73.20% - 74.40% 102.81% 19.09% 126.44% 179.73% 48.97% STD 0.865815Document7 pagesPantaloon Retail Shoppers Stop 84.51% - 65.31% - 5.32% 73.20% - 74.40% 102.81% 19.09% 126.44% 179.73% 48.97% STD 0.865815Ankit_4668No ratings yet

- First Global: Canara BankDocument14 pagesFirst Global: Canara BankAnkita GaubaNo ratings yet

- Faysal Bank Spread Accounts 2012Document133 pagesFaysal Bank Spread Accounts 2012waqas_haider_1No ratings yet

- Asian Paints Bse: 500820 - Nse: Asianpaint ISIN: INE021A01018 - Paints/VarnishesDocument27 pagesAsian Paints Bse: 500820 - Nse: Asianpaint ISIN: INE021A01018 - Paints/VarnishesGaurav ShahareNo ratings yet

- Maruti Suzuki: Performance HighlightsDocument13 pagesMaruti Suzuki: Performance HighlightsAngel BrokingNo ratings yet

- Intoduction: - Tata Steel Formerly Known As TISCO and Tata Iron and Steel CompanyDocument7 pagesIntoduction: - Tata Steel Formerly Known As TISCO and Tata Iron and Steel Companyaamit87No ratings yet

- Myntra The Product Challenge: Stylbiz'20Document9 pagesMyntra The Product Challenge: Stylbiz'20laksh goyalNo ratings yet

- Panera BreadDocument16 pagesPanera BreadannwareenNo ratings yet

- Competitive Exams Accountancy: Terminology: Definition of Accounting TerminologyDocument2 pagesCompetitive Exams Accountancy: Terminology: Definition of Accounting TerminologyVikas ChoudharyNo ratings yet

- Financial Accounting AssignmentDocument27 pagesFinancial Accounting AssignmentClaire joeNo ratings yet

- Evaluation of Six Sigma Concepts in Construction IndustryDocument6 pagesEvaluation of Six Sigma Concepts in Construction IndustryBuru KengeNo ratings yet

- Workday Hewlett Packard Company Case StudyDocument3 pagesWorkday Hewlett Packard Company Case Studynyi naingNo ratings yet

- 12 Favourite Sales Pitches of A Life Insurance 1215321666163853 9Document6 pages12 Favourite Sales Pitches of A Life Insurance 1215321666163853 9D.V.SUBBAREDDYNo ratings yet

- BSRV37MC2008Document368 pagesBSRV37MC2008sirishaakellaNo ratings yet

- ACF5F8Document116 pagesACF5F8daerie1661No ratings yet

- Iift Summer PLACEMENTS 2018-20: Indian Institute of Foreign TradeDocument14 pagesIift Summer PLACEMENTS 2018-20: Indian Institute of Foreign TradekalyaniNo ratings yet

- Chapter 03 - The Accounting Cycle: Capturing Economic EventsDocument120 pagesChapter 03 - The Accounting Cycle: Capturing Economic Eventsyujia ZhaiNo ratings yet

- Introduction To Lawtech October 2019Document37 pagesIntroduction To Lawtech October 2019Asma ElmangoushNo ratings yet

- HaiDocument8 pagesHaiPrajesh SrivastavaNo ratings yet

- Bursa Malaysia Toolkit - Themes and Indicators (2nd Edition)Document41 pagesBursa Malaysia Toolkit - Themes and Indicators (2nd Edition)kacaribuantonNo ratings yet

- XBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardDocument98 pagesXBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardBhagwan BachaiNo ratings yet

- Executive Excellence-Performance Appraisal An Ideal System A Perfect FormDocument8 pagesExecutive Excellence-Performance Appraisal An Ideal System A Perfect Formhisham_abdelaleemNo ratings yet

- A Research Paper Submited To Department of Management For Partalfulfilment of The Requirement in Ba Degree in ManagementDocument44 pagesA Research Paper Submited To Department of Management For Partalfulfilment of The Requirement in Ba Degree in ManagementEng-Mukhtaar CatooshNo ratings yet

- ED 221 Strategic Planning Management Module VIDocument33 pagesED 221 Strategic Planning Management Module VINescil Mae BaldemoroNo ratings yet

- Airpods: Presentation by Team 3Document11 pagesAirpods: Presentation by Team 3Khang Vũ BảoNo ratings yet

- Wahab Saeed Dogar: Career ObjectiveDocument2 pagesWahab Saeed Dogar: Career ObjectiveZakir AliNo ratings yet

- Company PresentationDocument12 pagesCompany PresentationTntkik KiktntNo ratings yet

- 2018 Management Accounting Ibm2 PrepDocument9 pages2018 Management Accounting Ibm2 PrepВероника КулякNo ratings yet

- Labor RelationDocument20 pagesLabor RelationJabeer Ibnu RasheedNo ratings yet