Professional Documents

Culture Documents

Results Tracker: Tuesday, 07 Aug 2012

Uploaded by

Mansukh Investment & Trading SolutionsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Results Tracker: Tuesday, 07 Aug 2012

Uploaded by

Mansukh Investment & Trading SolutionsCopyright:

Available Formats

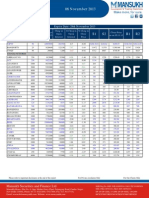

Results Tracker

Tuesday, 07 Aug 2012

make more, for sure.

Q1FY13

Results to be Declared on Tuesday, 7th August 2012

COMPANIES NAME

Aditya Ispat

Aksh Optifibre

BHILWRA TEC

Bombay Dyeing

ICDS

Innoventive Ind

Nila Infra

NITESH EST

SSPDL

Stanrose Mafat

Alka India

Brigade Enter

J&K Bank

Northern Proj

Sunraj Diamond

Alkyl Amines

Allcargo Logistics

Can Fin Homes

Carborundum Uni

Jenson & Nich India

Jumbo Bag

NRC

Panacea Bio

Surat Textile

Tata Chemicals

AMD Inds

Amines & Plasti

Amit Spinning

Chettinad Cem

DALMIASUG

Deccan Cements

Kanpur Plast

KLIFESTYLE

KMF Builders

Patel Integ

Poddar Pigm

Punj Lloyd

Tea Time

TPL Plastech

Unimers India

ANANDPROJ

Delta Mag

KMG Milk Food

Rainbow Papers

United Brew

APL Apollo Tubes

Arman Fin Serv

ARROW TEX

Asian Fert

Delton Cables

DFLINFRA

Ekam Leasing

Eskay Knit

Linc Pen

Lok Housing

Lotus Eye Care

Maral Overseas

Rajapalayam

Sambhaav Media

Sharp India

Shree Raj Syntex

United Credit

VGuard Inds

Vimal Oil

VIP Inds

Asutosh Enter

Aurobindo Phar

Galada Power

Gee El Woollens

Metropoli Over

Mindteck India

SIEL Financial

SIGNET IND

VMF Sof Tech

Wellesley Corp

Axis It&T

Great Offshore

MOIL

Sobha Dev

West Coast Paper

Balrampur Chini

GS Auto

Munjal Auto

South Asian Entr

Bhagwati Oxy

Hind Rectifiers

NHPC

SPMLINFRA

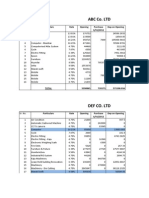

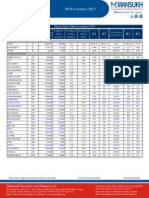

Results Announced on 6th Aug 2012 (Rs Million)

Andhra Bank

Quarter ended

Year to Date

201206

201106

Interest Earned

31214.9

Other Income

Interest Expended

Operating Expenses

Operating Profit

Prov.& Contigencies

Tax

PAT

2357.3

21830.1

4708.3

4968.3

2065.5

1350

3618.3

Equity

OPM

5595.8

22.53

Year ended

201206

201106

26342.3

% Var

18.5

201203

201103

26342.3

% Var

18.5

113387.3

82912.7

% Var

36.76

31214.9

2169.5

17238.5

4708.3

0

1769.5

1370

3857.1

8.66

26.64

10.09

0

16.73

-1.46

-6.19

2357.3

21830.1

4708.3

4968.3

2065.5

1350

3618.3

2169.5

17238.5

4276.7

0

1769.5

1370

3857.1

8.66

26.64

10.09

0

16.73

-1.46

-6.19

8599.3

75794.1

18042.5

18242.7

9907.3

4796

13446.7

8969.6

50703.1

17048.5

0

6460

5000

12670.7

-4.13

49.49

5.83

0

53.36

-4.08

6.12

5595.8

26.56

0

-15.16

5595.8

22.53

5595.8

26.56

0

-15.16

5595.8

24.83

5595.8

29.1

0

-14.7

The revenue for the June 2012 quarter is pegged at Rs. 31214.90 millions, about 18.50% up against Rs. 26342.30 millions recorded during

the year-ago period.Net profit declined -6.19% to Rs. 3618.30 millions from Rs. 3857.10 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

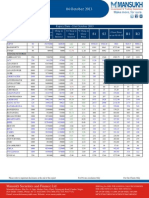

Results Tracker

Q1FY13

make more, for sure.

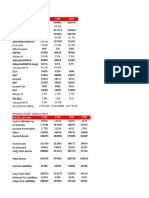

SAIL

Quarter ended

201206

201106

% Var

-1.5

Year to Date

201206

201106

109415.8

4660.5

17857.4

1713.1

16144.3

3748.1

12396.2

3912.8

23.5

8483.4

41305.3

16.32

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

107775

2784.5

15367.9

1248.8

14119.1

4018.3

10100.8

3136.7

502.2

6964.1

109415.8

4660.5

17857.4

1713.1

16144.3

3748.1

12396.2

3912.8

23.5

8483.4

-40.25

-13.94

-27.1

-12.54

7.21

-18.52

-19.83

2037.02

-17.91

107775

2784.5

15367.9

1248.8

14119.1

4018.3

10100.8

3136.7

502.2

6964.1

Equity

PBIDTM(%)

41305.3

12.75

41305.3

14.85

0

-14.13

41305.3

14.26

Year ended

201203

201103

-40.25

-13.94

-27.1

-12.54

7.21

-18.52

-19.83

2037.02

-17.91

463417.9

15557.3

76576.2

6777

67179

15670.3

51508.7

16081.5

1134.2

35427.2

433073.6

14406.4

90294.5

4747.7

86801.1

14858

71943.1

22895.7

-630.4

49047.4

7.99

-15.19

42.74

-22.61

5.47

-28.4

-29.76

-279.92

-27.77

0

-12.63

41305.3

15

41304

18.96

0

-20.85

% Var

-1.5

% Var

7.01

A slight decline in the revenue of Rs. 107775.00 millions was seen for the June 2012 quarter as against Rs. 109415.80 millions during yearago period.A slender decline of -17.91% was recorded to Rs. 6964.10 millions from Rs. 8483.40 millions in the corresponding previous

quarter.The Operating Profit of the company witnessed a decrease to 15367.90 millions from 17857.40 millions.

Cadila Healthcare

Sales

Quarter ended

201206

201106

8194.2

7818.7

% Var

4.8

Year to Date

201206

8194.2

201106

7818.7

% Var

4.8

Year ended

201203

31507.8

201103

29202.8

% Var

7.89

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

26.9

1936.1

268.9

1667.2

275.2

1392

65

0

1327

178

1990.7

68.7

1922

249.7

1672.3

143

0

1529.3

-84.89

-2.74

291.41

-13.26

10.21

-16.76

-54.55

0

-13.23

26.9

1936.1

268.9

1667.2

275.2

1392

65

0

1327

178

1990.7

68.7

1922

249.7

1672.3

143

0

1529.3

-84.89

-2.74

291.41

-13.26

10.21

-16.76

-54.55

0

-13.23

2391.4

9069.2

1282.6

7786.6

1082.3

6704.3

129.1

0

6575.2

747.8

7658.4

318.1

7340.3

968.5

6371.8

268

0

6103.8

219.79

18.42

303.21

6.08

11.75

5.22

-51.83

0

7.72

Equity

PBIDTM(%)

1023.7

23.31

1023.7

25.15

0

-7.31

1023.7

23.63

1023.7

25.46

0

-7.2

1023.7

28.39

1023.7

25.91

0

9.57

The total revenue for the quarter ended June 2012 remained nearly unchanged at Rs. 8194.20 millions.The Net proft of the company

remain more or less same to Rs. 1327.00 millions from Rs. 1529.30 millions ,decline by -13.23%.The company reported a degrowth in

operating Profit to 1936.10 millions from 1990.70 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

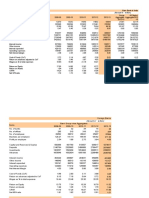

Wockhardt

Quarter ended

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

6073.8

57.5

1351.4

292

993.3

159.7

833.6

92.6

0

741

5508.5

53.4

1525.6

389.3

1136.3

229.5

906.8

80

0

826.8

Equity

PBIDTM(%)

547.2

22.25

547.2

27.7

Year to Date

201206

201106

7.68

-11.42

-24.99

-12.58

-30.41

-8.07

15.75

0

-10.38

6073.8

57.5

1351.4

292

993.3

159.7

833.6

92.6

0

741

5508.5

53.4

1525.6

389.3

1136.3

229.5

906.8

80

0

826.8

0

-19.66

547.2

22.25

547.2

27.7

% Var

10.26

Year ended

201203

201103

7.68

-11.42

-24.99

-12.58

-30.41

-8.07

15.75

0

-10.38

25604

201.2

8269.4

1607.7

4500.8

663.7

3837.1

1997.1

0

1840

17549.2

329.8

4254.7

2030.8

-704.9

615.8

-1320.7

0

0

-1320.7

-38.99

94.36

-20.83

-738.5

7.78

-390.54

0

0

-239.32

0

-19.66

547.2

32.3

547.2

24.24

0

33.22

% Var

10.26

% Var

45.9

The company witnessed a 10.26% growth in the revenue at Rs. 6073.80 millions for the quarter ended June 2012 as compared to Rs.

5508.50 millions during the year-ago period.The Net proft of the company remain more or less same to Rs. 741.00 millions from Rs.

26.80 millions ,decline by -10.38%.The Operating Profit of the company witnessed a decrease to 1351.40 millions from 1525.60 millions.

Britannia Inds

Quarter ended

Year to Date

Year ended

201206

201106

201106

201103

12288.9

11075.7

% Var

10.95

201203

11075.7

% Var

10.95

201206

12288.9

49741.9

42235.2

% Var

17.77

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

106.2

829.4

94.6

734.8

130.1

604.7

170.2

0

434.5

257.9

776.4

93

683.4

110.9

572.5

154.5

0

418

-58.82

6.83

1.72

7.52

17.31

5.62

10.16

0

3.95

106.2

829.4

94.6

734.8

130.1

604.7

170.2

0

434.5

257.9

776.4

93

683.4

110.9

572.5

154.5

0

418

-58.82

6.83

1.72

7.52

17.31

5.62

10.16

0

3.95

585.3

3377.6

380.7

2996.9

473.2

2523.7

656.3

0

1867.4

489.2

2804

377.5

2426.5

445.9

1980.6

527.7

0

1452.9

19.64

20.46

0.85

23.51

6.12

27.42

24.37

0

28.53

Equity

PBIDTM(%)

238.9

6.75

238.9

7.01

0

-3.72

238.9

6.75

238.9

7.01

0

-3.72

238.9

6.79

238.9

6.64

0

2.28

Sales

A fair growth of 10.95% in the revenue at Rs. 12288.90 millions was reported in the June 2012 quarter as compared to Rs. 11075.70

millions during year-ago period.Profit after tax improved marginally to Rs. 434.50 millions for the quarter ended June 2012 from Rs.

418.00 millions of corresponding previous quarter.OP of the company witnessed a marginal growth to 829.40 millions from 776.40

millions in the same quarter last year.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Aditya Birla Nuvo

Quarter ended

Year to Date

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

20371.4

208.1

2141.1

865.3

1275.8

500.5

775.3

197.1

0

578.2

18639.3

261

2421.2

662.1

1759.1

498.5

1260.6

318.9

0

941.7

Equity

PBIDTM(%)

1135.2

10.51

1135.1

12.99

% Var

9.29

Year ended

201206

201106

-20.27

-11.57

30.69

-27.47

0.4

-38.5

-38.19

0

-38.6

20371.4

208.1

2141.1

865.3

1275.8

500.5

775.3

197.1

0

578.2

18639.3

261

2421.2

662.1

1759.1

498.5

1260.6

318.9

0

941.7

0.01

-19.09

1135.2

10.51

1135.1

12.99

% Var

9.29

201203

201103

-20.27

-11.57

30.69

-27.47

0.4

-38.5

-38.19

0

-38.6

84334.8

1897.4

10505

3132.6

6333.6

2030.6

4303

849.1

0

3453.9

64472.4

748.6

9599.4

2708.1

6891.3

1940.5

4950.8

1153.9

0

3796.9

0.01

-19.09

1135.2

12.46

1135.1

14.89

% Var

30.81

153.46

9.43

15.68

-8.09

4.64

-13.08

-26.41

0

-9.03

0.01

-16.34

The revenue for the June 2012 quarter is pegged at Rs. 20371.40 millions, about 9.29% up against Rs. 18639.30 millions recorded during

the year-ago period.The Company to register a -38.60% fall in the net profit for the quarter ended June 2012.Operating profit for the

quarter ended June 2012 decreased to 2141.10 millions as compared to 2421.20 millions of corresponding quarter ended June 2011.

Uttam Galva Steels

Quarter ended

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

20577.2

11.3

1497.9

814.3

683.6

454

229.6

127.2

81.1

102.4

15332.1

14.4

1095.8

655.7

440.1

305.4

134.7

43.7

17.1

91

Equity

PBIDTM(%)

1222.6

7.28

1222.6

7.15

Year to Date

201206

201106

-21.53

36.69

24.19

55.33

48.66

70.45

191.08

374.27

12.53

20577.2

11.3

1497.9

814.3

683.6

454

229.6

127.2

81.1

102.4

15332.1

14.4

1095.8

655.7

440.1

305.4

134.7

43.7

17.1

91

0

1.85

1222.6

7.28

1222.6

7.15

% Var

34.21

Year ended

201203

201103

-21.53

36.69

24.19

55.33

48.66

70.45

191.08

374.27

12.53

51716

76.4

5135.9

2452.1

2683.9

1273.7

1410.1

630.5

347.7

779.6

50408.1

39.2

4451.8

2122.4

2329.4

1194.1

1135.4

367.6

151.7

767.7

0

1.85

1222.6

9.93

1222.6

8.83

% Var

34.21

% Var

2.59

94.9

15.37

15.53

15.22

6.67

24.19

71.52

129.2

1.55

0

12.45

The sales surged to Rs. 20577.20 millions, up 34.21% for the June 2012 quarter as against Rs. 15332.10 millions during the corresponding

quarter previous year.A slim rise of 12.53% was recorded in the Net profit for the quarter ended June 2012 to Rs. 102.40 millions From

Rs. 91.00 millions.OP of the company witnessed a marginal growth to 1497.90 millions from 1095.80 millions in the same quarter last

year.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

DCW

Quarter ended

Year to Date

201206

201106

Sales

3587.64

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

7.28

598.92

80.37

458.55

133.4

325.15

90

0

235.15

Equity

PBIDTM(%)

413.29

16.69

Year ended

201206

201106

2629.31

% Var

36.45

201203

201103

2629.31

% Var

36.45

11861.77

10625.44

% Var

11.64

3587.64

3.94

275.36

89.23

186.13

117.4

68.73

13

0

55.73

84.77

117.5

-9.93

146.36

13.63

373.08

592.31

0

321.95

7.28

598.92

80.37

458.55

133.4

325.15

90

0

235.15

3.94

275.36

89.23

186.13

117.4

68.73

13

0

55.73

84.77

117.5

-9.93

146.36

13.63

373.08

592.31

0

321.95

9.94

1624.52

334.27

970.48

512.1

458.38

149.9

0

308.48

3.17

986.11

285.71

834.47

475.58

358.89

69.78

0

289.11

213.56

64.74

17

16.3

7.68

27.72

114.82

0

6.7

392.31

10.47

5.35

59.4

413.29

16.69

392.31

10.47

5.35

59.4

406.2

13.7

392.31

9.28

3.54

47.58

The sales for the June 2012 quarter moved up 36.45% to Rs. 3587.64 millions as compared to Rs. 2629.31 millions during the

corresponding quarter last year.The company almost doubled its revenue to Rs. 235.15 millions from Rs. 55.73 millions in the quarter

?nded June 2012.OP of the company witnessed a marginal growth to 598.92 millions from 275.36 millions in the same quarter last year.

Wheels India

Quarter ended

Year to Date

201206

201106

Sales

5196.1

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

11.6

412.2

145.2

267

130.7

136.3

47

0

89.3

Equity

PBIDTM(%)

98.7

7.93

Year ended

201206

201106

4665.9

% Var

11.36

201203

201103

4665.9

% Var

11.36

20775.4

17006.1

% Var

22.16

5196.1

6

363.1

133.2

229.9

123.8

106.1

34.2

0

71.9

93.33

13.52

9.01

16.14

5.57

28.46

37.43

0

24.2

11.6

412.2

145.2

267

130.7

136.3

47

0

89.3

6

363.1

133.2

229.9

123.8

106.1

34.2

0

71.9

93.33

13.52

9.01

16.14

5.57

28.46

37.43

0

24.2

22.9

1749.3

703

1046.3

504.7

541.6

198.1

0

343.5

27.5

1322.8

536.2

786.6

460.8

325.8

79.4

0

246.4

-16.73

32.24

31.11

33.02

9.53

66.24

149.5

0

39.41

98.7

7.78

0

1.94

98.7

7.93

98.7

7.78

0

1.94

98.7

8.42

98.7

7.78

0

8.25

The revenue zoomed 11.36% to Rs. 5196.10 millions for the quarter ended June 2012 as compared to Rs. 4665.90 millions during the

corresponding quarter last year.A humble growth in net profit of 24.20% reported in the quarter ended June 2012 to Rs. 89.30 millions

from Rs. 71.90 millions.Operating profit for the quarter ended June 2012 rose to 412.20 millions as compared to 363.10 millions of

corresponding quarter ended June 2011.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Tube Investments

Quarter ended

Year to Date

201206

201106

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

9148

32.4

939.4

196.5

742.9

188.5

554.4

170.1

0

384.3

8742.6

12.5

1055.4

171.6

883.8

183.1

700.7

200.5

0

500.2

Equity

PBIDTM(%)

372.7

10.27

371.5

12.07

% Var

4.64

Year ended

201206

201106

159.2

-10.99

14.51

-15.94

2.95

-20.88

-15.16

0

-23.17

9148

32.4

939.4

196.5

742.9

188.5

554.4

170.1

0

384.3

8742.6

12.5

1055.4

171.6

883.8

183.1

700.7

200.5

0

500.2

0.32

-14.94

372.7

10.27

371.5

12.07

% Var

4.64

201203

201103

159.2

-10.99

14.51

-15.94

2.95

-20.88

-15.16

0

-23.17

34897.7

309.7

3973.5

761.7

3211.8

760.8

2451

650.1

0

1800.9

29811

107.9

3557.2

659.2

3104

691

2413

716.4

0

1696.6

0.32

-14.94

372.6

11.39

371.3

11.93

% Var

17.06

187.03

11.7

15.55

3.47

10.1

1.57

-9.25

0

6.15

0.35

-4.58

The Total revenue for the quarter ended June 2012 of Rs. 9148.00 millions remain, more or less, the same.The Company's Net profit for

the June 2012 quarter have declined marginally to Rs. 384.30 millions as against Rs. 500.20 millions reported during the corresponding

quarter ended.The company reported a degrowth in operating Profit to 939.40 millions from 1055.40 millions.

Essar Shipping

Quarter ended

Year to Date

Year ended

Sales

201206

4210.9

201106

2926.1

% Var

43.91

201206

4210.9

201106

2926.1

% Var

43.91

201203

12453.5

201103

5146.6

% Var

141.98

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

138.3

1200.2

761.9

438.3

370.5

67.8

5.6

0

62.2

137.1

1197.7

589

608.7

273.1

335.6

4

0

331.6

0.88

0.21

29.35

-27.99

35.66

-79.8

40

0

-81.24

138.3

1200.2

761.9

438.3

370.5

67.8

5.6

0

62.2

137.1

1197.7

589

608.7

273.1

335.6

4

0

331.6

0.88

0.21

29.35

-27.99

35.66

-79.8

40

0

-81.24

595.1

5007.3

2669

2338.3

1363.6

974.7

16.5

0

958.2

322.9

2596.8

1231.1

1365.7

569

796.7

15

0

781.7

84.3

92.83

116.8

71.22

139.65

22.34

10

0

22.58

Equity

PBIDTM(%)

2052.3

28.5

2052.3

40.93

0

-30.37

2052.3

28.5

2052.3

40.93

0

-30.37

2052.3

40.21

2052.3

50.46

0

-20.31

A decent increase of about 43.91% in the sales to Rs. 4210.90 millions was observed for the quarter ended June 2012. The sales figure stood

at Rs. 2926.10 millions during the year-ago period.Net Profit for the quarter ended June 2012 dipped to Rs. 62.20 millions from Rs. 331.60

millions in the corresponding previous quarter.Operating Profit saw a handsome growth to 1200.20 millions from 1197.70 millions in the

quarter ended June 2012.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q1FY13

make more, for sure.

Data Source : ACE Equity

NAME

DESIGNATION

Varun Gupta

Head - Research

varungupta@moneysukh.com

Pashupati Nath Jha

Research Analyst

pashupatinathjha@moneysukh.com

Vikram Singh

Research Analyst

vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you.

Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and

has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form.

The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or

employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding

any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations.

MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This

information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be

required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be

happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

You might also like

- Financial Modeling of TCS LockDocument62 pagesFinancial Modeling of TCS LocksharadkulloliNo ratings yet

- 2018 Suggested Tax Bar AnswerDocument14 pages2018 Suggested Tax Bar AnswerAudrey100% (3)

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocument68 pagesCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNo ratings yet

- 2010 Taxation Law Bar Examination QuestionsDocument5 pages2010 Taxation Law Bar Examination QuestionsMowan100% (1)

- Bank Reconciliation: Sir. JP MoralesDocument30 pagesBank Reconciliation: Sir. JP MoralesAshley Niña Lee Hugo100% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument10 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAkshat KeshariNo ratings yet

- Silkair (Singapore) Pte, LTD vs. CirDocument2 pagesSilkair (Singapore) Pte, LTD vs. CirMarylou Macapagal100% (2)

- Front Office Cash Checkout and SettlementDocument21 pagesFront Office Cash Checkout and Settlementpranith100% (1)

- Results Tracker: Saturday, 21 July 2012Document10 pagesResults Tracker: Saturday, 21 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 24 July 2012Document7 pagesResults Tracker: Tuesday, 24 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 02 Aug 2012Document7 pagesResults Tracker: Thursday, 02 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 26 July 2012Document7 pagesResults Tracker: Thursday, 26 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 20 Oct 2011Document6 pagesResults Tracker: Thursday, 20 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 08 Aug 2012Document4 pagesResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 20 July 2012Document7 pagesResults Tracker: Friday, 20 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 19 Oct 2011Document6 pagesResults Tracker: Wednesday, 19 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 16 Aug 2012Document8 pagesResults Tracker: Thursday, 16 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 21 Oct 2011Document8 pagesResults Tracker: Friday, 21 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 - Results Tracker 28.10.11Document7 pagesQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 19 July 2012Document4 pagesResults Tracker: Thursday, 19 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 04 Aug 2012Document7 pagesResults Tracker: Saturday, 04 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 01 Nov 2011Document13 pagesResults Tracker: Tuesday, 01 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 25 Oct 2011Document5 pagesResults Tracker: Tuesday, 25 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 14 July 2012Document4 pagesResults Tracker: Saturday, 14 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 02 Nov 2011Document8 pagesResults Tracker: Wednesday, 02 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 22.10.11Document14 pagesResults Tracker 22.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 28 July 2012Document13 pagesResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 03 Nov 2011Document6 pagesResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 03 Feb 2012Document7 pagesResults Tracker: Friday, 03 Feb 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Q1FY12 Results Tracker 17th August-Mansukh Investment and TradingDocument5 pagesQ1FY12 Results Tracker 17th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 21.04.12Document3 pagesResults Tracker 21.04.12Mansukh Investment & Trading SolutionsNo ratings yet

- PTCLDocument169 pagesPTCLSumaiya Muzaffar100% (1)

- Six Years Financial SummaryDocument133 pagesSix Years Financial Summarywaqas_haider_1No ratings yet

- Results Tracker: Tuesday, 18 Oct 2011Document4 pagesResults Tracker: Tuesday, 18 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Trend Analysis of Ultratech Cement - Aditya Birla Group.Document9 pagesTrend Analysis of Ultratech Cement - Aditya Birla Group.Kanhay VishariaNo ratings yet

- Accounts AssignmentDocument15 pagesAccounts AssignmentGagandeep SinghNo ratings yet

- Results Tracker: Friday, 03 Aug 2012Document4 pagesResults Tracker: Friday, 03 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- KSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutDocument2 pagesKSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutInam Ul Haq MinhasNo ratings yet

- Tickers Last Price 20day Avg VolumeDocument15 pagesTickers Last Price 20day Avg VolumeagoscapitalNo ratings yet

- Pidilite financial metrics and valuation analysisDocument3 pagesPidilite financial metrics and valuation analysisTejaswi KancherlaNo ratings yet

- First Resources 4Q12 Results Ahead of ExpectationsDocument7 pagesFirst Resources 4Q12 Results Ahead of ExpectationsphuawlNo ratings yet

- Dividen & Dividen Payout by Year Dividen Dalam RP 000.000 Dan DP % Dividen Net Income Before Tax DP 2010Document10 pagesDividen & Dividen Payout by Year Dividen Dalam RP 000.000 Dan DP % Dividen Net Income Before Tax DP 2010Sabar Andriko SianturiNo ratings yet

- Abc Co. LTD: Particulars Rate Opening Purchase Dep On Opening 3/31/2012Document4 pagesAbc Co. LTD: Particulars Rate Opening Purchase Dep On Opening 3/31/2012Mukesh KataraNo ratings yet

- Kingsbury AR - 2012 PDFDocument52 pagesKingsbury AR - 2012 PDFSanath FernandoNo ratings yet

- Results Tracker 04.11.11Document8 pagesResults Tracker 04.11.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 18 August 2011Document3 pagesResults Tracker 18 August 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Fauji Cement Company Limited Annual-Report-2012Document63 pagesFauji Cement Company Limited Annual-Report-2012Saleem Khan0% (1)

- Lakh RS, Y/e June FY09 FY08 FY07Document10 pagesLakh RS, Y/e June FY09 FY08 FY07gaurav910No ratings yet

- ET Top 500 Companies List India 2014Document45 pagesET Top 500 Companies List India 2014Saakshi KaulNo ratings yet

- Competitors in Millions of TL 2012 2011 2010 2009 2008 Iş BankDocument2 pagesCompetitors in Millions of TL 2012 2011 2010 2009 2008 Iş BankAnum CharaniaNo ratings yet

- Cost Accounting ProjectDocument14 pagesCost Accounting Projectdipesh bajajNo ratings yet

- Q1FY12 Results Tracker 13th August-Mansukh Investment and TradingDocument16 pagesQ1FY12 Results Tracker 13th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsNo ratings yet

- Nandan Denim Financial AnalysisDocument14 pagesNandan Denim Financial AnalysisAnkit SainiNo ratings yet

- Pantaloon Retail Shoppers Stop 84.51% - 65.31% - 5.32% 73.20% - 74.40% 102.81% 19.09% 126.44% 179.73% 48.97% STD 0.865815Document7 pagesPantaloon Retail Shoppers Stop 84.51% - 65.31% - 5.32% 73.20% - 74.40% 102.81% 19.09% 126.44% 179.73% 48.97% STD 0.865815Ankit_4668No ratings yet

- Income Statement: Altus Honda Cars Pakistan LimitedDocument23 pagesIncome Statement: Altus Honda Cars Pakistan LimitedTahir HussainNo ratings yet

- BJE Q1 ResultsDocument4 pagesBJE Q1 ResultsTushar DasNo ratings yet

- Acc LTD Rs 1020: Top Line Increases On Back of Higher Realization and Robust Dispatch GrowthDocument6 pagesAcc LTD Rs 1020: Top Line Increases On Back of Higher Realization and Robust Dispatch GrowthPearl MotwaniNo ratings yet

- Invest Ment Port FolioDocument2 pagesInvest Ment Port FolioVinay SinghNo ratings yet

- Bank DataDocument9 pagesBank DataAnonymous KvNac2YIkNo ratings yet

- Bharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0Document4 pagesBharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0sakiv1No ratings yet

- Income Statement For The Years Ended 2010-2012 Faran Sugar MillsDocument26 pagesIncome Statement For The Years Ended 2010-2012 Faran Sugar MillsZara RamisNo ratings yet

- Financial Reporting and Analysis ProjectDocument15 pagesFinancial Reporting and Analysis Projectsonar_neel100% (1)

- KingfisherDocument2 pagesKingfishersunnypatel8686No ratings yet

- Weekly Market Outlook 23.04.12Document5 pagesWeekly Market Outlook 23.04.12Mansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 08.11.2013Document3 pagesResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Budget at A Glance 2021-2022Document5 pagesBudget at A Glance 2021-2022Indranil MandalNo ratings yet

- Skrill Payment Gateway Integration ManualDocument44 pagesSkrill Payment Gateway Integration ManualSamir JunaidNo ratings yet

- Social Gaming Merchant AccountDocument2 pagesSocial Gaming Merchant AccountstarprocessingusNo ratings yet

- Comenity Capital Bank outage FAQs 6/30Document2 pagesComenity Capital Bank outage FAQs 6/30yitayewamlakNo ratings yet

- Paytm Is The Largest: Internet Ecosystem in IndiaDocument3 pagesPaytm Is The Largest: Internet Ecosystem in IndiaAnkit RawatNo ratings yet

- The Georgia Gun Club Adjusts Its Accounts Monthly and ClosesDocument1 pageThe Georgia Gun Club Adjusts Its Accounts Monthly and ClosesAmit PandeyNo ratings yet

- Cashback Tncs - Final PDFDocument3 pagesCashback Tncs - Final PDFPrasant GoelNo ratings yet

- Form 60Document1 pageForm 60Shrikant GawhaneNo ratings yet

- Othprocess For Actual Investment Proof - 2021-22 - 2 Process For Actual Investment Proof - 2021-22Document13 pagesOthprocess For Actual Investment Proof - 2021-22 - 2 Process For Actual Investment Proof - 2021-22Dhruv JainNo ratings yet

- History of Taxation in EthiopiaDocument6 pagesHistory of Taxation in EthiopiaEdlamu Alemie100% (1)

- Washington City Created An Information Technology Department in 2013 To PDFDocument1 pageWashington City Created An Information Technology Department in 2013 To PDFMuhammad ShahidNo ratings yet

- Summary of TRAIN LAWDocument45 pagesSummary of TRAIN LAWKyle JastillanaNo ratings yet

- Income Tax Return 480.20 (U)Document3 pagesIncome Tax Return 480.20 (U)Alan EscobarNo ratings yet

- VP 021LC972 InvoicesDocument4 pagesVP 021LC972 InvoicesVaishnav RaiNo ratings yet

- Success: Examination Fee DetailsDocument2 pagesSuccess: Examination Fee DetailsBharath M100% (1)

- Session 2 - Compensation Income and FBTDocument6 pagesSession 2 - Compensation Income and FBTMitzi WamarNo ratings yet

- AMA PenFed Platinum Cash Rewards-Pricing List InfoDocument4 pagesAMA PenFed Platinum Cash Rewards-Pricing List InfomattermarkusNo ratings yet

- Statement 08 183 197 8Document6 pagesStatement 08 183 197 8Olwethu NgwanyaNo ratings yet

- Egypt - Taxation of International Executives - KPMG GlobalDocument29 pagesEgypt - Taxation of International Executives - KPMG GlobalKhalil El AssaadNo ratings yet

- FMGHDocument3 pagesFMGHKeith Joanne SantiagoNo ratings yet

- 1559051463267lQpqLbRWjUIPzaEz PDFDocument8 pages1559051463267lQpqLbRWjUIPzaEz PDFSibu SorenNo ratings yet

- Final Black Book ProjectDocument53 pagesFinal Black Book ProjectHamzah ShaikhNo ratings yet

- WE PUT THE “FUN” IN FUNDRAISINGDocument1 pageWE PUT THE “FUN” IN FUNDRAISINGMarco SalasNo ratings yet

- Income Tax Quiz 6Document3 pagesIncome Tax Quiz 6Calix CasanovaNo ratings yet