Professional Documents

Culture Documents

Digital India Success

Digital India Success

Uploaded by

raghunandhan.cv0 ratings0% found this document useful (0 votes)

8 views10 pagesOriginal Title

digital-india-success

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views10 pagesDigital India Success

Digital India Success

Uploaded by

raghunandhan.cvCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

ndia's digital ecosystem has undergone an enormous change in

recent years. The progressive integration of government services into

digital platforms has made grassroots delivery of those services swift and

effective. With just one click, citizens can now access these programs and

get the help they require in a matter of seconds. The Government of India

has consistently increased the number of digital payment transactions as

part of its aim to digitise the economy and financial sector, Furthermore,

a great deal of work has been done to make financial inclusion a top

priority as a vital national objective, guaranteeing that every person has

access to financial services. Digital India has set a significant goal of

attaining a status characterised by presence-less, paperless, cashless,

backed with consent transactions. The Government of India has placed

utmost importance on promoting digital payments, aiming to include

every segment of the country's population within the formal framework

of digital payment services. The ultimate vision is to ensure that all Indian

citizens can access seamless digital payment facilities conveniently,

affordably, quickly, and securely.

There has been a technological revolution in

recent years in India. As part of the Government

of India's plan to digitise the financial industry

and economy, the number of digital payment

transactions has been steadily rising over the.

past several years. More concentrated efforts

have been made to advance financial inclusion

as one of the nation's key national goals. One of,

the key enablers at the centre of India’s

transformed digital payment landscape is JAN

Trinity- Jan Dhan, Aadhaar and Mobile.

Launched in August 2014, Pradhan Mantri Jan-

Dhan Yojana (PMJDY) is one of the biggest

financial inclusion initiatives in the world. It

contributes to providing universal banking

services for every unbanked household. The

main product of the Unique Identification

Authority of India, Aadhaar, is a straightforward

but efficient way to validate people and

beneficiaries using their biometric data.

Together, Jan Dhan accounts, Aadhaar, and

mobile connections have contributed to

building the groundwork for a Digital India,

where citizens may access a wide range of

government services directly and with greater

convenience without the need for middlemen.

The idea of digital India revolves around

achieving faceless, paperless, and cashless

status. To promote digital payments to

strengthen the Indian economy, the

government has been using various initiatives to

bring each segment of the country under one-

fold digitisation.

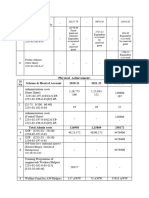

India has experienced large-scale digital adoption between 2013 and 2018,

triggered by both government action and market forces

@ @

870 million

up from 55.8 million

‘Aadhaat-linked bank accounts

1.22 billion

up trom 510 million

people with unique biometric

digital identities (Aadhaar)

292,748 sascranni 2018)

functional Common Services Centres

providing e-services?

98 million

up from 6.5 million

daily e-government

transactions

o

26.7 billion

up from 249 million

Aadhaar authentication transaictions?

Source: Ministry of Electronics & Information Technology, Government of India

560 million 294 million 200 million

up from 238.7 million up from $0 million up from 30 million

Internet subscriptions ‘Sovial media users WhatsApp subscribers

© ©

176.8 million 24.3 billion

up from 40 million up from 2.5 billion

e-commerce users annual digital payment transactions

(digital wallets, net banking, or credit or

Sebit card at point of sale)

1) Figies an 22nd Janay, 2019,

2 Common Servoes Gerires and Andhaar authentication varsactons data compared 10 2088

3 Digtal payments wansactons data fot January to Decembat 2018 compared to FY 2013-14 al ather fires for 2017/2018 compared t9 2013,

Source: Ministry of Electronics & Information Technology, Government of India

The Digital India program is a program of the

Government of India (Gol) that was launched in

July 2015 with the vision of transforming India

into a digitally empowered nation and a

progressive economy.

Digital payment is one of its aspects that offers a

faster and even more convenient alternative to

the conventional payment system. This offers the

convenience of avoiding long queues at banks or government to track and monitor all financial

‘Automatic Tailor Machines (ATMs) for money activities that are going on. This enables the

requirements. With the arrival of digital currency, __ elimination of counterfeit notes and facilitates

there's less risk involved in handling currency. better regulation of income taxes. During the

Moreover, digital transactions help in controlling pandemic, digital payments emerged as a boon

the circulation of black money by allowing the and enabled contactless and safe transactions.

Total Number of Digital Transactions (2017-2023)

saw os

sss

usr

2on i

1.06230 20460

nano a6 ss sera z

— _ -_ = = 1 |

2017-18 2018-19 2019-20 2020-21, 2021-22 2022-23"

mRs.Crore MUS Million

Source: Press Information Bureau (PIB), Reserve Bank of india (RBI)

Note: * December 2022, Digital payment modes considered are BHIM-UPI, IMPS, NACH, AePS, NETC, debit cards, credit cards,

NEFT, RTGS, PPI and others.

EHIMp

Lie)

During the last 5 years, various easy &

convenient modes of digital payments, including

Bharat Interface for Money-Unified Payments

Interface (BHIM-UPI), Immediate Payment

Service (IMPS), & National Electronic Toll

Collection (NETC), have registered substantial

growth and have transformed the digital

payment ecosystem by increasing person-to-

person (P2P) as well as person-to-merchant

(P2M) payments. BHIM UPI has emerged as the

preferred payment mode of the citizens & has

recorded Rs. 803.6 crore (US$ 96.6 million)

digital payment transactions with a value of Rs.

12.98 lakh crore (US$ 155.98 billion) in January

2023.

The expansion of digital payments in India and

the availability of various simple and practical

digital payment options have made life easier

for the populace and promoted financial

inclusion, business, and economic growth.

Contactless digital payment options like BHIM-

UPI made it easier for people to distance

themselves from one another and for

businesses, especially small ones, to continue

operating throughout the pandemic.

Some of the benefits of using digital payments

are as follows:

It offers an instant and convenient mode of

payment. Digital mechanisms like IMPS and

BHIM-UPI allow money to be instantly sent to

the beneficiary account, unlike cash.

Additionally, by utilising the BHIM-UPI mode, a

user can conduct a digital transaction through

their phone by providing a virtual payment

BEES

address (email-like address) or their cell phone

number, which is easy to recall. Payments are

now easier owing to BHIM-UPI, which has made

it possible to access various bank accounts with

a single mobile app. Citizens can easily receive

and make payments using their phones owing

to digital payments, which provide anytime,

anywhere access to accounts. Individuals who

might have been put off by the time and

expense of physically visiting a bank branch to

conduct transactions can now easily access their

bank account online and enjoy all the

advantages of joining the official banking system

and gaining financial inclusion. With the recent

implementation of UP! 123PAY, feature phone

users can now conduct digital transactions in

assisted voice mode using UPI, promoting

financial inclusion and digital transactions in

rural regions.

Unlike cash payments, digital payments

automatically establish a user's financial

footprint, thereby increasing access to formal

financial services, including credit. Banks and

other lending institutions can utilise digital

transaction histories to make cashflow-based

lending decisions for both retail lending and

lending to businesses, including small

businesses that may face difficulty in getting

credit in the absence of verifiable cashflows.

The Bharat Bill Payment System (BBPS) offers

users a simple, accessible, and interoperable

way to pay their bills using a variety of channels,

including BHIM-UPI, mobile apps, Internet

banking, and mobile banking. With BBPS,

citizens can conveniently pay their bills at any

time, from any location.

Earlier cash payments were vulnerable to

"ghost" (false) beneficiaries and "leakage"

(payments that do not reach the recipient in

full), especially when it came to government

transfers of social security funds. Benefits are

now sent via digital payment methods straight

to the target beneficiary's account (direct

benefit transfer).

IBEX

UPI Transations

10.73

Apr'i6 Apri? Apr't8_ prt

mm Volume (in Milion)

Source: Press Information Bureau (PIB)

One product that has been dubbed

revolutionary in the payment environment is.

UPI. Since its launch in 2016, it has grown to

become one of the most widely used digital

transaction platforms in the nation. The

National Payments Corporation of India (NPC!)

created the immediate payment system known

as UPI. It combines a number of banking

functions, smooth fund routing, and merchant,

payments under one roof, enabling numerous

bank accounts into a single mobile application.

Currently, considerably over 40% of all digital

transactions in India are made using UPI. Small

companies and street vendors have benefited as

it makes bank-to-bank transfers, even for

relatively small amounts, quick and secure. For

migrant workers, it also makes swift money

transfers possible. The technology is simple to

use because it involves no physical effort and

Ap'20—Apr’21—Apr22.—Apr'22.—Apr'22

== Volume (in Rs, Lakh Crore)

enables money transfers with just the scan of a

QR code. Because UPI makes it simple and

contactless to do transactions, it has also

proven to be a lifesaver during the COVID-19

outbreak. As a result, its use is growing quickly.

BHIM-UPI has emerged as the preferred

payment method among users. UPI has set a

new record of processing over 9 billion

transactions (worth US$ 179 billion) in May

2023. UPI accounts for 75% of the total retail

digital payments in India.

India has witnessed an unprecedented surge in

the digital economy and specifically digital

payments over the years. Digital payment

methods that are easy to use and convenient,

like Person-to-Person (P2P) and Person-to-

Merchant (P2M) payments, have revolutionised

the digital payment landscape. Examples of

these methods include Bharat Interface for

Money-Unified Payments Interface (BHIM-UP!),

Immediate Payment Service (IMPS), Pre-paid

Payment Instruments (PPIs), NACH, AePS, and

National Electronic Toll Collection (NETC). These

methods have experienced substantial growth.

ACHIEVEMENTS OF DIGITAL INITIATIVES

The government has started the Digital India

plan to make India a knowledge-based economy

and a society that is enabled by technology by

ensuring digital access, inclusion,

empowerment, and closing the digital divide.

The plan is focused on three main areas of

vision: digital infrastructure as a basic service

provided to all residents, on-demand

governance and services, and citizen

empowerment through digital means. The

objective is to guarantee that digital

technologies enhance the quality of life for the

population, grow the country's digital economy,

and provide investment and job opportunities.

The revolution has significantly shortened the

gap between the people and the government. It

has also helped in the transparent and

corruption-free direct delivery of significant

services to the recipient. India has become a

world leader in utilising technology to improve

the quality of life for its people as a result of this

approach. The Digital India program is a broad

initiative encompassing several programs from

several Central Ministries and Departments as

well as States and Union Territories (Uts).

In order to promote employment opportunities

and the spread of the Information Technology

and Information Technology Enabled Services

(ITES) industry in smaller cities and towns, the

government launched the India BPO Promotion

Scheme (IBPS) and the Northeast BPO

Promotion Scheme (NEBPS) as part of the

Digital India programme. These programmes

offer financial support of up to Rs.1 lakh (US$

1,201.74) per seat in the form of viability gap

funding towards capital and operational

expenditures, thereby encouraging the

establishment of BPO and ITES operations. 246

BPO/ITES units have begun operations under

IBPS and NEBPS, covering 27 States and UTs,

and are directly employing over 51,584 people.

Below is the status of some of the key

initiatives undertaken by the Ministry of

Electronics and Information Technology

(MeitY) under the Digital India programme

across the country:

es

* Aadhaar: It provides a 12-digit WN.

biometric and demographic-based “AADHAAR”

identity that is unique, lifelong,

‘online, and authenticable. It has over 135.5

crore (1.35 billion) residents enrolled in it.

* Common Services Centres (CSC): Through

Village Level Entrepreneurs (VLEs), CSCs are

providing government and business services in

digital mode in rural areas. It is offering over

400 digital services. As of now, 5.21 Lakh (0.52

million) CSCs are functional (including urban &

rural areas) across the country, out of which,

4.14 Lakh (0.44 million) CSCs are functional at

the Gram Panchayat level. There are 23,035

CSCs are functional in the State of Rajasthan,

‘out of which 18823 CSCs are

functional at the Gram

Panchayat level.

* Digi Locker: This initiative

provides an ecosystem with

the collection of repositories

and gateways for issuers to upload documents

in the digital repositories. It has over 13.7 crore

(137 million) users and almost 562 crore (5.62

billion) documents are made available through

Digi Locker from 2,311 issuer organisations.

* Unified Mobile Application for New-age

Governance (UMANG): This creates an

ecosystem which helps to provide government

services to citizens through mobile. Over 1,668,

e-services and 20,197+ bill payments are made

available at UMANG.

Reet ea

eae

ren

‘© E-Sign: These services contribute to

facilitating the instant signing of

forms/documents online by citizens in a legally

acceptable form. Many applications that use

UIDAI's OTP-based authentication services are

utilising the services. All agencies issued more

than 31.08 crore (310.8 million) e-signs, of

which 7.01 crore (70.1 million) were issued by

CDAC.

* Meri Pehchaan: In July 2022, the National

Single Sign-on (NSSO) platform called

MeriPehchaan was launched to facilitate

citizen's ease of access to government portals. A

total of 4,419 services of various ministries/

states integrated with NSSO.

* Digital Village: In October 2018, MeitY also

launched the "Digital Village Pilot Project.” The

initiative covers 700 Gramme Panchayats (GPs)/

Village, with at least one GP/Village per District

in each State/UT. Digital health services,

education services, financial services, skill

development, solar-powered streetlights,

Government-to-Citizen (G2C) and Business-to-

Citizen (B2C) services are among the digital

services provided.

* National Rollout of e-District Mission

Mode Project (MMP): At the district or sub-

district level, e-District is a Mission Mode

Project (MMP) that seeks to electronically

deliver high-volume citizen-centric services.

Currently, 709 districts in India have

implemented 4,671 e-services.

* Open Government Data Platform: It has

been developed to facilitate data sharing and

promote innovation over non-personal data

More than 5.93 lakh (0.59 million) datasets

across 12,940+ catalogues were published. The

platform has facilitated 94.8 lakh (9.48 million)

downloads.

© E-Hospital/ Online Registration System

(ORS): The Hospital Management Information

System, or e-Hospital application, is used by

hospitals for their internal workflows and

procedures. At the moment, 557 hospitals

ars

nationwide have implemented ORS, and 753

institutions have been onboarded on e-Hospital.

Over 68 lakh (6.8 million) appointments have

been scheduled through ORS.

* Jeevan Praman: The goal of Jeevan Praman

is to digitise the entire life certificate application

process for pensioners. The pensioner no longer

needed to appear in person in front of the

certification authority or the disbursing agency

‘owing to this initiative. Since 2014, more than

685.42 lakh (68.54 million) digital life

certificates have been issued

* Pradhan Mantri VA

Gramin Digital Saksharta

Abhiyaan (PMGDISHA): To

promote digital literacy in iz.

rural India, the government

has approved a new programme called the

Pradhan Mantri Gramin Digital Saksharta

Abhiyan (PMGDISHA), which will benefit 6 crore

(60 million) rural families (one person per

home). Out of the 6.63 crore (66.3 million)

candidates who have enrolled, 5.69 crore (56.9

jon) have received training, and 4.22 crore

(42.2 million) have received certification.

© Future Skills Prime: Future Skills Prime is an

initiative that MeitY and NASSCOM have started

together. In 10 new and emerging technologies-

augmented reality, virtual reality, blockchain, big

data analytics, artificial intelligence, robotic

process automation, cloud computing, social

media, mobile, cyber security, and additive

manufacturing/three-dimensional printing-the

programme aims to reskill and upskill IT

professionals.

futureskills

——-prime

A MeitY - NASSCOM Digital Skilling Initiative

E-RUPI: It is a digital voucher which a

beneficiary gets on the phone in the form of an

SMS or QR code. It is a pre-paid voucher that

‘one can redeem at any centre that accepts it. e-

RUPI is a one-time contactless, cashless

voucher-based mode of payment that helps

Users redeem the voucher without a card,

digital payments app, or internet banking

access. It isn’t a digital currency that the

Reserve Bank of India is contemplating. Instead,

it is a person or even purpose-specific digital

voucher. The National Payments Corporation of,

India (NPCI), which oversees the digital

payments ecosystem in India, has launched e-

RUPI, a voucher-based payments system to

promote cashless transactions.

11 banks and NPCI have joined to facilitate e-

RUPI transactions. They are Indian Bank,

Indusind Bank, Kotak Mahindra Bank, Punjab

National Bank, State Bank of India, Union Bank

of India, Axis Bank, Bank of Baroda, Canara

Bank, HDFC Bank, ICICI Bank, and Indian Bank.

Pine Labs, Bharat Pe, BHIM Baroda Merchant

IBEFS

LAp

PREPAID 0-VOUCHER.

Pay, PNB Merchant Pay, and YoNo SBI Merchant

Pay are the acquiring apps. More banks and

acquiring apps are expected to join the e-RUPI

initiative soon.

-RUPI stands out from other digital payment

methods in that it does not require the

beneficiary to own a bank account. It

guarantees a simple, contactless, two-step

redemption procedure that doesn't ask for

personal information to be shared. Another

benefit of e-RUPI is that it can be used in

locations without internet access or by people

without smartphones because it can be

operated on regular phones as well.

e-RUPI is expected to play a major role in

strengthening direct-benefit transfer and

making it more transparent. Since there is no

need for the physical issuance of vouchers, it

will also lead to some cost savings. NCPI has tied

up with over 1,600 hospitals where e-RUPI can

be redeemed. In the coming future, the user

base of e-RUPI is expected to widen, with even

the private sector using it to deliver employee

benefits and the Ministry of Micro, Small, and

Medium Enterprises (MSMEs) adopting it for

Business-to-Business (B2B) transactions.

CHALLENGES & SOLUTIONS OF DIGITAL

INITIATIVES

Some of the major challenges involve disparities

in digital infrastructure between urban and rural

areas in India. While metropolitan cities enjoy

high-speed internet and advanced connectivity,

rural regions lack basic access, hindering their

participation in the digital revolution. Another

one is limited internet penetration, although

India boasts a massive population, the

penetration of the internet remains relatively

low, especially in rural areas. This limited access

to the internet restricts the population's ability

to access essential services, educational

resources, and economic opportunities.

One of the major aspects include digital

illiteracy which a significant portion of the

Indian population still lacks. The ability to

navigate and use digital devices and services is a

crucial aspect of participating in the digital

economy, and the absence of these skills

hampers the country's progress. As digital

adoption grows, so does the potential for cyber

threats. India faces challenges related to data

privacy, online security, and the protection of

critical infrastructure from cyberattacks. The

country's diverse population speaks multiple

IBEFS

languages, making it imperative to provide

digital content and services in multiple

languages to ensure accessibility for all.

Such challenges can be solved and are being

solved by various government initiatives. It

includes rural internet connectivity to address

digital infrastructure disparities and the

government's investment in expanding high-

speed internet connectivity to remote areas.

Initiatives like the BharatNet project aim to

provide broadband access to every village in

India, which can be a crucial step in bridging the

urban-rural digital divide. Various digital literacy

programs are run to promote digital awareness

among the population. The Digital Saksharta

Abhiyan (DISHA) or National Digital Literacy

Mission (NDLM) Scheme has been formulated

to impart IT training. The government, in

collaboration with private organisations, is

working on the issue of digital illiteracy and

spreading awareness about it. New frameworks

are being developed to prevent cyberattacks

and keep the privacy of individuals secure.

THE ROAD AHEAD

India's environment for digital payments has

seen a dramatic change. The public has

responded well to government initiatives and

has demonstrated an impressive readiness to

adopt new technologies. The Government of

India is committed to making the nation a global

leader in international payment systems and is

working tirelessly towards this goal. The

objective is to establish India as one of the

world's most advanced and efficient payment

markets and to guarantee inexpensive, universal

internet and digital accessibility for al its

residents, especially those who are currently

underserved or without access.

India intends to accomplish this goal in order to

promote new digital ecosystems that can handle

diverse social and economic issues in a variety

of fields. This endeavour holds the potential to

IBEFX.

al

establish a thriving digital economy, generate an

economic value of up to USS 1 trillion by 2025,

and position India as a global hub for digital

innovation and production.

In India where technology helps guarantee

accountability and transparency while providing

access to improved services for agriculture,

health care, and education today, our vision of

governance—providing services via mobile

devices and guaranteeing universal access to

internet services—is a reality. Faceless, cashless,

and paperless governance is being ensured by

the implementation of programs like Aadhaar,

UPI, and Di

groundwork for a strong, stable, and secure

Digital india.

o—— (6) ——~

10

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Kannada English Lesson-4Document4 pagesKannada English Lesson-4raghunandhan.cvNo ratings yet

- Kannada English Lesson-5Document6 pagesKannada English Lesson-5raghunandhan.cvNo ratings yet

- Kannada English Lesson-1Document12 pagesKannada English Lesson-1raghunandhan.cvNo ratings yet

- Kannada English Lesson-8Document5 pagesKannada English Lesson-8raghunandhan.cvNo ratings yet

- 2022 23engannualreport 41 50Document10 pages2022 23engannualreport 41 50raghunandhan.cvNo ratings yet

- Volume-1-19 - Chapters-92-641-136-145Document10 pagesVolume-1-19 - Chapters-92-641-136-145raghunandhan.cvNo ratings yet

- Kannada English Lesson-20Document4 pagesKannada English Lesson-20raghunandhan.cvNo ratings yet

- Volume-1-19 - Chapters-92-641-122-135Document14 pagesVolume-1-19 - Chapters-92-641-122-135raghunandhan.cvNo ratings yet

- Kannada English Lesson-7Document6 pagesKannada English Lesson-7raghunandhan.cvNo ratings yet

- Modern Eye Hospital & Research CentreDocument1 pageModern Eye Hospital & Research Centreraghunandhan.cvNo ratings yet

- Volume-1-19 - Chapters-82-91Document10 pagesVolume-1-19 - Chapters-82-91raghunandhan.cvNo ratings yet

- Chemicals Infographic December 2023Document1 pageChemicals Infographic December 2023raghunandhan.cvNo ratings yet

- Kala CottonDocument8 pagesKala Cottonraghunandhan.cvNo ratings yet

- Volume-1-19 - Chapters-51-60Document10 pagesVolume-1-19 - Chapters-51-60raghunandhan.cvNo ratings yet

- Volume-1-19 - Chapters-41-50Document10 pagesVolume-1-19 - Chapters-41-50raghunandhan.cvNo ratings yet

- Biotechnology December 2023Document34 pagesBiotechnology December 2023raghunandhan.cvNo ratings yet

- A Partnership For The Digital WorldDocument39 pagesA Partnership For The Digital Worldraghunandhan.cvNo ratings yet

- Biotechnology Infographic December 2023Document1 pageBiotechnology Infographic December 2023raghunandhan.cvNo ratings yet

- Tata Coffee LTD - Ar - March 39 21Document214 pagesTata Coffee LTD - Ar - March 39 21raghunandhan.cvNo ratings yet

- Auto Components December 2023Document33 pagesAuto Components December 2023raghunandhan.cvNo ratings yet

- Agriculture and Allied Industries Infographic December 2023Document1 pageAgriculture and Allied Industries Infographic December 2023raghunandhan.cvNo ratings yet

- Tata Consumer Products Corporate Fact Sheet Dec2021Document2 pagesTata Consumer Products Corporate Fact Sheet Dec2021raghunandhan.cvNo ratings yet

- FedRAMP SAP Template 2016 06 27 V03 00Document19 pagesFedRAMP SAP Template 2016 06 27 V03 00raghunandhan.cvNo ratings yet

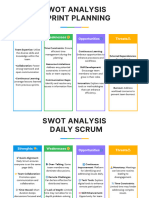

- Swot Analysis Sprint Planning: Strenghts : Weaknesses Opportunities ThreatsDocument5 pagesSwot Analysis Sprint Planning: Strenghts : Weaknesses Opportunities Threatsraghunandhan.cvNo ratings yet

- Group Medi Care 6c57b64356Document26 pagesGroup Medi Care 6c57b64356raghunandhan.cvNo ratings yet

- Trusting The Family: A Short History of Tata Sons OwnershipDocument1 pageTrusting The Family: A Short History of Tata Sons Ownershipraghunandhan.cvNo ratings yet

- Air India Vistara Consolidation 2911Document3 pagesAir India Vistara Consolidation 2911raghunandhan.cvNo ratings yet

- TCS Global Policy Corporate Social ResponsibilityDocument10 pagesTCS Global Policy Corporate Social Responsibilityraghunandhan.cvNo ratings yet

- Tata MENA Brochure June 2021Document15 pagesTata MENA Brochure June 2021raghunandhan.cvNo ratings yet

- Pen Test Metrics 2018Document28 pagesPen Test Metrics 2018raghunandhan.cvNo ratings yet