Professional Documents

Culture Documents

0.0 Case Study Question 2223-S1

Uploaded by

p869qmskm7Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0.0 Case Study Question 2223-S1

Uploaded by

p869qmskm7Copyright:

Available Formats

FIN4003 Financial Derivatives

Assignment: Group Case Study

Submission Deadline: 21 November 2022 (Monday)

You have recently joined the derivatives products division of HSU investment bank as an

analyst trainee. As part of your probationary assessment, you are asked to work with the team

to handle the following two cases in the pipeline. Satisfactory evaluation from clients and peers

about your performance must be acquired in order to pass your probationary period. Good luck!

Case 1 (50 marks)

BlueRock, a Hong Kong based hedge fund manager specialising in technology investment, is

holding an aggregate portfolio of HK and US stocks. The manager expects the stock market as

a whole to have a correction over the following two months. Details of the portfolio are given

as of 17 October 2022. USD/HKD exchange rate is quoted at 7.8000.

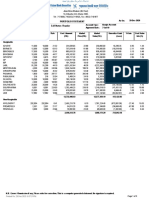

Stock Code Stock Name Currency Price Market Cap. (B) No. of Shares Beta

285 BYD Electronic HKD 17.82 40.38 300,000 0.89

700 Tencent HKD 245.20 2,339.00 100,000 0.44

941 China Mobile HKD 50.00 1,135.00 100,000 0.34

992 Lenovo HKD 5.53 67.80 800,000 1.23

1810 Xiaomi HKD 8.60 214.11 700,000 1.31

2382 Sunny Optical HKD 70.15 78.15 100,000 0.96

3690 Meituan HKD 146.00 909.13 100,000 0.84

9626 BiliBili HKD 91.05 35.86 100,000 1.19

9888 Bidu HKD 98.90 268.42 100,000 0.74

9988 Alibaba HKD 72.15 1,527.00 200,000 0.61

AAPL Apple USD 144.31 2,224.00 20,000 1.25

AMZN Amazon USD 114.10 1,089.00 20,000 1.32

CISCO CSCO USD 40.84 165.18 30,000 0.95

GOOG Alphabet USD 100.62 1,263.00 20,000 1.10

INTC Intel USD 26.46 106.39 50,000 0.71

MSFT Microsoft USD 235.54 1,705.00 10,000 0.96

NVDA NVIDIA USD 120.57 279.78 20,000 1.71

QCOM QUALCOMM USD 114.63 123.47 20,000 1.28

TSLA Tesla USD 224.01 642.33 10,000 2.13

V Visa USD 186.79 384.86 10,000 0.92

The following prices obtained from the futures markets as of 17 October 2022. The contract

specifications and other relevant information can be found in the websites www.hkex.com.hk,

www.cmegroup.com, www.hsi.com.hk, and www.slickcharts.com.

Futures Contract Spot Nov-2022 Dec-2022 Mar-2023 Jun-2023

Hang Seng Index 16,613 16,582 16,631 16,748 -

Hang Seng TECH Index 3,200 3,205 3,212 3,303 -

Hang Seng China Enterprises Index 5,633 5,646 5,666 5,739 -

E-Mini S&P 500 3,689.00 - 3,692.25 3,722.00 3,760.00

E-Mini Nasdaq-100 11,103.00 - 11,108.00 11,206.75 11,310.75

E-Mini Dow Jones Industrial 30,133.00 - 30,259.00 30,399.00 30,606.00

The Hang Seng University of Hong Kong 1

a) Calculate the values of HK portfolio and US portfolio, respectively. (2 marks)

b) Calculate the weights of individual stocks. (10 marks)

c) Calculate the betas of HK portfolio, US portfolio and the aggregate portfolio, respectively.

(3 marks)

d) The fund manager would like to reduce the market risk exposure by selling shares. Why is

it impracticable to do so? Explain in details what hedging strategy you would recommend the

hedge fund. Give reasons for your choice of derivatives contracts. (10 marks)

Suppose the fund manager implemented your recommendation and would like to close out the

futures positions on 19 December 2022 using the following market prices. USD/HKD

exchange rate remains unchanged.

Stock Code Stock Name Currency Price No. of Shares Beta

285 BYD Electronic HKD 16.50 300,000 0.89

700 Tencent HKD 236.00 100,000 0.44

941 China Mobile HKD 48.60 100,000 0.34

992 Lenovo HKD 4.90 800,000 1.23

1810 Xiaomi HKD 7.70 700,000 1.31

2382 Sunny Optical HKD 64.70 100,000 0.96

3690 Meituan HKD 136.20 100,000 0.84

9626 BiliBili HKD 82.30 100,000 1.19

9888 Bidu HKD 93.00 100,000 0.74

9988 Alibaba HKD 68.60 200,000 0.61

AAPL Apple USD 150.00 20,000 1.25

AMZN Amazon USD 119.00 20,000 1.32

CISCO CSCO USD 42.00 30,000 0.95

GOOG Alphabet USD 103.90 20,000 1.10

INTC Intel USD 27.00 50,000 0.71

MSFT Microsoft USD 242.00 10,000 0.96

NVDA NVIDIA USD 126.80 20,000 1.71

QCOM QUALCOMM USD 119.00 20,000 1.28

TSLA Tesla USD 238.00 10,000 2.13

V Visa USD 192.00 10,000 0.92

Futures Contract Spot Dec-2022 Mar-2023 Jun-2023

Hang Seng Index 15,342 15,359 15,467 -

Hang Seng TECH Index 2,943 2,953 3,037 -

Hang Seng China Enterprises Index 5,168 5,199 5,266 -

E-Mini S&P 500 3,803.50 3,807.00 3,837.00 3,877.00

E-Mini Nasdaq-100 11,430.50 11,436.00 11,537.00 11,644.00

E-Mini Dow Jones Industrial 30,976.00 31,106.00 31,250.00 31,463.00

The Hang Seng University of Hong Kong 2

e) Calculate the profit/loss of HK portfolio, US portfolio and the futures positions taken,

respectively. (4 marks)

f) Calculate the overall profit/loss and comment the effectiveness of the hedging strategy.

(4 marks)

After the market correction, the fund manager foresees the benefit of massive capital inflows

from mainland China to Hong Kong. He decides to increase the beta of HK portfolio to 1.2 and

re-allocate 30% of the US fund to the HK stock market until March 2023.

g) Advice the fund manage how this position can be achieved using the futures contracts as of

19 December 2022. (10 marks)

h) If retaining this position for 12 months, what alternative trading strategies should be taken?

(7 marks)

The Hang Seng University of Hong Kong 3

Case 2 (50 marks)

Suppose a private bank client has US$1,000,000 to investment. Advise the client on a

derivatives strategy that take advantage of the current market opportunity. The components of

your trading strategy could be more than one leg by using either futures or options or both. The

underlying asset is your choice.

only one good idea

a) What is the current market outlook and how does your trading strategy fit in?

b) Describe your trading strategy in details.

mporfat Hints - points to consider: xopyfommi

What is the underlying asset? e.g. commodity, stock, stock index, bond, etc.

What is the derivatives composition?

How many contracts? How is the trade structured?

How long is the maturity?

What is the cost?

How is the pricing done?

What are the upside and downside potential?

Any leverage? … etc.

The market prices can be obtained from e.g. Bloomberg, finance.yahoo.com, and exchanges

such as cmegroup.com, hkse.com.hk. A screenshot of the pricing reference must be provided

with your submission.

c) Discuss the risk, reward and breakeven associated with your trade idea.

d) Illustrate the payoff diagram and scenario analysis.

Your answers should be written in bullet points. Soft credit will be given to those who

presented the work professionally.

The Hang Seng University of Hong Kong 4

You might also like

- Case-Walmarts Expansion Into Specialty Online RetailingDocument9 pagesCase-Walmarts Expansion Into Specialty Online RetailingSYAHRUL ROBBIANSYAH RAMADHANNo ratings yet

- SDLC ResearchgateDocument10 pagesSDLC ResearchgateAlex PitrodaNo ratings yet

- Strategic Business Managegent Case Study of FIRST DIRECT BANK by SADIQ YUSUF YABODocument12 pagesStrategic Business Managegent Case Study of FIRST DIRECT BANK by SADIQ YUSUF YABOsadiq yusuf100% (6)

- Activiity 2 Investment in AssociateDocument3 pagesActiviity 2 Investment in AssociateAldrin Cabangbang67% (3)

- Mondol Securities Limited: Le Meridien (6th Floor), Block#2, Plot#79/A, Airport Road, Nikunja-2, Khilkhet, Dhaka-1229Document2 pagesMondol Securities Limited: Le Meridien (6th Floor), Block#2, Plot#79/A, Airport Road, Nikunja-2, Khilkhet, Dhaka-1229Istiaque AhmadNo ratings yet

- Ethics of Business Turnaround Mangement: Global Trade War (Us - China)Document12 pagesEthics of Business Turnaround Mangement: Global Trade War (Us - China)Ashlesh MangrulkarNo ratings yet

- OMSEC Morning Note 02 09 2022Document6 pagesOMSEC Morning Note 02 09 2022Ropafadzo KwarambaNo ratings yet

- OMSEC Morning Note 13 09 2022Document6 pagesOMSEC Morning Note 13 09 2022Ropafadzo KwarambaNo ratings yet

- OMSEC Morning Note 16 09 2022Document6 pagesOMSEC Morning Note 16 09 2022Ropafadzo KwarambaNo ratings yet

- Portfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularDocument3 pagesPortfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularSumitNo ratings yet

- Assumption Area: Income Statement: Product Code Product Name Transfer Price C&F Value Duties/ Taxes Packing MaterialDocument2 pagesAssumption Area: Income Statement: Product Code Product Name Transfer Price C&F Value Duties/ Taxes Packing MaterialzubayrmemonNo ratings yet

- Portfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularDocument3 pagesPortfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularSumitNo ratings yet

- OMSEC Morning Note 01 09 2022Document6 pagesOMSEC Morning Note 01 09 2022Ropafadzo KwarambaNo ratings yet

- Dar Es Salaam Stock Exchange Market Report Tuesday, 7 March, 2017Document8 pagesDar Es Salaam Stock Exchange Market Report Tuesday, 7 March, 2017FatherNo ratings yet

- 13jan2022 Portfolio 2442 DALTON079@YAHOO - COM Z232Document2 pages13jan2022 Portfolio 2442 DALTON079@YAHOO - COM Z232Nazneen SabinaNo ratings yet

- Friday November 26, 2010: Total Turnover (RS.)Document14 pagesFriday November 26, 2010: Total Turnover (RS.)Don Nuwan DanushkaNo ratings yet

- Daily Report 31.12Document59 pagesDaily Report 31.12Prabu DoraisamyNo ratings yet

- OMSEC Morning Note 06 09 2022Document6 pagesOMSEC Morning Note 06 09 2022Ropafadzo KwarambaNo ratings yet

- Inventory DetailsDocument4 pagesInventory DetailsaaronninfoNo ratings yet

- Mondol Securities Limited: Le Meridien (6th Floor), Block#2, Plot#79/A, Airport Road, Nikunja-2, Khilkhet, Dhaka-1229Document1 pageMondol Securities Limited: Le Meridien (6th Floor), Block#2, Plot#79/A, Airport Road, Nikunja-2, Khilkhet, Dhaka-1229Istiaque AhmadNo ratings yet

- Portfolio00710 01.12.10Document2 pagesPortfolio00710 01.12.10habibur.ibblNo ratings yet

- Stocks AC ALI BDO: ValuationsDocument15 pagesStocks AC ALI BDO: ValuationsRicarr ChiongNo ratings yet

- Stock Symbol 4/24 Price Current Spread 52 Week Low 52 Week High 52 Week SpreadDocument3 pagesStock Symbol 4/24 Price Current Spread 52 Week Low 52 Week High 52 Week SpreadJohn MonroseNo ratings yet

- NLI Securities Limited: Direct Trading AccountDocument12 pagesNLI Securities Limited: Direct Trading AccountSaiful IslamNo ratings yet

- OMSEC Morning Note 15 09 2022Document6 pagesOMSEC Morning Note 15 09 2022Ropafadzo KwarambaNo ratings yet

- TM-20 Apr 2018Document4 pagesTM-20 Apr 2018Anonymous 9xAmuLRrdyNo ratings yet

- DailyPrices 30 06 22Document1 pageDailyPrices 30 06 22emmanuel mtizwaNo ratings yet

- Intraday Setups BUY Trades: Watchlist and Trade Setups For Intraday Trading in Stocks (Based On 4H Timeframe)Document11 pagesIntraday Setups BUY Trades: Watchlist and Trade Setups For Intraday Trading in Stocks (Based On 4H Timeframe)rajnNo ratings yet

- Money Left On The Table in IPOs by Firm 2015-08-04Document6 pagesMoney Left On The Table in IPOs by Firm 2015-08-04mokus91No ratings yet

- OMSEC Morning Note 26 09 2022Document6 pagesOMSEC Morning Note 26 09 2022Ropafadzo KwarambaNo ratings yet

- Daily Report 01 10 4Document87 pagesDaily Report 01 10 4Gihan PereraNo ratings yet

- OMSEC Morning Note 07 09 2022Document6 pagesOMSEC Morning Note 07 09 2022Ropafadzo KwarambaNo ratings yet

- A. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramDocument13 pagesA. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramHaziq Hakimi100% (1)

- Rate 2023 01 11 1673416889Document1 pageRate 2023 01 11 1673416889বৃত্তের বাইরেNo ratings yet

- Flowsniper Daily ReportDocument1 pageFlowsniper Daily ReportMatt EbrahimiNo ratings yet

- Portfolio00710 - 05.05.11 - Loss - 0.98 LacDocument2 pagesPortfolio00710 - 05.05.11 - Loss - 0.98 Lachabibur.ibblNo ratings yet

- DSE. MKT REP 5 May 2016Document6 pagesDSE. MKT REP 5 May 2016Antony KashubeNo ratings yet

- DailyPrices 30 06 21Document1 pageDailyPrices 30 06 21emmanuel mtizwaNo ratings yet

- Shakil Rizvi Stock LTD.: 158-160 Motijheel C/A (4th Floor), Modhumita Building, Dhaka 1000Document2 pagesShakil Rizvi Stock LTD.: 158-160 Motijheel C/A (4th Floor), Modhumita Building, Dhaka 1000Onek KothaNo ratings yet

- 2187-Shahid-22 06 23Document2 pages2187-Shahid-22 06 23Shahid MahmudNo ratings yet

- 09b Valuation2Document8 pages09b Valuation2david AbotsitseNo ratings yet

- Dar Es Salaam Stock Exchange: Market Report Tuesday, 30 ʰ June 2020Document5 pagesDar Es Salaam Stock Exchange: Market Report Tuesday, 30 ʰ June 2020Muksin NgakolaNo ratings yet

- February 16-17, 2011 - UpdateDocument2 pagesFebruary 16-17, 2011 - UpdateJC CalaycayNo ratings yet

- Financial Statement For Quiz 3 PDFDocument4 pagesFinancial Statement For Quiz 3 PDFJiaXinLimNo ratings yet

- Dar Es Salaam Stock Exchange Market Report Monday, 6 March, 2017Document8 pagesDar Es Salaam Stock Exchange Market Report Monday, 6 March, 2017FatherNo ratings yet

- Asian Paints (Autosaved) 2Document32,767 pagesAsian Paints (Autosaved) 2niteshjaiswal8240No ratings yet

- Company Comparable Analysis My Apple Inc Quick CompDocument34 pagesCompany Comparable Analysis My Apple Inc Quick Comp/jncjdncjdnNo ratings yet

- Current ValueDocument1 pageCurrent Valuerawatamit1985No ratings yet

- Portfolio SampleDocument4 pagesPortfolio Sampleapi-707666208No ratings yet

- Dar Es Salaam Stock Exchange: Market Report Wednesday, 10 ʰ June 2020Document5 pagesDar Es Salaam Stock Exchange: Market Report Wednesday, 10 ʰ June 2020Hanzuruni RashidiNo ratings yet

- Trade Confirmation IDA1523 PDFDocument2 pagesTrade Confirmation IDA1523 PDFriyadh al kamalNo ratings yet

- High Dividend Yield 10 Dec 2022 1430Document6 pagesHigh Dividend Yield 10 Dec 2022 1430Bagya VetriNo ratings yet

- TREC Holder: DSE #181 - CSE#015Document1 pageTREC Holder: DSE #181 - CSE#015Arnob TanjimNo ratings yet

- GlobalCash Cumulative V2260J1020220625190901683449Document3 pagesGlobalCash Cumulative V2260J1020220625190901683449lalit JainNo ratings yet

- BAN000127 - NS Industry Champ - LUMPSUM - SM - 20240221 - 124806Document2 pagesBAN000127 - NS Industry Champ - LUMPSUM - SM - 20240221 - 124806Realm PhangchoNo ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- Market ResearchDocument22 pagesMarket ResearchBABU ANo ratings yet

- Attractive Bluechips 15 Mar 2023 1425Document5 pagesAttractive Bluechips 15 Mar 2023 1425P.g. SunilkumarNo ratings yet

- Company Name Last Price % CHG 52 WK High 52 WK Low Market CapDocument1 pageCompany Name Last Price % CHG 52 WK High 52 WK Low Market CapCriese lavileNo ratings yet

- RISHI21 - Alpha Bluechip - LUMPSUMDocument4 pagesRISHI21 - Alpha Bluechip - LUMPSUMPower of Stock MarketNo ratings yet

- Business Plan SampleDocument8 pagesBusiness Plan Sampleankitjuneja6661No ratings yet

- Script ShopeeDocument208 pagesScript ShopeetzNo ratings yet

- Hundred IslandsDocument11 pagesHundred IslandsJeremhia Mhay100% (1)

- QAF-080 Supplier Requirement Manual 03-20-09 Rev PDocument38 pagesQAF-080 Supplier Requirement Manual 03-20-09 Rev PJesus SanchezNo ratings yet

- Literature ReviewDocument3 pagesLiterature ReviewRohan SharmaNo ratings yet

- SLA Part 2 Entities - Event Class - Event Types PDFDocument6 pagesSLA Part 2 Entities - Event Class - Event Types PDFsoireeNo ratings yet

- Explain in Detail All Types of Trademarks With Related Case LawsDocument5 pagesExplain in Detail All Types of Trademarks With Related Case LawsPiku NaikNo ratings yet

- The Key Elements of The Financial PlanDocument27 pagesThe Key Elements of The Financial PlanEnp Gus AgostoNo ratings yet

- Preferential Taxation For Senior CitizensDocument53 pagesPreferential Taxation For Senior CitizensNddejNo ratings yet

- A Primer On The Impact of The New Economic Stimulus Laws and IRC 409A On Executive Compensation in Mergers and AcquisitionsDocument48 pagesA Primer On The Impact of The New Economic Stimulus Laws and IRC 409A On Executive Compensation in Mergers and AcquisitionsArnstein & Lehr LLPNo ratings yet

- HSBC May22 q2Document28 pagesHSBC May22 q2Meishizuo ZuoshimeiNo ratings yet

- Project of Merger Acquisition SANJAYDocument65 pagesProject of Merger Acquisition SANJAYmangundesanju77% (74)

- Citizen-Charter-15-Lfo-05-Issuance of Standards Compliance Certificate (SCC) For LPG Retail OutletsDocument4 pagesCitizen-Charter-15-Lfo-05-Issuance of Standards Compliance Certificate (SCC) For LPG Retail OutletsGenesis AdarloNo ratings yet

- Daniel F. Spulber - Global Competitive Strategy-Cambridge University Press (2007)Document306 pagesDaniel F. Spulber - Global Competitive Strategy-Cambridge University Press (2007)沈化文No ratings yet

- What Is 5S Principle?Document56 pagesWhat Is 5S Principle?Aldrin De jesusNo ratings yet

- Small & Medium-Sized Entities (Smes)Document8 pagesSmall & Medium-Sized Entities (Smes)Levi Emmanuel Veloso BravoNo ratings yet

- FinalpdndDocument32 pagesFinalpdndPulkit Garg100% (1)

- BUAD 807 SummaryDocument6 pagesBUAD 807 SummaryZainab Ibrahim100% (1)

- Workshop - Hari 1Document84 pagesWorkshop - Hari 1Vicky Yoga INo ratings yet

- Prowessiq Data Dictionary PDFDocument5,313 pagesProwessiq Data Dictionary PDFUtkarsh SinhaNo ratings yet

- The Anne T. and Robert M. Bass Initiative On Innovation and PlacemakingDocument62 pagesThe Anne T. and Robert M. Bass Initiative On Innovation and PlacemakingAnonymous Feglbx5No ratings yet

- Use of Fonts (1.1 MB)Document5 pagesUse of Fonts (1.1 MB)AIGA, the professional association for design50% (2)

- AP.3404 Audit of Cash and Cash EquivalentsDocument5 pagesAP.3404 Audit of Cash and Cash EquivalentsMonica GarciaNo ratings yet

- Aviva Life InsuranceDocument20 pagesAviva Life InsuranceGaurav Sethi100% (1)

- Event EntriesDocument6 pagesEvent EntriesSunnyNo ratings yet

- Personal Statement - ISEGDocument2 pagesPersonal Statement - ISEGMirza Mohammad AliNo ratings yet

- XYZ Investing INC. Trial BalanceDocument3 pagesXYZ Investing INC. Trial BalanceLeika Gay Soriano OlarteNo ratings yet

- Incoterms Latest PDFDocument1 pageIncoterms Latest PDFAnand VermaNo ratings yet