Professional Documents

Culture Documents

Brazil PIX Payments - Announcement On New Functionality

Brazil PIX Payments - Announcement On New Functionality

Uploaded by

AlmirFuncionalFIOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Brazil PIX Payments - Announcement On New Functionality

Brazil PIX Payments - Announcement On New Functionality

Uploaded by

AlmirFuncionalFICopyright:

Available Formats

2021-10-19 2996095

2996095 - Brazil: PIX Payments - Announcement on new

functionality

Version 4 Type SAP Note

Language English Master Language English

Priority Correction with medium priority Category Release planning information

Release Status Released for Customer Released On 18.10.2021

Component FI-LOC-CA-BR ( Brazil )

Please find the original document at https://launchpad.support.sap.com/#/notes/ 2996095

Symptom

THIS IS THE PIX

Discover the instant payment system, an innovation of the banking sector to bring more convenience to the

consumer in their financial transactions.

WHICH IS?

Pix is the Central Bank's instant payment system. With it, you send and receive money, 24 hours a day, 7

days a week and in up to 10 seconds. You can pay bills and purchases or make transfers instantly. The

system is another option for boleto, TED, DOC or even debit / credit card. The best thing is that the service is

free for Individuals.

HOW IT WORKS?

The Pix icon is inside the banking application and internet banking, as well as other features, such as DOC

and TED. The Pix key links the customer's information to a bank account (identification of the financial

institution, branch number, account number and type of account), you can recognize it as an alias to the bank

account and, to make a Pix, just know the key or read the recipient's QR code. In addition, Pix can be done

on any day and time.

Other Terms

Brazil, PIX Payments

Reason and Prerequisites

The reason is a new functionality required by the Brazilian marked to handle PIX instant payments.

Prerequisite

SAP strongly recommends you to make sure to update the environment for SW component FI-CA/S4CORE

before starting of the implementation of PIX payment processes to the support pack level at least:

SW Component Service Pack Link to SP level

FICA 606 SP 26 SAPK-60626INFICA

FICA 617 SP 21 SAPK-61721INFICA

FICA 618 SP 15 SAPK-61815INFICA

FICA 800 SP 11 SAPK-80011INFICA

FICA 801 SP 09 SAPK-80109INFICA

S4CORE 102 SP 07 SAPK-10207INS4CORE

S4CORE 103 SP 05 SAPK-10305INS4CORE

© 2021 SAP SE or an SAP affiliate company. All rights reserved 1 of 5

2021-10-19 2996095

S4CORE 104 SP 03 SAPK-10403INS4CORE

S4CORE 105 SP 01 SAPK-10501INS4CORE

The update will decrease the effort during the implementation of the solution.

Solution

1. Terms

• Payment service provider (PSP) is the bank you have the account

• PIX key as a Bank Account alias representation

• CPF or CNPJ – user’s tax identification number

• Email address

• Cell phone number

• Random key – a computer generated string of numbers that identifies the user’s PIX account

2. General considerations and limitations

Requirements

• Handling PIX payments in Real Time (single open item)

• Handling PIX payments through batch processing (multiple open items) resulting in the file generated for

further processing by PSP

For the details about the proces flows consult the attachment PIX_Schema.pdf of this SAP note.

3. Localization scope and availability

3.1. Incoming PIX payments

• Implementation is based on the newly developed Payment Request Framework functionality in FI-CA

(newly introduced transaction FPYR)

• Bidirectional batch communication to Payment Service Providers is available through CNAB750 file

Outgoing CNAB750 file mapping is prepared and based on standard DMEE Configuration framework

(format BR_FEBRABAN_750)

Incoming CNAB750 return file mapping is prepared and based on standard Bank Account Statement

processing

• API (synchronous and asynchronous) processing is supported by SAP through BADIs which are available

for customer to include technical implementation of API e.g. Web Service call, XI communication, etc.

SAP Localization Scope

• QR code creation

Confirmed issue

Rejected emission

• QR code cancelation

Cancellation by confirmed rec.

Cancellation by Payment Service Provider (PSP)

Cancellation rejected

• Payment confirmation

© 2021 SAP SE or an SAP affiliate company. All rights reserved 2 of 5

2021-10-19 2996095

Receiving

Out of SAP Localization Scope

• QR code change

Change confirmed

Change rejected

Registration of QR code at PSP is supported only for Dynamic QR code (Static QR Code can not be

registered)

3.2. Outgoing PIX payments

• Implementation is based on the standard Payment Run Program functionality in FI-CA (transaction FPY1)

• Batch communication to Payment Service Providers is available through CNAB240 file

Outgoing CNAB240 file mapping is prepared and based on standard DMEE Configuration framework

(format BR_FEBRABAN_A)

• PIX transfers (outgoing payment to PIX key only), PIX QR code payments (outgoing payment to QR code)

• Support for Both - Dynamic and Static QR codes

• PIX key storage - Bank Account Holder under technical bank and new Bank Account Alias functionality (in

S/4Hana releases)

SAP Localization Scope

• PIX payment transfer – the most frequent possibility for contract accounting since responsibility for

invoice for outgoing payment is triggered by the company

• PIX QR payment – as reaction on incoming invoice with QR code

Out of SAP Localization Scope

• Reading QR code

• Pix key verification with Business Partner,... master data

• Incoming CNAB240 return file mapping is prepared and based on standard Bank Account Statement

processing

3.3. Availability

The localization for handling PIX payments will be split into waves:

3.3.1. Phase 1, Part 1

• batch processing

• for handling of outgoing payments enhancements of structure dedicated to the payment format

based on the layout Febraban 240 will be shipped

• for handling of incoming payments new payment format according to layout Febraban 750 will be

delivered

• processing of the feedback from the PSP on canceled or processed payments over layout

Febraban 750

• handling of QR-code information provided by the PSP

• PIX key (alias for bank account) will be stored with the existing data model as an interim solution

3.3.1.1. Timeline

The localization for this wave is supposed to be delivered during October, 2021 [Status update 31-8-

© 2021 SAP SE or an SAP affiliate company. All rights reserved 3 of 5

2021-10-19 2996095

2021 - Pilot Mode starts in September 2021].

3.3.2. Phase 1, Part 2

• real time processing

• handling of the format for communication information about the QR-code (QR) to the PSP

3.3.2.1. Timeline

The localization for this wave is supposed to be delivered based as a consecutive phase in the project

based on the result from phase 1, part 1.

3.3.3. Phase 2

• PIX key (alias for bank account) will be stored with the final (redesigned) data model with the business

partner master data

• Migration report aligning the storage of the PIX key will be delivered

3.3.3.1. Timeline

Will be communicated here.

3.4. Delivery

The solution for contract accounting will happen via SAP notes present in the list on the collective SAP

note 3028556.

4. Piloting with us during early adoption phase

In case you are interested to participate in the piloting or in case of any questions, just get in contact with

the product management through email: maria.izilda@sap.com

5. Support for releases SAP ERP 6.0 - SAP ERP 6.0 EhP5

In case you implement support for PIX payments for the releases where sw.component FI-CA is

between 600 and 605 (check in main menu via System-->Status-->Product Version-->Details, search for

Component "Fi-CA"), just get in contact with the product management through email:

maria.izilda@sap.com

Disclaimer:

The planned dates for availability of the solution can be changed by SAP development. SAP will inform you

here in this SAP note about the update.

Software Components

Software Component Release

S4CORE 102 - 102

S4CORE 103 - 103

S4CORE 104 - 104

© 2021 SAP SE or an SAP affiliate company. All rights reserved 4 of 5

2021-10-19 2996095

S4CORE 105 - 105

S4CORE 106 - 106

S4CORE 107 - 107

FI-CA 606 - 606

FI-CA 616 - 616

FI-CA 617 - 617

FI-CA 618 - 618

FI-CA 800 - 800

FI-CA 801 - 801

FI-CA 619 - 619

Attachments

File Name File Size Mime Type

PIX_Schema.pdf 249 application/pdf

Terms of use | Copyright | Trademark | Legal Disclosure | Privacy

© 2021 SAP SE or an SAP affiliate company. All rights reserved 5 of 5

You might also like

- Configuration Guide For Connector For SAP Multi-Bank ConnectivityDocument54 pagesConfiguration Guide For Connector For SAP Multi-Bank ConnectivitymichellemoliveiraNo ratings yet

- SI Check 000Document17 pagesSI Check 000godiyal4uNo ratings yet

- Boleto Processing BrazilDocument13 pagesBoleto Processing BrazilQueli BelchiorNo ratings yet

- EMD-003-0 Pre-Used Inspection Checklist For EquipmentsDocument31 pagesEMD-003-0 Pre-Used Inspection Checklist For EquipmentsArjay AlvarezNo ratings yet

- Description Total Price (Taka) Qty SL No. VAT Amount (Taka) Supply Unit SD (Taka) VAT Rate Total Price (Taka) Per Unit Price (Taka) SDDocument1 pageDescription Total Price (Taka) Qty SL No. VAT Amount (Taka) Supply Unit SD (Taka) VAT Rate Total Price (Taka) Per Unit Price (Taka) SDSaimus SadatNo ratings yet

- Module Business Process ECC Tcode S/4HANA Fiori AppsDocument30 pagesModule Business Process ECC Tcode S/4HANA Fiori AppsEvelyn RochaNo ratings yet

- FCP PresentationDocument117 pagesFCP PresentationLeofqueirozNo ratings yet

- MRP User Exit Key User Exit ParameterDocument6 pagesMRP User Exit Key User Exit ParameterAjay KumarNo ratings yet

- Sap Exit de VendasDocument15 pagesSap Exit de VendaswelquisleyNo ratings yet

- Customizing Iss Pis Cofins For CBT v2 1Document33 pagesCustomizing Iss Pis Cofins For CBT v2 1roger_bx100% (1)

- SAP Errors - AssetDocument1 pageSAP Errors - Assetsateesh konatamNo ratings yet

- Analysis of Error AA698 - ERP Financials - SCN WikiDocument5 pagesAnalysis of Error AA698 - ERP Financials - SCN WikiFranki Giassi Meurer50% (2)

- Setup TaxbraDocument18 pagesSetup Taxbradri0510No ratings yet

- Quick Guide For Brazilian Localization InstallationDocument23 pagesQuick Guide For Brazilian Localization InstallationCláudia SalvadorNo ratings yet

- Argentina Localization - Tax ReportsDocument37 pagesArgentina Localization - Tax Reportssvgonzalez-183% (6)

- Overview On DMEE Tree With PMW Config StepsDocument33 pagesOverview On DMEE Tree With PMW Config StepsPallaviNo ratings yet

- SAP Community Network Wiki - ERP SCM - MM-IV-LIV-MRBR Invoice Release in LIV Transaction MRBRDocument5 pagesSAP Community Network Wiki - ERP SCM - MM-IV-LIV-MRBR Invoice Release in LIV Transaction MRBRMarsha LindsayNo ratings yet

- SAP Credit Management ConfigurationDocument8 pagesSAP Credit Management Configurationalma nurNo ratings yet

- CITI TrainingDocument1 pageCITI TrainingalysseriggsNo ratings yet

- RT II QueastionsDocument14 pagesRT II QueastionsEbin Charles100% (1)

- Introduction..Polysemy and HomonymyDocument6 pagesIntroduction..Polysemy and HomonymyClaudia Elena NegurăNo ratings yet

- Manual SAP Nfe CteDocument472 pagesManual SAP Nfe CteMarcel_cayres100% (2)

- Brazil Payment Files and Bank Statement Troubleshooting GuideDocument14 pagesBrazil Payment Files and Bank Statement Troubleshooting GuideRodrigoPepelascovNo ratings yet

- Definições SAP:: Especificação Funcional FF.5Document13 pagesDefinições SAP:: Especificação Funcional FF.5James Anderson Luna SilvaNo ratings yet

- Brasil Localiz SAP PTDocument78 pagesBrasil Localiz SAP PTMarcos XavierNo ratings yet

- PIS and COFINS ContributionsDocument2 pagesPIS and COFINS ContributionsRod Don PerinaNo ratings yet

- Customizing Guide: New Taxes 2004 (ISS, PIS, COFINS, MP-135 Withholding Taxes)Document19 pagesCustomizing Guide: New Taxes 2004 (ISS, PIS, COFINS, MP-135 Withholding Taxes)Rodrigo S. C. LacerdaNo ratings yet

- MM TAXBRA Migracao BatchDocument3 pagesMM TAXBRA Migracao BatchMárcio NascimentoNo ratings yet

- User Manual - Argentina Tax ReportingDocument9 pagesUser Manual - Argentina Tax ReportingIrina Castro100% (1)

- FF7AN - Credit ManagementDocument6 pagesFF7AN - Credit ManagementRoberta FernandesNo ratings yet

- 6975 - Validation - and - Substitution - RulesDocument2 pages6975 - Validation - and - Substitution - RulesValdevy PiresNo ratings yet

- ICMS Substituicao TributariaDocument4 pagesICMS Substituicao TributariaTuaregue_BRNo ratings yet

- SAP Brazil Localization PortfolioDocument31 pagesSAP Brazil Localization Portfoliosatishkr14No ratings yet

- Blueprint All MM e QuestionárioDocument59 pagesBlueprint All MM e QuestionárioPriscilla Freimam100% (1)

- Localizacao CATT Procedimentos 46Document11 pagesLocalizacao CATT Procedimentos 46Alexandre OliveiraNo ratings yet

- FI S4 FunctionalitiesDocument31 pagesFI S4 FunctionalitiesNikhil KaikadeNo ratings yet

- Enhancement of Default Account Assignment (OKB9) : Applies ToDocument5 pagesEnhancement of Default Account Assignment (OKB9) : Applies ToUsman Ali Khan100% (1)

- Business Partner - Customer-Vendor Integration S/4 HANADocument8 pagesBusiness Partner - Customer-Vendor Integration S/4 HANAJoão Douglas Dos SantosNo ratings yet

- Finance Accounting Asset AccountingDocument23 pagesFinance Accounting Asset AccountingManohar GoudNo ratings yet

- AR18N New Transaction Code For Depreciation SimulationDocument2 pagesAR18N New Transaction Code For Depreciation SimulationkayfontNo ratings yet

- S/4 HANA: New ML Costing Cockpit (AVR) - Transaction CKMLCPAVRDocument3 pagesS/4 HANA: New ML Costing Cockpit (AVR) - Transaction CKMLCPAVRDê GiàNo ratings yet

- Sapnote 0000025709Document1 pageSapnote 0000025709Amit PaulNo ratings yet

- DMEE Configuration - Step by Step Part 1 - Sap 4 AllDocument14 pagesDMEE Configuration - Step by Step Part 1 - Sap 4 AllМаксим БуяновNo ratings yet

- Error Message No f5702 Balance in Trassanction CurrencyDocument66 pagesError Message No f5702 Balance in Trassanction CurrencybiswajitNo ratings yet

- 1.how To Create Quotation From Service Order?Document1 page1.how To Create Quotation From Service Order?ValenciaNo ratings yet

- Customizing ISS PIS COFINS For ClassicDocument16 pagesCustomizing ISS PIS COFINS For ClassicJosimar SantosNo ratings yet

- Aei MonitorDocument23 pagesAei Monitorgsd_8720012092No ratings yet

- Nota SAP para Inclusão de CampoDocument2 pagesNota SAP para Inclusão de CampoJuliana Lopes LarguesaNo ratings yet

- SD - IMG-009 Aplicação Da SAP Note 747607 Ref MP 135 (ISS, PISDocument20 pagesSD - IMG-009 Aplicação Da SAP Note 747607 Ref MP 135 (ISS, PISLuiz O. Giordani100% (1)

- Run Sap Like A Factory: RSLF Bpo - Nfe MonitoringDocument15 pagesRun Sap Like A Factory: RSLF Bpo - Nfe MonitoringEverton Araujo PadilhaNo ratings yet

- Storage Location Excluded From MRP On SAP S4 HANADocument7 pagesStorage Location Excluded From MRP On SAP S4 HANARomar Jose Duran ZanottyNo ratings yet

- NFE 10.0 - Master Guide Version 1.4 For NFE 10.0 SP11Document28 pagesNFE 10.0 - Master Guide Version 1.4 For NFE 10.0 SP11Deivison FerreiraNo ratings yet

- Important Tables in SAP CODocument4 pagesImportant Tables in SAP COThiagoNo ratings yet

- Configuring A Payment Medium Format For A DME File Using Payment Medium WorkbenchDocument34 pagesConfiguring A Payment Medium Format For A DME File Using Payment Medium WorkbenchPedro DuarteNo ratings yet

- Todas Tabelas SAPDocument3,522 pagesTodas Tabelas SAPFredericoNo ratings yet

- SAP Liquid Planner - TransacoesDocument1 pageSAP Liquid Planner - TransacoesManuel RobalinhoNo ratings yet

- Sap SD Questions DocumentDocument31 pagesSap SD Questions DocumentSantosh ShindeNo ratings yet

- Automatic Determination of Tax Code in PODocument6 pagesAutomatic Determination of Tax Code in POupkumar871No ratings yet

- Spau 1Document11 pagesSpau 1rdtineoNo ratings yet

- Oamk Oak5Document2 pagesOamk Oak5Andrea CutreraNo ratings yet

- S4H - 399 Onboarding PresentationDocument65 pagesS4H - 399 Onboarding Presentationwai waiNo ratings yet

- DdaDocument3 pagesDdaregis0009No ratings yet

- SAPNOTE 3043409 - Brazilian Pix Payments in FinanceDocument9 pagesSAPNOTE 3043409 - Brazilian Pix Payments in FinanceAlmirFuncionalFINo ratings yet

- PIX Payments Process 18022022Document98 pagesPIX Payments Process 18022022carloshcardosoNo ratings yet

- Measurement Systems: Application and Design by Ernest O. DoebelinDocument12 pagesMeasurement Systems: Application and Design by Ernest O. Doebelinvlsipranati100% (1)

- 2007 Cts Proceedings PattersonDocument13 pages2007 Cts Proceedings PattersonKamagara Roland AndrewNo ratings yet

- Biostatistics and Epidemiology Syllabus-1Document7 pagesBiostatistics and Epidemiology Syllabus-1Dehnzel de LeonNo ratings yet

- THP CalculationDocument4 pagesTHP Calculationsatya agarwalNo ratings yet

- Assignment InstructionsDocument366 pagesAssignment InstructionsjhandwaalNo ratings yet

- Abu Azfar: Curriculum VitalDocument4 pagesAbu Azfar: Curriculum VitalBrueNo ratings yet

- PSA Operation ManualDocument83 pagesPSA Operation ManualAbassyacoubouNo ratings yet

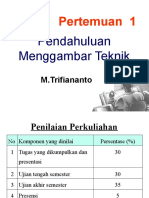

- Pendahuluan Menggambar Teknik: Pertemuan 1Document37 pagesPendahuluan Menggambar Teknik: Pertemuan 1Rifqi FakhrizalNo ratings yet

- Mobile Operating System SlidesDocument12 pagesMobile Operating System SlidesDaniyal AliNo ratings yet

- The Proper Way To Ohm A Single Phase Compressor PDFDocument3 pagesThe Proper Way To Ohm A Single Phase Compressor PDFslipargolokNo ratings yet

- ML in DBS Systematic Review PreprintDocument20 pagesML in DBS Systematic Review PreprintBen AllenNo ratings yet

- Unit 29 Construction in Civil EngineeringDocument15 pagesUnit 29 Construction in Civil EngineeringrachuNo ratings yet

- Integrated CMOS Tri-Gate TransistorsDocument7 pagesIntegrated CMOS Tri-Gate TransistorsAntonio ChangNo ratings yet

- Liebert Afc 500 1450 KW English BrochureDocument16 pagesLiebert Afc 500 1450 KW English BrochurePapaghiuc StefanNo ratings yet

- 8086 Unit IIDocument49 pages8086 Unit IISai Sreenath100% (1)

- 1-5/8" CELLFLEX Lite Low-Loss Foam-Dielectric Coaxial Cable: LCF158-50JLDocument2 pages1-5/8" CELLFLEX Lite Low-Loss Foam-Dielectric Coaxial Cable: LCF158-50JLPaulo AzevedoNo ratings yet

- AsdDocument10 pagesAsdCristian Sanabria DueñasNo ratings yet

- New Study Guide Communications Skills Fall 2024Document126 pagesNew Study Guide Communications Skills Fall 2024joannaNo ratings yet

- FCC Process Fundamentals & Technology EvolutionDocument42 pagesFCC Process Fundamentals & Technology Evolutionranjith_asp0% (1)

- Project 1 RevisedDocument8 pagesProject 1 Revisedapi-682002481No ratings yet

- Brochure Energy Storage PDFDocument64 pagesBrochure Energy Storage PDFaderitodomingos1531No ratings yet

- Vulcan RRE36DDocument2 pagesVulcan RRE36Ddstout74No ratings yet

- Instructivo Luxometro Steren Her-410 PDFDocument12 pagesInstructivo Luxometro Steren Her-410 PDFLuis CárdenasNo ratings yet

- HiLook ColorVu Lite FlyerDocument2 pagesHiLook ColorVu Lite FlyerToni HariantoNo ratings yet

- Harrison BergeronDocument1 pageHarrison BergeronRose TaezaNo ratings yet