Professional Documents

Culture Documents

The Importance of Facilitating Renewable Energy Transition For Abating C O2 Emissions in Morocco

Uploaded by

Assma ZarwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Importance of Facilitating Renewable Energy Transition For Abating C O2 Emissions in Morocco

Uploaded by

Assma ZarwalCopyright:

Available Formats

Environmental Science and Pollution Research

https://doi.org/10.1007/s11356-021-17179-x

RESEARCH ARTICLE

The importance of facilitating renewable energy transition for abating

CO2 emissions in Morocco

Soufiane Bouyghrissi1 · Muntasir Murshed2 · Abhinav Jindal3,4 · Abdelmoumen Berjaoui5 · Haider Mahmood6 ·

Maha Khanniba7

Received: 12 August 2021 / Accepted: 20 October 2021

© The Author(s), under exclusive licence to Springer-Verlag GmbH Germany, part of Springer Nature 2021

Abstract

Achieving environmental sustainability has become a core policy agenda of the Moroccan government. The nation’s mono-

tonic dependence on fossil fuels for meeting the local energy demand has been acknowledged as the major cause of envi-

ronmental distress. Besides, Morocco has traditionally been a major importer of fossil fuels whereby the nation’s fossil fuel

dependency could not be phased out to a large extent. Consequently, the greenhouse gas emission figures of Morocco have

persistently surged over the years. Moreover, Morocco has large reserves of untapped renewable energy sources which can be

employed for producing power without significantly degrading the environment. Against this backdrop, this study explores

the renewable energy consumption-carbon dioxide emissions nexus, controlling for economic growth, financial develop-

ment, and foreign direct investment inflows, in the context of Morocco over the period between 1980 and 2017. In addition,

along with the direct impacts, the indirect environmental impacts associated with renewable energy consumption are also

scrutinized in this study. The empirical strategy involves the application of econometric methods that are robust to handling

structural break issues in the data. Overall, the results reveal that renewable energy consumption curbs carbon dioxide emis-

sions both in the short and long run. In contrast, financial development and foreign direct investment inflows boost carbon

dioxide emissions in Mexico. However, these adverse environmental impacts are partially neutralized by facilitating greater

renewable energy use within Morocco. The results indicate that renewable energy consumption interacts with financial

development and foreign direct investment inflows to jointly reduce the carbon dioxide emission figures of Morocco in the

long run. Furthermore, the findings also validate the environmental Kuznets curve hypothesis in the long run only. In line

with these key findings, it is recommended that the Moroccan government should adopt relevant policies that can help the

nation overcome the existing barriers faced in transitioning from non-renewable to renewable energy use. Simultaneously,

it is also necessary for Morocco to achieve environmentally sustainable economic growth by greening its financial sector

and revisiting its financial globalization policies.

Keywords Renewable energy consumption · CO2 emissions · Economic growth · Financial development · Foreign direct

investments · EKC hypothesis · ARDL

Responsible Editor: Ilhan Ozturk

4

* Muntasir Murshed NTPC Ltd., NTPC Bhawan, Lodhi Road, New Delhi 110003,

muntasir.murshed@northsouth.edu India

5

* Abhinav Jindal Faculty of Legal, Economic and Social Sciences, Mohamed

fi17abhinavj@iimidr.ac.in V University, Rabat, Morocco

6

1 Department of Finance, College of Business Administration,

Laboratory of Economics and Organization Management.

Prince Sattam Bin Abdulaziz University, 173, Alkharj 11942,

Faculty of Economics and Management, Ibn Tofail

Saudi Arabia

University, Kenitra, Morocco

7

2 National School of Business and Management, Hassan II

School of Business and Economics, North South University,

University, Casablanca, Morocco

Dhaka 1229, Bangladesh

3

Economics Area, Indian Institute of Management Indore,

Rau‑Pithampur Road, Indore 453556, India

13

Vol.:(0123456789)

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

Introduction 2015). Morocco also organized the seventh Conference

of Parties (COP), known as COP7, in Marrakech in 2001,

Recognizing climate change as a potential threat to envi- which aimed at adopting all the legal rules pertinent for

ronmental and socioeconomic well-beings, the Paris the ratification and effective implementation of the Kyoto

Climate Change Agreement was signed in 2015. This Protocol. Also, the country hosted the COP22 to the UNF-

agreement has legally bounded the majority of the world CCC in Marrakech in 2016, which precisely focused on

economies to implement greenhouse gas emission-abating identifying mechanisms necessary for tackling climate

strategies to limit global warming to below 2° Celsius, and change. The COP22 was a great opportunity for Morocco

preferably reduce it further to below 1.5 degrees Celsius, to highlight the progress it made in the context of trans-

above to the pre-industrial level (Rau et al. 2018; Ullah forming its pollution-intensive economy into a green one,

et al. 2020; Rehman et al. 2021). Moreover, the persis- especially by incorporating renewable energy (RE) into

tent rise in Carbon dioxide (CO2) emissions around the the national energy system in order to reduce fossil fuel

globe has triggered concerns among the fossil fuel-reliant uses and mitigate the energy use-related CO2 emissions.

nations that have traditionally settled for higher economic However, despite being an active signatory member of the

gains at the expense of adverse environmental outcomes global climate change prevention initiatives, Morocco has

(Shahbaz et al. 2020; Li et al. 2021; Gyamfi et al. 2021). not managed to curb its aggregate CO2 emission figures

These nations, often characterized as developing econo- (World Bank 2021). This failure can largely be credited to

mies with low levels of technological innovation, have the nation’s unsuccessful attempts to lessen its fossil fuel

predominantly utilized the local and imported fossil fuels dependency. Subsequently, Morocco is enduring multifac-

for producing electricity; consequently, the fossil fuel eted climate change-related adversities including coastline

dependency within their respective power sectors has erosion and desertification (World Bank 2019).

substantially contributed to their economic growth but The CO2 emission figures of Morocco have steadily risen

has simultaneously jeopardized environmental quality over the years. Between 1971 and 2018, the annual level of CO2

(Shahbaz et al. 2014). However, in the contemporary era, emissions has multiplied by more than eightfold, while the CO2

it has become unimaginable to facilitate economic growth emissions per capita figures have risen by around 4 times (World

without ensuring environmental harmony by limiting the Bank 2021). Hence, considering both these trends, it can be

rise in CO2 emissions, in particular. As a result, achiev- asserted that the quality of the environment in Morocco has

ing environmentally sustainable economic growth has persistently aggravated over the last six decades or so. Figure 1

emerged as a global agenda. In this regard, recent studies graphically illustrates the contrasting trends in Morocco’s RE

have emphasized various macroeconomic variables that consumption shares and total annual CO2 emission levels.

can help decouple environmental degradation from eco- It is observed that between 1990 and 2018, the fossil fuel

nomic growth (Zhang et al. 2020; Wang et al. 2022a) dependency of Morocco has significantly increased which is

Like most of the fossil fuel-dependent developing evident from the decline in the share of renewables in Morocco’s

nations worldwide, Morocco has also recognized the total final energy consumption figures. On the other hand, the

importance of abating CO2 emissions for countering the annual CO2 emission figures have steadily gone up. Therefore,

aggravation of its environmental quality. Accordingly, the it can be assumed that the monotonic fossil fuel dependency in

nation ratified the United Nations Framework Convention Morocco is responsible for the nation’s environmental problems.

on Climate Change (UNFCCC) in 1995. Later on, it signed Currently, about 93% of Morocco’s energy demand is met by

the Kyoto Protocol in 1997 and endorsed it in 2002 (HCP, imported fossil fuels. The nation imports large volumes of

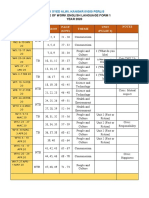

Fig. 1 The trends in CO2 emis- 18

65000

sions and RE consumption in

Morocco. Note: The total CO2

% of total final energy consumption

emission figures are presented 16

55000

along the secondary (right) axis.

Source: World Development

kilotons

Indicators (World Bank 2021) 14 45000

12 35000

10 25000

1990-95 1996-2000 2001-05 2006-10 2011-15 2016-18

CO2 emissions Renewable Energy Consumption

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

petroleum and natural gas from the international markets for Morocco in multiple ways. Firstly, it is expected to identify

(Bahgat 2013). As a result, such hefty volumes of energy imports the macroeconomic factors that are responsible for the aggra-

have not only surged the nation’s import bills, putting pressures vation of environmental quality in Morocco. Specifically,

on its economy, but have also boosted Morocco’s fossil fuel use- the factors both stimulating and inhibiting Morocco’s energy

based CO2 emissions within all the major economic sectors. use-related CO2 emissions are anticipated to be unearthed.

Therefore, underscoring the necessity to attain environmental Secondly, this study can reveal important policy implications

sustainability, reducing energy-related CO2 emissions by concerning the compliance of the Moroccan government with

making a RE transition has become an integral agenda of the its commitments made under the Paris Agreement and the

Moroccan government. Consequently, Morocco has declared 2030 SDG Agenda of the United Nations. Lastly, this study

an ambitious target of substantially enhancing its renewable can also be used to realize the importance of making a RE

electricity generation capacity, aiming to generate around 52% transition within the energy sector of Morocco. It is believed

of the nation’s electricity output using renewable sources by that Morocco has plentiful availability of untapped renewable

2030 (Choukri et al. 2017). It is believed that this declaration is resources that can be utilized for renewable electricity genera-

a strategic move made by the Moroccan government in respect tion purposes. Hence, the findings from this study can encour-

of complying with the SDG commitments. age investments for RE-related technology development to

Among the different types of RE, solar power is claimed significantly diversify Morocco’s national energy mix. In the

to be most appropriate for facilitating the RE transition in same vein, this study can be a blueprint for Morocco to reduce

Morocco. The nation has some of the largest solar parks in the its fossil fuel dependency and simultaneously ensure environ-

world, especially the Noor Ouarzazate solar complex which was mental sustainability.

inaugurated in 2016. Under this project, there are three opera- The contributions of this study to the environmental devel-

tional power plants, namely NOOR I, NOOR II, and NOOR opment-related literature are threefold. Firstly, this study is one

III, and a photovoltaic plant named NOOR IV. Collectively, of the very few studies that have evaluated the effects of RE

these four plants have a total installed capacity of generating consumption on Morocco’s CO2 emission figures using time-

580 megawatts of renewable electricity. Despite the fact that series models. The RE consumption-CO2 emissions nexus in

the core objective of the Noor Ouarzazate solar complex was to the context of Morocco has predominantly been explored using

develop a total electricity generation capacity of at least 2000 panel datasets of African countries (Jebli and Youssef 2017a;

megawatts by 2020, the targets were left unattained particularly Khoshnevis Yazdi and Ghorchi Beygi 2018; Dauda et al. 2021).

due to the technological constraints responsible for inhibited However, although cross-country analysis has several benefits,

renewable power generation in Morocco. Moreover, although for adopting country-specific policies, it is necessary to con-

this project was also envisioned to abate emission of 7,62,000 duct country-specific analysis by taking into consideration the

tons of CO2 per year over the timespan of 25 years of its opera- unique characteristics of the country of concern. Secondly, the

tion, the failure to significantly enhance the electricity generation existing studies have mostly documented findings related to the

capacity of the four power plants casts a shadow of doubt on this direct impacts of RE use on CO2 emissions (Kahia et al. 2019)

CO2 emission-reduction objective. Consequently, in response whereas not much is known regarding the indirect channels

to the national declaration of producing more than 50% of the through which RE consumption can affect CO2 emissions by

national electricity output from renewables by 2030, the renew- interacting with other key macroeconomic variables. Hence,

able electricity output share in Morocco’s aggregate electric- this study assesses both the direct and indirect environmental

ity output has merely been less than 15% (World Bank 2021). effects associated with the use of RE from Morocco’s perspec-

Moreover, between 2010 and 2016, the renewable electricity tive. Lastly, drifting away from the conventional approaches,

output shares in Morocco have declined by more than three this study controls for the structural break issues in the data

percentage points, which further certifies the rising fossil fuel within the analysis. Since Morocco has experienced several

dependency trends within the power sector of Morocco. There- macroeconomic shocks between 1980 and 2017, structural

fore, these statistics once again indicate that the Moroccan elec- break problems can be expected. As a result, ignoring these

tricity sector has traditionally faced constraints that have held data-related issues can lead to biased empirical outcomes

back the nation’s prospects of boosting the renewable electricity whereby the findings reported can be doubted.

generation capacity. On that account, it is extremely important This study is structured as follows: the “Literature review”

to identify the channels through which these constraints can be section provides a summary of the previous relevant studies.

wiped off. The “Methodology” section provides the methodology used

Against this milieu, this study attempts to examine the in selecting the empirical model, data, and the estimation

effects of renewable energy use on CO2 emissions, controlling strategy. Then the key results derived from the analysis are

for financial development, economic growth, and foreign direct presented and discussed in the “Results and discussion” sec-

investment (FDI) inflows, in the context of Morocco over the tion, while the “Conclusion and policy implications” section

1971–2018 period. The findings from this study can be helpful provides the concluding remarks.

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

Literature review Morocco, Kahia et al. (2019) concluded that RE energy use

is an effective means of curbing CO2 emissions. Besides,

This section chronologically reviews the previous studies Bilgili et al. (2016) utilized data of 17 countries that are

that have evaluated the impacts of RE use, economic growth, members of the Organization for Economic Cooperation

financial development, and FDI inflows on CO2 emissions. and Development (OECD) and remarked that RE consump-

The summary of the findings from these existing studies tion and CO2 emissions are negatively correlated in the

portrays the literature gaps that this current study aims to long run; hence, the authors emphasized the importance of

bridge. boosting RE use for abating emissions of CO2. Conversely,

a few preceding panel data studies have also denied the

The literature on RE consumption and CO2 efficacy of boosting RE employment in respect of reduc-

emissions ing CO2 emissions. Charfeddine and Kahia (2019) used

data of 24 MENA nations including Morocco and found

Although RE consumption has often been associated with that the extent of RE transition that has taken place in these

economic growth (Bouyghrissi et al. 2020), there is also countries is yet to reach the threshold level beyond which

a strong consensus among researchers regarding the cru- this clean energy transition can effectively curb their CO2

cial role of RE transition in reducing CO2 emissions (Al- emission figures. In another similar study on Morocco and

Mulali et al. 2015; Mendonca et al. 2020). These studies four other North African nations, Jebli and Youssef (2017b)

have recommended the promotion of RE as an alternative found evidence of RE consumption boosting CO2 emissions

to fossil fuels for reducing CO2 emissions, mitigating cli- in the long run but not in the short run. Parallel conclu-

mate change, and therefore, protecting the environmental sions in the context of a panel of 46 developing nations and

attributes. Over the last two decades, a large set of empirical the BRICS1 countries were reported by Weimin et al. (2021)

works has emerged to examine the link between RE con- and Chishti et al. (2021), respectively.

sumption and CO2 emissions for different countries across

the globe. Among the relevant country-specific studies, Dan- The literature on economic growth and CO2

ish et al. (2017) investigated the linkages between RE con- emissions

sumption and CO2 emissions over 1970–2012 for the case

of Pakistan and found that greater use of RE has a signifi- Economic expansion is often accused to be associated

cant inhibitory impact on the nation’s CO2 emission levels. with emissions of CO2 (Wang and Zhang 2020; Wang and

Recently, Koondhar et al. (2021) employed the autoregres- Wang 2022). Contrarily, it is also acknowledged in the lit-

sive distributed lag (ARDL) model to estimate the short- erature that greening the economic growth policies using

and long-run effects of RE consumption on China’s CO2 latest technology can decouple CO2 emissions from eco-

emission figures. The results unearthed that in the short- nomic growth (Wang and Zhang 2020; 2021). As per the

run greater consumption of RE contributes to the lowering theoretical underpinnings of the Environmental Kuznets

of CO2 emissions in China. Besides, this finding was also Curve (EKC) hypothesis, economic growth can boost but

supported by the outcome of the causality analysis which eventually curb CO2 emissions as a premature agriculture-

certified the presence of unidirectional causality running based economy transforms into a complex industrialized

from RE consumption to CO2 emissions. The CO2 emis- one (Grossman and Krueger 1995; Apergis and Ozturk

sion-curbing impact of RE was also confirmed in the stud- 2015; Ozturk and Al-Mulali 2015). The EKC hypothesis

ies by Naz et al. (2019) for Pakistan, Sarkodie and Adams is valid only in the context of the economic growth-CO2

(2018) for South Africa, and Bekhet and Othman (2018) for emissions nexus depicting an inverted U-shaped relation-

Malaysia. In contrast, Pata (2018), Boontome et al. (2017), ship (Gyamfi et al. 2020; Ajmi and Inglesi-Lotz 2020;

and Luqman et al. (2019) remarked that RE use is not effi- Alola and Ozturk 2021). Consequently, several studies have

cient in reducing CO2 emissions in Turkey, Thailand, and attempted to verify the authenticity of this hypothesis using

Pakistan, respectively. both country-specific and cross-sectional methods (Wang

On the other hand, among the existing panel data stud- et al. 2022b; Apergis 2016; Ozcan et al. 2018). Among the

ies, Sharif et al. (2020) recently studied the associations country-specific investigations of the EKC hypothesis for

between RE use and CO2 emissions in the top-10 most-pol- CO2 emissions, ul Haq et al. (2016) concluded that for the

luted global countries between 1990 and 2017. The authors case of Morocco, the EKC hypothesis holds in the short

concluded that there are bidirectional causalities between run but not in the long run. Besides, Ali et al. (2021) used

RE consumption and environmental degradation in the form the ARDL model using data from Pakistan and found the

of CO2 emissions. In the same vein, for selected Middle

Eastern and North African (MENA) countries including

1

BRICS stands for Brazil, Russia, India, China, and South Africa.

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

EKC hypothesis to be valid both in the short and long run. many studies have explored this nexus using both time-series

Similar findings were reported by Bekun et al. (2020) and and panel data estimators.

Hasan et al. (2021) for Nigeria and Bangladesh, respectively. Within the corresponding country-specific literature on

In contrast, for the case of China, Pata and Caglar (2021) the financial development-CO2 emission nexus, Pata (2018)

recently employed the augmented ARDL technique and advocated that financial development inhibits environmental

found the economic growth-CO2 emission nexus to depict well-being by stimulating CO2 emissions in Turkey. Using

a U-shaped association; thus, the EKC hypothesis was said the ARDL approach, Pata (2018) found that financial devel-

to not hold for China. Likewise, Koc and Bulus (2020), Ban- opment and CO2 emissions to be positively correlated both

dyopadhyay and Rej (2021), and Minlah and Zhang (2021) in the short and long run. Similarly, in the case of Greece,

also concluded that the CO2 emission-related EKC hypoth- Işik et al. (2017) also employed the ARDL technique to con-

esis is invalid in the context of Korea, India, and Ghana, clude that financial development boosts the long-run CO2

respectively. emission figures. Xu et al. (2018) used both the ARDL and

Among the related panel data studies, Yazdi and Beygi vector error correction model (VECM) approaches in the

(2018) found that the EKC hypothesis is supported for the context of Saudi Arabia and unearthed that financial devel-

African countries and that there is bidirectional causality opment does not influence the short-run CO2 emission lev-

between GDP and CO2 emissions. Similarly, Cheikh and els, but it does boost the emissions in the long run. Besides,

Zaied (2021) asserted that the EKC hypothesis is valid bidirectional causal associations between the variables, both

for the cases of Morocco and 11 other MENA nations. in the short and long run, were also put forward in the study.

In another panel data study on selected African nations, Likewise, Ali et al. (2019) also highlighted the adverse envi-

Mahmood et al. (2020) found evidence of the EKC hypoth- ronmental impacts of financial development in the Nigerian

esis being valid. On the other hand, in the context of selected context. Although most of these studies have advocated in

MENA countries including Morocco, Cheikh et al. (2021) favor of financial development exerting environmentally

concluded that the EKC hypothesis does not hold. In the unfriendly consequences, Saud et al. (2019) claimed that

context of selected South Asian countries, Murshed et al. financial development helps to abate CO2 emissions in Ven-

(2021a) and Murshed and Dao (2020) also verified the ezuela. On the other hand, for the case of Morocco, Sekali

authenticity of the CO2 emission-related EKC hypothesis. and Bouzahzah (2019) used the ARDL technique and con-

Similarly, for the cases of five European countries, Balsalo- cluded that financial development does not explain the vari-

bre-Lorente et al. (2021) documented statistical evidence to ations in the nation’s CO2 emission figures.

validate the CO2 emission-related EKC hypothesis. There- Among the existing cross-sectional studies, in the con-

fore, it can be observed that the preceding studies have col- text of 15 Asian economies, Anwar et al. (2021) recently

lectively highlighted the ambiguity concerning the validity concluded that financial development axes environmental

of the EKC hypothesis for CO2 emissions. well-being by triggering greater emissions of CO2. Simi-

larly, in another relevant study on 25 African nations includ-

The literature on financial development and CO2 ing Morocco, Yazdi and Beygi (2018) asserted that finan-

emissions cial development boosts CO2 emissions in the long run.

Moreover, using data from selected developing and devel-

A developing economy’s financial sector is referred to as one oped economies, Shoaib et al. (2020) opined that financial

of its major growth-driving sectors since a well-developed development impairs environmental welfare by boosting

financial sector is indicative of higher degrees of domestic CO2 emissions irrespective of a country being developed

consumption and investment. Therefore, it can be claimed or developing. Conversely, Zaidi et al. (2019) used data from

that financial development contributes to economic growth selected Asia Pacific Economic Cooperation (APEC) coun-

(De Gregorio and Guidotti 1995). However, the correspond- tries and found evidence of financial development curbing

ing impact of financial development on the environment is CO2 emissions in the long run. Similarly, for selected OECD

acknowledged to be ambiguous (Ahmad et al. 2021; Ahmad nations, Zafar et al. (2019) showed that financial develop-

et al. 2021; Shahbaz et al. 2022). Arguably, financial devel- ment helps to mitigate their long-run CO2 emission figures.

opment is asserted to foster industrialization which, in turn, In contrast, considering data from Morocco and 23 other

results in the degradation of environmental quality (Ali MENA countries, Charfeddine and Kahia (2019) discovered

et al. 2019). Conversely, developing the financial sector that financial development has limited power to explain the

can also be a means of achieving green growth by financing variations in the level of CO2 emissions in these countries.

environmental technology development projects (Paramati Saidi and Mbarek (2017) asserted that in the long run finan-

et al. 2017; Shahbaz et al. 2018). Therefore, considering the cial development improves environmental quality by abating

equivocal environmental effects of financial development, CO2 emissions in the context of 19 emerging economies

including Morocco. In a recent study on 88 developing

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

countries, Khan and Ozturk (2021) opined that financial figures. Thus, the authors argued that the PHE hypothesis is

development induces both direct and indirect impacts on valid for these nations. Conversely, verifying the PHH for

environmental quality. The results indicated that financial the case of four African Mediterranean countries including

development directly contributes to inhibit CO2 emissions Morocco, Abdouli and Omri (2021) recently asserted that

while indirectly reducing CO2 emissions by minimizing the FDI inflows boost CO2 emissions to aggravate the quality of

adverse environmental effects associated with economic the environment. On the other hand, Shobande and Ogbei-

growth, international trade, and FDI inflows. Moreover, fun (2021) authenticated the PHE hypothesis in the context

Zakaria and Bibi (2019) found evidence of financial devel- of selected OECD nations. The results from the long-run

opment aggravating environmental quality by stimulating regression analysis revealed that positive shocks to the level

greater emissions of CO2 across South Asia. of FDI inflows contribute to the curbing of the CO2 emis-

sion figures of the OECD countries of concern. In another

study 10 global nations, Teng et al. (2021) found evidence

The literature on FDI inflows and CO2 emissions of higher FDI inflows mitigating CO2 emissions only in the

long run.

Globalization, in all forms, has been acknowledged in

the literature as an influencer of CO2 emissions (Chishti

et al. 2020; Murshed et al. 2021b). Accordingly, quantify- Methodology

ing financial globalization in terms of FDI inflows, sev-

eral studies have evaluated the FDI inflow-CO2 emissions This section chronologically presents the empirical models

nexus in light of the pollution haven hypothesis (PPH).2 (the “Empirical model specifications and data” section) and

Among the country-specific studies on the PHH, Solarin the estimation strategy (the “Estimation strategy” section)

et al. (2017) employed the ARDL method and remarked considered in this study.

that the PHH hypothesis is valid in the case of Ghana

since FDI inflows were ascertained to boost CO2 emis- Empirical model specifications and data

sions in the long run. Similarly using the ARDL method

and accounting for the structural break issue, Sun et al. This study explores impacts of positive shocks to figures of

(2017) also reported evidence of the PHH for CO2 emis- RE consumption, economic growth, financial development,

sions holding in the context of China. Similar findings and FDI inflows on Morocco’s CO2 emission levels over

were reported for Tunisia by Mahmood et al. (2019). Like- the period from 1980 to 2017. Following Adedoyin et al.

wise, Bulut et al. (2021) also verified the authenticity of (2021a, 2021b) and Abbasi et al. (2021), this study consid-

the PHH by concluding that the FDI flowing into Turkey ers a non-linear model specification which is in line with the

are responsible for boosting the nation’s CO2 emission theoretical assumptions of the EKC hypothesis. The baseline

figures. In contrast to the theoretical underpinnings of the model in this regard can be expressed as:

PHH, the pollution halo effect (PHE) hypothesis postulates

LCO2t = β0 + β1 LRECt + β2 LGDPt + β3 LGDPSt

that FDI inflows induce technological innovations within (1)

the host economy to curb CO2 emissions (Balsalobre-Lor- + β4 FDt + β5 FDIt + εt

ente et al. 2019). Accordingly, in the context of Turkey, where the subscript t denotes the period (1980–2017) and

Mert and Caglar (2020) employed the ARDL and VECM ε stands for the error term. The parameters βi (i = 1, 2, …, 5)

approaches and found the PHE hypothesis to be valid. In are the elasticity parameters to be predicted. The dependent

another time-series analysis for the cases of Morocco and variable LCO2 is the natural logarithm of CO2 emissions

Tunisia, Hakimi and Hamdi (2016) concluded that the FDI which are used to proxy the environmental impacts associ-

flowing into these countries are unclean since higher FDI ated with positive shocks to the explanatory variables of

inflows were found to be associated with greater emissions interest. The CO2 emission figures are measured in terms

of CO2. of kilotons. The independent variable LREC refers to the

Among the preceding cross-sectional studies on the natural logarithm of the per capita RE consumption figures

FDI inflow-CO2 emission nexus, Kahia et al. (2019) used of Morocco and is measured in terms of kilograms of oil

data of 12 MENA countries including Morocco and found equivalent. The variables LGDP and LGDPS are the natu-

FDI inflows helping these nations curb their CO2 emission ral logarithms of the per capita real gross domestic product

(GDP) figures and the corresponding squared terms. These

per capita real GDP figures are used to proxy for the level

2

The PHH postulates that FDI inflows degrade environmental qual- of economic growth in Morocco. For the EKC hypothesis

ity in the host economies by triggering greater emissions of CO2. For to be verified, the elasticity parameters β2and β3require to

more information on the PHH, see Banerjee and Murshed (2020).

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

be positive and negative, respectively, and statistically sig- Unit root and cointegration analysis

nificant as well (Grossman and Krueger 1995). The variable

FD refers to the level of financial development in Morocco The presence of a structural break in the data, if left

which is measured in terms of the share of domestic credit unattended, compromises the accuracy of the unit root

provided to the private sector by banks in the GDP of and cointegration outcomes. Accordingly, the second

Morocco. A larger (smaller) share in this regard is indicative generation time-series estimators are used in this study

of a relatively more developed (underdeveloped) financial since the first-generation unit root and cointegration test-

sector. Lastly, the variable FDI stands for the share of FDI ing methods assume that there are no structural break

inflows in the GDP of Morocco. The inclusion of this vari- problems in the data. To predict the unit root proper-

able is motivated by the desire to test the authenticity of the ties, we follow Mehmood (2021) and utilize the Zivot

CO2 emission-related PHH in the context of Morocco. If the and Andrews (2002) method. This method allows for one

elasticity parameter β5 is statistically significant and positive, structural break in the data for each variable and pre-

then the PHH is valid; conversely, the negative sign and dicts test statistics under the null hypothesis of no unit

statistical significance of the elasticity parameter β5 would root issues. This analysis is followed by the cointegra-

affirm the authenticity of the PHE hypothesis. tion analysis which is conducted to ascertain the long-

Although the baseline model (model 1) is expected to run relationships between the variables of concern. In

predict the direct impacts of RE use on Morocco’s CO2 this regard, this study employs two alternative methods

emission figures, this study is also interested to ascertain to predict the cointegrating properties both in the absence

the indirect effects of RE use by evaluating the interactive and presence of structural breaks in the data. At first, the

impacts of this variable with other key macroeconomic vari- ARDL bounds testing approach of Pesaran et al. (2001)

ables. Hence, we augment the baseline models with interac- is employed which does not take into account the issue of

tion terms as shown below: structural breaks. In this method, a F statistic is estimated

under the null hypothesis of non-cointegration among the

LCO2t = β0 + β1 LRECt + β2 LGDPt + β3 LGDPSt + β4 FDt

( ) (2) variables in the respective model. Then the Maki (2012)

+ β5 FDIt + β6 LRECt ∗ FDt + εt cointegration analysis is conducted to predict the cointe-

grating properties by accounting for multiple unknown

LCO2t = β0 + β1 LRECt + β2 LGDPt + β3 LGDPSt + β4 FDt structural breaks in the data 4 . Similar to the ARDL

( ) (3) bound testing technique, the Maki (2012) method also

+ β5 FDIt + β6 LRECt ∗ FDIt + εt

predicts test statistics under the null hypothesis of non-

where the variables (LREC*FD) and (LREC*FDI) are cointegration. Both these methods have been employed in

the interaction terms between RE consumption and financial several of the latest studies documented within the CO2

development and between RE consumption and FDI inflows, emissions-induced literature (Zhang et al. 2021; Beşe

respectively. The predicted signs, provided statistically sig- and Kalayci 2021). Once the outcomes of the unit root

nificant, of the elasticity parameter β6 would portray the and cointegration analyses are ascertained, the regression

joint impacts of RE use and financial development and FDI analysis is conducted.

inflows on Morocco’s CO2 emissions levels. The data for

RE consumption is sourced from the US Energy Information Regression analysis

Administration database. The data for the other variables are

compiled from the World Development Indicators database Following Koondhar et al. (2021), we utilized the ARDL

of the World Bank3. technique proposed by Pesaran and Smith (1995) and

Pesaran et al. (2001) to predict the short- and long-run

Estimation strategy elasticities of CO2 emissions in the context of Morocco.

This technique has several advantageous features which

The estimation strategy followed in this study is classi- best fits the nature of the dataset employed in this study.

fied into multiple stages. Firstly, the structural break issue Among these, the ARDL method is particularly effi-

is diagnosed within the unit root analysis. Secondly, the cient in handling issues related to small sample size bias

structural break problems are further assessed within the (Odhiambo 2009). Besides, the issues of serial correla-

cointegration analysis. Lastly, the regression analysis is tions and endogenous covariates within the model are

conducted.

3 4

To ensure brevity, the descriptive statistics of the variables and the Although the Maki (2012) approach can identify up to five struc-

corresponding correlation matrix are not reported. However, these tural breaks in the data, we limit it to two considering the short length

tables can be made available upon request. of the period used in this study.

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

Table 1 The Zivot and Andrews Variable t-statistic Break Variable t-statistic Break Integra-

(2002) unit root results tion

order

LCO2 − 1.680 1990 ∆LCO2 − 4.850*** 1991 I(1)

LREC − 4.150*** 2002 ∆LREC - - I(0)

LGDP/LGDPS − 2.110 2000 ∆LGDP/∆LGDPS − 4.505*** 2000 I(1)

LFD − 3.102 1992 ∆LFD − 6.340*** 1992 I(1)

LFDI − 2.450 1998 ∆LFDI − 5.120*** 2000 I(1)

The Schwarz information criterion (SIC) is used for selecting optimal lags; ∆, I(0), and I(1) denote the

first difference operator, level, and first difference, respectively; *** denotes statistical significance at 1%

significance level

accommodated within this method by using flexible lags Table 2 The ARDL bound test results

for each of the variables in the respective model (Malik

Model F-stat. Critical value Lower bound Upper bound

et al. 2020). In addition, the ARDL technique does not

prerequisite all variables to have a common order of 1 5.240*** 1% 3.29 4.37

integration; rather, it allows for mixed integration orders 2 4.850*** 5% 2.56 3.49

among the variables either at level or at the first differ- 3 4.990*** 10% 2.20 3.09

ence, but not at the second difference (Ahmad and Du

The SIC is used for selecting optimal lags; *** denotes statistical sig-

2017). Lastly, it can produce both the short- and long-run nificance at 1% significance level.

outcomes, whereas the conventionally used methods such

as the fully modified ordinary least squares (FMOLS)

regression method of Phillips and Hansen (1990). In

the context of our baseline model (model 1), the ARDL Table 3 The Maki (2012) cointegration results

model can be specified as: Model t-stat. Critical value (5%) Break 1 Break 2

ΔLCO2t = β0 + β1 LCO2t−1 + β2 LRECt−1 + β3 LGDPt−1 + β4 LGDPSt−1 + β5 FDt−1

1 − 9.700** − 7.600 1990 2010

m

2 − 9.760** − 7.630 1991 2010

∑

+ β6 FDIt−1 + α1a ΔLCO2t−a

a=1

3 − 8.450** − 7.610 1991 2011

+

n

∑

α2b ΔLRECt−b +

o

∑

α3c ΔLGDPt−c +

p

∑

α4d ΔLGDPSt−d

(4)

b=0 c=0 d=0 The t-statistics are predicted considering the structural breaks in the

q

∑ r

∑ trends and regime shifts; the SIC is used for selecting optimal lags;

+ α5e ΔFDt−e + α6f ΔFDIt−f + θt

e=0 f=0

** denotes statistical significance at 5% significance level.

where ∆ stands for the first difference operator. From

Equation (4), the short-run elasticities of CO2 emissions

are predicted from the model given below:

Once the elasticities are predicted, it is pertinent to run

some diagnostic tests. In this regard, the Breusch-Godfrey

m

∑ n

∑

ΔLCO2t = 𝛼0 + α1a ΔLCO2t−a + α2b ΔLRECt−b

a=1 b=0 Lagrange Multiplier (χ2 LM) test is performed to explore

o p

the serial correlation problems in the model. Then, to check

(5)

∑ ∑

+ α3c ΔLGDPt−c + α4d ΔLGDPSt−d

c=0 d=0

whether the residuals are normally distributed or not, the

∑q r

∑ Jarque-Bera test (χ2 NORMALITY) is conducted. Besides,

+ α5e ΔFDt−e + α6f ΔFDIt−f + ∅ECTt−1 + 𝜀t the heteroscedasticity issues are diagnosed using the autore-

e=0 f=0

gressive conditional heteroskedasticity (ARCH) effects

where ECTt-1 refers to the one-period lagged error correc- analysis (χ2 ARCH). Furthermore, the model misspecifi-

tion term (ECT); the ECT provides the rate at which any dis- cation concerns are addressed using the Ramsey RESET (χ2

tortion from the long-run equilibrium in the current period RESET) test. Lastly, the stability of the elasticity parameters

is restored in the next period which is estimated using the is examined through the cumulative sum (CUSUM) and the

residuals of the long-run equation. From Equation (4), the cumulative sum of squares (CUSUMSQ) tests.

long-run equation can be derived and expressed as: Furthermore, the robustness of the long-run elasticity out-

comes, across alternative regression methods, is assessed

LCO2t = β0 + β1 LRECt + β2 LGDPt + β3 LGDPSt

(6) using the FMOLS technique introduced by Phillips and

+ β4 FDt + β5 FDIt + σt Hansen (1990).

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

Table 4 The short- and long-run elasticities from the ARDL analysis Results and discussions

Dependent variable: LCO2

This section begins by reporting the results obtained from

Model 1 Model 2 Model 3

Regressors Coefficient Coefficient Coefficient

the Zivot and Andrews (2002) unit root analysis. The cor-

Short-run results responding findings, as shown in Table 1, reveal that all

LREC 0.039** 0.049*** − 0.029** the variables (LCO2, LGDP/LGDPS, FD, and FDI) are

(0.021) (0.015) (0.016) integrated at the first difference [I(1)] while the variable

LGDP 1.715 1.149 1.237 LREC is integrated at level [I(0)]. Therefore, it can be said

(1.047) (1.217) (1.104) that there is a mixed order of integration among the vari-

LGDPS − 0.131 − 0.154 − 0.093

ables. Besides, the location for the structural break for the

(0.473) (0.485) (0.477)

FD 0.312*** 0.231*** 0.217***

respective variable is also identified.

(0.124) (0.029) (0.027) The unit root analysis is followed by the cointegration

FDI 0.119 0.059 0.081 analysis. The estimated F-statistics from the ARDL bound

(0.084) (0.051) (0.079) test for all three models, as shown in Table 2, are wit-

REC*FD - − 0.056 - nessed to be above the lower and upper critical bounds.

(0.072) Hence, the null hypothesis of non-cointegration is rejected

REC*FDI - - 0.042

at 1% significance level. Thus, it can be said that there

(0.048)

are long-run associations between Morocco’s CO2 emis-

D(Break 1) 1.240*** 1.410*** 1.441***

(0.350) (0.220) (0.212)

sions, per capita RE consumption, per capita economic

D(Break 2) − 1.098** − 1.212** − 1.120** growth, financial development, and FDI inflow figures.

(0.510) (0.611) (0.580) Table 3 reports the results from the Maki (2012) cointe-

ECTt-1 − 0.777*** − 0.724*** − 0.760*** gration analysis. It is evidenced that for all three models

(0.116) (0.231) (0.122) the predicted t-statistic is statistically significant at 5%

Constant − 6.573 − 2.434 0.356

significance level. Thus, once again, it can be claimed that

(5.745) (2.867) (7.523)

there are long-run cointegrating relationships between the

Long-run results

LREC 0.444*** 0.640*** 0.686***

variables of concern. Moreover, the Maki (2012) analysis

(0.147) (0.159) (0.130) also provides the locations of the two structural breaks for

LGDP 5.135** 2.439*** 2.662*** the respective model. These identified break years are used

(1.957) (1.022) (0.860) to create structural break dummy variables that are used

LGDPS − 0.312*** − 0.090** − 0.081** to augment the corresponding model for controlling for

(0.057) (0.044) (0.039)

the structural break issues within the regression analysis.

FD 0.400** 0.336*** 0.333***

Table 4 displays the short- and long-run elasticities of

(0.218) (0.048) (0.021)

FDI 0.069*** 0.042** 0.035**

Morocco’s CO2 emissions in respect of changes to the

(0.017) (0.022) (0.018) nation’s RE consumption, economic growth, financial

REC*FD - − 0.095*** - development, and FDI inflow figures. Overall, the pre-

(0.011) dicted signs of the elasticity parameters are homogenous

REC*FDI - - − 0.140** across all three model specifications considered in this

(0.065)

study. The elasticity estimates show that consuming RE is

D(Break 1) 1.195** 2.450*** 2.110***

efficient in mitigating Morocco’s CO2 emissions figures

(0.560) (0.765) (0.611)

D(Break 2) − 1.200*** − 1.400*** − 1.540**

both in the short and long run. A 1% rise in the amount of

(0.360) (0.510) (0.725) RE consumed per person is predicted to reduce CO2 emis-

Adjusted R2 0.740 0.746 0.767 sions by 0.03–0.05% in the short run and by 0.44–0.69%

Diagnostics in the long run. Hence, it is evident that, compared to the

χ2 ARCH 0.466 0.410 0.440 short run, the marginal CO2 emission-inhibiting effects

χ2 RESET 0.630 0.590 0.610 associated with RE energy use are relatively larger in the

χ2 NORMALITY 3.465 3.800 3.720

long run. This implies that a persistent increase in the

χ2 LM 1.450 1.520 1.555

level of per capita RE consumption is likely to monotoni-

D(Break 1) and D(Break 2) are the two structural break year dummy cally abate emissions of CO2 in Morocco. It is a reason-

variables as per the identified breaks from the Maki (2012) cointegra- able finding from the perspective that renewable energy

tion analysis; the standard errors are reported within the parentheses;

resources are free of hydrocarbon; consequently, combus-

***, **, and * denote statistical significance at 1%, 5%, and 10% sig-

nificance level, respectively. tion of these clean energy sources does not release CO2

into the atmosphere. Besides, enhancing RE use can also

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

be an indication of simultaneously curbing fossil fuel con- GDP is associated with a surge in Morocco’s long-run CO2

sumption provided the share of renewables in the total emission figures on average by 0.04–0.07%, ceteris paribus.

final energy consumption figures is increased. In this Hence, it can be presumed that Morocco has traditionally

regard, a reduction in fossil fuel dependency could justifi- attracted unclean FDI that may have triggered fossil fuel use

ably be responsible for improving environmental quality in to boost the energy use-related CO2 emissions. As a result,

Morocco. This finding is consistent with those reported in the financial globalization policies pursued in Morocco are

the preceding studies by Danish et al. (2017) and Koond- not aligned with the nation’s local and international com-

har et al. (2021) for Pakistan and China, respectively. mitments concerning the abatement of greenhouse gas emis-

Among the other key findings from the ARDL analysis, it sions for improving environmental well-being. The finding

can be witnessed that the EKC hypothesis holds for Morocco of the positive correlation between FDI inflows and CO2

but only in the long run. The positive and negative signs emissions is parallel to those documented in the studies by

of the statistically significant predicted long-run elasticity Solarin et al. (2017) for Ghana and Sun et al. (2017) for

parameters associated with LGDP and LGDPS, respec- China. In summary, the aforementioned findings highlight

tively, implicate that the economic growth-CO2 emission that RE consumption directly contributes to curb Moroc-

nexus exhibits an inverted U-shaped relationship. This find- co’s CO2 emission figures, the EKC hypothesis holds, and

ing is consistent with that reported by Bekun et al. (2020) financial development, and FDI inflows stimulate CO2 emis-

for Nigeria, Ali et al. (2021) for Pakistan, and Hasan et al. sions. However, this study also unearths some major findings

(2021) for Bangladesh. The validation of the EKC hypoth- related to the interactive (indirect) environmental impacts

esis implicates that if Morocco can achieve persistent growth associated with RE use.

of its economy, the nation is likely to attain and surpass the Comparing between the elasticity estimates from model

threshold economic growth level necessary for abating CO2 1 and models 2 and 3, it is evident that controlling for the

emissions to achieve green growth. Besides, the elasticity interactive impacts of RE consumption with financial devel-

estimates also reveal that financial development is detrimen- opment and FDI inflows reduces the marginal detrimental

tal to Morocco’s environmental well-being, both in the short impacts of financial development and FDI inflows. This

and long run. The positive signs and statistical significance claim is certified by the negative sign and the statistical

of the associated elasticity parameters affirm this claim. A significance of the long-run elasticity parameters attached

1% rise in the share of credit extended to the private sector to the interaction terms. These imply that RE consumption

by banks in the GDP is found to boost CO2 emissions on and financial development jointly reduce the CO2 emission

average by 0.22–0.31% in the short run and by 0.33–0.444% figures of Morocco. Therefore, it can be said that if private

in the long run, ceteris paribus. Therefore, these findings finances are utilized for boosting RE consumption within

implicate two major concerns for the government. Firstly, the Moroccan economy, the negative environmental impacts

the relatively larger adverse environmental effects in the long associated with financial development can be controlled to a

run imply that without greening the financial sector, it may large extent. Similarly, RE consumption can also be hypoth-

not be possible for Morocco to safeguard its environmental esized to reduce the adverse environmental implications of

attributes. Secondly, it can also be assumed that the finan- Morocco’s financial globalization initiatives. In line with

cial sector has conventionally been financing environmen- this finding, it can be asserted that if Morocco can attract

tally unfriendly consumption and production initiatives in clean FDI which can be utilized for the development of

Morocco; consequently, financial development is associated the nation’s RE sector, the financial globalization-induced

with the persistent aggravation of the nation’s CO2 emission CO2 emissions can be abated. Furthermore, the elastic-

figures. These findings corroborate those of Pata (2018) for ity estimates also reveal that controlling for the interac-

Turkey. However, these findings are inconsistent with the tive impacts reduces the economic growth-environmental

conclusions put forward by Sekali and Bouzahzah (2019) degradation trade-off in Morocco. This is evident from the

for the case of Morocco; the contrasting findings could be finding that the predicted long-run elasticity parameters

because the study by Sekali and Bouzahzah (2019) did not attached to LGDP are comparatively larger in the context

control for the structural breaks in the data5. of model 1 relative to those in the context of models 2 and

Furthermore, the elasticity estimates also verify the PHH 3. Hence, it can also be asserted that producing the national

in the context of Morocco only in the long run. The find- output by employing RE resources is likely to mitigate the

ings portray that a 1% rise in the share of FDI inflows in the environmental impacts associated with the growth of the

Moroccan economy. Consequently, these findings regarding

the interactive effects of RE consumption on CO2 emis-

5 sions in Morocco highlight the relevance of scrutinizing

It is to be noted that the coefficients corresponding to the structural

break dummy variables are found to be statistically significant. Thus, the mediating roles of key macroeconomic variables for

the relevance of controlling for structural break issues is justified. comprehensive policy-making purposes.

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

Furthermore, the findings reported in Table 4 show that be explained by the shocks to the nation’s per capita RE

the ECTs for all three models are negative and statisti- consumption, per capita economic growth, financial devel-

cally significant as well. Therefore, it can be said that any opment, and FDI inflow levels. Furthermore, the findings

distortion from the long-run equilibrium in the current from the diagnostic tests, as reported in Table 4, reveal

period is adjusted at a rate of around 72–78% in the next that all three models are free from heteroscedasticity,

period. Besides, the high values of the adjusted R-squared serial correlation, non-normality, and model misspecifica-

values imply a good fit for all three ARDL models. The tion problems. In addition, the stability of the parameters

adjusted R-squared values indicated that almost 74–78% of for the respective models is also ensured from the CUSUM

the total variations in Morocco’s CO2 emission figures can and CUSUMSQ plots shown in Figure 2.

CUSUM plot (Model 1) CSUMSQ plot (Model 1)

20 1.5

10 1

0 .5

-10 0

-20 -.5

1980 1990 2000 2010 2020 1980 1990 2000 2010 2020

Year Year

CUSUM plot (Model 2) CUSUMSQ plot (Model 2)

20 1.5

10 1

0 .5

-10 0

-20 -.5

1980 1990 2000 2010 2020 1980 1990 2000 2010 2020

Year Year

CUSUM plot (Model 3) CUSUMSQ plot (Model 3)

20 1.5

10 1

0 .5

-10 0

-20 -.5

1980 1990 2000 2010 2020 1980 1990 2000 2010 2020

Year Year

Fig. 2 The CUSUM and CUSUMSQ plots for models 1, 2, and 3. Note: The stability of the parameters for the respective model is ensured if the

plot line is within the 95% confidence interval

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

Table 5 The robustness analysis using FMOLS estimator it is deemed necessary for Morocco to diversify its energy

Dependent variable: LCO2

mix by augmenting renewable resources into its energy sector;

especially, for generating power. Therefore, to understand the

Model 1 Model 2 Model 3

importance of promoting RE use for achieving environmen-

Regressors Coefficient Coefficient Coefficient tal sustainability, it is pertinent for policymakers to have an

LREC − 0.130*** − 1.009*** − 1.309*** understanding of the effects of RE consumption on environ-

(0.046) (0.107) (0.192) mental attributes. Against this background, this study scruti-

LGDP 3.813*** 2.129** 2.558* nizes the RE consumption-CO2 emission nexus, controlling

(1.474) (0.992) (1.434) for economic growth, financial development, and FDI inflows,

LGDPS − 0.171* 0.099*** − 0.091*** in the context of Morocco over the 1980–2017 period. The

(0.096) (0.012) (0.009) major novelty of this study is highlighted in the sense that

FD 0.438*** 0.344*** 0.359*** it not only evaluates the direct impacts of RE use on CO2

(0.100) (0.119) (0.115) emissions but also emphasizes the indirect effects. Besides,

FDI 0.015*** 0.012*** 0.322** the econometric methods utilized are robust to accounting

(0.005) (0.003) (0.142) for structural break concerns in the data. Overall, the findings

REC*FD − 0.090*** revealed that RE use directly helps to abate CO2 emissions

(0.0124) both in the short and long run, while financial development

REC*FDI − 0.174*** and FDI inflows boost the emissions. However, the adverse

(0.0341) environmental impacts of financial development and FDI

D(Break 1) 1.231*** 2.112*** 2.331*** inflows are evidence to be partially neutralized by facilitat-

(0.160) (0.125) (0.245) ing greater use of RE in the long run. These results implied

D(Break 2) − 1.500*** − 1.505*** − 1.660*** that RE consumption can both directly and indirectly, via the

(0.321) (0.210) (0.472) channels of financial development and FDI inflows, contribute

Constant − 9.468* − 4.251 5.258 to CO2 emission reductions in Morocco. Besides, the EKC

(5.580) (3.544) (5.324) hypothesis is also found to hold.

R-squared 0.863 0.888 0.877 In line with these findings, several viable policies can

be recommended to the Moroccan government. Firstly, it

The standard errors are reported within the parentheses; ***, **, and

is important for Morocco to boost the level of RE use and

* denote statistical significance at 1%, 5%, and 10% significance lev-

els, respectively. simultaneously reduce fossil fuel consumption. In this regard,

the nation has to overcome the associate constraints that have

inhibited RE transition in Morocco. Besides, the government

For the robustness check of the long-run elasticity is recommended to impose higher tariffs on petroleum imports

parameters, the FMOLS estimator is employed to re- and rather make use of the untapped indigenous renewable

estimate all three models. The long-run elasticity param- sources for generating power, in particular. The government

eters derived from the FMOLS analysis are reported in should also incentivize research and development investments

Table 5. It can be witnessed that, despite differing in for developing the local RE technologies. Secondly, the eco-

terms of magnitude, the predicted signs of the FMOLS nomic growth strategies need alterations whereby green initia-

elasticity parameters are parallel to the correspond- tives should be introduced to facilitate sustainable consump-

ing long-run elasticity parameters estimated using the tion and production practices within the country. Once again,

ARDL technique. As a result, we can claim our findings for achieving green economic growth, the government should

to be robust across alternative regression methods. encourage the employment of RE resources within the indus-

try, residential buildings, and other key sectors. Thirdly, the

financial sector of Morocco also needs major transformations

Conclusion and policy implications whereby the access to concessional loans for green projects

has to be substantially increased. In this regard, the govern-

Morocco has always been committed to reducing its CO2 ment can introduce green bonds which can effectively help

emission figures in compliance with environmental welfare- to reduce the adverse environmental impacts associated with

enhancing targets mentioned under the Paris Agreement and financial development. Finally, the government should restrict

the SDG agenda of the United Nations. However, the nation the inflow of unclean FDI into Morocco. Instead, it is more

has not managed to abate its CO2 emissions particularly due relevant for the government to attract RE development-related

to the traditional reliance of the nation on fossil fuels. Con- FDI which can be expected to relieve the technological and

sequently, Morocco has been one of the major importers of financial barriers that have traditionally inhibited RE transi-

petroleum across the globe. Hence, under such circumstances, tion in Morocco.

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

Due to the unavailability of data, the period of analysis Ahmad N, Du L (2017) Effects of energy production and CO2 emis-

had to be limited from 1980 to 2017. In the same vein, sions on economic growth in Iran: ARDL approach. Energy

123:521–537

data unavailability also restricted our choice of control Ajmi AN, Inglesi-Lotz R (2020) Revisiting the Kuznets curve

variables. As far as the future research directions are hypothesis for Tunisia: carbon dioxide vs. Ecological foot-

concerned, this study can be extended by assessing the print. Energy Sources, Part B: Economics, Planning, and

asymmetric impacts of positive and negative shocks to Policy, 1–14

Ali HS, Law SH, Lin WL, Yusop Z, Chin L, Bare UAA (2019)

RE use on Morocco’s CO2 emission figures. Besides, the Financial development and carbon dioxide emissions in Nige-

causal relationships between the variables can also be ria: evidence from the ARDL bounds approach. GeoJournal

scrutinized. Moreover, for more comprehensive and robust 84(3):641–655

policy-making purposes, the environmental impacts of dif- Ali MU, Gong Z, Ali MU, Wu X, Yao C (2021) Fossil energy con-

sumption, economic development, inward FDI impact on

ferent types of RE (especially hydro, solar, and wind) in CO2 emissions in Pakistan: testing EKC hypothesis through

the context of Morocco can be evaluated. ARDL model. International Journal of Finance & Economics

26(3):3210–3221

Data availability The datasets used during the current study are avail- Al-Mulali U, Ozturk I, Lean HH (2015) The influence of economic

able from the corresponding author on reasonable request. growth, urbanization, trade openness, financial development,

and renewable energy on pollution in Europe. Nat Hazards

Authors contribution SB conceptualized, conducted the economet- 79(1):621–644

ric analysis, and wrote the introduction. MM conceptualized, wrote Alola AA, Ozturk I (2021) Mirroring risk to investment within the EKC

the original draft, conducted the econometric analysis, highlighted hypothesis in the United States. J Environ Manag 293:112890

the policy implications, and supervised the work. AJ conducted the Anwar A, Sinha A, Sharif A, Siddique M, Irshad S, Anwar W, Malik S

literature review and reviewed the draft. AM analyzed the findings (2021) The nexus between urbanization, renewable energy con-

and conducted the literature review. HM wrote the introduction and sumption, financial development, and CO2 emissions: evidence

concluding remarks. MK wrote the original draft and compiled the from selected Asian countries. Environ Dev Sustain. https://doi.

overall manuscript. org/10.1007/s10668-021-01716-2

Apergis N (2016) Environmental Kuznets curves: new evidence on

both panel and country-level CO2 emissions. Energy Econom-

Declarations ics 54:263–271

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve

Ethics approval Not applicable hypothesis in Asian countries. Ecol Indic 52:16–22

Bahgat G (2013) Morocco energy outlook: opportunities and chal-

Consent to participate Not applicable lenges. The Journal of North African Studies 18(2):291–304

Balsalobre-Lorente D, Driha OM, Leitão NC, Murshed M (2021) The

Consent for publication Not applicable carbon dioxide neutralizing effect of energy innovation on inter-

national tourism in EU-5 countries under the prism of the EKC

Competing interests The authors declare no competing interests. hypothesis. J Environ Manag 298:113513

Balsalobre-Lorente D, Gokmenoglu KK, Taspinar N, Cantos-Cantos

JM (2019) An approach to the pollution haven and pollution

halo hypotheses in MINT countries. Environ Sci Pollut Res

26(22):23010–23026

Bandyopadhyay A, Rej S (2021) Can nuclear energy fuel an environ-

References mentally sustainable economic growth? Revisiting the EKC

hypothesis for India. Environ Sci Pollut Res. https://doi.org/10.

Abbasi KR, Hussain K, Redulescu M, Ozturk I (2021) Does natural 1007/s11356-021-15220-7

resources depletion and economic growth achieve the carbon Banerjee S, Murshed M (2020) Do emissions implied in net export

neutrality target of the UK? A way forward towards sustainable validate the pollution haven conjecture? Analysis of G7 and

development. Resources Policy 74:102341 BRICS countries. International Journal of Sustainable Economy

Abdouli M, Omri A (2021) Exploring the nexus among FDI inflows, 12(3):297–319. https://doi.org/10.1504/IJSE.2020.10033008

environmental quality, human capital, and economic growth in Bekhet HA, Othman NS (2018) The role of renewable energy to

the Mediterranean region. Journal of the Knowledge Economy validate dynamic interaction between CO2 emissions and GDP

12(2):788–810 toward sustainable development in Malaysia. Energy economics

Adedoyin FF, Agboola PO, Ozturk I, Bekun FV, Agboola MO (2021) 72:47–61

Environmental consequences of economic complexities in the Bekun FV, Agboola MO, Joshua U (2020) Fresh insight into the EKC

EU amidst a booming tourism industry: accounting for the hypothesis in Nigeria: accounting for total natural resources

role of brexit and other crisis events. J Clean Prod 305:127117 rent. In Econometrics of green energy handbook (pp. 221–243).

Adedoyin FF, Ozturk I, Agboola MO, Agboola PO, Bekun FV Springer, Cham

(2021b) The implications of renewable and non-renewable Beşe E, Kalayci S (2021) Environmental Kuznets curve (EKC): empiri-

energy generating in sub-Saharan Africa: the role of economic cal relationship between economic growth, energy consumption,

policy uncertainties. Energy Policy 150:112115 and CO2 emissions: evidence from 3 developed countries. Pano-

Ahmad M, Ahmed Z, Yang X, Hussain N, Sinha A (2021) Finan- economicus 68(4):483–506

cial development and environmental degradation: do human Bilgili F, Koçak E, Bulut Ü (2016) The dynamic impact of renewable

capital and institutional quality make a difference? Gondwana energy consumption on CO2 emissions: a revisited Environmen-

Research. https://doi.org/10.1016/j.gr.2021.09.012 tal Kuznets curve approach. Renew Sust Energ Rev 54:838–845

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

Boontome P, Therdyothin A, Chontanawat J (2017) Investigating the and emissions: a tale of Bangladesh. Environ Dev Sustain.

causal relationship between non-renewable and renewable energy https://doi.org/10.1007/s10668-021-01704-6

consumption, CO2 emissions and economic growth in Thailand. Işik C, Kasımatı E, Ongan S (2017) Analyzing the causalities between

Energy Procedia 138:925–930 economic growth, financial development, international trade,

Bouyghrissi S, Berjaoui A, Khanniba M (2020) The nexus between tourism expenditure and/on the CO2 emissions in Greece. Energy

renewable energy consumption and economic growth in Sources, Part B: Economics, Planning, and Policy 12(7):665–673

Morocco. Environ Sci Pollut Res URL. https://doi.org/10.1007/ Jebli MB, Youssef SB (2017) The role of renewable energy and agri-

s11356-020-10773-5 culture in reducing co2 emissions: evidence for north africa

Bulut U, Ucler G, Inglesi-Lotz R (2021) Does the pollution haven countries. Ecol Indic 74:295–301

hypothesis prevail in Turkey? Empirical evidence from nonlin- Jebli MB, Youssef SB (2017) The role of renewable energy and agri-

ear smooth transition models. Environ Sci Pollut Res 28:38563– culture in reducing CO2 emissions: evidence for North Africa

38572. https://doi.org/10.1007/s11356-021-13476-7 countries. Ecol Indic 74:295–301

Caglar AE (2020) The importance of renewable energy consumption Kahia M, Jebli MB, Belloumi M (2019) Analysis of the impact of

and FDI inflows in reducing environmental degradation: boot- renewable energy consumption and economic growth on carbon

strap ARDL bound test in selected 9 countries. J Clean Prod dioxide emissions in 12 MENA countries. Clean Techn Environ

264:121663 Policy 21(4):871–885

Charfeddine L, Kahia M (2019) Impact of renewable energy consump- Khan M, Ozturk I (2021) Examining the direct and indirect effects

tion and financial development on CO2 emissions and economic of financial development on CO2 emissions for 88 developing

growth in the MENA region: a panel vector autoregressive countries. J Environ Manag 293:112812

(PVAR) analysis. Renew Energy 139:198–213 Khoshnevis Yazdi S, Ghorchi Beygi E (2018) The dynamic impact

Cheikh NB, Zaied YB (2021) A new look at carbon dioxide emissions of renewable energy consumption and financial development on

in MENA countries. Clim Chang 166(3):1–22. https://doi.org/ CO2 emissions: for selected African countries. Energy Sources,

10.1007/s10584-021-03126-9 Part B: Economics, Planning, and Policy 13(1):13–20

Cheikh NB, Zaied YB, Chevallier J (2021) On the nonlinear relationship Koc S, Bulus GC (2020) Testing validity of the EKC hypothesis in

between energy use and CO2 emissions within an EKC framework: South Korea: role of renewable energy and trade openness. Envi-

evidence from panel smooth transition regression in the MENA ron Sci Pollut Res 27(23):29043–29054

region. Research in International Business and Finance 55:101331 Koondhar MA, Shahbaz M, Ozturk I, Randhawa AA, Kong R (2021)

Chishti MZ, Ahmad M, Rehman A, Khan MK (2021) Mitigations path- Revisiting the relationship between carbon emission, renewable

ways towards sustainable development: assessing the influence energy consumption, forestry, and agricultural financial develop-

of fiscal and monetary policies on carbon emissions in BRICS ment for China. Environ Sci Pollut Res 28:45459–45473. https://

economies. J Clean Prod 292:126035 doi.org/10.1007/s11356-021-13606-1

Chishti MZ, Ullah S, Ozturk I, Usman A (2020) Examining the asym- Li R, Wang Q, Liu Y, Jiang R (2021) Per-capita carbonemissions

metric effects of globalization and tourism on pollution emis- in 147 countries: The effect of economic, energy, social,

sions in South Asia. Environ Sci Pollut Res 27(22) and tradestructural changes. Sustainable Production and

Choukri K, Naddami A, Hayani S (2017) Renewable energy in emer- Consumption 27:1149-1164.

gent countries: lessons from energy transition in Morocco. Luqman M, Ahmad N, Bakhsh K (2019) Nuclear energy, renewable

Energy, Sustainability and Society 7(1):1–11 energy and economic growth in Pakistan: evidence from non-

Danish ZB, Wang B, Wang Z (2017) Role of renewable energy and linear autoregressive distributed lag model. Renew Energy

non-renewable energy consumption on ekc: Evidence from paki- 139:1299–1309

stan. J Clean Prod 156:855–864 Mahmood H, Alkhateeb TTY, Furqan M (2020) Exports, imports,

Dauda L, Long X, Mensah CN, Salman M, Boamah KB, Ampon- foreign direct investment and CO2 emissions in North Africa:

Wireko S, Dogbe CSK (2021) Innovation, trade openness and spatial analysis. Energy Reports 6:2403–2409

CO2 emissions in selected countries in Africa. J Clean Prod Mahmood H, Maalel N, Zarrad O (2019) Trade openness and CO2

281:125143 emissions: evidence from Tunisia. Sustainability 11(12):3295

De Gregorio J, Guidotti PE (1995) Financial development and eco- Maki D (2012) Tests for cointegration allowing for an unknown num-

nomic growth. World Dev 23(3):433–448 ber of breaks. Econ Model 29(5):2011–2015

Farhani S, Ozturk I (2015) Causal relationship between CO 2 emis- Malik MY, Latif K, Khan Z, Butt HD, Hussain M, Nadeem MA (2020)

sions, real GDP, energy consumption, financial development, Symmetric and asymmetric impact of oil price, FDI and eco-

trade openness, and urbanization in Tunisia. Environ Sci Pollut nomic growth on carbon emission in Pakistan: evidence from

Res 22(20):15663–15676 ARDL and non-linear ARDL approach. Sci Total Environ

Grossman GM, Krueger AB (1995) Economic growth and the envi- 726:138421

ronment. The Quarterly Journal of Economics 110(2):353–377 Mehmood U (2021) Globalization-driven CO 2 emissions in Singa-

Gyamfi BA, Bein MA, Ozturk I, Bekun FV (2020) The moderating role pore: an application of ARDL approach. Environ Sci Pollut Res

of employment in an environmental Kuznets curve framework 28(9):11317–11322

revisited in G7 countries. Indonesian Journal of Sustainability Mendonca AKS, de Andrade Conradi Barni G, Moro MF, Bornia AC,

Accounting and Management 4(2):241–248 Kupek E, Fernandes L (2020) Hierarchical modeling of the 50

Gyamfi BA, Ozturk I, Bein MA, Bekun FV (2021) An investigation largest economies to verify the impact of gdp, population and

into the anthropogenic effect of biomass energy utilization and renewable energy generation in co2 emissions. Sustainable Pro-

economic sustainability on environmental degradation in E7 duction and Consumption

economies. Biofuels Bioprod Bioref 15(3):840–851 Mert M, Caglar AE (2020) Testing pollution haven and pollution halo

Hakimi A, Hamdi H (2016) Trade liberalization, FDI inflows, envi- hypotheses for Turkey: a new perspective. Environ Sci Pollut Res

ronmental quality and economic growth: a comparative anal- 27(26):32933–32943

ysis between Tunisia and Morocco. Renew Sust Energ Rev Minlah MK, Zhang X (2021) Testing for the existence of the Envi-

58:1445–1456 ronmental Kuznets Curve (EKC) for CO 2 emissions in Ghana:

Hasan MA, Nahiduzzaman KM, Aldosary AS, Hewage K, Sadiq R evidence from the bootstrap rolling window Granger causality

(2021) Nexus of economic growth, energy consumption, FDI test. Environ Sci Pollut Res 28(2):2119–2131

13

Content courtesy of Springer Nature, terms of use apply. Rights reserved.

Environ Sci Pollut Res

Murshed M, Dao NTT (2020) Revisiting the C O 2 emission- Shahbaz M, Haouas I, Sohag K, Ozturk I (2020). The financial

induced EKC hypothesis in South Asia: the role of export development-environmental degradation nexus in the United

quality improvement. GeoJournal. https://d oi.o rg/1 0.1 007/ Arab Emirates: the importance of growth, globalization and

s10708-020-10270-9 structural breaks. Environ Sci Pollut Res 1–15

Murshed M, Ahmed R, Kumpamool C, Bassim M, Elheddad M Shahbaz M, Nasir MA, Roubaud D (2018) Environmental degradation

(2021a) The effects of regional trade integration and renewable in France: the effects of FDI, financial development, and energy

energy transition on environmental quality: evidence from South innovations. Energy Economics 74:843–857

Asian neighbours. Bus Strateg Environ. https://doi.org/10.1002/ Shahbaz M, Sbia R, Hamdi H, Ozturk I (2014) Economic growth, elec-

bse.2862 tricity consumption, urbanization and environmental degradation

Murshed M, Rashid S, Ulucak R, Dagar V, Rehman A, Alvarado relationship in United Arab Emirates. Ecol Indic 45:622–631

R, Nathaniel SP (2021b) Mitigating energy production-based Shahbaz M, Sinha A, Raghutla C, Vo XV (2022) Decomposing scale

carbon dioxide emissions in Argentina: the roles of renewable and technique effects of financial development and foreign

energy and economic globalization. Environ Sci Pollut Res. direct investment on renewable energy consumption. Energy

https://doi.org/10.1007/s11356-021-16867-y 238:121758

Naz S, Sultan R, Zaman K, Aldakhil AM, Nassani AA, Abro MMQ Sharif A, Mishra S, Sinha A, Jiao Z, Shahbaz M, Afshan S (2020)

(2019) Moderating and mediating role of renewable energy con- The renewable energy consumption-environmental degradation

sumption, FDI inflows, and economic growth on carbon dioxide nexus in top-10 polluted countries: fresh insights from quantile-

emissions: evidence from robust least square estimator. Environ on-quantile regression approach. Renew Energy 150:670–690