Professional Documents

Culture Documents

Summary 2013

Uploaded by

noel sincoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summary 2013

Uploaded by

noel sincoCopyright:

Available Formats

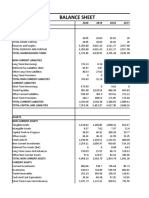

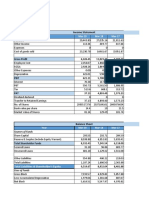

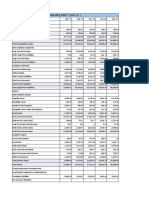

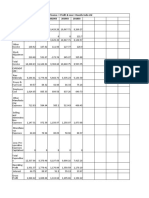

STATEMENT OF RECEIPTS AND EXPENDITURES

Summary by LGU Type

FY 2013 (Final)

In Php Million

Particulars PROVINCE CITY MUNICIPALITY TOTAL

LOCAL SOURCES 16,205.40 94,537.31 24,842.34 135,585.05

TAX REVENUE 7,306.44 75,444.52 13,752.35 96,503.31

Real Property Tax 5,571.06 29,517.42 6,184.10 41,272.58

Tax on Business 1,108.54 41,586.78 6,851.60 49,546.92

Other Taxes 626.84 4,340.32 716.65 5,683.81

NON-TAX REVENUE 8,898.97 19,092.79 11,089.99 39,081.74

Regulatory Fees (Permit and Licenses) 222.17 5,671.00 2,448.75 8,341.92

Service/User Charges (Service Income) 2,628.40 3,387.69 1,818.64 7,834.73

Receipts from Economic Enterprises (Business Income) 4,174.41 5,419.78 16,658.43

7,064.23

Other Receipts (Other General Income) 1,873.98 2,969.86 1,402.82 6,246.66

EXTERNAL SOURCES 74,234.24 73,319.98 107,682.37 255,236.59

Internal Revenue Allotment 69,441.74 69,478.72 102,029.50 240,949.95

Other Shares from National Tax Collections 2,915.63 2,495.99 3,826.33 9,237.96

Inter-Local Transfer 1,350.69 670.28 446.00 2,466.97

Extraordinary Receipts/Grants/Donations/Aids 526.18 674.98 1,380.55 2,581.71

TOTAL CURRENT OPERATING INCOME 90,439.64 167,857.29 132,524.72 390,821.64

LESS: CURRENT OPERATING EXPENDITURES (PS +

MOOE+FE)

General Public Services 31,728.84 62,594.58 69,488.44 163,811.86

Education, Culture & Sports/ Manpower Development 2,369.29 11,645.30 2,639.46 16,654.06

Health, Nutrition & Population Control 12,633.78 13,869.06 9,445.97 35,948.81

Labor & Employment 36.86 121.08 31.24 189.18

Housing & Community Development 542.89 5,647.58 1,501.85 7,692.31

Social Services & Social Welfare 3,397.90 6,158.28 6,707.66 16,263.84

Economic Services 16,171.97 20,647.35 18,266.58 55,085.90

Debt Service (FE) (Interest Expense & Other Charges) 1,181.46 2,091.19 1,103.07 4,375.72

TOTAL CURRENT OPERATING EXPENDITURES 68,063.01 122,774.41 109,184.26 300,021.68

NET OPERATING INCOME/(LOSS) FROM CURRENT

22,376.63 45,082.87 23,340.46 90,799.96

OPERATIONS

ADD: NON INCOME RECEIPTS

CAPITAL/INVESTMENT RECEIPTS 228.92 2,046.09 140.77 2,415.78

Proceeds from Sale of Assets 12.19 2,029.32 68.28 2,109.80

Proceeds from Sale of Debt Securities of Other Entities 194.49 0.00 0.00 194.49

Collection of Loans Receivables 22.24 16.77 72.49 111.49

RECEIPTS FROM LOANS AND BORROWINGS 2,901.16 5,658.20 1,941.52 10,500.87

Acquisition of Loans 2,901.16 5,328.20 1,889.97 10,119.33

Issuance of Bonds 0.00 330.00 51.55 381.55

OTHER NON-INCOME RECEIPTS 62.82 3.15 20.74 86.71

TOTAL NON-INCOME RECEIPTS 3,192.90 7,707.44 2,103.03 13,003.37

LESS: NON OPERATING EXPENDITURES

CAPITAL/INVESTMENT EXPENDITURES 7,731.49 21,597.02 10,219.75 39,548.26

Purchase/Construct of Property Plant and Equipment

7,731.49 10,216.90 39,545.42

(Capital Outlay) 21,597.02

Purchase of Debt Securities of Other Entities (Investment

0.00 2.85 2.85

Outlay) 0.00

Grant/Make Loan to Other Entities (Investment Outlay) 0.00 0.00 0.00 0.00

DEBT SERVICE (Principal Cost) 2,764.13 5,227.96 2,956.90 10,948.99

Payment of Loan Amortization 2,748.49 5,216.10 2,946.77 10,911.37

Retirement/Redemption of Bonds/Debt Securities 15.64 11.86 10.12 37.62

OTHER NON-OPERATING EXPENDITURES 0.00 0.00 84.67 84.67

TOTAL NON-OPERATING EXPENDITURES 10,495.62 26,824.98 13,261.32 50,581.93

NET INCREASE/(DECREASE) IN FUNDS 15,073.90 25,965.33 12,182.17 53,221.41

ADD: CASH BALANCE, BEGINNING 30,237.04 63,751.46 35,059.46 129,047.97

FUNDS AVAILABLE 45,310.95 89,716.79 47,241.63 182,269.37

Less: Payment of Prior Year Accounts Payable 10,914.07 19,387.89 5,163.86 35,465.82

CONTINUING APPROPRIATION 3,883.72 30,673.43 8,466.91 43,024.07

FUND BALANCE, END 30,513.15 39,655.47 33,610.86 103,779.48

Title: Statement of Receipts and Expenditures (SRE)

Originator: Bureau of Local Government Finance (BLGF)

Publication date: January 01, 2022

Extraction date: November 05, 2021

The Statement of Receipts and Expenditures report is the basic financial statement

prescribed by the Department of Finance to monitor the local government units’ (LGUs)

Abstract:

financial performance. This report is system generated through the LGU Integrated Financial

Tools (LIFT) System of the Bureau of Local Government Finance.

Process/Progress: Updated Annually

Access constraints: None

Use constraints: Acknowledgement of the Bureau of Local Government Finance as the source.

The data presented were based on the SRE reports submitted by the LGUs, through the local

treasurers, using the LIFT System of the BLGF.

The BLGF takes reasonable measures to ensure the accuracy and timeliness of the financial

data available. However, the BLGF assumes no responsibility for consequences, including

direct, indirect, special, or consequential damages arising out of or in connection with the use

or misuse of any information that is available. The user shall have the sole responsibility for

assessing the relevance and accuracy of the data.

Disclaimer: The BLGF uses its official website as the main medium of disclosing official information to the

public. Such information includes, but not limited to, quarterly and annual financial and

physical data sets and reports, annual reports, opinion and rulings, circulars, directives, and

other information related to local assessment and treasury operations, statement of revenues

and expenditures, and press/media releases, which are considered by the Bureau as material

information.

The data may be cited or reproduced in whole or in part provided that the BLGF is duly

informed and/or recognized. Users are restricted from reselling, redistributing, or creating

plagiaristic works for viable purposes without the expressed or written permission of BLGF.

Primary Contact Local Financial Data Analysis Division (LFDAD)

Contact Telephone number: (02) 8522-8771

Contact Fax Number: (02) 8522-8771

Contact Email Address: lfdad@blgf.gov.ph

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Data Submitted by Local Treasurers Thru Electronic Statement of Receipts and Expenditures (eSRE) System Data Extracted: October 2019Document1 pageData Submitted by Local Treasurers Thru Electronic Statement of Receipts and Expenditures (eSRE) System Data Extracted: October 2019Rudy LangeNo ratings yet

- Axis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKDocument2 pagesAxis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNo ratings yet

- Ratio Analysis of Asian PaintsDocument52 pagesRatio Analysis of Asian PaintsM43CherryAroraNo ratings yet

- Ch-3 Finance Department Trading & P&L AccountDocument4 pagesCh-3 Finance Department Trading & P&L AccountMit MehtaNo ratings yet

- Asian PaintsDocument40 pagesAsian PaintsHemendra GuptaNo ratings yet

- Business Valuation End TermDocument19 pagesBusiness Valuation End TermVaishali GuptaNo ratings yet

- Names of Team Members Roll No Criteria For Selection of Main CompanyDocument31 pagesNames of Team Members Roll No Criteria For Selection of Main CompanyGaurav SharmaNo ratings yet

- Bank ValuationDocument88 pagesBank Valuationsnithisha chandranNo ratings yet

- Assignment of Accounting For ManagersDocument17 pagesAssignment of Accounting For ManagersGurneet KaurNo ratings yet

- Consolidated Profit CanarabankDocument1 pageConsolidated Profit CanarabankMadhav LuthraNo ratings yet

- Financial Analysis (HAL) FinalDocument22 pagesFinancial Analysis (HAL) FinalAbhishek SoniNo ratings yet

- ICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- MKT Ca1Document96 pagesMKT Ca1Nainpreet KaurNo ratings yet

- Tata SteelDocument14 pagesTata Steeldevansh kakkarNo ratings yet

- CA2Document22 pagesCA2aryanvaish64No ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsJoydeep GoraiNo ratings yet

- Income Statement 2018-2019 %: Sources of FundsDocument8 pagesIncome Statement 2018-2019 %: Sources of FundsDebanjan MukherjeeNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDivya PandeyNo ratings yet

- Lakshmi Machine Works: PrintDocument9 pagesLakshmi Machine Works: Printlaxmi joshiNo ratings yet

- Finance Project On ITC (Statement Analysis)Document2 pagesFinance Project On ITC (Statement Analysis)jigar jainNo ratings yet

- Ashok Leyland Ltd.Document9 pagesAshok Leyland Ltd.Debanjan MukherjeeNo ratings yet

- Illustration Acc FMDocument22 pagesIllustration Acc FMHEMACNo ratings yet

- AK Sun Pharma UM21321Document4 pagesAK Sun Pharma UM21321akarshika raiNo ratings yet

- Group 10 - Apollo Tyre ModelDocument34 pagesGroup 10 - Apollo Tyre ModelJAY SANTOSH KHORENo ratings yet

- Group 1 Adani PortsDocument12 pagesGroup 1 Adani PortsshreechaNo ratings yet

- Print: Previous YearsDocument2 pagesPrint: Previous YearsArun BineshNo ratings yet

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaNo ratings yet

- Rs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37Document6 pagesRs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37priyanshu14No ratings yet

- Analysis of Adani PortsDocument63 pagesAnalysis of Adani PortsHarsh JaswalNo ratings yet

- CHAPTER - 4 Data Analysis and InterpretationDocument12 pagesCHAPTER - 4 Data Analysis and InterpretationSarva ShivaNo ratings yet

- VerticalDocument2 pagesVerticalPatricia PeñaNo ratings yet

- Annual Report 2021Document3 pagesAnnual Report 2021hxNo ratings yet

- Balance Sheet ITCDocument2 pagesBalance Sheet ITCProsenjit RoyNo ratings yet

- CV Assignment - Agneesh DuttaDocument14 pagesCV Assignment - Agneesh DuttaAgneesh DuttaNo ratings yet

- BS TataDocument18 pagesBS Tataitubanerjee28No ratings yet

- 02 BacarraIN2020 FSDocument9 pages02 BacarraIN2020 FSRichard MendezNo ratings yet

- Walt Disney Co/The (DIS US) - ADVERTDocument4 pagesWalt Disney Co/The (DIS US) - ADVERTRahil VermaNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisEashaa SaraogiNo ratings yet

- Hindalco Industries Balance Sheet, Hindalco Industries Financial Statement & AccountsDocument3 pagesHindalco Industries Balance Sheet, Hindalco Industries Financial Statement & AccountsSharon T100% (1)

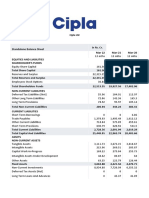

- Cipla LTDDocument6 pagesCipla LTDscribd sogawNo ratings yet

- Nestle P and LDocument2 pagesNestle P and Lashmit gumberNo ratings yet

- Financial Analysis of Sun PharmaDocument7 pagesFinancial Analysis of Sun PharmahemanshaNo ratings yet

- Itc LTD: Balance Sheet FY17-18 FY16-17 FY15-16Document4 pagesItc LTD: Balance Sheet FY17-18 FY16-17 FY15-16gouri khanduallNo ratings yet

- CMA CIA 3 YateeDocument38 pagesCMA CIA 3 YateeYATEE TRIVEDI 21111660No ratings yet

- Tatasteel Inclass DiscusionDocument6 pagesTatasteel Inclass DiscusionADAMYA VARSHNEYNo ratings yet

- Group Project - ACCDocument17 pagesGroup Project - ACCLovie GuptaNo ratings yet

- Balance Sheet As at 31St March, 2009: DirectorDocument4 pagesBalance Sheet As at 31St March, 2009: Directormj1990No ratings yet

- Tvs Motor 2019 2018 2017 2016 2015Document108 pagesTvs Motor 2019 2018 2017 2016 2015Rima ParekhNo ratings yet

- Surajit SahaDocument30 pagesSurajit SahaAgneesh DuttaNo ratings yet

- JL22PG002 NMDCDocument35 pagesJL22PG002 NMDCHemendra GuptaNo ratings yet

- Tata Motors - Strategy - DataDocument17 pagesTata Motors - Strategy - DataSarvesh SmartNo ratings yet

- The Magnificent-Equity ValuationDocument70 pagesThe Magnificent-Equity ValuationMohit TewaryNo ratings yet

- HDFC ValuationDocument112 pagesHDFC ValuationAmit Kumar PaswanNo ratings yet

- Assets Non-Current Assets: (' in Crores)Document6 pagesAssets Non-Current Assets: (' in Crores)Amit JhaNo ratings yet

- Assingment SCM SEM4 - 1Document17 pagesAssingment SCM SEM4 - 1KARTHIYAENI VNo ratings yet

- 09 Cuyo2021 - Part1 FSDocument6 pages09 Cuyo2021 - Part1 FSKebe VajionNo ratings yet

- Ceat Tyres LTD.: Fsa AssignmentDocument37 pagesCeat Tyres LTD.: Fsa AssignmentSourajit SanyalNo ratings yet

- Fsa GroupDocument25 pagesFsa Groupakarshika raiNo ratings yet

- Term Paper Sandeep Anurag GautamDocument13 pagesTerm Paper Sandeep Anurag GautamRohit JainNo ratings yet

- Backcasting Wheel WFR2020Document10 pagesBackcasting Wheel WFR2020noel sincoNo ratings yet

- Summary 2013Document2 pagesSummary 2013noel sincoNo ratings yet

- A. SRE by LGUDocument630 pagesA. SRE by LGUAdrian ManlangitNo ratings yet

- A. SRE by LGUDocument630 pagesA. SRE by LGUAdrian ManlangitNo ratings yet

- A. SRE by LGUDocument630 pagesA. SRE by LGUAdrian ManlangitNo ratings yet

- Summary 2013Document2 pagesSummary 2013noel sincoNo ratings yet

- Chapter 4 Draft 2011 04 20 PDFDocument21 pagesChapter 4 Draft 2011 04 20 PDFAnbu LiyonNo ratings yet

- Summary 2013Document2 pagesSummary 2013noel sincoNo ratings yet

- A. SRE by LGUDocument630 pagesA. SRE by LGUAdrian ManlangitNo ratings yet

- ADocument346 pagesAnoel sincoNo ratings yet

- A. SRE by LGUDocument630 pagesA. SRE by LGUAdrian ManlangitNo ratings yet

- Burnham Et Al - Research Methods in Politics - Chapter 1Document22 pagesBurnham Et Al - Research Methods in Politics - Chapter 1rein_nantesNo ratings yet

- Deed of AdjudicationDocument2 pagesDeed of Adjudicationnoel sincoNo ratings yet

- Philippine Legal Forms 2015bDocument394 pagesPhilippine Legal Forms 2015bJoseph Rinoza Plazo100% (14)

- C O M P L A I N T: Plaintiff, - VersusDocument6 pagesC O M P L A I N T: Plaintiff, - Versusnoel sinco100% (1)

- RDs Cup 201806212018114050Document2 pagesRDs Cup 201806212018114050noel sincoNo ratings yet

- Research Methods in Politics PDFDocument353 pagesResearch Methods in Politics PDFBrenette Abrenica100% (1)

- Research Methods in Politics PDFDocument353 pagesResearch Methods in Politics PDFBrenette Abrenica100% (1)

- Sample MoaDocument2 pagesSample Moanoel sinco100% (1)

- Affidavit of Desistance SampleDocument2 pagesAffidavit of Desistance Samplenoel sincoNo ratings yet

- Application For ProbationDocument2 pagesApplication For ProbationWilliam Enrile93% (15)

- March 2019 TransmittalDocument6 pagesMarch 2019 Transmittalnoel sincoNo ratings yet

- Judicial AffidavitDocument2 pagesJudicial Affidavitnoel sincoNo ratings yet

- Republic of The Philippines Municipal Trial Court in Cities 6th Judicial Region Branch 6 Iloilo CityDocument3 pagesRepublic of The Philippines Municipal Trial Court in Cities 6th Judicial Region Branch 6 Iloilo Citynoel sincoNo ratings yet

- Reply AffidavitDocument7 pagesReply Affidavitnoel sincoNo ratings yet

- Demand LetterDocument2 pagesDemand Letternoel sincoNo ratings yet

- Republic of The Philippines Municipal Trial Court in Cities 6th Judicial Region Branch 6 Iloilo CityDocument3 pagesRepublic of The Philippines Municipal Trial Court in Cities 6th Judicial Region Branch 6 Iloilo Citynoel sincoNo ratings yet

- Lto InquiryDocument1 pageLto Inquirynoel sincoNo ratings yet

- JAO No.2014-01 PDFDocument25 pagesJAO No.2014-01 PDFronald s. rodrigoNo ratings yet

- Miri Datalogger FlyerDocument1 pageMiri Datalogger FlyerernestoveigaNo ratings yet

- Sociology Internal AssessmentDocument21 pagesSociology Internal AssessmentjavoughnNo ratings yet

- Marking Scheme According To AIDocument2 pagesMarking Scheme According To AIAbdul RehmanNo ratings yet

- Lesson Plan Entre P Dec 7Document12 pagesLesson Plan Entre P Dec 7yannie isananNo ratings yet

- Water Cement RatioDocument5 pagesWater Cement RatioCastro FarfansNo ratings yet

- HRM ModelDocument6 pagesHRM ModelsakshiNo ratings yet

- QBM101Document37 pagesQBM101Shang BinNo ratings yet

- Functional Plant Manager 2. Geographical Vice PresidentDocument5 pagesFunctional Plant Manager 2. Geographical Vice PresidentVic FranciscoNo ratings yet

- Chemistry Bridging Course Lecture NotesDocument3 pagesChemistry Bridging Course Lecture NotesNNo ratings yet

- Anti LeproticDocument9 pagesAnti LeproticMeenakshi shARMANo ratings yet

- Shrutiand SmritiDocument9 pagesShrutiand SmritiAntara MitraNo ratings yet

- Q1 WK 2 To 3 Las Fabm2 Kate DionisioDocument8 pagesQ1 WK 2 To 3 Las Fabm2 Kate DionisioFunji BuhatNo ratings yet

- ParaklesisDocument23 pagesParaklesisDiana ObeidNo ratings yet

- Wind Turbine Power Plant Seminar ReportDocument32 pagesWind Turbine Power Plant Seminar ReportShafieul mohammadNo ratings yet

- John Deere CaseDocument2 pagesJohn Deere CaseAldo ReynaNo ratings yet

- Juan LunaDocument2 pagesJuan LunaClint Dave OacanNo ratings yet

- Reading Comprehension Pre TestDocument7 pagesReading Comprehension Pre TestMimimiyuhNo ratings yet

- Supplier Accreditation Application-V1 - RevisedDocument8 pagesSupplier Accreditation Application-V1 - RevisedCandiceCocuaco-ChanNo ratings yet

- With Pneumatic and Electric Actuators: Datasheet 448001 EnglishDocument7 pagesWith Pneumatic and Electric Actuators: Datasheet 448001 EnglishPinak ProjectsNo ratings yet

- 500KVA Rigsafe Framed Generator (8900Kgs)Document1 page500KVA Rigsafe Framed Generator (8900Kgs)Elsad HuseynovNo ratings yet

- Air Quality StandardsDocument2 pagesAir Quality StandardsJanmejaya BarikNo ratings yet

- Inertia Physics: Defi Ni Ti OnDocument2 pagesInertia Physics: Defi Ni Ti OnSentoash NaiduNo ratings yet

- Arid Agriculture University, RawalpindiDocument4 pagesArid Agriculture University, RawalpindiIsHa KhAnNo ratings yet

- Brand Loyalty & Competitive Analysis of Pankaj NamkeenDocument59 pagesBrand Loyalty & Competitive Analysis of Pankaj NamkeenBipin Bansal Agarwal100% (1)

- Segment Reporting Decentralized Operations and Responsibility Accounting SystemDocument34 pagesSegment Reporting Decentralized Operations and Responsibility Accounting SystemalliahnahNo ratings yet

- Scania DC12 Operator's ManualDocument65 pagesScania DC12 Operator's ManualAlex Renne Chambi100% (3)

- The Light BulbDocument6 pagesThe Light Bulbapi-244765407No ratings yet

- Analysis and Design of Suspended Buildings: Creative and Innovative Report-1Document14 pagesAnalysis and Design of Suspended Buildings: Creative and Innovative Report-1Nirmal RaviNo ratings yet

- BS en 13369-2018 - TC - (2020-11-30 - 09-45-34 Am)Document164 pagesBS en 13369-2018 - TC - (2020-11-30 - 09-45-34 Am)Mustafa Uzyardoğan100% (1)

- Inspection and Test Plan (ITP) For Spherical Storage Tanks: Dehloran Olefin PlantDocument9 pagesInspection and Test Plan (ITP) For Spherical Storage Tanks: Dehloran Olefin PlantbahmanNo ratings yet