Professional Documents

Culture Documents

Accounting Part 1

Uploaded by

Nabeel Siddiqui0 ratings0% found this document useful (0 votes)

9 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesAccounting Part 1

Uploaded by

Nabeel SiddiquiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

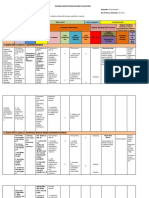

APEX GROUP OF COLLEGES

Paper: P. Accounting Send-up Examination 2023 Class: Intermediate (Part-I)

Marks: 20 OBJECTIVE TYPE Time:30 Minutes

Name: ____________________ Paper Code 6 0 8 2

Class/Section: ____________ Roll No.___________ Date:

NOTE: Write your Roll No. in space provided. Over-writing, Cutting, Erasing, using lead pencil will result in loss of marks.

Q.No.1: You have four choices for each objective type question as A, B, C and D. The choice which you think is

correct, fill that circle in front of that question number. Use marker or pen to fill the circle. Cutting or filling two or

more circles will result in zero mark in that question.

Note: Over-writing, cutting, erasing, using lead pencil, will result in loss of marks. (1x20=20)

Q.1 Question A B C Ds

All those things which are purchase

1 Goods Asset’s Liabilities Sale

for resale purpose are called.

Primary Final Secondary

2 Book- keeping provides the. All

function information function

3 How many branch of accounting? Two Three Four One

The term expenses and expenditures Singular or

4 Same Different Opposite

are. plural

A person who owes money to the

5 Debtor Creditor Shareholder Owner

business is called.

Stages for proceeding a transaction

6 Recording Classifying Summarizing All

are

Expenses paid by a business Cash and

7 Cash Capital None of these

decrease. Capital

8 Every transaction affects. One item Two items Four items So many items

9 Resources owned by the business. Assets Liabilities Capital Profit

When cash is paid to creditors, it will

10 Cash Capital Debtor None of these

decrease.

The excess of asset over liabilities is

11 Profit income Capital Equities

called.

Cash and Cash and Cash and

12 Received Cash from Azhar will affect. None

owner equity creditor debtor

Cash and Cash and Cash and Cash and

13 Cash paid to Nadeem will affect.

owner equity creditors debtors goods

14 Discount allowed is. An asset An expenses A revenue Liability

15 How many categories of accounts? Two Three Four Five

Asset’s Asset’s

16 Debit the increase in. Assets Capital All

expenses revenue

Preliminary

17 Journal is called the book of. Original entry First entry All

entry

18 Discount received is. Asset Expenses Revenue Liability

Increase Increase Increase

19 Credit signifies. All

liability revenue capital

Increase Increase Increase

20 Debit signifies All

liability revenue capital

APEX GROUP OF COLLEGES

Paper: P. Accounting Send-up Examination 2023 Class: Intermediate (Part-I)

Marks: 80 SUBJECTIVE TYPE Time:2:30 Hrs

Name: Date:

_____________________

SECTION-II

Q. NO.2: Attempt Any Five Definitions. 5x2=10

i. Define Accounting ? v. Define Transaction ?

ii. Define Book Keeping ? vi. Define Drawing ?

iii. Define Business ? vii. Define Liability ?

iv. What is Assets ? viii. What is mean by Sales ?

Q. NO.3: Attempt Any Five Definitions. 5x2=10

i. Define Trade Discount ? v. What is mean by Stock ?

ii. Define Double Entry System ? vi. Define Commission ?

iii. What is mean by Cash Sales ? vii. What is meant by Journal ?

iv. Define Real Account ? viii. Define Accounting Equation ?

Note: Attempt any THREE Questions? (20x3=60)

Q. NO.4 Record the given transactions in journal (20)

Business started with Cash Rs. 10,000

Goods purchased for cash Rs. 1000.

Paid Rent by Cash Rs. 500

Commission received by cash Rs. 500.

Sold Goods for Cash Rs. 1200.

Q. No 5 Show the effect of the following transactions upon the accounting equation: (20)

i. Ali started business with cash Rs.250000.

ii. Goods bought by cash Rs. 12000.

iii. He Purchase Building Rs. 100000.

iv. He paid Rent Rs. 1200

v. He sold goods for cash Rs. 3000

Q. NO.6 Prepare Journal of the Following Transactions,

1) Mr Sultan Started Business With cash Rs. 10,000.

2) He Purchased Goods Form Ali Rs. 2000.

3) He sold Goods for Cash Rs. 500.

4) He withdraw from business for personal use Rs. 1000

5) He Paid commission Rs. 100.

Q.No.7 Prepare Accounting Equation,

Ali started business with Cash Rs. 20000.

He purchased Goods Rs 10000.

He sold Goods to Raheel Rs 5000.

He paid salaries Rs 2000.

He paid into bank Rs 1000

Q. NO.8 Prepare Journal of the Following Transactions,

1) Mr Sultan Started Business With cash Rs. 10,000.

2) He Purchased Goods Form Ali Rs. 2000.

3) He sold Goods for Cash Rs. 500.

4) He withdraw from business for personal use Rs. 1000

5) He Paid commission Rs. 100.

You might also like

- Professional Accounting PackageDocument72 pagesProfessional Accounting PackageAnmol poudelNo ratings yet

- Financial Accounting I: Winter 2020-Lecture "2"Document32 pagesFinancial Accounting I: Winter 2020-Lecture "2"Malak RabieNo ratings yet

- Tutorial 1 - SsDocument3 pagesTutorial 1 - SsChigoziem OnyekawaNo ratings yet

- Debit and Credit: Fundamentals of Accountancy, Business and Management 1Document10 pagesDebit and Credit: Fundamentals of Accountancy, Business and Management 1triicciaa faith100% (1)

- Book Keeping AccountancyDocument8 pagesBook Keeping AccountancyNarra JanardhanNo ratings yet

- CFAB Accounting Chap02 Accounting EquationDocument38 pagesCFAB Accounting Chap02 Accounting EquationHoa NguyễnNo ratings yet

- Financial Statements As A Management ToolDocument20 pagesFinancial Statements As A Management TooldavidimolaNo ratings yet

- Ch.1: Accounting in Action (Cont'd)Document29 pagesCh.1: Accounting in Action (Cont'd)mariam raafatNo ratings yet

- Acct615 NjitDocument24 pagesAcct615 NjithjnNo ratings yet

- Lecture 5 - Cash Flow Statements - JJDocument23 pagesLecture 5 - Cash Flow Statements - JJTariq KhanNo ratings yet

- 01 Accounting StatementsDocument4 pages01 Accounting StatementsTijana DoberšekNo ratings yet

- Accounting Principles: Rapid ReviewDocument3 pagesAccounting Principles: Rapid ReviewAhmedNiazNo ratings yet

- Exercise 2 (Chapter 1, 3&4) - AnswerDocument4 pagesExercise 2 (Chapter 1, 3&4) - AnswerNURUL IZZATI AHMAD FERDAUSNo ratings yet

- Practice Assessment in Actg 1Document4 pagesPractice Assessment in Actg 1Roly Jr PadernaNo ratings yet

- The Expanded Ledger: Revenue, Expense, and DrawingsDocument37 pagesThe Expanded Ledger: Revenue, Expense, and DrawingsNavroopamNo ratings yet

- ACC406 - Topic 4a - Principle of Double Entry and Books of AccountDocument23 pagesACC406 - Topic 4a - Principle of Double Entry and Books of AccountCarol LeslyNo ratings yet

- Finance For Non Finance ProfessionalsDocument38 pagesFinance For Non Finance ProfessionalsdeepaliNo ratings yet

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Document7 pagesACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573No ratings yet

- Topic 3 - Accounting Classification and Accounting Equation LatestDocument28 pagesTopic 3 - Accounting Classification and Accounting Equation LatestKhairul AkmalNo ratings yet

- Chapter 2 Fundamentals of Accounting Module PDFDocument12 pagesChapter 2 Fundamentals of Accounting Module PDFCyrille Kaye TorrecampoNo ratings yet

- IAL Accounting SB 1 AnswersDocument144 pagesIAL Accounting SB 1 AnswersHarvey SahotaNo ratings yet

- Accounting Lecture 1Document3 pagesAccounting Lecture 1Karl haddadNo ratings yet

- LLH9e Ch03 SolutionsManual FINALDocument68 pagesLLH9e Ch03 SolutionsManual FINALIgnjat100% (1)

- Working Capital IDocument22 pagesWorking Capital IIsmiyar CahyaniNo ratings yet

- Chapter 4-JournalDocument35 pagesChapter 4-JournalVivek Garg100% (1)

- I. Liquidity Ratios No Ratio Method of Computation SignificanceDocument14 pagesI. Liquidity Ratios No Ratio Method of Computation SignificanceVictor M Akbar TukanNo ratings yet

- FinMan Chap2CDocument21 pagesFinMan Chap2CMandy GimeNo ratings yet

- Lecture - 2-3 - The - Accounting - Equation - 2017-18 - Student VersionDocument24 pagesLecture - 2-3 - The - Accounting - Equation - 2017-18 - Student VersionCharalambos KyprianouNo ratings yet

- Master of Accountancy - by SlidesgoDocument73 pagesMaster of Accountancy - by SlidesgoPhan Anh TúNo ratings yet

- Project of Financial Reporting AnalysisDocument29 pagesProject of Financial Reporting AnalysisAhmad Mujtaba PhambraNo ratings yet

- Lecture Slides - Chapter 1 2Document66 pagesLecture Slides - Chapter 1 2Van Dat100% (1)

- Lecture Slides - Chapter 1 & 2Document66 pagesLecture Slides - Chapter 1 & 2Phan Đỗ QuỳnhNo ratings yet

- Lecture Slides - Chapter 1 2Document69 pagesLecture Slides - Chapter 1 2Nhi BuiNo ratings yet

- Class Activity 4Document2 pagesClass Activity 4scrollen.salven0iNo ratings yet

- Ch02. Accounting EquationDocument22 pagesCh02. Accounting EquationHải TrầnNo ratings yet

- Chapter 03 Solutions ManualDocument75 pagesChapter 03 Solutions ManualElio AseroNo ratings yet

- Answers May Be Written Either in English or in Malayalam: Reg. No - NameDocument8 pagesAnswers May Be Written Either in English or in Malayalam: Reg. No - Namevimal johnsonNo ratings yet

- 6 - ConceptsDocument8 pages6 - ConceptsAsma GaniNo ratings yet

- FM With AnsDocument2 pagesFM With Ansriston dmelloNo ratings yet

- Seatwork Financial StatementsDocument3 pagesSeatwork Financial StatementsJean Diane JoveloNo ratings yet

- LLP Full NotesDocument15 pagesLLP Full NotesJay Desai100% (1)

- Accounting Chapter 4Document21 pagesAccounting Chapter 4MUHAMMAD ZULHAIRI BIN ROSLI STUDENTNo ratings yet

- Financial RatiosDocument9 pagesFinancial RatiosTariq qandeelNo ratings yet

- FAR Assignment 2Document2 pagesFAR Assignment 2Andrea Monique AlejagaNo ratings yet

- Part 1 AccountingDocument3 pagesPart 1 AccountingAl-Hafeez Group of AcademiesNo ratings yet

- Books of Accounts and Double Entry Sytem BSAIS 1A Group 2Document27 pagesBooks of Accounts and Double Entry Sytem BSAIS 1A Group 2Marydelle De Austria-De GuiaNo ratings yet

- DocumentDocument80 pagesDocumentzohaib bilgramiNo ratings yet

- Chapter 1 - Accounting in ActionDocument42 pagesChapter 1 - Accounting in ActionFify AmalindaNo ratings yet

- Chapter 3 (Accounting Steps 1-4)Document7 pagesChapter 3 (Accounting Steps 1-4)Danica Shane EscobidalNo ratings yet

- Final AccountsDocument7 pagesFinal AccountsSushank Kumar 7278No ratings yet

- Fabm 1 PS 11 Q3 0501Document59 pagesFabm 1 PS 11 Q3 0501Clyde LopezNo ratings yet

- Reporting and Analyzing Cash FlowsDocument39 pagesReporting and Analyzing Cash FlowslolokoNo ratings yet

- Book KeepingDocument19 pagesBook Keepingshwetabh sharmaNo ratings yet

- Accounting ConceptsDocument26 pagesAccounting ConceptsManoj A TalikotiNo ratings yet

- Accounting Essentials Chapter 3 SynthesisDocument1 pageAccounting Essentials Chapter 3 SynthesisdaraNo ratings yet

- Accounts 2018 AnsDocument32 pagesAccounts 2018 AnsAshish YadavNo ratings yet

- Adjusting Entries and Merchandising BusinessDocument5 pagesAdjusting Entries and Merchandising BusinessLing lingNo ratings yet

- AccountingDocument67 pagesAccountinggunanNo ratings yet

- Question - Chapter 2Document17 pagesQuestion - Chapter 2Mạnh Đỗ ĐứcNo ratings yet

- Guide To Growing MangoDocument8 pagesGuide To Growing MangoRhenn Las100% (2)

- Notifier AMPS 24 AMPS 24E Addressable Power SupplyDocument44 pagesNotifier AMPS 24 AMPS 24E Addressable Power SupplyMiguel Angel Guzman ReyesNo ratings yet

- PeopleSoft Application Engine Program PDFDocument17 pagesPeopleSoft Application Engine Program PDFSaurabh MehtaNo ratings yet

- Efs151 Parts ManualDocument78 pagesEfs151 Parts ManualRafael VanegasNo ratings yet

- NOP PortalDocument87 pagesNOP PortalCarlos RicoNo ratings yet

- 500 Logo Design Inspirations Download #1 (E-Book)Document52 pages500 Logo Design Inspirations Download #1 (E-Book)Detak Studio DesainNo ratings yet

- Financial Derivatives: Prof. Scott JoslinDocument44 pagesFinancial Derivatives: Prof. Scott JoslinarnavNo ratings yet

- 6 V 6 PlexiDocument8 pages6 V 6 PlexiFlyinGaitNo ratings yet

- Difference Between Mountain Bike and BMXDocument3 pagesDifference Between Mountain Bike and BMXShakirNo ratings yet

- Avalon LF GB CTP MachineDocument2 pagesAvalon LF GB CTP Machinekojo0% (1)

- Aisladores 34.5 KV Marca Gamma PDFDocument8 pagesAisladores 34.5 KV Marca Gamma PDFRicardo MotiñoNo ratings yet

- Fidp ResearchDocument3 pagesFidp ResearchIn SanityNo ratings yet

- Urun Katalogu 4Document112 pagesUrun Katalogu 4Jose Luis AcevedoNo ratings yet

- Heavy LiftDocument4 pagesHeavy Liftmaersk01No ratings yet

- HRO (TOOLS 6-9) : Tool 6: My Family and My Career ChoicesDocument6 pagesHRO (TOOLS 6-9) : Tool 6: My Family and My Career ChoicesAkosi EtutsNo ratings yet

- Microwave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDocument28 pagesMicrowave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDominico Delven YapinskiNo ratings yet

- 4109 CPC For ExamDocument380 pages4109 CPC For ExamMMM-2012No ratings yet

- Job Description For QAQC EngineerDocument2 pagesJob Description For QAQC EngineerSafriza ZaidiNo ratings yet

- HandloomDocument4 pagesHandloomRahulNo ratings yet

- Rebar Coupler: Barlock S/CA-Series CouplersDocument1 pageRebar Coupler: Barlock S/CA-Series CouplersHamza AldaeefNo ratings yet

- Web Technology PDFDocument3 pagesWeb Technology PDFRahul Sachdeva100% (1)

- Role of The Government in HealthDocument6 pagesRole of The Government in Healthptv7105No ratings yet

- Amare Yalew: Work Authorization: Green Card HolderDocument3 pagesAmare Yalew: Work Authorization: Green Card HolderrecruiterkkNo ratings yet

- CHAPTER 3 Social Responsibility and EthicsDocument54 pagesCHAPTER 3 Social Responsibility and EthicsSantiya Subramaniam100% (4)

- Pindyck TestBank 7eDocument17 pagesPindyck TestBank 7eVictor Firmana100% (5)

- Ludwig Van Beethoven: Für EliseDocument4 pagesLudwig Van Beethoven: Für Eliseelio torrezNo ratings yet

- Ishares Core S&P/TSX Capped Composite Index Etf: Key FactsDocument2 pagesIshares Core S&P/TSX Capped Composite Index Etf: Key FactsChrisNo ratings yet

- Basic Vibration Analysis Training-1Document193 pagesBasic Vibration Analysis Training-1Sanjeevi Kumar SpNo ratings yet

- Office Storage GuideDocument7 pagesOffice Storage Guidebob bobNo ratings yet

- Subqueries-and-JOINs-ExercisesDocument7 pagesSubqueries-and-JOINs-ExerciseserlanNo ratings yet