Professional Documents

Culture Documents

MAS03

Uploaded by

Jhanella BergonioOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MAS03

Uploaded by

Jhanella BergonioCopyright:

Available Formats

MANAGEMENT ADVISORY SERVICES

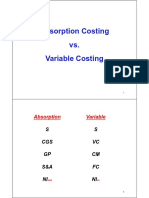

MAS03 – VARIABLE ABSORPTION COST

VARIABL ABSORPTION

E COST COST

1. TREATMENT PERIOD PERIOD COST

ON FIXED COST [PROPORTIONA

FACTORY [FULL L AMOUNT]

OVERHEAD AMOUNT] Problem No. 3, pg. 2

COST

MANUFACTURING

DIRECT MATERIALS ✔ ✔

DIRECT LABOR ✔ ✔

VARIABLE ✔ ✔

OVERHEAD

FIXED OVERHEAD EXCLUDE ✔

D

NON-MANUFACTURING COST

SELLING & EXCLUDE EXCLUDED

ADMINISTRATIVE D

COST

2. REQUIRED BY EXCLUDE ✔

PFRS D

3. FOCUS OF INTERNAL EXTERNAL

REPORTING Problem No. 4, pg. 3

4. INCOME CM/CVP TRADITIONAL

STATEMENT S – XX S – XX V Production Cost = 100,000 – 80,000 = 20,000 units

FORMAT VC –(XX) COGS – (XX) F

CM- XX GP – XX 20,000 * FFOH =?

FC (XX) OPEX – (XX) V

F 20,000 * (180,000/100,000) =?

OI - XX OI – XX

5. TREATMENT IGNORED CONSIDERED 20,000 * (1.8) = 36,000

ON VOLUME

VARIANCE Problem No. 5, pg. 3

6. INCOME SALES PRODUCTION

FLUCTUATES Absorption Cost Net Income xx

WITH

(+) B.I. [FFOH] (Units * FFOH/UNIT) xx

(-) E.I. [FFOH] (Units * FFOH/UNIT) 2,000

RULES ON NET INCOME

Variable Cost Net Income xx

SALES > SALES < SALES =

PRODUCTION PRODUCTION PRODUCTION 15,000 – 13,000 = 2,000

VARIABLE VARIABLE VARIABLE

COSTING NET COSTING NET COSTING 2,000 units * P4 = P8,000

INCOME > INCOME < NET INCOME

ABSORPTION ABSORPTION =

COSTING NET COSTING NET ABSORPTION

(P60,000/15,000 units)

INCOME INCOME COSTING

NET INCOME Problem No. 6, pg. 3 & No. 8, pg. 4

BEG. INC. > BEG. INC. < BEG. INC. =

ENDING INC. ENDING INC. ENDING INC. Variable Cost Absorption Cost

DM 3.00 3.00

DL 2.50 2.50

Absorption Cost Net Income xx VOH 1.80 1.80

(+) B.I. [FFOH] (Units * FFOH/UNIT) xx FOH - 4.00

7.30 (#8) 11.30 (#6)

(-) E.I. [FFOH] (Units * FFOH/UNIT) (xx)

Variable Cost Net Income xx

MANAGEMENT ADVISORY SERVICES

Actual FFOH xx

SPENDING

Budgeted FFOH (NC*FFOH/unit) xx

VOLUME

Applied FFOH (AC*FFOH/unit) xx

Problem No.7, pg. 4

Actual FFOH P200,000 0

Budgeted FFOH (50,000 * P4) P200,000

P4,000 (F)

Applied FFOH (51,000 * P4) P204,000

Problem No.9, pg. 4

Another way on how to solve the problem:

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Ch. 8 - Cost Analysis: Managerial Economics Applications Strategy and Tactics P. 275Document20 pagesCh. 8 - Cost Analysis: Managerial Economics Applications Strategy and Tactics P. 275William DC Rivera100% (2)

- Throughput Costing ExampleDocument10 pagesThroughput Costing ExampleNikunj NagarNo ratings yet

- Exercise 1 (Variable and Absorption Costing Unit Product Costs and Income Statements)Document7 pagesExercise 1 (Variable and Absorption Costing Unit Product Costs and Income Statements)Bella RonahNo ratings yet

- Cost Accounting Cycle (Multiple Choice)Document3 pagesCost Accounting Cycle (Multiple Choice)Rosselle Manoriña100% (1)

- Cost Accounting - AC, VC, ABCDocument21 pagesCost Accounting - AC, VC, ABCPortia TurianoNo ratings yet

- Problem Lecture - Relevant CostingDocument9 pagesProblem Lecture - Relevant CostingAhga MoonNo ratings yet

- Long Run Short RunDocument17 pagesLong Run Short RunA PNo ratings yet

- Chapter 5 MASDocument3 pagesChapter 5 MASDemie demsNo ratings yet

- Variable Cost Tools: As A DecisionDocument17 pagesVariable Cost Tools: As A DecisionTusif Islam RomelNo ratings yet

- Cost Volume Profit AnalysisDocument40 pagesCost Volume Profit AnalysisRajguru JavalagaddiNo ratings yet

- Strategic Cost Management 101Document8 pagesStrategic Cost Management 101Hoope JisonNo ratings yet

- Variable and Absorption CostingDocument52 pagesVariable and Absorption CostingcruzchristophertangaNo ratings yet

- CostingDocument6 pagesCostingLove IslamNo ratings yet

- Prelim ReviewerDocument19 pagesPrelim ReviewerMah2SetNo ratings yet

- MASDocument5 pagesMASMusic LastNo ratings yet

- Lesson 3 Sample Problem #1Document4 pagesLesson 3 Sample Problem #1not funny didn't laughNo ratings yet

- W14 - As8 Maranan, A2aDocument3 pagesW14 - As8 Maranan, A2aJere Mae MarananNo ratings yet

- CH10 Long Term Decision Payongayong-2Document1 pageCH10 Long Term Decision Payongayong-2Nadi HoodNo ratings yet

- Absorption and Variable CostingDocument13 pagesAbsorption and Variable CostingdarylNo ratings yet

- 06 Incremental AnalysisDocument11 pages06 Incremental AnalysisannarheaNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingSirshajit SanfuiNo ratings yet

- (Continuation Sheet For Form 1105) Section 1 - Taxpayer InformationDocument7 pages(Continuation Sheet For Form 1105) Section 1 - Taxpayer InformationWara GobeNo ratings yet

- MAC2601-SuggestedsolutionOct November2013Document12 pagesMAC2601-SuggestedsolutionOct November2013DINEO PRUDENCE NONGNo ratings yet

- 2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Document5 pages2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Navira MirajkarNo ratings yet

- Chapter 7-MarginalDocument2 pagesChapter 7-Marginalhusse fokNo ratings yet

- Mas Solutions To Problems Solutions 2018 PDFDocument13 pagesMas Solutions To Problems Solutions 2018 PDFMIKKONo ratings yet

- Costing English Answer 14.07.2020Document12 pagesCosting English Answer 14.07.2020Prathmesh JambhulkarNo ratings yet

- 09 Differential Cost Analysis KEYDocument5 pages09 Differential Cost Analysis KEYShiela Mae OperioNo ratings yet

- Absorption CostingDocument3 pagesAbsorption CostingmasatiNo ratings yet

- CVP Analysis: Muhammad Irvan M Afra YudhaDocument14 pagesCVP Analysis: Muhammad Irvan M Afra YudhaMuhammad IrvanNo ratings yet

- 28 Solved PCC Cost FM Nov09Document16 pages28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- Absorption Costing vs. Variable Costing GDocument11 pagesAbsorption Costing vs. Variable Costing GYamaapNo ratings yet

- Absorption Costing vs. Variable CostingDocument8 pagesAbsorption Costing vs. Variable CostingShaira GampongNo ratings yet

- CH 2 Assignmet DR-M YoussefDocument8 pagesCH 2 Assignmet DR-M YoussefDa HorseNo ratings yet

- Flexible BudgetsDocument23 pagesFlexible BudgetsAyushNo ratings yet

- GABATO-GENIE-ROSE-P. ACT121Assignment PDFDocument7 pagesGABATO-GENIE-ROSE-P. ACT121Assignment PDFBella RonahNo ratings yet

- Mas Solutions To Problems Solutions 2018Document14 pagesMas Solutions To Problems Solutions 2018Jahanna Martorillas0% (1)

- Master Budget Sample ProblemsDocument14 pagesMaster Budget Sample ProblemscykablyatNo ratings yet

- Cost Concepts P-1Document3 pagesCost Concepts P-1Ibeth Bello De CastroNo ratings yet

- Cost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyDocument16 pagesCost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyAnkit2020No ratings yet

- MA CVP SolutionDocument11 pagesMA CVP SolutionAll in ONENo ratings yet

- 4variable vs. Absorption ExerciseDocument2 pages4variable vs. Absorption ExerciseBlesa May SaliliNo ratings yet

- Practical Problems & Solutions Class Work Upto IL.10Document20 pagesPractical Problems & Solutions Class Work Upto IL.10Dhanishta PramodNo ratings yet

- Absorption and Variable Costing Quiz and SolutionsDocument11 pagesAbsorption and Variable Costing Quiz and SolutionsElaine Joyce GarciaNo ratings yet

- General Discussion Absorption Costing Variable Costing: FixedDocument4 pagesGeneral Discussion Absorption Costing Variable Costing: FixedHassan KhanNo ratings yet

- Accounting Chapter 06 Full SolutionDocument15 pagesAccounting Chapter 06 Full SolutionAsadullahil GalibNo ratings yet

- Faculty of Business and Law: Masters in International Business ManagementDocument8 pagesFaculty of Business and Law: Masters in International Business ManagementIkramNo ratings yet

- Absorption Costing vs. Variable CostinggDocument11 pagesAbsorption Costing vs. Variable CostinggGwyneth Ü ElipanioNo ratings yet

- Answer Key:: Do It Yourself (Enabling Activity 1)Document6 pagesAnswer Key:: Do It Yourself (Enabling Activity 1)Joseph PamaongNo ratings yet

- Absorption Variable and Throughput Costing Macaculop RayosDocument24 pagesAbsorption Variable and Throughput Costing Macaculop RayosJohn BernabeNo ratings yet

- Variable Costing: This Accounting Materials Are Brought To You byDocument18 pagesVariable Costing: This Accounting Materials Are Brought To You byjeodhyNo ratings yet

- Absorption & Direct Costing Format& Illust GMSISUCCESSDocument8 pagesAbsorption & Direct Costing Format& Illust GMSISUCCESSChetan BasraNo ratings yet

- Flexible BudgetsDocument23 pagesFlexible BudgetsscienceplexNo ratings yet

- Class WorkDocument10 pagesClass WorkRajesh MongerNo ratings yet

- Strategic Management: Topic 3 Variable Costing Versus Absorption CostingDocument20 pagesStrategic Management: Topic 3 Variable Costing Versus Absorption CostingKemerutNo ratings yet

- 2021 Answer Chapter 5 PDFDocument19 pages2021 Answer Chapter 5 PDFRianne NavidadNo ratings yet

- Production Theory and Theory of CostsDocument32 pagesProduction Theory and Theory of CostsChaseNo ratings yet

- PROBLEM 4 (Evaluation of Performance) : TotalDocument3 pagesPROBLEM 4 (Evaluation of Performance) : TotalArt IslandNo ratings yet

- Cost Management Anudeep Velagapudi PGDM6 1967Document9 pagesCost Management Anudeep Velagapudi PGDM6 1967Harsh Vardhan SinghNo ratings yet

- Ca51014 AssignmentDocument9 pagesCa51014 AssignmentRhn SbdNo ratings yet

- Production Cost Variances: Changes From Tenth EditionDocument15 pagesProduction Cost Variances: Changes From Tenth EditionAlka NarayanNo ratings yet

- Managerial accountingBreak-Even Point For Sales MixedDocument8 pagesManagerial accountingBreak-Even Point For Sales MixedZeinab MohamadNo ratings yet

- Cost AccountingDocument3 pagesCost Accountingdisturbedguy048No ratings yet

- Backflu SH Costing: Yusi, Mark Lawrence - Group 4Document19 pagesBackflu SH Costing: Yusi, Mark Lawrence - Group 4Mark Lawrence YusiNo ratings yet

- Minicase 3.2Document17 pagesMinicase 3.2OPS PMLCNo ratings yet

- Screenshot 2021-11-29 at 5.54.14 PM PDFDocument1 pageScreenshot 2021-11-29 at 5.54.14 PM PDFTshewang ChokiNo ratings yet

- Theory of CostDocument35 pagesTheory of Costarsalan khanNo ratings yet

- Mas Lecture Brad DelacruzDocument4 pagesMas Lecture Brad DelacruzAnnyeong AngeNo ratings yet

- Absorption CostingDocument33 pagesAbsorption CostingMohit PaswanNo ratings yet

- 11-Inventory Cost FlowDocument28 pages11-Inventory Cost FlowPatrick Jayson VillademosaNo ratings yet

- Concepts of CostsDocument14 pagesConcepts of CostsMughees Ahmed100% (1)

- Bab 2. C. Soal Jawab - Latihan BudgetingDocument16 pagesBab 2. C. Soal Jawab - Latihan BudgetingM Rafi Priyambudi100% (2)

- Rambaan CostDocument433 pagesRambaan CostSanjana SharmaNo ratings yet

- MAS Lecture Variable CostingDocument8 pagesMAS Lecture Variable CostingLhoel Delremedios100% (1)

- Sample Problems 13Document7 pagesSample Problems 13milagrosdiNo ratings yet

- Cost Analysis PPT Bec Bagalkot MbaDocument8 pagesCost Analysis PPT Bec Bagalkot MbaBabasab Patil (Karrisatte)100% (1)

- Micro-Econ Signature Assignment - Gavin WestDocument4 pagesMicro-Econ Signature Assignment - Gavin Westapi-531246385No ratings yet

- Cost & Cost CurvesDocument46 pagesCost & Cost CurvesManoj Kumar SunuwarNo ratings yet

- Fixed Cost: Areas of ConfusionDocument7 pagesFixed Cost: Areas of ConfusionDahshilla JunejoNo ratings yet

- Cost Theory & Analysis (CH 5)Document20 pagesCost Theory & Analysis (CH 5)sandeepanNo ratings yet

- Unit Cost Calculation: Afzal Ahmed, Fca Finance Controller NagadDocument27 pagesUnit Cost Calculation: Afzal Ahmed, Fca Finance Controller NagadsajedulNo ratings yet

- 2 Example Problems CH 7 8Document30 pages2 Example Problems CH 7 8Aldrin Zolina100% (1)

- Excercise 1-5 - VenesiaAbigaelNagara (1832088)Document3 pagesExcercise 1-5 - VenesiaAbigaelNagara (1832088)Nessa AbigaelNo ratings yet

- Activity Name Normal Time Normal Cost Crash Time Crash CostDocument3 pagesActivity Name Normal Time Normal Cost Crash Time Crash CostIbraheem DwikatNo ratings yet

- Absorption and Variable Costing - Illustrative Example - PagaddutDocument4 pagesAbsorption and Variable Costing - Illustrative Example - PagaddutLovely Rose GuinilingNo ratings yet

- Cost CurvesDocument2 pagesCost CurvesSumit Ray100% (1)

- Modul Praktikum APKM - Week 1 - Konsep Akuntansi Manajemen, Konsep Biaya, Dan Klasifikasi BiayaDocument15 pagesModul Praktikum APKM - Week 1 - Konsep Akuntansi Manajemen, Konsep Biaya, Dan Klasifikasi BiayaYosefin SumbayakNo ratings yet