Professional Documents

Culture Documents

Chapter 9 Tax Invoice, Credit and Debit Notes (Mnemonics)

Uploaded by

mohit lokhandeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 9 Tax Invoice, Credit and Debit Notes (Mnemonics)

Uploaded by

mohit lokhandeCopyright:

Available Formats

Tax Invoice, Credit and Debit Notes

9. TAX INVOICE, CREDIT AND DEBIT NOTES

Abbreviation/Mnemonics Full Form

NBFI N – NBFC (Non-Banking Financial Company)

(Tax Invoice to be issued within B – Banking company

45 days)

F – Financial Institution

I – Insurance company

BGPM GLS B – NBFI (NBFC, Banking, FI, Insurance)

(E-Invoice not applicable) G – GTA (Goods Transport Agency)

P – Supplier of Passenger transportation service

M – Multiplex (Compulsorily to issue an electronic ticket)

G – Government department

L – Local Authority

S – SEZ unit

RN BAR SP R – Revised Tax Invoice

(Section 31(3)) N – No tax invoice if value of supply < Rs. 200

B – Bill of Supply (Exempt Supply, Composition Dealer)

A – Receipt Voucher in case of receipt of Advance

R – Refund Voucher

S – Self Invoice

P – Payment Voucher

TI Tax Invoice

DQVTS Description, Quantity, Value, Tax, Such other particulars

FI Financial Institution

SOS Supply of Service

Bks of a/cs Books of accounts

Qtr Quarter

RP Registered Person

ATO Aggregate Turnover

PFY Preceding Financial Year

URP Unregistered Person

UPI Unified Payments Interface

NA Not Applicable

Conso. Consolidated

doc. Documents

GTA Goods Transport Agency

VOS Value of Supply

DC Delivery Challan

EWB Electronic Way Bill

SOG Supply of Goods

1m 1 month

RC Registration Certificate

CRTI Consolidated Revised Tax Invoice

TS Taxable Supplies

EOD End of day

BOS Bill of Supply

ROT Rate of Tax

DD Due Date

CA Ramesh Soni 9.1

Tax Invoice, Credit and Debit Notes

Abbreviation/Mnemonics Full Form

TOS Time of Supply

ES Exempt Supplies

MR Monthly Return

Sep September

NFY Next Financial Year

AR Annual Return

TOG Transportation of Goods

CKS/SKD Complete Knocked Down/Semi Knocked Down

bk in 6m Back in 6 months

HSN Harmonised System of Nomenclature

CA Ramesh Soni 9.2

You might also like

- Chapter 10 Accounts and Records (Mnemonics)Document1 pageChapter 10 Accounts and Records (Mnemonics)mohit lokhandeNo ratings yet

- Chapter 8 Value of Supply (Mnemonics)Document1 pageChapter 8 Value of Supply (Mnemonics)mohit lokhandeNo ratings yet

- IDT Ramesh Soni PnemonicsDocument53 pagesIDT Ramesh Soni PnemonicsJames BondNo ratings yet

- Chapter 2 Supply (Mnemonics)Document2 pagesChapter 2 Supply (Mnemonics)mohit lokhandeNo ratings yet

- It 000147370616 2024 12Document1 pageIt 000147370616 2024 12Revenue sectionNo ratings yet

- Income Tax Payment Challan: PSID #: 172247415Document1 pageIncome Tax Payment Challan: PSID #: 172247415fast fbrNo ratings yet

- Chapter 6 Registration (Mnemonics)Document3 pagesChapter 6 Registration (Mnemonics)mohit lokhandeNo ratings yet

- It 000147370561 2024 12Document1 pageIt 000147370561 2024 12Revenue sectionNo ratings yet

- Form 12 Remittance To Other Government AgenciesDocument1 pageForm 12 Remittance To Other Government Agenciesarfica zainal abidinNo ratings yet

- Bill of SupplyDocument3 pagesBill of SupplyAnas QasmiNo ratings yet

- It 000147370507 2024 12Document1 pageIt 000147370507 2024 12Revenue sectionNo ratings yet

- Income Tax Payment Challan: PSID #: 172780977Document1 pageIncome Tax Payment Challan: PSID #: 172780977fast fbrNo ratings yet

- Chapter 13 Input Tax Credit (Mnemonics)Document2 pagesChapter 13 Input Tax Credit (Mnemonics)mohit lokhandeNo ratings yet

- Chapter 4 Charge of GST (RCM - ECO) (Mnemonics)Document2 pagesChapter 4 Charge of GST (RCM - ECO) (Mnemonics)mohit lokhandeNo ratings yet

- It 000147370452 2024 12Document1 pageIt 000147370452 2024 12Revenue sectionNo ratings yet

- It 000147370701 2024 12Document1 pageIt 000147370701 2024 12Revenue sectionNo ratings yet

- It 000144418085 2024 10Document1 pageIt 000144418085 2024 10Sheeraz AhmedNo ratings yet

- Income Tax Payment Challan: PSID #: 42730325Document1 pageIncome Tax Payment Challan: PSID #: 42730325Muhammad Qaisar LatifNo ratings yet

- To Payment of Electricity Expenses For The Period of - As Per Billing Statement Hereto AttachedDocument6 pagesTo Payment of Electricity Expenses For The Period of - As Per Billing Statement Hereto AttachedShiela E. EladNo ratings yet

- Local Travel - DVDocument4 pagesLocal Travel - DVjohn tabierosNo ratings yet

- Payment Order: Komatsu India PTV LTD Pvno: DateDocument2 pagesPayment Order: Komatsu India PTV LTD Pvno: DateHari NarayananNo ratings yet

- It 000144384093 2024 10Document1 pageIt 000144384093 2024 10Sheeraz AhmedNo ratings yet

- Income Tax Payment Challan: PSID #: 42751407Document1 pageIncome Tax Payment Challan: PSID #: 42751407Muhammad Qaisar LatifNo ratings yet

- Income Tax Payment Challan: PSID #: 173203210Document1 pageIncome Tax Payment Challan: PSID #: 173203210Muhammad QayyumNo ratings yet

- Income Tax Payment Challan: PSID #: 145879823Document1 pageIncome Tax Payment Challan: PSID #: 145879823farhan aliNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- Income Tax Payment Challan: PSID #: 171709428Document1 pageIncome Tax Payment Challan: PSID #: 171709428fast fbrNo ratings yet

- It 000141511985 2022 00Document1 pageIt 000141511985 2022 00Abdul Basit KtkNo ratings yet

- It 000147087234 2024 12Document1 pageIt 000147087234 2024 12Revenue sectionNo ratings yet

- Background Information: Yes No 0 2 1 2Document3 pagesBackground Information: Yes No 0 2 1 2Vincent John RigorNo ratings yet

- Abdul Ghaffar 14-10-19 PDFDocument1 pageAbdul Ghaffar 14-10-19 PDFAyan BNo ratings yet

- It 000146384671 2022 00Document1 pageIt 000146384671 2022 00zohaib hassan ShahNo ratings yet

- Umair + Shahid PDFDocument1 pageUmair + Shahid PDFAyan BNo ratings yet

- It 000145640626 2023 11Document1 pageIt 000145640626 2023 11pleasemakemefilerNo ratings yet

- It 000144747898 2022 00Document1 pageIt 000144747898 2022 00hizbullahjantankNo ratings yet

- It 000141516198 2022 00Document1 pageIt 000141516198 2022 00Abdul Basit KtkNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaskiezer agrudaNo ratings yet

- Income Tax Payment Challan: PSID #: 42125287Document1 pageIncome Tax Payment Challan: PSID #: 42125287Muhammad Qaisar LatifNo ratings yet

- List of Document TypesDocument2 pagesList of Document Typesjay_kbNo ratings yet

- Accounting Voucher DisplayDocument1 pageAccounting Voucher DisplayASHISH VARNWALNo ratings yet

- Monthly Assessment CoverageDocument7 pagesMonthly Assessment CoverageJosh Cruz CosNo ratings yet

- Mushtaq & IshfaqDocument1 pageMushtaq & IshfaqAʌĸʌsʜ AƴʌŋNo ratings yet

- SK COA Annex 6 REGISTER OF CASH IN BANK AND OTHER RELATED FINANCIAL TRANSACTIONSDocument1 pageSK COA Annex 6 REGISTER OF CASH IN BANK AND OTHER RELATED FINANCIAL TRANSACTIONSJune Anthony DobleNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- Akash Reimbersment FormDocument8 pagesAkash Reimbersment FormPraveen KumarNo ratings yet

- Income Tax Payment Challan: PSID #: 150493633Document1 pageIncome Tax Payment Challan: PSID #: 150493633Shehla FarooqNo ratings yet

- Check List For Service Tax Units 2017: Cenvat IssuesDocument5 pagesCheck List For Service Tax Units 2017: Cenvat IssuesSushant SaxenaNo ratings yet

- It 000144586598 2022 00Document1 pageIt 000144586598 2022 00hizbullahjantankNo ratings yet

- EWT For The OCT-23 PeriodDocument12 pagesEWT For The OCT-23 Periodqhi.cgmacatiagNo ratings yet

- Private Limited: Sales Returns Interstate@18% Input CGST at 9% Input SGST at 9 %Document1 pagePrivate Limited: Sales Returns Interstate@18% Input CGST at 9% Input SGST at 9 %Chandan ManeNo ratings yet

- Tax Alerts Act Wise Sep 10Document1 pageTax Alerts Act Wise Sep 10radhikaannapurna2010No ratings yet

- Income Tax Payment Challan: PSID #: 35235957Document1 pageIncome Tax Payment Challan: PSID #: 35235957Ayan BNo ratings yet

- Income Tax Payment Challan: PSID #: 42719670Document1 pageIncome Tax Payment Challan: PSID #: 42719670Muhammad Qaisar LatifNo ratings yet

- Itax Form 2006Document4 pagesItax Form 2006AliMuzaffarNo ratings yet

- Iff 09avjps6011k1z7 012022Document2 pagesIff 09avjps6011k1z7 012022KaminariNo ratings yet

- It 000144041855 2024 10Document1 pageIt 000144041855 2024 10MUHAMMAD TABRAIZNo ratings yet

- GST Invoice FormatDocument17 pagesGST Invoice FormatSeetharam shanmugamNo ratings yet

- Home Loan Lap Login ChecklistDocument1 pageHome Loan Lap Login ChecklistAditya KhareNo ratings yet

- Checklist For FintreeDocument2 pagesChecklist For Fintreeshrijit “shri” tembhehar0% (1)

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Tugas Individual Operations - Benny Roy P NDocument7 pagesTugas Individual Operations - Benny Roy P NRoy NapitupuluNo ratings yet

- Design and Implementation of Real Processing in Accounting Information SystemDocument66 pagesDesign and Implementation of Real Processing in Accounting Information Systemenbassey100% (2)

- Accounting Concepts and Principles PDFDocument9 pagesAccounting Concepts and Principles PDFDennis LacsonNo ratings yet

- Importance of Project Management in ConstructionDocument10 pagesImportance of Project Management in ConstructionNicole SantillanNo ratings yet

- McMurray Métis 2015 - Financial Statements - Year Ended March 31, 2015Document13 pagesMcMurray Métis 2015 - Financial Statements - Year Ended March 31, 2015McMurray Métis (MNA Local 1935)No ratings yet

- Article of Association of LIMITED LIABILITY COMPANY - NUMBERDocument15 pagesArticle of Association of LIMITED LIABILITY COMPANY - NUMBERandriNo ratings yet

- Ilo Convetion 133Document12 pagesIlo Convetion 133Vicmel DiazNo ratings yet

- DELMIA V5 Automation Platform - Merging Digital Manufacturing With AutomationDocument20 pagesDELMIA V5 Automation Platform - Merging Digital Manufacturing With Automationomar_3dxNo ratings yet

- Autobus Vs BautistaDocument1 pageAutobus Vs BautistaJoel G. AyonNo ratings yet

- Database PanteneDocument4 pagesDatabase PanteneYahya CahyadiNo ratings yet

- Upcoming Exhibition Schedule - UAEDocument3 pagesUpcoming Exhibition Schedule - UAEAjay KrishnanNo ratings yet

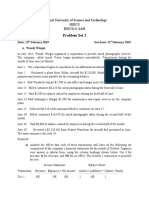

- Problem Set 2Document2 pagesProblem Set 2Rubab MirzaNo ratings yet

- Pricing Concepts & Setting The Right PriceDocument33 pagesPricing Concepts & Setting The Right PriceNeelu BhanushaliNo ratings yet

- Report On Corporate Communication Strategy Analysis ofDocument38 pagesReport On Corporate Communication Strategy Analysis ofNAFISA ISLAMNo ratings yet

- MGMT 324 Midterm Study Guide Summer 2018Document12 pagesMGMT 324 Midterm Study Guide Summer 2018أبومراد أبويوسفNo ratings yet

- River Eye Fashion CompanyDocument11 pagesRiver Eye Fashion Companyriver eyeNo ratings yet

- ISO 17025 PresentationDocument48 pagesISO 17025 PresentationSanthosh Srinivasan100% (1)

- Hypothesis Testing For A Single PopulationDocument37 pagesHypothesis Testing For A Single PopulationAna Salud LimNo ratings yet

- Knipex Gesamtkatalog 2021Document367 pagesKnipex Gesamtkatalog 2021Juan ChoNo ratings yet

- TVE Phase-1 Addendum No 8Document1 pageTVE Phase-1 Addendum No 8Anonymous Un3Jf6qNo ratings yet

- Faculty of Liberal Studies BBA (Hons.) Semester - I Division - CDocument13 pagesFaculty of Liberal Studies BBA (Hons.) Semester - I Division - CPrince BharvadNo ratings yet

- Exclusive Legislative ListDocument4 pagesExclusive Legislative ListLetsReclaim OurFutureNo ratings yet

- Nestle CSRDocument309 pagesNestle CSRMaha AbbasiNo ratings yet

- Permission To MortgageDocument14 pagesPermission To MortgageAabad BrandNo ratings yet

- What Is The Importance of An Entrepreneurial MindDocument10 pagesWhat Is The Importance of An Entrepreneurial Mindlaarni joy conaderaNo ratings yet

- Batman GuidesDocument3 pagesBatman GuidesMarco MazzaiNo ratings yet

- Chapter 1 Global ServiceDocument23 pagesChapter 1 Global ServiceRandeep SinghNo ratings yet

- An Occupation, Profession, or Trade. The Purchase and Sale of Goods in An Attempt To Make A ProfitDocument3 pagesAn Occupation, Profession, or Trade. The Purchase and Sale of Goods in An Attempt To Make A Profitmari_gogiNo ratings yet

- ISO 9001 CertificateDocument7 pagesISO 9001 CertificateMoidu ThavottNo ratings yet