Professional Documents

Culture Documents

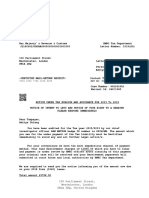

Account Reference: 3305530341: Amount Payable 120.31

Uploaded by

jeffreyhaswell219Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Account Reference: 3305530341: Amount Payable 120.31

Uploaded by

jeffreyhaswell219Copyright:

Available Formats

Corporate Director of Resources

18112923280699

Council Tax Bill 2023/2024

PO Box 238

Stanley Durham County Council

Co Durham Tel 03000 264 000

DH8 1FP www.durham.gov.uk/counciltax

Issue Date: 29/02/2024 Account Reference: 3305530341

Reason for Bill: New Liability

Mr J Haswell Property Valuation Band A

18b Sowerby Street Address of property giving rise to charge:

18B Sowerby Street

Sacriston Sacriston

Durham Durham

DH7 6NQ DH7 6NQ

Council Tax For Your Property Valuation Band 2023/2024 % Change

Durham County Council £1,062.73 3.0

Adult Social Care Precept* £165.43 2.0

Durham and Darlington Fire and Rescue Authority £76.46 4.6

Durham Police and Crime Commissioner £170.16 6.2

Sacriston Parish Council £30.61 0.0

Annual Charge for your Property Valuation Band £1,505.39 5.0%

Council Tax for period 22/02/24 to 31/03/24 £160.41

(25%) Single Person Discount £40.10 CR

*The Council Tax attributable to Durham County Council includes a precept to fund adult

social care.

This is in line with Government guidance to help cover the rising costs of social care

services provided to vulnerable adults. Further information on the Council's spending

plans can be found at www.durham.gov.uk/counciltaxleaflets

Amount Payable £120.31

PAYMENT DETAILS

Payable by Monthly Direct Debit. Payments will be collected by Durham County Council.

1 payment of £120.31 is due 08/04/24.

Please note instalments are due and payable on the dates shown above.

Payments not made by these dates will become subject to recovery action.

18112923280699

HOW TO PAY YOUR COUNCIL TAX

Council Tax is considered to be a priority bill

Direct Debit is the cheapest and most convenient method of payment

Cash payments will only be accepted at Post Offices and PayPoint outlets

The Council Tax reference number shown on the front of this notice must be quoted in all

cases to ensure that your account is correctly credited

Direct Debit If you are not already paying in this way please register online at

www.durham.gov.uk/counciltaxonline alternatively contact us on 03000 264 000.

Online Please visit our site at www.durham.gov.uk and go to Do it online, Pay for it,

Council Tax .You can pay by debit/credit card or PayPal.

.

By telephone Call using our 24 hour automated telephone payment service on 0300 456 2771

and have your debit/credit card, Council Tax account number, and a pen and

paper to note your receipt number.

Through Make your payments to Lloyds Bank Plc, account number 51009868 sort code

your bank 30-92-79. Please make sure that you quote only your Council Tax account

number. Remittances for BACS payments should be e-mailed to

suspense@durham.gov.uk.

Post Office There is a barcode on the front of this bill which means it can be taken to any

and PayPoint Post Office or PayPoint outlet where it will be scanned and payment taken.

Payment may also be made by this method if you have an existing payment card.

Please retain your receipt for future reference.

By Post You can send your payment to the following postal address. Please do not send

cash through the post. Cheques should be made payable to Durham County

Council with your Council Tax account number quoted on the reverse.

Please do not hand deliver payments.

Durham County Council, PO Box 253, Stanley, County Durham, DH8 1GF

For enquiries about this bill please email help@durham.gov.uk or call us on 03000 264 000.

If the amount payable has been reduced by a discount, exemption or reduction, and is either

incorrect, no longer applicable, or there has been a change in circumstances, the taxpayer is

required to notify the council within 21 days with the correct information. Failure to do so may result

in a financial penalty.

For adult social care authorities, council tax demand notices show two percentage changes: one

for the overall change attributable to the adult social care precept, and one for the part attributable

to general expenditure.

For information: In line with Data Protection law we may use information you give us to prevent or

detect fraud or other crimes. We may also share it with other Council Services or public

organisations if they need it to carry out their duties. To read our Council Tax privacy notice about

how we use your personal data or for more information about the council's data privacy go to:

www.durham.gov.uk/dataprivacy.

You might also like

- COUNCIL TAX BILL 2023/2024: The Valuation Office Agency Valued This Property As Band EDocument2 pagesCOUNCIL TAX BILL 2023/2024: The Valuation Office Agency Valued This Property As Band Erboadu71No ratings yet

- My Islington Council Tax DocumentDocument4 pagesMy Islington Council Tax Documentjohnsonwto15No ratings yet

- My Islington Council Tax DocumentDocument4 pagesMy Islington Council Tax Documentjohnsonwto15No ratings yet

- My Islington Council Tax DocumentDocument4 pagesMy Islington Council Tax DocumentYerina Elizabeth Feliz PinedaNo ratings yet

- Date of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDocument2 pagesDate of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDaniel HollandsNo ratings yet

- Extct Bill 905431x 677697Document2 pagesExtct Bill 905431x 677697clinica.sante.resultsNo ratings yet

- Council Tax 2023 - 2023-03-06 - 1Document2 pagesCouncil Tax 2023 - 2023-03-06 - 1tunlinoo.067433No ratings yet

- How Your Council Tax Bill Has Been Worked Out How Your Council Tax Bill Has Been Worked OutDocument2 pagesHow Your Council Tax Bill Has Been Worked Out How Your Council Tax Bill Has Been Worked Outmagurean.viorel18No ratings yet

- Council Tax Bill 2024/25Document2 pagesCouncil Tax Bill 2024/25OanaNo ratings yet

- Council Tax Sample BilllDocument2 pagesCouncil Tax Sample BilllMaisa SantosNo ratings yet

- Council Tax Demand Notice 2020/2021: :-U-Can) 82®Document2 pagesCouncil Tax Demand Notice 2020/2021: :-U-Can) 82®Amruta Lambat DaulatkarNo ratings yet

- Council Tax Bill 2021/22Document2 pagesCouncil Tax Bill 2021/22Lucas Victor VargasNo ratings yet

- Council Tax Notes 2020 To 2021Document2 pagesCouncil Tax Notes 2020 To 2021Keith BandaNo ratings yet

- Non-Domestic Rates Bill 2018/19: Please Quote On All EnquiriesDocument4 pagesNon-Domestic Rates Bill 2018/19: Please Quote On All Enquiriesautos osmanNo ratings yet

- British GasDocument2 pagesBritish GasrinramtechapkNo ratings yet

- Reminder 19507679Document1 pageReminder 19507679Ion IovuNo ratings yet

- Hac Ctbill 311139418 044 00021Document2 pagesHac Ctbill 311139418 044 00021esthermabengiNo ratings yet

- Moneyent InclusionDocument4 pagesMoneyent InclusionOladimeji Raphael OnibonNo ratings yet

- Pay Vehicle TaxDocument2 pagesPay Vehicle TaxDarius KompNo ratings yet

- TMBC Council Tax Charges Supplementary Information 2021 2022Document2 pagesTMBC Council Tax Charges Supplementary Information 2021 2022georgerouseNo ratings yet

- 11 Appendix J B 1st-31st March 2020 - 2Document2 pages11 Appendix J B 1st-31st March 2020 - 2Adita DayNo ratings yet

- BillDocument5 pagesBillAndreisorin PeneNo ratings yet

- Statement Date: Your Plan IDDocument2 pagesStatement Date: Your Plan IDMarin ReluNo ratings yet

- Dart Charge PAYG - Tems - and - ConditionsDocument2 pagesDart Charge PAYG - Tems - and - ConditionsGavinNo ratings yet

- Ð Ì@P ) Lfory 9Dî87Ó: Your Electricity AccountDocument5 pagesÐ Ì@P ) Lfory 9Dî87Ó: Your Electricity Accounthtd6ky569mNo ratings yet

- BGB 601125513 Copy Final InvoiceDocument2 pagesBGB 601125513 Copy Final Invoicekamran shoNo ratings yet

- Allegations Cancellation Notice For Aditya TelengDocument3 pagesAllegations Cancellation Notice For Aditya TelengAaditya TelangNo ratings yet

- My3bill-August-2022 220910 211326Document10 pagesMy3bill-August-2022 220910 211326Dascalu AlexNo ratings yet

- Council Tax 2019 To 2020: Assessor@lanarkshire-Vjb - Gov.ukDocument2 pagesCouncil Tax 2019 To 2020: Assessor@lanarkshire-Vjb - Gov.ukSteven HamiltonNo ratings yet

- Bill 2Document3 pagesBill 2helenfloresbakeryNo ratings yet

- Summary of Charges: My Bill Summary For May 2023Document3 pagesSummary of Charges: My Bill Summary For May 2023AmitNo ratings yet

- Att 1Document3 pagesAtt 1shankharisohag007No ratings yet

- 18 Feb 2023Document3 pages18 Feb 2023Andrei AlbertoNo ratings yet

- Virgin Media Ebill PDFDocument5 pagesVirgin Media Ebill PDFTHIMMAPPA100% (3)

- Case Resolvement Charges Notice For Aditya TelangDocument3 pagesCase Resolvement Charges Notice For Aditya TelangAaditya TelangNo ratings yet

- HMRC-CGT - Payment ConfirmationDocument3 pagesHMRC-CGT - Payment Confirmationluca.artesani90No ratings yet

- Electricity BillDocument2 pagesElectricity Billjuanitabezm100% (1)

- LT Bill 05001185713 201601Document2 pagesLT Bill 05001185713 201601joramNo ratings yet

- COUNCILBUNDocument1 pageCOUNCILBUNdelicious streetfoodNo ratings yet

- Council Tax LeafletDocument2 pagesCouncil Tax LeafletabaragbcNo ratings yet

- BillDocument5 pagesBillAkshat SinhaNo ratings yet

- PDF ResizeDocument2 pagesPDF Resizeasim maitla03No ratings yet

- Bill 210823Document5 pagesBill 210823kyaxbeeNo ratings yet

- My Vodafone Bill 2022-10-03Document2 pagesMy Vodafone Bill 2022-10-03Solomon0% (1)

- 2022 2022 Interim Tax Bill Interim Tax Bill: City of Markham City of MarkhamDocument5 pages2022 2022 Interim Tax Bill Interim Tax Bill: City of Markham City of MarkhamTony ParkNo ratings yet

- Oct 2023Document3 pagesOct 2023poonamNo ratings yet

- MR Rajnan Kumar: Other Bill Payment OptionsDocument2 pagesMR Rajnan Kumar: Other Bill Payment OptionsMukesh BohraNo ratings yet

- ReminderDocument1 pageReminderbhargavkakaniNo ratings yet

- British GasDocument1 pageBritish GasWadie Nsiri100% (1)

- (See Below) : Account NumberDocument2 pages(See Below) : Account NumberAleksandra CvetkovicNo ratings yet

- Hello Cristian: Have You Heard The News? You'Re in Control With My EeDocument4 pagesHello Cristian: Have You Heard The News? You'Re in Control With My Eesava cristianNo ratings yet

- Summary of Charges: My Bill Summary For October 2022Document3 pagesSummary of Charges: My Bill Summary For October 2022AmitNo ratings yet

- Council Tax BenifitDocument5 pagesCouncil Tax BenifitPaula Starling100% (1)

- Í!" ("Y (B!!!-Hw#AYHÎ: Hello ThomasDocument17 pagesÍ!" ("Y (B!!!-Hw#AYHÎ: Hello Thomaswalshtom1984No ratings yet

- ReceiptDocument1 pageReceiptPHINEAS NDEREBANo ratings yet

- Utility Bill Template 02Document3 pagesUtility Bill Template 02melchNo ratings yet

- How To Pay: Account DetailsDocument2 pagesHow To Pay: Account DetailsBalkar DhanianNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Law Society Property Information Form TA6Document16 pagesLaw Society Property Information Form TA6bigboydeluxeNo ratings yet

- Skeleton Argument DraftDocument28 pagesSkeleton Argument DraftLGOComplaint100% (1)

- Income From Property Frequently Asked Questions - HandoutDocument12 pagesIncome From Property Frequently Asked Questions - Handoutkwok wing kwanNo ratings yet

- CT 2018 FinalDocument19 pagesCT 2018 FinalminorblueNo ratings yet

- Case Stated Freedom of Information RedactDocument35 pagesCase Stated Freedom of Information RedactGotnitNo ratings yet

- Tameside Council TaxDocument2 pagesTameside Council TaxnorthernmeldrewNo ratings yet

- DCLG Letter Re Second Homes and Empty Homes Sept 14Document2 pagesDCLG Letter Re Second Homes and Empty Homes Sept 14LeedsCommunityHomesNo ratings yet

- Transformation Services: Council Tax Exemption FormDocument2 pagesTransformation Services: Council Tax Exemption FormSanjeev KambojNo ratings yet

- Lodger Information PackDocument15 pagesLodger Information PackKelvin BongNo ratings yet

- Council Tax Bill 2021/22Document2 pagesCouncil Tax Bill 2021/22Lucas Victor VargasNo ratings yet

- Council Tax Additional Info For WebDocument6 pagesCouncil Tax Additional Info For WebKomagalNo ratings yet

- Exhibit 4Document7 pagesExhibit 4IR Tribunal - vexatiousNo ratings yet

- Defendants (Supp) Grounds of Appeal - RedactDocument113 pagesDefendants (Supp) Grounds of Appeal - RedactGotnitNo ratings yet

- Accommodation Brochure (v1 Dec 2016)Document8 pagesAccommodation Brochure (v1 Dec 2016)Daniel HendersonNo ratings yet

- Your Charges and Discounts: Amount Payable by You Payment Instruction (When and What To Pay)Document2 pagesYour Charges and Discounts: Amount Payable by You Payment Instruction (When and What To Pay)Caleb PriceNo ratings yet

- GFD Marital Status Declaration 2Document2 pagesGFD Marital Status Declaration 2Jane Hinton100% (1)

- Misconduct in Public Office 24 Feb 2017Document25 pagesMisconduct in Public Office 24 Feb 2017GotnitNo ratings yet

- Statutory Declaration To CourtDocument3 pagesStatutory Declaration To CourtKelz Youknowmyname100% (1)

- Sample Lodger AgreementDocument4 pagesSample Lodger Agreementmusy9999No ratings yet

- Student Grant Application FormDocument5 pagesStudent Grant Application FormWilson Marques de Andrade FilhoNo ratings yet

- HH AgreementDocument22 pagesHH Agreementtamas.kszemanNo ratings yet

- Student Declaration3Document2 pagesStudent Declaration3w1933194No ratings yet

- Grounds of Appeal N161Document34 pagesGrounds of Appeal N161LGOComplaintNo ratings yet

- Formal Complaint - 15 March 14 RedactDocument7 pagesFormal Complaint - 15 March 14 RedactGotnitNo ratings yet

- Question A1: F6 - Taxation (UK)Document38 pagesQuestion A1: F6 - Taxation (UK)osmantaha100% (1)

- Account Reference: 3305530341: Amount Payable 120.31Document2 pagesAccount Reference: 3305530341: Amount Payable 120.31jeffreyhaswell219No ratings yet

- Nip HC 2Document6 pagesNip HC 2bizNo ratings yet

- Council Tax Sample BilllDocument2 pagesCouncil Tax Sample BilllMaisa SantosNo ratings yet

- Nawaal Form Edited 21 Oct.Document6 pagesNawaal Form Edited 21 Oct.Empereur GeorgesNo ratings yet