Professional Documents

Culture Documents

ACCT108 IP4 - Intercompany Sales of Inventories

ACCT108 IP4 - Intercompany Sales of Inventories

Uploaded by

Melissa SenonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT108 IP4 - Intercompany Sales of Inventories

ACCT108 IP4 - Intercompany Sales of Inventories

Uploaded by

Melissa SenonCopyright:

Available Formats

ACCT108 Illustrative Problem 4

Intercompany Sales of Inventories

Intercompany Sales of Inventories between ABC Co. (Parent) and XYZ Co. (Subsidiary) are presented below:

Downstream Sales: 20X1 20X2 20X3 20X4 20X5

Price 2,400,000 3,900,000 6,250,000 9,600,000 11,250,000

Cost 2,000,000 3,000,000 5,000,000 8,000,000 9,000,000

Unsold at Year-End (@ Selling Price) 480,000 780,000 1,250,000 1,920,000 2,250,000

Upstream Sales: 20X1 20X2 20X3 20X4 20X5

Price 1,500,000 2,700,000 4,200,000 6,300,000 9,800,000

Cost 1,200,000 1,890,000 3,150,000 5,040,000 7,350,000

Unsold at Year-End (@ Selling Price) 300,000 540,000 840,000 1,260,000 1,960,000

Selected accounting information for the two companies are as follows:

ABC Company 20X1 20X2 20X3 20X4 20X5

Sales 24,000,000 39,000,000 62,500,000 96,000,000 112,500,000

Cost of Goods Sold 14,400,000 23,400,000 37,500,000 57,600,000 67,500,000

Net Income 5,280,000 8,580,000 13,750,000 21,120,000 24,750,000

Dividends Declared and Paid 1,584,000 2,574,000 4,125,000 6,336,000 7,425,000

XYZ Company 20X1 20X2 20X3 20X4 20X5

Sales 7,500,000 13,500,000 21,000,000 31,500,000 49,000,000

Cost of Goods Sold 4,875,000 8,775,000 13,650,000 20,475,000 31,850,000

Net Income 1,350,000 2,430,000 3,780,000 5,670,000 8,820,000

Dividends Declared and Paid 405,000 729,000 1,134,000 1,701,000 2,646,000

80% ownership interest in XYZ Company was acquired by ABC Company on January 1, 20X1 for a total

capitalizable cost of P25,000,000 when the book value of XYZ's net assets amounted to P25,000,000.

On the date of acquisition, the fair values of the identifiable assets and liabilities of XYZ were equal

to their fair values except for the following:

Book Value Fair Value Remaining Life

1. Inventory 600,000 400,000 All sold in 20X1

2. Equipment 810,000 910,000 4 years

3. Building 2,200,000 1,600,000 12 years

4. Land 3,400,000 5,100,000 Not Applicable

On January 1, 20X1, ABC Co. and XYZ Co. Retained Earnings amounted to P48,200,000 and

and P12,800,000, respectvely.

Required: Determine the following

1. Consolidated Sales 5. CNI-Controlling 8. NCI, 12/31 (@ fair value)

2. Consolidated Cost of Goods Sold 6. CNI-Total 9. NCI, 12/31 (@ proportionate share)

3. CINIS 7. CRE

4. NCINIS

You might also like

- Annex 30 - BRSDocument1 pageAnnex 30 - BRSLikey PromiseNo ratings yet

- Consolidation Exercises With AsnwerDocument47 pagesConsolidation Exercises With Asnwerjessica amorosoNo ratings yet

- Accounting Test Bank 2Document73 pagesAccounting Test Bank 2likesNo ratings yet

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Hedge Fund Modelling and Analysis: An Object Oriented Approach Using C++From EverandHedge Fund Modelling and Analysis: An Object Oriented Approach Using C++No ratings yet

- Himadri Chemical Inv-5 - 2009 - 2016Document29 pagesHimadri Chemical Inv-5 - 2009 - 2016Poonam AggarwalNo ratings yet

- Factors Affecting Dividend PolicyDocument3 pagesFactors Affecting Dividend PolicyAarti TawaNo ratings yet

- Accounting For Business Combinations Second Grading ExaminationDocument21 pagesAccounting For Business Combinations Second Grading ExaminationMjoyce A. Bruan86% (29)

- Accounting For Business Combinations ExaminationDocument20 pagesAccounting For Business Combinations ExaminationJanella Umieh De UngriaNo ratings yet

- Consolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)Document3 pagesConsolidated Financial Statements: XYZ, Inc. Carrying Amounts Fair Values Fair Value Adjustments (FVA)mhar lon100% (2)

- Chapter 31 - Lower of Cost and Net Realizable Value: Purchase CommitmentDocument21 pagesChapter 31 - Lower of Cost and Net Realizable Value: Purchase CommitmentKimberly Claire Atienza100% (5)

- Statement of Comprehensive IncomeDocument15 pagesStatement of Comprehensive IncomeSai Alvior50% (2)

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- Digest: - Series 8Document44 pagesDigest: - Series 8Pratyaksha RoyNo ratings yet

- Inventory Valuation PDFDocument29 pagesInventory Valuation PDFReverie Sevilla78% (9)

- Chapter 1 - Current LiabilitiesDocument6 pagesChapter 1 - Current LiabilitiesXiena100% (1)

- Separate and Consolidated QuizDocument6 pagesSeparate and Consolidated QuizAllyssa Kassandra LucesNo ratings yet

- Chapter 7 BusscomDocument65 pagesChapter 7 BusscomJM Valonda Villena, CPA, MBANo ratings yet

- 3 KKPDocument104 pages3 KKPWismi NuriaNo ratings yet

- Dynamic Society of Accounting Students Monthly Examinations Practical Accounting 1Document9 pagesDynamic Society of Accounting Students Monthly Examinations Practical Accounting 1Queenie Valle100% (1)

- Soal Kombinasi Bisnis 1Document4 pagesSoal Kombinasi Bisnis 1Melati Sepsa100% (1)

- Chapter 4 - Statement of Comprehensive Income: Problem 4-1 (AICPA Adapted)Document14 pagesChapter 4 - Statement of Comprehensive Income: Problem 4-1 (AICPA Adapted)Asi Cas Jav100% (1)

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- Use The Following Information For The Next Three Questions:: Oral QuizDocument6 pagesUse The Following Information For The Next Three Questions:: Oral QuizLourdios EdullantesNo ratings yet

- Quiz 2 AnswersDocument7 pagesQuiz 2 AnswersAlyssa CasimiroNo ratings yet

- QPractical Accounting Problems IIDocument34 pagesQPractical Accounting Problems IIZee GuillebeauxNo ratings yet

- Documents - Tips Cpa Aditional CorlynDocument34 pagesDocuments - Tips Cpa Aditional CorlynCarol Ferreros PanganNo ratings yet

- Rev 003 Midterm - Short QuizDocument2 pagesRev 003 Midterm - Short QuizJames LuoNo ratings yet

- Midterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerDocument9 pagesMidterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerJoanne RomaNo ratings yet

- BusCom Intercompany SalesDocument13 pagesBusCom Intercompany SalesCarmela BautistaNo ratings yet

- BusCom Intercompany SalesDocument18 pagesBusCom Intercompany SalesCarmela BautistaNo ratings yet

- Illustration InventoriesDocument5 pagesIllustration InventoriesRiyhu DelamercedNo ratings yet

- FLE2 Questions and Key To Correction v2Document10 pagesFLE2 Questions and Key To Correction v2Miru YuNo ratings yet

- Buscom DiscussionDocument3 pagesBuscom DiscussionLorie Grace LagunaNo ratings yet

- Reporting Intercorporate InterestDocument21 pagesReporting Intercorporate Interestwahyu dirosoNo ratings yet

- Officers' Salaries Officers' SalariesDocument6 pagesOfficers' Salaries Officers' SalariesCaptain ObviousNo ratings yet

- GEN4Document7 pagesGEN4Mylene HeragaNo ratings yet

- C1 Buscom Classroom Activity With AnswersDocument3 pagesC1 Buscom Classroom Activity With AnswerskimberlyroseabianNo ratings yet

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Document5 pagesJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNo ratings yet

- Statement of Comprehensive IncomeDocument23 pagesStatement of Comprehensive IncomeYou Knock On My DoorNo ratings yet

- Questions Cma-2Document5 pagesQuestions Cma-2Daniel100% (1)

- Quiz Chapter 4 Consol. Fs Part 1Document7 pagesQuiz Chapter 4 Consol. Fs Part 1Avril Denise NavarroNo ratings yet

- Sanchez Activity2.2Document5 pagesSanchez Activity2.2Carmina SanchezNo ratings yet

- ACC 102 - QuizDocument11 pagesACC 102 - QuizSarah Mae EscutonNo ratings yet

- Tutorial 8 C10 Q and ADocument6 pagesTutorial 8 C10 Q and A杰小No ratings yet

- Business Combination Asset Acquisition: Third YearDocument6 pagesBusiness Combination Asset Acquisition: Third YearRosalie Colarte LangbayNo ratings yet

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- Assignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliDocument5 pagesAssignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliReema SajuNo ratings yet

- Product Production Units Sales Units: Selling Price Per UnitDocument3 pagesProduct Production Units Sales Units: Selling Price Per UnitKamisiro RizeNo ratings yet

- 1.statement of Cash Flows - MIDTERMDocument27 pages1.statement of Cash Flows - MIDTERMMaeNo ratings yet

- Bus - Com - 1Document2 pagesBus - Com - 1Blythe AzodnemNo ratings yet

- Quiz - Consolidated FS Part 2Document3 pagesQuiz - Consolidated FS Part 2skyieNo ratings yet

- Inventory Costing ScheduleDocument7 pagesInventory Costing Schedulelala gasNo ratings yet

- A1c019112 Jeremy Christ Manuel AklDocument21 pagesA1c019112 Jeremy Christ Manuel AklJeremy Christ ManuelNo ratings yet

- Inventory Valuation C10Document5 pagesInventory Valuation C10music niNo ratings yet

- Additional ProblemDocument3 pagesAdditional ProblemLabLab ChattoNo ratings yet

- Business Combinations Midterm 2023 For LMSDocument4 pagesBusiness Combinations Midterm 2023 For LMSSarah Del teodoroNo ratings yet

- Cpa Aditional CorlynDocument34 pagesCpa Aditional CorlynAlexaMarieAliboghaNo ratings yet

- 3 Departmental AccountsDocument13 pages3 Departmental AccountsJayesh VyasNo ratings yet

- Discontinued Operations, Segment and Interim Reporting, Biological AssetsDocument5 pagesDiscontinued Operations, Segment and Interim Reporting, Biological AssetsElaine Joyce GarciaNo ratings yet

- Accounting For Price Level Changes 2Document9 pagesAccounting For Price Level Changes 2lil telNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- POINTERSDocument6 pagesPOINTERSHezekiah Bando BoilesNo ratings yet

- Responsibility Accounting Group 3 StraBanDocument49 pagesResponsibility Accounting Group 3 StraBanMelissa SenonNo ratings yet

- Evolution of Philippine CultureDocument8 pagesEvolution of Philippine CultureMelissa SenonNo ratings yet

- Popular Culture 01Document14 pagesPopular Culture 01Melissa SenonNo ratings yet

- Indian Financial SystemDocument4 pagesIndian Financial SystemDivya BhadriNo ratings yet

- 2020127131025DLOFDocument233 pages2020127131025DLOFKeshav ChinnuNo ratings yet

- Reading 22 Market-Based Valuation - Price and Enterprise Value MultiplesDocument50 pagesReading 22 Market-Based Valuation - Price and Enterprise Value Multiplestristan.riolsNo ratings yet

- Accounting Concepts and ConventionsDocument40 pagesAccounting Concepts and ConventionsAmrita TatiaNo ratings yet

- Chapter 13 SolutionsDocument45 pagesChapter 13 Solutionsaboodyuae2000No ratings yet

- ACCN02B Partnership and Corporation Accounting SyllabusDocument5 pagesACCN02B Partnership and Corporation Accounting SyllabusJoan TorresNo ratings yet

- Government Accounting (Chapter 13 and 14) - Florentin, Shaniah Racelle D. - BSA 3BDocument10 pagesGovernment Accounting (Chapter 13 and 14) - Florentin, Shaniah Racelle D. - BSA 3BRacelle FlorentinNo ratings yet

- Subsidiary Books - DPP 05 - (Aarambh 2024)Document5 pagesSubsidiary Books - DPP 05 - (Aarambh 2024)Shubh KhandelwalNo ratings yet

- Capital Fixed & Working - New SyllabusDocument6 pagesCapital Fixed & Working - New SyllabusNaaz AliNo ratings yet

- Ijabf 06Document21 pagesIjabf 06mohit vermaNo ratings yet

- Problem Set 3Document5 pagesProblem Set 3Lawly GinNo ratings yet

- Essentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution ManualDocument9 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution Manualbeatrice100% (24)

- 2017 Al Accounting Marking Scheme Sinhala Medium Alevelapi. Com PDFDocument25 pages2017 Al Accounting Marking Scheme Sinhala Medium Alevelapi. Com PDFIma LiyanageNo ratings yet

- 2023 Guide To Startup FundingDocument47 pages2023 Guide To Startup FundingssdipaNo ratings yet

- DghhuDocument16 pagesDghhuLOUIEVIE MAY SAJULGANo ratings yet

- Full Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions ManualDocument36 pagesFull Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manualkisslingcicelypro100% (35)

- BiduDocument9 pagesBiduandre.torresNo ratings yet

- Account Balance SheetDocument2 pagesAccount Balance Sheetsaikatdn555No ratings yet

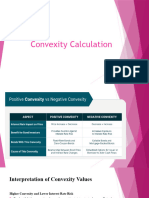

- Convexity CalculationDocument7 pagesConvexity CalculationRabeya AktarNo ratings yet

- Ca Final Afm RtpsDocument31 pagesCa Final Afm Rtpschandrakantchainani606No ratings yet

- Tybms Sem5 Fa Nov19Document6 pagesTybms Sem5 Fa Nov19Hola GamerNo ratings yet

- Applying For A Business LoanDocument5 pagesApplying For A Business LoanAhmed AlhaddadNo ratings yet

- CasesDocument74 pagesCasesPollsNo ratings yet

- Thesis of ManagementDocument12 pagesThesis of Managementsangamsapkota0007No ratings yet

- Adani Enterprises 3 Statement F.MDocument15 pagesAdani Enterprises 3 Statement F.MArnav DasNo ratings yet