Professional Documents

Culture Documents

Final 2017 Reconcilation

Uploaded by

lovellev.ev3Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final 2017 Reconcilation

Uploaded by

lovellev.ev3Copyright:

Available Formats

Notes to Cash Flow Statement

a) Cash and Cash Equivalent

Cash and cash equivalents consist of cash on hand, balances

with banks, and investment in time deposits. Cash and cash

equivalents included in the cash flow statement comprise the

following statement of financial position amounts:

2017

Cash on hand and balances with banks 353,775.86

Cash Equivalents

353,775.86

The entity has undrawn borrowing facilities of P000, of

which P000 must be used in infrastructure projects.

b) Reconciliation of Net Cash Flows from Operating Activities to Surplus/(Deficit)

2017

Surplus/(Deficit) (38,526.37)

Non-cash transactions

Depreciation 25,744.59

Amortization of Intangible Assets

Impairment Loss

Decrease in current liabilities (1,228,872.56)

Increase in other payables -

(Gains) Losses on Sale of PPE

(Gains) Losses on Sale of Investments

Increase in current assets

Increase in investments due to revaluation

Decrease in receivables 1,251,963.05

Prior Period Adjustment 0.33

Net Cash from Operating Activities 10,309.04

Certified Correct:

AIMIE G. AGAN, CPA

Municipal Accountant

Notes to Cash Flow Statement

a) Cash and Cash Equivalent

Cash and cash equivalents consist of cash on hand, balances

with banks, and investment in time deposits. Cash and cash

equivalents included in the cash flow statement comprise the

following statement of financial position amounts:

2017

Cash on hand and balances with banks 1,629,905.11

Cash Equivalents

1,629,905.11

The entity has undrawn borrowing facilities of P000, of

which P000 must be used in infrastructure projects.

b) Reconciliation of Net Cash Flows from Operating Activities to Surplus/(Deficit)

2017

Surplus/(Deficit) (128,482.39)

Non-cash transactions

Depreciation 9,721.92

Amortization of Intangible Assets Depreciation -

Impairment Loss Total

Decrease in Payables (82,130.41)

Increase in other payables 6,396.09

(Gains) Losses on Sale of PPE Advances for O

(Gains) Losses on Sale of Investments

Increase in assets due to reclassification Payables

Increase in investments due to revaluation Accounts Paya

Decrease in receivables 9,925.00

Prior Period Adjustment (79,543.00)

Net Cash from Operating Activities (264,112.79)

Other Payable

Certified Correct:

AIMIE G. AGAN, CPA

Municipal Accountant

Notes to Cash Flow Statement

a) Cash and Cash Equivalent

Cash and cash equivalents consist of cash on hand, balances

with banks, and investment in time deposits. Cash and cash

equivalents included in the cash flow statement comprise the

following statement of financial position amounts:

2017

Cash on hand and balances with banks 63,959,803.82

Cash Equivalents

63,959,803.82

The entity has undrawn borrowing facilities of P000, of which

P000 must be used in infrastructure projects.

b) Reconciliation of Net Cash Flows from Operating Activities to Surplus/(Deficit)

2017

Surplus/(Deficit) 12,747,601.55

Non-cash transactions

Depreciation 3,001,685.56

Amortization of Intangible Assets

Impairment Loss

Increase in payable 10,690,713.34

Increase in other payables 32,354.91

(Gains) Losses on Sale of PPE

(Gains) Losses on Sale of Investments

Decrease in current assets 151,766.71

Increase in investments due to revaluation

Decrease in receivables 9,346,472.35

Increase in receivables

Prior Period Adjustment (11,355,141.51)

Net Cash from Operating Activities 24,615,452.91

Certified Correct:

AIMIE G. AGAN, CPA

Municipal Accountant

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Standalone Statement of Cash Flows For The Year Ended 31St March, 2020Document6 pagesStandalone Statement of Cash Flows For The Year Ended 31St March, 2020C17ShagunNo ratings yet

- Practice Exercise - Springbok - BlankDocument3 pagesPractice Exercise - Springbok - Blank155- Salsabila GadingNo ratings yet

- Practice Solution 2Document4 pagesPractice Solution 2Luigi NocitaNo ratings yet

- Cash FlowDocument6 pagesCash FlowRazi KamrayNo ratings yet

- Session 5a Cash Flow Statement: HI5020 Corporate AccountingDocument11 pagesSession 5a Cash Flow Statement: HI5020 Corporate AccountingFeku RamNo ratings yet

- Trần Thị Thu Nguyệt-Pa3-Hwchapter17Document2 pagesTrần Thị Thu Nguyệt-Pa3-Hwchapter17Nguyet Tran Thi ThuNo ratings yet

- Bashyal Emporium7677Document6 pagesBashyal Emporium7677Ravi KarnaNo ratings yet

- St. Haniel C.A Exercise 6Document11 pagesSt. Haniel C.A Exercise 6ArthurLeonard MalijanNo ratings yet

- Half - Prime Bank 1st ICB AMCL Mutual Fund 10-11Document1 pageHalf - Prime Bank 1st ICB AMCL Mutual Fund 10-11Abrar FaisalNo ratings yet

- Session - Cash FlowsDocument42 pagesSession - Cash Flowsmohit rajputNo ratings yet

- Riddhi Siddhi Grain StoreDocument9 pagesRiddhi Siddhi Grain StoreRavi KarnaNo ratings yet

- Astralabs FY2021 FinancialsDocument3 pagesAstralabs FY2021 Financialsrichie0293No ratings yet

- CH 12 Wiley Plus Kimmel Quiz & HWDocument9 pagesCH 12 Wiley Plus Kimmel Quiz & HWmkiNo ratings yet

- Cash Flow AnalysisDocument6 pagesCash Flow AnalysisSUDHI MALHOTRANo ratings yet

- SFPOSDocument1 pageSFPOSShaira May Dela CruzNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument12 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Statement of Cash Flow: A. Cash Flows From Operating ActivitiesDocument2 pagesStatement of Cash Flow: A. Cash Flows From Operating ActivitiesRtr. Jai NandhikaNo ratings yet

- Aristro 73.74Document8 pagesAristro 73.74Bikash SedhainNo ratings yet

- Gacl Ar-21 CFDocument7 pagesGacl Ar-21 CFNikhil KuraNo ratings yet

- Financial Accounting AOLDocument7 pagesFinancial Accounting AOLNatasha HerlianaNo ratings yet

- Asian Paints Annual Report 2016-17Document2 pagesAsian Paints Annual Report 2016-17Amit Pandey0% (1)

- SFP - Notes (Problem A-C)Document22 pagesSFP - Notes (Problem A-C)The Brain Dump PHNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Assignment 4Document3 pagesAssignment 4mariyaNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementVora JeetNo ratings yet

- Tobias Co. Problem AssignmentDocument2 pagesTobias Co. Problem AssignmentMiss MegzzNo ratings yet

- Bhaivav Laxmi Ma Galla Bhandar7677Document14 pagesBhaivav Laxmi Ma Galla Bhandar7677Ravi KarnaNo ratings yet

- Financial Report - EditedDocument7 pagesFinancial Report - EditedMaina PeterNo ratings yet

- Standalone Cash Flow 2Document2 pagesStandalone Cash Flow 2rahulNo ratings yet

- ACC1002X Cheat Sheet 2Document2 pagesACC1002X Cheat Sheet 2Paul DavisNo ratings yet

- FIN 6060 Module 5 AssignmentDocument7 pagesFIN 6060 Module 5 Assignmentr.olanibi55100% (1)

- © The Institute of Chartered Accountants of IndiaDocument14 pages© The Institute of Chartered Accountants of IndiasolomonNo ratings yet

- Solution Q1Document10 pagesSolution Q1سنبل ملکNo ratings yet

- Class Day Test BSC Finance Year 2Document5 pagesClass Day Test BSC Finance Year 2Revatee HurilNo ratings yet

- (In Millions) : Consolidated Statements of Cash FlowsDocument1 page(In Millions) : Consolidated Statements of Cash FlowsrocíoNo ratings yet

- Adrac Ifrs Training ProgramDocument6 pagesAdrac Ifrs Training ProgramfrancoolNo ratings yet

- Procter & Gamble Hygiene and Health Care Limited: Annual Report 2020-21Document14 pagesProcter & Gamble Hygiene and Health Care Limited: Annual Report 2020-21parika khannaNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 9Document15 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 9Hung LeNo ratings yet

- Trust CFDocument1 pageTrust CFShaira May Dela CruzNo ratings yet

- Cashflow Analysis - Beta - GammaDocument14 pagesCashflow Analysis - Beta - Gammashahin selkarNo ratings yet

- Consolidated Cash Flow StatementDocument5 pagesConsolidated Cash Flow Statementlal kapdaNo ratings yet

- Statement of CashflowDocument9 pagesStatement of CashflowOwen Lustre50% (2)

- TML Ir Ar 2018 19Document1 pageTML Ir Ar 2018 19SRINIDHI PEESAPATINo ratings yet

- Cash Flow Statement: For The Year Ended December 31, 2015Document2 pagesCash Flow Statement: For The Year Ended December 31, 2015Sahrish KhanNo ratings yet

- Conceptual Framework & Accounting Standards: Preparation & Presentation of Financial StatementsDocument35 pagesConceptual Framework & Accounting Standards: Preparation & Presentation of Financial StatementsJocy DelgadoNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- PIOCORE 2022 - ThousandDocument7 pagesPIOCORE 2022 - ThousandAbhishek RaiNo ratings yet

- June 2009 Fa4a1Document9 pagesJune 2009 Fa4a1ksakala58No ratings yet

- FR AS ScannerDocument144 pagesFR AS ScannerPooja GuptaNo ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- 1 - 433 - 1 - Cash Flow Statement 2016 2017Document1 page1 - 433 - 1 - Cash Flow Statement 2016 2017Avnit kumarNo ratings yet

- Acc101 Am14 - Eleria - Financial Reporting CorporationDocument21 pagesAcc101 Am14 - Eleria - Financial Reporting CorporationChristian Gerard Eleria ØSCNo ratings yet

- Budhanilkantha Healthcare Pvt. LTD: For: R. Puri & AssociatesDocument3 pagesBudhanilkantha Healthcare Pvt. LTD: For: R. Puri & AssociatesSanjiv GuptaNo ratings yet

- Fund FlowDocument15 pagesFund FlowArunRamachandranNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentQala LimitedNo ratings yet

- Accounts AssignmentDocument17 pagesAccounts AssignmentApoorvNo ratings yet

- AOP Sales - 23.12.2017Document12 pagesAOP Sales - 23.12.2017Rubayat MatinNo ratings yet

- LLH9e Chapter 12Document40 pagesLLH9e Chapter 12Anil K KashyapNo ratings yet

- Materials Management-Unit-3Document15 pagesMaterials Management-Unit-3Garima KwatraNo ratings yet

- Part ViiDocument19 pagesPart ViiNghia TrungNo ratings yet

- Chapter 02 - CONCEPTUAL FRAMEWORK: Objective of Financial ReportingDocument6 pagesChapter 02 - CONCEPTUAL FRAMEWORK: Objective of Financial ReportingKimberly Claire AtienzaNo ratings yet

- (Student Version) Comparison and Selection Among AlternativeDocument60 pages(Student Version) Comparison and Selection Among AlternativeAyish CehcterNo ratings yet

- Terms of Business: Define The FollowingDocument3 pagesTerms of Business: Define The FollowingBetyou WannaNo ratings yet

- Danielle BeckmannDocument1 pageDanielle Beckmannapi-491113890No ratings yet

- Sanskriti Presentationnnnnnnnn (1)Document14 pagesSanskriti Presentationnnnnnnnn (1)Sahil OfficialNo ratings yet

- CV - Devina Aprilia RahardjoDocument2 pagesCV - Devina Aprilia Rahardjosyafrial rezaNo ratings yet

- Articles of IncorporationDocument3 pagesArticles of IncorporationLenard Josh Ingalla100% (1)

- HR Policies of PTCLDocument39 pagesHR Policies of PTCLSalik LatifNo ratings yet

- HR Management Report VitalStrats Creative SolutionsDocument9 pagesHR Management Report VitalStrats Creative SolutionsLara Ysabelle CappsNo ratings yet

- VP Director HR Talent Development in OK Resume Tom HillDocument3 pagesVP Director HR Talent Development in OK Resume Tom HillTomHill2No ratings yet

- 17.forecasting of Forex Market Using Technical AnalysisDocument65 pages17.forecasting of Forex Market Using Technical Analysisharrydeepak100% (1)

- Solution Manual For Managerial Accounting For Managers 4th Edition Noreen Brewer Garrison 1259578542 9781259578540Document36 pagesSolution Manual For Managerial Accounting For Managers 4th Edition Noreen Brewer Garrison 1259578542 9781259578540richardwilsonmgftzpsjxq100% (27)

- MGT 610-Final Exam - Nafisa Sanjida - 18364074Document8 pagesMGT 610-Final Exam - Nafisa Sanjida - 18364074afroz ashaNo ratings yet

- Jeypore Civil Supply Monthly Progress ReportDocument76 pagesJeypore Civil Supply Monthly Progress ReportJitendra Kumar SahooNo ratings yet

- Entrep 4THQ ReviewerDocument2 pagesEntrep 4THQ ReviewerJhasse Dela CruzNo ratings yet

- Make-Up Printers: (Citation Cla15 /L 1033)Document6 pagesMake-Up Printers: (Citation Cla15 /L 1033)Ch Hamza SajidNo ratings yet

- What Makes A Children - Reflection Paper.Document1 pageWhat Makes A Children - Reflection Paper.Panis, Mark DaveNo ratings yet

- Case Analysis For GARMIN 2019Document9 pagesCase Analysis For GARMIN 2019Juewei Chen100% (2)

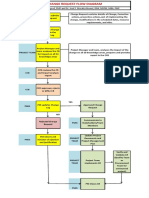

- Change Request Flow DiagramDocument2 pagesChange Request Flow DiagramSwapnil0% (1)

- PL 5570027 PDFDocument2 pagesPL 5570027 PDFHarvinder SinghNo ratings yet

- Corporate Valuation NotesDocument45 pagesCorporate Valuation NotesSujata Tiwari100% (1)

- Semester 4 Reg Apr 2022 MPCCDocument10 pagesSemester 4 Reg Apr 2022 MPCCThakor sunilNo ratings yet

- Domino's Pizza, Inc.: Case AnalysisDocument22 pagesDomino's Pizza, Inc.: Case Analysisgisel w100% (2)

- Start UpDocument7 pagesStart UpLoveBabbarNo ratings yet

- EOI For FILTERSDocument7 pagesEOI For FILTERSbiswasdipankar05No ratings yet

- Inglés Decim O C: Second Period/Lesson 3: Module 2: Globalization Money Makes The World Go AroundDocument10 pagesInglés Decim O C: Second Period/Lesson 3: Module 2: Globalization Money Makes The World Go AroundMonica HerreraNo ratings yet

- Industry Analysis of Airline Industry in IndiaDocument13 pagesIndustry Analysis of Airline Industry in IndiaVivek KumarNo ratings yet

- Sample DissertationDocument32 pagesSample DissertationAnamika VatsaNo ratings yet