Professional Documents

Culture Documents

Money & Credit - Mind Map

Uploaded by

Mohd Raza0 ratings0% found this document useful (0 votes)

3 views2 pagesMind map

Original Title

money & credit _mind map

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMind map

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesMoney & Credit - Mind Map

Uploaded by

Mohd RazaMind map

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

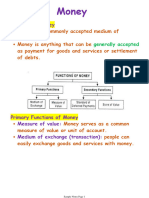

MONEY AND CREDIT

1. MONEY AS A MEDIUM OF EXCHANGE 2. MODERN FORMS OF MONEY

• Money acts as an intermediate in the exchange • During early ages, i.e., before introducing coins or currency notes a variety of objects were used for exchange and settlement of transactions.

process & it is called Medium of exchange. In India grains and cattle were used as money.

• In a BARTER SYSTEM, goods are directly exchanged • After that, metallic coins gold, silver & copper coins that lasted till the last century.

without the use of money.

• Double coincidence of wants is an essential feature

of barter system. Currency Deposits with Banks

• Double coincidence of wants what a person

• In the Modern forms of currency paper notes and coins are used as a • The other form in which people hold Money is as deposits with banks. Bank deposits

desires to sell is exactly what the other wishes

medium of exchange. are also a form of the modern economy.

to buy.

• Money is accepted as a medium of exchange because the currency is • In this, people can open a bank account and deposit their extra cash with the Bank

authorized by the government of the country. and Banks accept the deposits and also pay an amount as interest on the deposits.

• In India, the Reserve Bank of India issues currency notes on behalf of the • The deposits in the bank accounts can be withdrawn on demand; these deposits

central government are called demand deposits.

3. LOAN ACTIVITIES OF BANK • According to the law no one can refuse payment made in rupees to • Demand deposits offer another interesting facility The payments being made by

settling transactions. Rupee is widely accepted as a medium of exchange. cheques instead of cash.

• The majority of people deposit their money in banks. • A cheque is a paper instructing the bank to pay a specific amount from the

The banks only keep a small portion of these person’s account to the person in whose name the cheque has been issued

deposits with themselves. It is used when the • The facility of cheque against demand deposits makes it possible to directly settle

depositors come to withdraw their money. payments without the use of cash.

• Banks in India these days hold about 15 per cent of

their deposits as cash. This is kept as provision to

pay the depositors who might come to withdraw

money from the bank on any given day. 4. TWO DIFFERENT CREDIT SITUATIONS

• The other major portion of the deposits is used to

offer loans to borrowers. People need loans for

Credit (Loan): It is an agreement in which a borrower receives money, goods, or services from a lender for now and promises to return the resources or repay the lender in

various economic activities like buying a house,

the future.

vehicles etc.

• Thus, Banks act as a mediator between the

depositors (those who have surplus funds) and First Situation Second Situation

Borrowers (those who need funds).

A person (manufacturer) obtains credit to meet the working capital needs A person obtains credit for producing goods. For example, in rural areas, the

• These banks charge a higher rate of interest on

of production. The credit helps him to meet the on-going expenses of main demand for credit is for crop production involves considerable costs

the loans than what they offer on deposits.

production, complete production on time, and thereby increase his on seeds, fertilisers, pesticides, water, electricity, repair of equipment, etc.

• The difference between what is charged from

earnings. Credit therefore plays a vital and positive role in this situation.

borrowers and what is paid to depositors is their

main source of income. There is a minimum of 3 to 4 months gap between the sowing and harvesting. Farmers usually take crop loans at the beginning of the season and repay the loan after

harvest. Repayment of the loan is crucially dependent on the income from farming.

In case of the failure of the crop, loan repayment is impossible. One has to sell part of the land to repay the loan. Credit, instead of helping to improve one’s earnings,

leaves oneself worse off. This is an example of what is commonly called debt-trap. Credit in this case pushes the borrower into a situation from which recovery is

5. TERMS OF CREDIT very painful.

• Every loan agreement specifies an interest rate

which the borrower must pay to the lender along

with the repayment of the principal. In addition, 6. FORMAL SECTOR CREDIT IN INDIA

lenders also demand collateral (security) against

loans.

We have seen that people obtain loans from various sources. These sources can be grouped as Formal sector loans and Informal sector loans.

• Collateral is an asset that the borrower owns (such

as land, building, vehicle, livestock, deposits with

banks) and given to the lender as a guarantee until a. Formal sector loans b. Informal sector loans

the loan is repaid.

o These are the loans from banks and cooperatives. o The informal lenders include moneylenders, traders, employers, relatives and friends, etc.

• If the borrower is unable to repay the loan then the

o Need proper documents and collateral before lending o There is no need of documents and collateral for loans

lender has the right to sell it and get the money back.

o Loans are provided at Low rate of interest o In this loans are provided at very High rate of interest

• Interest rate, collateral and documentation

o Supervised by Reserve Bank of India (RBI) o There is No organisation supervises these credit activities like RBI in formal sector

requirement and the mode of repayment, together

is called the terms of credit.

c. Formal and Informal Credit: Who gets what? Reserve Bank of India

o 85% of the loans taken by poor households in the urban areas are from informal sources. o Reserve Bank of India supervises the activities of formal sector and keeps the track of their activities but there

o Urban households take only 10% of their loans are from informal sources, while 90% are from formal sources. is no one supervises the functioning of informal sector.

o The formal sector still meets only about half of the total credit needs of the rural people. The remaining credit o The RBI assures that banks provide loans to small cultivators, small-scale industries, etc., at cheap rates and

needs are met from informal sources. not only to profit-making businesses and traders.

o Because of this reason, the banks and cooperatives must make provisions to provide loans at cheaper rates o The banks must periodically submit data about their interest rate, borrowers’ information, etc., to the RBI.

in rural areas, which would enable people to set their own businesses, new industries, grow more crops, etc.

o It is important that the formal credit is distributed more equality so that the poor can benefit from the cheaper

loans.

o The formal sector also needs to expand, and it should be accessible to everyone. Cheap and affordable credit

is crucial for the development of the country.

7. SELF-HELP GROUPS FOR THE POOR

• Poor households are majorly dependent on informal sector credits. This is because Banks are not available in rural areas.

• Banks require proper documentation and collateral for lending a loan. The absence of collateral prevents the poor from getting a loan.

• On the other hand, moneylenders willing to give loans to the poor at a much higher rate without any collateral. They keep no data of the transactions and harass the poor.

• To overcome these problems Self Help Groups (SHGs) were created.

o SHGs are small groups of poor people which promote small savings among their members.

o A typical SHG has 15-20 members, usually belonging to one neighbourhood, who meet and save regularly Saving per member varies from Rs. 25 to Rs. 100 or more.

o The group lends loans to its members at a comparatively low-interest rate than the moneylender without collateral.

o If the group is regular in savings, it becomes eligible to receive a loan from banks.

o Loan is sanctioned in the name of the group and is meant to create self-employment opportunities for the members.

o Most of the important decisions regarding the savings and loan activities are taken by the group members the purpose, amount, interest to be charged, repayment schedule etc.

o Any case of non-repayment of loan by any one member is followed up seriously by other members in the group. Because of this feature, banks are willing to lend to the poor

women when organised in SHGs, even though they have no collateral as such.

o SHGs are the building blocks of organisation of the rural poor. It helps women to become financially self-reliant.

You might also like

- Economics - Money and CreditDocument1 pageEconomics - Money and CreditGg YyNo ratings yet

- Money and Credit Class-X MoneyDocument9 pagesMoney and Credit Class-X MoneyAryan KumarNo ratings yet

- Money and Credit NotesDocument4 pagesMoney and Credit Notesadityamanjhi108No ratings yet

- Money and CreditDocument7 pagesMoney and Creditraimaali220077No ratings yet

- Chapter 2 Money and CreditDocument8 pagesChapter 2 Money and CreditKiran shukla100% (1)

- Self PPT On Money and CreditDocument15 pagesSelf PPT On Money and CreditTripti SinghaNo ratings yet

- Money and Credit One ShotDocument13 pagesMoney and Credit One Shotmrsnightmare76No ratings yet

- Modern Money FormsDocument1 pageModern Money FormsKajal RanaNo ratings yet

- 3 Money N Credit NotesDocument15 pages3 Money N Credit NotesAbhay100% (1)

- Money & Credit SlideDocument64 pagesMoney & Credit SlideFREE FIRE SHORT VIDEO'SNo ratings yet

- Economics, Chapter 3 Money and CreditDocument3 pagesEconomics, Chapter 3 Money and CreditshambhaviNo ratings yet

- Economics Chapter 3 Handwritten Notes Money and Credit EconomicsDocument11 pagesEconomics Chapter 3 Handwritten Notes Money and Credit EconomicsRenu Yadav100% (1)

- Economics-Money and Fcredit 01 - Handwritten NotesDocument23 pagesEconomics-Money and Fcredit 01 - Handwritten NotesShashank GoyalNo ratings yet

- December-10-Eco-Ch-3 Money & Credit-NotesDocument36 pagesDecember-10-Eco-Ch-3 Money & Credit-Notesananyamishra11122007No ratings yet

- Banking in Financial System. ProjectDocument40 pagesBanking in Financial System. Projectvickyrawat1983No ratings yet

- 1.money and CreditDocument18 pages1.money and CreditNandita KrishnanNo ratings yet

- Commercial BanksDocument95 pagesCommercial BanksKavya sri nalamatiNo ratings yet

- Notes - Money & Credit - Class X - EconomicsDocument9 pagesNotes - Money & Credit - Class X - EconomicsabhinavsinghbaliyanraghuvanshiNo ratings yet

- Money and CreditDocument2 pagesMoney and CreditChris JudeNo ratings yet

- 1 Overview Slides Banking v2 SCDocument39 pages1 Overview Slides Banking v2 SCsahilmonga1No ratings yet

- Class 10 Study Notes on Money and Credit ChapterDocument6 pagesClass 10 Study Notes on Money and Credit ChapterAavy MishraNo ratings yet

- Banking SystemDocument12 pagesBanking SystemDilip RCNo ratings yet

- MONEY X EconomicsDocument7 pagesMONEY X EconomicsAvika SinghNo ratings yet

- NCERT Solutions For Class 10 Economics Chapter 3 Money and CreditDocument32 pagesNCERT Solutions For Class 10 Economics Chapter 3 Money and CreditK.SrisudharsanVIII.A K.K.Rohith IV.BNo ratings yet

- Evolution of MoneyDocument9 pagesEvolution of MoneySenthil Kumar GanesanNo ratings yet

- Money and Credit - Shobhit NirwanDocument11 pagesMoney and Credit - Shobhit Nirwansannigrahipriyanshu08No ratings yet

- Sample NotesDocument20 pagesSample NotesKenpin EteNo ratings yet

- Money and Credit Class 10Document27 pagesMoney and Credit Class 10amritadevi121979No ratings yet

- PCR 4 y 6 JJ 3 VKPX6 MF02 TUy H3 RM RFC 4 DDG XT Nexu JVWDocument18 pagesPCR 4 y 6 JJ 3 VKPX6 MF02 TUy H3 RM RFC 4 DDG XT Nexu JVWapriliantiNo ratings yet

- Money and CreditDocument7 pagesMoney and CreditSunil Sharma100% (1)

- Money and Credit NotesDocument3 pagesMoney and Credit NotestanishqNo ratings yet

- Class 10 Economics Chapter 3 Money and Credit NotesDocument14 pagesClass 10 Economics Chapter 3 Money and Credit Notesmexeb28867No ratings yet

- Money and BankingpptDocument19 pagesMoney and BankingpptSania ZaheerNo ratings yet

- Lecturer: Nesar Ahmad Yosufzai: Bakhtar UniversityDocument31 pagesLecturer: Nesar Ahmad Yosufzai: Bakhtar UniversityAltaf HyssainNo ratings yet

- Money and Credit: Economics Class-10Document7 pagesMoney and Credit: Economics Class-10Ankita MondalNo ratings yet

- 3 Money and CreditDocument5 pages3 Money and CreditRounak BasuNo ratings yet

- Chapter 3 Money and CreditDocument33 pagesChapter 3 Money and Creditneevnk2008No ratings yet

- Money and BankingDocument26 pagesMoney and BankingutkarshNo ratings yet

- Unit 5,6 and 75Document24 pagesUnit 5,6 and 75Akshita KambojNo ratings yet

- Class 10 Eco Money & CreitDocument5 pagesClass 10 Eco Money & CreitPrarthna AgrawalNo ratings yet

- Money and CreditDocument12 pagesMoney and CreditthinkiitNo ratings yet

- MoneyCreditDocument4 pagesMoneyCreditNisha SinghNo ratings yet

- Banking and Financial Institutions Chapter 5Document34 pagesBanking and Financial Institutions Chapter 5Lorena100% (1)

- Chapter 4 MacroeconomicDocument9 pagesChapter 4 MacroeconomicPham Phu Cuong B2108182No ratings yet

- 3-Banking Financial Institution PDFDocument29 pages3-Banking Financial Institution PDFYna AlejoNo ratings yet

- Money and Credit Class 10 Notes CBSE Economics Chapter 3 (PDF)Document9 pagesMoney and Credit Class 10 Notes CBSE Economics Chapter 3 (PDF)jangdesarthakNo ratings yet

- CHP 17 - Commercial Bank Sources & Uses of FundsDocument22 pagesCHP 17 - Commercial Bank Sources & Uses of Fundsrashu892No ratings yet

- Money and CreditDocument3 pagesMoney and CreditMayank SainiNo ratings yet

- Unit 3 The Individual As Producer, Consumer and Borrower: Activities: Guidance and AnswersDocument8 pagesUnit 3 The Individual As Producer, Consumer and Borrower: Activities: Guidance and AnswersJada CameronNo ratings yet

- Unit 5,6 and 71Document24 pagesUnit 5,6 and 71Akshita KambojNo ratings yet

- Chp 17 - Commercial Bank Sources & Uses of FundsDocument22 pagesChp 17 - Commercial Bank Sources & Uses of FundsAadya instituteNo ratings yet

- Money and CreditDocument14 pagesMoney and CreditAbhimanyu Chauhan72% (57)

- Money and BankingDocument10 pagesMoney and BankingIsha KembhaviNo ratings yet

- Econ6049 Economic Analysis, S1 2021: Week 7: Unit 10 - Banks, Money and The Credit MarketDocument27 pagesEcon6049 Economic Analysis, S1 2021: Week 7: Unit 10 - Banks, Money and The Credit MarketTom WongNo ratings yet

- 32 Nature and Scope of BankingDocument20 pages32 Nature and Scope of Bankingpatilamol019100% (1)

- Money and CreditDocument5 pagesMoney and CreditAYUSH DEYNo ratings yet

- CH 12 Lo - Money - and - BankingDocument20 pagesCH 12 Lo - Money - and - Bankingtariku1234No ratings yet

- Debt 101: From Interest Rates and Credit Scores to Student Loans and Debt Payoff Strategies, an Essential Primer on Managing DebtFrom EverandDebt 101: From Interest Rates and Credit Scores to Student Loans and Debt Payoff Strategies, an Essential Primer on Managing DebtRating: 4 out of 5 stars4/5 (3)

- Nissan FinalDocument4 pagesNissan FinalPrince Jayanmar BerbaNo ratings yet

- CM 6549 20220528025414Document7 pagesCM 6549 20220528025414AT100% (1)

- Scotsman201610ce DLDocument101 pagesScotsman201610ce DLHelpin HandNo ratings yet

- The Impact of COVID-19 in South AfricaDocument6 pagesThe Impact of COVID-19 in South AfricaThe Wilson Center100% (10)

- Project 3 FinalDocument11 pagesProject 3 Finalapi-261340346No ratings yet

- 5-8 Financial Markets McqsDocument26 pages5-8 Financial Markets McqsdmangiginNo ratings yet

- Financial Literacy Chapter Defines Key Concepts Assesses LevelDocument14 pagesFinancial Literacy Chapter Defines Key Concepts Assesses LevelCj Arante100% (1)

- Action Plan JICA TrainingDocument7 pagesAction Plan JICA TrainingashrafulalamNo ratings yet

- 227 QDocument12 pages227 Qtanvi virmaniNo ratings yet

- LPD 2019 PDFDocument161 pagesLPD 2019 PDFDivya YallaturiNo ratings yet

- Personal Financial StatementDocument3 pagesPersonal Financial StatementIPS SAINSA SASNo ratings yet

- Private Equity Investment Banking Hedge Funds Venture CapitalDocument26 pagesPrivate Equity Investment Banking Hedge Funds Venture Capitalpankaj_xaviersNo ratings yet

- Statistics CIA 3 - 2nd SemesterDocument23 pagesStatistics CIA 3 - 2nd SemesterHigi SNo ratings yet

- Bank AttachmentDocument7 pagesBank AttachmentAnanshya R VNo ratings yet

- Understanding the DBRS Rating ScaleDocument1 pageUnderstanding the DBRS Rating ScaleJonathan OrdóñezNo ratings yet

- AKR Industries 19mar2020Document8 pagesAKR Industries 19mar2020Karthikeyan RK SwamyNo ratings yet

- Continental Finance FIT PDFDocument1 pageContinental Finance FIT PDFJoe AcevesNo ratings yet

- Mortgage Key Facts SheetDocument2 pagesMortgage Key Facts Sheetpeter_martin9335No ratings yet

- PNB e-MUDRA Loan DetailsDocument1 pagePNB e-MUDRA Loan DetailsAnkit TyagiNo ratings yet

- CMBS Basic Overview enDocument79 pagesCMBS Basic Overview enEd HuNo ratings yet

- Foreclosure0815 PDFDocument8 pagesForeclosure0815 PDFNick ReismanNo ratings yet

- Transaction Codes (T-Codes) in SAP FI - CODocument8 pagesTransaction Codes (T-Codes) in SAP FI - COvivekan_kumarNo ratings yet

- Financial Risk ManagementDocument34 pagesFinancial Risk Managementakash agarwalNo ratings yet

- Kfs DocumentDocument2 pagesKfs DocumentNayan ShindeNo ratings yet

- 22 Finance Company OperationsDocument18 pages22 Finance Company OperationsPaula Ella BatasNo ratings yet

- SVB Financial Group: United States Securities and Exchange Commission FORM 10-KDocument264 pagesSVB Financial Group: United States Securities and Exchange Commission FORM 10-KBit BitNo ratings yet

- S M T W T F S: Late Payment WarningDocument4 pagesS M T W T F S: Late Payment Warningeva ramseyNo ratings yet

- Ch. 4 LoansandannuitiesDocument40 pagesCh. 4 LoansandannuitiesayaanNo ratings yet

- Credit Management of Sonali Bank Limited27 6Document49 pagesCredit Management of Sonali Bank Limited27 6Md Alamgir KabirNo ratings yet

- Contract of Sales 2Document88 pagesContract of Sales 2Desiree100% (2)