Professional Documents

Culture Documents

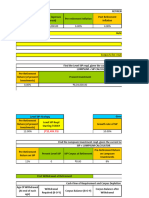

Financial Planning Process

Financial Planning Process

Uploaded by

Bharathi 3280Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Planning Process

Financial Planning Process

Uploaded by

Bharathi 3280Copyright:

Available Formats

1.

Learn More About Financial Vitals

What is financial wellness?

The term financial wellness, also commonly known as financial well-being, is still in its nascent stages

of being studied and defined by academicians and scholars. Although a relatively novel concept, global

policymakers have been consistent in recognising the importance of financial wellness, and considering

it while formulating household economic policies for over a decade now. As early as 2013, the World

Bank noted how Policymakers across the world have been concerned about improving the financial

well-being of households.

Academic disciplines such as economics, financial planning and advisory, household and personal

finance, consumer decision-making, and behavioural finance have all examined financial well-being

through their own lenses. However, there is no consensus on a single definition or metric for it.

The term financial wellness, its conceptualisation, and its constituent parts remain loosely defined at

best. This urged us to dive deeper and conduct our own research to understand it from a holistic

perspective.

Financial wellness means being at peace, and in control of one’s financial journey. It is a subjective

term and entails several ways of achieving it.

A multi-dimensional concept, financial wellness describes the overall financial health of a person,

which depends on four main variables - an individual’s personal situation, their level of financial

awareness, their financial choices, and the macro-economic environment, where -

Personal situation includes an individual’s personality, demography, family generation, and

life constraints.

Financial awareness is the ability to understand one's own economic situation as well as

financial concepts and products.

Financial choices cover an individual’s spending patterns, saving habits, borrowing behaviour,

and financial planning efforts.

Macro-economic environment comprises factors such as inflation, recession, geopolitical

considerations, etc.

All of these factors, in their own measures, impact the financial well-being of an individual. Empirical

studies have shown that the personality and characteristics of an individual have a far greater impact on

their financial well-being than their ability to understand financial concepts.

How do we assess your financial wellness?

In contrast to income, net worth, and cash flow - all of which are simple metrics that can be assessed

using a mathematical formula, financial well-being is a complex concept. It encapsulates multiple

elements (such as a person’s savings habits, their understanding of financial concepts, etc.) that cannot

be statistically evaluated via a simple equation. It also takes into account the individual’s personal

situation (the current state of their finances, their demographic and other personal information, their

near-term and long-term needs and goals), their financial awareness, factors influencing their financial

choices, and the macro-economic environment impacting the individual and their household finances.

Furthermore, financial well-being is a multifaceted concept that cannot be evaluated by looking at one

aspect of it in isolation from the others. There is currently no scientifically supported data-driven model

that people can use to understand and evaluate their financial well-being. In light of this, 1 Finance has

devised a step-by-step mechanism to get to the point where we can assess your financial wellness, in a

comprehensive and meaningful manner.

Strictly for private circulation only

2.

The 1 Finance ecosystem was created with the sole purpose of ensuring financial wellness for all our

members, and ultimately helping them achieve financial freedom.

After understanding yourself (with the help of MoneySign ), knowing your finances (with the help of

TM

1 View), and learning how your financial choices align with your personality (with the help of Financial

Behaviour Score), we can now prepare to dive deeper and explore your financial well-being and

establish a road map for better financial health - together encapsulated in 1 Finance’s ‘Financial

Wellness Plan’.

What is a Financial Wellness Plan?

Financial Wellness Plan is the 4th offering on 1 Finance’s advisory ecosystem - and the fourth step in

your financial well-being journey. By considering your financial, personal and behavioural information,

the Financial Wellness Plan provides a holistic assessment of your financial health along with

customised actionable insights that align with your inherent personality and behavioural traits.

Unlike any other financial plans that only touch upon certain specific aspects of a person’s finances -

whether it is an investment plan, a tax plan or a cash flow budget, the Financial Wellness Plan offered

by 1 Finance provides a complete picture of your current financial health encompassing all areas such

as investments, debt, expense management, emergency savings, insurance; your past behavioural

patterns that impact your financial decisions; and a blueprint of sound financial decisions that you can

take in the future.

The insights and recommendations provided by the Financial Wellness Plan are rooted in

a. the human expertise of our qualified and experienced financial concierge* specialists and

financial advisors, and

b. our proprietary algorithms that facilitate advanced portfolio analysis and help identify the right

financial instruments for our members

*financial concierge: 1 Finance’s team of certified, qualified, and experienced financial planners,

wealth managers and financial advisors

The end-goal of all personal finance advisory, whether related to investments, or expense management,

or even emergency planning is to ensure responsible financial decisions. In the end, it all boils down to

one simple question: What steps can I take? How can I make changes to my financial situation that will

allow me to feel content with where I am in my financial journey? By tailoring a customised approach,

the Financial Wellness Plan outlines simple and achievable steps in its action plan that one can take to

better their financial health.

A breakdown of your Financial Wellness Plan - Explore all financial vitals

The Financial Wellness Plan offers

A. COMPLETE INFORMATION

MoneySign - a complete break-down of an individual’s personality, core instincts and traits,

TM

behavioural biases that impact their finances

1 View - a comprehensive and real-time picture of all the various components that make up a

person’s finances (including but not limited to assets, liabilities, income, expenses, and insurance)

Personal Balance Sheet - a detailed snapshot of a person’s financial standing

Net Worth (current and projected) - the difference between what a person owns (assets like your

house, retirement funds, etc) and what they owe (your liabilities such as mortgage, credit card debt

and so forth)

Strictly for private circulation only

3.

Financial Behaviour Score - how their money decisions fare according to key financial metrics

that evaluate one's financial health across critical dimensions - expense and liability management,

asset allocation, and emergency planning, along with

B. DETAILED ASSESSMENT

An in-depth analysis of personal and financial information - instead of having to make sense of

numbers and complicated ratios, the Financial Wellness Plan offers a meaningful and easy-to-

understand assessment of one’s financial health, coupled with

C. AN ACTION-PLAN FOR IMPROVED FINANCIAL HEALTH

The step-by-step guidance from 1 Finance allows you to thoroughly assess your financial history, take

stock of your present financial situation, and have a clear roadmap for your future.

Key takeaways that suggest quick steps to address key areas of concern in your current financial

situation

Actionable insights and recommendations, tailored to align with your financial journey

Lifestyle-based planning that considers your personal journey and helps you prepare financially

for key life events that are important to you

How is your Financial Wellness Plan different from your Personal Balance Sheet?

The Financial Wellness Plan is a comprehensive approach to managing your financial health. It involves

taking a holistic view of your financial situation and identifying areas where you can improve your

financial well-being.

A personal balance sheet, on the other hand, is a snapshot of your financial situation at a specific point

in time. It lists your assets (e.g., cash, investments, gold, property, etc.) and liabilities (e.g., home loan,

auto loan, etc.) and calculates your net worth by subtracting your liabilities (what you own) from your

assets (what you owe).

The Financial Wellness Plan integrates a 360 degree approach to financial planning touching upon

aspects such as evaluating life or health cover adequacy, creating a well-guided investment strategy that

aligns with your personality, contingency planning, and personal debt management. This holistic

approach to financial planning is built on information derived from the Personal Balance Sheet, the

MoneySign Assessment that evaluates your personality and your 1 View that considers your assets,

TM

liabilities, incomes, expenses, and insurance.

While both the Financial Wellness Plan and a personal balance sheet are useful tools for managing your

financial health, they serve different purposes. The Financial Wellness Plan is a proactive approach to

improving your financial situation as it offers a route map for a sound financial journey, while a personal

balance sheet is a summary of your current financial position.

A Personal Balance Sheet serves as an important starting point for holistic financial planning. The

Financial Wellness Plan comes at a later stage in one’s financial wellness journey - as it considers your

unique financial situation and milestones. You can learn more about Financial Concierge Specialists

here.

Personal Balance Sheet Financial Wellness Plan

Snapshot of assets and liabilities at a given point The Financial Wellness Plan is a blueprint for

in time better financial health.

Strictly for private circulation only

4.

Retrospective in nature Forward-looking in nature

Gives details about financial information Gives details about financial, behavioural as well

as aspirational information

Users will need to evaluate the Personal Balance Already includes specific actionable insights and

Sheet themselves to arrive at their own recommendations that members can adopt to

conclusions about their personal finances improve their financial health

How can the Financial Wellness Plan help with better financial decisions?

Before you dive deeper into understanding how to use your Financial Wellness Plan, it is important to

keep in mind that your Financial Wellness Plan is created to help you improve your overall financial

health and not just one aspect of your finances (like earning better returns on investments).

The Financial Wellness Plan paints a comprehensive picture of your overall financial well-being,

including how your past habits and decisions have shaped your current situation, and how to best

proceed in the future.

The plan serves as a strong foundation for making informed financial decisions by analysing your

financial situation in detail. The Financial Wellness Plan can help you assess each aspect of your

personal finances by giving you a detailed report of not just your holdings but also other aspects of your

finances such as debt, expense management, insurance, etc. This helps us identify areas where you may

need to make changes.

The Financial Wellness Plan captures important financial milestones in your life. For instance, buying

a new car, buying your first house, funding your child’s higher education, and building a retirement

corpus. This provides a clear direction for your financial planning and helps you make decisions that

align with your goals.

The Financial Wellness Plan offers an in-depth evaluation of your investments to ensure you’re on the

right track. The plan incorporates recommendations based on your corpus analysis, by not just

proposing diversification strategies for improved financial health but also suggesting financial decisions

that align with your personality, etc.

The plan also includes strategies for reducing debt, such as paying off high-interest credit card debt or

consolidating loans. Reducing debt can help you free up money for other financial goals and make it

easier to make informed financial decisions.

Not just that, the Financial Wellness Plan also offers insight into your insurance requirements by taking

into account your life stage, number of dependents, and financial details such as income, assets, and

liabilities.

Overall, the Financial Wellness Plan can help you walk on the path to your financial freedom by

providing a comprehensive approach to managing your financial health.

Strictly for private circulation only

You might also like

- 200 Secret Tools E-BookDocument23 pages200 Secret Tools E-BookAnnaNo ratings yet

- CFPB Report Financial-Well-Being PDFDocument48 pagesCFPB Report Financial-Well-Being PDFjoshuamaun1998No ratings yet

- Personal Financial PlanningDocument21 pagesPersonal Financial PlanningAparna PavaniNo ratings yet

- Chapte R4 Financ Ial Lite RacyDocument34 pagesChapte R4 Financ Ial Lite RacyJenelyn L. Malintad100% (1)

- Chapter 7 Variable CostingDocument47 pagesChapter 7 Variable CostingEden Faith AggalaoNo ratings yet

- PFM Blackbook 19022014Document57 pagesPFM Blackbook 19022014dp100% (1)

- Pursue Lesson 1Document14 pagesPursue Lesson 1Kent Andojar MarianitoNo ratings yet

- AR Manual Sect 4-5Document33 pagesAR Manual Sect 4-5HungNo ratings yet

- M D L 8: Financial: LiteracyDocument15 pagesM D L 8: Financial: LiteracyAngela Casimero SuspeneNo ratings yet

- LESSON 20: What Is Personal Finance? TargetDocument8 pagesLESSON 20: What Is Personal Finance? TargetMai RuizNo ratings yet

- SEC Personal Financial PlanningDocument13 pagesSEC Personal Financial PlanningJagriti100% (3)

- Money Matrix - The practical guideline for financial intelligence and sovereign money managementFrom EverandMoney Matrix - The practical guideline for financial intelligence and sovereign money managementNo ratings yet

- Financial Planning Made Easy: A Beginner's Handbook to Financial SecurityFrom EverandFinancial Planning Made Easy: A Beginner's Handbook to Financial SecurityNo ratings yet

- CFPB Report Financial-Well-BeingDocument48 pagesCFPB Report Financial-Well-BeingPavan KumarNo ratings yet

- Personal Finance Chapter 1Document6 pagesPersonal Finance Chapter 1SUMAYYAH MANALAONo ratings yet

- G. Regio-Final Paper-Financial Management PDFDocument29 pagesG. Regio-Final Paper-Financial Management PDFGENELYN REGIONo ratings yet

- Personal FinanceDocument4 pagesPersonal FinanceFrancine Joy AvenidoNo ratings yet

- Stressing Less Over Dollars & Sense: Your Personal Guide to Monetary WellnessFrom EverandStressing Less Over Dollars & Sense: Your Personal Guide to Monetary WellnessNo ratings yet

- Commerce ProjectDocument11 pagesCommerce Projectshaqash744No ratings yet

- Financial PlanningDocument4 pagesFinancial PlanningVarun IyerNo ratings yet

- RM - J229 - Research PaperDocument10 pagesRM - J229 - Research PaperRishikaNo ratings yet

- Personal FDXFFinancial PlanningDocument34 pagesPersonal FDXFFinancial Planningmanali.270694No ratings yet

- Personal Finance CourseDocument9 pagesPersonal Finance CourseMulusaNo ratings yet

- Financial Planning of Individual Synosis.....Document14 pagesFinancial Planning of Individual Synosis.....Ronak SethiaNo ratings yet

- Personal Finance Topic 1Document7 pagesPersonal Finance Topic 1Ken TuazonNo ratings yet

- 8 Financial Literacy Lesson1Document6 pages8 Financial Literacy Lesson1hlmd.blogNo ratings yet

- Benlac - LayosaDocument3 pagesBenlac - LayosaLyra Cristel DaitolNo ratings yet

- Benefits of Financial PlanningDocument5 pagesBenefits of Financial PlanningKimberlie MiguelNo ratings yet

- Financial LiteracyDocument16 pagesFinancial LiteracyAkire BantilanNo ratings yet

- Personal FinanceDocument4 pagesPersonal FinanceAyeshaNo ratings yet

- Personal Financial PlanningDocument27 pagesPersonal Financial Planningannampunga25No ratings yet

- Module 1 and 2 IMP Question AnswerDocument21 pagesModule 1 and 2 IMP Question AnswerAnkit JajalNo ratings yet

- FPT ALL Module IMP QuestionDocument40 pagesFPT ALL Module IMP QuestionAnkit JajalNo ratings yet

- Standard of Living: Explain The Benefits of Financial Education?Document9 pagesStandard of Living: Explain The Benefits of Financial Education?NoreenNo ratings yet

- Module 1 IMP Question AnswerDocument6 pagesModule 1 IMP Question AnswerAnkit JajalNo ratings yet

- FINAL MahantheshDocument138 pagesFINAL MahantheshKapil DevNo ratings yet

- A2 WmaDocument6 pagesA2 WmaRajeswariNo ratings yet

- FinanceDocument5 pagesFinanceAlne Amor TuriagaNo ratings yet

- Financial Literacy: Building and Enhancing New Literacies Across The CurriculumDocument11 pagesFinancial Literacy: Building and Enhancing New Literacies Across The CurriculumJasper Mortos VillanuevaNo ratings yet

- Personal Finance - Chapter 1Document5 pagesPersonal Finance - Chapter 1a.wilson7980No ratings yet

- MASTERING PERSONAL FINANCE: A Comprehensive Guide to Financial Well-beingFrom EverandMASTERING PERSONAL FINANCE: A Comprehensive Guide to Financial Well-beingNo ratings yet

- The HPAX Wealth Blueprint: Your Ultimate Guide to Financial Freedom: various topics related to personal finance and wealth generationFrom EverandThe HPAX Wealth Blueprint: Your Ultimate Guide to Financial Freedom: various topics related to personal finance and wealth generationNo ratings yet

- For A Rich Future: Owning A Car, A HouseDocument11 pagesFor A Rich Future: Owning A Car, A Housedbsmba2015No ratings yet

- Financial Literacy ReportDocument12 pagesFinancial Literacy Reportrafaelmariahanne2029No ratings yet

- All F.MDocument145 pagesAll F.Mbookabdi186% (7)

- Financial LiteracyDocument121 pagesFinancial LiteracyshainamariebertoNo ratings yet

- ProjectDocument29 pagesProjectSanket PatilNo ratings yet

- BF 4QW3Document48 pagesBF 4QW3Ian Bethelmar UmaliNo ratings yet

- Final FinanceDocument40 pagesFinal FinanceSophia morinoNo ratings yet

- Mindful Money Management : Transforming Your Future Through Personal FinanceFrom EverandMindful Money Management : Transforming Your Future Through Personal FinanceNo ratings yet

- Old Transcription of Introduction Revised Transcription of IntroductionDocument3 pagesOld Transcription of Introduction Revised Transcription of IntroductionXylinNo ratings yet

- Financial LiteracyDocument1 pageFinancial LiteracyDejan DabicNo ratings yet

- PFP Book PDFDocument176 pagesPFP Book PDFYashi MathurNo ratings yet

- SM-Personal Finance-Unit1to3Document176 pagesSM-Personal Finance-Unit1to3Priyanshu BhattNo ratings yet

- Financial LiteracyDocument21 pagesFinancial LiteracyShekeena MarbaNo ratings yet

- THE FINANCIAL BLUEPRINT: MASTERING PERSONAL FINANCES FOR A PROSPEROUS FUTUREFrom EverandTHE FINANCIAL BLUEPRINT: MASTERING PERSONAL FINANCES FOR A PROSPEROUS FUTURENo ratings yet

- BF MODULE 10 MNG Personal FinanceDocument6 pagesBF MODULE 10 MNG Personal Financekent de guzmanNo ratings yet

- Research On Financial PlanningDocument9 pagesResearch On Financial PlanningvaradNo ratings yet

- The Secrets Of Financial Independence: Building Wealth For A Secure FutureFrom EverandThe Secrets Of Financial Independence: Building Wealth For A Secure FutureNo ratings yet

- Book 1 CFPDocument6 pagesBook 1 CFPBharathi 3280No ratings yet

- NameDocument1 pageNameBharathi 3280No ratings yet

- Last Will and TestamentDocument3 pagesLast Will and TestamentBharathi 3280No ratings yet

- CBSE Syllabus For Class 11 Accountancy 2023-24 (Revised) PDF DownloadDocument9 pagesCBSE Syllabus For Class 11 Accountancy 2023-24 (Revised) PDF DownloadBharathi 3280No ratings yet

- 3Document4 pages3Bharathi 3280No ratings yet

- Trust DeedDocument2 pagesTrust DeedBharathi 3280No ratings yet

- Class11-English 1Document46 pagesClass11-English 1Bharathi 3280No ratings yet

- PGP Retirement Planning UnlockedDocument9 pagesPGP Retirement Planning UnlockedBharathi 3280No ratings yet

- Retirement Planning - NewDocument12 pagesRetirement Planning - NewBharathi 3280No ratings yet

- Old Bridge Mutual Fund - Factsheet March 2024Document8 pagesOld Bridge Mutual Fund - Factsheet March 2024Bharathi 3280No ratings yet

- Action PlanDocument2 pagesAction PlanBharathi 3280No ratings yet

- TH TH THDocument1 pageTH TH THBharathi 3280No ratings yet

- Annexure H - Various Printed FormsDocument3 pagesAnnexure H - Various Printed FormsBharathi 3280No ratings yet

- Businessn Communication SBAA1101 - Unit - 2Document68 pagesBusinessn Communication SBAA1101 - Unit - 2Bharathi 3280No ratings yet

- Relationship Between Poverty and Inequality in IndiaDocument10 pagesRelationship Between Poverty and Inequality in IndiaBharathi 3280No ratings yet

- Risk Profiler Form IndividualsDocument4 pagesRisk Profiler Form IndividualsBharathi 3280No ratings yet

- Neurology speciality-Plagiarism-ReportDocument2 pagesNeurology speciality-Plagiarism-ReportBharathi 3280No ratings yet

- Sbaa1206 Business Law Unit 4 NotesDocument21 pagesSbaa1206 Business Law Unit 4 NotesBharathi 3280No ratings yet

- General English I SHSA1104Document170 pagesGeneral English I SHSA1104Bharathi 3280No ratings yet

- AEGIS - Social Media Strategy PresentationDocument13 pagesAEGIS - Social Media Strategy PresentationBharathi 3280No ratings yet

- Master of Business Administration (Marketing) YearSession 2022-2023-July REGULAR Term 1 Grade CardDocument2 pagesMaster of Business Administration (Marketing) YearSession 2022-2023-July REGULAR Term 1 Grade CardBharathi 3280No ratings yet

- Velilla Vs PosadasDocument7 pagesVelilla Vs PosadasKennethQueRaymundoNo ratings yet

- Chem Assignment-1Document6 pagesChem Assignment-1Daniel ConcessaoNo ratings yet

- Ghasemi and BasuDocument11 pagesGhasemi and BasuPreethiNo ratings yet

- Antalyapark Antalya Park Indoor Playground CatalogueDocument42 pagesAntalyapark Antalya Park Indoor Playground CatalogueChafik KeycusNo ratings yet

- Sweet Nechako Honey TearsheetsDocument20 pagesSweet Nechako Honey TearsheetsdmalikbpdigitalNo ratings yet

- Effective Project Management: Pt. Bukaka Teknik Utama - Balikpapan - 2014Document11 pagesEffective Project Management: Pt. Bukaka Teknik Utama - Balikpapan - 2014Did GamesNo ratings yet

- Gpa Proposal FormatDocument3 pagesGpa Proposal FormatMargaret Quiachon ChiuNo ratings yet

- 10CS 33 LOGIC DESIGN UNIT - 2 Combinational Logic CircuitsDocument10 pages10CS 33 LOGIC DESIGN UNIT - 2 Combinational Logic CircuitsMallikarjunBhiradeNo ratings yet

- ABC Same Code S.piragash PDFDocument116 pagesABC Same Code S.piragash PDFRaishaNo ratings yet

- Dip in Engg BOOK LIST AND PLAN 2010 All 8 SemesterDocument129 pagesDip in Engg BOOK LIST AND PLAN 2010 All 8 Semestermd mehedi shuvo khan100% (1)

- Chữa Bài Chi Tiết: HomeworkDocument3 pagesChữa Bài Chi Tiết: Homeworkaduc55799No ratings yet

- DG19.Credit Oppotunities FundDocument14 pagesDG19.Credit Oppotunities FundMikhail RadomyselskiyNo ratings yet

- (Open Up Study Skills) Diana Medlicott - How To Design and Deliver Enhanced Modules - A Case Study Approach-Open University Press (2009) (Z-Lib - Io)Document162 pages(Open Up Study Skills) Diana Medlicott - How To Design and Deliver Enhanced Modules - A Case Study Approach-Open University Press (2009) (Z-Lib - Io)babomorNo ratings yet

- NGAS 2019 eBOOKDocument128 pagesNGAS 2019 eBOOKGabinu AngNo ratings yet

- Chemical Engg AdmissionDocument10 pagesChemical Engg AdmissionKARTHIKEYAN SIVANANTHAMNo ratings yet

- Write The Boolean Expression For The Logic Circuit in Figure 8 FDocument8 pagesWrite The Boolean Expression For The Logic Circuit in Figure 8 FsyukzzNo ratings yet

- Appeal For Regulariza Tion of Contract Employees (BS-01 To BS-15) Who Are Appointed/ Joined in 2009Document1 pageAppeal For Regulariza Tion of Contract Employees (BS-01 To BS-15) Who Are Appointed/ Joined in 2009cerpunjab2009No ratings yet

- RMS USA Field Employee Handbook - Aug 2020Document35 pagesRMS USA Field Employee Handbook - Aug 2020Esteban TorresNo ratings yet

- Happy Family Floater Policy-2021 Policy Schedule: UIN: OICHLIP22010V042223Document4 pagesHappy Family Floater Policy-2021 Policy Schedule: UIN: OICHLIP22010V042223pkNo ratings yet

- Exteranl Alarm Connection GuideDocument5 pagesExteranl Alarm Connection GuideMuhammad KashifNo ratings yet

- Product Recommendation New Holland TX TX 34 (1987-1994)Document3 pagesProduct Recommendation New Holland TX TX 34 (1987-1994)ANo ratings yet

- Philacor Credit Corporation V. Commissioner of Internal RevenueDocument10 pagesPhilacor Credit Corporation V. Commissioner of Internal RevenueCharity Gene AbuganNo ratings yet

- SM 1 PDFDocument148 pagesSM 1 PDFAkash JainNo ratings yet

- Digital Integrated Circuits: Week 3 Melik YAZICIDocument44 pagesDigital Integrated Circuits: Week 3 Melik YAZICIboubiidNo ratings yet

- Knowledge Horizons - Economics: Maria Mirabela DOCIU (ANCHIDIN)Document8 pagesKnowledge Horizons - Economics: Maria Mirabela DOCIU (ANCHIDIN)SebastianMateusNo ratings yet

- Hearing BrochureDocument16 pagesHearing BrochureAbhayNo ratings yet

- NOE/F/G18 & NOE/F/G35: Heavy Oil Burner 161kW - 893kWDocument2 pagesNOE/F/G18 & NOE/F/G35: Heavy Oil Burner 161kW - 893kWTurbo Snail RNo ratings yet