Professional Documents

Culture Documents

Special Quiz 1

Special Quiz 1

Uploaded by

JoyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Special Quiz 1

Special Quiz 1

Uploaded by

JoyCopyright:

Available Formats

On August 1 of the current year, Scooby Company recorded purchases of P800,000 and

P1,000,000 under credit terms of 2/15, n/30. The payment due on the P800,000 purchase

was remitted on August 14. The payment due on the P1,000,000 was remitted on August 31.

Under the net method and the gross method, these purchases should be included at what

respective amounts in the determination of cost of goods available for sale?

a. P1,784,000 and P1,764,000

b. P1,764,000 and P1,800,000

c. P1,764,000 and P1,784,000

d. P1,800,000 and P1,764,000

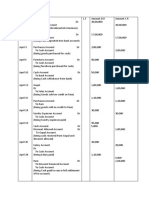

NET METHOD

Aug 01 Purchases 784,000

Accounts Payable 784,000

To record purchase on account P800,000 X 98%

Aug 01 Purchases 980,000

Accounts Payable 980,000

To record purchase on account P1,000,000 X 98%

Aug 14 Accounts Payable 784,000

Cash 784,000

To record payment of Aug 01 purchases WITHIN the discount period

Aug 31 Accounts Payable 1,000,000

Cash 980,000

Purchase Discount Lost 20,000

To record payment of Aug 01 purchases BEYOND the discount period

GROSS METHOD

Aug 01 Purchases 800,000

Accounts Payable 800,000

To record purchase on account 2/15; N/30

Aug 01 Purchases 1,000,000

Accounts Payable 1,000,000

To record purchase on account 2/15; N/30

Aug 14 Accounts Payable 800,000

Cash 784,000

Purchase Discount 16,000

To record payment of Aug 01 purchases WITHIN the discount period

Aug 31 Accounts Payable 1,000,000

Cash 1,000,000

To record payment of Aug 01 purchases BEYOND the discount period

You might also like

- StatementDocument3 pagesStatementwarfa jibrilNo ratings yet

- MERCHANDISING BUSINESS (Periodic Vs Perpetual)Document3 pagesMERCHANDISING BUSINESS (Periodic Vs Perpetual)Laurence Karl CurboNo ratings yet

- Inventory LossDocument7 pagesInventory LossEarl Hyannis ElauriaNo ratings yet

- Ang Exam Parang LOVE Bawal Tumingin Sa Iba, Baka Mahuli KaDocument4 pagesAng Exam Parang LOVE Bawal Tumingin Sa Iba, Baka Mahuli KaRutchelNo ratings yet

- Acctg Ass No. 10 Merchandising BusinessDocument5 pagesAcctg Ass No. 10 Merchandising BusinessDaisy Marie A. Rosel75% (4)

- TBChap 012Document237 pagesTBChap 012omar altamimiNo ratings yet

- Journal Entries in Merchandising OperationsDocument4 pagesJournal Entries in Merchandising OperationsArrabela PalmaNo ratings yet

- GCC Startup Ecosystem News Roundup 2020 12 V1Document4 pagesGCC Startup Ecosystem News Roundup 2020 12 V1Ajun FranklinNo ratings yet

- Pilipinas Marketing ExercisesDocument16 pagesPilipinas Marketing Exercisesnigihayami210% (1)

- Customs Manual 2023Document424 pagesCustoms Manual 2023Hitesh PatilNo ratings yet

- Atty - Celyn - General Provisions and Fundamentals Principles On Real Property TaxationDocument28 pagesAtty - Celyn - General Provisions and Fundamentals Principles On Real Property TaxationJheovane Sevillejo LapureNo ratings yet

- Accounting 1aDocument23 pagesAccounting 1aFaith Marasigan88% (16)

- Merchandising Business PDFDocument5 pagesMerchandising Business PDFJenny Valerie SualNo ratings yet

- Worksheet and Financial Statement 4Document21 pagesWorksheet and Financial Statement 4Bhebz Erin MaeNo ratings yet

- Pangan CompanyDocument18 pagesPangan CompanyWendy Lupaz80% (5)

- Eva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Document7 pagesEva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Stephen ReloxNo ratings yet

- Cash Basis Accrual Basis Exercises With AnswersDocument6 pagesCash Basis Accrual Basis Exercises With AnswersRNo ratings yet

- (03A) Inventories Quiz 01 ANSWER KEYDocument8 pages(03A) Inventories Quiz 01 ANSWER KEYGabriel Adrian ObungenNo ratings yet

- Syllabus AnswerDocument24 pagesSyllabus AnswerasdfNo ratings yet

- Accounting Record SystemDocument36 pagesAccounting Record Systemmanishpareta5No ratings yet

- ADRIANO, Glecy C. CAÑADA, Lyka Joyce MDocument14 pagesADRIANO, Glecy C. CAÑADA, Lyka Joyce MADRIANO, Glecy C.No ratings yet

- AJC - FABM 10.5ptDocument4 pagesAJC - FABM 10.5ptAshley Jean CosmianoNo ratings yet

- Ajc - Fabm 10.5Document4 pagesAjc - Fabm 10.5Ashley Jean CosmianoNo ratings yet

- BibDocument2 pagesBibVivian TamerayNo ratings yet

- Accounts ReceivableDocument10 pagesAccounts Receivablel mNo ratings yet

- Assignment 1Document14 pagesAssignment 1Ibrar AnsarNo ratings yet

- EdlynDocument10 pagesEdlynDona AdlogNo ratings yet

- Ricardo Pangan Company General Journal For The Month of January 2021 Date Accounts Receivable Debit CreditDocument14 pagesRicardo Pangan Company General Journal For The Month of January 2021 Date Accounts Receivable Debit CreditTiamzon Ella Mae M.No ratings yet

- Pengetahuan Umum Akuntansi A. Please Explain Three Processes in Recording ProcessDocument21 pagesPengetahuan Umum Akuntansi A. Please Explain Three Processes in Recording ProcessSyahna MarisahNo ratings yet

- Cash Basis, Accrual Basis and Single Entry Method: General ConceptsDocument7 pagesCash Basis, Accrual Basis and Single Entry Method: General ConceptsNhel AlvaroNo ratings yet

- Test SolutionDocument4 pagesTest SolutionDibyani DashNo ratings yet

- Jornal MerchandiseDocument12 pagesJornal MerchandiseHannah Jane Toribio100% (1)

- Chapter 9Document5 pagesChapter 9syraNo ratings yet

- ABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 2 (A02) - Inventory Accounting Systems 3.0Document4 pagesABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 2 (A02) - Inventory Accounting Systems 3.0Lorraine Joy AbanillaNo ratings yet

- Pauline Anne R. Grana 11-ABM-A: To Record Purchase of Merchandise For CashDocument4 pagesPauline Anne R. Grana 11-ABM-A: To Record Purchase of Merchandise For CashPark EunbiNo ratings yet

- 4.2 Answers and Solutions - Assignment On Materials and LaborDocument8 pages4.2 Answers and Solutions - Assignment On Materials and LaborRoselyn LumbaoNo ratings yet

- SOLETRADER ACCOUNTING Handout 2Document4 pagesSOLETRADER ACCOUNTING Handout 2DenishNo ratings yet

- Exercise-1 Merchandising Melanie-RodilDocument13 pagesExercise-1 Merchandising Melanie-RodilShiela RengelNo ratings yet

- FABM - L-10Document16 pagesFABM - L-10Seve HanesNo ratings yet

- Journalizing Merchandising TransactionsDocument2 pagesJournalizing Merchandising TransactionsAnj SueloNo ratings yet

- Henri Emanuel Reforba - Learning Task #2Document6 pagesHenri Emanuel Reforba - Learning Task #2Rhea BernabeNo ratings yet

- Accounting Tutorial 2Document6 pagesAccounting Tutorial 2Mega Pop LockerNo ratings yet

- Accounts 1.5Document2 pagesAccounts 1.5Prashant ShokeenNo ratings yet

- For IyanDocument11 pagesFor Iyanvasquezjohn0829No ratings yet

- Accounting For Sales PDFDocument20 pagesAccounting For Sales PDFJasmine Acta100% (1)

- Class On Periodic - PerpetualDocument2 pagesClass On Periodic - PerpetualmerakiNo ratings yet

- AccountingDocument10 pagesAccountingRuffa Mae CabangunayNo ratings yet

- Journal Entries RemarksDocument5 pagesJournal Entries RemarksAl Shane Lara CabreraNo ratings yet

- AccountingDocument5 pagesAccountingAl Shane Lara CabreraNo ratings yet

- Day 5 QuizDocument15 pagesDay 5 QuiznimnimNo ratings yet

- Class No - 8, 9Document38 pagesClass No - 8, 9WILD๛SHOTッ tanvirNo ratings yet

- Castro Company ZABALLADocument11 pagesCastro Company ZABALLAHelping Five (H5)No ratings yet

- MASDocument6 pagesMASDan RyanNo ratings yet

- UntitledDocument2 pagesUntitledinto the unknownNo ratings yet

- FABMDocument12 pagesFABMJhayn NonNo ratings yet

- Merchandising 1Document32 pagesMerchandising 1krisllyuyuyNo ratings yet

- Sales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalDocument15 pagesSales Journal Purcase Journal Cash Receipt Journal Cash Disbursement Journal General JournalNathalia Alexandra PagulayanNo ratings yet

- Bookkeepping Bsba CompanyDocument3 pagesBookkeepping Bsba CompanyLovely Rose GuinilingNo ratings yet

- Problem SolvingDocument14 pagesProblem SolvingJericho EncarnacionNo ratings yet

- Arief Siklus-AkuntansiDocument70 pagesArief Siklus-AkuntansiArief FadilahNo ratings yet

- Cash and Accrual Basis and Single EntryDocument21 pagesCash and Accrual Basis and Single EntryJohn Mark FernandoNo ratings yet

- General Journal Date Particulars Folio DebitDocument6 pagesGeneral Journal Date Particulars Folio DebitJelaina AlimansaNo ratings yet

- General Ledger - Books of AccountDocument6 pagesGeneral Ledger - Books of AccountCharlotte Balladares LarideNo ratings yet

- Problem 7 - 16Document2 pagesProblem 7 - 16Jao FloresNo ratings yet

- Account Details and Transaction History: Sa Passbook Acct-IDocument12 pagesAccount Details and Transaction History: Sa Passbook Acct-Ifiza hassanNo ratings yet

- 4offer MJ 04.03 .21Document3 pages4offer MJ 04.03 .21SANDESH GHANDATNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNandhini_16No ratings yet

- Deloitte Localisation in Africas Oil & Gas Industry Oct 2015Document18 pagesDeloitte Localisation in Africas Oil & Gas Industry Oct 2015Jim BabanNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFmann chalaNo ratings yet

- Problem Set I For International Trade # Partial Solutions ... - CER-ETH PDFDocument14 pagesProblem Set I For International Trade # Partial Solutions ... - CER-ETH PDFJGNo ratings yet

- Supply Chain Drivers and MetricsDocument34 pagesSupply Chain Drivers and MetricsMostafa Amir FayesalNo ratings yet

- SD - MEGqfS7 FZBBQN - U - KW - IIoT Case Project - LearnerDocument5 pagesSD - MEGqfS7 FZBBQN - U - KW - IIoT Case Project - LearnerMahrane AIDINo ratings yet

- Bus 5110-WK 4-Written AssignmentDocument3 pagesBus 5110-WK 4-Written Assignmentdavid olayiwolaNo ratings yet

- Assessment 10 Acctg 7Document2 pagesAssessment 10 Acctg 7Judy Ann GacetaNo ratings yet

- Business Econ - 3Document13 pagesBusiness Econ - 3Tharindu DhananjayaNo ratings yet

- 6815Document19 pages6815JAAB AUTOMOBILESNo ratings yet

- A Life Changing Experience EssayDocument55 pagesA Life Changing Experience Essayuwuxovwhd100% (2)

- Introduction To Privatisation and Liberalisation in India: by Anmol SharmaDocument10 pagesIntroduction To Privatisation and Liberalisation in India: by Anmol SharmaAnmol SharmaNo ratings yet

- Electric Bill - VTpass - Meter Token (PHED - Port Harcourt Electric)Document2 pagesElectric Bill - VTpass - Meter Token (PHED - Port Harcourt Electric)Basil OgbunudeNo ratings yet

- Bba Iii Year Assignment Question PapersDocument8 pagesBba Iii Year Assignment Question PapersAfrina ThasneemNo ratings yet

- Foreign Affairs (May & June 2020)Document220 pagesForeign Affairs (May & June 2020)muhammad aslamNo ratings yet

- Drill 1 - MidtermDocument3 pagesDrill 1 - MidtermcpacpacpaNo ratings yet

- IDFC BANK Repayment Schedule-10865556Document2 pagesIDFC BANK Repayment Schedule-10865556Dinesh KumarNo ratings yet

- Division of Investment Management: Frequently Asked Questions About Form 13FDocument19 pagesDivision of Investment Management: Frequently Asked Questions About Form 13FAlex WongNo ratings yet

- AR API 2017 + LK Final (Upload Website)Document147 pagesAR API 2017 + LK Final (Upload Website)Maulidia ImastaryNo ratings yet

- 2.1 Pricing BasicsDocument14 pages2.1 Pricing BasicsPoulomiDas100% (1)

- Rezime: Klju Čne Riječi: Promjene, TehnologijaDocument21 pagesRezime: Klju Čne Riječi: Promjene, TehnologijagogaNo ratings yet