Professional Documents

Culture Documents

Liquidity, Leverage, Coverage and Activity (LLCA) Ratios

Uploaded by

Jess AlexOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Liquidity, Leverage, Coverage and Activity (LLCA) Ratios

Uploaded by

Jess AlexCopyright:

Available Formats

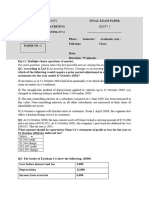

Part 2 : 11/10/17 09:52:04

Question 1 - CIA 593 IV.40 - Ratios: Liquidity, Leverage, Coverage and Activity

A condensed comparative balance sheet for a company appears below:

12-31-Year 1 12-31-Year 2

Cash $ 40,000 $ 30,000

Accounts receivable 120,000 100,000

Inventory 200,000 300,000

Property, plant & equipment 500,000 550,000

Accumulated depreciation (280,000) (340,000)

Total assets $580,000 $640,000

Current liabilities $60,000 $100,000

Long-term liabilities 390,000 420,000

Stockholders' equity 130,000 120,000

Total liabilities and equity $580,000 $640,000

In looking at liquidity ratios at both balance sheet dates, what happened to the (1) current ratio and (2) acid-test (quick)

ratio?

A. (1) Decreased (2) Increased

B. (1) Increased (2) Decreased

C. (1) Increased (2) Increased

D. (1) Decreased (2) Decreased

Question 2 - ICMA 10.P2.037 - Ratios: Liquidity, Leverage, Coverage and Activity

The capital structure of four corporations is as follows.

Corporation

Sterling Cooper Warwick Pane

Short-term debt 10% 10% 15% 10%

Long-term debt 40% 35% 30% 30%

Preferred stock 30% 30% 30% 30%

Common equity 20% 25% 25% 30%

Which corporation is the most highly leveraged?

A. Cooper.

B. Pane.

C. Sterling.

D. Warwick.

Question 3 - ICMA 10.P2.035 - Ratios: Liquidity, Leverage, Coverage and Activity

Dedham Corporation has decided to include certain financial ratios in its year-end annual report to shareholders.

Selected information relating to its most recent fiscal year is provided below.

Cash $ 10,000

Accounts receivable 20,000

Prepaid expenses 8,000

Inventory 30,000

Available-for-sale securities classified as current assets

At cost 9,000

(c) HOCK international, page 1

Part 2 : 11/10/17 09:52:04

Fair value at year end 12,000

Accounts payable 15,000

Notes payable (due in 90 days) 25,000

Bonds payable (due in 10 years) 35,000

Dedham's quick (acid-test) ratio at year end is

A. 1.80 to 1.

B. 2.00 to 1.

C. 1.05 to 1.

D. 1.925 to 1.

Question 4 - CMA 692 1.9 - Ratios: Liquidity, Leverage, Coverage and Activity

Carlisle Company currently sells 400,000 bottles of perfume each year. Each bottle costs $0.84 to produce and sells

for $1.00. Fixed costs are $28,000 per year. The firm has annual interest expense of $6,000, preferred stock dividends

of $2,000 per year, and a 40% tax rate. Carlisle uses the following formulas to determine the company's leverage.

Operating leverage = [Q(S − VC)] ÷ [Q(S − VC) − FC]

Financial leverage = EBIT ÷ {EBIT − I − [P / (1 − T)]}

Total leverage = Q(S − VC) ÷ {Q(S − VC) − FC − I − [P / (1 − T)]}

Where:

Q=Quantity

FC=Fixed Cost

VC=Variable Cost

S=Selling Price

I=Interest Expense

P=Preferred Dividends

T=Tax Rate

EBIT=Earnings Before Interest and Taxes

The degree of financial leverage for Carlisle Company is

A. 2.3

B. 1.35

C. 2.4

D. 1.78

Question 5 - ICMA 10.P2.040 - Ratios: Liquidity, Leverage, Coverage and Activity

Firms with high degrees of financial leverage would be best characterized as having

A. high debt-to-equity ratios.

B. zero coupon bonds in their capital structures.

C. low current ratios.

D. high fixed-charge coverage.

(c) HOCK international, page 2

Part 2 : 11/10/17 09:52:04

Question 6 - CMA 695 2.2 - Ratios: Liquidity, Leverage, Coverage and Activity

CPZ Enterprises had the following account information.

Accounts receivable $200,000

Accounts payable 80,000

Bonds payable, due in ten years 10,000

Cash 100,000

Interest payable, due in three months 10,000

Inventory 400,000

Land 250,000

Notes payable, due in six months 50,000

Prepaid expenses 40,000

The company has an operating cycle of five months.

What is the company's acid test (quick) ratio?

A. 2.14

B. 1.68

C. 0.68

D. 2.31

Question 7 - CMA 693 2.2 - Ratios: Liquidity, Leverage, Coverage and Activity

Lisa, Inc.

Statement of Financial Position

December 31, 20X4

(in thousands)

20X4 20X3

Assets

Current assets:

Cash $ 30 $ 25

Trading securities 20 15

Accounts receivable (net) 45 30

Inventories (at lower of cost of market) 60 50

Prepaid items 15 20

Total Current Assets $170 $140

Long-term assets:

Long-term investments:

Available-for-sale investments $ 25 $ 20

Property, plant & equipment:

Land (at cost) 75 75

Building (net) 80 90

Equipment (net) 95 100

Intangible assets:

Patents (net) 35 17

Goodwill (net) 20 13

Total Long-Term Assets $330 $315

Total Assets $500 $455

(c) HOCK international, page 3

Part 2 : 11/10/17 09:52:04

Liabilities and Equity

Current liabilities:

Notes payable $ 23 $ 12

Accounts payable 47 28

Accrued interest $ 15 $ 15

Total current liabilities $ 85 $ 55

Long-term liabilities:

Long-term Notes payable 10% due 12/31/20X6 $ 10 $ 10

Bonds payable 12% due 12/31/20X9 15 15

Total long-term debt $ 25 $ 25

Total liabilities $110 $ 80

Shareholders' Equity

Preferred stock - 5% cumulative, $100 par, nonparticipating

authorized, issued and outstanding, 1,000 shares $100 $100

Common stock - $10 par 20,000 shares authorized, 15,000

shares issued and outstanding 150 150

Additional paid-in capital - common 75 75

Retained earnings 65 50

Total Equity $390 $375

Total Liabilities & Equity $500 $455

Assume net credit sales and cost of goods sold for 20X4 were $300,000 and $220,000 respectively. Lisa Inc.'s

accounts receivable turnover for 20X4 was

A. 5.9 times.

B. 8.0 times.

C. 4.9 times.

D. 6.7 times.

Question 8 - ICMA 10.P2.060 - Ratios: Liquidity, Leverage, Coverage and Activity

Cornwall Corporation's net accounts receivable were $68,000 and $47,000 at the beginning and end of the year,

respectively. Cornwall's condensed Income Statement is shown below.

Sales $900,000

Cost of goods sold 527,000

Operating expenses 175,000

Operating income 198,000

Income tax 79,000

Net income $119,000

Cornwall's average number of days' sales in accounts receivable (using a 360-day year) is

A. 8 days.

B. 13 days.

C. 19 days.

D. 23 days.

Question 9 - CMA 1294 2.23 - Ratios: Liquidity, Leverage, Coverage and Activity

(c) HOCK international, page 4

Part 2 : 11/10/17 09:52:04

The following inventory and sales data are available for the current year for Volpone Company. Volpone uses a

365-day year when computing ratios.

November 30, 2010 November 30, 2009

Net credit sales $6,205,000

Gross receivables 350,000 320,000

Inventory 960,000 780,000

Cost of goods sold 4,380,000

Volpone Company's average number of days to sell inventory for the current year is

A. 72.50 days.

B. 80.00 days.

C. 51.18 days.

D. 65.00 days.

Question 10 - ICMA 10.P2.053 - Ratios: Liquidity, Leverage, Coverage and Activity

Maydale Inc.'s financial statements show the following information.

Accounts receivable, end of Year 1$ 320,000

Credit sales for Year 2 3,600,000

Accounts receivable, end of Year 2 400,000

Maydale's accounts receivable turnover ratio is

A. 10.00.

B. 11.25.

C. 0.10.

D. 9.00.

Question 11 - ICMA 10.P2.026 - Ratios: Liquidity, Leverage, Coverage and Activity

Markowitz Company increased its allowance for uncollectible accounts. This adjustment will

A. reduce the current ratio.

B. reduce debt-to-asset ratio.

C. increase the acid test ratio.

D. increase working capital.

Question 12 - ICMA 10.P2.042 - Ratios: Liquidity, Leverage, Coverage and Activity

A financial analyst with Mineral Inc. calculated the company's degree of financial leverage as 1.5. If net income before

interest increases by 5%, earnings to shareholders will increase by

A. 7.50%.

B. 5.00%.

C. 1.50%.

D. 3.33%.

(c) HOCK international, page 5

Part 2 : 11/10/17 09:52:04

Question 13 - ICMA 10.P2.049 - Ratios: Liquidity, Leverage, Coverage and Activity

The interest expense for a company is equal to its earnings before interest and taxes (EBIT). The company's tax rate is

40%. The company's times-interest earned ratio is equal to

A. 1.2.

B. 0.6.

C. 2.0.

D. 1.0.

Question 14 - ICMA 10.P2.054 - Ratios: Liquidity, Leverage, Coverage and Activity

Zubin Corporation experiences a decrease in sales and the cost of good sold, an increase in accounts receivable, and

no change in inventory. If all else is held constant, what is the total effect of these changes on the receivables turnover

and inventory ratios?

A. Inventory turnover decreased; receivables turnover increased.

B. Inventory turnover increased; receivables turnover increased.

C. Inventory turnover decreased; receivables turnover decreased.

D. Inventory turnover increased; receivables turnover decreased.

Question 15 - ICMA 10.P2.062 - Ratios: Liquidity, Leverage, Coverage and Activity

On its year-end financial statements, Caper Corporation showed sales of $3,000,000, net fixed assets of $1,300,000,

and total assets of $2,000,000. The company's fixed asset turnover is

A. 1.5 times.

B. 43.3%.

C. 66.7%.

D. 2.3 times.

Question 16 - CMA 690 1.16 - Ratios: Liquidity, Leverage, Coverage and Activity

This year, Nelson Industries increased earnings before interest and taxes (EBIT) by 17%. During the same period, net

income after tax increased by 42%. The degree of financial leverage that existed during the year is:

A. 2.47.

What is the answer if EBIT decreases by 17 %

B. 5.90.

C. 4.20.

D. 1.70.

Question 17 - CIA 590 IV.47 - Ratios: Liquidity, Leverage, Coverage and Activity

Given an acid test ratio of 2.0, current assets of $5,000, and inventory of $2,000, the value of current liabilities is

(c) HOCK international, page 6

Part 2 : 11/10/17 09:52:04

A. $3,500

B. $2,500

C. $6,000

D. $1,500

Question 18 - CMA 692 1.8 - Ratios: Liquidity, Leverage, Coverage and Activity

Carlisle Company currently sells 400,000 bottles of perfume each year. Each bottle costs $0.84 to produce and sells

for $1.00. Fixed costs are $28,000 per year. The firm has annual interest expense of $6,000, preferred stock dividends

of $2,000 per year, and a 40% tax rate. Carlisle uses the following formulas to determine the company's leverage.

Operating leverage = [Q(S − VC)] ÷ [Q(S − VC) − FC]

Financial leverage = EBIT ÷ {EBIT − I − [P / (1 − T)]}

Total leverage = Q(S − VC) ÷ {Q(S − VC) − FC − I − [P / (1 − T)]}

Where:

Q=Quantity

FC=Fixed Cost

VC=Variable Cost

S=Selling Price

I=Interest Expense

P=Preferred Dividends

T=Tax Rate

EBIT=Earnings Before Interest and Taxes

The degree of operating leverage for Carlisle Company is

A. 1.35

B. 1.78

C. 1.2

D. 2.4

Question 19 - ICMA 10.P2.057 - Ratios: Liquidity, Leverage, Coverage and Activity

Makay Corporation has decided to include certain financial ratios in its year-end annual report to shareholders.

Selected information relating to its most recent fiscal year is provided below.

Cash $ 10,000

Accounts receivable (end of year) 20,000

Accounts receivable (beginning of year) 24,000

Inventory (end of year) 30,000

Inventory (beginning of year) 26,000

Notes payable (due in 90 days) 25,000

Bonds payable (due in 10 years) 35,000

Net credit sales for year 220,000

Cost of goods sold 140,000

Makay's average inventory turnover for the year was

A. 4.7 times.

(c) HOCK international, page 7

Part 2 : 11/10/17 09:52:04

B. 5.0 times.

C. 5.4 times.

D. 7.9 times.

Question 20 - CMA 1295 2.13 - Ratios: Liquidity, Leverage, Coverage and Activity

All of the following financial indicators are measures of either liquidity or activity except the

A. Accounts receivable turnover.

B. Average collection period in days.

C. Merchandise inventory turnover.

D. Times-interest-earned ratio.

Question 21 - CMA 1293 2.17 - Ratios: Liquidity, Leverage, Coverage and Activity

Norton, Inc. has a 2-to-1 current ratio. This ratio would increase to more than 2 to 1 if

A. The company wrote off an uncollectible receivable.

B. A previously declared stock dividend was distributed.

C. The company purchased inventory on open account.

D. The company sold merchandise on open account that earned a normal gross margin.

Question 22 - CIA 595 IV.51 - Ratios: Liquidity, Leverage, Coverage and Activity

Everything else being equal, a <<_____>> highly leveraged firm will have <<_____>> earnings per share.

A. Less; Less volatile

B. More; Less volatile

C. Less; Higher

D. More; Lower

Question 23 - CMA 688 4.15 - Ratios: Liquidity, Leverage, Coverage and Activity

The days' sales in receivables ratio will be understated if the company

A. Uses a calendar year for its accounting period.

B. Does not use average receivables in the ratio calculation.

C. Uses a natural business year for its accounting period.

D. Uses average receivables in the ratio calculation.

Question 24 - ICMA 10.P2.025 - Ratios: Liquidity, Leverage, Coverage and Activity

Davis Retail Inc. has total assets of $7,500,000 and a current ratio of 2.3 times before purchasing $750,000 of

(c) HOCK international, page 8

Part 2 : 11/10/17 09:52:04

merchandise on credit for resale. After this purchase, the current ratio will

A. remain at 2.3 times.

B. be lower than 2.3 times.

C. be higher than 2.3 times.

D. be exactly 2.53 times.

Question 25 - CMA 687 4.27 - Ratios: Liquidity, Leverage, Coverage and Activity

When compared to a debt-to-assets ratio, a debt to equity ratio would

A. Have no relationship at all to the debt to assets ratio.

B. Be about the same as the debt to assets ratio.

C. Be higher than the debt to assets ratio.

D. Be lower than the debt to assets ratio.

Question 26 - ICMA 10.P2.021 - Ratios: Liquidity, Leverage, Coverage and Activity

Broomall Corporation has decided to include certain financial ratios in its year-end annual report to shareholders.

Selected information relating to its most recent fiscal year is provided below.

Cash $ 10,000

Accounts receivable 20,000

Prepaid expenses 8,000

Inventory 30,000

Available-for-sale securities classified as current assets

At cost 9,000

Fair value at year end 12,000

Accounts payable 15,000

Notes payable (due in 90 days) 25,000

Bonds payable (due in 10 years) 35,000

Net credit sales for year 220,000

Cost of goods sold 140,000

Broomall's working capital at year end is

A. $37,000.

B. $40,000.

C. $10,000.

D. $28,000.

Question 27 - ICMA 13.P2.004 - Ratios: Liquidity, Leverage, Coverage and Activity

Financial information for Arbat Inc. for two years of operation is shown below.

Year 1 Year 2

Sales $4,000,000$4,400,000

Total operating costs 3,200,000 3,440,000

Earnings before interest and taxes $ 800,000 $ 960,000

Interest payments 320,000 275,000

(c) HOCK international, page 9

Part 2 : 11/10/17 09:52:04

Income taxes 245,000 354,000

Net income $ 235,000 $ 331,000

Earnings per share $ 2.35 $ 3.31

The degree of operating leverage for Arbat Inc. is

A. 2.67.

B. 2.00.

C. 0.75.

D. 4.09.

Question 28 - ICMA 10.P2.044 - Ratios: Liquidity, Leverage, Coverage and Activity

The Liabilities and Shareholders' Equity section of Mica Corporation's Statement of Financial Position is shown below.

January 1December 31

Accounts payable $ 32,000 $ 84,000

Accrued liabilities 14,000 11,000

7% bonds payable 95,000 77,000

Common stock ($10 par value) 300,000 300,000

Reserve for bond retirement 12,000 28,000

Retained earnings 155,000 206,000

Total liabilities and shareholders' equity $608,000 $706,000

Mica's debt/equity ratio is

A. 25.1%.

B. 25.6%.

C. 33.9%.

D. 32.2%.

Question 29 - ICMA 10.P2.041 - Ratios: Liquidity, Leverage, Coverage and Activity

The use of debt in the capital structure of a firm

A. decreases its financial leverage.

B. decreases its operating leverage.

C. increases its operating leverage.

D. increases its financial leverage.

Question 30 - CMA 692 2.27 - Ratios: Liquidity, Leverage, Coverage and Activity

If a company decided to change from the first-in, first-out (FIFO) inventory method to the last-in, first-out (LIFO) method

during a period of rising prices, its

A. Inventory turnover ratio would be reduced.

B. Cash flow would be decreased.

C. Current ratio would be reduced.

D. Debt-to-equity ratio would be decreased.

(c) HOCK international, page 10

Part 2 : 11/10/17 09:52:04

Question 31 - ICMA 13.P2.003 - Ratios: Liquidity, Leverage, Coverage and Activity

A company's cash ratio will decrease if the company

A. purchases materials on account.

B. receives cash by issuing a short-term note payable.

C. purchases commercial paper.

D. sells goods for cash at a selling price lower than cost.

Question 32 - ICMA 10.P2.033 - Ratios: Liquidity, Leverage, Coverage and Activity

The acid test ratio shows the ability of a company to pay its current liabilities without having to

A. reduce its cash balance.

B. collect its receivables.

C. borrow additional funds.

D. liquidate its inventory.

Question 33 - CMA 1294 2.22 - Ratios: Liquidity, Leverage, Coverage and Activity

The following inventory and sales data are available for the current year for Volpone Company. Volpone uses a

365-day year when computing ratios.

November 30, 2012 November 30, 2011

Net credit sales $6,205,000

Gross receivables 350,000 320,000

Inventory 960,000 780,000

Cost of goods sold 4,380,000

Volpone Company's average number of days to collect accounts receivable for the current year is

A. 19.71 days.

B. 18.87 days.

C. 21.17 days.

D. 19.43 days.

Question 34 - ICMA 13.P2.015 - Ratios: Liquidity, Leverage, Coverage and Activity

Since incorporating three years ago, Lawrence Inc. has estimated bad debts at a rate of 3% using the income

statement approach. During its fourth year in business, after recording the uncollectible accounts expense based on its

previous estimate, Lawrence determined that its estimate of bad debts should be increased to 4.5%. During this fourth

year, Lawrence recorded sales of $25,000,000 and had an ending accounts receivable balance of $2,000,000. This

change would decrease

A. the current year's income by $375,000 and increase the firm's degree of operating leverage.

B. the current year's income by $30,000 and decrease the firm's financial leverage.

(c) HOCK international, page 11

Part 2 : 11/10/17 09:52:04

C. both degree of operating leverage and times interest earned.

D. the current year's income by $1,125,000 and decrease the firm's degree of operating leverage.

Question 35 - CIA 1193 IV.46 - Ratios: Liquidity, Leverage, Coverage and Activity

The following account balances represent the end-of-year balance sheet of a company.

Accounts payable $ 67,000

Accounts receivable (net) 115,000

Accumulated depreciation - building 298,500

Accumulated depreciation - equipment 50,500

Cash 27,500

Common stock ($10 par value) 100,000

Deferred tax liabilities - noncurrent 37,500

Equipment 136,000

Income taxes payable 70,000

Inventory 257,000

Land and building 752,000

Long-term notes payable 123,000

Trading securities 64,000

Notes payable within 1 year 54,000

Other current liabilities 22,500

Paid-in capital in excess of par 150,000

Prepaid expenses 27,000

Retained earnings 403,500

The company's quick ratio is:

A. 0.97

B. 1.09

C. 0.82

D. 1.44

Question 36 - ICMA 10.P2.059 - Ratios: Liquidity, Leverage, Coverage and Activity

Lancaster Inc. had net accounts receivable of $168,000 and $147,000 at the beginning and end of the year,

respectively. The company’s net income for the year was $204,000 on $1,700,000 in total sales. Cash sales were 6%

of total sales. Lancaster's average accounts receivable turnover ratio for the year is

A. 10.15.

B. 10.79.

C. 9.51.

D. 10.87.

Question 37 - ICMA 10.P2.046 - Ratios: Liquidity, Leverage, Coverage and Activity

Which one of the following is the best indicator of long-term debt paying ability?

A. Current ratio.

(c) HOCK international, page 12

Part 2 : 11/10/17 09:52:04

B. Working capital turnover.

C. Debt-to-total assets ratio.

D. Asset turnover.

Question 38 - CMA 1280 4.2 - Ratios: Liquidity, Leverage, Coverage and Activity

Depoole Company is a manufacturer of industrial products and employs a calendar year for financial reporting

purposes. Assume that total quick assets exceeded total current liabilities both before and after the transaction

described. Further assume that Depoole has positive profits during the year and a credit balance throughout the year in

its retained earnings account.

The purchase of raw materials for $85,000 on open account would

A. Decrease the current ratio.

B. Decrease net working capital.

C. Increase net working capital.

D. Increase the current ratio.

Question 39 - CMA 679 4.13 - Ratios: Liquidity, Leverage, Coverage and Activity

Stock options are frequently provided to officers of companies. Stock options that are exercised improve

A. The ownership interest of existing stockholders.

B. Basic earnings per share.

C. The total asset turnover.

D. The debt-to-equity ratio.

Question 40 - ICMA 10.P2.052 - Ratios: Liquidity, Leverage, Coverage and Activity

Lowell Corporation has decided to include certain financial ratios in its year-end annual report to shareholders.

Selected information relating to its most recent fiscal year is provided below.

Cash $ 10,000

Accounts receivable (end of year) 20,000

Accounts receivable (beginning of year) 24,000

Inventory (end of year) 30,000

Inventory (beginning of year) 26,000

Notes payable (due in 90 days) 25,000

Bonds payable (due in 10 years) 35,000

Net credit sales for year 220,000

Cost of goods sold 140,000

Using a 365-day year, compute Lowell's accounts receivable turnover in days.

A. 36.5 days.

B. 26.1 days.

C. 33.2 days.

D. 39.8 days.

(c) HOCK international, page 13

Part 2 : 11/10/17 09:52:04

Question 41 - CIA 1195 IV.36 - Ratios: Liquidity, Leverage, Coverage and Activity

Which of the following financial ratios is used to assess the liquidity of a company?

A. Current Ratio.

B. Profit Margin on Sales.

C. Total Debt to Total Assets Ratio.

D. Days' Sales Outstanding.

Question 42 - ICMA 10.P2.058 - Ratios: Liquidity, Leverage, Coverage and Activity

Globetrade is a retailer that buys virtually all of its merchandise from manufacturers in a country experiencing

significant inflation. Globetrade is considering changing its method of inventory costing from first-in, first-out (FIFO) to

last-in, first-out (LIFO). What effect would the change from FIFO to LIFO have on Globetrade’s current ratio and

inventory turnover ratio?

A. Both the current ratio and the inventory turnover ratio would increase.

B. Both the current ratio and the inventory turnover ratio would decrease.

C. The current ratio would increase but the inventory turnover ratio would decrease.

D. The current ratio would decrease but the inventory turnover ratio would increase.

Question 43 - ICMA 13.P2.029 - Ratios: Liquidity, Leverage, Coverage and Activity

All other things being equal, which one of the following factors would result in an increase in cash reported on the

balance sheet from one period to the next?

A. Decrease in the accrued vacation liability.

B. Reduction of days sales outstanding of accounts receivable.

C. Increase in the speed with which accounts payable invoices are paid.

D. Increase in the level of inventory held.

Question 44 - CMA 692 1.10 - Ratios: Liquidity, Leverage, Coverage and Activity

Carlisle Company currently sells 400,000 bottles of perfume each year. Each bottle costs $0.84 to produce and sells

for $1.00. Fixed costs are $28,000 per year. The firm has annual interest expense of $6,000, preferred stock dividends

of $2,000 per year, and a 40% tax rate. Carlisle uses the following formulas to determine the company's leverage.

Operating leverage = [Q(S − VC)] ÷ [Q(S − VC) − FC]

Financial leverage = EBIT ÷ {EBIT − I − [P / (1 − T)]}

Total leverage = Q(S − VC) ÷ {Q(S − VC) − FC − I − [P / (1 − T)]}

Where:

Q=Quantity

FC=Fixed Cost

VC=Variable Cost

S=Selling Price

(c) HOCK international, page 14

Part 2 : 11/10/17 09:52:04

I=Interest Expense

P=Preferred Dividends

T=Tax Rate

EBIT=Earnings Before Interest and Taxes

If Carlisle Company did not have preferred stock, the degree of total leverage would

A. Decrease but not be proportional to the decrease in financial leverage.

B. Decrease in proportion to a decrease in financial leverage.

C. Increase in proportion to an increase in financial leverage.

D. Remain the same.

Question 45 - CMA 1280 4.7 - Ratios: Liquidity, Leverage, Coverage and Activity

Depoole Company is a manufacturer of industrial products and employs a calendar year for financial reporting

purposes. Assume that total quick assets exceeded total current liabilities both before and after the transaction

described. Further assume that Depoole has positive profits during the year and a credit balance throughout the year in

its retained earnings account.

The early liquidation of a long-term note with cash affects the

A. Current ratio but not the quick ratio.

B. Current ratio to a greater degree than the quick ratio.

C. Quick ratio to a greater degree than the current ratio.

D. Current and quick ratio to the same degree.

Question 46 - ICMA 10.P2.038 - Ratios: Liquidity, Leverage, Coverage and Activity

A summary of the Income Statement of Sahara Company is shown below.

Sales $15,000,000

Cost of sales 9,000,000

Operating expenses 3,000,000

Interest expense 800,000

Taxes 880,000

Net income $ 1,320,000

Based on the above information, Sahara's degree of financial leverage is

A. 1.36.

B. 0.96.

C. 1.61.

D. 2.27.

Question 47 - CMA 1291 1.5 - Ratios: Liquidity, Leverage, Coverage and Activity

The purchase of treasury stock with a firm's surplus cash

A. Increases a firm's equity.

B. Increases a firm's assets.

(c) HOCK international, page 15

Part 2 : 11/10/17 09:52:04

C. Increases a firm's financial leverage.

D. Increases a firm's interest-coverage ratio.

Question 48 - CMA 685 4.17 - Ratios: Liquidity, Leverage, Coverage and Activity

If the ratio of total liabilities to equity increases, a ratio that must also increase is

A. Return on equity.

B. Total liabilities to total assets.

C. The current ratio.

D. Times interest earned.

Question 49 - CMA 1280 4.6 - Ratios: Liquidity, Leverage, Coverage and Activity

Depoole Company is a manufacturer of industrial products and employs a calendar year for financial reporting

purposes. Assume that total quick assets exceeded total current liabilities both before and after the transaction

described. Further assume that Depoole has positive profits during the year and a credit balance throughout the year in

its retained earnings account.

The issuance of serial bonds in exchange for an office building, with the first installment of the bonds due late this year,

A. Affects all of the answers as indicated.

B. Decreases the quick ratio.

C. Decreases net working capital.

D. Decreases the current ratio.

Question 50 - ICMA 10.P2.031 - Ratios: Liquidity, Leverage, Coverage and Activity

When reviewing a credit application, the credit manager should be most concerned with the applicant's

A. profit margin and return on assets.

B. working capital and current ratio.

C. price-earnings ratio and current ratio.

D. working capital and return on equity.

Question 51 - ICMA 10.P2.028 - Ratios: Liquidity, Leverage, Coverage and Activity

Garstka Auto Parts must increase its acid test ratio above the current 0.9 level in order to comply with the terms of a

loan agreement. Which one of the following actions is most likely to produce the desired results?

A. Expediting collection of accounts receivable.

B. Selling auto parts on account.

C. Purchasing marketable securities for cash.

D. Making a payment to trade accounts payable.

(c) HOCK international, page 16

Part 2 : 11/10/17 09:52:04

Question 52 - ICMA 10.P2.063 - Ratios: Liquidity, Leverage, Coverage and Activity

The following information was obtained from a company’s financial statements.

Beginning of the

End of the Year

Year

Inventory $6,400 $7,600

Accounts receivable 2,140 3,060

Accounts payable 3,320 3,680

Total sales for the year were $85,900, of which $62,400 were credit sales. The cost of goods sold was $24,500. The

company's payable turnover was

A. 6.7 times.

B. 17.8 times.

C. 7.0 times.

D. 16.9 times.

Question 53 - CMA 1287 4.1 - Ratios: Liquidity, Leverage, Coverage and Activity

When a balance sheet amount is related to an income statement amount in computing a ratio,

A. The income statement amount should be converted to an average for the year.

B. Comparisons with industry ratios are not meaningful.

C. The balance sheet amount should be converted to an average for the year.

D. Both amounts should be converted to market value.

Question 54 - CMA 1280 4.4 - Ratios: Liquidity, Leverage, Coverage and Activity

Depoole Company is a manufacturer of industrial products and employs a calendar year for financial reporting

purposes. Assume that total quick assets exceeded total current liabilities both before and after the transaction

described. Further assume that Depoole has positive profits during the year and a credit balance throughout the year in

its retained earnings account.

Obsolete inventory of $125,000 was written off during the year. This transaction

A. Increased the quick ratio.

B. Decreased the quick ratio.

C. Decreased the current ratio.

D. Increased net working capital.

Question 55 - CMA 1291 1.9 - Ratios: Liquidity, Leverage, Coverage and Activity

Which one of the following factors would likely cause a firm to increase its use of debt financing as measured by the

debt-to-total-capitalization ratio?

A. An increase in the price-earnings ratio.

B. An increase in the degree of operating leverage.

C. An increase in the corporate income tax rate.

(c) HOCK international, page 17

Part 2 : 11/10/17 09:52:04

D. Increased economic uncertainty.

Question 56 - CMA 693 2.1 - Ratios: Liquidity, Leverage, Coverage and Activity

Lisa, Inc.

Statement of Financial Position

December 31, 20X4

(in thousands)

20X4 20X3

Assets

Current assets:

Cash $ 30 $ 25

Trading securities 20 15

Accounts receivable (net) 45 30

Inventories (at lower of cost of market) 60 50

Prepaid items 15 20

Total Current Assets $170 $140

Long-term assets:

Long-term investments:

Available-for-sale investments $ 25 $ 20

Property, plant & equipment:

Land (at cost) 75 75

Building (net) 80 90

Equipment (net) 95 100

Intangible assets:

Patents (net) 35 17

Goodwill (net) 20 13

Total Long-Term Assets $330 $315

Total Assets $500 $455

Liabilities and Equity

Current liabilities:

Notes payable $ 23 $ 12

Accounts payable 47 28

Accrued interest $ 15 $ 15

Total current liabilities $ 85 $ 55

Long-term liabilities:

Long-term Notes payable 10% due 12/31/20X6 $ 10 $ 10

Bonds payable 12% due 12/31/20X9 15 15

Total long-term debt $ 25 $ 25

Total liabilities $110 $ 80

Shareholders' Equity

Preferred stock - 5% cumulative, $100 par, nonparticipating

authorized, issued and outstanding, 1,000 shares $100 $100

Common stock - $10 par 20,000 shares authorized, 15,000

shares issued and outstanding 150 150

Additional paid-in capital - common 75 75

Retained earnings 65 50

(c) HOCK international, page 18

Part 2 : 11/10/17 09:52:04

Total Equity $390 $375

Total Liabilities & Equity $500 $455

Lisa Inc.'s acid test (quick) ratio at December 31, 20X4 was

A. 0.6

B. 1.1

C. 1.8

D. 2.0

Question 57 - ICMA 13.P2.010 - Ratios: Liquidity, Leverage, Coverage and Activity

A retail company has experienced rapid growth in sales during the current year. An analyst has calculated the following

ratios for this company.

Prior Year Current Year

Inventory Turnover 5.4 9.3

Receivables turnover 4.2 3.5

Fixed asset turnover 2.4 3.6

Quick ratio 1.5 1.2

Based on the above, the analyst may conclude that sales increased due to more

A. favorable credit policies.

B. stores open in current year.

C. control over inventory levels.

D. competitive pricing.

Question 58 - CIA 1196 IV.35 - Ratios: Liquidity, Leverage, Coverage and Activity

A company has a current ratio of 1.4, a quick, or acid test, ratio of 1.2, and the following partial summary balance sheet:

Cash $ 10 Current liabilities $

Accounts receivable ___ Long-term liabilities 40

Inventory ___ Shareholders' equity 30

Fixed Assets ___

Total assets $100 Total liabilities and equity$100

The company has a fixed assets balance of:

A. $58

B. $16

C. $64

D. $0

Question 59 - ICMA 10.P2.055 - Ratios: Liquidity, Leverage, Coverage and Activity

Peggy Monahan, controller, has gathered the following information regarding Lampasso Company.

Beginning of the year End of the year

Inventory $6,400 $7,600

(c) HOCK international, page 19

Part 2 : 11/10/17 09:52:04

Accounts receivable $2,140 $3,060

Accounts payable $3,320 $3,680

Total sales for the year were $85,900, of which $61,400 were credit sales. The cost of goods sold was $24,500.

Lampasso's inventory turnover ratio for the year was

A. 3.5 times.

B. 8.9 times.

C. 3.2 times.

D. 8.2 times.

Question 60 - CMA 695 2.1 - Ratios: Liquidity, Leverage, Coverage and Activity

CPZ Enterprises had the following account information.

Accounts receivable $200,000

Accounts payable 80,000

Bonds payable, due in ten years 10,000

Cash 100,000

Interest payable, due in three months 10,000

Inventory 400,000

Land 250,000

Notes payable, due in six months 50,000

Prepaid expenses 40,000

The company has an operating cycle of five months.

The current ratio for CPZ Enterprises is

A. 5.00

B. 5.29

C. 1.68

D. 2.14

Question 61 - ICMA 10.P2.039 - Ratios: Liquidity, Leverage, Coverage and Activity

A degree of operating leverage of 3 at 5,000 units means that a

A. 3% change in earnings before interest and taxes will cause a 3% change in sales.

B. 1% change in sales will cause a 3% change in earnings before interest and taxes.

C. 3% change in sales will cause a 3% change in earnings before interest and taxes.

D. 1% change in earnings before interest and taxes will cause a 3% change in sales.

Question 62 - ICMA 10.P2.061 - Ratios: Liquidity, Leverage, Coverage and Activity

The following financial information is given for Anjuli Corporation (in millions of dollars).

Prior Year Current Year

Sales $10 $11

(c) HOCK international, page 20

Part 2 : 11/10/17 09:52:04

Cost of goods sold 6 7

Current Assets:

Cash 2 3

Accounts receivable 3 4

Inventory 4 5

Between the prior year and the current year, did the days sales in inventory and days sales in receivables for Anjuli

increase or decrease? Assume a 365-day year.

A. Days sales in inventory increased; days sales in receivables decreased.

B. Days sales in inventory decreased; days sales in receivables decreased.

C. Days sales in inventory decreased; days sales in receivables increased.

D. Days sales in inventory increased; days sales in receivables increased.

Question 63 - CIA 1196 IV.34 - Ratios: Liquidity, Leverage, Coverage and Activity

A company has a current ratio of 1.4, a quick, or acid test, ratio of 1.2, and the following partial summary balance sheet:

Cash $ 10 Current liabilities $

Accounts receivable ___ Long-term liabilities 40

Inventory ___ Shareholders' equity 30

Fixed Assets ___

Total assets $100 Total liabilities and equity$100

The company has an accounts receivable balance of:

A. $12

B. $26

C. $36

D. $66

Question 64 - CMA 1289 P4 Q17 - Ratios: Liquidity, Leverage, Coverage and Activity

Excerpts from the statement of financial position for Landau Corporation as of September 30 of the current year are

presented as follows.

Cash $ 950,000

Accounts receivable (net) 1,675,000

Inventories 2,806,000

Total current assets $5,431,000

Accounts payable $1,004,000

Accrued liabilities 785,000

Total current liabilities $1,789,000

The board of directors of Landau Corporation met on October 4 of the current year and declared the regular quarterly

cash dividend amounting to $750,000 ($0.60 per share). The dividend is payable on October 25 of the current year to

all shareholders of record as of October 12 of the current year.

Assume that the only transactions to affect Landau Corporation during October of the current year are the dividend

transactions and that the closing entries have been made.

If the dividend declared by Landau Corporation had been a 10% stock dividend instead of a cash dividend, Landau's

(c) HOCK international, page 21

Part 2 : 11/10/17 09:52:04

total shareholders' equity would have been

A. Increased by the dividend declaration and unchanged by the dividend distribution.

B. Unchanged by the dividend declaration and increased by the dividend distribution.

C. Decreased by the dividend declaration and increased by the dividend distribution.

D. Unchanged by either the dividend declaration or the dividend distribution.

Question 65 - CMA 1285 4.23 - Ratios: Liquidity, Leverage, Coverage and Activity

Windham Company has current assets of $400,000 and current liabilities of $500,000. Windham Company's current

ratio would be increased by

A. The collection of $100,000 of accounts receivable.

B. The purchase of $100,000 of inventory on account.

C. Refinancing a $100,000 long-term loan with short-term debt.

D. The payment of $100,000 of accounts payable.

Question 66 - CMA 696 1.15 - Ratios: Liquidity, Leverage, Coverage and Activity

Spotech Co.'s budgeted sales and budgeted cost of sales for the coming year are $212,000,000 and $132,500,000,

respectively. Short-term interest rates are expected to average 5%. If Spotech could increase inventory turnover from

its current 8 times per year to 10 times per year, its expected cost savings in the current year would be

A. $331,250

B. $250,000

C. $82,812

D. $165,625

Question 67 - CMA 691 2.8 - Ratios: Liquidity, Leverage, Coverage and Activity

Selected data from Ostrander Corporation's financial statements for the years indicated are presented in thousands.

20X2 Operations

Net sales $4,175

Cost of goods sold 2,880

Interest expense 50

Income tax 120

Gain on disposal of a segment (net of tax) 210

Net income 385

December 31, 20X2

20X2 20X1

Cash $ 32 $ 28

Trading securities 169 172

Accounts receivable (net) 210 204

Merchandise inventory 440 420

Tangible fixed assets 480 440

Total assets 1,397 1,320

(c) HOCK international, page 22

Part 2 : 11/10/17 09:52:04

Current liabilities 370 368

Total liabilities 790 750

Common stock outstanding 226 210

Retained earnings 381 360

The total debt-to-equity ratio for Ostrander Corporation in 20X2 is

A. 1.85

B. 3.49

C. 1.30

D. 2.07

Question 68 - CMA 688 4.2 - Ratios: Liquidity, Leverage, Coverage and Activity

The data presented below shows actual figures for selected accounts of McKeon Company for the fiscal year ended

May 31, 20X0, and selected budget figures for the 20X1 fiscal year. McKeon's controller is in the process of reviewing

the 20X1 budget and calculating some key ratios based on the budget. McKeon Company monitors yield or return

ratios using the average financial position of the company. (Round all calculations to three decimal places if necessary.)

May 31, May 31,

20X1 20X0

Current assets $210,000 $180,000

Noncurrent assets 275,000 255,000

Current liabilities 78,000 85,000

Long-term debt 75,000 30,000

Common stock ($30 par value) 300,000 300,000

Retained earnings 32,000 20,000

20X1 Operations

Sales* $350,000

Cost of goods sold 160,000

Interest expense 3,000

Income taxes (40% rate) 48,000

Dividends declared and paid in 20X1 60,000

Administrative expense 67,000

*All sales are credit sales.

Composition of Current Assets

May 31, May 31,

20X1 20X0

Cash $ 20,000 $ 10,000

Accounts receivable 100,000 70,000

Inventory 70,000 80,000

Other 20,000 20,000

$210,000 $180,000

McKeon Company's debt to total asset ratio for 20X1 is

A. 0.315

B. 0.237

C. 0.264

D. 0.352

(c) HOCK international, page 23

Part 2 : 11/10/17 09:52:04

Question 69 - CMA 690 4.20 - Ratios: Liquidity, Leverage, Coverage and Activity

Assume the information below for Ramer Company, for Matson Company, and for their common industry represents a

recent year.

Industry

Ramer Matson Average

Current ratio 3.50 2.80 3.00

Accounts receivable turnover 5.00 8.10 6.00

Inventory turnover 6.20 8.00 6.10

Times interest earned 9.00 12.30 10.40

Debt-to-equity ratio 0.70 0.40 0.55

Return on investment 0.15 0.12 0.15

Dividend payout ratio 0.80 0.60 0.55

Earnings per share $3.00 $2.00 --

The attitudes of both Ramer and Matson concerning risk are best explained by the

A. Current ratio and earnings per share.

B. Dividend payout ratio and earnings per share.

C. Debt/equity ratio and times interest earned.

D. Current ratio, accounts receivable turnover, and inventory turnover.

Question 70 - ICMA 10.P2.056 - Ratios: Liquidity, Leverage, Coverage and Activity

Garland Corporation's Income Statement for the year just ended is shown below.

Net sales $900,000

Cost of goods sold:

Inventory - beginning $125,000

Purchases 540,000

Goods available for sale 665,000

Inventory - ending 138,000

Cost of goods sold 527,000

Gross profit 373,000

Operating expenses 175,000

Income from operations $198,000

Garland's average inventory turnover ratio is

A. 4.01.

B. 6.84.

C. 3.82.

D. 6.52.

Question 71 - CIA 596 IV.53 - Ratios: Liquidity, Leverage, Coverage and Activity

A growing company is assessing current working capital requirements. An average of 58 days is required to convert

raw materials into finished goods and to sell them. Then an average of 32 days is required to collect on receivables. If

the average time the company takes to pay for its raw materials is 15 days after they are received, then the total cash

conversion cycle for this company is:

(c) HOCK international, page 24

Part 2 : 11/10/17 09:52:04

A. 11 days.

B. 90 days.

C. 41 days.

D. 75 days.

Question 72 - CMA 693 2.4 - Ratios: Liquidity, Leverage, Coverage and Activity

Lisa, Inc.

Statement of Financial Position

December 31, 20X4

(in thousands)

20X4 20X3

Assets

Current assets:

Cash $ 30 $ 25

Trading securities 20 15

Accounts receivable (net) 45 30

Inventories (at lower of cost of market) 60 50

Prepaid items 15 20

Total Current Assets $170 $140

Long-term assets:

Long-term investments:

Available-for-sale investments $ 25 $ 20

Property, plant & equipment:

Land (at cost) 75 75

Building (net) 80 90

Equipment (net) 95 100

Intangible assets:

Patents (net) 35 17

Goodwill (net) 20 13

Total Long-Term Assets $330 $315

Total Assets $500 $455

Liabilities and Equity

Current liabilities:

Notes payable $ 23 $ 12

Accounts payable 47 28

Accrued interest $ 15 $ 15

Total current liabilities $ 85 $ 55

Long-term liabilities:

Long-term Notes payable 10% due 12/31/20X6 $ 10 $ 10

Bonds payable 12% due 12/31/20X9 15 15

Total long-term debt $ 25 $ 25

Total liabilities $110 $ 80

Shareholders' Equity

Preferred stock - 5% cumulative, $100 par, nonparticipating

authorized, issued and outstanding, 1,000 shares $100 $100

Common stock - $10 par 20,000 shares authorized, 15,000

(c) HOCK international, page 25

Part 2 : 11/10/17 09:52:04

shares issued and outstanding 150 150

Additional paid-in capital - common 75 75

Retained earnings 65 50

Total Equity $390 $375

Total Liabilities & Equity $500 $455

Assume sales and cost of goods sold for 20X4 were $300,000 and $220,000, respectively. Lisa Inc.'s inventory

turnover, using a 360-day year, was

A. 4.4 times.

B. 3.7 times.

C. 4.0 times.

D. 5.0 times.

Question 73 - ICMA 10.P2.030 - Ratios: Liquidity, Leverage, Coverage and Activity

Selected financial data for Boyd Corporation are shown below.

January 1 December 31

Cash $ 48,000 $ 62,000

Accounts receivable (net) 68,000 47,000

Trading securities 42,000 35,000

Inventory 125,000 138,000

Plant & equipment (net) 325,000 424,000

Accounts payable 32,000 84,000

Accrued liabilities 14,000 11,000

Deferred taxes 15,000 9,000

Long-term bonds payable 95,000 77,000

Boyd's net income for the year was $96,000. Boyd's current ratio at the end of the year is

A. 2.71.

B. 1.71.

C. 2.97.

D. 1.56.

Question 74 - ICMA 10.P2.032 - Ratios: Liquidity, Leverage, Coverage and Activity

Both the current ratio and the quick ratio for Spartan Corporation have been slowly decreasing. For the past two years,

the current ratio has been 2.3 to 1 and 2.0 to 1. During the same time period, the quick ratio has decreased from 1.2 to

1 to 1.0 to 1. The disparity between the current and quick ratios can be explained by which one of the following?

A. The cash balance is unusually low.

B. The accounts receivable balance has decreased.

C. The current portion of long-term debt has been steadily increasing.

D. The inventory balance is unusually high.

Question 75 - CIA 1193 IV.48 - Ratios: Liquidity, Leverage, Coverage and Activity

(c) HOCK international, page 26

Part 2 : 11/10/17 09:52:04

A company is considering the early retirement of its 10%, 10-year bonds payable. Before retiring the bonds, the

company's capital structure was

Current liabilities $125,000

Long-term liabilities: Notes payable (due in 5 years) 200,000

Bonds payable 300,000

Premium on bonds payable 25,000

Owner's equity: Common stock ($5 par value) 150,000

Paid-in capital in excess of par 50,000

Retained earnings 450,000

If the bonds can be retired at 103.5%, the

A. Asset turnover ratio will decrease.

B. Financial leverage will decrease.

C. Debt-equity ratio will increase.

D. Return on owner's equity will decrease.

Question 76 - CMA 1293 2.13 - Ratios: Liquidity, Leverage, Coverage and Activity

In computing inventory turnover, the base to use is the

A. Sales base because it more clearly represents operational activity.

B. Sales base because it is more likely to reflect a change in trend.

C. Cost of sales base because it eliminates any changes due solely to sales price changes.

D. Sales base because it provides turnover rates that are considerably higher.

Question 77 - CMA 688 4.3 - Ratios: Liquidity, Leverage, Coverage and Activity

The data presented below shows actual figures for selected accounts of McKeon Company for the fiscal year ended

May 31, 20X0, and selected budget figures for the 20X1 fiscal year. McKeon's controller is in the process of reviewing

the 20X1 budget and calculating some key ratios based on the budget. McKeon Company monitors yield or return

ratios using the average financial position of the company. (Round all calculations to three decimal places if necessary.)

May 31, May 31,

20X1 20X0

Current assets $210,000 $180,000

Noncurrent assets 275,000 255,000

Current liabilities 78,000 85,000

Long-term debt 75,000 30,000

Common stock ($30 par value) 300,000 300,000

Retained earnings 32,000 20,000

20X1 Operations

Sales* $350,000

Cost of goods sold 160,000

Interest expense 3,000

Income taxes (40% rate) 48,000

Dividends declared and paid in 20X1 60,000

Administrative expense 67,000

*All sales are credit sales.

(c) HOCK international, page 27

Part 2 : 11/10/17 09:52:04

Composition of Current Assets

May 31, May 31,

20X1 20X0

Cash $ 20,000 $ 10,000

Accounts receivable 100,000 70,000

Inventory 70,000 80,000

Other 20,000 20,000

$210,000 $180,000

The 20X1 accounts receivable turnover for McKeon Company is

A. 5.000

B. 1.882

C. 4.118

D. 3.500

Question 78 - CMA 688 4.11 - Ratios: Liquidity, Leverage, Coverage and Activity

A measure of its long-term debt-paying ability is a company's

A. Inventory turnover.

B. Times interest earned.

C. Return on assets.

D. Length of the operating cycle.

Question 79 - CMA 688 4.12 - Ratios: Liquidity, Leverage, Coverage and Activity

Using the data presented below, calculate the cost of sales for the Beta Corporation for the past year.

Current ratio 3.5

Acid test ratio 3.0

Current liabilities at year end $600,000

Beginning inventory $500,000

Inventory turnover 8.0

A. $2,400,000

B. $1,600,000

C. $3,200,000

D. $6,400,000

Question 80 - CMA 1280 4.1 - Ratios: Liquidity, Leverage, Coverage and Activity

Depoole Company is a manufacturer of industrial products and employs a calendar year for financial reporting

purposes. Assume that total quick assets exceeded total current liabilities both before and after the transaction

described. Further assume that Depoole has positive profits during the year and a credit balance throughout the year in

its retained earnings account.

Payment of a trade account payable of $64,500 would

(c) HOCK international, page 28

Part 2 : 11/10/17 09:52:04

A. Increase the current ratio but the quick ratio would not be affected.

B. Decrease both the current and quick ratios.

C. Increase the quick ratio but the current ratio would not be affected.

D. Increase both the current and quick ratios.

Question 81 - ICMA 10.P2.027 - Ratios: Liquidity, Leverage, Coverage and Activity

Shown below are selected data from Fortune Company's most recent financial statements.

Marketable securities $10,000

Accounts receivable 60,000

Inventory 25,000

Supplies 5,000

Accounts payable 40,000

Short-term debt payable 10,000

Accruals 5,000

What is Fortune's net working capital?

A. $35,000

B. $80,000

C. $50,000

D. $45,000

Question 82 - CMA 690 4.13 - Ratios: Liquidity, Leverage, Coverage and Activity

To determine the operating cycle for a wholesaler, which one of the following pairs of items is needed?

A. Asset turnover and return on sales.

B. Days' sales in accounts receivable and average merchandise inventory.

C. Cash turnover and net sales.

D. Accounts receivable turnover and inventory turnover.

Question 83 - HOCK MP1 E21 - Ratios: Liquidity, Leverage, Coverage and Activity

The annual sales revenue of an enterprise is $3,000,000. Half of the sales are on credit terms; half are cash sales.

Accounts receivable at the balance sheet date are $165,000. What is the average receivables collection period, to the

nearest day, using a 365 day year?

A. 9 days

B. 20 days

C. 40 days

D. 18 days

Question 84 - CMA 688 4.4 - Ratios: Liquidity, Leverage, Coverage and Activity

The data presented below shows actual figures for selected accounts of McKeon Company for the fiscal year ended

(c) HOCK international, page 29

Part 2 : 11/10/17 09:52:04

May 31, 20X0, and selected budget figures for the 20X1 fiscal year. McKeon's controller is in the process of reviewing

the 20X1 budget and calculating some key ratios based on the budget. McKeon Company monitors yield or return

ratios using the average financial position of the company. (Round all calculations to three decimal places if necessary.)

May 31, May 31,

20X1 20X0

Current assets $210,000 $180,000

Noncurrent assets 275,000 255,000

Current liabilities 78,000 85,000

Long-term debt 75,000 30,000

Common stock ($30 par value) 300,000 300,000

Retained earnings 32,000 20,000

20X1 Operations

Sales* $350,000

Cost of goods sold 160,000

Interest expense 3,000

Income taxes (40% rate) 48,000

Dividends declared and paid in 20X1 60,000

Administrative expense 67,000

*All sales are credit sales.

Composition of Current Assets

May 31, May 31,

20X1 20X0

Cash $ 20,000 $ 10,000

Accounts receivable 100,000 70,000

Inventory 70,000 80,000

Other 20,000 20,000

$210,000 $180,000

Using a 365-day year, McKeon's days of sales in inventory is

A. 160 days.

B. 183 days.

C. 171 days.

D. 78 days.

Question 85 - CMA 1280 4.3 - Ratios: Liquidity, Leverage, Coverage and Activity

Depoole Company is a manufacturer of industrial products and employs a calendar year for financial reporting

purposes. Assume that total quick assets exceeded total current liabilities both before and after the transaction

described. Further assume that Depoole has positive profits during the year and a credit balance throughout the year in

its retained earnings account.

The collection of a current accounts receivable of $29,000 would

A. Increase the current ratio.

B. Decrease the current ratio and the quick ratio.

C. Not affect the current or quick ratios.

D. Increase the quick ratio.

(c) HOCK international, page 30

Part 2 : 11/10/17 09:52:04

Question 86 - CMA 690 1.9 - Ratios: Liquidity, Leverage, Coverage and Activity

Sylvan Corporation has the following capital structure.

Debenture bonds: $10,000,000

Preferred equity: $1,000,000

Common equity: $39,000,000

The financial leverage of Sylvan Corporation would increase as a result of:

A. Issuing common stock and using the proceeds to retire preferred stock.

B. Financing its future investments with a higher percentage of bonds.

C. Maintaining the same dollar level of cash dividends as the prior year, even though earnings have increased by 7%.

D. Financing its future investments with a higher percentage of equity funds.

Question 87 - ICMA 10.P2.036 - Ratios: Liquidity, Leverage, Coverage and Activity

If a company has a current ratio of 2.1 and pays off a portion of its accounts payable with cash, the current ratio will

A. remain unchanged.

B. decrease.

C. increase.

D. move closer to the quick ratio.

Question 88 - CMA 695 1.1 - Ratios: Liquidity, Leverage, Coverage and Activity

A higher degree of operating leverage compared with the industry average implies that the firm

A. Has profits that are more sensitive to changes in sales volume.

B. Has higher variable costs.

C. Is more profitable.

D. Is less risky.

Question 89 - ICMA 10.P2.066 - Ratios: Liquidity, Leverage, Coverage and Activity

The assets of Moreland Corporation are presented below.

January 1 December 31

Cash $ 48,000 $ 62,000

Marketable securities 42,000 35,000

Accounts receivable 68,000 47,000

Inventory 125,000 138,000

Plant & equipment

(net of accumulated depreciation) 325,000 424,000

For the year just ended, Moreland had net income of $96,000 on $900,000 of sales. Moreland's total asset turnover

ratio is

A. 1.48.

B. 1.50.

(c) HOCK international, page 31

Part 2 : 11/10/17 09:52:04

C. 1.37.

D. 1.27.

Question 90 - ICMA 10.P2.034 - Ratios: Liquidity, Leverage, Coverage and Activity

All of the following are included when calculating the acid test ratio except

A. six-month treasury bills.

B. 60-day certificates of deposit.

C. prepaid insurance.

D. accounts receivable.

Question 91 - ICMA 10.P2.024 - Ratios: Liquidity, Leverage, Coverage and Activity

Shown below are beginning and ending balances for certain of Grimaldi Inc.'s accounts.

January 1 December 31

Cash $ 48,000 $ 62,000

Marketable securities 42,000 35,000

Accounts receivable 68,000 47,000

Inventory 125,000 138,000

Plant & equipment 325,000 424,000

Accounts payable 32,000 84,000

Accrued liabilities 14,000 11,000

7% bonds payable 95,000 77,000

Grimaldi's acid test ratio or quick ratio at the end of the year is

A. 1.02.

B. 0.83.

C. 1.52.

D. 1.15.

Question 92 - CIA 1190 IV.55 - Ratios: Liquidity, Leverage, Coverage and Activity

Assume that a company's total debt to total assets (debt-to-asset) ratio is currently 50%. It plans to purchase fixed

assets either by using borrowed funds for the purchase or by entering into an operating lease. The company's

debt-to-asset ratio as measured by the balance sheet will

A. Increase whether the assets are purchased or leased.

B. Increase if the assets are purchased, and remain unchanged if the assets are leased.

C. Remain unchanged whether the assets are purchased or leased.

D. Increase if the assets are purchased, and decrease if the assets are leased.

Question 93 - ICMA 10.P2.022 - Ratios: Liquidity, Leverage, Coverage and Activity

(c) HOCK international, page 32

Part 2 : 11/10/17 09:52:04

All of the following are affected when merchandise is purchased on credit except

A. current ratio.

B. total current assets.

C. total current liabilities.

D. net working capital.

Question 94 - HOCK MP1 E2 - Ratios: Liquidity, Leverage, Coverage and Activity

Ray Corporation has long-term debt of $1,200,000 and equity of $1,000,000. The board of directors has set a goal of

1:1 for the company's debt-equity ratio. Which of the following could the company employ to achieve this goal?

A. Issuing rights to purchase new common stock.

B. Issuing new bonds.

C. Paying a stock dividend to the existing shareholders.

D. Paying a dividend on its common stock.

Question 95 - CIA 594 IV.52 - Ratios: Liquidity, Leverage, Coverage and Activity

The degree of operating leverage (DOL) is

A. lower if the degree of total leverage is higher, other things held constant.

B. a measure of the change in earnings before interest and taxes (EBIT) resulting from a given change in sales.

C. higher if the degree of total leverage is lower, other things held constant.

D. a measure of the change in earnings available to common stockholders associated with a given change in operating

earnings.

Question 96 - CMA 695 2.3 - Ratios: Liquidity, Leverage, Coverage and Activity

CPZ Enterprises had the following account information.

Accounts receivable $200,000

Accounts payable 80,000

Bonds payable, due in ten years 10,000

Cash 100,000

Interest payable, due in three months 10,000

Inventory 400,000

Land 250,000

Notes payable, due in six months 50,000

Prepaid expenses 40,000

The company has an operating cycle of five months.

What will happen to the current and quick ratios if CPZ Enterprises uses cash to pay 50 percent of the accounts

payable?

A. Both ratios will increase.

B. The current ratio will decrease and the quick ratio will increase.

C. The current ratio will increase and the quick ratio will decrease.

D. Both ratios will decrease.

(c) HOCK international, page 33

Part 2 : 11/10/17 09:52:04

Question 97 - CMA 1293 2.16 - Ratios: Liquidity, Leverage, Coverage and Activity

The ratio that measures a firm's ability to generate earnings from its resources is

A. Asset turnover.

B. Sales to working capital.

C. Days' sales in inventory.

D. Days' sales in receivables.

Question 98 - CMA 693 2.3 - Ratios: Liquidity, Leverage, Coverage and Activity

Lisa, Inc.

Statement of Financial Position

December 31, 20X4

(in thousands)

20X4 20X3

Assets

Current assets:

Cash $ 30 $ 25

Trading securities 20 15

Accounts receivable (net) 45 30

Inventories (at lower of cost of market) 60 50

Prepaid items 15 20

Total Current Assets $170 $140

Long-term assets:

Long-term investments:

Available-for-sale investments $ 25 $ 20

Property, plant & equipment:

Land (at cost) 75 75

Building (net) 80 90

Equipment (net) 95 100

Intangible assets:

Patents (net) 35 17

Goodwill (net) 20 13

Total Long-Term Assets $330 $315

Total Assets $500 $455

Liabilities and Equity

Current liabilities:

Notes payable $ 23 $ 12

Accounts payable 47 28

Accrued interest $ 15 $ 15

Total current liabilities $ 85 $ 55

Long-term liabilities:

Long-term Notes payable 10% due 12/31/20X6 $ 10 $ 10

Bonds payable 12% due 12/31/20X9 15 15

(c) HOCK international, page 34

Part 2 : 11/10/17 09:52:04

Total long-term debt $ 25 $ 25

Total liabilities $110 $ 80

Shareholders' Equity

Preferred stock - 5% cumulative, $100 par, nonparticipating

authorized, issued and outstanding, 1,000 shares $100 $100

Common stock - $10 par 20,000 shares authorized, 15,000

shares issued and outstanding 150 150

Additional paid-in capital - common 75 75

Retained earnings 65 50

Total Equity $390 $375

Total Liabilities & Equity $500 $455

Assume net credit sales were $300,000 for 20X4. Lisa Inc.'s average collection period for 20X4, using a 360-day year,

was

A. 61 days.

B. 36 days.

C. 54 days.

D. 45 days.

Question 99 - ICMA 10.P2.023 - Ratios: Liquidity, Leverage, Coverage and Activity

Birch Products Inc. has the following current assets.

Cash $ 250,000

Marketable securities 100,000

Accounts receivable 800,000

Inventories 1,450,000

Total current assets $2,600,000

If Birch's current liabilities are $1,300,000, the firm's

A. current ratio will not change if a payment of $100,000 cash is used to pay $100,000 of accounts payable.

B. quick ratio will not change if a payment of $100,000 cash is used to purchase inventory.

C. quick ratio will decrease if a payment of $100,000 cash is used to purchase inventory.

D. current ratio will decrease if a payment of $100,000 cash is used to pay $100,000 of accounts payable.

Question 100 - CMA 1289 P4 Q14 - Ratios: Liquidity, Leverage, Coverage and Activity

Excerpts from the statement of financial position for Landau Corporation as of September 30 of the current year are

presented as follows.

Cash $ 950,000

Accounts receivable (net) 1,675,000

Inventories 2,806,000

Total current assets $5,431,000

Accounts payable $1,004,000

Accrued liabilities 785,000

Total current liabilities $1,789,000

The board of directors of Landau Corporation met on October 4 of the current year and declared the regular quarterly

(c) HOCK international, page 35

Part 2 : 11/10/17 09:52:04

cash dividend amounting to $750,000 ($0.60 per share). The dividend is payable on October 25 of the current year to

all shareholders of record as of October 12 of the current year.

Assume that the only transactions to affect Landau Corporation during October of the current year are the dividend

transactions and that the closing entries have been made.

Landau Corporation's current ratio was

A. Decreased by the dividend declaration and increased by the dividend payment.

B. Unchanged by either the dividend declaration or the dividend payment.

C. Decreased by the dividend declaration and unchanged by the dividend payment.

D. Increased by the dividend declaration and unchanged by the dividend payment.

Question 101 - ICMA 10.P2.029 - Ratios: Liquidity, Leverage, Coverage and Activity

The owner of a chain of grocery stores has bought a large supply of mangoes and paid for the fruit with cash. This

purchase will adversely impact which one of the following?

A. Price earnings ratio.

B. Working capital.

C. Quick or acid test ratio.

D. Current ratio.

Question 102 - CMA 690 4.14 - Ratios: Liquidity, Leverage, Coverage and Activity

Accounts receivable turnover will normally decrease as a result of

A. A change in credit policy to lengthen the period for cash discounts.

B. The write-off of an uncollectible account (assume the use of the allowance for doubtful accounts method).

C. An increase in cash sales in proportion to credit sales.

D. A significant sales volume decrease near the end of the accounting period.

Question 103 - CMA 1289 P4 Q13 - Ratios: Liquidity, Leverage, Coverage and Activity

Excerpts from the statement of financial position for Landau Corporation as of September 30 of the current year are

presented as follows.

Cash $ 950,000

Accounts receivable (net) 1,675,000

Inventories 2,806,000

Total current assets $5,431,000

Accounts payable $1,004,000

Accrued liabilities 785,000

Total current liabilities $1,789,000

The board of directors of Landau Corporation met on October 4 of the current year and declared the regular quarterly

cash dividend amounting to $750,000 ($0.60 per share). The dividend is payable on October 25 of the current year to

all shareholders of record as of October 12 of the current year.

Assume that the only transactions to affect Landau Corporation during October of the current year are the dividend

(c) HOCK international, page 36

Part 2 : 11/10/17 09:52:04

transactions and that the closing entries have been made.

Landau Corporation's working capital was

A. Decreased by the dividend declaration and increased by the dividend payment.

B. Unchanged by either the dividend declaration or the dividend payment.

C. Unchanged by the dividend declaration and decreased by the dividend payment.

D. Decreased by the dividend declaration and unchanged by the dividend payment.

Question 104 - ICMA 10.P2.043 - Ratios: Liquidity, Leverage, Coverage and Activity

Which one of the following statements concerning the effects of leverage on earnings before interest and taxes (EBIT)

and earnings per share (EPS) is correct?

A. Financial leverage affects both EPS and EBIT, while operating leverage only affects EBIT.

B. If Firm A has a higher degree of operating leverage than Firm B, and Firm A offsets this by using less financial

leverage, then both firms will have the same variability in EBIT.

C. A decrease in the financial leverage of a firm will increase the beta value of the firm.

D. For a firm using debt financing, a decrease in EBIT will result in a proportionally larger decrease in EPS.

Question 105 - ICMA 10.P2.048 - Ratios: Liquidity, Leverage, Coverage and Activity

The following information has been derived from the financial statements of Boutwell Company.

Current assets $640,000

Total assets 990,000

Long-term liabilities 130,000

Current ratio 3.2

The company's debt-to-equity ratio is

A. 0.50 to 1.

B. 0.13 to 1.

C. 0.33 to 1.

D. 0.37 to 1.

(c) HOCK international, page 37

Part 2 : 11/10/17 09:52:04

Question 1 - CIA 593 IV.40 - Ratios: Liquidity, Leverage, Coverage and Activity

A. Both ratios decreased in Year 2 compared to Year 1. See the correct answer for a complete explanation.

B. Both ratios decreased in Year 2 compared to Year 1. See the correct answer for a complete explanation.

C. Both ratios decreased in Year 2 compared to Year 1. See the correct answer for a complete explanation.

D.

In Year 1 the current ratio was 6.0 ($360 ÷ 60) and in Year 2 it was 4.3 ($430 ÷ $100). The current ratio has

therefore decreased.

In Year 1 the quick ratio was 2.67 ($160 ÷ $60) and in Year 2 it was 1.3 ($130 ÷ $100). The quick ratio has also

decreased.

Question 2 - ICMA 10.P2.037 - Ratios: Liquidity, Leverage, Coverage and Activity

A.

Leverage refers to how much debt a company has in its capital structure. Capital structure refers to the way a firm

chooses to finance its business, i.e., what proportion of its total capital (debt and equity) is in debt and what proportion

is in equity.

The most highly leveraged company is the company with the greatest proportion of debt in its capital structure. Cooper

is not the most highly leveraged of the four corporations.

B.

Leverage refers to how much debt a company has in its capital structure. Capital structure refers to the way a firm

chooses to finance its business, i.e., what proportion of its total capital (debt and equity) is in debt and what proportion

is in equity.

The most highly leveraged company is the company with the greatest proportion of debt in its capital structure. Pane is

not the most highly leveraged of the four corporations.

C.

Leverage refers to how much debt a company has in its capital structure. Capital structure refers to the way a

firm chooses to finance its business, i.e., what proportion of its total capital (debt and equity) is in debt and

what proportion is in equity.

The most highly leveraged company is the company with the greatest proportion of debt in its capital

structure. Looking at the percentages of long-term debt for the four companies, we see that Sterling has 40%

of its capital structure in debt, Cooper has 35%, Warwick has 30%, and Pane also has 30%. Based on that,

Sterling is the most highly leveraged corporation.

Leverage can also include short-term debt, because short-term debt is also used to fund assets. Whether

short-term debt is included or not really depends on the facts given. Here, the percentages of short-term debt

have been included in the calculation of 100% of the firms' capital structures, so it would be best to include

short-term debt in the calculation of debt in the capital structure. When we sum the short-term and long-term

debt for each company, we see that Sterling has 50% debt, Cooper has 45% debt, Warwick has 45% debt, and

Pane has 40% debt. Using both short-term and long-term debt, Sterling is again the most highly leveraged of

the four corporations.

(c) HOCK international, page 38

Part 2 : 11/10/17 09:52:04

D.

Leverage refers to how much debt a company has in its capital structure. Capital structure refers to the way a firm

chooses to finance its business, i.e., what proportion of its total capital (debt and equity) is in debt and what proportion

is in equity.

The most highly leveraged company is the company with the greatest proportion of debt in its capital structure.

Warwick is not the most highly leveraged of the four corporations.

Question 3 - ICMA 10.P2.035 - Ratios: Liquidity, Leverage, Coverage and Activity

A. The quick or acid test ratio is Cash + Marketable Securities + Accounts Receivable divided by Current Liabilities.

This answer results from including Inventory in the numerator.

B. The quick or acid test ratio is Cash + Marketable Securities + Accounts Receivable divided by Current Liabilities.

This answer results from including Prepaid Expenses and Inventory in the numerator.

C. The quick or acid test ratio is Cash + Marketable Securities + Accounts Receivable divided by Current

Liabilities. The numerator of the ratio is Cash ($10,000) + Accounts Receivable ($20,000) + Available-for-sale

Securities ($12,000 at fair value), for a total of $42,000. The denominator is Accounts Payable ($15,000) + Notes

payable due in 90 days ($25,000), for a total of $40,000. $42,000 ÷ $40,000 = 1.05.

D. The quick or acid test ratio is Cash + Marketable Securities + Accounts Receivable divided by Current Liabilities.

This answer results from including Available-for-sale Securities in the numerator at cost instead of at fair value, and

also including Prepaid Expenses and Inventory in the numerator.

Question 4 - CMA 692 1.9 - Ratios: Liquidity, Leverage, Coverage and Activity

A.

This is not the correct answer. Please see the correct answer for an explanation.

We have been unable to determine how to calculate this incorrect answer choice. If you have calculated it, please let

us know how you did it so we can create a full explanation of why this answer choice is incorrect. Please send us an

email at support@hockinternational.com. Include the full Question ID number and the actual incorrect answer choice --

not its letter, because that can change with every study session created. The Question ID number appears in the upper

right corner of the ExamSuccess screen. Thank you in advance for helping us to make your HOCK study materials

better.

B. Degree of financial leverage can be calculated as % Change in Net Income ÷ % Change in Operating Profit

(EBIT). When only one year of financial results is available, it can also be calculated as EBIT ÷ (EBIT −

Interest). When there is preferred stock, the second formula is modified as given in the problem: EBIT ÷ (EBIT

− I − [P / (1 − T)])

Earnings before interest and taxes equal $36,000 [$400,000 sales − ($0.84 x 400,000 units) VC − $28,000 FC].

Using the formula given in the problem, the calculation is as follows:

DFL = $36,000 ÷ [$36,000 − $6,000 − ($2,000 ÷ 0.6)]

= $36,000 ÷ $26,667

(c) HOCK international, page 39

Part 2 : 11/10/17 09:52:04

= 1.35

C. This is the degree of total leverage.

D. This is the degree of operating leverage, not financial leverage.

Question 5 - ICMA 10.P2.040 - Ratios: Liquidity, Leverage, Coverage and Activity

A. The Degree of Financial Leverage is the factor by which net income changes when related to a change in

earnings before interest and tax, since interest on debt is a fixed expense. If a company has a high degree of

financial leverage, it has a high amount of debt in its capital structure and thus would also have a high ratio of

debt to equity.

B.