Professional Documents

Culture Documents

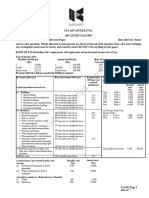

New Capital Alloweances Rates Effective 25th April 2020

Uploaded by

BENSON NGARI0 ratings0% found this document useful (0 votes)

4 views1 pageThe document outlines new capital allowances rates in Kenya effective April 25, 2020. It provides the capital allowance component, exclusions from allowances, and rates for the first and subsequent years. Key allowances include: Investment Deduction at 50% for the first year and 25% annually reducing balance thereafter; Industrial Building Deductions at 10% each year; and Wear and Tear Allowance ranging from 10-25% annually reducing balance depending on the class of asset.

Original Description:

Original Title

New Capital Alloweances Rates Effective 25th April 2020 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines new capital allowances rates in Kenya effective April 25, 2020. It provides the capital allowance component, exclusions from allowances, and rates for the first and subsequent years. Key allowances include: Investment Deduction at 50% for the first year and 25% annually reducing balance thereafter; Industrial Building Deductions at 10% each year; and Wear and Tear Allowance ranging from 10-25% annually reducing balance depending on the class of asset.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageNew Capital Alloweances Rates Effective 25th April 2020

Uploaded by

BENSON NGARIThe document outlines new capital allowances rates in Kenya effective April 25, 2020. It provides the capital allowance component, exclusions from allowances, and rates for the first and subsequent years. Key allowances include: Investment Deduction at 50% for the first year and 25% annually reducing balance thereafter; Industrial Building Deductions at 10% each year; and Wear and Tear Allowance ranging from 10-25% annually reducing balance depending on the class of asset.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

NEW CAPITAL ALLOWEANCES RATES EFFECTIVE 25th APRIL 2020

By MR. P KAMURE

CAPITAL COMPONENTS AND RATES

ALLOWANCE EXCLUSIONS 1 YEAR (from FROM 2nd YEAR

st

25th April 2020)

Investment Deduction • This include items

(ID), Farm work previously granted

Deduction (FWD), these capital

Mining Allowance allowances 50% 25% P.a Reducing

(MA), Shipping • Aircrafts are new balance

Investment Deduction additions

(SID) and Aircrafts

Others-Hotels,

Hospitals and its

Equipment

• This include Shops,

Industrial Building Offices, showrooms 10% 10% p.a Reducing

Deductions (IBD) and others balance

previously granted

Others-Hostels and IBD

Education Buildings • This exclude factory

buildings which is

purely ID now

• Class 1,2 and 3 25% p.a Reducing

balance

• This Include

software 25%

• Saloon cars and

SUV’s New limit is 3

Wear And Tear Million

Allowance (WTA) • This exclude

aircrafts and Ships

• Class 4 10% 10% p.a Reducing

• Telecommunication balance

Equipment

You might also like

- Project Finance Solar PV ModelDocument81 pagesProject Finance Solar PV ModelSaurabh SharmaNo ratings yet

- PROJECT EXECUTION PLAN - DISTRICT COOLING FOR RIHAN HEIGHTS - Part BDocument7 pagesPROJECT EXECUTION PLAN - DISTRICT COOLING FOR RIHAN HEIGHTS - Part Bjamsheer.aaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- KPMG Analysis of The Finance Act 2021 - FinalDocument47 pagesKPMG Analysis of The Finance Act 2021 - FinalNirvan MaudhooNo ratings yet

- Beyond Crisis: The Financial Performance of India's Power SectorFrom EverandBeyond Crisis: The Financial Performance of India's Power SectorNo ratings yet

- Williams 2002: - A Case On Financial DistressDocument18 pagesWilliams 2002: - A Case On Financial DistressGmitNo ratings yet

- GCEMP 2021 PPT Participants Part2Document40 pagesGCEMP 2021 PPT Participants Part2Deepu Mannatil50% (2)

- Chapter 6 Capital AllowanceDocument59 pagesChapter 6 Capital AllowanceKailing KhowNo ratings yet

- Updates On Global Credit Exposure Policy 2020 - KEDAR KULKARNIDocument11 pagesUpdates On Global Credit Exposure Policy 2020 - KEDAR KULKARNIShilpa JhaNo ratings yet

- Provision For DepreciationDocument11 pagesProvision For Depreciationdpak bhusalNo ratings yet

- Chapter 6 Capital Allowance Industrial Building AllowanceDocument57 pagesChapter 6 Capital Allowance Industrial Building AllowancePatricia TangNo ratings yet

- Chapter 6 - Profits and Gains From Business or Profession - NotesDocument66 pagesChapter 6 - Profits and Gains From Business or Profession - NotesMuskan Jha100% (1)

- Global Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Document9 pagesGlobal Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Rajkot academyNo ratings yet

- Merak Fiscal Model Library: Colombia Association (2002)Document2 pagesMerak Fiscal Model Library: Colombia Association (2002)Libya TripoliNo ratings yet

- Chapter 6 Capital Allowance A231Document55 pagesChapter 6 Capital Allowance A231Patricia TangNo ratings yet

- A Case On Toll Road Project: Author: Dr. Pradeep Kumar GuptaDocument2 pagesA Case On Toll Road Project: Author: Dr. Pradeep Kumar GuptaNANDINI GUPTANo ratings yet

- The Ground Realty Is ShakyDocument37 pagesThe Ground Realty Is Shakyb15028No ratings yet

- 3.5 Published - Fitch China Oilfield Services LimitedDocument16 pages3.5 Published - Fitch China Oilfield Services LimitedAsim khanNo ratings yet

- Trade Finance StrategyDocument11 pagesTrade Finance Strategysuvarna27No ratings yet

- Depreciation Accounting & Methods: Dr. Pallavi IngaleDocument37 pagesDepreciation Accounting & Methods: Dr. Pallavi IngalePallavi IngaleNo ratings yet

- Ace Designers Limited: Summary of Rated InstrumentsDocument7 pagesAce Designers Limited: Summary of Rated InstrumentskachadaNo ratings yet

- MSL Driveline Systems - R - 16102020Document8 pagesMSL Driveline Systems - R - 16102020DarshanNo ratings yet

- Package Scheme IncentivesDocument29 pagesPackage Scheme IncentivesAshish JhagarawatNo ratings yet

- Tata Motors Investor Presentation Q2 FY24 1Document49 pagesTata Motors Investor Presentation Q2 FY24 1NagendranNo ratings yet

- BUDGET PROPOSALS - 2020-21.: Streamlining The Tax Structure On Pakistan Steel Line Pipe IndustryDocument4 pagesBUDGET PROPOSALS - 2020-21.: Streamlining The Tax Structure On Pakistan Steel Line Pipe Industrypspa pakNo ratings yet

- Capital Budgeting PPT 2Document32 pagesCapital Budgeting PPT 2Gupta AashiyaNo ratings yet

- BD Finance Act 2022 Key SummariesDocument29 pagesBD Finance Act 2022 Key SummariesMd SelimNo ratings yet

- PGBP (Contd.)Document45 pagesPGBP (Contd.)Aarti SainiNo ratings yet

- PST AT 2015 2023Document110 pagesPST AT 2015 2023nataliecheung324No ratings yet

- GM 2020 Q2 Earnings Presentation 7.29.20 VFDocument27 pagesGM 2020 Q2 Earnings Presentation 7.29.20 VFMeng KeNo ratings yet

- Full Service Carriers - Adapting To The New Environment: Wolfgang Prock-Schauer CEO, Jet Airways (India) LTDDocument20 pagesFull Service Carriers - Adapting To The New Environment: Wolfgang Prock-Schauer CEO, Jet Airways (India) LTDLokesh DuttNo ratings yet

- PWC - Budget - 2020 - Analysis - 20 FebDocument35 pagesPWC - Budget - 2020 - Analysis - 20 FebGaury DattNo ratings yet

- CA Inter PGBP Nov. 2020 PDFDocument27 pagesCA Inter PGBP Nov. 2020 PDFAmar SharmaNo ratings yet

- Business Plan Supervised by College of HDocument82 pagesBusiness Plan Supervised by College of HkevoroyalprinzNo ratings yet

- Wayne Shaw - SMU 11 18wDocument47 pagesWayne Shaw - SMU 11 18wMichael MyintNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- Schedule of Withholding TaxDocument2 pagesSchedule of Withholding TaxLance MontealtoNo ratings yet

- West Coast Paper Mills LTDDocument6 pagesWest Coast Paper Mills LTDRavi KNo ratings yet

- The Income Tax Act PDFDocument15 pagesThe Income Tax Act PDFvuv2bav6No ratings yet

- Budget PresDocument31 pagesBudget Presapi-347075670No ratings yet

- Salient Features of Income Tax Act 2023Document79 pagesSalient Features of Income Tax Act 2023Md. Abdullah Al ImranNo ratings yet

- Capital AllowanceDocument9 pagesCapital AllowanceAlfred MphandeNo ratings yet

- DT A MTP 1 Final May22Document14 pagesDT A MTP 1 Final May22Kanchana SubbaramNo ratings yet

- Merak Fiscal Model Library: Algeria R/T (2005)Document3 pagesMerak Fiscal Model Library: Algeria R/T (2005)Libya TripoliNo ratings yet

- Budget Tax Card Master 2007 FinalDocument2 pagesBudget Tax Card Master 2007 FinalcmutoniNo ratings yet

- ECO PPT Team 6Document10 pagesECO PPT Team 6Darshan Changole PCMNo ratings yet

- PPAs (Bbpf2) 2024 - CoralDocument4 pagesPPAs (Bbpf2) 2024 - CoralRenante AgustinNo ratings yet

- BYD Company LimitedDocument17 pagesBYD Company LimitedVasuNo ratings yet

- Loyal Textile Mills Financial ReportDocument5 pagesLoyal Textile Mills Financial Reportsaikiran reddyNo ratings yet

- Rev Syllabus RAEDocument14 pagesRev Syllabus RAEsmarttalksaurabhNo ratings yet

- Consulate General of India New York Highlights of Foreign Trade Policy 2009-14 GeneralDocument7 pagesConsulate General of India New York Highlights of Foreign Trade Policy 2009-14 Generalbhavna88No ratings yet

- Direct TAX: & International TaxationDocument531 pagesDirect TAX: & International Taxationavinashkives21No ratings yet

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDocument2 pagesInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDeepak Singh PundirNo ratings yet

- Industrial Park at Moran: Under Msme CDP SchemeDocument15 pagesIndustrial Park at Moran: Under Msme CDP SchemeBiswajit ChakrabartyNo ratings yet

- INCOME FROM BUSINESS OR PROFESSIONcrDocument22 pagesINCOME FROM BUSINESS OR PROFESSIONcrAshrafNo ratings yet

- Accounts of Public UtilitiesDocument31 pagesAccounts of Public Utilitiessumit pathakNo ratings yet

- Capital A LlowancesZimbabwe Revenue AuthorityDocument2 pagesCapital A LlowancesZimbabwe Revenue AuthorityRobinson ChinyerereNo ratings yet

- Tata-Motors-Group-Investor-Presentation-Q3 FY23Document51 pagesTata-Motors-Group-Investor-Presentation-Q3 FY23Sai Biplab BeheraNo ratings yet

- FD Bonds Interest RatesDocument5 pagesFD Bonds Interest RatesshivarachappaNo ratings yet

- Financial Model PRGFEE - 30-June-2015Document71 pagesFinancial Model PRGFEE - 30-June-2015AbhishekNo ratings yet

- August 2023 CBE TimetableDocument14 pagesAugust 2023 CBE TimetableBENSON NGARINo ratings yet

- Department of Botany: Providence College For WomenDocument1 pageDepartment of Botany: Providence College For WomenBENSON NGARINo ratings yet

- 5 6282766430756667711Document1 page5 6282766430756667711BENSON NGARINo ratings yet

- Soil 25 MocksDocument6 pagesSoil 25 MocksBENSON NGARINo ratings yet

- PHD Thesis (F/M) Offer: 36 Month From 01/09/2022, Funded by Icpar/Cefipra (Campus France) 1,500 Net Salary/MonthDocument1 pagePHD Thesis (F/M) Offer: 36 Month From 01/09/2022, Funded by Icpar/Cefipra (Campus France) 1,500 Net Salary/MonthBENSON NGARINo ratings yet

- 2021 CBIO Janssen Postdoctoral PositionDocument2 pages2021 CBIO Janssen Postdoctoral PositionBENSON NGARINo ratings yet

- Topic 9-10 Data Communication and Computer NetworksDocument12 pagesTopic 9-10 Data Communication and Computer NetworksBENSON NGARI100% (1)

- 5 6262340300736299622Document1 page5 6262340300736299622BENSON NGARINo ratings yet

- Company Law May 2017Document2 pagesCompany Law May 2017BENSON NGARINo ratings yet

- AD23 Business Mathematics and StatisticsDocument3 pagesAD23 Business Mathematics and StatisticsBENSON NGARINo ratings yet

- Vaccine Development Process': International WebinarDocument1 pageVaccine Development Process': International WebinarBENSON NGARINo ratings yet

- Jobs 788 Combine Advt July 2021Document3 pagesJobs 788 Combine Advt July 2021BENSON NGARINo ratings yet