Professional Documents

Culture Documents

3 Risk Based Process

3 Risk Based Process

Uploaded by

Irish SanchezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 Risk Based Process

3 Risk Based Process

Uploaded by

Irish SanchezCopyright:

Available Formats

Excel Professional Services, Inc.

Management Firm of Professional Review and Training Center (PRTC)

(LUZON) Manila 87339344 * Calamba City, Laguna * Dasmariñas City, Cavite * Lipa City,

Batangas (0917) 8852769 * (VISAYAS) Bacolod City (034) 4346214 * Cebu City (032)

2537900 loc. 218 (MINDANAO) Cagayan De Oro (0917) 7081465 * Davao City (082) 2250049

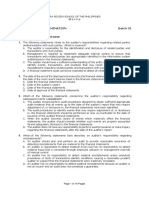

AUDITING THEORY

AT.3003 – Risk-based Financial R.C.P. SOLIMAN/ K.J. UY Statements Audit, Responsibilities &

Objectives MAY 2021

Reference:

a. PSA 200 (Revised and Redrafted), Overall Objectives of the Independent Auditor and the Conduct of an Audit in

Accordance with Philippine Standards on Auditing

DISCUSSION QUESTIONS

a. Identifying areas posing the highest risk of

Risk-based Financial Statements Audit financial statement errors.

b. Analysis of internal control.

1. The purpose of an audit is to enhance the degree of c. Collecting and evaluating evidence.

confidence of intended users in the financial d. Concentrating audit resources in those areas

statements. presenting the highest risk of financial statement

errors.

The financial statements subject to audit are those of

the entity, prepared and presented by management The Financial Statements and The Management’s

of the entity with oversight from those charged with Responsibilities

governance.

a. True, False 5. An audit is conducted on the premise that

b. False, True management and, where appropriate, those charged

c. True, True with governance, have acknowledged and understand

d. False, False that they have responsibilities that are fundamental

to the conduct of an audit in accordance with PSAs.

2. Which of the following statements about theoretical Which of the following is not one of those

framework of auditing is(are) incorrect? I. The data responsibilities?

to be audited can be verified a. To provide the auditor unrestricted access to

II. Long-term conflicts may exist between managers persons within the entity from which the auditor

who prepare the data and auditors who examine determines it necessary to obtain audit evidence.

the data b. The preparation and presentation of financial

III. Auditors act on behalf of management statements in accordance with the

IV. An audit benefits the public pronouncements issued by AASC.

a. II and III only c. II only c. The establishment and maintenance of internal

control relevant to the preparation and

b. II, III and IV only d. III only

presentation of financial statements that are free

from material misstatement, whether due to fraud

3. Which of the following procedures is not one of the

or error.

features of a risk-based audit process in accordance

d. To provide complete information to the auditor.

with PSAs?

a. Identify and assess risks of material

Overall Objectives of the Auditor

misstatement, whether due to fraud or error,

based on an understanding of the entity and its

environment, including the entity’s internal 6. Which of the following statements is false?

control. a. In an audit of financial statements, being an

b. Obtain sufficient appropriate audit evidence about assurance engagement, the auditor is engaged

whether material misstatements exist, through for purposes of expressing an opinion designed to

designing and implementing appropriate enhance the degree of confidence of intended

responses to the assessed risks. users in the financial statements.

c. Subject all available evidence related to entity’s b. The overall objective of the independent auditor is

financial statements to testing to get reasonable to obtain reasonable assurance about whether the

assurance that the financial statements are free financial statements as a whole are free from

from material misstatements. material misstatement, whether due to fraud or

d. Form an opinion on the financial statements error, and to report on the financial statements in

based on conclusions drawn from the audit accordance with the auditor’s findings.

evidence obtained. c. In order to obtain reasonable assurance, the

auditor shall obtain sufficient appropriate audit

evidence to be able to draw reasonable

4. Which of the following is not a distinguishing feature

conclusions on which to base the audit opinion.

of risk-based auditing?

Reasonable assurance is obtained when the

Page 1 of 4 www.teamprtc.com.ph AT.3003

EXCEL PROFESSIONAL SERVICES, INC.

auditor has thereby reduced audit risk to an c. The auditor shall not represent compliance with

acceptably high level. PSAs unless the auditor has complied with all of

d. The objective of an audit cannot be fulfilled unless the PSAs relevant to the audit.

the auditor achieves the overall objective of the d. The auditor would ordinarily expect to find

auditor. In all cases when the overall objective of evidence to support management representations

the auditor cannot be achieved, the PSAs require and assume they are necessarily correct.

that the auditor modifies the auditor’s opinion

accordingly or withdraws from the engagement. 12. The following are the general principles governing an

audit of FS Audit, except

7. The concept of reasonable assurance indicates that a. Independence c. Confidentiality

the auditor is: b. Professionalism d. Professional behavior

a. not an insurer of the correctness of the financial

statements. Professional Skepticism and Professional Judgment

b. not responsible for the fairness of the financial

statements. 13. The auditor shall plan and perform an audit with an

c. responsible only for issuing an opinion on the attitude of professional skepticism recognizing that

financial statements. circumstances may exist that cause the financial

d. responsible for finding all misstatements. statements to be materially misstated.

The Auditor’s Opinion The auditor shall exercise professional judgment in

planning and performing the audit in accordance with

8. The auditor’s opinion PSAs.

a. Guarantees the credibility of the financial a. True, True c. False, True

statements. b. False, False d. True, False

b. Is an assurance as to the future viability of the

entity. 14. Which of the following is least likely an application of

c. Is not an assurance as to the efficiency with maintaining an attitude of professional skepticism?

which management has conducted the affairs of a. The auditor does not consider representations

the entity. from management as substitute for obtaining

d. Certifies the correctness of the financial sufficient and appropriate audit evidence to be

statements. able to draw reasonable conclusions on which to

base the audit opinion.

b. The auditor is alert to audit evidence that

9. When an auditor issues a qualified opinion, the

contradicts or brings into question the reliability

implication is that the auditor

of documents or management representations.

a. Does not know if the financial statements are

c. The auditor makes a critical assessment, with a

presented fairly.

questioning mind, of the validity of audit evidence

b. Does not believe the financial statements are

d. In planning and performing an audit, the auditor

fairly presented.

assumes that management is dishonest.

c. Is satisfied that the financial statements are

presented fairly except for a specific aspect of

them. Materiality

d. Is satisfied that the financial statements are

presented fairly. 15. Financial reporting frameworks often discuss the

concept of materiality in the context of the

preparation and presentation of financial statements.

10. When an auditor issues an adverse opinion, the

Although financial reporting frameworks may discuss

implication is that the auditor

materiality in different terms, they generally explain

a. Does not know if the financial statements are

that

presented fairly.

a. Misstatements, including omissions, are

b. Does not believe the financial statements are

considered to be material if they, individually or in

fairly presented.

the aggregate, could reasonably be expected to

c. Is satisfied that the financial statements are influence the economic decisions of users taken

presented fairly except for a specific aspect of

on the basis of the financial statements.

them.

b. Judgments about materiality are made in the light

d. Is satisfied that the financial statements are

of surrounding circumstances and are affected by

presented fairly. the size or nature of a misstatement, or a

combination of both.

Conduct of an Audit of Financial Statements c. Judgments about matters that are material to

users of the financial statements are based on a

Ethical Requirements consideration of the common financial information

needs of users as a group. The possible effect of

11. Which of the following is incorrect regarding the misstatements on specific individual users, whose

general principles of an audit? needs may vary widely, is not considered.

a. The auditor should comply with the “Code of d. All of the above

Ethics for Professional Accountants in the

Philippines.” 16. Materiality is:

b. The auditor should conduct an audit in accordance a. Expressed only in terms of pesos

with PSAs. b. Measured using guidelines established by PICPA

c. Not applicable to assurance engagements

d. Addressed within a practitioner’s audit and other

Page 2 of 4 www.teamprtc.com.ph AT.3003

EXCEL PROFESSIONAL SERVICES, INC.

assurance reports corrected on a timely basis by the accounting and

internal control systems.

Sufficient Appropriate Audit Evidence c. The risk that an auditor's substantive procedures

will not detect a misstatement that exists in an

17. Two overriding considerations affect the many ways account balance or class of transactions that

an auditor can accumulate evidence: could be material, individually or when

I. Sufficient appropriate evidence must be aggregated with misstatements in other balances

accumulated to meet the auditor’s professional or classes.

responsibility. d. The susceptibility of an account balance or class

II. Cost of accumulating evidence should be of transactions to misstatement that could be

minimized. material, individually or when aggregated with

misstatements in other balances of classes,

In evaluating these considerations: assuming that there were no related internal

controls.

a. the first is more important than the second.

b. the second is more important than the first.

22. Inherent risk and control risk differ from detection

c. they are equally important.

risk in that inherent risk and control risk

d. it is impossible to prioritize them.

a. arise from the misapplication of auditing

procedures

Audit Risk

b. may be assessed in either quantitative or

nonquantitative terms

18. The existence of audit risk is recognized by the c. exist independently of the financial statement

statement in the standard auditor’s report that the audit

a. The auditor is responsible for expressing an d. can be changed at the auditor’s discretion

opinion on the financial statements, which are the

responsibility of management.

23. Which of the following is an incorrect statement?

b. Financial statements are presented fairly, in all

a. Detection risk cannot be changed at the auditor’s

material respects, in conformity with GAAP.

discretion

c. Audit includes examining, on a test basis,

b. Detection risk bears an inverse relationship to

evidence supporting the amounts and disclosures

inherent and control risks

in the financial statements.

c. The greater the inherent and control risks the

d. Auditor obtains reasonable assurance about

auditor believes exists, the less detection risk that

whether the financial statements are free of

can be accepted

material misstatement.

d. The auditor might make separate or combined

assessments of inherent risk and control risk

19. Risk of material misstatement is

a. The risk that the auditor might express an opinion

24. In implementing the audit risk model, which of the

that the financial statements are materially

following is not a limitation of the model that makes

misstated when they are not.

its implementation difficult?

b. The likelihood that the financial statements are

a. Inherent risk is difficult to formally assess.

materiality misstated prior to the audit.

b. Audit risk is objectively determined.

c. Both a and b.

c. The model treats each risk component as

d. Neither a nor b.

separate and independent.

d. Audit technology is not precisely developed in

20. What are the two elements of the risk of material

assessing each component.

misstatement at the assertion level? a. Inherent risk

and detection risk

b. Audit risk and detection risk 25. Which of the following statements does not properly

describe a limitation of an audit?

c. Inherent risk and control risk

a. Some evidence supporting peso representations

d. Detection risk and control risk

in the financial statements must be obtained by

oral or written representation of management.

DO-IT-YOURSELF (DIY) DRILL

21. Detection risk is b. Human weakness, such as fatigue and

a. The risk that the auditor gives an inappropriate carelessness, can cause auditors to overlook

audit opinion when the financial statements are pertinent evidence or cause them to make the

materially misstated. wrong conclusions.

b. The risk that a misstatement, that could occur in c. Judgment is used throughout

an account balance or class of transactions and the audit engagement.

that could be material individually or when d. Many audit conclusions are made on the basis of

aggregated with misstatements in other balances examining all available evidence.

or classes, will not be prevented or detected and

- now do the DIY drill –

The independent auditor’s opinion is an assurance as

1. The objective of the ordinary examination of financial to the future viability of the entity.

statements is the expression of an opinion on the a. The first statement is false, the second statement

accuracy of such financial statements. is true

Page 3 of 4 www.teamprtc.com.ph AT.3003

EXCEL PROFESSIONAL SERVICES, INC.

b. The first statement is true, the second statement d. Qualified, disclaimer, or adverse

is true

c. The first statement is false, the second statement

is false 8. Which of the following criteria is unique to the

d. The first statement is true, the second statement independent auditor's attest function? a. General

is false competence.

b. Familiarity with the particular industry of each

2. Users of the audit report can reasonably expect the client.

audited financial statements to c. Due professional care.

a. Include complete information and contain all d. Independence.

financial disclosures

b. Be presented fairly according to the substance of 9. Which of the following best describes an auditor’s

GAAP professional skepticism?

c. Be Free from all errors a. Auditors must remember that they will be

d. All of the above responsible for the financial statements once they

are audited.

3. Why does a company choose to have an independent b. Auditors should treat all management

auditor report on its financial statements? representations with suspicion until they are

a. Independent auditor will always detect proven.

management fraud c. Auditors should make a critical assessment, with

b. The company’s management preparing the an inquisitive mind, of the sufficiency and

financial statements may have a vested interest appropriateness of audit evidence obtained.

in reporting certain results. d. Auditors should expect that there will be material

c. Independent auditors guarantee the accuracy of misstatements in the financial records being

the financial statements audited.

d. An independent audit is designed to search for

deficiencies in the company’s internal control 10. Which of the following elements of the audit risk

model is most likely to be the same across a range of

4. Which of the following is not one of the basic audits performed by a professional accounting firm?

assumptions of financial statements audit? a. Data is a. Audit risk c. Detection risk

auditable b. Control risk d. Inherent risk

b. No long-term conflict between the auditor and the

management - end of AT.3003 -

c. Effective internal control system does not reduce

risk of material misstatement of the financial

statements

d. An audit benefits the public

5. The responsibility for the preparation of the financial

statements and the accompanying footnotes belongs

to:

a. the auditor.

b. management.

c. both management and the auditor equally.

d. management for the statements and the auditor

for the notes.

6. Which of the following statements is correct

concerning an auditor’s responsibilities regarding

financial statements?

a. An auditor’s responsibilities for audited FSs are

not confined to the expression of the auditor’s

opinion.

b. Making suggestions that are adopted about the

form and content of an entity’s financial

statements impairs an auditor’s independence.

c. The fair presentation of audited financial

statements in conformity with GAAP is an implicit

part of the auditor’s responsibilities.

d. An auditor may draft an entity’s FSs based

information from management’s accounting

system.

7. When an auditor encounters a material GAAP

departure that is unresolved at the conclusion of the

audit, which of the following opinions are possible? a.

Qualified or adverse

b. Unqualified or qualified

c. Only adverse is possible

Page 4 of 4 www.teamprtc.com.ph AT.3003

You might also like

- Items 1Document7 pagesItems 1RYANNo ratings yet

- AT.2816 - Completing The Audit PDFDocument7 pagesAT.2816 - Completing The Audit PDFMae100% (1)

- Sushilog Ac503Document251 pagesSushilog Ac503SadAccountant100% (1)

- Pizza Bomb Feasib CompiledDocument235 pagesPizza Bomb Feasib CompiledSadAccountant100% (3)

- Lbc-110-Internal Audit Manual For Local Government Units (2016)Document160 pagesLbc-110-Internal Audit Manual For Local Government Units (2016)Ryan Socorro Dy100% (2)

- Cash and Cash Equivalents - MidtermDocument9 pagesCash and Cash Equivalents - MidtermDan RyanNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument6 pagesExcel Professional Services, Inc.: Discussion QuestionskæsiiiNo ratings yet

- At.3004-Nature and Type of Audit EvidenceDocument6 pagesAt.3004-Nature and Type of Audit EvidenceSadAccountantNo ratings yet

- At.3213 - Application of Audit Process To Transaction Cycles Part 1Document9 pagesAt.3213 - Application of Audit Process To Transaction Cycles Part 1Denny June CraususNo ratings yet

- Auditing Problems Test Banks - LIABILITIES Part 2Document6 pagesAuditing Problems Test Banks - LIABILITIES Part 2Alliah Mae ArbastoNo ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- 3 4Document5 pages3 4RenNo ratings yet

- Answer Key: Audit Planning, Understanding The Client, Assessing Risks, and RespondingDocument15 pagesAnswer Key: Audit Planning, Understanding The Client, Assessing Risks, and RespondingRizza OmalinNo ratings yet

- AP.2906 InvestmentsDocument6 pagesAP.2906 InvestmentsmoNo ratings yet

- Test Bank - NFJPIA - UP Diliman - Auditing Theory QuestionsDocument14 pagesTest Bank - NFJPIA - UP Diliman - Auditing Theory QuestionsMarkie Grabillo100% (1)

- Excel Professional Services, Inc.: Discussion QuestionsDocument5 pagesExcel Professional Services, Inc.: Discussion QuestionsSadAccountantNo ratings yet

- PRTC First Answer Key PDFDocument48 pagesPRTC First Answer Key PDFnanabaNo ratings yet

- Audit of Revenue Cycle Questions and AnswersDocument3 pagesAudit of Revenue Cycle Questions and AnswersstoneNo ratings yet

- Auditing and Assurance Concepts and Applications 2Document6 pagesAuditing and Assurance Concepts and Applications 2mhadzmp100% (1)

- Cebu Cpar Center: Auditing Problems Audit of Inventories Problem No. 1Document10 pagesCebu Cpar Center: Auditing Problems Audit of Inventories Problem No. 1PaupauNo ratings yet

- Fourth Year - Bsa: University of Makati Set BDocument11 pagesFourth Year - Bsa: University of Makati Set BYedam BangNo ratings yet

- Auditing Theory PRTC PDFDocument35 pagesAuditing Theory PRTC PDFArah OpalecNo ratings yet

- PRTC AUD 1stPB - 10.21Document15 pagesPRTC AUD 1stPB - 10.21Luna VNo ratings yet

- AP03 Audit of Inventories QDocument6 pagesAP03 Audit of Inventories Qbobo kaNo ratings yet

- At.3001 Assurance Engagements Other Services of A PractitionerDocument4 pagesAt.3001 Assurance Engagements Other Services of A PractitionerSadAccountantNo ratings yet

- Midterm Examination - AUDITING REVIEWDocument7 pagesMidterm Examination - AUDITING REVIEWFrancis MateosNo ratings yet

- Chapter 14Document32 pagesChapter 14faye anneNo ratings yet

- QUIZ 2 Airline IndustryDocument4 pagesQUIZ 2 Airline IndustrySia DLSLNo ratings yet

- Unit Xii Copleting The Audit Audit Reports Other ServicesDocument66 pagesUnit Xii Copleting The Audit Audit Reports Other ServicesDieter LudwigNo ratings yet

- At Reviewer Part II - (May 2015 Batch)Document22 pagesAt Reviewer Part II - (May 2015 Batch)Jake BundokNo ratings yet

- Multiple Choice Questions: Finance and Investment CycleDocument19 pagesMultiple Choice Questions: Finance and Investment Cyclemacmac29No ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- AT.2813 - Determining The Extent of Testing PDFDocument7 pagesAT.2813 - Determining The Extent of Testing PDFMaeNo ratings yet

- Practice Questions For Audit TheoryDocument4 pagesPractice Questions For Audit TheoryHanna Lyn BaliscoNo ratings yet

- FINALS - Auditing TheoryDocument8 pagesFINALS - Auditing TheoryAngela ViernesNo ratings yet

- Department of Accountancy: Page - 1Document47 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- Ap2904 Cash and Cash EquivalentsDocument8 pagesAp2904 Cash and Cash EquivalentsMa Yra YmataNo ratings yet

- Auditing Multiple ChoicesDocument8 pagesAuditing Multiple ChoicesyzaNo ratings yet

- Audit of Cash and Cash Equivalents PDFDocument4 pagesAudit of Cash and Cash Equivalents PDFRandyNo ratings yet

- National Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Document14 pagesNational Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Tricia Jen TobiasNo ratings yet

- Auditing Theory Test BanksDocument2 pagesAuditing Theory Test BanksJea Balagtas100% (1)

- Aaconapps2 00-C92pb2aDocument17 pagesAaconapps2 00-C92pb2aJane DizonNo ratings yet

- AUD Final Preboard Examination QuestionnaireDocument16 pagesAUD Final Preboard Examination QuestionnaireJoris YapNo ratings yet

- CHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocument2 pagesCHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNo ratings yet

- Chapter 7: Audit of Intangibles and Other Assets: Internal Control Over IntangiblesDocument28 pagesChapter 7: Audit of Intangibles and Other Assets: Internal Control Over IntangiblesUn knownNo ratings yet

- Quiz On Audit SamplingDocument5 pagesQuiz On Audit SamplingTrisha Mae AlburoNo ratings yet

- PSA 220 Quality Control For Historical Info SummaryDocument6 pagesPSA 220 Quality Control For Historical Info SummaryAbraham ChinNo ratings yet

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- TEST BANK Auditing Tak KerjainDocument15 pagesTEST BANK Auditing Tak Kerjaindian agitaNo ratings yet

- CHAPTER 8 - Audit of Liabilities: Problem 1Document27 pagesCHAPTER 8 - Audit of Liabilities: Problem 1Chinee CastilloNo ratings yet

- 01 - Audit of Cash & Cash EquivalentsDocument4 pages01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesNo ratings yet

- AT2. Quiz - Audit SamplingDocument5 pagesAT2. Quiz - Audit SamplingKathleenNo ratings yet

- Ap 9004-IntangiblesDocument5 pagesAp 9004-IntangiblesSirNo ratings yet

- Auditing Theory - MockDocument10 pagesAuditing Theory - MockCarlo CristobalNo ratings yet

- Business ProcessesDocument30 pagesBusiness ProcessesMarisol AunorNo ratings yet

- Aud Theo Reviewer Chap 3 To 5Document55 pagesAud Theo Reviewer Chap 3 To 5Angelica DuarteNo ratings yet

- AT123Document59 pagesAT123John Rashid Hebaina100% (1)

- FAR B41 Final Pre-Board Exam (Questions, Answers - Solutions)Document14 pagesFAR B41 Final Pre-Board Exam (Questions, Answers - Solutions)Joanna MalubayNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument4 pagesExcel Professional Services, Inc.: Discussion QuestionsMaria Theresa AltaresNo ratings yet

- Jose Rizal University: College Ob Business Administration and AccountancyDocument2 pagesJose Rizal University: College Ob Business Administration and AccountancyLorielyn AgoncilloNo ratings yet

- Jose Rizal University: College Ob Business Administration and AccountancyDocument2 pagesJose Rizal University: College Ob Business Administration and AccountancykmarisseeNo ratings yet

- Auditing ReviewerDocument2 pagesAuditing Reviewerhannah3jane3amadNo ratings yet

- Final Paper November22Document123 pagesFinal Paper November22SadAccountantNo ratings yet

- Prof. Ryan C. Roque, CPA, MBADocument109 pagesProf. Ryan C. Roque, CPA, MBASadAccountantNo ratings yet

- Group 2 Sec 1 Taco LabDocument159 pagesGroup 2 Sec 1 Taco LabSadAccountant100% (1)

- At.3009-Internal Control ConsiderationsDocument9 pagesAt.3009-Internal Control ConsiderationsSadAccountant100% (1)

- At.3008 Understanding The Entity and Its EnvironmentDocument6 pagesAt.3008 Understanding The Entity and Its EnvironmentSadAccountant100% (1)

- At.3006-Planning An Audit of Financial StatementsDocument5 pagesAt.3006-Planning An Audit of Financial StatementsSadAccountantNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument5 pagesExcel Professional Services, Inc.: Discussion QuestionsSadAccountantNo ratings yet

- At.3004-Nature and Type of Audit EvidenceDocument6 pagesAt.3004-Nature and Type of Audit EvidenceSadAccountantNo ratings yet

- Excel Professional Services, Inc.: Discussion QuestionsDocument4 pagesExcel Professional Services, Inc.: Discussion QuestionsSadAccountantNo ratings yet

- CH 1 Nature of StramanDocument17 pagesCH 1 Nature of StramanSadAccountantNo ratings yet

- At.3001 Assurance Engagements Other Services of A PractitionerDocument4 pagesAt.3001 Assurance Engagements Other Services of A PractitionerSadAccountantNo ratings yet

- Internal Audit Method & ProcedureDocument2 pagesInternal Audit Method & ProcedureYang LishengNo ratings yet

- Standards On AuditingDocument69 pagesStandards On AuditingSaba Kazi100% (1)

- Teaching Plan Auditing - PAS2183 - APRIL 2023Document3 pagesTeaching Plan Auditing - PAS2183 - APRIL 2023DIVA RTHININo ratings yet

- Chapter 3Document89 pagesChapter 3Nancy Mohamed Mahmoud AhmedNo ratings yet

- LA Audit-Mozell Pennington Boys Center, Group Home, (Dec 2011)Document14 pagesLA Audit-Mozell Pennington Boys Center, Group Home, (Dec 2011)Rick ThomaNo ratings yet

- Quiz 3 Specialized IndustriesDocument5 pagesQuiz 3 Specialized IndustriesLyca Mae CubangbangNo ratings yet

- Chapter 11Document45 pagesChapter 11MangoStarr Aibelle VegasNo ratings yet

- Materiality Practice QuestionsDocument12 pagesMateriality Practice QuestionsSindhuNo ratings yet

- Daftar List Jurnal (Seminar Audit)Document4 pagesDaftar List Jurnal (Seminar Audit)Citra leriaNo ratings yet

- Audit ProcessDocument21 pagesAudit ProcessCarmelie CumigadNo ratings yet

- Issn: 2338 - 9729Document14 pagesIssn: 2338 - 9729Dita RahayuNo ratings yet

- At Preweek (Final)Document31 pagesAt Preweek (Final)Jane Michelle EmanNo ratings yet

- Pengaruh Standar Audit 570 Terhadap Opini AuditDocument15 pagesPengaruh Standar Audit 570 Terhadap Opini AuditNidia KumalaNo ratings yet

- Stages of The Audit Process Learning ObjDocument14 pagesStages of The Audit Process Learning ObjJanis RutkaNo ratings yet

- MaterialityDocument4 pagesMaterialityEdison HyltonNo ratings yet

- Auditing Notes - Chapter 1 OutlineDocument25 pagesAuditing Notes - Chapter 1 OutlinechaseNo ratings yet

- Unit 6 AUDITORS' REPORTSDocument5 pagesUnit 6 AUDITORS' REPORTSzelalem kebedeNo ratings yet

- The Impact of Internal Audit Function Characteristics On Internal Control Quality2018managerial Auditing JournalDocument20 pagesThe Impact of Internal Audit Function Characteristics On Internal Control Quality2018managerial Auditing JournalMama MamamaNo ratings yet

- Saica Handbook Auditing - CompressDocument8 pagesSaica Handbook Auditing - Compresscykfkkxgs7No ratings yet

- CA Final - Paper 3 - CH - 1 - AUDITING STANDARDSDocument21 pagesCA Final - Paper 3 - CH - 1 - AUDITING STANDARDSLathaNo ratings yet

- Auditing An International Approach 8th Edition Smieliauskas Test BankDocument11 pagesAuditing An International Approach 8th Edition Smieliauskas Test Banktheresagreensayxgiwkod98% (43)

- At 9306Document10 pagesAt 9306Aang GrandeNo ratings yet

- Topic3 Engagement PlanningDocument29 pagesTopic3 Engagement PlanningPRINCESS MENDOZANo ratings yet

- Arens Aas17 PPT 04 PDFDocument30 pagesArens Aas17 PPT 04 PDFSin TungNo ratings yet

- IACM For The Public SectorDocument147 pagesIACM For The Public SectorNur Asyiah100% (2)

- EarthWear Clothier MaterialsDocument1 pageEarthWear Clothier MaterialsZhining LimNo ratings yet

- 02 - Audi.... Chap. 02 - OKDocument48 pages02 - Audi.... Chap. 02 - OKFazila AzharNo ratings yet

- ISA 210 Agreeing The Terms of Audit EngagementsDocument6 pagesISA 210 Agreeing The Terms of Audit EngagementsBilal RazaNo ratings yet

- Trust Dan Tanggung Jawab Auditor Kepada PublikDocument4 pagesTrust Dan Tanggung Jawab Auditor Kepada PublikHena AdyaniNo ratings yet