Professional Documents

Culture Documents

Materiality 01-03-21

Materiality 01-03-21

Uploaded by

mian UmairOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Materiality 01-03-21

Materiality 01-03-21

Uploaded by

mian UmairCopyright:

Available Formats

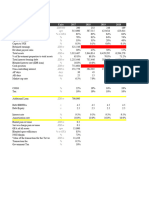

JADEED FEEDS INDUSTRIES (PRIVATE) LIMITED

MATERIALITY LEVEL CALCULATION

FOR THE AUDIT OF YEAR ENDED JUNE 30 2021

PLANNING MATERIALITY

PLANNING/

RELEVENT

PERCENTAG PERCENTAG REPORTING

BENCH MARK AMOUNT E RANGE E SELECTED

MATERIALIT

Y BASE MATERIALITY

(Average Blending Rule)

Total Assets 18,517,355,377 0.5-1.5% 1% 185,173,554

Gross Revenue 27,278,745,840 0.5-1.5% 0.50% 136,393,729

108,004,906

Pre - tax Income 926,789,101 5%-10% 5% 46,339,455

Total Equity 6,411,288,567 1-5% 1% 64,112,886

PERFORMANCE MATERIALITY /TOLERABLE MISTATEMENT

PERFORMANCE MATERIALITY

Tolerable Misstatement

/TOLERABLE MISTATEMENT

HEAD OF ACCOUNT AMOUNT PKR

PERFORMANCE

Risk Level RATE MATERIALITY

% AMOUNT PKR

Property, plant and equipment 7,405,042,347 Low 70% 75,603,434 75% 56,702,576

Investment property 712,500 Low 70% 75,603,434 75% 56,702,576

Security deposits 9,407,997 Low 70% 75,603,434 75% 56,702,576

Biological assets 2,035,850,395 High 50% 54,002,453 75% 40,501,840

Inventories 4,514,980,086 Moderate 60% 64,802,944 75% 48,602,208

Trade and other receivables 2,538,015,656 Moderate 60% 64,802,944 75% 48,602,208

Advances, deposits and prepayments 1,178,010,941 Moderate 60% 64,802,944 75% 48,602,208

Tax refunds due from the Government, 628,286,628 Low 70% 75,603,434 75% 56,702,576

income tax

Cash and bank balances 207,048,827 Low 70% 75,603,434 75% 56,702,576

Long term financing 258,869,505 Low 70% 75,603,434 75% 56,702,576

Deferred income - Government grant 7,151,202 Low 70% 75,603,434 75% 56,702,576

Liability against assets subject to 173,596,645 Low 70% 75,603,434 75% 56,702,576

finance lease

Diminishing musharakah finance 225,000,000 Low 70% 75,603,434 75% 56,702,576

Trade and other payables 3,175,102,696 Moderate 60% 64,802,944 75% 48,602,208

Accrued mark-up 223,789,074 Moderate 60% 64,802,944 75% 48,602,208

Short-term borrowings 7,189,845,620 Low 70% 75,603,434 75% 56,702,576

Revenue 27,278,745,840 Moderate 60% 64,802,944 75% 48,602,208

Gain on fair value measurement of 666,793,713 High 50%

biological assets 54,002,453 75% 40,501,840

Cost of sales 24,888,300,581 Moderate 60% 64,802,944 75% 48,602,208

Distribution cost 271,520,339 Low 70% 75,603,434 75% 56,702,576

Administrative expenses 687,869,221 Low 70% 75,603,434 75% 56,702,576

Other income 61,488,079 Low 70% 75,603,434 75% 56,702,576

Other expenses 53,584,178 Low 70% 75,603,434 75% 56,702,576

Finance cost 1,178,964,212 Moderate 60% 64,802,944 75% 48,602,208

If risk is : Materiality Level

Low 70%

Moderate 60%

High 50%

Conclusion: Risk assesmsnt st completion stage was covered by materiality at planning stage, therefore materiality is not revised.

MUNIFF ZIAUDDIN & CO.

CHARTERED ACCOUNTANTS

JADEED FEEDS INDUSTRIES (PRIVATE) LIMITED

MATERIALITY LEVEL CALCULATION

FOR THE AUDIT OF YEAR ENDED JUNE 30 2021

FINAL MATERIALITY

PLANNING/

RELEVENT

PERCENTAG PERCENTAG REPORTING

BENCH MARK AMOUNT E RANGE E SELECTED

MATERIALIT

Y BASE MATERIALITY

(Average Blending Rule)

Total Assets 17,648,730,228 0.5-1.5% 1% 176,487,302

Gross Revenue 37,878,275,181 0.5-1.5% 0.50% 189,391,376

132,732,754

Pre - tax Income 1,769,751,892 5%-10% 5% 88,487,595

Total Equity 7,656,474,332 1-5% 1% 76,564,743

PERFORMANCE MATERIALITY /TOLERABLE MISTATEMENT

PERFORMANCE MATERIALITY

Tolerable Misstatement

/TOLERABLE MISTATEMENT

HEAD OF ACCOUNT AMOUNT PKR

PERFORMANCE

Risk Level RATE MATERIALITY

% AMOUNT PKR

Property, plant and equipment 7,560,272,874 Low 70% 92,912,928 75% 69,684,696

Long term investments 1,012,000,000 Low 70% 92,912,928 75% 69,684,696

Investment property 712,500 Low 70% 92,912,928 75% 69,684,696

Security deposits 4,066,500 High 50% 66,366,377 75% 49,774,783

Biological assets 2,911,856,135 Moderate 60% 79,639,652 75% 59,729,739

Inventories 3,191,620,564 Moderate 60% 79,639,652 75% 59,729,739

Trade and other receivables 1,617,241,541 Moderate 60% 79,639,652 75% 59,729,739

Advances, deposits and prepayments 671,094,104 Low 70% 92,912,928 75% 69,684,696

Tax refunds due from the Government, Low 92,912,928 75% 69,684,696

income tax 425,681,594 70%

Cash and bank balances 254,184,416 Low 70% 92,912,928 75% 69,684,696

Long term financing 207,523,478 Low 70% 92,912,928 75% 69,684,696

Deferred income - Government grant 3,808,800 Low 70% 92,912,928 75% 69,684,696

Liability against assets subject to 152,437,011 Low 70% 92,912,928 75% 69,684,696

finance lease

Diminishing musharakah finance 75,000,000 Moderate 60% 79,639,652 75% 59,729,739

Trade and other payables 2,661,445,928 Moderate 60% 79,639,652 75% 59,729,739

Accrued mark-up 103,927,063 Low 70% 92,912,928 75% 69,684,696

Short-term borrowings 5,373,921,165 Moderate 60% 79,639,652 75% 59,729,739

Revenue 37,878,275,181 High 50% 66,366,377 75% 49,774,783

Gain on fair value measurement of 2,577,927,774 Moderate 60% 79,639,652 75% 59,729,739

biological assets

Cost of sales 36,870,010,616 Low 70% 92,912,928 75% 69,684,696

Distribution cost 350,057,869 Low 70% 92,912,928 75% 69,684,696

Administrative expenses 770,866,811 Low 70% 92,912,928 75% 69,684,696

Other income 113,605,615 Low 70% 92,912,928 75% 69,684,696

Other expenses 127,977,888 Moderate 60% 79,639,652 75% 59,729,739

Finance cost 681,143,494 High 50% 66,366,377 75% 49,774,783

If risk is : Materiality Level

Low 70%

Moderate 60%

High 50%

Conclusion: Risk assesmsnt st completion stage was covered by materiality at planning stage, therefore materiality is not revised.

MUNIFF ZIAUDDIN & CO.

CHARTERED ACCOUNTANTS

SADIQ POULTRY FARMS (PRIVATE) LIMITED

MATERIALITY LEVEL CALCULATION

FOR THE AUDIT OF YEAR ENDED JUNE 30 2018

COMPLETION MATERIALITY

RELEVENT PLANNING/REPORTING

MATERIALITY

HEAD OF ACCOUNT AMOUNT MATERIALIT MATERIALITY (Average

LEVEL

Y BASE Blending Rule)

Total Assets 1,131,810,041 1% 11,318,100

Gross Revenue 648,880,977 0.5% 3,244,405

5,795,695

Pre - tax Income 36,390,041 5% 1,819,502

Total Equity 680,077,330 1% 6,800,773

PERFORMANCE MATERIALITY /TOLERABLE

MISTATEMENT AND ENTRY LEVEL

MISTATEMENT

PERFORMANCE

ENTRY LEVEL

MATERIALITY /TOLERABLE

MISTTAEMENT

MISTATEMENT

HEAD OF AMOUNT

ACCOUNT PKR PLANNING PERFORMANC POSTING

POSTING

MATERIALIT RATE E THRESHOL

THRESHOLD

Y MATERIALITY D%

Non Current Liabilities 295,222,970 5,795,695 60% 3,477,417 4% 139,097

Assets Subject to

Finance Lease #NAME? 5,795,695 50% 2,897,848 5% 144,892

Trade and Other

payables 86,590,637 5,795,695 50% 2,897,848 5% 144,892

Property , plant and

equipment 548,761,932 5,795,695 50% 2,897,848 5% 144,892

Stock in trade 37,910,433 5,795,695 60% 3,477,417 5% 173,871

Advance 346,938,707 5,795,695 50% 2,897,848 5% 144,892

Debtors 28,787,595 5,795,695 50% 2,897,848 5% 144,892

Cash and bank balances 13,768,726 5,795,695 60% 3,477,417 5% 173,871

Cost of sales (613,579,520) 5,795,695 60% 3,477,417 5% 173,871

Sales 648,880,977 5,795,695 40% 2,318,278 3% 69,548

Distribution costs (33,300,767) 24,839,107 60% 14,903,464 5% 745,173

Administrative expense (18,812,941) 24,839,107 60% 14,903,464 5% 745,173

If risk is : Materiality Level

Ver Low 70%

Low 60%

Moderate 50%

High 40%

Conclusion: Risk assesmsnt st completion stage was covered by materiality at planning stage, therefore materiality is not revised.

MUNIFF ZIAUDDIN & CO.

CHARTERED ACCOUNTANTS

You might also like

- Wings TowerDocument8 pagesWings Towerricardosax93gmailcomNo ratings yet

- 2022 01 17 - StatementDocument3 pages2022 01 17 - Statementng, ashley yuet heiNo ratings yet

- Budget Highlights: The Institute of Chartered Accountants of NepalDocument31 pagesBudget Highlights: The Institute of Chartered Accountants of Nepalshankar k.c.No ratings yet

- No. Item Description Reference Acquisition DateDocument35 pagesNo. Item Description Reference Acquisition DateSebesebie FassilNo ratings yet

- EMISSION Feasibility AnalysisDocument28 pagesEMISSION Feasibility AnalysisJay ArNo ratings yet

- BSBA FM140 AutosavedDocument23 pagesBSBA FM140 AutosavedJay ArNo ratings yet

- CK Healthcare Limited - Financial Model - All Errors FixedDocument82 pagesCK Healthcare Limited - Financial Model - All Errors FixedjvNo ratings yet

- Financial Model EE ProjectDocument24 pagesFinancial Model EE ProjectRetno PamungkasNo ratings yet

- Citizens Accountability Report On The Implementation of Year 2022 BudgetDocument23 pagesCitizens Accountability Report On The Implementation of Year 2022 Budgetakintade24No ratings yet

- SSFB Intimation Investors PresentationDocument27 pagesSSFB Intimation Investors PresentationShashank PalNo ratings yet

- BEP - Breakeven Point ، نقطة تعادلDocument4 pagesBEP - Breakeven Point ، نقطة تعادلSalah HusseinNo ratings yet

- Project Work On Financial Management: Prepared By:-Siddharth S. KothariDocument22 pagesProject Work On Financial Management: Prepared By:-Siddharth S. Kotharisunilsims2No ratings yet

- Fs Analysis - SampleDocument7 pagesFs Analysis - SampleRui ManaloNo ratings yet

- Summary Mill Cost by StationDocument22 pagesSummary Mill Cost by StationAndreas Eduard LerrickNo ratings yet

- Business Projection BMP 2020 MC PDFDocument24 pagesBusiness Projection BMP 2020 MC PDFLalit carpenterNo ratings yet

- VERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Document8 pagesVERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Touqeer HussainNo ratings yet

- Abrar Engro Excel SheetDocument4 pagesAbrar Engro Excel SheetManahil FayyazNo ratings yet

- 2021 08 CBT Pemakaian Sparepart Fitting - Rev.01Document590 pages2021 08 CBT Pemakaian Sparepart Fitting - Rev.01winda listya ningrumNo ratings yet

- Monthly Report With Dummy DataDocument1 pageMonthly Report With Dummy Datasenthil velNo ratings yet

- Mba533 Group 17 Assignment Performance Evaluation of Zeco Holdings LTDDocument26 pagesMba533 Group 17 Assignment Performance Evaluation of Zeco Holdings LTDAvenues Women's ClinicNo ratings yet

- Jawaban KOMPUTASI MDA PT SEMEN INDONESIADocument4 pagesJawaban KOMPUTASI MDA PT SEMEN INDONESIAAyu TriNo ratings yet

- PWF Tax Compliance1Document1 pagePWF Tax Compliance1SaraNo ratings yet

- Financial Audit Manual Veranda, Malaybalay City, Bukidnon November 06-07,2019Document4 pagesFinancial Audit Manual Veranda, Malaybalay City, Bukidnon November 06-07,2019Lail PDNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- Software House Project CostDocument8 pagesSoftware House Project Costhymnaduu8250No ratings yet

- Mawjihan Tsakilla 023001701045 710:13.15 Selpita&LisnaDocument8 pagesMawjihan Tsakilla 023001701045 710:13.15 Selpita&Lisnaadis salsabilaNo ratings yet

- Name Akansha Chauhan Division B Roll No. 11 PRN 21020441025Document13 pagesName Akansha Chauhan Division B Roll No. 11 PRN 21020441025Shubham DeyNo ratings yet

- Agri Auto IndustriesDocument14 pagesAgri Auto IndustriesHamza TahirNo ratings yet

- Sr3 Minerals - Fin Model - 22 MayDocument39 pagesSr3 Minerals - Fin Model - 22 MayghouseNo ratings yet

- Feasibility of Establishing "Outdoor Advertising" in Meycauayan City, BulacanDocument27 pagesFeasibility of Establishing "Outdoor Advertising" in Meycauayan City, BulacanNicodeo IgnacioNo ratings yet

- P&L SEPTEMBER 2023 (Consumption)Document23 pagesP&L SEPTEMBER 2023 (Consumption)kashan.ahmed1985No ratings yet

- Nepal Budget Highlights FY 78-79Document33 pagesNepal Budget Highlights FY 78-79Shraddha NepalNo ratings yet

- Rolling Forecast Template V2Document1 pageRolling Forecast Template V2cherifsambNo ratings yet

- Assets Non - Current AssetsDocument12 pagesAssets Non - Current AssetssssssssNo ratings yet

- Corfin Study Case - Data Book and Working Paper - GalihAbimataDocument10 pagesCorfin Study Case - Data Book and Working Paper - GalihAbimataDImas AntonioNo ratings yet

- Summary of Flood Relief 2022.-07092023 - 00Document1 pageSummary of Flood Relief 2022.-07092023 - 00Farooq MaqboolNo ratings yet

- TSU - Public AdminDocument45 pagesTSU - Public AdminaileenrconcepcionNo ratings yet

- Account Statement 24-Aug-2022 19 12 28Document3 pagesAccount Statement 24-Aug-2022 19 12 28saicharanNo ratings yet

- Assignement 1 Finance.Document17 pagesAssignement 1 Finance.farwa shahidNo ratings yet

- Pohuat (7088)Document100 pagesPohuat (7088)Wong Kai WenNo ratings yet

- Финансовая модель СтартапаDocument107 pagesФинансовая модель СтартапаЧудо НяниNo ratings yet

- Ka Eme HanDocument23 pagesKa Eme Hanmuyotzkie28No ratings yet

- 9f1 - 20% Cash & 80% Bank FinancingDocument1 page9f1 - 20% Cash & 80% Bank FinancingArvin Amiel LiceraldeNo ratings yet

- Adesoye, Adeniji-Scena - CorrectDocument11 pagesAdesoye, Adeniji-Scena - CorrectAdesoye AdenijiNo ratings yet

- Listed Companies Highlights: Financial FocusDocument1 pageListed Companies Highlights: Financial FocusT'Tee MiniOns'TmvsNo ratings yet

- ithoughtPMS Solitaire Note April 2024Document23 pagesithoughtPMS Solitaire Note April 2024prasadNo ratings yet

- JTA Administration-CorporateDocument1 pageJTA Administration-CorporateActionNewsJaxNo ratings yet

- Investor Fact Sheet q3 Fy23Document16 pagesInvestor Fact Sheet q3 Fy23Anshul SainiNo ratings yet

- Submitted By: Harmanpal Singh Roll No: Class MBA 2 Submitted To: Dr. Pallavi Dawra (Professor at PCTE)Document24 pagesSubmitted By: Harmanpal Singh Roll No: Class MBA 2 Submitted To: Dr. Pallavi Dawra (Professor at PCTE)HIMANSHU RAWATNo ratings yet

- Morepen Financial AnalysisDocument30 pagesMorepen Financial AnalysisSourav SNo ratings yet

- Corporate ValuationDocument32 pagesCorporate ValuationNishant DhakalNo ratings yet

- PAGSDocument24 pagesPAGSAndre TorresNo ratings yet

- Assignment 2 - Strategic Financial Management - Abdulhakeem MustafaDocument7 pagesAssignment 2 - Strategic Financial Management - Abdulhakeem MustafaHakeem SnrNo ratings yet

- Majeed Traders Projections 2024 To 2025Document12 pagesMajeed Traders Projections 2024 To 2025vayave5454No ratings yet

- ACE - Fundtech LargeCap BA-FOTMDocument12 pagesACE - Fundtech LargeCap BA-FOTMMotilal Oswal Financial ServicesNo ratings yet

- Valuation of Tata Power, Based On Prof. Aswath Damodaran: DCF Base Year 1 2 3 AssumptionsDocument6 pagesValuation of Tata Power, Based On Prof. Aswath Damodaran: DCF Base Year 1 2 3 Assumptionspriyal batraNo ratings yet

- Commercial Proposal - Ooredoo RFIDocument4 pagesCommercial Proposal - Ooredoo RFIAntony KanyokoNo ratings yet

- Rolling Forecast TemplateDocument4 pagesRolling Forecast TemplatebenaikodonNo ratings yet

- NIB Financial ModelDocument229 pagesNIB Financial ModelMilin RaijadaNo ratings yet

- Budgetary For Renewable Energy PlantDocument1 pageBudgetary For Renewable Energy PlanthuskyjackNo ratings yet

- CF YpphDocument9 pagesCF YpphashxerNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- Parameter ft-450Document3 pagesParameter ft-450Boed SNo ratings yet

- G.R. No. 199648. January 28, 2015. First Optima Realty Corporation, Petitioner, vs. Securitron Security SERVICES, INC., RespondentDocument14 pagesG.R. No. 199648. January 28, 2015. First Optima Realty Corporation, Petitioner, vs. Securitron Security SERVICES, INC., RespondentRhei Marco BarbaNo ratings yet

- Annex A - Secretary's Certificate - ScribdDocument2 pagesAnnex A - Secretary's Certificate - ScribdKristine MagbojosNo ratings yet

- History of Environment Protection in IndiaDocument5 pagesHistory of Environment Protection in IndiaSadhika SharmaNo ratings yet

- Form 6Document4 pagesForm 6BDO BongaonNo ratings yet

- Reflection PaperDocument1 pageReflection Paper0506sheltonNo ratings yet

- Law On Sales Part 1Document6 pagesLaw On Sales Part 1Ren EyNo ratings yet

- Four Steps To Writing A Position Paper You Can Be Proud ofDocument32 pagesFour Steps To Writing A Position Paper You Can Be Proud oftwinkleNo ratings yet

- Genuino v. de Lima - Fuentes v. OmbudsmanDocument30 pagesGenuino v. de Lima - Fuentes v. OmbudsmanJude Thaddeus DamianNo ratings yet

- ZSN Law Immigration Retainer Agreement - RPD (LAO)Document5 pagesZSN Law Immigration Retainer Agreement - RPD (LAO)m.n.ahmadzai34No ratings yet

- The Judgment of IndraDocument12 pagesThe Judgment of IndraAnmol SharmaNo ratings yet

- Discussions Questions Donor S TaxDocument5 pagesDiscussions Questions Donor S TaxMary DenizeNo ratings yet

- 1562674866MANISH NEGI - Offer Letter - 20190709 - 175014Document7 pages1562674866MANISH NEGI - Offer Letter - 20190709 - 175014manish negiNo ratings yet

- 01 - Quotation 4020015844Document3 pages01 - Quotation 4020015844Aum4Eng HelpNo ratings yet

- Jashmir - SPL RESPONDENTSDocument24 pagesJashmir - SPL RESPONDENTSTarannum khatriNo ratings yet

- Bsa Midterm Exam - TaxDocument12 pagesBsa Midterm Exam - TaxHazel Grace PaguiaNo ratings yet

- 122-Palalan Carp Farmers Multi-Purpose Coop v.Document9 pages122-Palalan Carp Farmers Multi-Purpose Coop v.Anna Fe SyNo ratings yet

- African Customary LawsDocument56 pagesAfrican Customary LawsSea K100% (1)

- G.R. No. 159261 - PEOPLE OF THE PHILIPPINES v. COURT OF APPEALS, ET ALDocument7 pagesG.R. No. 159261 - PEOPLE OF THE PHILIPPINES v. COURT OF APPEALS, ET ALJoses Nino AguilarNo ratings yet

- 33rd Regular SessionDocument4 pages33rd Regular SessionAllen HidalgoNo ratings yet

- Form No25,26,4Document3 pagesForm No25,26,4Welcome Real Estate ServicesNo ratings yet

- FC Gen Ed St. Louis 2022Document25 pagesFC Gen Ed St. Louis 2022gretelabelong10No ratings yet

- Parking Space Lease Agreement: AddressDocument3 pagesParking Space Lease Agreement: AddresspochNo ratings yet

- Conflicts - Chap 2 and 12 FINALDocument19 pagesConflicts - Chap 2 and 12 FINALFranz GarciaNo ratings yet

- Invoice: Issue Date Due DateDocument2 pagesInvoice: Issue Date Due DateCheikh Ahmed Tidiane GUEYENo ratings yet

- O Ravi KumarDocument2 pagesO Ravi KumarHari AmaNo ratings yet

- Lunod Vs MenesesDocument2 pagesLunod Vs MenesesPetallar Princess LouryNo ratings yet

- 4.05 Graded Assignment - Unit Project - Play ScriptDocument9 pages4.05 Graded Assignment - Unit Project - Play ScriptAsher KramerberryNo ratings yet