Professional Documents

Culture Documents

Kate Pallaya 2023 CCC

Uploaded by

Peter ParkerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kate Pallaya 2023 CCC

Uploaded by

Peter ParkerCopyright:

Available Formats

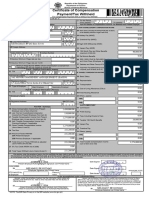

Republic of the Philippines

Department of Finance

Bureau of Intenatl Revenue

BIR Form No.

Certificate of Compensation

2316

January 2018 (ENCS)

Payment/Tax Withheld

For Compensation Payment With or Without Tax Withheld 2316 01/18ENCS

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1 For the Year 2 For the Period

( YYYY )

2023 From (MM/DD)

09 01 To (MM/DD)

12 31

Part I - Employee Information Part IV-B Details of Compensation Income and Tax Withheld from Present Employer

3 TIN

628 143 324 0000 A. NON-TAXABLE/EXEMPT COMPENSATION INCOME

4 Employee's Name (Last Name, First Name, Middle Name) 5 RDO Code Amount

27 Basic Salary(including the exempt P250,000 & below)

PALLAYA, KATE NICOLINE AMBATALI 014 of the Statutory Minimum Wage of the MWE

34,000.00

6 Registered Address 6A Zip Code 28 Holiday Pay (MWE)

0.00

29 Overtime Pay (MWE)

6B Local Home Address 6C Zip Code 0.00

30 Night Shift Differential (MWE)

0.00

6D Foreign Address 6E Zip Code 31 Hazard Pay (MWE)

0.00

32 13th Month Pay and Other Benefits

7 Date of Birth (MM/DD/YYYY) 8 Telephone Number (maximum of P90,000)

2,730.00

33 De Minimis Benefits

0.00

9 Statutory Minimum Wage rate per day 34 SSS, GSIS, PHIC & Pag-ibig Contributions

0.00 and Union Dues (Employee share only) 2,730.00

10 Statutory Minimum Wage rate per month 35 Salaries & Other Forms of Compensation

0.00 0.00

11 X Minimum Wage Earner whose compensation is exempt from 36 Total Non-Taxable/Exempt Compensation

39,460.00

withholding tax and not subject to income tax Income (Sum of Items 27 to 35)

Part II - Employer Information (Present)

12 Taxpayer B. TAXABLE COMPENSATION INCOME REGULAR

008 381 324 0000

13 Employer's Name 37 Basic Salary

UNITED METHODIST CHRISTIAN SCHOOL OF 0.00

BAYOMBONG, IN 38 Representation

14 Registered Address 14A Zip Code

LB PEREZ DON DOMINGO MADDELA 39 Transportation

3700

BAYOMBONG NUEVA VIZCAYA

15 Type of Employer Main Employer Secondary Employer 40 Cost of Living Allowance (COLA)

Part III - Employer Information (Previous) 41 Fixed Housing Allowance

16 TIN

42 Others (Specify)

17 Employer's Name 42A

0.00

42B

18 Registered Address 18A Zip Code

SUPPLEMENTARY

Part IVA - Summary

19 Gross Compensation Income from Present 43 Commission

Employer (Sum of Items 36 and 50) 0.00

20 Less: Total Non-Taxable/Exempt Compensation 44 Profit Sharing

Income from Present Employer (From Item 36) 39,460.00

21 Taxable Compensation Income from Present 45 Fees Including Director's Fees

Employer (Item 19 Less Item 20) (From Item 50) 0.00

22 Add: Taxable Compensation Income from 46 Taxable 13th Month Pay Benefits

Previous Employer, if applicable 0.00 0.00

23 Gross Taxable Compensation Income 47 Hazard Pay

(Sum of Items 21 and 22) 0.00

24 Tax Due 48 Overtime Pay

0.00

25 Amount of Taxes Withheld 49 Others (Specify)

25A Present Employer 49A

0.00

25B Previous Employer 49B

0.00

26 Total Amount of Taxes Withheld as adjusted 50 Total Taxable Compensation Income

(Sum of Items 25A and 25B) 0.00 (Sum of Items 37 and 49B) 0.00

I/We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of my/our knowledge and belief, is true and correct pursuant to

the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information

as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

51 LORMA J. BASILIO

Present Employer/ Authorized Agent Signature Over Printed Name Date Signed

CONFORME:

KATE NICOLINE AMBATALI

52 PALLAYA Date Signed

Employee Signature Over Printed Name Amount Paid, if CTC

CTC/Valid ID No. Place of Date of Issue

of Employee Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury, that the information herein stated are reported I declare,under the penalties of perjury that I am qualified under substituted filing of

under BIR Form No. 1604C which has been filed with the Bureau of Internal Revenue. Income Tax Returns(BIR Form No. 1700), since I received purely compensation income

from only one employer in the Philippines for the calendar year; that taxes have been

correctly withheld by my employer (tax due equals tax withheld); that the BIR Form

53 LORMA J. BASILIO No. 1604-C filed by my employer to the BIR shall constitute as my income tax return;

Present Employer/ Authorized Agent Signature Over Printed Name and that BIR Form No. 2316 shall serve the same purpose as if BIR Form No. 1700

(Head of Accounting/ Human Resource or Authorized Representative) has been filed pursuant to the provisions of Revenue Regulations (RR) No. 3-2002, as amended.

54

KATE NICOLINE AMBATALI PALLAYA

Employee Signature Over Printed Name

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Aclon 4726323910000 12312023Document1 pageAclon 4726323910000 12312023Jeanne D. GozoNo ratings yet

- Cruz 413519429 122022Document1 pageCruz 413519429 122022Rhea C CabillanNo ratings yet

- 2316 PepitoDocument1 page2316 PepitoRiezel PepitoNo ratings yet

- 1 ZDS Bir 2316 2023Document2 pages1 ZDS Bir 2316 2023Cheny RojoNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: January 2018 (ENCS)Document1 pageCertificate of Compensation Payment/Tax Withheld: January 2018 (ENCS)jacotesaluna09No ratings yet

- Bayani, JeniferDocument1 pageBayani, JenifergeekerytimeNo ratings yet

- BIR 2316 UPDATED 2023 DEGUZMAN SignedDocument1 pageBIR 2316 UPDATED 2023 DEGUZMAN Signedmikel bautistaNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldKimberly IgbalicNo ratings yet

- 2316 Jan 2018 ENCSDocument262 pages2316 Jan 2018 ENCSAndrea BuenoNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Part I - Employee InformationDocument1 pageCertificate of Compensation Payment/Tax Withheld: Part I - Employee InformationIvy Baarde AlmarioNo ratings yet

- Caringal 477712081Document1 pageCaringal 477712081Jennifer LambinoNo ratings yet

- Amc 2316 2022Document14 pagesAmc 2316 2022Boracay BeachAthonNo ratings yet

- 2022 BIR Form 2316 - 2013650Document1 page2022 BIR Form 2316 - 2013650erik skiNo ratings yet

- Eoyt 2020Document1 pageEoyt 2020Izza Joy MartinezNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Maria Cristina TuazonNo ratings yet

- 2316 (1) 1 Manilyn Nervar 2023Document1 page2316 (1) 1 Manilyn Nervar 2023Beng moralesNo ratings yet

- Osea Aileen 2316Document1 pageOsea Aileen 2316Maricel PestañoNo ratings yet

- Grimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesGrimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldFranc Anthony GalaoNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Charles C. ArsolonNo ratings yet

- CARDOITRFINALNA!2316Document1 pageCARDOITRFINALNA!2316كيمبرلي ماري إنريكيز100% (1)

- Certificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityACYATAN & CO., CPAs 2020No ratings yet

- 2316 (1) 2Document2 pages2316 (1) 2jeniffer pamplona100% (2)

- Delgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageDelgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldACYATAN & CO., CPAs 2020No ratings yet

- Jai2316 Sep 2021 ENCS - Final - CorrectedDocument2 pagesJai2316 Sep 2021 ENCS - Final - Correctedmariefe.wvillacoraNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityDocument46 pagesCertificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityMariluz GregorioNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityMaria Cristina TuazonNo ratings yet

- Adobe Scan Jun 27, 2023Document1 pageAdobe Scan Jun 27, 2023Lalyn PasaholNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigDocument1 pageCertificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigJay De LeonNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Maricar CoronelDocument1 pageCertificate of Compensation Payment/Tax Withheld: Maricar CoronelAmy P. DalidaNo ratings yet

- De gUIADocument3 pagesDe gUIAjeffrey s. lebatiqueNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldJane Tricia Dela penaNo ratings yet

- ITR2015Document1 pageITR2015Drizza FerrerNo ratings yet

- Ferrer 0000 12312022Document1 pageFerrer 0000 12312022Vincent FerrerNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldJexterNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- Itr Rosare RobertoDocument8 pagesItr Rosare RobertoRafael ZamoraNo ratings yet

- 2012 ItrDocument1 page2012 Itrregin pioNo ratings yet

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldLency FelarcaNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- 2316 Jan 2018 ENCS FinalDocument1 page2316 Jan 2018 ENCS FinalCaina LeyvaNo ratings yet

- Form 2316 Eb Member RegularDocument1 pageForm 2316 Eb Member Regularmha anneNo ratings yet

- 2316 Sep 2021 ENCS - Final - CorrectedDocument1 page2316 Sep 2021 ENCS - Final - Correctedchelleabogado27No ratings yet

- 2022 Bir2316Document1 page2022 Bir2316CalyxNo ratings yet

- Form 2316 Eb Chairperson RegularDocument1 pageForm 2316 Eb Chairperson Regularmha anneNo ratings yet

- Payslip 2023 2024 5 100000000546055 IGSL PDFDocument1 pagePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNo ratings yet

- 2022 NleDocument24 pages2022 NleFrancis Anthony EspesorNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316Kaye ApostolNo ratings yet

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 page1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationEljoe Vinluan0% (1)

- Payslip For The Month of June, 2023: Toyota Kirloskar Motor PVT LTDDocument2 pagesPayslip For The Month of June, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666No ratings yet

- 01.dcreative 1601c Jan2019 FinalDocument2 pages01.dcreative 1601c Jan2019 FinalChristopher John CarmenNo ratings yet

- Payslip 2023 2024 5 100000000546055 IGSL PDFDocument1 pagePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNo ratings yet

- Jagan Mohan Absli Payslip AprilDocument1 pageJagan Mohan Absli Payslip AprilSurya GodasuNo ratings yet

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument1 page1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationNards SVNo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit Sagar0% (1)

- Key Account Managment.Document11 pagesKey Account Managment.bushraNo ratings yet

- Cost Abc Sugar1 PDFDocument4 pagesCost Abc Sugar1 PDFEdu Miguel100% (1)

- 1consultancy ServicesDocument5 pages1consultancy ServicesRajesh WaniNo ratings yet

- Arithmetic & Applied Arithmetic For Officer (General) Written Exam 05.04.2024 PDFDocument15 pagesArithmetic & Applied Arithmetic For Officer (General) Written Exam 05.04.2024 PDFMuslim TomNo ratings yet

- FINANCE MANAGEMENT FIN420 CHP 6Document52 pagesFINANCE MANAGEMENT FIN420 CHP 6Yanty IbrahimNo ratings yet

- Gartner Business Quarterly 2q22 PDFDocument65 pagesGartner Business Quarterly 2q22 PDFblablablaNo ratings yet

- Hajj Finance Company LTDDocument30 pagesHajj Finance Company LTDBenjamin BeanNo ratings yet

- Calapan City, Inc. St. Anthony College: Module For Entrepreneurial MindDocument7 pagesCalapan City, Inc. St. Anthony College: Module For Entrepreneurial MindTintin TagupaNo ratings yet

- Simple InterestDocument20 pagesSimple InterestEngel QuimsonNo ratings yet

- BCLE 2000C PG 04 Jan2019Document21 pagesBCLE 2000C PG 04 Jan2019myturtle gameNo ratings yet

- MGT330 AssignmentDocument16 pagesMGT330 AssignmentArifin Ahmed ZawadNo ratings yet

- When Should The Government Intervene in The Economy?: 1. Market FailureDocument4 pagesWhen Should The Government Intervene in The Economy?: 1. Market FailurenishmaNo ratings yet

- Materi PT Bayer IndonesiaDocument19 pagesMateri PT Bayer IndonesiaJing FeeNo ratings yet

- Management of HondaDocument8 pagesManagement of HondafarhansufiyanNo ratings yet

- History of Banking in India GK Notes in PDF 2Document6 pagesHistory of Banking in India GK Notes in PDF 2Yogesh LondheNo ratings yet

- Audit Report Elesterio 1Document5 pagesAudit Report Elesterio 1Jeffrey DuranNo ratings yet

- Hyosung Advanced Materials: Sustainability ReportDocument56 pagesHyosung Advanced Materials: Sustainability ReportKhánh Nguyễn NgHNo ratings yet

- Erp BPR PDFDocument2 pagesErp BPR PDFDavidNo ratings yet

- Solved Claire Consumes Three Goods Out of Her Income Food FDocument1 pageSolved Claire Consumes Three Goods Out of Her Income Food FM Bilal SaleemNo ratings yet

- Shs Economics Syllabus V FinalDocument114 pagesShs Economics Syllabus V FinalLeslie N.T. AnnanNo ratings yet

- Matketing Management Ii: Submitted To Submitted byDocument29 pagesMatketing Management Ii: Submitted To Submitted byKritu GuptaNo ratings yet

- Frankfurt UpdatedDocument2 pagesFrankfurt UpdatedFaizan HassanNo ratings yet

- Finance 22393Document23 pagesFinance 22393Rajesh Kumar100% (1)

- Matching Dell AssignmentDocument7 pagesMatching Dell AssignmentMuthamil Selvan Chellappan100% (2)

- Elective 1 Topics 6&7Document13 pagesElective 1 Topics 6&7Elenita AkosiNo ratings yet

- JO2058 - 2019-05-08-Bca-A320-Captain-Brief-2 - 18 Jul 2019Document3 pagesJO2058 - 2019-05-08-Bca-A320-Captain-Brief-2 - 18 Jul 2019gfernandezv0% (1)

- McDonalds Russia CaseDocument3 pagesMcDonalds Russia CaseRaihaan PujaniNo ratings yet

- Reid and Adams - HRM Family and Non Family FirmsDocument16 pagesReid and Adams - HRM Family and Non Family FirmsFanny MartdiantyNo ratings yet

- (Cô Vũ Mai Phương) Đề Cương Ôn Thi Giữa Học Kì 2 Môn Tiếng Anh - Lớp 10Document6 pages(Cô Vũ Mai Phương) Đề Cương Ôn Thi Giữa Học Kì 2 Môn Tiếng Anh - Lớp 10Lam PhuongNo ratings yet

- FAST MorningstarDocument9 pagesFAST MorningstarmichaelkitloNo ratings yet