Professional Documents

Culture Documents

JIGYASAFeb 2015

Uploaded by

Sivapriya SamyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JIGYASAFeb 2015

Uploaded by

Sivapriya SamyCopyright:

Available Formats

Jigyasa –February, 2015 1

FROM THE DESK OF EDITOR

On an average 1/3 rd of our life is spent in earning money. We all are aware what value; money adds to

an individual, family, society and country apart from monetary benefits.

Start with savings, next step is judicious investment and money shall multiply, seems ridiculously simple and

workable, we promise it would become so with this edition.

We bring you February, 2015 edition here with lots of tips to generate savings, some experienced advice

for smart investment options and updates from the Procurement family.

We are very grateful for our guest writer Mr. Ramyar Balsara for sharing expert analysis on taxation.

Enjoy reading.

Team Jigyasa : Vikram, Vipul, Manoj, Ravinder, Snehal, Pratima, Ankush

CONTENTS

Preface

Earn from saving on Taxes

To Have It All - Women's Day Special

Systematic Investment Plan

Soldier turned Entrepreneur

On a Lighter Note

Riddle

Congratulations

Celebrations

Jigyasa –February, 2015 2

PREFACE

In today’s fast pace, uncertain and high risk Apart from the

world, where rate of change is faster than ever, conventional avenues of

one aspect of life which needs careful, disciplined investments – I believe

and innovative approach is ‘investing hard following could be

earned money’ and ‘to see it grow’. rewarding and satisfying

approaches:

In my mind today’s generation are more aware

and investment savvy than the generation 25 to Education of self /

30 years back. Though it’s true that there are children

many avenues to invest and benefit from, there Buy a piece of land and Plant trees

are equal or more ways to lose money. Hence Charity by adopting a child or educating a

one needs to be diligent and careful before well deserving student

committing oneself. As they say, the best Invest in an initiative for social cause which

insurance against losing money is to guard will help you to remain engaged after

against greed. Whichever scheme / plan / retirement in fruitful manner

business / bank / company / institution / Help out a friend to come up in life that is left

investment agency promises overnight behind

multiplication are the ones to be avoided for sure. Support a NGO or Socio-cultural

Staying with reputed, trustworthy and organization

dependable will result in realistic gains while

Just before I put the pen down, I would want to

guarding against capital erosion.

recommend a few ideas while servicing loans,

An element of investing which has always been and they are:

stressed is to have a balanced investment basket

Start by paying off credit card debt and high

which includes fixed term deposits, gold (jewelry

interest car loans. Then chisel away at your

unfortunately is not an investment), stocks, real

mortgage. Then use periodic bonus, performance

estate and tax saving instruments. One need to

reward, tax refunds if any, any other windfall –

realize that insurance plan should not be viewed

every single deposit will see your interest payout

as investment but it is rather a necessity and a

shrink and releasing more money for investments.

safety net which provides security in case of any

Following steps can be fruitful while availing any

eventuality.

loan.

At the beginning of my career one of my

Make biggest down payment for Loan.

acquaintances advised me, that a sure way to

Ensure fore closure charges are minimal

secure, peaceful and comfortable life at all times,

Pay off debt as soon as possible results in

is to assume that the income is only 70% of what

huge interest savings.

we get in our hands and invest 30% meticulously!

Interest saved which can again be invested

– how I wish today - I had listened and acted

to generate to increase the capital

upon his advice ! So what if I could not act on this

maybe somebody else will be fastidious enough

to do so.

“If you’re out of debt, you have a tremendous

amount of freedom to decide what you want to

do,” and “If you’re in debt, you’re chained to

your desk and if you lose your job you’re really in

trouble.”

----From the desk of Zishan Razvi

Jigyasa –February, 2015 3

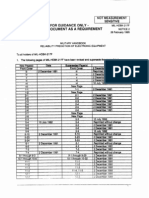

EARNING FROM SAVING ON TAXES

The hardest thing in the world to understand Row 3: PROFESSION TAX -

is the income tax- Albert Einstein. Profession Tax recovered from

Salary is allowed as a deduction.

The financial year 2015-16 is upon us, this perhaps [Maximum of Rs.2,500/- p.a.]

would be the adequate time to equip ourselves

with the basic knowledge of Taxation and its Row 4: (Row 1-2-3) INCOME CHARGEABLE UNDER

computation on total income. Let’s try out the THE HEAD SALARIES -

simplest method to calculate tax here: Row 4 represents the Head Income Chargeable

under the Head “Salaries”.

TAX COMPUTATION STEPS (FY 2015-16)

1 Annual Gross Salary. Row 5: ANY OTHER INCOME-

2 LESS: Allowance Exempt Under Other Taxable income includes:

Sec 10. 1. Income other than Salary

3 LESS: Profession Tax. 2. Interest received except for interest on

4 1-2-3 Income Chargeable Under a. Employee Provident Fund

The Head Salaries b. Public Provident Fund

5 ADD: Any Other Income c. Notified Tax Exempt Securities

3. Interest paid on housing loan

6 4+5 Gross Total Income

Example: if interest paid for F.Y.2014-15 and

7 LESS: Deductions U/Sec 80.

F.Y.2015-16 is Rs.2 Lacs each, and possession of

8 6-7 Total Income.

the property against which the loan has been

9 Computation Tax On Total Income –

availed is received in Mar.2016.

(Refer Next Slide)

The total interest deduction available would be

10 ADD: Education Cess (3% Of Tax)

=Rs. 2,40,000/- (Rs.2,00,000/- paid in F.Y.2015-16

11 LESS: Rajiv Gandhi Equity Scheme

entirely and Rs.40,000/- (1/5 of Rs.2,00,000/- paid

12 9+10-11 Total Tax

in F.Y.2014-15).

*Interest paid for period prior to completion of the completion of the

Row 1: GROSS SALARY – property, can be claimed in 5 equal installments, once the house is

completed.

Gross Salary covers all earnings received in cash

as well the monetary value of certain perquisites

Row 6: (GROSS INCOME = Row 4 + Row 5)-

such as Company Housing, Car and ESOPS.

Total of Row 4 and Row 5 would give the Gross

Total Income.

Row 2: ALLOWANCES EXEMPT UNDER SEC-10 -

Allowable deductions from the Gross Salary can

Row 7: SECTION 80

be broadly summarized as under:

DEDUCTIONS -

Section 80 of the Income

Tax Act covers

deductions which

enable a person to

reduce the income

chargeable to tax and hence the tax payable.

A] Sec 80 C –

Items under Sec 80 C can be broadly divided

into 2 principal sub-categories –

a) Non-Investments (eg: Tuition Fees, Life Insurance premium

*Salary- Salary is defined as the amount on which PF is deducted. paid and principal repayment of Housing Loans.)

*Items (d) & (e) are available as a flat deduction irrespective of

b) Investments (eg: PPF, NSC, FD, SCSS & ELSS.)

actual expenditure incurred.

Jigyasa –February, 2015 4

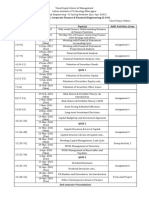

ELSS and the rest

4) Sec 80 U –[Deduction in respect of person with

Schemes Minimum Lock in Return Tax Risk

Investments years s (%) treatment profile disability for Self]- A flat deduction of Rs 75,000/- or

Public 500 15 8.70% Interest tax- Low Rs 1,25,000/- is available under this category .

Provident free

Fund (PPF)

National 1,000 5-10 8.5- Interest Low C] Sec.80E – [Interest on Education Loan]-

Savings 8.8% Income

Any interest paid on Education Loan is allowed

Certificate taxable

(NSC)/Kisan as a deduction.

Vikas Patra

Bank FD with 1,000 5 8.5% Interest Low

D] Sec.80G –[Qualified Donations]-

5-year Lock-in Income

taxable Donation qualify for deduction in categories of

Senior Citizen’s 1,000 5 9.2% Interest Low

100% - National Level Donations to scheme like

Savings Income

Scheme (SCSS) taxable PM Relief Fund or 50% to Religious or Similar

Equity-Linked 500 3 Market Dividend and High approved institutions.

Savings Linked capital gains *This deduction has to be claimed separately while filing Income Tax

Scheme(ELSS) tax free return.

Following investment options can be looked

upon if threshold of 1.5 Lacs is not crossed. E) Sec 80 TTA-(Interest on Savings Bank) -

Interest earned during the year is allowed as a

Recent Developments: deduction subject to the actual amount

received or Rs 10,000/- p.a. whichever is less.

- “Sukanya Samriddhi Account New Saving

Scheme for Girl Child”- Deposit Range

Row 8: (Row 6-Row 7) TOTAL INCOME -

(Rs.1,000/- to Rs. 1,50,000/- p.a) with an

Gross Total Income Less Deductions under

attractive interest rate of 9.10% tax free.

Section 80 is Net Total Income on which Tax is

- Additional deduction of Rs. 50,000/- computed.

granted for investments in Pension

Schemes. With this additional benefit, an Row 9 & 10: TAX ON TOTAL INCOME -

aggregate of up to Rs.2,00,000/- can be Tax Rates for FY 2015-16 are as under:

claimed as a deduction. GROSS TOTAL INCOME RATE SURCHARGE E.CESS TOTAL

(Rs) (%) (%) (%) (%)

FIRST Rs.2,50,000/- NIL NIL NIL NIL

B] 1) Sec 80D - [Medical Insurance Premium]- Rs.2,50,001/- To Rs.5,00,000/- 10 - 0.30 10.30

Rs.25,000/- for individuals below the age of 60 & Rs.5,00,001/- To Rs.10,00,000/- 20 - 0.60 20.60

Rs.30,000/- for senior citizens. Total deduction up Rs.10,00,001/-To Rs.1,00,00,000- 30 - 0.90 30.90

to Rs.55,000/- can be claimed under family Above Rs.1,00,00,000/- 30 3.6 1.02 34.62

floater Medical Insurance Policy.

*Medical Insurance Premium deduction is available to the person Row 11: RAJIV GANDHI EQUITY SCHEME -

who pays the premium by any mode other than cash. Investments under RGE Scheme are available as

a deduction up to 50% of amount invested.

2) Sec 80DD-[Medical Treatment of Handicapped

Maximum Investment is Rs.50,000/- .

Dependents]- A flat deduction of Rs 75,000/- or Rs

*This deduction is available only to a person who has Gross Total

1, 25,000/-(for persons with severe disability).

Income (Row 6) of less than 12 Lacs and is available for 3

*Original certificate certifying the disability should be obtained from

Consecutive Years.

a notified hospital or institution.

Row 12: (Row 9+Row 10 –Row 11).TOTAL TAX

3) Sec 80DDB- [Medical Treatment for specified

PAYABLE –

disease or ailment]-

Deduction subject to a maximum of Rs.40,000/- Computed figure represents the tax payable.

(Rs.60,000/- for a senior citizen, Rs.80,000/- for a The tax will be recovered progressively each

very senior citizen) is available for treatment of month.

Neurological Diseases, Cancer, Aids, Chronic In conclusion, Let us remember that “Tax

Renal failure, Haemophilia and Thalassemia. Payment is our contribution to the noble cause of

Nation Building” and accordingly discharge our

responsibility correctly and completely.

---Ramyar Balsara

Jigyasa –February, 2015 5

TO HAVE IT ALL- WOMEN’S DAY SPECIAL

First of all accept for some time

in life, priorities WILL change

and it’s absolutely alright that

way. Let the perfection in

Old Indian scriptures define ideal women as the each and every small thing be

one who can play all roles in life successfully. an aim which can be missed

Centuries have passed, the whole concept of sometimes.

why should woman play so many roles have been Use help, no point in doing every donkey work

questioned but still she continues to do so. This ourselves when there is so much to do. Most

Women’s day we salute and celebrate the importantly stop worrying about it. Slowly and

amazing ability of a woman to multitask. steadily you will be back on route. You will again

be flying and leading, taking decisions with the

same zeal before. Fortunately we are born in the

generation where the men are more considerate

and helpful than before, where it has become

impossible for organizations to ignore us, where

day cares and similar helps have significantly

improved. We have more females at workplace

whom we can relate to and seek guidance from.

A section of my generation feels we are not

Make use of all that.

obliged to do all this just because society expects

us to. I partially agree with it. We are not obliged

to do ANYTHING UNDER THE SUN because

someone expects us to. But once you do this role

playing, you know only you can do it and it’s a

blessing. If you lead the largest private bank in our

country like any other man would have, it’s a big

deal but when you do it along with being a History has witnessed that the patriarchal world

caring mother and wife its even a bigger deal. we live in has sometimes thought, expressed and

Chanda Kochhar gives us a live example that it is even made us think that we are physically weak,

possible to HAVE IT ALL. Survey has indicated that can’t compete with men, has lots of personal

93% of Indian women feel it is possible to do so. restrictions and the lady in us has proved them

Currently going through the experience myself, I wrong again and again.

know how physically and emotionally difficult it is Obstacles come and go but a lady is true fighter,

to leave your little one home and work. But doing she rises above all.

that is important. Important for yourself more than

anyone else. Like every human being a woman

also needs her own identity. So how difficult it is to

Have it all and how do we make it easier

especially after the cute addition to family.

-----Snehal Karangle

Jigyasa –February, 2015 6

SYSTEMATIC INVESTMENT PLAN (SIP)

Having money and having desire to invest is not Power of

enough to actually multiply your money. Various Compounding:

tools and financial instruments may lead to

confusion. SIP will help you invest your money Albert Einstein once

smartly while worrying less for losing it. said, “Compound

interest is the eighth

What is SIP? wonder of the world. He who understands it, earns

A systematic Investment Plan (SIP) is a smart and it……he who doesn’t…..pays it.” The rule of

hassle free mode for investing money in mutual compound is simple – the sooner you start

funds. SIP allows you to invest a certain pre- investing, the more your money has to grow.

determined amount at a regular interval (weekly,

monthly, quarterly, etc.) A SIP is a planned Other Benefits of Systematic Investment Plans

approach towards investments and helps you Disciplined Saving – Discipline is the key to

inculcate the habit of saving and building wealth successful investments. When you invest through

for the future. SIP, you commit yourself to save regularly. Every

investment is a step towards attaining your

financial objectives.

Flexibility - While it is advisable to continue SIP

investments with a long-term perspective, there is

no compulsion. Investors can discontinue the plan

at any time. Once can also increase/decrease

the amount being invested.

How does it work?

A SIP is a flexible and easy investment plan. Your

money is auto-debited from your bank account

and invested into a specific mutual fund scheme.

You are allocated certain number of units based

on the ongoing market rate (called NAV or net

asset value) for the day. Every time, you invest

money, additional units of the scheme are

purchased at market rate and added to your

account. Hence, units are bought at different

rates and investors benefit from Rupee-Cost

averaging and the power of Compounding. Long Term Gains

Due to rupee-cost averaging and the power of

compounding SIPs have the potential to deliver

attractive returns over a long investment horizon.

Convenience – SIP is a hassle-free mode of

investment. You can issue standing instructions to

Rupee Cost Averaging your bank to facilitate auto-debits from your bank

With volatile markets, most investors remain account.

skeptical about the best time to invest and try to SIPs have proved to be an ideal mode of

“time” their entry into the market. Rupee-cost investment for retail investors who do not have

averaging allows you to opt out of the guessing the resources to pursue active investments.

game. Since you are a regular investor, your

money fetches more units when the price is low or

lesser when the price is high. During volatile ---- K.P.Singh

period, it may allow you to achieve a lower

average cost per unit.

Jigyasa –February, 2015 7

SOLDIER TURNED ENTREPRENEUR

“You shouldn’t focus on why you can’t do requirements. With Initial

something, which is what most people do. You investment of mere 4 Lacs he

should focus on why perhaps you can, and be started a small Factory and

one of the exceptions.” employed around 10 workers.

- Steve Case, co-founder of AOL. He made up his mind to

invest in Bakery products,

Attempt is to narrate a story of Rajeev and realizing people still used to

Sanjeev, retired Army soldiers & brothers, who are travel to town for such requirements. With Initial

currently running successful small scale industries investment of mere 4 Lacs he started a small

in a small Village called Lachmanghari located in Factory and employed around 10 workers. Rajeev

Bulandshar district of U.P. has been Successful in wining customers across all

nearby villages becoming sole distributor, making

almost 80K per month, after just being for a year

into this business.

Sanjeev too with the help of his brother has

recently set up a ‘Jaggery Factory’ with initial

investment of 10 Lacs employing 15-20 workers,

the business is a season old and 50% of investment

has already been recovered.

I have had the privilege of meeting these bothers

They joined Indian Army as soldiers at the age of when they were serving in Army, my grandparents

16 after completing their 10th std in the Municipal being their neighbors in the Village. This year I am

School, in mid-90’s leave internet even electricity looking forward to meet two successful

would take another 10 years to reach. entrepreneurs instead.

The stories they heard had ‘soldiers’ as heroes

and the father, whom they considered the real

hero would toil in fields for hours to meet the ends.

Rajeev being elder was first to realize the

responsibility and joined the Army, younger

brother Sanjeev followed later.

15 years after serving Army, most of their tenure

being in J&K, they held notable posts at Siachen,

retiring with honor they preferred to return to their

village. Rajeev had noticed in his short trips over

the years, the improvement in infrastructure, new

roads connecting the village and electricity If you have an idea, work on it, implement it, my

powering up the Tube wells. search for another success Story would end

sooner then.

He made up his mind to invest in Bakery products,

realizing people still used to travel to town for such ---Ankush Singh

Jigyasa –February, 2015 8

ON A LIGHTER NOTE

कई बार आपको कई शब्दों के ऐसे अर्थ पढ़ने या सन

ु ने

को मिलते हैं, जिन्हें पढ़ या सन

ु कर आपके चेहरे पर िस्

ु कुराहट

फैल िाती है । आि ऐसे ही कुछ अंग्रेिी के शब्दों के ििेदार

अर्थ आपके सािने है इन्हें पढ़कर िरूर आपके पेट िें हं सते-

हं सते बल पड़ िाएँगे।

cricket – गोल गट्ट

ु ि लक्कड़ फ़ट्टि दे दनादन प्रततयोगगता

Table Tennis – अष्टकोणी काष्ठ फलक पे ले टकाटक दे टकाटक

Lawn Tennis – हररत घास पर ले तड़ातड़ दे तड़ातड़

Light Bulb – विद्यत

ु प्रकामशत कांच गोलक

Tie – कंठ लंगोट

Match Box – अजनन उत्पादन पेटी

Traffic Signal – आिन िािन सच

ू क पट्टट्टका

Tea – दनु ध िल मिगित शकथरा यक्

ु त पिथतीय बट

ू ी

Train – सहस्र चक्र लौह पर् गामिनी/ अजनन रर्

Railway Station – अजनन रर् विराि स्र्ल

Rail Signal – लौह पर् आित िाित लाल रक्त पट्टट्टका

Button(In Clothes) – अस्त व्यस्त िस्र तनयंरक

Mosquito – गंि

ु नहारी िानि रक्त वपपासु िीि

Cigarette – धम्र

ू शलाका

All Route Pass – यर तर सिथर गिन आज्ञा पर

“A Bank is a place that will lend you money

If you can prove you don’t need it “

Jigyasa –February, 2015 9

RIDDLE

Match the columns for Country-Symbol of the currency-Title of Currency

Sr.No Nation Symbol Currency

1 Ireland Euro

2 Saudi Arabia Ruble

Israeli new shekel

3 Colombia

4 Israel Saudi Riyal

5 Russia Colombian Peso

CONGRATULATIONS

Congratulations Yogesh and Urvashi

A successful marriage requires falling in

love many times, always with the same

person.

The Celebrations have started for you

with wedding, may they last for lifetime.

Here wishing you a very blissful married

life

Congratulations Divyesh Deshwaria

On completing

M.S. - Manufacturing Management- from BITS Pilani

with CGPA of 9.06

This part time course is spread upon 4 semesters

(total 2 years) and covers subjects such as

Supply chain management ,Project management,

Marketing, TQM, Product design, Strategy mgmt. &

business policy

Jigyasa –February, 2015 10

CELEBRATIONS

Answers for Riddle: N5-S1-C2, N4-S2-C3,N3-S4-C5,N2-S5-C4,N1-S3-C1

Jigyasa –February, 2015 11

Jigyasa –February, 2015 12

You might also like

- Beginners Guide To Personal Finance PDFDocument22 pagesBeginners Guide To Personal Finance PDFLuke Mading100% (4)

- Passive Income in 2021Document25 pagesPassive Income in 2021Little Saves100% (1)

- NSDL Primer On Personal FinanceDocument180 pagesNSDL Primer On Personal FinanceRatnaPrasadNalam100% (1)

- Multiple Streams of IncomeDocument9 pagesMultiple Streams of IncomeWarren BuffetNo ratings yet

- How To Make Your Money Work HarderDocument32 pagesHow To Make Your Money Work HarderPrudential UK100% (1)

- How To Be A BillionaireDocument11 pagesHow To Be A BillionairehauNo ratings yet

- Passive Income Mastery: A Comprehensive Guide to Financial Freedom: FinancesFrom EverandPassive Income Mastery: A Comprehensive Guide to Financial Freedom: FinancesRating: 5 out of 5 stars5/5 (1)

- Financial LiteracyDocument30 pagesFinancial LiteracyRegine Mae MabulayNo ratings yet

- How To Start Your Investment Journey?Document59 pagesHow To Start Your Investment Journey?ElearnmarketsNo ratings yet

- 5 Ways Youre Killing Your Passive IncomeDocument12 pages5 Ways Youre Killing Your Passive IncomeayyashsyauqyNo ratings yet

- Rule 1 Cheat SheetDocument10 pagesRule 1 Cheat SheetPramodh RobbiNo ratings yet

- Become Your Own BankerDocument3 pagesBecome Your Own BankerKpsikaNo ratings yet

- Passive Income: How to Build Wealth Without Trading Time for Money and Achieve Financial Freedom Through Online Business, Entrepreneurship, Real Estate, Stock Market Investing, Dividends, and More.From EverandPassive Income: How to Build Wealth Without Trading Time for Money and Achieve Financial Freedom Through Online Business, Entrepreneurship, Real Estate, Stock Market Investing, Dividends, and More.Rating: 5 out of 5 stars5/5 (45)

- Hazardous Area Classification - Guidelines - Process and HSE EngineeringDocument30 pagesHazardous Area Classification - Guidelines - Process and HSE EngineeringSivapriya SamyNo ratings yet

- Itthad ChemicalsDocument50 pagesItthad ChemicalsZavyar100% (2)

- Integrated Township and Smart CitiesDocument34 pagesIntegrated Township and Smart Citieschetankhanna93No ratings yet

- Money Management PhilosophiesDocument18 pagesMoney Management PhilosophiesSuzaine Camilo100% (1)

- Practice Midterm SolutionsDocument18 pagesPractice Midterm SolutionsGNo ratings yet

- Investing for Beginners: Minimize Risk, Maximize Returns, Grow Your Wealth, and Achieve Financial Freedom Through The Stock Market, Index Funds, Options Trading, Cryptocurrency, Real Estate, and More.From EverandInvesting for Beginners: Minimize Risk, Maximize Returns, Grow Your Wealth, and Achieve Financial Freedom Through The Stock Market, Index Funds, Options Trading, Cryptocurrency, Real Estate, and More.Rating: 5 out of 5 stars5/5 (49)

- The Passive Income Mindset: Smart Ways to Achieve Financial FreedomFrom EverandThe Passive Income Mindset: Smart Ways to Achieve Financial FreedomRating: 3.5 out of 5 stars3.5/5 (6)

- The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical CounselFrom EverandThe Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical CounselNo ratings yet

- 8th Maintenance Forum-Presentation-finalDocument31 pages8th Maintenance Forum-Presentation-finalSivapriya SamyNo ratings yet

- 2015 Bar Q - MERCANTILE LAWDocument16 pages2015 Bar Q - MERCANTILE LAWLimVianesseNo ratings yet

- Investing - The Beginner's Guide to Investing: The Foundation of Knowledge That All Rich Investors HaveFrom EverandInvesting - The Beginner's Guide to Investing: The Foundation of Knowledge That All Rich Investors HaveRating: 4 out of 5 stars4/5 (2)

- How to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingFrom EverandHow to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingNo ratings yet

- Understanding Fire and Gas MappingDocument26 pagesUnderstanding Fire and Gas MappinghiosmoNo ratings yet

- SEBI Financial Education Booklet English 02122021053656Document73 pagesSEBI Financial Education Booklet English 02122021053656JayNo ratings yet

- Personal FinanceDocument24 pagesPersonal FinanceKirosTeklehaimanotNo ratings yet

- NOV Piggy BankDocument4 pagesNOV Piggy BankDenzelle Anne GonzalesNo ratings yet

- SRE Intro To Financial PlanningDocument11 pagesSRE Intro To Financial PlanningKaran GuptaNo ratings yet

- Introduction To Investment Maam KassDocument7 pagesIntroduction To Investment Maam KassKassandra KayNo ratings yet

- What Are The Five Core Competencies of Financial Literacy? Five Core CompetenciesDocument2 pagesWhat Are The Five Core Competencies of Financial Literacy? Five Core CompetenciesMaria Riza ValenciaNo ratings yet

- Presentati On For Viva: Akshita Subhash PatilDocument25 pagesPresentati On For Viva: Akshita Subhash PatilAkshita patilNo ratings yet

- RichDocument6 pagesRichmanish.ee.2.718No ratings yet

- Lesson 5 - Creating WealthDocument8 pagesLesson 5 - Creating WealthMarc Loui RiveroNo ratings yet

- Basic ConceptDocument11 pagesBasic ConceptSoumya TiwaryNo ratings yet

- SPECIAL REPORT - 8 Steps To Financial FreedomDocument16 pagesSPECIAL REPORT - 8 Steps To Financial Freedomkhanhduy10214No ratings yet

- Investment in Stock Market NotesDocument11 pagesInvestment in Stock Market Notesappuzzz2000zzzzNo ratings yet

- Planning For RetirementDocument9 pagesPlanning For RetirementMaimai DuranoNo ratings yet

- I Put Half of My Retirement Savings Into These InvestmentsDocument13 pagesI Put Half of My Retirement Savings Into These InvestmentsEugeneNo ratings yet

- Wealth ManagementDocument14 pagesWealth ManagementYousha KhanNo ratings yet

- The Halal Investment Checklist: A Step-By-Step Guide + 7 Great Places To Put Your Money To Build Your WealthDocument21 pagesThe Halal Investment Checklist: A Step-By-Step Guide + 7 Great Places To Put Your Money To Build Your WealthRmxNo ratings yet

- Business Finance Second QuarterDocument28 pagesBusiness Finance Second QuarterJessa GallardoNo ratings yet

- Home Makers: Investment PlanningDocument30 pagesHome Makers: Investment PlanningmishrackantNo ratings yet

- Our Founder Reliance InfoDocument22 pagesOur Founder Reliance Infosagar09No ratings yet

- Finideas - Steps Towards Financial FreedomDocument28 pagesFinideas - Steps Towards Financial FreedomChetan KumarNo ratings yet

- Investing, Purchaing Power, & Frictional CostsDocument12 pagesInvesting, Purchaing Power, & Frictional Costss2mcpaul100% (1)

- Lesson 13 - Creating-WealthDocument5 pagesLesson 13 - Creating-WealthKaryll Kelvet GoñaNo ratings yet

- Optimizing On TaxDocument2 pagesOptimizing On TaxvijaysNo ratings yet

- Key Financial Management Skills For Small Businesses - English-CompressedDocument8 pagesKey Financial Management Skills For Small Businesses - English-CompressedNGANJANI WALTERNo ratings yet

- Lesson 1Document28 pagesLesson 1June Ann OberezNo ratings yet

- Unovest The LightHouse April 2023 EditionDocument26 pagesUnovest The LightHouse April 2023 EditionJpNo ratings yet

- Investing Retirement Savings in Zero-Risk Products Is A Terrible Idea - The Economic TimesDocument2 pagesInvesting Retirement Savings in Zero-Risk Products Is A Terrible Idea - The Economic Timesvparthibban37No ratings yet

- Microfinance and Development Session 5Document16 pagesMicrofinance and Development Session 5Anthony John BrionesNo ratings yet

- Determinants of Risk AppetiteDocument38 pagesDeterminants of Risk AppetitedmewadaNo ratings yet

- 1 Learn To Earn 21042023 105748 AMDocument3 pages1 Learn To Earn 21042023 105748 AMmrumar7850No ratings yet

- Personal Finance 101: ChecklistDocument3 pagesPersonal Finance 101: ChecklistunifespwiebNo ratings yet

- 04 Handout 2Document7 pages04 Handout 2jerome cortonNo ratings yet

- SEBI-Financial Education Booklet - October 2021Document73 pagesSEBI-Financial Education Booklet - October 2021Aniruddha PatilNo ratings yet

- Retirement Planning Guide Book: Expert Strategic Choices to Turbocharge Your Retirement WealthFrom EverandRetirement Planning Guide Book: Expert Strategic Choices to Turbocharge Your Retirement WealthNo ratings yet

- Behavioral Finance BookDocument17 pagesBehavioral Finance BookRitesh BagholeNo ratings yet

- Perfin Unit 2Document3 pagesPerfin Unit 2Johnloyd daracanNo ratings yet

- Financial Planning - Webinar 1Document12 pagesFinancial Planning - Webinar 1Pakistan Stock Exchange Limited PSXNo ratings yet

- The laws of Wealth: Unlock the Secrets to Prosperity and Lifelong AffluenceFrom EverandThe laws of Wealth: Unlock the Secrets to Prosperity and Lifelong AffluenceNo ratings yet

- 2nd Grade Circle Noun 1 1Document1 page2nd Grade Circle Noun 1 1Sivapriya SamyNo ratings yet

- Trans Chapter7Document48 pagesTrans Chapter7Sivapriya SamyNo ratings yet

- LNG physical propertiesDocument6 pagesLNG physical propertiesSivapriya SamyNo ratings yet

- 031416crSmokeAlarmDocument2 pages031416crSmokeAlarmSivapriya SamyNo ratings yet

- Specification For Fireproofingof Structural Steel and EquipmentDocument11 pagesSpecification For Fireproofingof Structural Steel and EquipmentSivapriya SamyNo ratings yet

- SP 1075Document65 pagesSP 1075cyruskuleiNo ratings yet

- Mil HDBK 217FDocument80 pagesMil HDBK 217FSivapriya SamyNo ratings yet

- Noise CalculatorDocument9 pagesNoise CalculatorSivapriya SamyNo ratings yet

- Manaji Rajput: Vendor Recruitment Company Jal International Al Yousuf Enterprises Name Production EngineerDocument2 pagesManaji Rajput: Vendor Recruitment Company Jal International Al Yousuf Enterprises Name Production EngineerSivapriya SamyNo ratings yet

- Gasification Technology For Rolling Mills - PPTDocument29 pagesGasification Technology For Rolling Mills - PPTSivapriya SamyNo ratings yet

- Part Time PG Diploma in Scientific Computing and Industrial MathematicsDocument20 pagesPart Time PG Diploma in Scientific Computing and Industrial MathematicsSivapriya SamyNo ratings yet

- IRCTC LTD, Booked Ticket Printing2Document2 pagesIRCTC LTD, Booked Ticket Printing2Siva TejaNo ratings yet

- IMChap 001Document19 pagesIMChap 001Saida BanooNo ratings yet

- Edgestone Capital Equity FundDocument2 pagesEdgestone Capital Equity Fund/jncjdncjdnNo ratings yet

- Cost of CapitalDocument68 pagesCost of CapitalJohn Ervin TalagaNo ratings yet

- BM60112 - CFFA - FP 2021 - v1.0Document2 pagesBM60112 - CFFA - FP 2021 - v1.0MousumiNo ratings yet

- Ch03 Accounting Information SystemDocument56 pagesCh03 Accounting Information SystemdadiiNo ratings yet

- Investment GuideDocument72 pagesInvestment Guideaqibaziz76No ratings yet

- Challinor - Debunking STDocument6 pagesChallinor - Debunking STLyra Loh Hui Min100% (1)

- Intern Report On BRAC BANk LimitedDocument81 pagesIntern Report On BRAC BANk LimitedRoni KumarNo ratings yet

- AAMD's 2011 Statistical SurveyDocument6 pagesAAMD's 2011 Statistical SurveyLee Rosenbaum, CultureGrrlNo ratings yet

- Mahindra Annual Report SummaryDocument3 pagesMahindra Annual Report Summaryvishakha AGRAWALNo ratings yet

- 200case StudyDocument11 pages200case StudyRituraj ShekharNo ratings yet

- IPO Factsheet Cosmos Technology International BerhadDocument2 pagesIPO Factsheet Cosmos Technology International Berhadsj7953No ratings yet

- Xa M S. In: Rishi Academy of Competitive ExamsDocument26 pagesXa M S. In: Rishi Academy of Competitive Examsraghu_534No ratings yet

- Graded Exam #1Document14 pagesGraded Exam #1RamsyNo ratings yet

- 4NI20CS104 SklitaDocument12 pages4NI20CS104 SklitaSandeep HangaragiNo ratings yet

- MBAB 5P01 - Chapter 1Document3 pagesMBAB 5P01 - Chapter 1Priya MehtaNo ratings yet

- Foreign Market Selection ProcessDocument26 pagesForeign Market Selection ProcessSaurabh GuptaNo ratings yet

- Specialty Pharma - Exploiting Growth Opportunities in The New Industry SpaceDocument196 pagesSpecialty Pharma - Exploiting Growth Opportunities in The New Industry SpacevishansNo ratings yet

- Chapter 5Document42 pagesChapter 5Annalyn MolinaNo ratings yet

- ACCA SBR PapersDocument9 pagesACCA SBR PapersKaran KumarNo ratings yet

- Developing A TargetDocument6 pagesDeveloping A Targetraja2jayaNo ratings yet

- Purely PrahaladDocument94 pagesPurely PrahaladChalam Jayavarapu100% (1)

- Birla Cable SplitDocument3 pagesBirla Cable SplitJoydeep GoraiNo ratings yet

- Ratio AnalysisDocument114 pagesRatio Analysisanil_birre1No ratings yet

- Mahagun Presents Mantra, Plot No - GH-01A, Sec-10, Greater Noida (W) - 201301 Location AdvantageDocument4 pagesMahagun Presents Mantra, Plot No - GH-01A, Sec-10, Greater Noida (W) - 201301 Location Advantageshannbaby22No ratings yet

- Case Digest - The Corporate Brand: Help or Hindrance?Document4 pagesCase Digest - The Corporate Brand: Help or Hindrance?Nic SaraybaNo ratings yet