Professional Documents

Culture Documents

Law-P6.3 2022

Law-P6.3 2022

Uploaded by

bijay.desunOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law-P6.3 2022

Law-P6.3 2022

Uploaded by

bijay.desunCopyright:

Available Formats

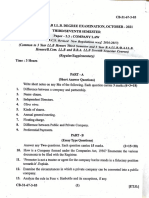

Total Pages—2 C/22/3Yr/LLB/6th Sem/6.

!î”Äy¢y†îû !îÙ»!î”Äyœëû

VIDYASAGAR UNIVERSITY

3 Year L.L.B.

ity

6th Semester Examination 2022

rs

PRINCIPLES OF TAXATION LAW

ive

PAPER—6.3

Un

Full Marks : 80

Time : 3 Hours

ar

The figures in the right-hand margin indicate full marks.

ag

Candidates are required to give their answers in their

own words as far as practicable.

as

Illustrate the answers wherever necessary.

dy

Group – A

Answer any one question. 1×16

Vi

1. Discuss the classification of taxes. 16

2. Explain the following : 8+8

(a) Features of Tax.

(b) Uses of Tax.

2

Group – B

Answer any two questions. 2×16

3. (a) Discuss the provisions of ‘Total Income’.

(b) Define ‘Assessee’. 12+4

4. (a) Discuss the Residential status of a company.

(b) Write down the concept of ‘Income deemed to accrue or arise in India’.

ity

(c) Define ‘Assessment year’. 4+10+2

rs

5. (a) Define ‘Salary’.

ive

(b) Discuss the concept of ‘Gratuity’ and ‘Leave Salary’. 6+10

Un

Group – C

ar

Answer any two questions. 2×16

ag

6. Discuss the provisions relating to the ‘Registration of dealers’ according

to the West Bengal Value Added Tax Act 2003. 16

as

7. Discuss the concept of offences and penalties under Central Excise Act.

dy

16

Vi

8. Discuss the following :

(a) Advantages and disadvantages of VAT.

(b) The provisions relating to submission of return according to Service

Tax rules. 10+6

C/22/3Yr/LLB/6th Sem/6.3

You might also like

- Cheat Sheet TaxDocument6 pagesCheat Sheet TaxShravan NiranjanNo ratings yet

- Taxation 1 Course Syllabus A. General Principles of Taxation I. TaxationDocument11 pagesTaxation 1 Course Syllabus A. General Principles of Taxation I. TaxationAjay Ann De La CruzNo ratings yet

- Let's Practise: Maths Workbook Coursebook 5From EverandLet's Practise: Maths Workbook Coursebook 5No ratings yet

- Company - Law - 2021Document2 pagesCompany - Law - 2021Praveen Kumar KokkantiNo ratings yet

- Accountancy: Mock PaperDocument24 pagesAccountancy: Mock PaperSuman Bala0% (1)

- Namma Kalvi 12th Accountancy Loyola Guide em 219220 PDFDocument75 pagesNamma Kalvi 12th Accountancy Loyola Guide em 219220 PDFBharath JawaharNo ratings yet

- Math Achievement, Grade 1: Enriching Activities Based on NCTM StandardsFrom EverandMath Achievement, Grade 1: Enriching Activities Based on NCTM StandardsNo ratings yet

- 2021 S.3 1st Term TestDocument11 pages2021 S.3 1st Term Testirene fungNo ratings yet

- Practice Problems - Decision AnalysisDocument3 pagesPractice Problems - Decision AnalysisasaqNo ratings yet

- Let's Practise: Maths Workbook Coursebook 6From EverandLet's Practise: Maths Workbook Coursebook 6No ratings yet

- 2ndmonthly Exam - GMDocument2 pages2ndmonthly Exam - GMJonavi Luyong100% (1)

- Introductory Mathematical Analysis For Business Economics and The Life and Social Sciences 14Th Edition Paul Test Bank Full Chapter PDFDocument52 pagesIntroductory Mathematical Analysis For Business Economics and The Life and Social Sciences 14Th Edition Paul Test Bank Full Chapter PDFmrissaancun100% (10)

- Law LLB 6.3Document2 pagesLaw LLB 6.3bijay.desunNo ratings yet

- Company Law 2022 Question PaperDocument2 pagesCompany Law 2022 Question PaperPraveen Kumar KokkantiNo ratings yet

- CMA December 2019Document4 pagesCMA December 2019Nazneen BashirNo ratings yet

- BankingLaw 2022Document2 pagesBankingLaw 2022Praveen Kumar KokkantiNo ratings yet

- III Semester CSE & CSTDocument11 pagesIII Semester CSE & CSTSuthari AmbikaNo ratings yet

- Derivatives and Risk ManagementDocument2 pagesDerivatives and Risk ManagementAivin JosephNo ratings yet

- B-I - Economics IDocument20 pagesB-I - Economics IANAND R. SALVENo ratings yet

- Introduction To Optimization MS&E 111/MS&E 211/ENGR 62 HW2 Course Instructor: Ashish GoelDocument3 pagesIntroduction To Optimization MS&E 111/MS&E 211/ENGR 62 HW2 Course Instructor: Ashish GoelMuhammad Raza RafiqNo ratings yet

- Final Model Paper SSC-I General MathsDocument8 pagesFinal Model Paper SSC-I General Mathsak1875235No ratings yet

- Advanced Financial Accounting Sample Paper 3Document27 pagesAdvanced Financial Accounting Sample Paper 3Vijay SinghNo ratings yet

- Law-P6.2 2022Document3 pagesLaw-P6.2 2022bijay.desunNo ratings yet

- Himilo University: Direct QuestionsDocument2 pagesHimilo University: Direct QuestionsSabina MaxamedNo ratings yet

- Nims Group of Schools, Uae: (Accounting For Partnership Firms and Companies)Document10 pagesNims Group of Schools, Uae: (Accounting For Partnership Firms and Companies)qx6qm7yfgvNo ratings yet

- MS-Accountancy-12-Practice Paper 2Document9 pagesMS-Accountancy-12-Practice Paper 2im subbing to everyone subbing to meNo ratings yet

- Accounts Class 12 Set 2Document21 pagesAccounts Class 12 Set 2Jelli UNo ratings yet

- Set 2Document41 pagesSet 2zainab.xf77No ratings yet

- GENERAL MATH MODEL PAPER 9thDocument2 pagesGENERAL MATH MODEL PAPER 9thHasnain Ahmad KhanNo ratings yet

- R.exam - 9 (25.10.2020)Document7 pagesR.exam - 9 (25.10.2020)KOTHA SAINo ratings yet

- Btech 1 Sem Basic Mathematics 1 75371 Dec 2020Document2 pagesBtech 1 Sem Basic Mathematics 1 75371 Dec 2020Siddhartha JadounNo ratings yet

- Class Xi Accountancy 7.depreciation, Provisions and Reserves (Competency - Based Test Items) Marks WiseDocument20 pagesClass Xi Accountancy 7.depreciation, Provisions and Reserves (Competency - Based Test Items) Marks Wisegowtham.ttfaNo ratings yet

- Accounts Question PaperDocument7 pagesAccounts Question PaperMahi GuptaNo ratings yet

- Acc Xi See QP With BP, MS-31-43Document13 pagesAcc Xi See QP With BP, MS-31-43Sanjay PanickerNo ratings yet

- Income Tax MCQ PDFDocument26 pagesIncome Tax MCQ PDFSachin PanchalNo ratings yet

- Maths Class 5 Mid TermDocument2 pagesMaths Class 5 Mid TermbeakraamNo ratings yet

- Brief MathsDocument10 pagesBrief Mathsudesh ishankaNo ratings yet

- Re-Sendup 05.01.2024 Class 9 General MathematicsDocument2 pagesRe-Sendup 05.01.2024 Class 9 General MathematicsAdeelNo ratings yet

- FINA 200 Sample Final ExamDocument19 pagesFINA 200 Sample Final ExamHC1990No ratings yet

- AS Model Question PaperDocument4 pagesAS Model Question PaperKumuthaa IlangovanNo ratings yet

- UACE Economics 2017 Paper 1Document3 pagesUACE Economics 2017 Paper 1fahrah daudaNo ratings yet

- Sample Paper Class 12Document13 pagesSample Paper Class 12akshatbarnwal124No ratings yet

- Screenshot 2024-02-15 at 11.26.31 PMDocument16 pagesScreenshot 2024-02-15 at 11.26.31 PMfaiq19561No ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Mathematics)Document3 pagesAllama Iqbal Open University, Islamabad: (Department of Mathematics)ilyas muhammadNo ratings yet

- BA-BBA-BCom LL.B-I-ECONOMICS I FC03 CC03Document1 pageBA-BBA-BCom LL.B-I-ECONOMICS I FC03 CC03vijay.s12usNo ratings yet

- QP - Xii - Economics - Unit Test 1 - Set A - 2021-22Document5 pagesQP - Xii - Economics - Unit Test 1 - Set A - 2021-22Vivek SahNo ratings yet

- EXAM MATHEMATICS S4 AccDocument4 pagesEXAM MATHEMATICS S4 AccMUHIREALNo ratings yet

- 2nd Semester Both Sec All Mid QuestionDocument7 pages2nd Semester Both Sec All Mid QuestionSahadat Hosen ArnavNo ratings yet

- J.K Shah Full Course Practice Question PaperDocument10 pagesJ.K Shah Full Course Practice Question PapermridulNo ratings yet

- Question 1289909Document11 pagesQuestion 1289909groverpankaj04No ratings yet

- Operation Research Sec BDocument11 pagesOperation Research Sec BTremaine AllenNo ratings yet

- (Case Studies) - ValuationDocument96 pages(Case Studies) - Valuationofficialmailarun123No ratings yet

- Introductory Mathematical Analysis For Business Economics and The Life and Social Sciences 14th Edition Paul Test BankDocument44 pagesIntroductory Mathematical Analysis For Business Economics and The Life and Social Sciences 14th Edition Paul Test Bankjesselact0vvk100% (28)

- Cost and Management Accounting-QP-6th Sem-2014 To 2022Document18 pagesCost and Management Accounting-QP-6th Sem-2014 To 2022vyshna2002ekNo ratings yet

- S8 Banking LawDocument11 pagesS8 Banking LawTomin K VargheseNo ratings yet

- FM & Eco - Test 1Document3 pagesFM & Eco - Test 1Ritam chaturvediNo ratings yet

- MAS 132 - Statistics IIDocument6 pagesMAS 132 - Statistics IIAmit Kumar AroraNo ratings yet

- 12 Acc SP 04aDocument26 pages12 Acc SP 04aठाकुर रुद्र प्रताप सिंहNo ratings yet

- ACT B861F - Tutorial Questions and SolutionDocument13 pagesACT B861F - Tutorial Questions and SolutionCalvin MaNo ratings yet

- Economics Sample Paper 2019 PDFDocument8 pagesEconomics Sample Paper 2019 PDFDaksh DhamiNo ratings yet

- Applied Math Test Paper - Xi Set 3 - Sem 2Document4 pagesApplied Math Test Paper - Xi Set 3 - Sem 2Prajin MuruganNo ratings yet

- Tut Ebook Let s1 2011 13th EdDocument25 pagesTut Ebook Let s1 2011 13th EdCamilia ZhangNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791No ratings yet

- 6 Customer ProfitabilityDocument23 pages6 Customer ProfitabilityVivek SahNo ratings yet

- Maa Ujaleswari Tour & Travels: Name: Address: Dist.: Contact No.Document1 pageMaa Ujaleswari Tour & Travels: Name: Address: Dist.: Contact No.Kamala MotorNo ratings yet

- Pre Colonial Ancient Filipinos Practice Paying Taxes For The Protection From Their "Datu". The Spanish EraDocument4 pagesPre Colonial Ancient Filipinos Practice Paying Taxes For The Protection From Their "Datu". The Spanish EraAbegael Joyce RiveraNo ratings yet

- Tax NotesDocument23 pagesTax Noteslavkush1234No ratings yet

- Purchase Order FormatDocument1 pagePurchase Order Formatsri Venkateshwara gear wheelsNo ratings yet

- Internet Bill Mar 2023Document2 pagesInternet Bill Mar 2023gsreekrishna27No ratings yet

- Sep 706 Jio BillDocument2 pagesSep 706 Jio Billvishwa0202No ratings yet

- Gst-Act: Goods and Services Tax. One Nation-One TaxDocument63 pagesGst-Act: Goods and Services Tax. One Nation-One TaxKunal ChawlaNo ratings yet

- Chapter 1 - Introduction To TaxationDocument43 pagesChapter 1 - Introduction To TaxationGladysNo ratings yet

- Gmail - Ticket For Dehradun-DelhiDocument1 pageGmail - Ticket For Dehradun-DelhiPRASHANT VAISHNAVNo ratings yet

- HT 23 24 1438Document1 pageHT 23 24 1438KarthickNo ratings yet

- Turn Any App Into A Wallet EbookDocument21 pagesTurn Any App Into A Wallet EbookAmbi DexterNo ratings yet

- Utility Bill Template 02Document5 pagesUtility Bill Template 02dzh4422No ratings yet

- C 3 Project Investment EvaluationDocument21 pagesC 3 Project Investment EvaluationAbenezer WondimuNo ratings yet

- Invoice Dmart 6811264Document1 pageInvoice Dmart 6811264Siva MahanthyNo ratings yet

- Parmesh Construction Co. LTD - (From 1-Apr-2015: Particulars Credit DebitDocument3 pagesParmesh Construction Co. LTD - (From 1-Apr-2015: Particulars Credit DebitAshish MishraNo ratings yet

- Bank StatementDocument9 pagesBank Statementadarsh marketingNo ratings yet

- 13 37Document2 pages13 37mynameisjca1No ratings yet

- Personal Banking SOC POSTERDocument1 pagePersonal Banking SOC POSTERmrv462No ratings yet

- Previous Bill This Bill: Your Payment HistoryDocument4 pagesPrevious Bill This Bill: Your Payment HistorySuchitra WathiNo ratings yet

- 3 Depreciation 2Document84 pages3 Depreciation 2Angel NaldoNo ratings yet

- G.O. Rt. No. 611Document2 pagesG.O. Rt. No. 611Surya TejaNo ratings yet

- DOF Order No. 137-87Document8 pagesDOF Order No. 137-87AicaPascual100% (1)

- Conditional Sale of A Parcel of Land-De VeraDocument3 pagesConditional Sale of A Parcel of Land-De VeraJohn Mark ParacadNo ratings yet

- Tally - All in One (Part) - 2Document3 pagesTally - All in One (Part) - 2A KumarNo ratings yet

- Tuition Fee Deposit PolicyDocument8 pagesTuition Fee Deposit PolicyRuddro IslamNo ratings yet

- SmartphoneDocument1 pageSmartphoneNur Syahira KhalidNo ratings yet