Professional Documents

Culture Documents

Final Withholding Tax

Uploaded by

gwynethvm030 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

FINAL_WITHHOLDING_TAX(2)(4)(3)(2)(2)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesFinal Withholding Tax

Uploaded by

gwynethvm03Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

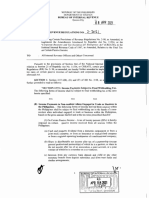

FINAL WITHHOLDING TAX

TAX TAX ATC

DESCRIPTION

TYPE RATE IND CORP

Interest on Foreign loans payable to Non-Resident Foreign WC18

WF 20%

Corporation (NRFCs) 0

Interest and other income payments on foreign currency WC19

WF 10%

transactions/loans payable of Offshore Banking Units (OBUs) 0

Interest and other income payments on foreign currency

WC19

WF transactions/loans payable of Foreign Currency Deposits Units 10%

1

(FCDUs)

W120

Cash dividend payment by domestic corporation to citizens ans 10%

WF 2

residents aliens/NRFCs

30% WC212

WI20

Property dividend payment by domestic corporation to citizens 10%

WF 3

and resident aliens/NRFCs

30% WC213

Cash dividend payment by domestic corporation to NFRCs

WC22

WF whose countries allowed tax deemed paid credit (subject to 15%

2

tax sparing rule)

Property dividend payment by domestic corporation to NFRCs

whose countries allowed tax deemed paid credit (subject to 15% WC223

tax sparing rule)

Cash dividend payment by domestic corporation to non-

WI22

WF resident alien engaged in Trade or Business within the 20%

4

Philippines (NRAETB)

WI22

WF Property dividend payment by domestic corporation to NRAETB 20%

5

Share of NRAETB in the distributable net income after tax of a

partnership (except GPPs) of which he is a partner, or share in

WI22

WF the net income after tax of an association, joint account or a 20%

6

joint venture taxable as a corporation of which he is a member

or a co-venturer

WF On other payments to NRFCs 30% WC230

Distributive share of individual partners in a taxable

WI24

WF partnership, association, joint account or joint venture or 10%

0

consortium

All kinds of royalty payments to citizens, resident aliens and

WI25 WC25

WF NRAETB (other than WI380 and WI341), domestic and resident 20%

0 0

foreign corporations

On prizes exceeding P10,000 and other winnings paid to WI26

WF 20%

individuals 0

Branch profit remittance by all corporations except

WF 15% WC280

PEZA/SBMA/CDA registered

On the gross rentals, lease and charter fees derived by non-

WF 4.5% WC290

resident owner or lessor of foreign vessels

On gross rentals, charter and other fees derived by non-

WF 7.5% WC300

resident lessor or aircraft, machineries and equipment

On payments to oil exploration service contractors/sub- WI31

WF 8% WC310

contractors 0

Payments to non-resident alien not engage in trade or business

WI33

WF within the Philippines (NRANETB) except on sale of shares in 25%

0

domestic corporation and real property

On payments to non-residnet individual/foreign corporate WI34

WF 25% WC340

cinematographic film owners, lessors or distributors 0

Royalties paid to NRAETB on cinematographic films and similar WI34

WF 25%

works 1

Final tax on interest or other payments upon tax-free covenant

WI35

WF bonds, mortgages, deeds of trust or other obligations under 30%

0

Sec. 57C of the NIRC of 1997, as amended

Royalties paid to citizens, resident aliens and nraetb on books, WI38

WF 10%

other literary works and musical compositions 0

WI41

WF Informers cash reward to individuals/juridical persons 10% WC410

0

Cash on property dividend paid by a Real Estate Investment WI70

WF 10% WC700

Trust 0

You might also like

- US Tax Refund MethodDocument4 pagesUS Tax Refund MethodGonza Fred100% (5)

- Solution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, RaoDocument5 pagesSolution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, Raoa289899847No ratings yet

- Chapter 05 Final Income Taxation1Document2 pagesChapter 05 Final Income Taxation1raven dayritNo ratings yet

- Some Thoughts About RetributivismDocument24 pagesSome Thoughts About RetributivismMAVillarNo ratings yet

- Achievers in Focus (JAN - 2023)Document124 pagesAchievers in Focus (JAN - 2023)Moumi DeNo ratings yet

- Economic Impact of Accelerating Permit Local Development and Govt RevenuesDocument6 pagesEconomic Impact of Accelerating Permit Local Development and Govt RevenuesQQuestorNo ratings yet

- Tesla Motors Expansion StrategyDocument26 pagesTesla Motors Expansion StrategyVu Nguyen75% (4)

- 2306 PDFDocument1 page2306 PDFMaria Pia Miranda GuiaoNo ratings yet

- Monthly Remittance Return of Final Income Taxes Withheld: Kawanihan NG Rentas InternasDocument2 pagesMonthly Remittance Return of Final Income Taxes Withheld: Kawanihan NG Rentas InternasAlfred BryanNo ratings yet

- Activity4 MPortarcosDocument14 pagesActivity4 MPortarcosMichaela T PortarcosNo ratings yet

- Tax On CorporationsDocument37 pagesTax On CorporationsvanNo ratings yet

- Tax Rate SummaryDocument3 pagesTax Rate SummaryPamela Jean CuyaNo ratings yet

- Tax Table Corporations 2022Document4 pagesTax Table Corporations 2022Xandredg Sumpt LatogNo ratings yet

- Source Final Tax: Interest Income or Yield From Local Currency Bank Deposits or Deposit SubstitutesDocument3 pagesSource Final Tax: Interest Income or Yield From Local Currency Bank Deposits or Deposit SubstitutesJhon Ariel JulatonNo ratings yet

- Passive-Income MidtermsDocument2 pagesPassive-Income MidtermsJessa Belle EubionNo ratings yet

- CPAR Tax On Corporations (Batch 89) - HandoutDocument28 pagesCPAR Tax On Corporations (Batch 89) - HandoutMark LapidNo ratings yet

- Withholding Taxes Learning ObjectivesDocument8 pagesWithholding Taxes Learning ObjectivesAce AlquinNo ratings yet

- FWTX, CWTX and CGTX (Points To Remember and Tax Rates)Document2 pagesFWTX, CWTX and CGTX (Points To Remember and Tax Rates)Justz LimNo ratings yet

- HO4Passive Income - Revision 1Document2 pagesHO4Passive Income - Revision 1Christopher SantosNo ratings yet

- Appendix A Final Withholding Tax TableDocument3 pagesAppendix A Final Withholding Tax TablemaureenNo ratings yet

- TAX of PinalizeDocument19 pagesTAX of PinalizeDennis IsananNo ratings yet

- Tax On Certain Passive IncomeDocument2 pagesTax On Certain Passive IncomeCristel Ann DotimasNo ratings yet

- Corporate TaxationDocument11 pagesCorporate TaxationYoite MiharuNo ratings yet

- W14 Module 12withholding TaxesDocument7 pagesW14 Module 12withholding Taxescamille ducutNo ratings yet

- Certificate of Final Income Tax Withheld: BIR Form NoDocument3 pagesCertificate of Final Income Tax Withheld: BIR Form NoTophe ProvidoNo ratings yet

- Corporation GPP Income Taxation PDFDocument22 pagesCorporation GPP Income Taxation PDFMaeNo ratings yet

- Final Tax Rates Notes: General CoverageDocument3 pagesFinal Tax Rates Notes: General CoverageDarius DelacruzNo ratings yet

- Final Tax Rates Notes: General CoverageDocument3 pagesFinal Tax Rates Notes: General CoverageDarius DelacruzNo ratings yet

- Handout - 03 CorporationDocument10 pagesHandout - 03 CorporationKiyo KoNo ratings yet

- Bir Form 1600Document3 pagesBir Form 1600Joseph Rod Allan AlanoNo ratings yet

- Final Income Taxation,: As Amended by Train LawDocument29 pagesFinal Income Taxation,: As Amended by Train LawElle Vernez100% (1)

- Tax Tables Latest Revisions 2022Document2 pagesTax Tables Latest Revisions 2022Novyh Angelique CabreraNo ratings yet

- Business IncomeDocument11 pagesBusiness IncomeIrish D DagmilNo ratings yet

- Tax ReviewerDocument10 pagesTax Revieweraira nialaNo ratings yet

- Taxation-2 2Document5 pagesTaxation-2 2Yeshua Liebt PhoenixNo ratings yet

- Final Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Document109 pagesFinal Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Bien Bowie A. CortezNo ratings yet

- Budget Synopsis Fy 2078-79 - TDSDocument1 pageBudget Synopsis Fy 2078-79 - TDSSahu BhaiNo ratings yet

- Withholding Tax On Government Money PaymentsDocument2 pagesWithholding Tax On Government Money Paymentsgwynethvm03No ratings yet

- RateDocument3 pagesRatemikamiiNo ratings yet

- General Rule: Types of Income Subject To TaxDocument2 pagesGeneral Rule: Types of Income Subject To TaxNikolai DanielovichNo ratings yet

- EX EX EX EX: Regular Income TaxDocument7 pagesEX EX EX EX: Regular Income TaxMary Leigh TenezaNo ratings yet

- TDS ChartDocument4 pagesTDS ChartjaoceelectricalNo ratings yet

- Individual Income Tax NOTESDocument1 pageIndividual Income Tax NOTESNavsNo ratings yet

- Regular Business/Corporate Tax: DC RFC NRFCDocument2 pagesRegular Business/Corporate Tax: DC RFC NRFCGrace Angelie C. Asio-SalihNo ratings yet

- Module No. 2 - Special CorporationsDocument8 pagesModule No. 2 - Special CorporationsJohn Russel PacunNo ratings yet

- FT TableDocument4 pagesFT TableChantie BorlonganNo ratings yet

- San Beda College of Law: 2005 C B O Annex B T R CDocument3 pagesSan Beda College of Law: 2005 C B O Annex B T R CRachel LeachonNo ratings yet

- Income Taxation (With Create Bill Application) Com-Ex ReviewerDocument4 pagesIncome Taxation (With Create Bill Application) Com-Ex Reviewerlonely ylenolNo ratings yet

- TAX 702 - Income Tax Rates CorporationsDocument6 pagesTAX 702 - Income Tax Rates CorporationsJuan Miguel UngsodNo ratings yet

- Tax InformationDocument11 pagesTax InformationHenry WoodsNo ratings yet

- A.J. Gen. MerchandisingDocument5 pagesA.J. Gen. MerchandisingErish Jay ManalangNo ratings yet

- Class Notes On Income Tax On CorporationsDocument3 pagesClass Notes On Income Tax On CorporationsJeremie R. PlazaNo ratings yet

- Sample 2307 2017Document4 pagesSample 2307 2017jordzNo ratings yet

- 2018 Income Tax RatesDocument14 pages2018 Income Tax RatesMaria Celiña PerezNo ratings yet

- FT and CGTDocument12 pagesFT and CGTLiyana ChuaNo ratings yet

- Table of Creditable Withholding Tax RatesDocument4 pagesTable of Creditable Withholding Tax RatesZandra Mari Dela PenaNo ratings yet

- Classification of Corporations: Ordinary Income Corporate Taxpayer Source of Taxable Income Tax Base Tax RatesDocument3 pagesClassification of Corporations: Ordinary Income Corporate Taxpayer Source of Taxable Income Tax Base Tax RatesMeghan Kaye LiwenNo ratings yet

- Individual TaxpayerDocument20 pagesIndividual TaxpayerIrish D DagmilNo ratings yet

- Taxable Income Citizenship & Residency Inside RP Outside RP Tax Rate On Certain Passive Income On Citizen and Resident Alien Final TaxDocument10 pagesTaxable Income Citizenship & Residency Inside RP Outside RP Tax Rate On Certain Passive Income On Citizen and Resident Alien Final TaxShasharu Fei-fei LimNo ratings yet

- Changes Due To CREATE Law Corporate Income Tax (CIT) Reforms Under CREATE ActDocument7 pagesChanges Due To CREATE Law Corporate Income Tax (CIT) Reforms Under CREATE ActYietNo ratings yet

- Schedules of Alphanumeric Tax Codes Nature of Income Payment TAX Rate ATC Nature of Income Payment TAX Rate ATC IND Corp Ind CorpDocument1 pageSchedules of Alphanumeric Tax Codes Nature of Income Payment TAX Rate ATC Nature of Income Payment TAX Rate ATC IND Corp Ind CorpMhyckee GuinoNo ratings yet

- Section 192:: Payment of SalaryDocument7 pagesSection 192:: Payment of SalaryCacptCoachingNo ratings yet

- RR No. 2-2021Document3 pagesRR No. 2-2021Anostasia NemusNo ratings yet

- The Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeFrom EverandThe Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- What Is Meant by Protectionism?: Chapter Three: Protectionism and Free TradeDocument4 pagesWhat Is Meant by Protectionism?: Chapter Three: Protectionism and Free TradeBenazir HitoishiNo ratings yet

- DOSCarmela 1Document3 pagesDOSCarmela 1Carmela InsigneNo ratings yet

- AVillas Blanc Pricelist - September 11 2017Document1 pageAVillas Blanc Pricelist - September 11 2017Snorri RaleNo ratings yet

- Up Land LawsDocument22 pagesUp Land LawsLakshit100% (1)

- University of Perpetual Help System Laguna - JONELTA: Basic Education Department - Senior High SchoolDocument15 pagesUniversity of Perpetual Help System Laguna - JONELTA: Basic Education Department - Senior High SchoolGONZALES CamilleNo ratings yet

- p4 LSBF Notes Afm Advanced Financial Management PDFDocument158 pagesp4 LSBF Notes Afm Advanced Financial Management PDFVeer Pratab SinghNo ratings yet

- Assignment On I.T & Pharma IndustryDocument11 pagesAssignment On I.T & Pharma IndustryGolu SinghNo ratings yet

- BMBEs (RA 9178), IRRDocument5 pagesBMBEs (RA 9178), IRRtagabantayNo ratings yet

- Buraks Final PaperDocument2 pagesBuraks Final Paperapi-187838124No ratings yet

- Assignment On: Case StudyDocument7 pagesAssignment On: Case Studyimran mahmudNo ratings yet

- TDS ChalanDocument1 pageTDS ChalanRAKHAL BAIRAGINo ratings yet

- Report InernDocument30 pagesReport Inernshanmugam cNo ratings yet

- Capitol Wireless v. Provl Treasurer of BatangasDocument11 pagesCapitol Wireless v. Provl Treasurer of BatangasMassabielleNo ratings yet

- Pay Bill Inner SheetDocument16 pagesPay Bill Inner SheetDebojyoti Boral100% (1)

- Cir v. Traders Royal BankDocument17 pagesCir v. Traders Royal BankPauline100% (1)

- This Research Guide Summarizes The Sources of Philippine Tax LawDocument6 pagesThis Research Guide Summarizes The Sources of Philippine Tax LawMeanne Estaño CaraganNo ratings yet

- Business Taxation AssignmentDocument7 pagesBusiness Taxation AssignmentThe Social KarkhanaNo ratings yet

- REPUBLIC v. CITY OF PARAÑAQUE, GR No. 191109, 2012-07-18Document3 pagesREPUBLIC v. CITY OF PARAÑAQUE, GR No. 191109, 2012-07-18LawrenceAltezaNo ratings yet

- Worksheet - Government Microeconomic IntervenDocument20 pagesWorksheet - Government Microeconomic IntervenNguyễn AnnaNo ratings yet

- Morocco Economic MonitorDocument44 pagesMorocco Economic MonitorReddahi BrahimNo ratings yet

- Revenue Memorandum Order No. 40-94: Claims For Value-Added Tax Credit/RefundDocument17 pagesRevenue Memorandum Order No. 40-94: Claims For Value-Added Tax Credit/RefundjohnnayelNo ratings yet

- Billing Certificate SampleDocument1 pageBilling Certificate SampleGenevieve GayosoNo ratings yet

- Hoover Digest, 2011, No. 2, SpringDocument211 pagesHoover Digest, 2011, No. 2, SpringHoover Institution100% (1)

- Atif Raza..Document1 pageAtif Raza..Atif RazaNo ratings yet