Professional Documents

Culture Documents

Lecture 3 With Notes - PDF

Uploaded by

Chan Chin Chun0 ratings0% found this document useful (0 votes)

5 views11 pages1) The lecture covered Bayes' theorem, random variables, probability distributions including binomial, Poisson, and exponential distributions.

2) The binomial distribution describes the probability of successes in independent Bernoulli trials while the Poisson distribution describes independent arrivals in a fixed time period.

3) Key characteristics of these distributions are presented such as the formulas for mean and variance. Examples are provided to illustrate real world applications.

Original Description:

Original Title

Lecture 3 with Notes_pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The lecture covered Bayes' theorem, random variables, probability distributions including binomial, Poisson, and exponential distributions.

2) The binomial distribution describes the probability of successes in independent Bernoulli trials while the Poisson distribution describes independent arrivals in a fixed time period.

3) Key characteristics of these distributions are presented such as the formulas for mean and variance. Examples are provided to illustrate real world applications.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views11 pagesLecture 3 With Notes - PDF

Uploaded by

Chan Chin Chun1) The lecture covered Bayes' theorem, random variables, probability distributions including binomial, Poisson, and exponential distributions.

2) The binomial distribution describes the probability of successes in independent Bernoulli trials while the Poisson distribution describes independent arrivals in a fixed time period.

3) Key characteristics of these distributions are presented such as the formulas for mean and variance. Examples are provided to illustrate real world applications.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

2 4

Recap of Last Lecture Binomial Distribution

• Bayes’ Theorem • The binomial distribution is used to find the probability of a

▪ Update prior probability assessment based on new information specific number of successes out of 𝑛 independent trials of a

➢ General form Bernoulli process.

➢ Venn diagram

• Random variables and probability distributions • 𝑛 = the number of trials

▪ A mapping from all possible outcomes to real numbers. • 𝑝 = the probability of success on any single trial

▪ Discrete → histogram, cumulative probability graph • 𝑟 = the number of successes

▪ Continuous → cumulative distribution function (CDF), probability

density function (PDF) • ! means factorial (0! = 1)

𝑛!

➢ The probability value of each outcome of the continuous RV is 0. • 𝑃 𝑟; 𝑛, 𝑝 = ∙ 𝑝𝑟 ∙ 1 − 𝑝 𝑛−𝑟

➢ In the graph of PDF, the area underneath the curve represents probability. 𝑟! 𝑛−𝑟 ! 5!

▪ P (Getting 4 heads in 5 tosses) = ? ∙ 0.54 ∙ 1 − 0.5 5−4

= 0.15625

▪ Summary statistics → expected value and variance 4! 5−4 !

• Binomial distribution & Bernoulli process

• If 𝑋~𝐵 𝑛, 𝑝 , then 𝐸 𝑋 = 𝑛𝑝 and 𝑉 𝑋 = 𝑛𝑝 1 − 𝑝 .

3

Binomial Distribution

• The probability of obtaining specific outcomes in a Bernoulli

Chapter 01 Probability Concepts process is described by the binomial probability distribution.

and Applications • Characteristics of Bernoulli process

▪ Each trial in a Bernoulli process has only two possible outcomes (e.g.,

IIMT3636 success vs. failure, yes vs. no, head vs. tail, etc.).

Faculty of Business and Economics ▪ The probability stays the same from one trial to the next.

▪ The trials are statistically independent.

The University of Hong Kong

▪ The number of trials is a positive integer.

Instructor: Dr. Yipu DENG

• Example

▪ Tossing a coin for several times and counting the number of heads

6 8

Poisson Distribution Poisson Distribution in Excel

• A Poisson RV describes the number of independent arrivals

during a unit period of time.

▪ Patients arriving at a health clinic

▪ Customers arriving at a bank window

▪ Passengers arriving at an airport

• 𝜆 = average number of arrivals per unit of time

• 𝑒 = 2.718, the base of the natural logarithm

• 𝑥 = the actual number of arrivals (0, 1, 2, …)

𝑒 −𝜆 ∙𝜆𝑥

• 𝑃 𝑥; 𝜆 = (Note: if x’ time length ≠ a unit period of time, adjust 𝜆)

𝑥!

▪ If the average number of arrivals per hour is 𝜆, the average number of

arrivals in every two hours should be 2𝜆.

• If 𝑋~𝑃𝑜𝑖𝑠𝑠𝑜𝑛 𝜆 , then 𝐸 𝑋 = 𝜆 and 𝑉 𝑋 = 𝜆.

5 7

Binomial Distribution in Excel Poisson Distribution 𝑃 𝑋≥1

𝑒 −𝜆 ∙ 𝜆𝑥

= 1−𝑃 𝑋 =0 𝑃 𝑥; 𝜆 =

• Example = 1 − 𝑒 −0.13 = 12.2% 𝑥!

▪ Assume the number of financial crisis in one year follows Poisson

distribution.

▪ How many crises are there in 100 years?

▪ What is the probability of seeing at least one crisis next year?

10 12

Exponential Distribution Exponential Distribution in Excel

• The exponential distribution often describes the time

required to serve a customer or the interarrival time or the

lifespan of a product (e.g., a light bulb).

→ continuous

• If 𝑋~𝐸𝑋𝑃 𝜆 , then 𝑓 𝑥 = 𝜆𝑒 −𝜆𝑥 and 𝐹 𝑥 = 𝑃 𝑋 ≤ 𝑥 =

1 − 𝑒 −𝜆𝑥 , where 𝜆 = 1/𝐸 𝑋 .

▪ 𝜆 = average number of arrivals per unit of time

▪ E(X) = average service time or interarrival time or lifespan

➢ Example: a chef needs 0.5 hours on average to cook one meal.

X = the actual waiting time between completing two meals.

E(X) = 0.5, which means the average waiting time between completing

two meals. (Note: The unit used in describing 𝜆 determines the unit for the time X.)

𝜆 = 2, which means the average rate at which meals are cooked per hour.

• 𝐸 𝑋 = 1/𝜆 and 𝑉 𝑋 = 1/𝜆2 .

9 11

Binomial and Poisson Distributions Exponential Distribution

• It turns out the Poisson distribution is just a special case of the • Example 𝐹 𝑥 = 𝑃 𝑋 ≤ 𝑥 = 1 − 𝑒 −𝜆𝑥

binomial distribution — where the number of trials is very large,

▪ The service person can install new doors at a rate about 3 per

and the probability of success in any given one is small.

hour.

• We can use a Binomial distribution with parameters (𝑛, 𝑝) to

▪ The service time is exponentially distributed.

approximate a Poisson distribution with rate 𝜆 by setting 𝑛 to a large

number and 𝑝 = 𝜆/𝑛. ▪ What is the probability that the time to install a new door will be

30 minutes or less?

▪ If n≥100 and np≤10, the approximation can be very good.

Poisson, l = 5

0.2

𝑃 𝑋 ≤ 0.5

0.15 = 1 − 𝑒 −3∗0.5

= 1 − 𝑒 −1.5 = 77.7%

0.1

0.05

0

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

14 16

Exponential and Poisson Distributions Uniform Distribution in Excel

• Example • The 𝑟𝑎𝑛𝑑() function generates a number from a uniformly

▪ Suppose customer arrivals at a retail store per hour follow distributed random variable on [0,1]

Poisson with mean 𝜆 = 3. Given that a customer arrived at

2:30pm, what is the probability that the next customer will arrive

• For a general uniform distribution on [a,b], we can use

before 3:00pm? (Hint: how to define the random variable?)

“= 𝑎 + 𝑟𝑎𝑛𝑑() ∗ 𝑏 − 𝑎 ”

▪ 𝑃𝑃 𝑋 ≥ 1; 𝜆 = 1.5 or 𝑃𝐸 𝑌 ≤ 0.5; 𝜆 = 3

13 15

Exponential and Poisson Distributions Uniform Distribution

• Exponential and Poisson are related: if the number of • A random variable 𝑋 is uniformly distributed if it takes

arrivals per time period follows Poisson(𝜆0 ), then the any value equally likely from a finite interval 𝑎, 𝑏 .

time between arrivals (1/ 𝜆1 ) follows exponential Probability density function Cumulative distribution function

distribution EXP(𝜆1 ) with an identical rate 𝜆1 = 𝜆0 .

𝑥−𝑎

= 𝑏−𝑎

▪ Example: if the number of phone calls arriving at a customer

service center follows a Poisson distribution with a mean of 10

calls per hour (𝜆 = 10), the time between each phone call would

be exponentially distributed, with the average time between calls

as 1/10 hours or 6 minutes.

1 1

• 𝐸 𝑋 = 𝑎+𝑏 ;𝑉 𝑋 = (𝑏 − 𝑎)2

2 12

18 20

Normal Distribution (PDF) Normal Distribution

• Normal distribution with different 𝜇. (shape unchanged)

| | |

40 m = 50 60

Smaller m, same s

| | |

m = 40 50 60

Larger m, same s

| | |

40 50 m = 60

17 19

Normal Distribution Normal Distribution

• The normal distribution is the most popular and useful • Normal distribution with different 𝜎. (always symmetric)

continuous probability distribution.

▪ E.g., return of a stock portfolio, forecast errors, and test scores.

• The probability density function is

1 𝑥−𝜇 2 Same m, smaller s

−

𝑓 𝑥 = ∙ 𝑒 2𝜎2

𝜎 2𝜋

Same m, larger s

• The normal distribution is specified completely when we

know the mean 𝐸(𝑥), 𝜇, and the standard deviation, 𝜎.

We often use the notation 𝑁 𝜇, 𝜎 2 .

m

22 24

Standard Normal Distribution: Example In-class Exercise

• If 𝑋 follows normal distribution with mean 𝜇 = 100, 𝜎 = • If 𝑋 follows normal distribution with mean 𝜇 = 100 and

15, and we are interested in finding the probability that X s.d. 𝜎 = 22, then 𝑃 𝑋 < 120 = ?

is less than 130, then z = ?

▪ Hint: P(X ≤ x) = P (Z ≤ z) 𝑋−𝜇 120−𝜇

• 𝑃 𝑋 < 120 = 𝑃 𝑋 − 𝜇 < 120 − 𝜇 = 𝑃 <

𝜎 𝜎

𝑋−𝜇

𝑥−𝜇

• Define 𝑍 = .

𝑧=

𝜎

𝜎

130−100 • 𝑃 𝑋 < 120 = 𝑃 𝑍 < 0.91 = 0.8186

= =2

15

21 23

P(Z<-z) = P(Z>z)

Standard Normal Distribution Standard Normal Distribution: Z Table

P(Z<0.57)? 0.7157

If P(Z<z) = 0.65, z? 0.385

z = 2.00, the area is 0.97725, P(X<130)? 0.97725

Areas under the normal curve

𝑋−𝜇

If 𝑿~𝑵 𝝁, 𝝈𝟐 , then 𝑍 = 𝜎 follows standard normal distribution.

Here, Z represents the number of standard deviations from X to the mean, 𝜇

26 28

Haynes Construction Company Haynes Construction Company

• Builds three- and four-unit apartment buildings • Suppose Haynes can hire more workers to reduce the

• Total construction time follows a normal distribution mean construction time while keeping the standard

• For triplexes, μ = 100 days and σ = 20 days deviation constant (i.e., 20 days). Hence, to ensure a

penalty is avoided with probability 0.95, what should be

• Contract calls for completion in 125 days

the new mean?

• Late completion will incur a severe penalty fee

• Probability of completing in 125 days? 𝑋 ′ −𝜇

• Objective: find 𝜇 such that 𝑃 𝑋′ < 125 = 𝑃 ቀ <

20

125−𝜇

ቁ = 0.95

20

𝑃 𝑋 < 125 = 𝑃 𝑍 < 1.25 = 0.8944 • Step 1: 𝑧0.95 = 1.645

125−𝜇

m = 100 days • Step 2: find 𝜇 such that = 1.645; 𝜇 = 92.1

s = 20 days 20

x = 125 days

25 27

Finding the x value Haynes Construction Company

• If 𝑋 follows normal distribution with mean 𝜇 = 100 and s.d. • If finished in 75 days or less, bonus = $5,000. Probability of bonus?

𝜎 = 22 and we want 𝑋 to be less than a certain value with • 𝑃 𝑋 < 75 = 𝑃 𝑍 < −1.25

probability 0.8, then how to find this value? Or 𝑃 𝑋 < ? = • = 𝑃 𝑍 > 1.25 = 1 − 𝑃 𝑍 < 1.25 = 1 - 0.8944 = 0.1056

0.8.

• What is the probability of completing between 110 and 125 days?

• Step 1: Finding the z value corresponding to 𝑃 𝑋 < 𝑥 . • 𝑃 110 < 𝑋 < 125 = 𝑃 𝑋 < 125 − 𝑃 𝑋 < 110

▪ If we need 𝑥 for 𝑃 𝑋 < 𝑥 , find 𝑧 corresponding to 𝑃 𝑋 < 𝑥 .

𝑧0.8 = 0.84

= 0.8944 – P(Z<0.5)

If we need 𝑥 for 𝑃 𝑋 > 𝑥 , find 𝑧 corresponding to 1 − 𝑃 𝑋 > 𝑥 .

= 0.8944 – 0.6915

• Step 2: Setting 𝑥 to 𝑥𝑧 = 𝜇 + 𝑧 ∙ 𝜎. = 0.2029

𝑋−𝜇

▪ 𝑃 𝑋 < 𝑥𝑧 = 𝑃 𝑋 < 𝜇 + 𝑧 ∙ 𝜎 = 𝑃 𝜎 < 𝑧 = 𝑃 𝑍 < 𝑧 = 𝑃 𝑋 < 𝑥

𝑃 𝑋 < 100 + 𝑧0.8 × 22 = 𝑃 𝑋 < 118.48 = 0.8

110 days 125 days

31 33

In-Class Exercise In-Class Exercise

• When a man passes the airport security check, they • A candidate for public office has claimed that 60% of

discover a bomb in his bag. He explains. “Statisticians voters will vote for her. If 5 registered voters were

show that the probability of one bomb being on an sampled, what is the probability that exactly 3 would say

airplane is 1/10,000. However, the chance that there are they favor this candidate? (hint: utilize BINOM.DIST in

two bombs on one plane is 1/10,000,000. So, I am much Excel)

safer …”

• Suppose the statisticians are right and it is impossible to Binomial distribution with n = 5, p = 0.6, r = 3, prob = 0.3456

have more than two bombs on an airplane. Do you agree

with the man?

No. The conditional probability of flying with another bomb is 1/1,000.

29 32

Normal Distribution in Excel In-Class Exercise

• A class contains 30 students. Ten are female (F) and U.S.

citizens (U); 12 are male (M) and U.S. citizens; 6 are

female and non-U.S. citizens (N); 2 are male and non-

U.S. citizens.

• A name is randomly selected from the class roster, and it

is female. What is the probability that the student is a

U.S. citizen?

P(U|F) = P(UF)/P(F) = (10/30)/[(10+6)/30] = 0.625

2 4

Decision makers have

The Science of Decision Making Thompson Lumber Company no control over it.

• Making a decision is about choosing among alternatives. • List all possible alternatives (i.e., course of action or strategies)

▫ Whether to pursue a graduate study (BA or Marketing); whether to • Identify possible outcomes/states of nature (e.g., high vs. low demand)

seek a job

▫ Whether to buy a stock and how much money to invest (e.g., all, half, • List the payoff of the combination of alternatives and outcomes

1/3); other investment opportunities • Select and apply the decision theory model, make decisions

▫ Whether to expand the product line and how to expand (e.g., new or

existing technology)

STATE OF NATURE

• Six Steps in Decision Making FAVORABLE MARKET UNFAVORABLE MARKET

▫ Clearly define the problem (Goal to achieve) ALTERNATIVE (profit in $) (profit in $)

▫ List the possible alternatives

Construct a large plant 200,000 –180,000

▫ Identify the possible outcomes or states of nature

▫ List the payoff of each alternative in each state of nature Construct a small plant 100,000 –20,000

▫ Select one of the decision theory models Do nothing 0 0

▫ Apply the model and make your decision

Decision/payoff table

3

Thompson Lumber Company

• John Thompson, the founder and president, needs to make the

decision on whether to expand his product line by manufacturing

Chapter 02 and marketing a new product.

• Define the problem

Decision Analysis à whether to expand the product line

IIMT3636

Faculty of Business and Economics

The University of Hong Kong

Instructor: Dr. Yipu DENG

6 8

Decision Making under Risk Decision Making under Risk

• EMV is the weighed sum of possible payoffs for each alternative.

• EVwPI = ∑ best payoff in state - . probability of state -

STATE OF NATURE Expected

Monetary Expected

FAVORABLE UNFAVORABLE Value STATE OF NATURE

Monetary

ALTERNATIVE MARKET (profit in $) MARKET (profit in $) (EMV, $) FAVORABLE UNFAVORABLE Value

ALTERNATIVE MARKET (profit in $) MARKET (profit in $) (EMV, $)

Construct a large plant 200,000 –180,000 –9,000

Construct a small plant 100,000 –20,000 34,000 Construct a large plant 200,000 –180,000 –9,000

Do nothing 0 0 0 Construct a small plant 100,000 –20,000 34,000

Probability 0.45 0.55 Do nothing 0 0 0

Best payoff 200,000 0 90,000

Probability 0.45 0.55 EVwPI

If John maximizes the EMV, then he should choose to construct a small plant.

EVPI = EVwPI – Best EMV

= $90,000 – $34,000 = $56,000 < $65,000. Don’t buy!

5 7

Types of Decision-Making Environments Decision Making under Risk

• Decision making under certainty • Scientific Marketing, Inc. offers analysis that will provide

▫ The decision maker knows with certainty the consequences of every

alternative or decision choice. certainty about market conditions. S.M. would charge

▫ Example: have $1,000 to invest for 1 year (open a savings account $65,000 for the information. Should John buy the

with 4% interest vs. invest in a government bond with 6% interest)

• Decision making under risk information?

▫ There are several possible outcomes for each alternative, and

decision maker knows the probabilities of each outcome.

▫ Example: get $10 if we roll a 5 on a standard dice à maximize • To make this decision, John has to evaluate the expected

expected monetary value or minimize opportunity loss value of perfect information (EVPI) by computing the

• Decision making under uncertainty expected value with perfect information (EVwPI) and

▫ There are several possible outcomes for each alternative, and

decision maker does not know the probabilities of the various the best EMV under risk.

outcomes.

▫ Example: the probability of success of a new product

10 12

Decision Making under Risk In-class Exercise: Café du Donut

Favorable Market VwPI Unfavorable Market

• Monetary Payoff (Profit) Table

OL2

OL3

VwPI • Cost = $40, revenue = $60

MV1

OL2

MV2 MV3 OL1 MV3

MV2 D=4 D=5 D=6 D=7 D=8 D=9 D = 10 EMV

MV1 4x60 6x40 6x60 6 x40

Q=6 0 60Go 120 120 120 120 120 105

-

-

Option Option Option Option Option Option O 120 120 10 120 120 105

1 2 3 1 2 3 60 7 x 40

4-40 7x 60 7 x 40

Q=7 x

202 O 80 140 140 140 140 104

-

-

- 40 80 140 140 140 140 104

Prob. 0.05 0.15 0.15 0.20 0.25 0.10 0.10

EVwPI EMVLQ =

6) = 0x0 05 + 60 x 0 .

15 + 120 x (0 .

15 +0 . 20 +

0 .

25 +0 .

10 + 0 -

10) =

105

EOL2

.

EOL1 EOL3

• Should we reduce the order size from 6 to 5? What is the EMV of Q=5?

EMV1 EMV2 EMV3

Option 1 Option 2 Option 3 • If we can only choose between 6 and 7, what is the EVPI?

9 11

Decision Making under Risk In-class Exercise: Café du Donut

• To minimize expected opportunity loss (EOL) • The Café buys donuts each day for $40 per carton of 20 dozen

• Opportunity loss = optimal payoff – actual payoff (in a given state of nature)

donuts. Any cartons not sold are thrown away at the end of

STATE OF NATURE Expected the day. If a carton is sold, the total revenue is $60.

Monetary

FAVORABLE

FAVORABLE Mkt UNFAVORABLE

UNFAVORABLE Mkt EOL

Value DAILY DEMAND PROBABILITY CUMULATIVE

ALTERNATIVE (Opp. Loss

MARKET in $)

(profit in $) (Opp. Loss

MARKET in $)

(profit in $) (EMV,

(in $) (CARTONS) PROBABILITY

Construct a large plant 0

200,000 180,000

–180,000 99,000

–9,000 • The original plan 4 0.05 0.05

Construct a small plant 100,000 20,000

–20,000 56,000

34,000

is to order 6 5 0.15 0.2

Do nothing 200,000

0 0 90,000

0

cartons per day. 6 0.15 0.35

Probability 0.45 0.55 Should the Café 7 0.20 0.55

• Minimizing EOL always results in the same decision as maximizing increase the 8 0.25 0.8

9 0.10 0.9

EMV. order size to 7?

• The minimum EOL always equal the EVPI. 10 0.10 1.0

Total 1.00

You might also like

- Math ProbabilityDocument5 pagesMath ProbabilityMukhtaar CaseNo ratings yet

- Alberto - Leon-Garcia 2009 Student Solutions ManualDocument204 pagesAlberto - Leon-Garcia 2009 Student Solutions ManualPeps Peps Peps86% (7)

- Math Practice Simplified: Pre-Algebra (Book L): Squares, Square Roots, Exponents, Signed NumbersFrom EverandMath Practice Simplified: Pre-Algebra (Book L): Squares, Square Roots, Exponents, Signed NumbersRating: 5 out of 5 stars5/5 (1)

- Math Practice Simplified: Division (Book F): Developing Fluency with Basic Number Combinations for DivisionFrom EverandMath Practice Simplified: Division (Book F): Developing Fluency with Basic Number Combinations for DivisionNo ratings yet

- Durability Design of Concrete Structures - Part 1 Analysis FundamentalsDocument18 pagesDurability Design of Concrete Structures - Part 1 Analysis FundamentalsCivilEngClubNo ratings yet

- Central Limit TheoremDocument36 pagesCentral Limit TheoremManishNo ratings yet

- RISK Management and InsuranceDocument10 pagesRISK Management and InsuranceWonde Biru100% (1)

- IIMT3636 Lecture 3 With NotesDocument44 pagesIIMT3636 Lecture 3 With NotesChan Chin ChunNo ratings yet

- Lecture 3-4 (With Ans)Document20 pagesLecture 3-4 (With Ans)劉泳No ratings yet

- Unit 06b - Midterm Review - 4 Per PageDocument6 pagesUnit 06b - Midterm Review - 4 Per PageKase1No ratings yet

- BD Part 2Document28 pagesBD Part 2Tanay KochrekarNo ratings yet

- 1sensitivity Lecture SlidesDocument59 pages1sensitivity Lecture SlidesKhaled HamdaouiNo ratings yet

- Normal DistributionDocument11 pagesNormal DistributionBreane Denece LicayanNo ratings yet

- Module01 ProbabilityAndStatisticsDocument68 pagesModule01 ProbabilityAndStatisticsDevansh GuptaNo ratings yet

- CSE291D Lecture 3: Conjugate Priors Generative Models For Discrete DataDocument71 pagesCSE291D Lecture 3: Conjugate Priors Generative Models For Discrete DataballechaseNo ratings yet

- 2.parameter EstimationDocument59 pages2.parameter EstimationLEE LEE LAUNo ratings yet

- Lect28 4upDocument11 pagesLect28 4upalialatabyNo ratings yet

- Regression Analysis 1683992943Document22 pagesRegression Analysis 1683992943Richard RichieNo ratings yet

- Lecture Statistics 07Document26 pagesLecture Statistics 07AGNo ratings yet

- Session3 Probability 2Document13 pagesSession3 Probability 2Mohd SaudNo ratings yet

- Review of The Binomial Distribution: by Young Jun ChoiDocument22 pagesReview of The Binomial Distribution: by Young Jun ChoiaimypolosNo ratings yet

- 1.5 Common Probability DistributionDocument48 pages1.5 Common Probability DistributionMarioNo ratings yet

- Sex, Extra-Marital Affairs, and Death. Otherwise Known As : The Binomial Distribution!Document22 pagesSex, Extra-Marital Affairs, and Death. Otherwise Known As : The Binomial Distribution!MykolasŠveistrysNo ratings yet

- The Poster 2.0 Templates FinalDocument4 pagesThe Poster 2.0 Templates FinalSam NeavesNo ratings yet

- Final ReviewDocument20 pagesFinal ReviewstoryNo ratings yet

- BS Chapter4 2021 Discrete Probability Distribution Binomial Hyper Poisen 22Document40 pagesBS Chapter4 2021 Discrete Probability Distribution Binomial Hyper Poisen 22ShayanNo ratings yet

- Nearest NeighbourDocument25 pagesNearest Neighbourbobe1500No ratings yet

- Tutorial 5: General Random Variables 1: MENG Yitong Ytmeng@cse - Cuhk.edu - HK 27, February, 2016Document19 pagesTutorial 5: General Random Variables 1: MENG Yitong Ytmeng@cse - Cuhk.edu - HK 27, February, 2016bunnie xDNo ratings yet

- CSE291D Lecture 4: Exponential Families Generalized Linear ModelsDocument67 pagesCSE291D Lecture 4: Exponential Families Generalized Linear ModelsballechaseNo ratings yet

- AE 248: AI and Data Science: Prabhu Ramachandran 2024-03-01Document8 pagesAE 248: AI and Data Science: Prabhu Ramachandran 2024-03-01prasan0311dasNo ratings yet

- Naive Bayes: Tim Pengajaran Mata Kuliah Jurusan Teknologi Informasi Tahun 2021Document37 pagesNaive Bayes: Tim Pengajaran Mata Kuliah Jurusan Teknologi Informasi Tahun 2021FITRANZA AKBARNo ratings yet

- Computer Science Machine Learning Predictive Model: Probability and StatsDocument34 pagesComputer Science Machine Learning Predictive Model: Probability and Statsaparna1407No ratings yet

- Lec 05Document53 pagesLec 05Hassan AhmadNo ratings yet

- Section06 UnsupervisedLearningDocument30 pagesSection06 UnsupervisedLearningVarun ErankiNo ratings yet

- BUSN 2429 Chapter 6 Continuous Probability Distribution - SDocument70 pagesBUSN 2429 Chapter 6 Continuous Probability Distribution - SAwais SadaqatNo ratings yet

- Bayes Decision TheoryDocument53 pagesBayes Decision TheoryNikhil GuptaNo ratings yet

- Machine Language: Supervised Learning Unsupervised LearningDocument34 pagesMachine Language: Supervised Learning Unsupervised Learningsamin1213No ratings yet

- Ec310 Day 4 Lecture NotesDocument12 pagesEc310 Day 4 Lecture NotesmikeywilfertNo ratings yet

- Maximum Likelihood and Bayesian Parameter Estimation: Chapter 3, DHSDocument35 pagesMaximum Likelihood and Bayesian Parameter Estimation: Chapter 3, DHSNikhil GuptaNo ratings yet

- 03 ProbDocument38 pages03 ProbNiranjan PandeyNo ratings yet

- Lecture 4 - Linear ClassificationDocument34 pagesLecture 4 - Linear ClassificationRajdip NayekNo ratings yet

- 08 Causal Inference I: MSBA7003 Quantitative Analysis MethodsDocument32 pages08 Causal Inference I: MSBA7003 Quantitative Analysis MethodsAmanda WangNo ratings yet

- Ch.3 Normal DistributionDocument1 pageCh.3 Normal Distributionjacksonjj208No ratings yet

- 03a - Math Prob Solving (I N D Reasoning)Document3 pages03a - Math Prob Solving (I N D Reasoning)anigygrhtNo ratings yet

- Module - 4 - Analyze Phase - Oct 20Document210 pagesModule - 4 - Analyze Phase - Oct 20mohmedkelioy1No ratings yet

- Chapter 2Document31 pagesChapter 2shifaratesfayeNo ratings yet

- Q3 - Wk3-4 - STATISTICS AND PROBABILITYDocument28 pagesQ3 - Wk3-4 - STATISTICS AND PROBABILITYpabloNo ratings yet

- Unit 3 Part IIDocument45 pagesUnit 3 Part IIPrakhar BhatnagarNo ratings yet

- Q4 W6 WGStatDocument3 pagesQ4 W6 WGStatAndrea KateNo ratings yet

- ADMS 2320 Test 1 SheetDocument1 pageADMS 2320 Test 1 SheetJustin St Louis WoodNo ratings yet

- Business Statistics: Types of Probability Distributions For Random VariablesDocument19 pagesBusiness Statistics: Types of Probability Distributions For Random Variablesikki123123No ratings yet

- 03 - Review of Probabilistic ModelsDocument34 pages03 - Review of Probabilistic ModelsRizkyAnugrahPratamaNo ratings yet

- Cap 5 Pagano Z ScoreDocument20 pagesCap 5 Pagano Z ScoreangieNo ratings yet

- Week 6 - Important Random Variables and Their DistributionsDocument24 pagesWeek 6 - Important Random Variables and Their DistributionsHaris GhafoorNo ratings yet

- Counting PrinciplesDocument31 pagesCounting Principlesapi-612593865No ratings yet

- Web PageDocument13 pagesWeb PageSwapan Kumar SahaNo ratings yet

- Fall 2022 Midterm Notes PDFDocument15 pagesFall 2022 Midterm Notes PDFJack ANo ratings yet

- Neural Network IDocument85 pagesNeural Network IpepitoNo ratings yet

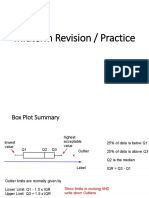

- Midterm Revision / PracticeDocument19 pagesMidterm Revision / PracticeAhmad MalakNo ratings yet

- Multiple Linear Regression ModelDocument99 pagesMultiple Linear Regression Modelbrianmfula2021No ratings yet

- IE4102 Lecture4Document48 pagesIE4102 Lecture4emirklc1907No ratings yet

- Logistics: CSE 473 Markov Decision ProcessesDocument10 pagesLogistics: CSE 473 Markov Decision ProcessesOtong noxNo ratings yet

- Beyond Binary ClassificationDocument34 pagesBeyond Binary Classificationlalitha lalliNo ratings yet

- Partnership - Goodwill QDocument7 pagesPartnership - Goodwill QChan Chin ChunNo ratings yet

- Partnership I - NotesDocument11 pagesPartnership I - NotesChan Chin ChunNo ratings yet

- 7 Class Freud and Religion Revised 22-3-2023Document52 pages7 Class Freud and Religion Revised 22-3-2023Chan Chin ChunNo ratings yet

- CBS UG BSTC1003 Syllabus 2022 23Document5 pagesCBS UG BSTC1003 Syllabus 2022 23Chan Chin ChunNo ratings yet

- IIMT3636 Lecture 6 With NotesDocument39 pagesIIMT3636 Lecture 6 With NotesChan Chin ChunNo ratings yet

- Mathematics8 Q4 Mod8 FindingTheProbabilityOfASimpleEvent v3Document26 pagesMathematics8 Q4 Mod8 FindingTheProbabilityOfASimpleEvent v3Cedie BeldaNo ratings yet

- DLL 4TH Quarter 41ST Week Math March 19-23, 2018Document5 pagesDLL 4TH Quarter 41ST Week Math March 19-23, 2018angeliNo ratings yet

- Normal DistributionDocument20 pagesNormal DistributionPaulo EsguerraNo ratings yet

- Unit-2 Some Special Probability DistributionsDocument17 pagesUnit-2 Some Special Probability DistributionsSandip MouryaNo ratings yet

- The Future of Forecasting White Paper - JDADocument3 pagesThe Future of Forecasting White Paper - JDASanthosh VemisettyNo ratings yet

- Exercises and Solutions Manual For Integration and Probability PDFDocument2 pagesExercises and Solutions Manual For Integration and Probability PDFDaveNo ratings yet

- SololasivarogomajiwofDocument2 pagesSololasivarogomajiwofMUSHFIQ UR RAHMANNo ratings yet

- Research Papers in Probability and Statistics: Festschrift For Lucien Le CamDocument3 pagesResearch Papers in Probability and Statistics: Festschrift For Lucien Le CamFahad Rasool DarNo ratings yet

- Min MaxDocument2 pagesMin MaxKashif KhalidNo ratings yet

- Iit Jam Mathematical Statistics Paper 2013Document35 pagesIit Jam Mathematical Statistics Paper 2013Nilotpal ChattorajNo ratings yet

- Chapter 3 - Market Data AnalysisDocument55 pagesChapter 3 - Market Data AnalysisVishwajit GoudNo ratings yet

- Recap W5 L10: - Identify Various Event TypesDocument28 pagesRecap W5 L10: - Identify Various Event TypesSu FiNo ratings yet

- Generalized Pareto DistributionDocument7 pagesGeneralized Pareto DistributionSri Muslihah BakhtiarNo ratings yet

- STAT 333 Assignment 1Document1 pageSTAT 333 Assignment 1Danny XuNo ratings yet

- Edu 2008 Spring C QuestionsDocument180 pagesEdu 2008 Spring C QuestionswillhsladeNo ratings yet

- Time Series Analysis: Henrik MadsenDocument25 pagesTime Series Analysis: Henrik MadsenAdolfo Rocha SantanaNo ratings yet

- EA Prep Integrated Reasoning SlidesDocument30 pagesEA Prep Integrated Reasoning SlidesSai Sunil ChandraaNo ratings yet

- Baye's Theorem VEERARAJANDocument9 pagesBaye's Theorem VEERARAJAN16Julie KNo ratings yet

- MCQs in Venn Diagram, Permutation, Combination and Probability Part IDocument6 pagesMCQs in Venn Diagram, Permutation, Combination and Probability Part IlucasNo ratings yet

- MCQ Set1 PTSPDocument2 pagesMCQ Set1 PTSPPrabhakara RaoNo ratings yet

- 20171013152531ba HWDocument6 pages20171013152531ba HWChristian Kim MedranoNo ratings yet

- Decision Making Analysis (Risk&Uncertainty)Document6 pagesDecision Making Analysis (Risk&Uncertainty)akankshaNo ratings yet

- Chapter 8 - Queueing TheoryDocument21 pagesChapter 8 - Queueing TheoryKamrun NaharNo ratings yet