Professional Documents

Culture Documents

Lendingdepositrates

Uploaded by

Muhammad HasnainOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lendingdepositrates

Uploaded by

Muhammad HasnainCopyright:

Available Formats

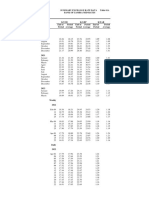

Overall Weighted Average Lending and Deposit Rates

(Percent per annum)

Gross Disbursements Outstanding Loans Fresh Deposits Outstanding Deposits

Including Zero Markup Excluding Zero Markup Including Zero Markup Excluding Zero Markup Including Zero Markup Excluding Zero Markup Including Zero Markup Excluding Zero Markup

Items

Including Excluding Including Excluding Including Excluding Including Excluding Including Excluding Including Excluding Including Excluding Including Excluding

Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs Inter FIs

Jan-24 P 1. Scheduled Banks 20.97 20.81 21.35 21.24 18.56 18.53 19.87 19.85 10.62 10.53 18.77 18.71 11.92 12.02 18.16 18.16

1.1. Public 22.65 22.90 22.67 22.93 19.61 19.63 21.95 21.98 17.28 17.70 19.62 19.62 14.27 15.05 18.82 18.81

1.2. Private 21.87 21.83 22.32 22.34 18.65 18.60 19.74 19.71 9.65 9.46 18.57 18.48 11.21 11.18 17.91 17.90

1.3. Foreign 9.81 9.81 9.81 9.81 10.61 10.59 10.62 10.60 5.21 5.53 15.70 15.70 15.15 15.24 19.31 19.31

1.4. Specialized 27.52 27.52 27.53 27.53 20.09 20.12 27.16 27.16 11.59 11.58 20.48 20.48 17.78 17.74 19.83 19.82

2. DFIs 22.47 22.47 22.53 22.53 15.78 16.48 17.13 18.22 21.34 21.37 21.34 21.37 21.80 21.83 21.82 21.84

3. MFBs 34.12 34.12 38.86 38.86 34.88 34.88 36.16 36.16 11.37 11.29 19.76 19.75 15.86 15.69 20.90 20.85

All Financial Institutions 21.04 20.89 21.44 21.33 19.04 19.03 20.37 20.38 10.64 10.55 18.78 18.72 12.02 12.12 18.24 18.23

Dec-23 R 1. Scheduled Banks 21.00 20.84 21.47 21.39 18.88 18.83 20.33 20.29 10.87 10.85 19.04 19.00 11.61 11.79 18.20 18.19

1.1. Public 22.50 22.75 22.67 22.96 20.03 20.02 22.23 22.23 16.79 17.51 19.69 19.68 13.23 14.38 18.64 18.63

1.2. Private 21.92 21.89 22.48 22.57 18.95 18.88 20.24 20.18 9.84 9.72 18.87 18.82 11.08 11.06 18.02 18.01

1.3. Foreign 10.58 10.58 10.58 10.58 10.64 10.64 10.65 10.65 5.23 5.53 15.59 15.59 14.60 14.72 19.25 19.25

1.4. Specialized 27.16 27.16 27.17 27.17 19.91 19.94 27.25 27.25 12.04 12.01 20.52 20.52 18.33 18.30 20.76 20.76

2. DFIs 22.91 22.91 22.94 22.94 17.63 17.63 19.47 19.46 21.93 21.94 21.93 21.94 22.17 22.19 22.18 22.20

3. MFBs 35.23 35.23 40.61 40.61 34.74 34.74 35.97 35.97 11.49 11.32 19.82 19.73 15.85 15.67 21.05 20.99

All Financial Institutions 21.10 20.95 21.59 21.52 19.36 19.32 20.82 20.80 10.88 10.86 19.05 19.01 11.72 11.88 18.28 18.27

Jan-23 1. Scheduled Banks 17.09 17.52 17.22 17.68 14.59 14.50 15.74 15.70 7.48 7.44 13.89 13.83 7.94 7.97 13.53 13.52

1.1. Public 17.64 17.66 17.87 17.89 13.38 13.37 15.76 15.75 8.84 10.16 13.78 13.77 9.44 9.77 13.66 13.66

1.2. Private 17.06 17.51 17.19 17.66 14.84 14.73 15.65 15.59 7.35 7.20 13.90 13.83 7.47 7.45 13.45 13.44

1.3. Foreign 17.35 17.35 17.35 17.35 16.76 16.76 17.08 17.08 7.83 8.75 14.29 14.29 10.65 10.72 14.42 14.42

1.4. Specialized 23.69 23.70 23.69 23.70 15.72 15.71 22.35 22.37 7.65 7.64 14.84 14.84 13.25 13.23 14.82 14.82

2. DFIs 17.84 17.84 18.09 18.09 12.65 13.27 13.57 14.49 16.87 16.87 16.87 16.87 16.42 16.42 16.42 16.42

3. MFBs 33.23 33.23 34.70 34.70 30.77 30.77 31.29 31.29 7.45 7.21 13.74 13.61 11.56 11.31 15.00 14.88

All Financial Institutions 17.18 17.62 17.31 17.78 15.09 15.04 16.24 16.25 7.49 7.44 13.89 13.84 8.03 8.05 13.58 13.57

P: Provisional R: Revised Source: Core Statistics Department

Explanatory Notes:

1. Gross disbursements mean the amounts disbursed by Financial Institutions (FIs) either in pak rupees or in foreign currency against loans during the month. It also includes loans repriced, renewed or rolled over during the month. In case of running finance, the disbursed amount means the total amount availed by the

borrower during the month.

2. Foreign currency deposits/loans are first converted into pak rupees at the prevalent exchange rates of the last day of the reporting month.

3. Loans (Disbursed & Outstanding) mean all types of FIs’s advances including working capital finance and disbursements against payments of documents i.e. Letters of credit, inland bills etc. but excluding foreign bills. Advances cover all types of advances including inter FIs placements. Interest accrued is not a

disbursement and therefore it is not considered as loan. Nano Loans of MFBs are not included.

4. All disbursements made to non-residents, private sector, public sector and government are included.

5. All credit facilities such as credit cards, personal loans etc. and credit schemes such as LMM, export finance scheme and commodity operations are included.

6. Outstanding loans mean the loans recoverable at the end of the month. Weighted Average rates of advances and deposits have been compiled by;

a. Including advances and deposits at zero markup of return, i.e. non-remunerative advances and deposits

b. Excluding advances and deposits at zero markup of return, i.e. non-remunerative advances and deposits

7. Deposits include all types of deposits including inter FIs deposits and placements. Margin deposits (deposits held by FIs as collateral against letters of credits, letters of guarantees etc.) are however, not included.

8. Fresh deposits mobilized during the month include outstanding balance of:

a Fresh deposits (new accounts) mobilized during the month

b Re-priced and /or rolled-over deposits during the month

9. Outstanding deposits show position of deposits held by FIs at the end of the month.

10. “Public” stands for Public Sector Banks - the banks incorporated in Pakistan or the shares/capital controlled by the federal and /or provincial governments, “Private” stands for Private Sector Banks incorporated in Pakistan, owned and controlled by private sector, “Foreign” stands for the branches of banks working

in Pakistan but incorporated abroad and “Specialized” stands for Specialized Banks established to provide credit facilities, assistance and advice to clients in a designated sector or in a designated line of credit; for example, agriculture sector, industrial sector, etc.

11. DFIs stands for Development Finance Institutions and MFBs stands for Microfinance Banks.

12. Financial Institutions (Fis) means Scheduled Banks, Development Finance Institutions and Microfinance Banks.

13. Weighted Averages have been worked out by weighting interest rates by the corresponding amounts of loans/deposits. The formula used is:

Weighted Average Rate = ∑ ( rate ×amount )÷ ∑ ( amount )

Contact Person: Muhammad Khalid

Designation: Sr Joint Director

Phone: 021-33138294

Email: Feedback.statistics@sbp.org.pk

You might also like

- Code Billing Heads Rate Quantity Amount in RsDocument2 pagesCode Billing Heads Rate Quantity Amount in RsPrasanna Nammalwar85% (27)

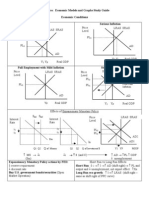

- AP Macroeconomic Models and Graphs Study GuideDocument23 pagesAP Macroeconomic Models and Graphs Study GuideAznAlexT90% (21)

- SK Singh Lab Report 09042018Document8 pagesSK Singh Lab Report 09042018Iasam Groups'sNo ratings yet

- Surface Area of DuctsDocument6 pagesSurface Area of Ductsanwerquadri40% (5)

- Vocational Training EmploymentDocument99 pagesVocational Training EmploymentHemant KumarNo ratings yet

- DLL Grade 8 Q3-Week 1-4Document16 pagesDLL Grade 8 Q3-Week 1-4Angela Camille Paynante100% (1)

- Learn To Create A Basic Calculator in Java Using NetbeansDocument9 pagesLearn To Create A Basic Calculator in Java Using NetbeansRicardo B. ViganNo ratings yet

- Excel CalculationDocument21 pagesExcel CalculationBint OsmanNo ratings yet

- Waktu Trading Saldo Modal Profit 10% Total SaldoDocument4 pagesWaktu Trading Saldo Modal Profit 10% Total Saldoarif rohmanNo ratings yet

- Statistics Fortnightly 2022 Vol 29 No 08Document25 pagesStatistics Fortnightly 2022 Vol 29 No 08elishankampila3500No ratings yet

- Nifty PE PB Dividend Yield ChartDocument12 pagesNifty PE PB Dividend Yield ChartJayaprakash MuthuvatNo ratings yet

- Pitti EnggDocument10 pagesPitti EnggvkwglNo ratings yet

- Dataset For Pivot Chart and Pivot TableDocument9 pagesDataset For Pivot Chart and Pivot TableBipin SharmaNo ratings yet

- Vertoz AdvertisDocument33 pagesVertoz AdvertismivomNo ratings yet

- Accounts FFDocument2 pagesAccounts FFjigopen219No ratings yet

- Tiempo (Min.) Concentracion RXN N de Datos X Mínimo X Máximo N de ClasesDocument10 pagesTiempo (Min.) Concentracion RXN N de Datos X Mínimo X Máximo N de ClasesAngie J MarleyNo ratings yet

- Price To Sales 10 ANDDocument13 pagesPrice To Sales 10 ANDravi.youNo ratings yet

- Susah BGT Astaghfirullah TP AKU BISADocument4 pagesSusah BGT Astaghfirullah TP AKU BISAMaulid dina AyuNo ratings yet

- Rajratan GlobalDocument10 pagesRajratan Globalravi.youNo ratings yet

- Condensate Recovery Calcs For DMDocument11 pagesCondensate Recovery Calcs For DMMusaib KhanNo ratings yet

- New Microsoft Excel WorksheetDocument3 pagesNew Microsoft Excel WorksheetsaraNo ratings yet

- Mid Exam Solution by EsayasDocument20 pagesMid Exam Solution by EsayasChanako DaneNo ratings yet

- Subproject Name Project Name Project Status Auditor Name CertifierDocument6 pagesSubproject Name Project Name Project Status Auditor Name CertifierNguyên Trịnh CaoNo ratings yet

- Case 1 Bidding Stage: Annexure II (A) DSCR & IRR CalculationDocument4 pagesCase 1 Bidding Stage: Annexure II (A) DSCR & IRR CalculationSantosh HiredesaiNo ratings yet

- RatiosDocument2 pagesRatiosEkambaram Thirupalli TNo ratings yet

- CAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Document22 pagesCAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Garima GulatiNo ratings yet

- Peta Kendali Xbar S MS-EXCEL (JAWABAN TUGAS)Document11 pagesPeta Kendali Xbar S MS-EXCEL (JAWABAN TUGAS)Jefri ZakariaNo ratings yet

- m2 Pintura VictorDocument7 pagesm2 Pintura VictorAlexandra TamayoNo ratings yet

- Graficos de ControlDocument3 pagesGraficos de ControlCristal TorresNo ratings yet

- summary#NFBNFfri 20122019Document554 pagessummary#NFBNFfri 20122019BHAVESH MEHTANo ratings yet

- Stanca Aurelian Rares - YoungDocument5 pagesStanca Aurelian Rares - YoungRareş StancaNo ratings yet

- 2021 Statistical Bulletin - Financial SectorDocument81 pages2021 Statistical Bulletin - Financial SectorIbeh CosmasNo ratings yet

- LB With 19mDocument4 pagesLB With 19mFaheem ShahzadNo ratings yet

- Yash PakkaDocument10 pagesYash PakkaanupNo ratings yet

- Theo DỏiDocument6 pagesTheo DỏiMón Quà Vô GiáNo ratings yet

- Formula 1 Rolex Magyar Nagydíj 2021 - Budapest: First Practice Session Lap TimesDocument4 pagesFormula 1 Rolex Magyar Nagydíj 2021 - Budapest: First Practice Session Lap Timesarunji76884No ratings yet

- LB With 20.5mDocument4 pagesLB With 20.5mFaheem ShahzadNo ratings yet

- Laurus LabsDocument32 pagesLaurus LabsAkash GowdaNo ratings yet

- Laurus LabsDocument32 pagesLaurus LabsAkash GowdaNo ratings yet

- Laurus LabsDocument32 pagesLaurus LabsAkash GowdaNo ratings yet

- Narayana HrudayaDocument18 pagesNarayana HrudayaVishalPandeyNo ratings yet

- Control: No Phases Activity OctorberDocument12 pagesControl: No Phases Activity OctorberZainab SattarNo ratings yet

- SP 6 SheetDocument1 pageSP 6 Sheetvaruna KNo ratings yet

- 7 Disbursement and Recovery Performance On Agricultural and Rural Credit by The InstitutionsDocument6 pages7 Disbursement and Recovery Performance On Agricultural and Rural Credit by The Institutionsorihime inoieNo ratings yet

- LendingdepositratesDocument1 pageLendingdepositratessherman ullahNo ratings yet

- Liberty Balance SheetDocument2 pagesLiberty Balance SheetAravind KrishnaNo ratings yet

- Garware TechDocument13 pagesGarware TechShashwat DesaiNo ratings yet

- Narration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst CaseJeniffer RayenNo ratings yet

- AcrysilDocument10 pagesAcrysilJeniffer RayenNo ratings yet

- CAPAIAN REMAJA 22-2 BaruDocument48 pagesCAPAIAN REMAJA 22-2 Baruemmy alwanNo ratings yet

- WB Grading Summary ReportDocument5 pagesWB Grading Summary ReportrohmanNo ratings yet

- Pix TransmissionDocument10 pagesPix TransmissionJeniffer RayenNo ratings yet

- Dec 2022 46 S1Document1 pageDec 2022 46 S1Pasca DavidNo ratings yet

- Enugu Disco - Fixed Charge: Tariff Code 2012 2013 2014 2015Document2 pagesEnugu Disco - Fixed Charge: Tariff Code 2012 2013 2014 2015Tony AppsNo ratings yet

- Vinati Organics - NewDocument18 pagesVinati Organics - NewVishalPandeyNo ratings yet

- 2020 Statistical Bulletin - Financial Sector - FinalDocument81 pages2020 Statistical Bulletin - Financial Sector - FinalMuhammed GbagbaNo ratings yet

- Data Patterns Income&CashFlow - 4 Years - 19052020Document8 pagesData Patterns Income&CashFlow - 4 Years - 19052020Sundararaghavan RNo ratings yet

- QTR Shareholding PatternDocument2 pagesQTR Shareholding PatternKrish BhoutikaNo ratings yet

- Nepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538Document15 pagesNepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538axzc sNo ratings yet

- Data Red Banjo BrewingDocument7 pagesData Red Banjo BrewingRishabh SoniNo ratings yet

- Case 1-Beer - Sales - With - XLSTAT - AnalysisDocument64 pagesCase 1-Beer - Sales - With - XLSTAT - AnalysisReetika GuptaNo ratings yet

- Narration Dec-99 Dec-99 Dec-99 Dec-99 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst CaseDocument10 pagesNarration Dec-99 Dec-99 Dec-99 Dec-99 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst Casechandrajit ghoshNo ratings yet

- Ememi BlanceDocument6 pagesEmemi BlanceAnonymous ldN95iANo ratings yet

- Consum X-Bar Data Chart ExcelDocument4 pagesConsum X-Bar Data Chart ExcelDearRed FrankNo ratings yet

- Weight SheetDocument1 pageWeight Sheetmasoodifarhan82% (11)

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- ARREST PROCEDURES CssDocument8 pagesARREST PROCEDURES CssMuhammad HasnainNo ratings yet

- Document Digiskills EnglishDocument3 pagesDocument Digiskills EnglishMuhammad HasnainNo ratings yet

- Correctional InstitutionsDocument2 pagesCorrectional InstitutionsMuhammad HasnainNo ratings yet

- Juvenile DelinquencyDocument18 pagesJuvenile DelinquencyMuhammad HasnainNo ratings yet

- JUVENILE Justice SystemDocument26 pagesJUVENILE Justice SystemMuhammad HasnainNo ratings yet

- Lecture 1 Applied CriminologyDocument30 pagesLecture 1 Applied CriminologyMuhammad HasnainNo ratings yet

- Media and Its TypesDocument10 pagesMedia and Its TypesMuhammad HasnainNo ratings yet

- Significance of Mass CommunicationDocument3 pagesSignificance of Mass CommunicationMuhammad HasnainNo ratings yet

- Role of Government Microeconomics FinalDocument21 pagesRole of Government Microeconomics FinalMuhammad HasnainNo ratings yet

- Biological HarmonalDocument4 pagesBiological HarmonalMuhammad HasnainNo ratings yet

- Social EcologyDocument4 pagesSocial EcologyMuhammad HasnainNo ratings yet

- Consumption and Saving TheoryDocument6 pagesConsumption and Saving TheoryMuhammad HasnainNo ratings yet

- Money of Banking System Microeconomics FinalDocument7 pagesMoney of Banking System Microeconomics FinalMuhammad HasnainNo ratings yet

- (Re-) Mapping The Concept of DreamingDocument5 pages(Re-) Mapping The Concept of DreamingEduardo VLNo ratings yet

- KHKJHKDocument8 pagesKHKJHKMD. Naimul Isalm ShovonNo ratings yet

- Gpi UkDocument3 pagesGpi UkAnil VermaNo ratings yet

- Dwnload Full Introduction To Environmental Geology 5th Edition Keller Test Bank PDFDocument35 pagesDwnload Full Introduction To Environmental Geology 5th Edition Keller Test Bank PDFgilmadelaurentis100% (12)

- 7 Problems - CompressorDocument2 pages7 Problems - CompressorBenedict TumlosNo ratings yet

- Treatment of LeprosyDocument11 pagesTreatment of LeprosyFajar YuniftiadiNo ratings yet

- Dave Brubeck BiographyDocument4 pagesDave Brubeck Biographyiana2525No ratings yet

- Multi Channel AV Receiver: Operating Instructions STR-DH510Document80 pagesMulti Channel AV Receiver: Operating Instructions STR-DH510Angus WongNo ratings yet

- WORKING CAPITAL MANAGEMENT of Axis Bank Finance Research 2014 2Document112 pagesWORKING CAPITAL MANAGEMENT of Axis Bank Finance Research 2014 2pawanmamaniyaNo ratings yet

- Design and Details of Elevated Steel Tank PDFDocument10 pagesDesign and Details of Elevated Steel Tank PDFandysupaNo ratings yet

- Open School Installation GuideDocument17 pagesOpen School Installation GuideHarryTendulkarNo ratings yet

- Acc 103 Course OutlineDocument3 pagesAcc 103 Course OutlineAnitha KimamboNo ratings yet

- DLP Extra On Formation of ElementsDocument9 pagesDLP Extra On Formation of ElementsDaniah AllemaNo ratings yet

- Chinese Canadian Life On The RailwayDocument13 pagesChinese Canadian Life On The Railwayapi-246989026No ratings yet

- Generating EquipmentDocument15 pagesGenerating EquipmentRajendra Lal ShresthaNo ratings yet

- BBC-Cellpack Produktbroschuere Smart Sensors EN 0821Document12 pagesBBC-Cellpack Produktbroschuere Smart Sensors EN 0821Javier CuzcoNo ratings yet

- Books Published in Goa 2007Document24 pagesBooks Published in Goa 2007Frederick NoronhaNo ratings yet

- DR: A.P.J Abdul Kalam'S Biography: By, Githu RajuDocument11 pagesDR: A.P.J Abdul Kalam'S Biography: By, Githu RajuGithu RajuNo ratings yet

- Credentials Evaluation Service Applicant HandbookDocument26 pagesCredentials Evaluation Service Applicant HandbookdramachicNo ratings yet

- Water Source (Level 1) (Bacalla) : Criteria Score Weight Computation Actual Score JustificationDocument2 pagesWater Source (Level 1) (Bacalla) : Criteria Score Weight Computation Actual Score JustificationlovlyNo ratings yet

- Noes Flex CubeDocument8 pagesNoes Flex CubeSeboeng MashilangoakoNo ratings yet

- Unit 4 Grammar Standard PDFDocument1 pageUnit 4 Grammar Standard PDFCarolina Mercado100% (2)

- DVIN0008 Mitsubishi M800 OEM EVO89 Installation NotesDocument18 pagesDVIN0008 Mitsubishi M800 OEM EVO89 Installation NotesRickyTongNo ratings yet

- EMDT49 Echoes From Fomalhaut #03 Blood, Death, and TourismDocument48 pagesEMDT49 Echoes From Fomalhaut #03 Blood, Death, and Tourismfreepdf11062023No ratings yet