Professional Documents

Culture Documents

T24 - Securities

Uploaded by

dipakmangnaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

T24 - Securities

Uploaded by

dipakmangnaniCopyright:

Available Formats

T24 Securities

Welcome to the T24 Securities Course

Temenos University - September 2012 1

T24 Securities

This is the agenda of this course

Temenos University - September 2012 2

T24 Securities

In this course we will learn

• The Basic features of the Securities Module

• The Static Tables for this Application

• The Mandatory and Additional Details required

• How Trade Settlement works

• And how to handle a securities order

Temenos University - September 2012 3

T24 Securities

We will start with a product overview

Temenos University - September 2012 4

T24 Securities

Some of the functions of private banking include:

trading in the securities market

handling Corporate actions like dividend and coupon payments on the securities held

managing the assets of client portfolios

Performing portfolio valuations

and the handling of client deposits with other institutions.

Though T24 can handle all these functions, in this session we will only look at the basics of

handling securities trading.

The T24 Securities module handles trading of both debt and equity types of instruments

namely shares and bonds in their various forms. The characteristics of the underlying

instruments are all pre-defined before they are used in trade.

Trading is performed on behalf of Bank’s clients as well as for the Bank’s own investments.

The latter is called Own Book.

In T24, the front office of the Bank takes orders from clients. The orders are transmitted to

the Broker, who identifies the opposite party and confirms the price details. Now, the order

could be executed fully or partially. On acceptance of the price, the back office of the Bank

performs the trade completion. Settlement takes place with the movement of securities to

or from the depository of the investor.

Generally, for own books, the first step of order placement is skipped and the orders are

transmitted to the broker.

Open positions for order capture and confirmed positions for trade completion are

appropriately updated after authorisation.

Temenos University - September 2012 5 5

T24 Securities

When one or more customers want to buy or sell a particular security, a single

order can be captured and the consolidated requirement would be

transmitted to the Broker. This could even be a mix of clients and own book.

It is possible for the Broker to identify the opposite party for a partial quantity

which could be confirmed and the trade completed for that quantity.

Subsequently, the same Broker or another one could identify another

counterparty for the remaining quantity. These can be executed separately

The Broker could also locate multiple parties on the other side of the trade

with different offer prices. So, now we have a case of multiple prices from the

same Broker. The order can be executed with an average price for the

transaction.

Positions are maintained by security for each portfolio. A customer can have

multiple portfolios. Details of the holdings of an investor with different

depositories can also be extracted.

In addition to handling orders, T24 can also handle the direct input of a trade

for its customers. This is generally done for own book. A combination or a mix

of buy and sell between the customers can be input in a trade. T24 validates

that the total quantity to buy equals total quantity to sell.

Temenos University - September 2012 6 6

T24 Securities

However, when an order is captured, it can only be a buy or sell trade for a

particular security for a particular portfolio.

Temenos University - September 2012 ‹#›

T24 Securities

Client orders are placed with the front office. They are generally transmitted

to the broker by the Front office. On price confirmation , the Middle office

executes the order. Then, the Back office takes care of the settlement of the

trade .

As for the Bank’s own Book, the bank may prefer to directly complete the

trade, but this is normally done by the Front office.

Temenos University - September 2012 7 7

T24 Securities

We will now look at the Parameter tables

Temenos University - September 2012 8

T24 Securities

These are some of the Top level Parameter Tables.

Temenos University - September 2012 9 9

T24 Securities

And here are explanations of other parameters tables that are needed for

definition of Securities

Temenos University - September 2012 10 10

T24 Securities

We will now look at the static tables

Temenos University - September 2012 11

T24 Securities

Out of all the Core static tables that are linked to Securities, CUSTOMER,

ACCOUNT and CURRENCY play an important role.

In addition to these tables, it also needs other module-specific static tables to

be setup for its Participants, Instruments and Portfolios.

The participant can be the Buyer, Seller, Broker, Depository or Own Book.

Suitable records should be created in the CUSTOMER table.

A customer can select specific accounts to be used for security transactions.

Additionally, it is also possible to indicate the same or different account

numbers to be used by T24 for various other applications like Funds Transfer,

Money Market and Loans & Deposits.

It is possible to perform multi-currency transactions

Exchange rates are defaulted from the CURRENCY table.

The stock exchange has a role in the securities transaction and needs to be

setup in the STOCK.EXCHANGE file.

In the CUSTOMER.SECURITY table, the role of each participant is defined.

Examples of roles are customer, broker, stock exchange, and depository.

Each tradable instrument is fully defined in the SECURITY.MASTER.

Temenos University - September 2012 12 12

T24 Securities

An Investor would own a portfolio which would be made up of securities. The

Nature of the portfolio is defined in SEC.ACC.MASTER.

Temenos University - September 2012 ‹#›

T24 Securities

We will now see the mandatory and additional information

Temenos University - September 2012 13

T24 Securities

We will first see how to capture a direct trade.

Security or Order details, Customer details and Broker details have to be

provided to complete a direct trade.

A trade is captured for one security at a time but the buyers and sellers could

be numerous. The security which is to be traded needs to be defined either by

its Id or Mnemonic. A drop down list of securities is also available for easy

reference.

Based on the ID selected, T24 validates the trade with the details from the

SECURITY.MASTER table. Details would include the Depository where

positions are to be held, the exchange where it is traded on and the currency

of the security.

Additionally, in the case of a Bond, the interest details for the calculation of

accruals are obtained. The details would include the accrual start date,

interest rate, and interest basis.

Most of the inputs can be amended or overwritten by the user at the

transaction level.

For example: A security can be listed on more than one exchange.

Temenos University - September 2012 14 14

T24 Securities

SECURITY.MASTER can hold only the exchange where the security is transacted

most often, but it is possible for a particular transaction to be done at another

exchange. In this case the user can amend the value defaulted in the trade.

Temenos University - September 2012 ‹#›

T24 Securities

The next section is about the Customer details of the investor, who could be a Buyer

or Seller.

The Customer ID is used and T24 validates the record against the record defined in

CUSTOMER.SECURITY to determine the role. For the Bank’s own book trading, a

suitable record needs to be pre-defined in CUSTOMER.SECURITY.

Further, these customers should also have a portfolio defined for them in the

SEC.ACC.MASTER. T24 will default the first portfolio of the customer, but if the

transaction is related to a different portfolio, the user has to input that portfolio

number.

The transaction type could be a Buy or Sell.

The nominals are the number or quantity of the instrument that is traded on behalf

of the customer.

The price at which the trade is completed for the customer has to be input. The

value of the trade is then calculated by the system.

The settlement account is defaulted from the portfolio definition in

SEC.ACC.MASTER. If need be, the account specified can be amended by the user.

There can be multiple customers involved in a trade. Hence, all the previously

mentioned details need to be furnished for each customer in the associated multi

value set of fields.

Temenos University - September 2012 15 15

T24 Securities

In the Broker details section, the ID of the Broker is indicated. The Broker should

have a record in the CUSTOMER table as well as in CUSTOMER.SECURITY. T24

validates the role as defined in CUSTOMER.SECURITY as BROKER. No portfolio is

available for the Broker.

The transaction type should be opposite to what was defined on the Customer side.

If the Customer side of the transaction is a Buy, then it is a sell on the broker side.

The nominals are the number or quantity of the instrument that is traded with the

Broker. The price at which the trade is completed with the Broker is supplied. If

applicable, multiple prices can be given for each Broker, by expanding the sub value

for each Broker quantity.

The market price for the security is available in the SECURITY.MASTER record. T24

will compare the price defined on record and the transaction price and will raise a

suitable override for deviations.

Since there can be multiple Brokers, all the mentioned details need to be furnished

for each Broker in the associated multi value set of fields.

When the details are validated, T24 checks that the total quantity of the Buy and

Sell match before accepting the trade as completed.

For example when there are five Investors each buying 1,000 shares through two

Brokers, then the total sale of shares by the two Brokers must be equal to 5,000

Temenos University - September 2012 16 16

T24 Securities

In this next section we will discuss how to settle a trade

Temenos University - September 2012 17

T24 Securities

A Contractual Settlement is when a trade is authorized.

T24 raises accounting entries by trade date.

Customer’s accounts are debited or credited.

Positions are updated as settled.

Under Actual Settlement, when the trade is completed, T24 requires further

processing. T24 generates suspense entries upon the authorisation of the

trade. Upon the confirmation of cash settlements, the suspense entries are

reversed and the customer’s account is debited or credited. Positions are

updated as unsettled up until the settlement of the securities is confirmed by

the Depository.

This is done to ensure that positions are updated only after settlement has

occurred.

During this training module, we will only look at contractual settlements.

Temenos University - September 2012 18 18

T24 Securities

In this first workshop we will input a purchase to trade shares for own book

Temenos University - September 2012 19

T24 Securities

Here is the information to fill in.

Temenos University - September 2012 20 20

T24 Securities

We will now look at the Customer Portfolios concept

Temenos University - September 2012 21

T24 Securities

CUSTOMER.SECURITY and SEC.ACC.MASTER are mandatory for own book and

investor trading.

For own book trading, these are set up at the initial stage by creating a record

in the CUSTOMER table for the bank and then using that Id.

CUSTOMER.SECURITY is created for the Bank with role as CUSTOMER.

For every investing customer, a suitable record is required in

CUSTOMER.SECURITY. This defines the relationship of the customer by setting

the Customer Type as Customer. Other options include Broker and Depository.

It is possible to apply multiple roles by multi valuing the CUSTOMER.TYPE

field. For example, the same customer could be the Broker and the

Depository.

Portfolio is to be defined as the next stage. This is also done for the Bank’s

own book. A portfolio is a basket of assets to be classified for investment. This

is defined in the SEC.ACC.MASTER table. The Portfolio number is the

Customer Id followed by a sequence number.

This also defines accounts in various currencies to be defaulted while

inputting trades for this portfolio. These accounts can be subsequently added.

A customer can have multiple portfolios.

Temenos University - September 2012 22 22

T24 Securities

In this workshop we will include the individual customer created earlier as an

investor of securities

Temenos University - September 2012 23

T24 Securities

Here is how we proceed.

Temenos University - September 2012 24 24

T24 Securities

We will now create the first portfolio for the customer

Temenos University - September 2012 25

T24 Securities

Here is how we proceed.

Temenos University - September 2012 26 26

T24 Securities

We will now learn how to input an order

Temenos University - September 2012 27

T24 Securities

Most of the input details needed for a trade are also required for the order.

However, additional details are also needed.

Rules for different types of orders are defined in the table SC.ORDER.TYPE.

• A Market order is to be sent to the Market to be filled at the going price

on the market.

• A Limit order enables the placement of a minimum or maximum cap on

the price allowable that the trade is to be filled on.

• With a Cash order, the value of the trade is known but not the quantity.

Once the order is filled, the quantity will be known.

An Activity is the transaction from the customer side, namely the Buy or Sell.

Broker details are not mandatory at the initial input.

Price is not input in the order. It will be fetched from the market and then

updated later.

At this point, the Order will be in transmitted status.

Temenos University - September 2012 28 28

T24 Securities

We will now input a market order

Temenos University - September 2012 29

T24 Securities

The Security, order type, Customer, Nominal and Broker information are all

entered

Temenos University - September 2012 30 30

T24 Securities

We will now see how to execute and complete an order

Temenos University - September 2012 31

T24 Securities

In SEC.OPEN.ORDER, we had captured and transmitted the order to Brokers.

When the order is transmitted, a record is created for execution in

SC.EXE.SEC.ORDERS application with the same Id as SEC.OPEN.ORDER.

In SC.EXE.SEC.ORDERS application, the order is duly executed by giving Broker

details and execution prices. This could be partially executed and unexecuted

portions can be executed again and again till the order is fully executed.

Execution can even be done by using multiple Brokers.

When SC.EXE.SEC.ORDERS application is authorised for an execution, it

creates records in SEC.TRADE application in IHLD status with Ids commencing

with SCTRSC.

All the details from SC.EXE.SEC.ORDERS are defaulted while creating records in

SEC.TRADE. Details can be amended in the trade if necessary.

SEC.TRADE will have a reference of the order number and the order in

SEC.OPEN.ORDER will now automatically have reference of the relevant

SEC.TRADE.

Temenos University - September 2012 32 32

T24 Securities

In this workshop, we will execute the order.

Temenos University - September 2012 33

T24 Securities

Here, we execute the order at the price of 99 USD

Temenos University - September 2012 34 34

T24 Securities

We will now complete the trade

Temenos University - September 2012 35

T24 Securities

We can view the details here

Temenos University - September 2012 36 36

T24 Securities

Here, we input settlement instructions for the Broker

Temenos University - September 2012 37 37

T24 Securities

We remove the values defaulted in these Fields

Temenos University - September 2012 38 38

T24 Securities

We can now view the Transactions

Temenos University - September 2012 39

T24 Securities

You will first need to retrieve the accounting entry in order to get the trade ID

of your transaction

Temenos University - September 2012 40 40

T24 Securities

We will look at the positions by portfolio

Temenos University - September 2012 41

T24 Securities

We select the portfolio and then, drill-down to the details

Temenos University - September 2012 42 42

T24 Securities

Up to the Security details of bond and calculation of interest accruals

Temenos University - September 2012 43 43

T24 Securities

We will now sell a position

Temenos University - September 2012 44

T24 Securities

We select the position to sell

Temenos University - September 2012 45 45

T24 Securities

We indicate the nominal amount and the broker

Temenos University - September 2012 46 46

T24 Securities

Here is an additional workshop

Temenos University - September 2012 47

T24 Securities

We will now look at the available Enquiries and Reports

Temenos University - September 2012 48

T24 Securities

Position Summary gives the list of all positions held in T24. It is not necessary

input a portfolio or security, if full details are required.

Positions by Portfolio needs a portfolio number. Then T24 will display the

details of the positions held by the portfolio.

Positions by Security will display a list of all portfolios which have a position in

the specified security.

Positions by Depository will display the positions with a Depository for each

portfolio, by security.

Own book positions will display the details for the Bank’s own book. Details

include accruals and market values.

Position as on Trade/value date will provide the position on the selected trade

and value dates.

Position between two dates will provide the movement between the two

dates

We will now see examples of the first 3 enquiries that are listed on this

screen.

Temenos University - September 2012 49 49

T24 Securities

Here is the Client Security Position Summary

Temenos University - September 2012 50 50

T24 Securities

Here is the Client Security Position By Portfolio for the selected portfolio

Temenos University - September 2012 51 51

T24 Securities

Here is the Client Security Position by Security for the selected security

Temenos University - September 2012 52 52

T24 Securities

During the Close of Business, three different reports are generated by the

system.

The first report lists the orders which have expired and hence could be

purged.

The second report provides details of the orders which have been executed

and the third report lists the pending orders.

Temenos University - September 2012 53 53

T24 Securities

Here is the Open Orders To Be Purged Report

Temenos University - September 2012 54 54

T24 Securities

Here is the Open Orders Executed Report

Temenos University - September 2012 55 55

T24 Securities

And finally here is the Pending Open Orders Report

Temenos University - September 2012 56 56

T24 Customer

1) False

2) True

3) False

4) False

5) True

Temenos University - June 2012 57 57

T24 Securities

Here is what we have learned during this Securities course

Temenos University - September 2012 58

T24 Securities

Temenos University - September 2012 59

You might also like

- Securitized Real Estate and 1031 ExchangesFrom EverandSecuritized Real Estate and 1031 ExchangesNo ratings yet

- T3TSCO - Securities Back Office - R13 1Document457 pagesT3TSCO - Securities Back Office - R13 1Gnana SambandamNo ratings yet

- Options Trading Crash Course 2022: A Complete Beginner’s Guide To Learn The Basics About Trading Options And Start Making Money In Just 30 DaysFrom EverandOptions Trading Crash Course 2022: A Complete Beginner’s Guide To Learn The Basics About Trading Options And Start Making Money In Just 30 DaysNo ratings yet

- Business SecuritiesDocument19 pagesBusiness SecuritiesStephens Tioluwanimi Oluwadamilare100% (5)

- Securitization and Foreclosure by Robert RamersDocument8 pagesSecuritization and Foreclosure by Robert RamersBob Ramers100% (2)

- LimitsDocument30 pagesLimitsSwapnali100% (1)

- Investment Banking Domain Knowledge For TestersDocument8 pagesInvestment Banking Domain Knowledge For Testerspravin2160% (1)

- Investments Workbook: Principles of Portfolio and Equity AnalysisFrom EverandInvestments Workbook: Principles of Portfolio and Equity AnalysisRating: 4 out of 5 stars4/5 (1)

- R48 Derivative Markets and InstrumentsDocument179 pagesR48 Derivative Markets and InstrumentsAaliyan Bandealy100% (1)

- T3TDX - Derivatives - R15 PDFDocument316 pagesT3TDX - Derivatives - R15 PDFUmesh Bansode0% (1)

- Derivatives PDFDocument309 pagesDerivatives PDFmarkNo ratings yet

- 04b Receivables (Part 2)Document6 pages04b Receivables (Part 2)JEFFERSON CUTE100% (1)

- T3TSL - Syndicated Loans - R14Document283 pagesT3TSL - Syndicated Loans - R14tayutaNo ratings yet

- Understand The Trade Settlements and Over ViewDocument4 pagesUnderstand The Trade Settlements and Over ViewChowdary PurandharNo ratings yet

- Luxembourg Regulated Investment Vehicles 2018Document21 pagesLuxembourg Regulated Investment Vehicles 2018Georgio RomaniNo ratings yet

- Property Tax Payment ReceiptDocument1 pageProperty Tax Payment ReceiptC.A. Ankit JainNo ratings yet

- Introduction To T24 - Customer - T2ITC - Customer R10 (1) .1Document36 pagesIntroduction To T24 - Customer - T2ITC - Customer R10 (1) .1MullerNo ratings yet

- T24 Induction Business - Customer - R14Document47 pagesT24 Induction Business - Customer - R14Developer T240% (1)

- A Random Walk Down Wall Street Malkiel en 2834Document5 pagesA Random Walk Down Wall Street Malkiel en 2834Min Park100% (6)

- Dfgsdstrade Life Scycle EweentsDocument5 pagesDfgsdstrade Life Scycle EweentsRana Prathap100% (1)

- British Gas - OldDocument2 pagesBritish Gas - Oldky139396No ratings yet

- T24 For IslamicbankingDocument5 pagesT24 For IslamicbankingZahidBhattiNo ratings yet

- T24 Induction Business - TellerDocument63 pagesT24 Induction Business - TellerKrishna100% (1)

- T24 For Islamic BankingDocument12 pagesT24 For Islamic BankingCoolboy RanaNo ratings yet

- Islamin Banking ProjectDocument8 pagesIslamin Banking Projectapi-3749668No ratings yet

- Payables 11i Test ScenariosDocument58 pagesPayables 11i Test ScenariosyasserlionNo ratings yet

- 1504107521148Document53 pages1504107521148ameerpet100% (1)

- Amortization & Sinking FundDocument27 pagesAmortization & Sinking FundkimNo ratings yet

- Methods of Accelarating Cash-InflowDocument23 pagesMethods of Accelarating Cash-InflowChannaveerayya Hiremath100% (1)

- SAP Assets Accounting T CodesDocument6 pagesSAP Assets Accounting T CodesGopa Kambagiri SwamyNo ratings yet

- T24 Induction Business - Money Market DepositsDocument40 pagesT24 Induction Business - Money Market DepositsdipakmangnaniNo ratings yet

- Futures 101: Get A Handle On The BasicsDocument3 pagesFutures 101: Get A Handle On The Basicsjohn butkerNo ratings yet

- Investment ManagementDocument4 pagesInvestment ManagementCaroline B CodinoNo ratings yet

- Unit 2. Trading Mechanist in Stock Market.: 1.meaning of ShareDocument6 pagesUnit 2. Trading Mechanist in Stock Market.: 1.meaning of ShareLokesh TalegaonkarNo ratings yet

- Loukesh Pandarkar, 27, Like Many Indians His Age, Has Dreams: To Own A House, Get Married and Find TheDocument8 pagesLoukesh Pandarkar, 27, Like Many Indians His Age, Has Dreams: To Own A House, Get Married and Find TheKrishna GNo ratings yet

- Week 7 Learning EbookDocument169 pagesWeek 7 Learning EbookAnniNo ratings yet

- Assignment 1Document10 pagesAssignment 1Ringkel BaruaNo ratings yet

- Premier University: Assignment 1 & 2Document22 pagesPremier University: Assignment 1 & 2Ringkel BaruaNo ratings yet

- R48 Derivative Markets and Instruments IFT NotesDocument22 pagesR48 Derivative Markets and Instruments IFT NotesShehroz JamshedNo ratings yet

- Dummies' Guide To The Stock Market: Get Quote Get QuoteDocument7 pagesDummies' Guide To The Stock Market: Get Quote Get Quoteajayanagar022756No ratings yet

- Investment Banking KnowledgeDocument7 pagesInvestment Banking Knowledge1raju1234100% (1)

- What Are Shares Bonds Amp SukukDocument6 pagesWhat Are Shares Bonds Amp Sukukkhalid_ghafoor6226No ratings yet

- Investor Guide: A Y N T K (Vol: II)Document15 pagesInvestor Guide: A Y N T K (Vol: II)Jaleel AhmadNo ratings yet

- SYBFM+Equity+Market+II+Session+IV+Ver1 0Document52 pagesSYBFM+Equity+Market+II+Session+IV+Ver1 0Rohit G. TawdeNo ratings yet

- Investements AccountingDocument9 pagesInvestements AccountingShiyas FazalNo ratings yet

- Shares: Shares Demat Account Trading Types of AnalysisDocument13 pagesShares: Shares Demat Account Trading Types of AnalysisVivek DixitNo ratings yet

- Buying A Business in The UK Jan 2017Document12 pagesBuying A Business in The UK Jan 2017Nescire NescireNo ratings yet

- Real Estate (Skills) : Workshop 3 Note On Certificates of TitleDocument6 pagesReal Estate (Skills) : Workshop 3 Note On Certificates of TitleKimberly TanNo ratings yet

- Term Sheet - NotesDocument10 pagesTerm Sheet - NotesarafatNo ratings yet

- 209 - F - IndiabullsDocument75 pages209 - F - IndiabullsPeacock Live ProjectsNo ratings yet

- Guiding Light: Some Frequently Asked Questions by InvestorsDocument45 pagesGuiding Light: Some Frequently Asked Questions by InvestorsPriya GargNo ratings yet

- Capital-markets-Midterm With ExplanationDocument9 pagesCapital-markets-Midterm With ExplanationfroelanangusatiNo ratings yet

- Cash Money Markets: Minimum Correct Answers For This Module: 6/12Document15 pagesCash Money Markets: Minimum Correct Answers For This Module: 6/12Jovan SsenkandwaNo ratings yet

- R45 Derivative Markets and InstrumentsDocument24 pagesR45 Derivative Markets and InstrumentsSumair ChughtaiNo ratings yet

- Print Article - Dummies' Guide To The Stock MarketDocument7 pagesPrint Article - Dummies' Guide To The Stock MarketmmyemailNo ratings yet

- Online Investments: The iFOREX Guide ToDocument11 pagesOnline Investments: The iFOREX Guide ToPaiNo ratings yet

- Unit # 2 CAPITAL AND MONY MARKETDocument9 pagesUnit # 2 CAPITAL AND MONY MARKETDija AwanNo ratings yet

- Unit # 2 Capital and Mony MarketDocument9 pagesUnit # 2 Capital and Mony MarketDija Awan100% (1)

- Warrants & Certificates: An Introductory GuideDocument32 pagesWarrants & Certificates: An Introductory GuideFaridNo ratings yet

- Case 2Document10 pagesCase 2Kim BihagNo ratings yet

- CustomerDocument31 pagesCustomerSuraj JPNo ratings yet

- Xii Commercs Secretrial PracticeDocument9 pagesXii Commercs Secretrial PracticeSakshi JeswaniNo ratings yet

- T24 Induction Business - AccountDocument73 pagesT24 Induction Business - AccountprathaNo ratings yet

- Fund Accounting NotesDocument33 pagesFund Accounting NotesnirbhayNo ratings yet

- 11 - Chapter 4Document36 pages11 - Chapter 4aswinecebeNo ratings yet

- Online Investments: The FXMARKER Guide ToDocument11 pagesOnline Investments: The FXMARKER Guide ToGeraldino MNo ratings yet

- Case StudyDocument7 pagesCase StudyJoyNo ratings yet

- Chapter 2 MONEY MARKETDocument14 pagesChapter 2 MONEY MARKETNur Dina AbsbNo ratings yet

- A Beginner's Guide to Investing: Investing For Tomorrow - Discover Proven Strategies To Trade and Invest In Any Type of MarketFrom EverandA Beginner's Guide to Investing: Investing For Tomorrow - Discover Proven Strategies To Trade and Invest In Any Type of MarketNo ratings yet

- Cash Book ProblemsDocument6 pagesCash Book Problemsshahid sjNo ratings yet

- Final Report of Strategic ManagementDocument5 pagesFinal Report of Strategic ManagementMuhammad ShakeelNo ratings yet

- Research Paper About BanksDocument7 pagesResearch Paper About BankscwzobjbkfNo ratings yet

- Ivrcl Indore Toll Ways NCLTDocument15 pagesIvrcl Indore Toll Ways NCLTveeruNo ratings yet

- JAIIB Paper 4 RMWM Module D Wealth Management PDFDocument51 pagesJAIIB Paper 4 RMWM Module D Wealth Management PDFAssr MurtyNo ratings yet

- 6 Disposal of Fixed AssetsDocument6 pages6 Disposal of Fixed Assetsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Nexans Kabelmetal QUOTEDocument1 pageNexans Kabelmetal QUOTERonald KaakuNo ratings yet

- The Basics of Accounting For Derivatives and Hedge AccountingDocument7 pagesThe Basics of Accounting For Derivatives and Hedge AccountingRENU BALANo ratings yet

- Export CreditDocument3 pagesExport CreditVikas PandeyNo ratings yet

- BoAt InvoiceDocument1 pageBoAt InvoiceUnknown MysteryNo ratings yet

- Valuation Practice QuizDocument6 pagesValuation Practice QuizSana KhanNo ratings yet

- Shrewsbury Herbal Products, LTDDocument1 pageShrewsbury Herbal Products, LTDWulandari Pramithasari0% (1)

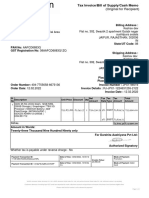

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)erjasdNo ratings yet

- 6EC02 01R Que 20140521 PDFDocument32 pages6EC02 01R Que 20140521 PDFJaneNo ratings yet

- Jin Zhijia SES Term 2 Graded AssignmentDocument2 pagesJin Zhijia SES Term 2 Graded AssignmentZENG XIANYU JASON HCINo ratings yet

- Is-Lm Analysis AND Aggregate Demand: Dr. Laxmi NarayanDocument36 pagesIs-Lm Analysis AND Aggregate Demand: Dr. Laxmi NarayanHappy MountainsNo ratings yet

- Aecon - Project IDocument39 pagesAecon - Project IRaji MohanNo ratings yet

- Quarterly Report Q3 2010 MJNADocument20 pagesQuarterly Report Q3 2010 MJNAcb0bNo ratings yet

- Sti ImfDocument88 pagesSti ImfPema DorjiNo ratings yet

- T AccountsDocument3 pagesT AccountsEdizon De Andres JaoNo ratings yet