Professional Documents

Culture Documents

Radico NV Distilleries Maharashtra Ltd. Tax Invoice

Uploaded by

manoranjan31030 ratings0% found this document useful (0 votes)

3 views1 pageOriginal Title

1-16

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageRadico NV Distilleries Maharashtra Ltd. Tax Invoice

Uploaded by

manoranjan3103Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

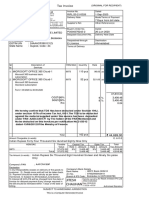

ORIGINAL FOR RECIPIENT Radico NV Distilleries Radico NV Distilleries Maharashtra Ltd.

Regd. Office : Plot No.D-192 To 195,

CIN: No:U15429MH2000PLC193208 Maharashtra Ltd. MIDC Shendra, Five Star Industrial Area,

TAN No: NSKS10538D TAX INVOICE Aurangabad-431 007

GSTIN: 27AAHCS6987N5Z6

Name of consignee(Shipped to):266573 Invoice no JJ003131

PRORICH AGRO PRIVATE LIMITED

Singhpura, Invoice date 18.03.2024

Buyer`s Ord No Cattel Fodder DDGS

ZIRAKPUR_ SAS NAGAR_ PUNJAB140603 PUNJAB GSTIN:

Name of Buyer(Billed to) 266573 Road Permit No

PRORICH AGRO PRIVATE LIMITED

Mode Of By Road Transporter name

ZIRAKPUR_ SAS NAGAR_ PUNJAB140603 Truck No MH09FL3204 DVR Contact No

PUNJAB GSTIN: 03AALCP0169P1Z1

Place of Supply :PB 03-PUNJAB Receiving Date Of Removal

IRN: LR/RR No: Time Of Removal

f8724d4c3367a4de4cabdf2251af70629aa9f0730a58886952f191e00536b4f9

FSSAI LIC NO: & MANUFACTURING UNIT LIC NO:

Details :98595918 Shipping Mark:

S.N Materia Description Of HSN UOM Qty Rate Basic Taxable IGST IGST CGST CGST SGST SGST Total

l Code Material Code Value Amount % Amount % Amount % Amount Amount

10 203957 DDGS-DRYED 23033000 KG

CATTLE 30,180 16.25 490,425.00 490,425.00 5.0 24,521.25 0.0 0.00 0.0 0.00 514,946.25

FODDER

Grand Total

514,946.25

1)Our responsibility ceases upon delivery . Total Amount Before Tax 490,425.00

2)If there is any change in GSTIN,TIN, PAN, NAME & ADDRESS, please inform about the same immediately, in writing. Add IGST 24,521.25

3)Payment should be made within due date vide Demand draft / A/c payee cheque in favour of Radico NV Distilleries Add CGST 0.00

Maharastra Limited. Interest @ 24% per annum will be charged if this bill is not paid within due date. Add SGST 0.00

4)Please send declaration forms along with the payments. (if any) Trade Dis 0.00

5)Any dispute (whether contractual or otherwise) arising out of this transaction between the Parties or arising out of or relating Tax Amount 24,521.25

to or in connection with this invoice shall be referred for arbitration in terms of Arbitration and Conciliation Act 1996 or any TCS Amount 514.95

amendment thereof. Freight 0.00

6)The seat of Arbitration shall be Aurangabad. This invoice shall be governed by the laws of India and courts in Aurangabad s

hall have exclusive jurisdiction over matters arising from this transaction/invoice. The Buyer shall be deemed to have accepted Total Amount After Tax to be Rounded off 515,461.00

all terms and conditions contained in the invoice including the arbitration agreement by accepting the goods delivered under

this invoice.

7)unless otherwise stated, this invoice is not payable under reverse charge

Invoice Amount in words: FIVE LAKH FIFTEEN THOUSAND FOUR HUNDRED SIXTY ONE Rupees

FOR RADICO NV DISTILLERIES MAHARASTRA LTD. FOR BUYER

(Signature of recipient of autorized representative in case

E.&O.E. Signature of Driver Signature of licensee or his Authorised Agents supply on which tax is paid on reverse charges )

Regd. Office: D-192 to D-195,MIDCShendra,Five Star Industrial AreaAurangabad-431007

Page1 of 1

You might also like

- Taxmann Companies Act 2013: Taxmann Companies Act 2013From EverandTaxmann Companies Act 2013: Taxmann Companies Act 2013Rating: 4.5 out of 5 stars4.5/5 (7)

- Eshwar Tradesr..Document1 pageEshwar Tradesr..ANAND KAGALENo ratings yet

- 012-PSS - IGL - GorakhpurDocument1 page012-PSS - IGL - GorakhpurNishant KumarNo ratings yet

- Securitas Engineers: Buyer: ConsigneeDocument1 pageSecuritas Engineers: Buyer: Consigneesvarn groupNo ratings yet

- Invoice 209Document5 pagesInvoice 209AkhilaNo ratings yet

- 9011496693Document3 pages9011496693RITVIK ARORANo ratings yet

- Fosroc 518Document1 pageFosroc 518vinoth kumar SanthanamNo ratings yet

- 2593 GwaliorDocument2 pages2593 GwaliorUtkarsh MalhotraNo ratings yet

- Warshi Bill No-3297Document1 pageWarshi Bill No-3297Aafak KhanNo ratings yet

- Work Order: Draft Printout - Unreleased PoDocument16 pagesWork Order: Draft Printout - Unreleased PoJaiprakash PatelNo ratings yet

- Iphone 8Document1 pageIphone 8leo thomasNo ratings yet

- SupplyOutward GST 22 23 816Document1 pageSupplyOutward GST 22 23 816nikunjsingh04No ratings yet

- 23 PFDocument2 pages23 PFSunil PatelNo ratings yet

- CG04NH9088 EndorsementDocument2 pagesCG04NH9088 EndorsementSiddhantNo ratings yet

- PO5200490820Document8 pagesPO5200490820gawademadhavi30No ratings yet

- Sale Bill 081Document2 pagesSale Bill 081Nilesh PatilNo ratings yet

- PIIX00260 Dev AutomationDocument1 pagePIIX00260 Dev AutomationSabhyaNo ratings yet

- Invoice No.62 BBM (Foundation Bolts)Document2 pagesInvoice No.62 BBM (Foundation Bolts)sales.saimedhaNo ratings yet

- Purchase Order T&CDocument2 pagesPurchase Order T&CsatendraNo ratings yet

- 0069 OcilabsDocument1 page0069 OcilabsOCI LABSNo ratings yet

- All Risk PolicyDocument25 pagesAll Risk PolicyPlanning DAPLNo ratings yet

- MP 0001Document1 pageMP 0001Design DevelopmentNo ratings yet

- Iffco - Tokio General Insurance Co. LTDDocument2 pagesIffco - Tokio General Insurance Co. LTDkRiZ kRiShNaNo ratings yet

- Morph Ser202324027 31102023 277Document6 pagesMorph Ser202324027 31102023 277gokulpics1No ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherDIPL MUMBAINo ratings yet

- Iphone SEDocument1 pageIphone SEleo thomasNo ratings yet

- Invoice 209Document4 pagesInvoice 209AkhilaNo ratings yet

- PO 7300000420 Bajrang WireDocument6 pagesPO 7300000420 Bajrang WireSM AreaNo ratings yet

- Advance To PayDocument1 pageAdvance To PayMayank RathodNo ratings yet

- PO No 33225004100210 DESIGN, SUPPLY, INSTALLATION, COMMISSIONING & MAINTENANCE OF ASPIRATION TYPE AUTOMATIC SMOKE FIRE DETECTION WITH ALARM SYSTEMDocument3 pagesPO No 33225004100210 DESIGN, SUPPLY, INSTALLATION, COMMISSIONING & MAINTENANCE OF ASPIRATION TYPE AUTOMATIC SMOKE FIRE DETECTION WITH ALARM SYSTEMSrDEN CoordinationNo ratings yet

- Iphone SE - PDF - Invoice - BusinessDocument1 pageIphone SE - PDF - Invoice - BusinessAnoop JangraNo ratings yet

- Tin No. 08530101044: Shree Cement Limited Regd. Office, Bangur Nagar, Post Box No. 33, BEAWAR-305 901, Rajasthan, IndiaDocument3 pagesTin No. 08530101044: Shree Cement Limited Regd. Office, Bangur Nagar, Post Box No. 33, BEAWAR-305 901, Rajasthan, IndiaSANJAY DEOPURANo ratings yet

- 109 e InvoiceDocument4 pages109 e Invoicestores.hexatronNo ratings yet

- Iffco - Tokio General Insurance Co. LTDDocument2 pagesIffco - Tokio General Insurance Co. LTDRajendra VinerkarNo ratings yet

- APMS665424Document1 pageAPMS665424dudde niranjanNo ratings yet

- Document DetailsDocument1 pageDocument DetailszaidkhanNo ratings yet

- AP01900174Document1 pageAP01900174dudde niranjanNo ratings yet

- Duben DasDocument9 pagesDuben DasHariom Professional Education & Training CentreNo ratings yet

- Adinath 2Document4 pagesAdinath 2stores.hexatronNo ratings yet

- 2223TBS0002254Document1 page2223TBS0002254Huskee CokNo ratings yet

- Ukni QuotationsDocument4 pagesUkni QuotationsBunty SharmaNo ratings yet

- Inv Parida 2488512662Document8 pagesInv Parida 2488512662Ashish ParidaNo ratings yet

- Cummins 380KVA QuotationDocument1 pageCummins 380KVA QuotationabhibawaNo ratings yet

- UP72AT2190Document4 pagesUP72AT2190Aashray JindalNo ratings yet

- Garg JJ400276 - 9045101903Document2 pagesGarg JJ400276 - 9045101903Sanju DhatwaliaNo ratings yet

- Lakshmi Agencies: Tax Invoice (Cash)Document2 pagesLakshmi Agencies: Tax Invoice (Cash)srinivas kandregulaNo ratings yet

- LaborParts RJC FACF24 000173Document2 pagesLaborParts RJC FACF24 000173vractivaNo ratings yet

- DKSH Po 52 DT 06.09.2022Document1 pageDKSH Po 52 DT 06.09.2022Nova TransfersNo ratings yet

- Inv. # 579 - MediconnectDocument1 pageInv. # 579 - MediconnectNikhil DanakNo ratings yet

- Inv WBL Insha Hp0099Document4 pagesInv WBL Insha Hp0099digitalseva.japanigateNo ratings yet

- F22nb01a00044 Nb01a F2410989Document1 pageF22nb01a00044 Nb01a F2410989HEMANTHNo ratings yet

- Invoice No.59 Durga Stone (Sedum)Document2 pagesInvoice No.59 Durga Stone (Sedum)sales.saimedhaNo ratings yet

- Rohan TyagiDocument1 pageRohan TyagirohanZorbaNo ratings yet

- Invoice - No - 1181 - DT - 03112022 Original For RecipientDocument1 pageInvoice - No - 1181 - DT - 03112022 Original For RecipientAshwani SharmaNo ratings yet

- 4177 BVCPSDocument1 page4177 BVCPSpawansinghpk9993No ratings yet

- Tax Invoice: Edutech Mentor Mangrodih, Giridih 815302Document2 pagesTax Invoice: Edutech Mentor Mangrodih, Giridih 815302Sonu Kumar SinghNo ratings yet

- SalesBill VI 139 DigitallySignedDocument1 pageSalesBill VI 139 DigitallySignedKundariya MayurNo ratings yet

- Po 164 RMC Nuvoco SVGLLPDocument1 pagePo 164 RMC Nuvoco SVGLLPAmit Ranjan SharmaNo ratings yet

- Description of Goods Amount Disc. % Per Rate Quantity Hsn/SacDocument1 pageDescription of Goods Amount Disc. % Per Rate Quantity Hsn/SacBharat SharmaNo ratings yet

- Rahman Industries LTD: Tax InvoiceDocument1 pageRahman Industries LTD: Tax InvoiceRashid KhanNo ratings yet

- DenmarkDocument4 pagesDenmarkFalcon KingdomNo ratings yet

- South West Mining LTD - Combined CFO & HWA - VerDocument8 pagesSouth West Mining LTD - Combined CFO & HWA - Verapi-3809359No ratings yet

- Course Syllabus: Ecommerce & Internet MarketingDocument23 pagesCourse Syllabus: Ecommerce & Internet MarketingMady RamosNo ratings yet

- Notes On Mass and Energy Balances For Membranes 2007 PDFDocument83 pagesNotes On Mass and Energy Balances For Membranes 2007 PDFM TNo ratings yet

- Cam 12 Test 2 ReadingDocument7 pagesCam 12 Test 2 ReadingLê Nguyễn Ái DuyênNo ratings yet

- Payment Systems Worldwide: Appendix Country-by-Country AnswersDocument306 pagesPayment Systems Worldwide: Appendix Country-by-Country Answersravinewatia27No ratings yet

- 50 Hotelierstalk MinDocument16 pages50 Hotelierstalk MinPadma SanthoshNo ratings yet

- CV Najim Square Pharma 4 Years ExperienceDocument2 pagesCV Najim Square Pharma 4 Years ExperienceDelwarNo ratings yet

- DCF ModelDocument14 pagesDCF ModelTera ByteNo ratings yet

- User Manual OptiPoint 500 For HiPath 1220Document104 pagesUser Manual OptiPoint 500 For HiPath 1220Luis LongoNo ratings yet

- Balanza Pediatrica Health o Meter 549KL Mtto PDFDocument18 pagesBalanza Pediatrica Health o Meter 549KL Mtto PDFFix box Virrey Solís IPSNo ratings yet

- Future Generation Computer SystemsDocument18 pagesFuture Generation Computer SystemsEkoNo ratings yet

- Kudla Vs PolandDocument4 pagesKudla Vs PolandTony TopacioNo ratings yet

- Negative Sequence Current in Wind Turbines Type 3 1637954804Document6 pagesNegative Sequence Current in Wind Turbines Type 3 1637954804Chandra R. SirendenNo ratings yet

- Wheel CylindersDocument2 pagesWheel Cylindersparahu ariefNo ratings yet

- Learning Activity Sheet Science 10 Second Quarter - Week 8Document4 pagesLearning Activity Sheet Science 10 Second Quarter - Week 8Eller Jansen AnciroNo ratings yet

- Unit 1: Exercise 1: Match The Words With The Pictures. Use The Words in The BoxDocument9 pagesUnit 1: Exercise 1: Match The Words With The Pictures. Use The Words in The BoxĐoàn Văn TiếnNo ratings yet

- EC312 Object Oriented ProgrammingDocument3 pagesEC312 Object Oriented ProgrammingJazir HameedNo ratings yet

- Factors Affecting The Rate of Chemical Reactions Notes Key 1Document3 pagesFactors Affecting The Rate of Chemical Reactions Notes Key 1api-292000448No ratings yet

- Organization of Brigada Eskwela Steering and Working CommitteesDocument2 pagesOrganization of Brigada Eskwela Steering and Working CommitteesCherry Lou RiofrirNo ratings yet

- CPI As A KPIDocument13 pagesCPI As A KPIKS LimNo ratings yet

- Case Title: G.R. No.: Date: Venue: Ponente: Subject: TopicDocument3 pagesCase Title: G.R. No.: Date: Venue: Ponente: Subject: TopicninaNo ratings yet

- Book Notes Covering: Andy Kirk's Book, Data Visualization - A Successful Design ProcessDocument10 pagesBook Notes Covering: Andy Kirk's Book, Data Visualization - A Successful Design ProcessDataVersed100% (1)

- TIP - IPBT M - E For MentorsDocument3 pagesTIP - IPBT M - E For Mentorsallan galdianoNo ratings yet

- Phet Body Group 1 ScienceDocument42 pagesPhet Body Group 1 ScienceMebel Alicante GenodepanonNo ratings yet

- Cosare V BroadcomDocument2 pagesCosare V BroadcomapbueraNo ratings yet

- F9 Smart Study NotesDocument97 pagesF9 Smart Study NotesSteven Lino100% (5)

- Autoclave 2Document52 pagesAutoclave 2SILVANA ELIZABETH ROMO ALBUJANo ratings yet

- CDCS Self-Study Guide 2011Document21 pagesCDCS Self-Study Guide 2011armamut100% (2)

- Sparse ArrayDocument2 pagesSparse ArrayzulkoNo ratings yet