Professional Documents

Culture Documents

Chapter 9 Solutions: Exercise 8-23

Uploaded by

Tahir DestaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 9 Solutions: Exercise 8-23

Uploaded by

Tahir DestaCopyright:

Available Formats

540 Solutions To Exercises

The ECL increase is deemed to be significant by management and as a result, the ECL

has changed from a 12-month ECL to the investment’s lifetime (Lifetime ECL).

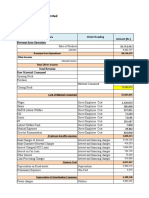

EXERCISE 8–23

General Journal

Date Account/Explanation PR Debit Credit

Loss on impairment (NI) . . . . . . . . . . . . . . . . . . . . 1,725

Unrealized gain/loss (OCI) . . . . . . . . . . . . . . . . . . 4,025

Investment in bonds, amortized cost . . . . . 5,750

For Unrealized gain/loss: (1,150,000 × (1 −

0.995) = 5,750 − 1,725)

Chapter 9 Solutions

EXERCISE 9–1

The following costs should be capitalized with respect to this equipment:

Cash price paid, net of $1,600 discount, excluding $3,900 of recoverable tax $ 78,400

Freight cost to ship equipment to factory 3,300

Direct employee wages to install equipment 5,600

External specialist technician needed to complete final installation 4,100

Materials consumed in the testing process 2,200

Direct employee wages to test equipment 1,300

Legal fees to draft the equipment purchase contract 2,400

Government grant received on purchase of the equipment (8,000)

Total cost capitalized 89,300

The recoverable tax should be disclosed as an amount receivable on the balance sheet.

The repair costs, costs of training employees, overhead costs, and insurance cost would

all be expensed as regular operating expenses on the income statement.

An alternative treatment for the government grant would be to defer it as an unearned

revenue liability and then amortize it on the same basis as the equipment depreciation.

You might also like

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Module 2 - Problems On Cost Sheet New 2019 PDFDocument7 pagesModule 2 - Problems On Cost Sheet New 2019 PDFJibin JoseNo ratings yet

- 1.2 Far1 Vol II Autumn 2022Document417 pages1.2 Far1 Vol II Autumn 2022rana m harisNo ratings yet

- Plant AssetsDocument17 pagesPlant AssetsGizaw Belay100% (1)

- Cost and Management Accounting 01 - Class NotesDocument114 pagesCost and Management Accounting 01 - Class NotessaurabhNo ratings yet

- Responsibility AccountingDocument21 pagesResponsibility AccountingMicaella GrandeNo ratings yet

- Far-1 Vol 2 Autumn 2023Document364 pagesFar-1 Vol 2 Autumn 2023midrarkhan820No ratings yet

- Chapter Two-Plant AssetsDocument21 pagesChapter Two-Plant Assetsaddisyawkal18No ratings yet

- Lecture-7 Overhead (Part 3)Document9 pagesLecture-7 Overhead (Part 3)Nazmul-Hassan SumonNo ratings yet

- Chapter 2 Plant Asset PDFDocument20 pagesChapter 2 Plant Asset PDFWonde Biru100% (1)

- OverheadsDocument38 pagesOverheadsHebaNo ratings yet

- Chapter 7 - Manufacturing Overhead - DepartmentalizationDocument77 pagesChapter 7 - Manufacturing Overhead - DepartmentalizationJiko GuintoNo ratings yet

- Lecture-8.1 Job Order Costing (Theory)Document7 pagesLecture-8.1 Job Order Costing (Theory)Nazmul-Hassan SumonNo ratings yet

- Overhead Analysis8Document14 pagesOverhead Analysis8AberraNo ratings yet

- 3 Revision of Absorption Costing: Key TermDocument2 pages3 Revision of Absorption Costing: Key TermSyed Attique KazmiNo ratings yet

- CMA CU - Chap5Document29 pagesCMA CU - Chap5TAMANNANo ratings yet

- B. Cash FlowsDocument4 pagesB. Cash Flowsvee kimsNo ratings yet

- Muhammad Asghar SAP ID #7448 Answer # 01Document16 pagesMuhammad Asghar SAP ID #7448 Answer # 01Muhammad AsgharNo ratings yet

- Business Plan of Manufacturing Air PurifiersDocument7 pagesBusiness Plan of Manufacturing Air PurifiersSakshi BaiwalNo ratings yet

- Exercises (8.1) : 180 Part OneDocument7 pagesExercises (8.1) : 180 Part OneZakaria HasaneenNo ratings yet

- Cost SheetDocument20 pagesCost SheetKeshviNo ratings yet

- Pisodira PDFDocument46 pagesPisodira PDFjhouvanNo ratings yet

- Module 4 (Topic 4) - MachineryDocument8 pagesModule 4 (Topic 4) - MachineryAnn BergonioNo ratings yet

- George Fayne Mining Co Received A 760 000 Low Bid FromDocument1 pageGeorge Fayne Mining Co Received A 760 000 Low Bid FromM Bilal SaleemNo ratings yet

- 21S1 AC1103 Lesson 09 Discussion QuestionsDocument10 pages21S1 AC1103 Lesson 09 Discussion Questionsxiu yingNo ratings yet

- AFAR 15 Job Order CostingDocument11 pagesAFAR 15 Job Order CostingMartin ManuelNo ratings yet

- Acc116 G7Document6 pagesAcc116 G7ABDUL HAFIZ ABDULLAHNo ratings yet

- Lobj19 - 0000055 CR 1907 02 A PDFDocument28 pagesLobj19 - 0000055 CR 1907 02 A PDFqqqNo ratings yet

- MA2 Mock 2-As - 2023-24Document8 pagesMA2 Mock 2-As - 2023-24daniel.maina2005No ratings yet

- T04 Overheads - STDDocument18 pagesT04 Overheads - STDkhairul sbrNo ratings yet

- Cost Accounting: Job Order Costing SystemDocument6 pagesCost Accounting: Job Order Costing SystemErika LanezNo ratings yet

- Foh DistributionDocument91 pagesFoh Distributionkhalid1173No ratings yet

- Tutorial 1.1 QDocument4 pagesTutorial 1.1 QDashania GregoryNo ratings yet

- Ias 16Document31 pagesIas 16Reever RiverNo ratings yet

- Cma Adnan Rashid Complete NotesDocument541 pagesCma Adnan Rashid Complete NotesHAREEM25% (4)

- Guintu, Joshua S. (Manacc 313, Bsie-3d)Document2 pagesGuintu, Joshua S. (Manacc 313, Bsie-3d)Joshua GuintuNo ratings yet

- Document 42Document5 pagesDocument 42Comm SofianNo ratings yet

- Smchap08 160310162253Document71 pagesSmchap08 160310162253Jesus SantosNo ratings yet

- Cost Accounting FA1Document3 pagesCost Accounting FA1Emmanuelle MazaNo ratings yet

- Company Tax SS Sept 2021 (Rate 2021) .For StudentsDocument3 pagesCompany Tax SS Sept 2021 (Rate 2021) .For StudentsizzahNo ratings yet

- Unit 3 Part 1 - CostingDocument17 pagesUnit 3 Part 1 - CostingPrarthana R Industrial EngineeringNo ratings yet

- Introduction To Management AccountingDocument10 pagesIntroduction To Management AccountingPatrick Panlilio RetuyaNo ratings yet

- CAC C5M1 Accounting For Factory OverheadDocument6 pagesCAC C5M1 Accounting For Factory OverheadKyla Mae AllamNo ratings yet

- LKAS - 16 Property Plant and Equipment: ACC1340 - Financial Accounting Department of AccountingDocument49 pagesLKAS - 16 Property Plant and Equipment: ACC1340 - Financial Accounting Department of AccountingMenaka KulathungaNo ratings yet

- Week 9 - 10 - OverheadDocument44 pagesWeek 9 - 10 - OverheadMohammad EhsanNo ratings yet

- Cost Management Accounting AM1 STDocument5 pagesCost Management Accounting AM1 STAash RedmiNo ratings yet

- M/s Malik Polychem Limited: Amount (RS.) Revenue Form OperationDocument4 pagesM/s Malik Polychem Limited: Amount (RS.) Revenue Form OperationVarun MalhotraNo ratings yet

- Raw MaterialsDocument1 pageRaw Materialstan jamesNo ratings yet

- Activity Based CostingDocument19 pagesActivity Based CostingChristine Mae MataNo ratings yet

- Tutorial 5Document7 pagesTutorial 5YANG YUN RUINo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Diyana NabihahNo ratings yet

- Lkas 16 - PpeDocument45 pagesLkas 16 - PpeKogularamanan Nithiananthan100% (1)

- Chapter 5Document20 pagesChapter 5Clyette Anne Flores Borja100% (1)

- Costs - Concepts and ClassificationsDocument5 pagesCosts - Concepts and ClassificationsCarlo B CagampangNo ratings yet

- Assignment Cover Sheet: Northrise UniversityDocument6 pagesAssignment Cover Sheet: Northrise UniversitySapcon ThePhoenixNo ratings yet

- Bsa - 1201 A2Document7 pagesBsa - 1201 A2ALYSSA SERRANONo ratings yet

- Bergerac XLS ENGDocument12 pagesBergerac XLS ENGTelmo Barros0% (1)

- Difference Between Conventional and Islamic Products AssetDocument9 pagesDifference Between Conventional and Islamic Products AssetTahir DestaNo ratings yet

- Data InterpretationDocument242 pagesData InterpretationTahir DestaNo ratings yet

- Fintech in Financial Reporting and Audit For Fraud Prevention and Safeguarding Equity InvestmentsDocument45 pagesFintech in Financial Reporting and Audit For Fraud Prevention and Safeguarding Equity InvestmentsTahir DestaNo ratings yet

- 05 Accounting For CashDocument37 pages05 Accounting For CashTahir DestaNo ratings yet

- 00 PersonalAccounting FinancialAccountingDocument27 pages00 PersonalAccounting FinancialAccountingTahir DestaNo ratings yet

- Statement of Cash Flows: Learning ObjectivesDocument75 pagesStatement of Cash Flows: Learning ObjectivesTahir DestaNo ratings yet

- Peachtree Accounting ProjectDocument12 pagesPeachtree Accounting ProjectTahir DestaNo ratings yet

- Salvin-Lepcha2019 ReferenceWorkEntry FinancialFraudsAndScamsDocument8 pagesSalvin-Lepcha2019 ReferenceWorkEntry FinancialFraudsAndScamsTahir DestaNo ratings yet

- 03 RecordingBusinessTransactions FinancialAccountingDocument30 pages03 RecordingBusinessTransactions FinancialAccountingTahir DestaNo ratings yet

- 1 SMDocument24 pages1 SMTahir DestaNo ratings yet

- Best 3Document15 pagesBest 3Tahir DestaNo ratings yet

- Analysis-2 Taxation Policy DevelopmentDocument24 pagesAnalysis-2 Taxation Policy DevelopmentTahir DestaNo ratings yet

- Financial Fraud, Scandals, and Regulation: A Conceptual Framework and Literature ReviewDocument42 pagesFinancial Fraud, Scandals, and Regulation: A Conceptual Framework and Literature ReviewTahir DestaNo ratings yet

- Raising Revenue: Five Country Cases Illustrate How Best To Improve Tax CollectionDocument4 pagesRaising Revenue: Five Country Cases Illustrate How Best To Improve Tax CollectionTahir DestaNo ratings yet

- The Scams Among Us: Who Falls Prey and Why: Yaniv Hanoch and Stacey WoodDocument7 pagesThe Scams Among Us: Who Falls Prey and Why: Yaniv Hanoch and Stacey WoodTahir DestaNo ratings yet

- Tourism & Management Studies 2182-8458: Issn: Tms-Journal@ualg - PTDocument10 pagesTourism & Management Studies 2182-8458: Issn: Tms-Journal@ualg - PTTahir DestaNo ratings yet

- This Content Downloaded From 196.191.248.6 On Fri, 06 May 2022 17:36:12 UTCDocument32 pagesThis Content Downloaded From 196.191.248.6 On Fri, 06 May 2022 17:36:12 UTCTahir DestaNo ratings yet

- This Content Downloaded From 196.191.248.6 On Fri, 06 May 2022 17:05:39 UTCDocument33 pagesThis Content Downloaded From 196.191.248.6 On Fri, 06 May 2022 17:05:39 UTCTahir DestaNo ratings yet

- National Tax Association Proceedings. Annual Conference On Taxation and Minutes of The Annual Meeting of The National Tax AssociationDocument7 pagesNational Tax Association Proceedings. Annual Conference On Taxation and Minutes of The Annual Meeting of The National Tax AssociationTahir DestaNo ratings yet

- Risk and Return For PrintDocument30 pagesRisk and Return For PrintTahir DestaNo ratings yet

- Damene Summer Externship ReportDocument49 pagesDamene Summer Externship ReportTahir DestaNo ratings yet