Professional Documents

Culture Documents

Principles of Accounting 2 Exam Marking Key

Uploaded by

Yus LindaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Principles of Accounting 2 Exam Marking Key

Uploaded by

Yus LindaCopyright:

Available Formats

Assessment / Examination Marking Key

TN -

DETAILS MARKS

CLO

DIM1353- PRINCIPLES OF ACCOUNTING 2

CLO 1

SEM JAN 2024 (SET 1)

TN 1 QUESTION 1

(a) Straight line method:

Depreciation = RM52,000 – RM2,000 / 5 = RM10,000 per year

Year Depreciation Accu. depreciation NBV

1 10,000 10,000 42,000 2

2 10,000 20,000 32,000 2

3 10,000 30,000 22,000 2

4 10,000 40,000 12,000 2

2

5 10,000 50,000 2000 (10)

(b) reducing balance method

Year Accumulated

depreciation

1 Cost 52,000

Depreciation 52,000 x 20% = 10,400 10,400 1

NBV 41,600 1

1

2 Depreciation 41,600 x 20% = 8,320 18,720

1

NBV 33,280

1

3 Depreciation 33,280x 20% = 6,656 25,376 1

NBV 26,624 1

4 Depreciation 26,624x 20% = 5,325 30,701 1

NBV 21,299 1

5 Depreciation 21,299 x 20% = 4,260 34,961 1

NBV 17,039

(10)

TN - Topic Number CLO – Course learning outcome

ad/008/1 w.e.f August 2022

Page 1 of 6

Assessment / Examination Marking Key

TN -

DETAILS MARKS

CLO

QUESTION 2

PART A

(a) journal entry

Debit Credit

i Purchase 500 1

Suspense 500 1

ii Suspense 3,400 1

Sales 3,400 1

iii Suspense 400 1

TN2 Rent received 400 1

iv Suspense 974 1

Discount received 974 1

(double counting )

v Lorry 43,000 1

Bank 43,000 1

(b) Suspense account

Sales 3,400 Trial Balance 4274 2

Rent received 400 Purchases 500 2

1

Discount received 974

4,774 4,774 (15)

PART B Subscription

TN 5 Bal b/d 140 Bal b/d 180 2

Income Statement 3,230 Bank 3,220 1

Bal c/d 260 Bal c/d 230 2

(5)

3,630 3,630

TN - Topic Number CLO – Course learning outcome

ad/008/1 w.e.f August 2022

Page 2 of 6

Assessment / Examination Marking Key

TN -

DETAILS MARKS

CLO

TN 3 QUESTION 3

√=1mk

Sales ledger Control Account ½ √

RM RM

Balance b/d ½ √14,300 Balance b/d ½ √610

Credit sales √570,300 Returns inwards daybook √3,120

Dishonoured cheque √530 Bank √482,780 10.5 mk

Balance c/d √150 Discounts allowed √4,100

Set-offs √2,341

Bad debts √2,453

Balance c/d √89,876

585,280 585,280

Purchases ledger Control Account ½ √

RM RM

Balance b/d ½ √350 Balance b/d ½ √21,900

Returns outwards √2,620 Purchases daybook √300,500 9.5mk

Bank √297,420 Bank - Refund √5,320

Discounts received √3,800 Balance c/d √511

Set-offs √2,341

Balance c/d √21,700

328,231 328,231

TN - Topic Number CLO – Course learning outcome

ad/008/1 w.e.f August 2022

Page 3 of 6

Assessment / Examination Marking Key

TN -

DETAILS MARKS

CLO

TN 4 QUESTION 4

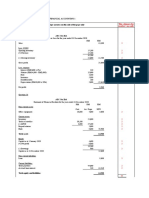

Manufacturing, Trading and Profit and Loss Account

for year ended 31 December 2023√

RM RM

Opening inventory of raw materials √27,300

Add Purchases of raw materials √250,000

√277,300 √=1 mk

Less Closing inventory of raw materials √(20,300)

Cost of raw materials consumed 257,000

Direct labour (43,000 + 500) √ √43,500 20 mk

Direct expenses √12,340

Prime Cost √312,840

Add Indirect manufacturing costs:

Indirect labour √15,000

Factory depreciation (20% x 200,000) √ √20,000

Factory utilities √17,300

Factory rent (12,000 x ¾)√ √9,000

√61,300

√374,140

Add Work in progress 1.1.2023 √6,500

380,640

Less Work in progress 31.12.2023 √(6,890)

Production cost √373,750

TN - Topic Number CLO – Course learning outcome

ad/008/1 w.e.f August 2022

Page 4 of 6

Assessment / Examination Marking Key

TN -

DETAILS MARKS

CLO

TN 6 QUESTION 5

Partnership Appropriation Account

31 December 2023

Net profit √100,500

Add:

Interest on drawing: Danial(6%x8000) √480 √=1mk

Ganesh(6%x12000) √720 1,200

101,700

Less: 10 mk

Interest on capital Danial(8%x30000) √2,400

Ganesh(8%x30000) √2,400

Wong(8%x15000) √1,200

Salary: Wong √36,000 (42,000)

59,700

Shared of profit: Danial(2/5x59700) √23,880

Ganesh(2/5x59700) √23,880

Wong(1/5x59700) √11,940

59,700

Current Account

D G W D G W

Drawing √8,000 √12,000 - Interest on √2,400 √2,400 √1,200

capital √14x8

Interest on √480 √720 - Salary - - √36,000 14

drawing

Bal c/d √17,800 √13,560 √47,650 Share of profit √23,880 √23,880 √10,450

26,280 26,280 47,650 26,280 26,280 47,650 =8mk

Capital Account

D G W D G W √6x2

Bal c/d √30,000 √30,000 √15,000 Bal b/d √30,000 √30,000 √15,000 6

=2mk

TN - Topic Number CLO – Course learning outcome

ad/008/1 w.e.f August 2022

Page 5 of 6

Assessment / Examination Marking Key

TN -

DETAILS MARKS

CLO

TN 7 QUESTION 6

ARFA Sdn. Bhd

Financial Position as at 31 December 2023. √

RM RM RM

Cost Acc. Dep NBV √25 x 20

√630,000 √40,000 √590,000 25

Non-current assets

Buildings √74,000 √41,000 √33,000 =20mk

Motors √9,200 √5,100 √4,100

Fixtures 413,200 86,100 √627,100

Current Assets

Inventories √21,400

Account Receivables √10,300

Bank √26,900 √58,600

√685,700

Current Liabilities

Account Payables √33,700

Net current assets √652,000

Non-current liabilities

Loan notes √40,000

√612,000

Capital and Reserves

Issued hare capital – ordinary shares at √500,000

RM1 each

Non-current assets replacement reserve √30,000

General Reserve √50,000

Retained profits √32,000

√612,000

TN - Topic Number CLO – Course learning outcome

ad/008/1 w.e.f August 2022

Page 6 of 6

You might also like

- Assignment 4 - Financial Accounting - February 11Document4 pagesAssignment 4 - Financial Accounting - February 11Ednalyn PascualNo ratings yet

- f1 Cima Workbook Q & A PDFDocument276 pagesf1 Cima Workbook Q & A PDFYounus KhanNo ratings yet

- Sam's Introductory Accounting AnswersDocument1 pageSam's Introductory Accounting AnswersSamuelNo ratings yet

- Quiz 1.02 Cash and Cash Equivalents To Loan ImpairmentDocument13 pagesQuiz 1.02 Cash and Cash Equivalents To Loan ImpairmentJohn Lexter MacalberNo ratings yet

- Quiz 102 Cash and Cash Equivalents To Loan Impairment PDF FreeDocument13 pagesQuiz 102 Cash and Cash Equivalents To Loan Impairment PDF FreeNashaNo ratings yet

- JAIBB Accounting Solution - Final AccountingDocument6 pagesJAIBB Accounting Solution - Final AccountingShakil MahmodNo ratings yet

- Grade 10 Provincial Exam Accounting p1 AnswersDocument7 pagesGrade 10 Provincial Exam Accounting p1 AnswershobyanevisionNo ratings yet

- Viraj Wijeratne 2223 Revised SET ComputationDocument1 pageViraj Wijeratne 2223 Revised SET Computationattackdfg2002No ratings yet

- November 2019 Exam Solution Final PaperDocument7 pagesNovember 2019 Exam Solution Final Paper2603803No ratings yet

- Net SolutionsDocument2 pagesNet Solutionsmbm369No ratings yet

- Suggested Solutions June 2006Document11 pagesSuggested Solutions June 2006kalowekamoNo ratings yet

- BppuDocument2 pagesBppuni made safitriNo ratings yet

- Financial Accounting - MGT101 Power Point Slides Lecture 39Document22 pagesFinancial Accounting - MGT101 Power Point Slides Lecture 39Mr. JalilNo ratings yet

- Gov't Grant, Depreciation, Revaluation and ImpairmentDocument6 pagesGov't Grant, Depreciation, Revaluation and Impairment夜晨曦No ratings yet

- Retirement of BondsDocument16 pagesRetirement of BondsEUNICE LAYNE AGCONo ratings yet

- Ans m2 PaperDocument6 pagesAns m2 Paperbigab31327No ratings yet

- ACCOUNTING P1 GR10 MEMO NOV2020 - EnglishDocument6 pagesACCOUNTING P1 GR10 MEMO NOV2020 - EnglishMolemo mabeleNo ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- E2,3Document12 pagesE2,3hieuluu.31221023224No ratings yet

- Grade 11 ACC P2 (English) June 2023 Possible AnswersDocument11 pagesGrade 11 ACC P2 (English) June 2023 Possible AnswerszembenomazwiNo ratings yet

- Answer Key Quiz 5 Actbas2 T3 PDFDocument5 pagesAnswer Key Quiz 5 Actbas2 T3 PDFCharles TuazonNo ratings yet

- 9706 s12 Ms 22 PDFDocument6 pages9706 s12 Ms 22 PDFmarryNo ratings yet

- Part 1 Examination - Paper 1.1 (INT) Preparing Financial Statements (InternationalDocument8 pagesPart 1 Examination - Paper 1.1 (INT) Preparing Financial Statements (InternationalAUDITOR97No ratings yet

- 4ac1 02 Rms 20220825Document10 pages4ac1 02 Rms 20220825attackdfg2002No ratings yet

- PRACTICE EXAM AnswersDocument7 pagesPRACTICE EXAM Answersarhamjain269No ratings yet

- Book 1Document2 pagesBook 1Shiela DimaculanganNo ratings yet

- 1-1hkg 2002 Dec ADocument8 pages1-1hkg 2002 Dec AWing Yan KatieNo ratings yet

- Statement of Changes in Owners' Equity: P/L Balance SheetDocument6 pagesStatement of Changes in Owners' Equity: P/L Balance SheetJF FNo ratings yet

- ACC-March-QP & Memo-2020-Gr11Document21 pagesACC-March-QP & Memo-2020-Gr11Kabelo SefaliNo ratings yet

- 01 Quiz 1Document3 pages01 Quiz 1Emperor SavageNo ratings yet

- BANGI, Joshua Celton - Assign2.Document7 pagesBANGI, Joshua Celton - Assign2.Joshua BangiNo ratings yet

- Answer 14 Gu January 2013 QUESTION 1Document2 pagesAnswer 14 Gu January 2013 QUESTION 1skye SNo ratings yet

- Chapter 3 - Bonds PayableDocument6 pagesChapter 3 - Bonds PayablePatricia EsplagoNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document11 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Kathrina RoxasNo ratings yet

- T11 Ans. 1Document1 pageT11 Ans. 1PUI TUNG CHONGNo ratings yet

- EBITDADocument2 pagesEBITDAAshraf Rabie AhmedNo ratings yet

- Chapter 4, Accounting CycleDocument13 pagesChapter 4, Accounting CyclekhanNo ratings yet

- Solution - Exercise Chapter 7 - ACC117Document3 pagesSolution - Exercise Chapter 7 - ACC117nurhidayah sadonNo ratings yet

- Assignment 1Document6 pagesAssignment 1Nichole TumulakNo ratings yet

- Exam 2 Review SolutionDocument6 pagesExam 2 Review Solutionsimonedana97No ratings yet

- Downloaded by Rheigne Maxxene Gana Maglente (422000758@ntc - Edu.ph)Document7 pagesDownloaded by Rheigne Maxxene Gana Maglente (422000758@ntc - Edu.ph)RheigneNo ratings yet

- Downloaded by Rheigne Maxxene Gana Maglente (422000758@ntc - Edu.ph)Document7 pagesDownloaded by Rheigne Maxxene Gana Maglente (422000758@ntc - Edu.ph)RheigneNo ratings yet

- Financial Accounting: Enter Your Name HereDocument2 pagesFinancial Accounting: Enter Your Name HereNasrullah IqbalNo ratings yet

- Financial Statement Anaysis-Cat1 - 2Document16 pagesFinancial Statement Anaysis-Cat1 - 2cyrusNo ratings yet

- Chapter 07 - Financial StatementsDocument40 pagesChapter 07 - Financial StatementsMkhonto XuluNo ratings yet

- Solution For MFRS112 ExercisesDocument11 pagesSolution For MFRS112 Exercisesm-7039266No ratings yet

- BT Accounting Group 7Document7 pagesBT Accounting Group 7Yến Trần HảiNo ratings yet

- 32 - 14 - M Prio - Pengakun 2Document2 pages32 - 14 - M Prio - Pengakun 2Mochamad Prio PambudiNo ratings yet

- Group Project 2 Far620Document8 pagesGroup Project 2 Far620NUR ATHIRAH SUKAIMINo ratings yet

- Problem 6-1: Interest Expense Present ValueDocument3 pagesProblem 6-1: Interest Expense Present ValueAngieNo ratings yet

- PRACTICE CLASS 3, 4 and 5Document6 pagesPRACTICE CLASS 3, 4 and 5Zain JamilNo ratings yet

- (Fig in Rs Lacs) Trade Spends 618 1,237 1,855 3,092 4,947 Cogs Marketing Finance Cost 317 286 257 231 Dep Profit After Tax - 15 215 844 2,124 4,056Document4 pages(Fig in Rs Lacs) Trade Spends 618 1,237 1,855 3,092 4,947 Cogs Marketing Finance Cost 317 286 257 231 Dep Profit After Tax - 15 215 844 2,124 4,056RahulSamaddarNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerDocument9 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerChantelle IsaksNo ratings yet

- Poa T - 10Document4 pagesPoa T - 10SHEVENA A/P VIJIANNo ratings yet

- Running Head: Financial AccountingDocument9 pagesRunning Head: Financial AccountingKashémNo ratings yet

- Comprehensive Audit of Balance Sheet and Income Statement AccountsDocument25 pagesComprehensive Audit of Balance Sheet and Income Statement AccountsLuigi Enderez Balucan100% (1)

- Quiz 2 - Audit of Receivables SolutionDocument1 pageQuiz 2 - Audit of Receivables SolutionmillescaasiNo ratings yet

- Microeconomics Marking Key SET 1Document7 pagesMicroeconomics Marking Key SET 1Yus LindaNo ratings yet

- Chapter 2 Demand SupplyDocument9 pagesChapter 2 Demand SupplyYus LindaNo ratings yet

- DIM1363 MK Set 1Document4 pagesDIM1363 MK Set 1Yus LindaNo ratings yet

- DIM2183 Exam Jan 2024 Set 1Document4 pagesDIM2183 Exam Jan 2024 Set 1Yus LindaNo ratings yet

- Microeconomics: Chapter 3 Market Equilibrium: DD SSDocument9 pagesMicroeconomics: Chapter 3 Market Equilibrium: DD SSYus LindaNo ratings yet

- Chapter 5 Theory of ProductionDocument5 pagesChapter 5 Theory of ProductionYus Linda100% (1)

- Chapter 7 and 8 Market StructureDocument16 pagesChapter 7 and 8 Market StructureYus LindaNo ratings yet

- Tutorial 9Document2 pagesTutorial 9Yus LindaNo ratings yet

- Chapter 4 Theory of Consumer BehaviourDocument9 pagesChapter 4 Theory of Consumer BehaviourYus Linda100% (1)

- Chapter 6 Cost of ProductionDocument9 pagesChapter 6 Cost of ProductionYus LindaNo ratings yet

- Tutorial 6Document2 pagesTutorial 6Yus LindaNo ratings yet

- Tutorial 5: Chapter 5Document3 pagesTutorial 5: Chapter 5Yus LindaNo ratings yet

- Name: Tutorial Chapter 3Document3 pagesName: Tutorial Chapter 3Yus LindaNo ratings yet

- Tutorial Principles of Accounting 1Document9 pagesTutorial Principles of Accounting 1Yus Linda100% (1)

- Tutorial 1Document3 pagesTutorial 1Yus LindaNo ratings yet

- Quiz: Chapter 2Document2 pagesQuiz: Chapter 2Yus LindaNo ratings yet

- Important !: We Can Only AddDocument7 pagesImportant !: We Can Only AddYus LindaNo ratings yet

- Acf2 2024Document30 pagesAcf2 2024rodrigo.felix17012002No ratings yet

- HDFC Balanced Advantage Fund - Apr 22 - 1 PDFDocument2 pagesHDFC Balanced Advantage Fund - Apr 22 - 1 PDFAkash BNo ratings yet

- Assignment 1 - Fin242 Set 2Document4 pagesAssignment 1 - Fin242 Set 22022328009No ratings yet

- AFAR Quiz 2Document3 pagesAFAR Quiz 2Philip LarozaNo ratings yet

- ch11 Fin202Document51 pagesch11 Fin202Nguyễn Thanh Nhàn K16No ratings yet

- Intermediate Accounting Reporting and Analysis 2nd Edition Wahlen Test Bank DownloadDocument70 pagesIntermediate Accounting Reporting and Analysis 2nd Edition Wahlen Test Bank DownloadEdna Nunez100% (27)

- Unit 5 Slip Test 2 Without AnswerDocument3 pagesUnit 5 Slip Test 2 Without AnswerE.Harish EakambaramNo ratings yet

- The Little Book of Valuation Book SummaryDocument12 pagesThe Little Book of Valuation Book SummaryKapil AroraNo ratings yet

- Solution Manual For Financial Statements Analysis Subramanyam Wild 11th EditionDocument35 pagesSolution Manual For Financial Statements Analysis Subramanyam Wild 11th EditionJenniferPalmerdqwf100% (35)

- STV InsightsDocument20 pagesSTV InsightsAli AlharbiNo ratings yet

- Ent300 Financial PlanDocument32 pagesEnt300 Financial Planakaunsimpan123No ratings yet

- Business CombinationDocument8 pagesBusiness CombinationPhia CustodioNo ratings yet

- Ashish Rana 12538..Document3 pagesAshish Rana 12538..hiren4kachhadiyaNo ratings yet

- Stock and Bonds - ActivityDocument11 pagesStock and Bonds - Activitysab x btsNo ratings yet

- Leverage Analysis DONEDocument5 pagesLeverage Analysis DONEshivani dholeNo ratings yet

- Lecture 10Document39 pagesLecture 10Zixin GuNo ratings yet

- StockDocument60 pagesStockPhan Tú AnhNo ratings yet

- (Key) - HOC THUAT CHUYEN NGANH NGUYEN LY KE TOANDocument8 pages(Key) - HOC THUAT CHUYEN NGANH NGUYEN LY KE TOANLê Cung NhưNo ratings yet

- Lecture W14Revsine 8e Chap17Document38 pagesLecture W14Revsine 8e Chap17杰小No ratings yet

- CRaigielaw 3 With SolutionDocument3 pagesCRaigielaw 3 With SolutionSelin PusatNo ratings yet

- 5, 6 & 7 Capital BudgetingDocument42 pages5, 6 & 7 Capital BudgetingNaman AgarwalNo ratings yet

- CG Croup 2 ExcelDocument25 pagesCG Croup 2 ExcelKhanh LinhNo ratings yet

- Financial Ratios PracticeDocument20 pagesFinancial Ratios PracticeAditya PathakNo ratings yet

- Financial Modelling All ChaptersDocument61 pagesFinancial Modelling All Chaptersmagarsa hirphaNo ratings yet

- Capital Budgeting SolutionDocument36 pagesCapital Budgeting SolutionMadhav SoodNo ratings yet

- Capital Adequacy RatioDocument2 pagesCapital Adequacy Ratiohothrehman9No ratings yet

- Master Thesis Private EquityDocument6 pagesMaster Thesis Private Equitybsend5zk100% (2)

- Book 1Document6 pagesBook 1Afani HanifahNo ratings yet

- SUMMER HOLIDAY HOMEWORK 2024 - ACCOUNTANCY & BUSINESS STUDIESDocument5 pagesSUMMER HOLIDAY HOMEWORK 2024 - ACCOUNTANCY & BUSINESS STUDIESsanskarprasad18No ratings yet

- (44-54) A Study of Mutual Fund Awareness in Gandhinagar CityDocument11 pages(44-54) A Study of Mutual Fund Awareness in Gandhinagar CityKhan Shadab -27No ratings yet