Professional Documents

Culture Documents

As 5

Uploaded by

sanjay sOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

As 5

Uploaded by

sanjay sCopyright:

Available Formats

1

AS 5:- NET PROFIT OR LOSS FOR THE PERIOD, PRIOR PERIOD

ITEMS AND CHANGES IN ACCOUNTING POLICIES

1. Objective

1. Presentation & Disclosure of

• Certain ordinary activities;

• Extra ordinary activities;

• Prior period items;

2. Accounting Treatment & Presentation and disclosure of

• Changes in Accounting Estimates

• Changes in Accounting policies

This standard doesn’t deal with tax effect of the above items.

2. Net Profit or Loss for the period

All items of income and expense which are recognised in a financial year should be part of P &

La/c for the period. If any AS suggests or permits a different treatment, it should be accounted as

guided by that AS.

Net profit or loss for the period includes

• Profit or loss from ordinary activities; and

• Profit or loss from extra ordinary items;

3. Ordinary Activities

Ordinary activities are:

1. Entity’s business activities &

2. Related & incidental to such business activities

Note

✓ These activities arise in the normal course of business , so the frequency of the activities

is high;

✓ These activities are excepted to occur as part of business;

E.g. Sale of goods, providing services, sale of scrap, interest income/expense, salary expenses,

provisions, profit or loss on sale of fixed assets, etc.

Extraordinary items are

Swasthik Academy Gokul G

2

• Activities which are clearly distinct from the ordinary activities of the entity ;

• These are not expected to occur as part of business;

• Generally frequency of such transaction is low. But frequency is not the only

criteria to determine;

• Classification of items is based on the NATURE of the but NOT on frequency;

Classification requires some degree of professional judgment.

E.g. An earthquake, attachment of property, refund of government grant (as per AS 12), seizure

of assets by the government, etc. These are not expected to occur as a part of business.

4. Presentation and Disclosure requirements

Extraordinary activities: Extraordinary activities should be separately disclosed in P&L a/c so as

to show the impact on profit and loss.

Exceptional items: (Certain items of ordinary activities)

The following items are ordinary activities as they are expected to occur as part of a business.

But based on size, nature, or incidence of transaction those activities require separate disclosure.

These items are generally termed as exceptional items.

❖ The writing down of inventories to net realizable value (NRV) as well as the

reversal of the same;

❖ A restructuring of the activities of an entity and the reversal of any provision

for the costs of restructuring;

❖ Profit or loss on disposal of long –term investments

❖ Profit or loss on disposal of fixed assets;

❖ Legislative changes having retrospective application;

❖ Litigation settlements; and

❖ Other reversals of provisions;

Note:

✓ Separate disclosure helps the users to understand the performance & position of the

company and it helps them in making projections of performance & financial position.

✓ Disclose the nature & amount of the transactions separately in P&L a/c and relevant

information in notes on accounts.

5. Prior Period Items

Prior period items are income or expense which arise in the current period as a result of errors

or omissions in the preparation of the financial statements of one or more be prior periods.

6. Presentation and Disclosure requirements

Swasthik Academy Gokul G

3

Prior period items should be disclosed separately in the profit and loss a/c so as to show the

impact of prior period items in the current year.

Errors may occur as a result of

• Mathematical mistakes in calculations;

• Mistakes in application of accounting policies;

• Misinterpretation of facts; or

• Oversight (Failure to notice);

Omission means reliable information was available at the time of preparation of previous year

financial statements but the information was NOT considered.

7. Changes in Accounting Estimates

Estimation means an approximate calculation. Many items in the financials cannot be measured

accurately or exactly. The use of reasonable estimates is an essential part for the preparation of

financial statements. Usage of estimates doesn’t reduce the reliability of financial statements.

Following are general estimations used in preparation of financial statements.

• Useful life of assets ;

• Allowance for doubtful debts

• Inventory obsolescence ;

• Provisions for taxation, warranty, etc.

Estimations are made based on the latest information available and the circumstances on the

date of preparation of financial statements. Professional judgement is required while estimating.

As we discussed above, estimation is approximation, hence it requires revision as and when

a) There is any change in the circumstances and information available;

b) New information is available;

c) More experience or subsequent developments.

Revision in estimation is expected to occur, hence it is an ordinary activity and it CANNOT be

treated as an extraordinary item. Estimations are revised in the above circumstances but not

because of errors or omissions. Hence revision of estimation is NOT a prior period item. Changes

in accounting estimate should be accounted prospectively.

If the effect of change in estimation is significant - the entity should disclose the nature of

change and amount of change. Any change in an accounting estimate which is expected to have

a material effect in later periods should also be disclosed.

8. Changes in Accounting Policy

As per AS 1, Entity should follow the accounting policies consistently i.e. accounting policies

followed in PY should be continued in the current year also.

Swasthik Academy Gokul G

4

It doesn't mean that the entity should not change its accounting policies. The entity can change

accounting policies in the following circumstances:

1. When it is a requirement of a statute;

2. Requirement of Accounting standard; or

3. Change in policy reflects better presentation of financial statements; (This should be justified

by the entity)

Accounting for change in accounting policy:

There is NO guidance in AS 5 on accounting for change in policy.

As a practice & IND AS- change in accounting policy is accounted RETROSPECTIVELY.

Retrospective recomputation means the entity should recompute the carrying amount as if the

new policy is followed from the beginning. The surplus or deficiency in carrying amount should

be taken to P&L a/c in the year of change in policy.

When the entity is not able to distinguish the change in estimate and change in accounting policy

– It should treat the change as change in accounting estimate only.

The following are NOT changes in accounting policy:

(a) Adoption of new accounting policy; and

(b) The adoption of an accounting policy for events or transactions that differ in substance from

previously occurring events or transactions.

9. Disclosure requirement

✓ If change in accounting policy has material effect it should be disclosed in the year of

change.

✓ If the impact is not ascertainable, the entity should disclose the fact in financial

statements.

✓ If there is no impact in the year of change but there is material impact in the future years,

the fact of such impact should be disclosed in the year of change in policy.

✓ As part of better practice, entity should disclose the reason for change in policy.

10.Try to understand various terminologies used with respect to fixed assets

Change in depreciation method e.g. from WDV Change in accounting policies

to SLM

Change in useful life of the asset Change in accounting estimate

Mathematical error in calculation of Prior period item

Depreciation in PY

Fixed assets destroyed in an earthquake Extraordinary item

Major disposal of fixed assets Ordinary activity (Exceptional items)

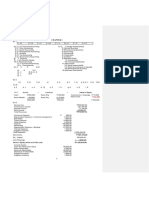

Example for disclosure of Ordinary, Extraordinary and Prior Period Items:

Statement of profit and loss account of XYZ Ltd for the year ended 31 st March, 2019

Swasthik Academy Gokul G

5

Income: Rs. Rs.

Revenue from operation XXX

Other income XX

Total Revenue (A) XXX

Expenses:

Cost of goods sold XXX

Employee benefits expense XXX

Finance costs XXX

Depreciation and amortization expense XXX

Other expenses XXX

Total expenses(B) XXX

Profit before exceptional and extraordinary items and XXX

tax C= A-B

Exceptional items (D) XXX

Profit before extraordinary items and tax E= C-D XXX

Extraordinary Items XXX

Prior period items XXX

Profit before tax XXX

Tax expense XXX

Net profit after tax XXX

Examples

Examples of Changes in Accounting Policy:

a. Change of depreciation method from WDV to SLM and vice-versa.

b. Change in cost formula in measuring the cost of inventories.

Examples of Changes in Accounting Estimates:

a. Change in estimate of provision for doubtful debts on sundry debtors.

b. Change in estimate of useful life of fixed assets.

Examples of Extraordinary items:

a. Loss due to earthquakes / fire / strike

b. Attachment of property of the enterprise by government

Examples of Prior period items:

a. Applying incorrect rate of depreciation in one or more prior periods.

b. Omission to account for income or expenditure in one or more prior periods

Swasthik Academy Gokul G

6

Questions

Q1

A limited company created a provision for bad and doubtful debts at 2.5% on debtors in

preparing the financial statements for the year 2010-2011.

Subsequently on a review of the credit period allowed and financial capacity of the

customers, the company decided to increase the provision to 8% on debtors as on 31.3.2011.

The accounts were not approved by the Board of Directors till the date of decision. While

applying the relevant accounting standard can this revision be considered as an extraordinary

item or prior period item?

Q2

X Co. Ltd. signed an agreement with its employees union for revision of wages in June, 2012. The

wage revision is with retrospective effect from 1.4.2008. The arrear wages upto 31.3.2012

amounts to 80 lakhs. Arrear wages for the period from 1.4.2012 to 30.06.2012 (being the date of

agreement) amounts to 7 lakhs.

Decide whether a separate disclosure of arrear wages is required.

Q3

Fuel surcharge is billed by the State Electricity Board at provisional rates. Final bill for fuel

surcharge of Rs 5.30 lakhs for the period October, 2008 to September, 2015 has been received

and paid in February, 2016. However, the same was accounted in the year 2016-17. Comment on

the accounting treatment done in the said case.

Q4

i. During the year 2016-2017, a medium size manufacturing company wrote down its

inventories to net realisable value by Rs 5,00,000. Is a separate disclosure necessary?

ii. A company signed an agreement with the Employees Union on 1.9.2016 for revision of

wages with retrospective effect from 30.9.2015. This would cost the company an

additional liability of Rs 5,00,000 per annum. Is a disclosure necessary for the amount

paid in 2016-17?

Q5

The company finds that the inventory sheets of 31.3.2016 did not include two pages containing

details of inventory worth Rs 14.5 lakhs. State, how you will deal with the following matters in

the accounts of Omega Ltd. for the year ended 31st March, 2017.

Swasthik Academy Gokul G

7

Q6

Explain whether the following will constitute a change in accounting policy or not as par AS 5.

(1) Introduction of a formal retirement gratuity scheme by an employer in place of ad hoc

ex-gratia payments to employees on retirement.

(2) Management decided to pay pension to those employees who have retired after

completing 5 years of service in the organisation. Such employees will get pension of Rs

20,000 per month. Earlier there was no such scheme of pension in the organisation.

Q7

S.T.B. Ltd. makes provision for expenses worth Rs 7,00,000 for the year ending March 31, 2011,

but the actual expenses during the year ending March 31, 2012 comes to Rs 9,00,000 against

provision made during the last year. State with reasons whether difference of Rs 2,00,000 is to

be treated as prior period item as per AS-5.

Swasthik Academy Gokul G

8

Answers

Q1

As per AS 5 'Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting

Policies', the preparation of financial statements involves making estimates which are based on

the circumstances existing at the time when the financial statements are prepared. It may be

necessary to revise an estimate in a subsequent period if there is a change in the circumstances

on which the estimate was based. Revision of an estimate, by its nature, does not bring the

adjustment within the definitions of a prior period item or an extraordinary item.

In the given case, a limited company created 2.5% provision for doubtful debts for the

year 2010-2011. Subsequently in 2011 the company revised the estimates based on the changed

circumstances and wants to create 8% provision. As per AS-5, this change in estimate is neither a

prior period item nor an extraordinary item.

However, as per AS 5, a change in accounting estimate which has material effect in the

current period, should be disclosed and quantified. Any change in the accounting estimate which

is expected to have a material effect in later periods should also be disclosed and quantified

Q2

It is given that revision of wages took place in June, 2012 with retrospective effect from

1.4.2008. The arrear wages payable for the period from 1.4.2008 to 31.3.2012 cannot be taken

as an error or omission in the preparation of financial statements of earlier years and hence this

expenditure cannot be taken as a prior period item.

Additional wages liability of 87 lakhs (from 1.4.2008 to 3062012 should be included in

current year wages.

It may be mentioned that additional wages is an expense arising from the ordinary

activities of the company. Although abnormal in amount, such an expense does not qualify as an

extraordinary item.

However, as per AS 5,' Net Profit or loss for the Period, Prior Period Items and Changes in

the Accounting Policies', when items of income and expense within profit or loss from ordinary

activities are of such size, nature or incident that their disclosure is relevant to explain the

performance of the enterprise for the period, the nature and amount of such items should be

disclosed separately.

However, wages payable for the current year (from 1.4.2012 to 30.6.2012) amounting Rs

7 lakhs is not a prior period item hence need not be disclosed separately. This may be shown as

current year wages.

Swasthik Academy Gokul G

9

Q3

The final bill having been paid in February, 2016 should have been accounted for in the annual

accounts of the company for the year ended 31st March, 2016. However, it seems that as a

result of error or omission in the preparation of the financial statements of prior period i.e., for

the year ended 31st March 2016, this material charge has arisen in the current period i.e., year

ended 31st March, 2017. Therefore it should be treated as 'Prior period item' as per AS 5. As per

AS 5, prior period items are normally included in the determination of net profit or loss for the

current period. An alternative approach is to show such items in the statement of profit and loss

after determination of current net profit or loss. In either case, the objective is to indicate the

effect of such items on the current profit or loss.

It may be mentioned that it is an expense arising from the ordinary course of business.

Although abnormal in amount or infrequent in occurrence, such an expense does not qualify an

extraordinary item as per AS 5. For better understanding, the fact that power bill is accounted

for at provisional rates billed by the state electricity board and final adjustment thereof is made

as and when final bill is received may be mentioned as an accounting policy.

Q4

i. Although the case under consideration does not relate to extraordinary item, but the

nature and amount of such item may be relevant to users of financial statements in

understanding the financial position and performance of an enterprise and in making

projections about financial position and performance. AS 5 on 'Net Profit or Loss for the

Period, Prior Period Items and Changes in Accounting Policies' states that

"When items of income and expense within profit or loss from ordinary activities are of

such size, nature or incident that their disclosure is relevant to explain the performance

of the enterprise for the period, the nature and amount of such items should be disclosed

separately."

Circumstances which may give to separate disclosure of items of income and expense in

accordance with AS 5 include the write-down of inventories to net realisable value as well

as the reversal of such write-downs.

ii. It is given that revision of wages took place on 1st September, 2016 with retrospective

effect from 30.9.2015. Therefore wages payable for the half year from 1.10.2016 to

31.3.2017 cannot be taken as an error or omission in the preparation of financial

statements and hence this expenditure cannot be taken as a prior period item.

Additional wages liability of Rs 7,50,000 (for 1.5 years @ 5,00,000 per annum) should be

included in current year wages. It may be mentioned that additional wages is an expense

arising from the ordinary activities of the company. Such an expense does not qualify as

Swasthik Academy Gokul G

10

an extraordinary item. However, as per AS 5, when items of income and expense within

profit or loss from ordinary activities are of such size, nature or incidence that their

disclosure is relevant to explain the performance of the enterprise for the period, the

nature and amount of such items should be disclosed separately

Q5

AS 5 on 'Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies',

defines Prior Period items as "income or expenses which arise in the current period as a result of

errors or omissions in the preparation of the financial statements of one or more prior periods".

Rectification of error in inventory valuation is a prior period item vide AS 5. Separate disclosure

of this item as a prior period item is required as per AS 5.

Q6

As per AS 5 'Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting

Policies', the adoption of an accounting policy for events or transactions that differ in substance

from previously occurring events or transactions, will not be considered as a change in

accounting policy.

(1) Accordingly, introduction of a formal retirement gratuity scheme by an employer in place

of ad hoc ex-gratia payments to employees on retirement is not a change in an

accounting policy.

(2) Similarly, the adoption of a new accounting policy for events or transactions which did

not occur previously or that were immaterial will not be treated as a change in an

accounting policy.

Q7

As per AS 5 'Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting

Policies', as a result of the uncertainties inherent in business activities, many financial statement

items cannot be measured with precision but can only be estimated. The estimation process

involves judgments based on the latest information available. The use of reasonable estimates is

an essential part of the preparation of financial statements and does not undermine their

reliability.

Estimates may have to be revised, if changes occur regarding the circumstances on which the

estimate was based, or as a result of new information, more experience or subsequent

developments.

Swasthik Academy Gokul G

11

As per the standard, the effect of a change in an accounting estimate should be classified using

the same classification in the statement of profit and loss as was used previously for the

estimate. Prior period items are income or expenses which arise in the current period as a result

of errors or omissions in the preparation of the financial statements of one or more prior

periods. Thus, revision of an estimate by its nature i.e. the difference of 2 lakhs, is not a prior

period item.

Therefore, in the given case expenses amounting 2,00,000 (i.e. Rs 9,00,000- Rs 7,00,000) relating

to the previous year recorded in the current year, should not be regarded as prior period item.

Swasthik Academy Gokul G

You might also like

- Indigolearn: Accounting Standard 5Document7 pagesIndigolearn: Accounting Standard 5chandreshNo ratings yet

- As 5 Net Profit or Loss For The Period Prior Period Items and Changes in Accounting PoliciesDocument33 pagesAs 5 Net Profit or Loss For The Period Prior Period Items and Changes in Accounting PoliciesCitadel MeruNo ratings yet

- Accounting Standard 5Document11 pagesAccounting Standard 5Payal Malik100% (1)

- Net Profit or Loss RequirementsDocument10 pagesNet Profit or Loss RequirementsKrishna JhaNo ratings yet

- AS - 5: Ι) N P L P Ⅱ) P P I Ⅲ) C A P: ET Rofit Or Oss For The Eriod Rior Eriod Tems Hange In Ccounting OliciesDocument22 pagesAS - 5: Ι) N P L P Ⅱ) P P I Ⅲ) C A P: ET Rofit Or Oss For The Eriod Rior Eriod Tems Hange In Ccounting OliciesbosskeyNo ratings yet

- AS 5 Net Profit or Loss, Prior Period Items Changes in AccountingDocument9 pagesAS 5 Net Profit or Loss, Prior Period Items Changes in AccountingakulamNo ratings yet

- 2009 F-1 Class NotesDocument4 pages2009 F-1 Class NotesgqxgrlNo ratings yet

- Analyzing Operating Activities: ReviewDocument38 pagesAnalyzing Operating Activities: Reviewandrea de capellaNo ratings yet

- Financial Accounting MasterDocument80 pagesFinancial Accounting Mastertimbuc202No ratings yet

- Special Income ItemsDocument11 pagesSpecial Income ItemsFantayNo ratings yet

- Financial Statements OverviewDocument36 pagesFinancial Statements OverviewIrvin OngyacoNo ratings yet

- Reclassification AdjustmentsDocument3 pagesReclassification AdjustmentsRanilo HeyanganNo ratings yet

- AS 5 Net Profit or Loss For The Period, Prior Period Items and Changes in Accounting PoliciesDocument8 pagesAS 5 Net Profit or Loss For The Period, Prior Period Items and Changes in Accounting PoliciesChandan KumarNo ratings yet

- 8 - Anlysis of Financial StatementsDocument3 pages8 - Anlysis of Financial StatementsMohammad ImaduddinNo ratings yet

- 01 Net Profit of Loss For The Period, Fundamental Errors and Changes in Accounting PoliciesDocument3 pages01 Net Profit of Loss For The Period, Fundamental Errors and Changes in Accounting PoliciesMd. Iqbal HasanNo ratings yet

- 74705bos60485 Inter p1 cp7 U2Document14 pages74705bos60485 Inter p1 cp7 U2jdeconomic06No ratings yet

- Aik CH 6Document15 pagesAik CH 6rizky unsNo ratings yet

- Ac Standard - AS05Document6 pagesAc Standard - AS05api-3705877No ratings yet

- 27272asb As 5Document9 pages27272asb As 5teamhackerNo ratings yet

- Ind As 1, 7,8,10, 34Document40 pagesInd As 1, 7,8,10, 34Dr. Meghna DangiNo ratings yet

- Financial Statements I: Income Statement and Accounting ChangesDocument64 pagesFinancial Statements I: Income Statement and Accounting ChangesHILDANo ratings yet

- Preparation and Presentation of Financial StatementsDocument56 pagesPreparation and Presentation of Financial StatementsKogularamanan NithiananthanNo ratings yet

- As Quick PDFDocument23 pagesAs Quick PDFChandreshNo ratings yet

- Wahlen 9e CH06 PPT Accounting QualityDocument26 pagesWahlen 9e CH06 PPT Accounting QualityAshraf ZamanNo ratings yet

- Presentation - Accounting Standards 5 and 9Document31 pagesPresentation - Accounting Standards 5 and 9raj100% (1)

- Lecture 2: Accounting AnalysisDocument6 pagesLecture 2: Accounting AnalysislphuonghdNo ratings yet

- Understanding Financial Statements /TITLEDocument26 pagesUnderstanding Financial Statements /TITLEMARC BENNETH BERIÑANo ratings yet

- Accounting ChangesDocument5 pagesAccounting Changeskty yjmNo ratings yet

- AS 5 Net Profit Loss ChangesDocument12 pagesAS 5 Net Profit Loss ChangesRattan Preet SinghNo ratings yet

- Statement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTDocument21 pagesStatement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTRuaya AilynNo ratings yet

- CfasDocument49 pagesCfasBlesse PascuaNo ratings yet

- EDHEC - MSC Fin - FAA - Overview of The Income StatementDocument27 pagesEDHEC - MSC Fin - FAA - Overview of The Income StatementGabriele GabrieliNo ratings yet

- Materi Meet 10 Evaluating, Recording MethodsDocument12 pagesMateri Meet 10 Evaluating, Recording MethodsSiti Nuranisa AziarNo ratings yet

- Financial Analysis - Maruti Udyog LimitedDocument32 pagesFinancial Analysis - Maruti Udyog LimitedbhagypowaleNo ratings yet

- Accounting Standard (As) 5Document19 pagesAccounting Standard (As) 5Ashish NemaNo ratings yet

- Accounting Policy and EstimateDocument5 pagesAccounting Policy and EstimateADEYANJU AKEEMNo ratings yet

- SFAC No 5Document28 pagesSFAC No 5Clara Indira PurnamasariNo ratings yet

- FAC1502 - Study Unit 3 - 2023Document11 pagesFAC1502 - Study Unit 3 - 2023Olwethu PhikeNo ratings yet

- As-5Document20 pagesAs-5Amrit TejaniNo ratings yet

- Enphase Investor Day 11 - 16 - 2021 - LowresDocument68 pagesEnphase Investor Day 11 - 16 - 2021 - LowresBruno CarvalheiroNo ratings yet

- Module 1B - PFRS For Medium Entities NotesDocument25 pagesModule 1B - PFRS For Medium Entities NotesLee SuarezNo ratings yet

- Reporting the financial performance of entitiesDocument31 pagesReporting the financial performance of entitiesZHI KANG KONGNo ratings yet

- Akm 1Document7 pagesAkm 1Mohammad Alfiyan SyahrilNo ratings yet

- 2020 CMA P1 A A Financial StatementsDocument48 pages2020 CMA P1 A A Financial StatementsLhenNo ratings yet

- Financial Accounting Window Dressing TechniquesDocument28 pagesFinancial Accounting Window Dressing TechniquesKathrinaRodriguezNo ratings yet

- PAS 1 Financial Statement PresentationDocument7 pagesPAS 1 Financial Statement PresentationArtemisNo ratings yet

- As 5Document2 pagesAs 5charul kapuriyaNo ratings yet

- Chapter 6 Income Statement & Statement of Changes in EquityDocument7 pagesChapter 6 Income Statement & Statement of Changes in EquitykajsdkjqwelNo ratings yet

- Understanding Financial StatementsDocument25 pagesUnderstanding Financial StatementsFarah AtikahNo ratings yet

- Statement of Comprehensive IncomeDocument32 pagesStatement of Comprehensive IncomeJonathan NavalloNo ratings yet

- CH 12Document93 pagesCH 12Saskia SpencerNo ratings yet

- Chapter 9 - Pas 1 Statement of Comprehensive IncomeDocument26 pagesChapter 9 - Pas 1 Statement of Comprehensive IncomeMarriel Fate CullanoNo ratings yet

- CH 13Document8 pagesCH 13Gaurav KarkiNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Current liabilities of multiple companiesDocument5 pagesCurrent liabilities of multiple companiesPhoebe Dayrit CunananNo ratings yet

- BTap-TCDN 2Document22 pagesBTap-TCDN 2baonguyen.31211022084No ratings yet

- Overview of GST On Government Works ContractDocument9 pagesOverview of GST On Government Works ContractChaithanya RajuNo ratings yet

- Ghana Revenue Authority: Company Self-Assessment FormDocument2 pagesGhana Revenue Authority: Company Self-Assessment FormDavid BiahNo ratings yet

- Capital TransactionsDocument3 pagesCapital TransactionsPrinceCharmIngMuthilyNo ratings yet

- FSA TERM ASSIGNMENT on Eicher MotorsDocument10 pagesFSA TERM ASSIGNMENT on Eicher MotorsNaman BishtNo ratings yet

- Tax Law Class NotesDocument126 pagesTax Law Class NotesANAND GEO 1850508No ratings yet

- Aescartin/Tlopez/Jpapa: Mobile Telephone GmailDocument4 pagesAescartin/Tlopez/Jpapa: Mobile Telephone GmailKarenNo ratings yet

- Introdoction of Strategic Tax PlanningDocument17 pagesIntrodoction of Strategic Tax Planningharshit sinhaNo ratings yet

- Gautam NayakDocument10 pagesGautam Nayakdivya chawlaNo ratings yet

- Additional Performance Measurement 123Document7 pagesAdditional Performance Measurement 123Aditi AggarwalNo ratings yet

- Leon Joaquin R. Valdez BSA2-1 Income Taxation (TRAIN Law Reflection)Document2 pagesLeon Joaquin R. Valdez BSA2-1 Income Taxation (TRAIN Law Reflection)LEON JOAQUIN VALDEZNo ratings yet

- Trends in Indian Tax RevenuesDocument29 pagesTrends in Indian Tax RevenuesjhawarenterprisesNo ratings yet

- Seminar Workshop On The Updating of Municipal Revenue CodeDocument37 pagesSeminar Workshop On The Updating of Municipal Revenue CodeOren Estabillo Mendoza100% (1)

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- Taxation of TrustDocument4 pagesTaxation of TrustRahul ARNo ratings yet

- Apax PE Associate Recruiting PromptDocument2 pagesApax PE Associate Recruiting PromptLuisNo ratings yet

- FM Question BookletDocument66 pagesFM Question Bookletdeepu deepuNo ratings yet

- QuickBooks HelpDocument3 pagesQuickBooks HelpPukkah JoshNo ratings yet

- Partnership and Corporation Accounting Chapter 1 SolManDocument11 pagesPartnership and Corporation Accounting Chapter 1 SolManDavid BarletaNo ratings yet

- NextGenIAS Economy Full Static PF SampleDocument50 pagesNextGenIAS Economy Full Static PF SamplescribeNo ratings yet

- FY 2019 Annual Financial Report SummaryDocument40 pagesFY 2019 Annual Financial Report SummaryAkin A. OkupeNo ratings yet

- PIC MicroprojectDocument19 pagesPIC MicroprojectDevdas JadhavNo ratings yet

- Taxation Semester VI T. Y. B. ComDocument265 pagesTaxation Semester VI T. Y. B. ComSushant kawadeNo ratings yet

- f7sgp 2009 Dec QDocument9 pagesf7sgp 2009 Dec Q10 SPACENo ratings yet

- CHP 3Document78 pagesCHP 3Vivek SaraogiNo ratings yet

- BCF AssignmentDocument2 pagesBCF AssignmentArchismanNo ratings yet

- Annual Report Insights for Investors and StakeholdersDocument37 pagesAnnual Report Insights for Investors and StakeholdersAshutosh SharmaNo ratings yet

- Payroll Audit ProgramsDocument6 pagesPayroll Audit ProgramsMirage100% (1)

- CFI Jeff Schmidt - Three Financial StatementsDocument7 pagesCFI Jeff Schmidt - Three Financial StatementsDR WONDERS PIBOWEINo ratings yet