Professional Documents

Culture Documents

Ghana Revenue Authority: Company Self-Assessment Form

Uploaded by

David BiahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ghana Revenue Authority: Company Self-Assessment Form

Uploaded by

David BiahCopyright:

Available Formats

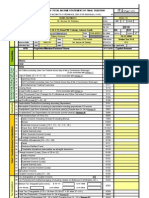

GHANA REVENUE AUTHORITY

DOMESTIC TAX REVENUE DIVISION

COMPANY SELF-ASSESSMENT FORM

ANNUAL ESTIMATE

LTO MTO STO

CURRENT TAX OFFICE

(Tick One) Name of Tax Office

YEAR OF ASSESSMENT

(yyyy)

PERIOD: FROM TO

(dd/mm) (dd/mm)

Select currency in which data is presented. GH¢ US$ £ €

COMPANY

NAME

TIN

COMPUTATION OF TAX

(Please refer to the completion notes overleaf for guidance in completing this form)

AMOUNT

1. Annual Chargeable Income

2. Annual Total Income Tax payable

3. Quarterly Income Tax Payable

4. Annual Levy Payable

5. Quarterly Levy Payable

DECLARATION

I, hereby declare that the Information in this form is true and accurate.

(Full Name)

Designation / Position Signature Date

Internal Use Only

Vetted By

DT 0102 ver 1.1

COMPANY SELF-ASSESSMENT ESTIMATE FORM

COMPLETION NOTES

If you need further clarification or assistance in completing this Form please contact your nearest Domestic Tax

Revenue Division Office. The Return should be completely filled. All boxes should be completed. Where a response is

not applicable enter n/a for text or zero (0) for value or number boxes.

This form gives a summary of the Estimated Computation of Tax for a Self-Assessed Company

Form DT 0102A (Revised Self-Assessment Estimate Form) is to be completed any time the Estimate is

revised

CURRENT TAX OFFICE: This is the Tax office assigned to the taxpayer

YEAR OF ASSESSMENT: This is the financial year to which the return relates

PERIOD: This refers to the beginning and end of the basis period (The Accounting year) of the Company

NAME OF COMPANY: Legally registered name of the company (no abbreviations)

TIN: This is the eleven (11) character Taxpayer Identification Number

ANNUAL CHARGEABLE INCOME: The estimated annual income that is to be subjected to Tax

ANNUAL TOTAL INCOME TAX PAYABLE: The estimated annual income tax to be paid to the Ghana

Revenue Authority.

QUARTERLY INCOME TAX PAYABLE: A quarter (1/4) of the estimated annual income tax to be paid

to the Ghana Revenue Authority at the end of every quarter.

ANNUAL LEVY PAYABLE: The estimated annual amount of levy or Levies to be paid to the Ghana

Revenue Authority (e.g. National Fiscal Stabilization Levy. These levies by law applies to taxpayers in certain

industries)

QUARTERLY LEVY PAYABLE: A quarter (1/4) of the estimated annual levy to be paid to the Ghana

Revenue Authority at the end of every quarter.

DECLARATION: This section is to be completed by a responsible officer showing Name, Designation /

Position, Signature and Date

DT 0102 ver 1.1

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Ghana Revenue Authority: Company Self-Assessment FormDocument2 pagesGhana Revenue Authority: Company Self-Assessment Formokatakyie1990No ratings yet

- Ghana Revenue Authority Company Self Assessment FormDocument2 pagesGhana Revenue Authority Company Self Assessment Formokatakyie1990No ratings yet

- DT 0108 Annual Paye Deductions Return Form v1 2Document2 pagesDT 0108 Annual Paye Deductions Return Form v1 2Kwasi DankwaNo ratings yet

- DT 0107a Employer Monthly Tax Deductions Schedule v1 2Document2 pagesDT 0107a Employer Monthly Tax Deductions Schedule v1 2Gael OrtizNo ratings yet

- Ghana Revenue Authority PAYE scheduleDocument1 pageGhana Revenue Authority PAYE schedulejoseph borketeyNo ratings yet

- Annex A - Application Form BIR Form 2119Document2 pagesAnnex A - Application Form BIR Form 2119Antonio Reyes IVNo ratings yet

- BIR Form No. 2119 - Rev - Guidelines2Document3 pagesBIR Form No. 2119 - Rev - Guidelines2rhea CabillanNo ratings yet

- TIEP Application TemplatesDocument6 pagesTIEP Application TemplatesactivatedcarbonsolutionsNo ratings yet

- BIR Form 2307Document2 pagesBIR Form 2307Angelique MasupilNo ratings yet

- GETFund NHIL VERSION 218AUG 2018Document2 pagesGETFund NHIL VERSION 218AUG 2018joseph borketeyNo ratings yet

- IT 2 Return2010witoutFormulas (Draft)Document7 pagesIT 2 Return2010witoutFormulas (Draft)abdakbarNo ratings yet

- WHVAT ReturnDocument6 pagesWHVAT ReturnbatuchemNo ratings yet

- RMC No. 108-2020 Annex ADocument3 pagesRMC No. 108-2020 Annex AJoel SyNo ratings yet

- Non Individual Tax Clearance Certificate Application FormDocument1 pageNon Individual Tax Clearance Certificate Application FormNwogboji EmmanuelNo ratings yet

- Ghana Revenue Authority: Monthly Vat & Nhil Flat Rate ReturnDocument2 pagesGhana Revenue Authority: Monthly Vat & Nhil Flat Rate Returnokatakyie1990No ratings yet

- 1604e 2018Document2 pages1604e 2018FedsNo ratings yet

- Date Entry: Fsic: Assessor: Batch No.: Checker: Return No.:: (Tick One Box Only)Document7 pagesDate Entry: Fsic: Assessor: Batch No.: Checker: Return No.:: (Tick One Box Only)Alvin KumarNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document32 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Sakura AvhrynNo ratings yet

- Itax Form 2006Document4 pagesItax Form 2006AliMuzaffarNo ratings yet

- Annual Income Tax Return: Yes No Yes NoDocument4 pagesAnnual Income Tax Return: Yes No Yes NoDerwin AraNo ratings yet

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Document3 pagesD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarNo ratings yet

- 2307 BlankDocument2 pages2307 BlankJames Brooke PalomaNo ratings yet

- DT 0107 Monthly Paye Deductions Return Form v1 2 PDFDocument2 pagesDT 0107 Monthly Paye Deductions Return Form v1 2 PDFpapapetroNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceMaricar Lelaine SecretarioNo ratings yet

- 2307 LessorDocument3 pages2307 LessorPaul EspinosaNo ratings yet

- 433-D Installment Agreement: (Taxpayer) (Spouse) (Including Area Code) (Home) (Work, Cell or Business)Document4 pages433-D Installment Agreement: (Taxpayer) (Spouse) (Including Area Code) (Home) (Work, Cell or Business)douglas jonesNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- 2307 Thedeleons Co LTDDocument2 pages2307 Thedeleons Co LTDRACHEL DAMALERIONo ratings yet

- 1701 Mixed TemplateDocument11 pages1701 Mixed TemplateDaniel B. MalillinNo ratings yet

- RMC No. 3-2020 Annex A - 1702Q 2018 PDFDocument3 pagesRMC No. 3-2020 Annex A - 1702Q 2018 PDFJemila Paula DialaNo ratings yet

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument36 pagesCertificate of Creditable Tax Withheld at SourceProbinsyana KoNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3SK GACAO PALO, LEYTENo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- US Internal Revenue Service: F940ez - 1997Document4 pagesUS Internal Revenue Service: F940ez - 1997IRSNo ratings yet

- Bir 1701Document4 pagesBir 1701Vanesa Calimag ClementeNo ratings yet

- " Part-II A: Return of Total Income/Statement of Final TaxationDocument7 pages" Part-II A: Return of Total Income/Statement of Final TaxationNomanAliNo ratings yet

- 1604-F Jan 2018 Final 2Document2 pages1604-F Jan 2018 Final 2Nguyen LinhNo ratings yet

- 1604-C Jan 2018 Final Annex A PDFDocument1 page1604-C Jan 2018 Final Annex A PDFAs Li NahNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- 2307 New PDFDocument2 pages2307 New PDFallan paolo neveidaNo ratings yet

- BIR FORM 1604-F New FormDocument2 pagesBIR FORM 1604-F New FormJhen S. DomingoNo ratings yet

- PH TAX FILER RELATED PARTY TRANSACTIONSDocument3 pagesPH TAX FILER RELATED PARTY TRANSACTIONSErica Caliuag0% (1)

- Republic of the Philippines CertificateDocument2 pagesRepublic of the Philippines CertificateLe Lhiin CariñoNo ratings yet

- 2307 Creditable Tax Withheld at SourceDocument6 pages2307 Creditable Tax Withheld at SourceBarangay BugasNo ratings yet

- US Internal Revenue Service: F940ez - 1995Document4 pagesUS Internal Revenue Service: F940ez - 1995IRSNo ratings yet

- Bir Form 1701Document4 pagesBir Form 1701Ajoi SevillaNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Aircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryFrom EverandAircraft Rental & Leasing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Berekum Remaining WorksDocument5 pagesBerekum Remaining WorksDavid BiahNo ratings yet

- Berekum Remaining WorksDocument5 pagesBerekum Remaining WorksDavid BiahNo ratings yet

- Science Block Material Schedule (Priced)Document10 pagesScience Block Material Schedule (Priced)David BiahNo ratings yet

- The Otchere Residence PresentationDocument7 pagesThe Otchere Residence PresentationDavid BiahNo ratings yet

- Science Block Material Schedule (Priced)Document10 pagesScience Block Material Schedule (Priced)David BiahNo ratings yet

- Request For Revision of RatesDocument2 pagesRequest For Revision of RatesDavid BiahNo ratings yet

- Postgraduate Taught Course Information 2021 / 2022 Academic YearDocument2 pagesPostgraduate Taught Course Information 2021 / 2022 Academic YearDavid BiahNo ratings yet

- PLUS 10% Item Description Quantity Unit Waste TotalDocument2 pagesPLUS 10% Item Description Quantity Unit Waste TotalDavid BiahNo ratings yet

- Ghana Revenue Authority: Personal Income Tax ReturnDocument5 pagesGhana Revenue Authority: Personal Income Tax ReturnDavid Biah100% (1)

- Request For Revision of RatesDocument2 pagesRequest For Revision of RatesDavid BiahNo ratings yet

- Curriculum Vitae: Personal DetailsDocument3 pagesCurriculum Vitae: Personal DetailsDavid BiahNo ratings yet

- Water Utility Benchmarking: Measurement, Methodologies, and Performance IncentivesDocument58 pagesWater Utility Benchmarking: Measurement, Methodologies, and Performance IncentivesCPJT JeurissenNo ratings yet

- Capital Structure ProjectDocument56 pagesCapital Structure ProjectHarshita chauhanNo ratings yet

- Non ProfitDocument7 pagesNon ProfitBabatunde DokunNo ratings yet

- Unclaimed Balances Act OutlineDocument5 pagesUnclaimed Balances Act OutlineJannah Mae NeneNo ratings yet

- Unit 2 Marketing ResearchDocument6 pagesUnit 2 Marketing ResearchDr Priyanka TripathyNo ratings yet

- Psychology From Inquiry To Understanding Canadian 3rd Edition Lynn Test BankDocument12 pagesPsychology From Inquiry To Understanding Canadian 3rd Edition Lynn Test BankJodyArcherdkco100% (50)

- Strategic Management Concepts and Cases - 17th EditionDocument666 pagesStrategic Management Concepts and Cases - 17th EditionKholoud Al-Ajlouni96% (27)

- Technology and Livelihood Education: Quarter 2 - Module 3: Front Office ServicesDocument28 pagesTechnology and Livelihood Education: Quarter 2 - Module 3: Front Office ServicesREYNOLD MILLONDAGANo ratings yet

- Metro Laundry Services Vs Commission Proper, Commission On Audit, and City of Manila, G.R. No. 252411, February 15, 2022Document2 pagesMetro Laundry Services Vs Commission Proper, Commission On Audit, and City of Manila, G.R. No. 252411, February 15, 2022Gi NoNo ratings yet

- Dhan Ki BaatDocument12 pagesDhan Ki Baattest hrmNo ratings yet

- Eir March2021Document1,475 pagesEir March2021Ashutosh BhandekarNo ratings yet

- Survey On Customer Satisfaction of Medical Tourism in INDIA With Special Reference To Kerela StateDocument41 pagesSurvey On Customer Satisfaction of Medical Tourism in INDIA With Special Reference To Kerela Statebapunritu0% (1)

- M&E-TOR (Rev - May2015)Document53 pagesM&E-TOR (Rev - May2015)Sara Ikhwan Nor SalimNo ratings yet

- Advertising Promotion and Other Aspects of Integrated Marketing Communications 9th Edition Shimp Test Bank Full Chapter PDFDocument42 pagesAdvertising Promotion and Other Aspects of Integrated Marketing Communications 9th Edition Shimp Test Bank Full Chapter PDFjudaizerwekaezo8a100% (11)

- Guatemala Case Study FV 21AUG2015Document62 pagesGuatemala Case Study FV 21AUG2015Denia Eunice Del ValleNo ratings yet

- 1JSBED597588AU3081Document23 pages1JSBED597588AU3081Sasquarch VeinNo ratings yet

- Tech Mahindra Talent Management Practices SummaryDocument3 pagesTech Mahindra Talent Management Practices SummarySAYANTH SUDHEERNo ratings yet

- Partnership Accounting With AnsDocument22 pagesPartnership Accounting With Ansjessica amorosoNo ratings yet

- Circumstances Allowing Piercing of Corporate VeilDocument8 pagesCircumstances Allowing Piercing of Corporate VeilSipho NdlovuNo ratings yet

- Guyana Trade Unions Act SummaryDocument18 pagesGuyana Trade Unions Act SummaryAaliyahNo ratings yet

- Chapter 01 GlobalizationDocument34 pagesChapter 01 GlobalizationNiladri RaianNo ratings yet

- Non-Disclosure ContractDocument5 pagesNon-Disclosure ContractErika Marie DequinaNo ratings yet

- Answer:: 1. Describe Three Reasons Why Waiting Is Damaging To Organizations?Document2 pagesAnswer:: 1. Describe Three Reasons Why Waiting Is Damaging To Organizations?Laiza Joyce SalesNo ratings yet

- Prospectus 2016 07 19Document199 pagesProspectus 2016 07 19Nicolas GrossNo ratings yet

- SMCC-13 Memorial For Opposite PartyDocument21 pagesSMCC-13 Memorial For Opposite PartyUdhithaa S K KotaNo ratings yet

- Bangladesh Leasing Industry OverviewDocument22 pagesBangladesh Leasing Industry OverviewAyesha SiddikaNo ratings yet

- Answer Key For MarketingDocument3 pagesAnswer Key For Marketingtammy a. romuloNo ratings yet

- Part 4B Investment Decision Analysis 216 QuestionsDocument62 pagesPart 4B Investment Decision Analysis 216 QuestionsFernando III PerezNo ratings yet

- TOEFL Reading Comprehension Lesson 3: Đọc đoạn văn sau và trả lời các câu hỏiDocument3 pagesTOEFL Reading Comprehension Lesson 3: Đọc đoạn văn sau và trả lời các câu hỏiThành PhạmNo ratings yet

- Hotel Industry Report Provides Insights on Growth, Costs, and FinancialsDocument12 pagesHotel Industry Report Provides Insights on Growth, Costs, and FinancialssparasavediNo ratings yet