Professional Documents

Culture Documents

LU 5 Solutions

Uploaded by

bison3216Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LU 5 Solutions

Uploaded by

bison3216Copyright:

Available Formats

IIE Workbook Solutions MFAC6211

Learning Unit 5: Job costing systems

Activity 5.1

a) Direct Material Control

Opening Balance 120 000 Issued SH 18 250

Issued WF 32 860

Issued BN 12 640

Issued CF 6 580

Closing Balance 49 670

Manufacturing Overhead Control

Actual 64 220 Recovered 56 264

Under Recovered 7 956

Work-in-Process Control

Material 70 330 Finished Goods 160 510

Wages 45 760

Overhead 56 264

Closing Balance 11 844

Finished Goods

Straw Hats 45 090 Straw Hats 45 090

Wooden Fishes 83 708 Beaded Necklaces 31 712

Beaded Necklaces 31 712

Closing Balance 83 708

© The Independent Institute of Education (Pty) Ltd 2018 – Page 1 of 7

IIE Module Guide Solutions MFAC6211

Calculations:

Job Material Wages Overhead* Total

Straw Hats 18 250 12 240 14 600 45 090

Wooden Fishes 32 860 24 560 26 288 83 708

Beaded Necklaces 12 640 8 960 10 112 31 712

Colourful fabric 6 580 - 5 264 11 844

70 330 45 760 56 264

* - Overhead recovered at 80% of Material costs

Beaded

b) Profit or Loss Straw Hats Necklaces Total

Sales 76 653 53 910 130 563

Manufacturing Cost 45 090 31 712 76 802

Under Recovery of Overheads 7 956

Gross Profit 45 805

Non-Manufacturing Costs -

Net Profit 45 805

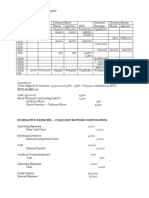

Revision Exercise 5.1

a)

i) Material Control Account

Opening Balance 26 000 Issues - Job A 32 000

Purchases 78 000 Issues - Job B 27 000

Issues - Job C 15 000

Closing Balance 30 000

a)

ii) Salaries and wages control account

Bank 43 400 Job A 16 000

Job B 19 800

Job C 7 600

Closing Balance -

b) Job A

© The Independent Institute of Education (Pty) Ltd 2018 – Page 2 of 7

IIE Module Guide Solutions MFAC6211

i)

Direct Material 32 000 Finished Goods 60 000

Direct Labour 16 000

Fixed Overhead (R 15 x

800) 12 000

Closing Balance -

Job B

Direct Material 27 000

Direct Labour 19 800

Fixed Overhead (R 15 x

990) 14 850

Closing Balance 61 650

c) Actual Overhead 35 000

Applied Overhead R 15 x (800 + 990 + 380) 32 550

Under applied (2 450)

Dr Cost of sales 2 450

Cr Manufacturing overhead 2 450

Revision Exercise 5.2

a) i) Profit Job Meanteam

Sales 65 000

COS

Material 18 000

Labour (16 x 36 x R 30) 17 280

Variable Manuf O/H (R 12 x 16 x 36) 6 912

Fixed Manuf O/H (R 16 x 16 x 36) Calc 1 9 216

Profit/(Loss) 13 592

Calc 1: Fixed Manuf O/H Recovery Rate:

16 000 / (400 + 600) = R 16

a) ii) Job Greatone (WIP)

Opening WIP 20 000

Material 8 000

Labour (R 40 x 8 x 48) 15 360

© The Independent Institute of Education (Pty) Ltd 2018 – Page 3 of 7

IIE Module Guide Solutions MFAC6211

Variable Manuf O/H (R 12 x 8 x 48) 4 608

Fixed Manuf O/H (R 16 x 8 x 48) Calc 1 6 144

Direct Material

15 000 + 38 000 - 8 000 - 18 000 27 000

Inventory Value 81 112

b) WIP

Opening Balance 20 000 Finished Goods 51 408

Material (18 000 + 8 000) 26 000 (18 000 + 17 280 + 6 912 +

Labour (17 280 + 15 360) 32 640 9 216)

Variable Manuf O/H (6 912 + 4 608) 11 520

Fixed Manuf O/H (9 216 + 6 144) 15 360

Closing Balance 54 112

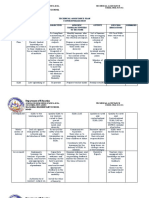

Revision Exercise 5.3

a)

Direct Material Control

Opening Balance 210,000 X3000 120,500

Purchases 440,300 X4520 180,300

X5850 215,600

Closing Balance 133,900

Wages Control

Bank 240,000 X3000 (1 100 x 50) 55,000

X4520 (1 600 x 50) 80,000

X5850 (2 100 x 50) 105,000

Manufacturing Overhead Control

Bank/Creditors 372,000 Work-in-progress 408,000

Cost of sales 36,000

Budgeted rate = 360 000 / (950 + 1 400 + 1 900) = R85

Applied overhead = 85 x (1 100 + 1 600 + 2 100) = R408 000

© The Independent Institute of Education (Pty) Ltd 2018 – Page 4 of 7

IIE Module Guide Solutions MFAC6211

Work-in-Process Control

Material 516,400 Finished Goods 768,100

Wages 240,000

Manufacturing Overhead 408,000

Closing Balance 396,300

Finished Goods

X3000 269,000 Cost of sales 269,000

X5850 499,100

Closing Balance 499,100

Cost of sales

Finished goods 269,000 Cost of sales 36,000

b)

Calculations:

Job Material Wages Overhead Total

X3000 120,500 55,000 93,500 269,000

X4520 180,300 80,000 136,000 396,300

X5850 215,600 105,000 178,500 499,100

516,400 240,000 408,000

Profit or Loss Total

Sales 384,286

-

Manufacturing Cost 269,000

36,00

Over applied overheads 0

Gross Profit 151,286

Non-manufacturing Costs -

Net Profit 151,286

© The Independent Institute of Education (Pty) Ltd 2018 – Page 5 of 7

IIE Module Guide Solutions MFAC6211

Revision Exercise 5.4

a)

Direct Material Control

Opening Balance 25,400 Hand Luxurious 1,200

Purchases 2,300 Sporty Deluxe 860

Leisure Galore 1,850

Closing Balance 23,790

Manufacturing Overhead Control

Bank/Creditors 2,100 Work-in-progress 2,346

24

Cost of sales 6

Applied overhead = (1200 + 860 + 1850) x 60%

Finished Goods

Hand Luxurious 2,280 Cost of sales 1,856

Sporty Deluxe 1,856

Closing Balance 2,280

Cost of sales

Finished goods 1,856 Over applied overheads 246

b)

Hand Luxurious

Direct Material 1,200 Finished Goods 2,280

36

Direct Labour 0

72

Manufacturing Overheads 0

Leisure Galore

Direct Material 1,850 Work-in-progress 3,590

63

Direct Labour 0

© The Independent Institute of Education (Pty) Ltd 2018 – Page 6 of 7

IIE Module Guide Solutions MFAC6211

Manufacturing Overheads 1,110

c)

Calculations:

Job Material Wages Overhead Total

1,20 3 7

Hand Luxurious 0 60 20 2,280

8 4 5

Sporty Deluxe 60 80 16 1,856

1,85 6 1,11

Leisure Galore 0 30 0 3,590

3,91 1,47 2,34

0 0 6

Profit or Loss Total

Sales 2,970

Manufacturing Cost (1,856)

24

Over applied overheads 6

Gross Profit 1 360

Non Manufacturing Costs -

Net Profit 1 360

© The Independent Institute of Education (Pty) Ltd 2018 – Page 7 of 7

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Mycology 1 PrelimDocument4 pagesMycology 1 PrelimKaye Angel VillonNo ratings yet

- Profit and Loss Statement TemplateDocument2 pagesProfit and Loss Statement TemplateAlisa VisanNo ratings yet

- Toaz - Info Chapter 5 2019 Problem 1 Alexis Company PRDocument3 pagesToaz - Info Chapter 5 2019 Problem 1 Alexis Company PRAngela Ruedas33% (3)

- C0904 091814 PDFDocument54 pagesC0904 091814 PDFBuddy JohnsonNo ratings yet

- 1 - Coating Solutions For Centrifugal Compressor Fouling (LR)Document4 pages1 - Coating Solutions For Centrifugal Compressor Fouling (LR)Mokhammad Fahmi Izdiharrudin100% (1)

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- Auraton 2005Document24 pagesAuraton 2005Muhidin KozicaNo ratings yet

- NutritionDocument109 pagesNutritionjay_eshwaNo ratings yet

- SK KK-Survey and DatabaseDocument8 pagesSK KK-Survey and DatabaseMaria ImmaNo ratings yet

- Hockey Stick 1Document1,617 pagesHockey Stick 1sabyasachi sarkarNo ratings yet

- Acco 20073 - Cost Accounting & Control: ApplicationsDocument23 pagesAcco 20073 - Cost Accounting & Control: ApplicationsMaria Kathreena Andrea AdevaNo ratings yet

- Study of Spray DryingDocument18 pagesStudy of Spray DryingMahe Rukh100% (2)

- Captopril (Drug Study)Document3 pagesCaptopril (Drug Study)Franz.thenurse6888100% (3)

- Worthington RollairDocument32 pagesWorthington RollairLucyan Ionescu100% (1)

- Assignment DFA6127Document3 pagesAssignment DFA6127parwez_0505No ratings yet

- LU 5 Solutions - 5.1 & 5.2Document3 pagesLU 5 Solutions - 5.1 & 5.2bison3216No ratings yet

- Midterm Winter 2017 - SolutionDocument7 pagesMidterm Winter 2017 - SolutionAya Ben MohamedNo ratings yet

- Job Order CostingDocument5 pagesJob Order Costing0322-1975No ratings yet

- Yolanda Reality Work Sheet For The Month Ended April 2020Document2 pagesYolanda Reality Work Sheet For The Month Ended April 2020Hannah DimalibotNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2021Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2021Maham IlyasNo ratings yet

- Chapter 30 Costing Principles and Systems - Total (Or Absorption) Costing Q1 (A)Document2 pagesChapter 30 Costing Principles and Systems - Total (Or Absorption) Costing Q1 (A)Fegason FegyNo ratings yet

- Name: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Document5 pagesName: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Cherry MaeNo ratings yet

- Exercise No 1 (CGS CGM) - P SDocument11 pagesExercise No 1 (CGS CGM) - P SArun kumarNo ratings yet

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- Chapter 01 - Answers - Job Order CostingDocument15 pagesChapter 01 - Answers - Job Order CostingEmmanuelle MazaNo ratings yet

- Process costing: ﺻ ﻔ ﺣ ﺔ ا ﻟﺑ ﺎ ﺣ ث ا ﻟ ﻌ ﻠ ﻣ ﻲ ﻋ ﻼ ء ﻣ ﺣ ﺳ ن ﺷ ﺣ م ﺗﻠ ﻛ ر ا م @aliasreiDocument14 pagesProcess costing: ﺻ ﻔ ﺣ ﺔ ا ﻟﺑ ﺎ ﺣ ث ا ﻟ ﻌ ﻠ ﻣ ﻲ ﻋ ﻼ ء ﻣ ﺣ ﺳ ن ﺷ ﺣ م ﺗﻠ ﻛ ر ا م @aliasreiDr. M. SamyNo ratings yet

- Balaibo M6 PDFDocument4 pagesBalaibo M6 PDFKarenn Estrañero LuzonNo ratings yet

- 30.00 Points: Raw Materials $ 21,000 Work in Process $ 12,000 Finished Goods $ 31,000Document5 pages30.00 Points: Raw Materials $ 21,000 Work in Process $ 12,000 Finished Goods $ 31,000Mikulas HarvankaNo ratings yet

- Solution of Trial Balance Problem - Exam MEM-3 PDFDocument4 pagesSolution of Trial Balance Problem - Exam MEM-3 PDFEltayeb ElhigziNo ratings yet

- CTH Financial StatementDocument2 pagesCTH Financial StatementyhuzaimiNo ratings yet

- MILLICHEM FormatDocument2 pagesMILLICHEM FormatMuhammad JunaidNo ratings yet

- Ifrs Feb 2019 KeyDocument4 pagesIfrs Feb 2019 Keyjad NasserNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- Tutorial 2 Manufacturing Account 2 AnswerDocument15 pagesTutorial 2 Manufacturing Account 2 AnswerNG JIA LUNGNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- Working CapitalDocument2 pagesWorking CapitalPayal bhatiaNo ratings yet

- Cost Accounting: 1/4/2010 10:55:09 AM Page 1 of 7Document7 pagesCost Accounting: 1/4/2010 10:55:09 AM Page 1 of 7meelas123No ratings yet

- Final AccountsDocument36 pagesFinal AccountsHammadNo ratings yet

- 00000Document30 pages00000ImanNo ratings yet

- Cebu Wine FactoryDocument5 pagesCebu Wine FactorySally Ubando Delos ReyesNo ratings yet

- 1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Document14 pages1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Shien Angel Delos ReyesNo ratings yet

- Costco2-Quiz End-TermDocument4 pagesCostco2-Quiz End-TermmhikeedelantarNo ratings yet

- Additional Answers Exercises COGM-COGS-JEs PDFDocument2 pagesAdditional Answers Exercises COGM-COGS-JEs PDFNicola Erika EnriquezNo ratings yet

- Bacc232 .309 Management Accounting Assignment 1Document13 pagesBacc232 .309 Management Accounting Assignment 1TarusengaNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialDocument39 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialAniket100% (1)

- Mock ExamDocument4 pagesMock ExamAna-Maria GhNo ratings yet

- 1-1hkg 2002 Dec ADocument8 pages1-1hkg 2002 Dec AWing Yan KatieNo ratings yet

- Acco 20073 Instructional Materials CompressDocument23 pagesAcco 20073 Instructional Materials CompressNestyn Hanna VillarazaNo ratings yet

- Jawaban CH 3 (2) Problem 3-43 AKB ASLABDocument5 pagesJawaban CH 3 (2) Problem 3-43 AKB ASLABRantiyaniNo ratings yet

- Afe 3582Document6 pagesAfe 3582sarah josephNo ratings yet

- Ca Ass - 5Document9 pagesCa Ass - 5Aprameya BalasubramanyaNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialDocument38 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialMinni BegumNo ratings yet

- P5-6 Dan P5-8Document13 pagesP5-6 Dan P5-8rama100% (1)

- CHAPTER 3.costdocxDocument5 pagesCHAPTER 3.costdocxJapPy QuilasNo ratings yet

- Tutorial 2 AnswerDocument2 pagesTutorial 2 AnswerDiana TuckerNo ratings yet

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocument4 pagesP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipieNo ratings yet

- Baf 2202Document3 pagesBaf 2202deborah obunguNo ratings yet

- No Dominant Product in The Presence of A Dominant Product: InputDocument24 pagesNo Dominant Product in The Presence of A Dominant Product: Inputvaibhav kumar KhokharNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Ch09Part02.Home Office and Branch Accounting (Special Problems) PDFDocument2 pagesCh09Part02.Home Office and Branch Accounting (Special Problems) PDFStephanie Ann AsuncionNo ratings yet

- June 2021Document64 pagesJune 2021new yearNo ratings yet

- AC 212 Test 1 SolutionDocument4 pagesAC 212 Test 1 SolutionJoyce PamendaNo ratings yet

- Intro To FA SS May 2018Document8 pagesIntro To FA SS May 2018Munodawafa ChimhamhiwaNo ratings yet

- Solution Financial Accounting FundamentalsDocument7 pagesSolution Financial Accounting Fundamentalsone thymeNo ratings yet

- Maths Answers KeyDocument9 pagesMaths Answers KeyLaiba TkdNo ratings yet

- CH 14 Wiley Kimmel Homework QuizDocument16 pagesCH 14 Wiley Kimmel Homework QuizmkiNo ratings yet

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument4 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanShehrozSTNo ratings yet

- SOLUTION DEC 2018 No TicksDocument8 pagesSOLUTION DEC 2018 No Ticksanis izzatiNo ratings yet

- Job Order Pure ProblemsDocument19 pagesJob Order Pure Problemsakber khan khanNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- PMIC Test 1 2019 MEMODocument11 pagesPMIC Test 1 2019 MEMObison3216No ratings yet

- Using The T TableDocument5 pagesUsing The T Tablebison3216No ratings yet

- LU 4 SolutionsDocument3 pagesLU 4 Solutionsbison3216No ratings yet

- Lu 9 - CH20Document23 pagesLu 9 - CH20bison3216No ratings yet

- LU 3 Workbk Solutions 3.1 - 3.4Document4 pagesLU 3 Workbk Solutions 3.1 - 3.4bison3216No ratings yet

- Lu 2 - CH14Document50 pagesLu 2 - CH14bison3216No ratings yet

- PMAC Practice Exam 2022Document5 pagesPMAC Practice Exam 2022bison3216No ratings yet

- Riding+out+the+storm+-+LatAm+2012 HSBC Dec2012Document98 pagesRiding+out+the+storm+-+LatAm+2012 HSBC Dec2012Sergio Gana GonzalezNo ratings yet

- Perilite Exposure and Hot Sitz BathDocument67 pagesPerilite Exposure and Hot Sitz Bathbanana cueNo ratings yet

- Aipmt-Neet Cutoff 2012Document178 pagesAipmt-Neet Cutoff 2012rahuldayal90No ratings yet

- Don Honorio Ventura Technological State University Bacolor, PampangaDocument10 pagesDon Honorio Ventura Technological State University Bacolor, PampangaAnonymous Xwd7uWe0YUNo ratings yet

- Anurag DubeyDocument4 pagesAnurag DubeyVishal ChhokerNo ratings yet

- ASTM Hydrometers: Standard Specification ForDocument12 pagesASTM Hydrometers: Standard Specification FordawoodNo ratings yet

- Brunei 2Document16 pagesBrunei 2Eva PurnamasariNo ratings yet

- The Complete Aqueous Hydrochloric Acid Solutions Density-Concentration CalculatorDocument2 pagesThe Complete Aqueous Hydrochloric Acid Solutions Density-Concentration CalculatorEngr. Md. Tipu SultanNo ratings yet

- Mech Seal VISPACDocument2 pagesMech Seal VISPACJamesNo ratings yet

- Three Things in Life Once Gone Never Come BackDocument27 pagesThree Things in Life Once Gone Never Come BackhemendreNo ratings yet

- Chapter 1 HRMDocument31 pagesChapter 1 HRMABDULLAH MUHAMMAD RAFIQ ANWARNo ratings yet

- Proyecto 4 InglesDocument11 pagesProyecto 4 InglesAlfonsina GarciaNo ratings yet

- Pregnancy in Dental TreatmentDocument62 pagesPregnancy in Dental TreatmentChinar HawramyNo ratings yet

- Gender Neutrality of Criminal Law in India A Myth or Reality With Special Reference To Criminal Law Amendment Bill 2019Document19 pagesGender Neutrality of Criminal Law in India A Myth or Reality With Special Reference To Criminal Law Amendment Bill 2019AbhiNo ratings yet

- Camy Plants: RT Offer LetterDocument1 pageCamy Plants: RT Offer LetterShailesh DeshmukhNo ratings yet

- Quality Control Inspection ReportDocument5 pagesQuality Control Inspection ReportjaymarNo ratings yet

- Reaction PaperDocument3 pagesReaction PaperMondejar KhriziaNo ratings yet

- Lesson 14 Reference Notes Class 10Document3 pagesLesson 14 Reference Notes Class 10Seetha Lekshmi KishoreNo ratings yet

- E25 - Lyn Joy v. Mendoza - Technical Assistance ContextualizationDocument3 pagesE25 - Lyn Joy v. Mendoza - Technical Assistance Contextualizationlyn joyNo ratings yet