Professional Documents

Culture Documents

Construction Company Analysis Foi

Construction Company Analysis Foi

Uploaded by

Karuna KsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Construction Company Analysis Foi

Construction Company Analysis Foi

Uploaded by

Karuna KsCopyright:

Available Formats

Karuna KS (21bc346)

Bcom hons H - H37

Fundamentals of Investment- Company Analysis

1. Hindustan Construction Ltd

Company Profile:

Founded : 27 January 1926; 98 years ago

Founder : Walchand Hirachand

Hindustan Construction Company Limited (HCC) is an Indian multinational engineering

involved in high-value projects that span across diverse sectors such as transportation,

power, marine projects, irrigation and water supply, special buildings and industrial

plants.

Objective : To be the industry leader and a market driven engineering construction

company renowned for excellence, quality, performance and reliability in all types of

construction.

Chairman : Ajit Gulabchand

Stake : 2117294 shares (0.14%)

CEO : Arjun Dhawan

Stake : nil

Growth:

(in cr.) Mar’23 Mar’22

Revenue 9,856 10,669

Profit/Loss -36 195

Ratios:

EPS P/E ratio Debt to Return on Dividend/

equity equity share

mar’23 -01.9 -72.11 -7.41 0 0

mar’22 2.64 5.95 -2.28 -50.92 0

2. Reliance Infrastructure Ltd

Company Profile :

Founded : 1 October 1929

The Company is engaged in the business of providing Engineering and Construction

(E&C) services for power, roads, metro rail and other infrastructure sectors. The

Company is also engaged in implementation, operation and maintenance of several

projects in defence sector and infrastructural areas through its special purpose vehicles.

Objective : To create world-class assets and infrastructure to provide the platform for

faster, consistent growth for India to become a major world economic power.

CEO : Shri Punit Garg

Stake : ₹ 321.1k (0.00038%)

Growth:

(in cr) Mar’23 Mar’22

Revenue 810 1,467

Profit/Loss -3,197 -368

Ratios:

EPS P/E ratio Debt to Return on Dividend/

equity equity share

mar’23 -112 -1.28 1.23 -35 0

mar’22 -35 -3.15 1.01 -7 0

3. Larsen & Toubro Ltd.

Company Profile:

Founded- 7 February 1946.

L&T, is an Indian multinational conglomerate, with interests in engineering, construction,

manufacturing, technology, information technology, military and financial services. It is

headquartered in Chennai.

Objective: To utilize the power of new and emerging technologies to make significant

improvements to our business - save costs, improve productivity and efficiency, and

reduce execution time.

Chairman and MD: S N Subrahmanyan (no CEO)

Stake: nil

Public and Non-promoter non-public entities are the shareholders of L&T.

Growth:

(in cr.) Mar’23 Mar’22

Revenue 183,340 156,521

Profit/Loss 12,624 10,291

Ratios:

EPS P/E ratio Debt to Return on Dividend/

equity equity share

mar’23 74.51 29.05 1.33 11.72 24

mar’22 61.71 28.64 1.5 10.52 22

4. IRB Infrastructure Ltd

Company profile: It was incorporated in 1998, with its headquarters in Mumbai,

Maharashtra, India. It is an Indian highway construction company[2] headed by Mr.

Virendra Dattatraya

Objective: “At IRB, we firmly believe that to truly enhance stakeholder value. Our

actions are aligned towards bringing value to our communities as well. We are

committed to work towards creating sustained benefits so as to promote inclusive

growth.”

CEO: Ajay Deshmukh

Stake: 5,06,39,850.00 shares (0.84%)

Growth:

(in cr.) Mar’23 Mar’22

Revenue 6,401 5,803

Profit/Loss 827 587

Ratios:

EPS P/E ratio Debt to Return on Dividend/

equity equity share

mar’23 1.19 21.13 1.25 5.38 0.20

mar’22 8.69 2.89 1.33 2.87 0

5. Man infra Ltd

Company Profile: It began as engineering contractors and have since built several

challenging landmark projects pan India across verticals like ports, infrastructure,

residential townships, commercial projects, institutions, IT projects and futuristic lifestyle

houses.

Objective: To be a leading integrated Real Estate Development company with strong in-

house execution expertise and capabilities with attention to detail and utmost customer

satisfaction and continue to grow in infrastructure space thereby enhancing

shareholder’s value.

Managing Director: Manan P. Shah

Stake: 21377245 shares (5.76%)

Growth:

(in cr.) Mar’23 Mar’22

Revenue 1,890 961

Profit/Loss 284 297

Ratios:

EPS (rs) P/E ratio Debt to Return on Dividend/

equity equity % share (rs)

mar’23 6.96 9.8 0.19 23.73 0.90

mar’22 5.83 17.2 0.65 25.17 1.26

You might also like

- Standard Data Book For Analysis of Rates - 1Document577 pagesStandard Data Book For Analysis of Rates - 1Pruthvi Teja87% (45)

- Method Statement For Roads WorksDocument39 pagesMethod Statement For Roads WorksAbdullahSharawiNo ratings yet

- KP-00+++-CQ712-B7907 - F01 - Rev.0 - MV Switchgear Installation Inspection Checklist1Document1 pageKP-00+++-CQ712-B7907 - F01 - Rev.0 - MV Switchgear Installation Inspection Checklist1Utku Can KılıçNo ratings yet

- Albany Union Station L&RP No. 12 Jan. - Feb. 1988Document14 pagesAlbany Union Station L&RP No. 12 Jan. - Feb. 1988staustell92100% (1)

- LKP Moldtek 01feb08Document2 pagesLKP Moldtek 01feb08nillchopraNo ratings yet

- Mindtree: Reference ModelDocument54 pagesMindtree: Reference ModelLiontiniNo ratings yet

- Happiest Minds TechnologiesLtd IPO NOTE07092020Document7 pagesHappiest Minds TechnologiesLtd IPO NOTE07092020subham mohantyNo ratings yet

- Repco Home Finance Ltd. (Repco) : Background Stock Performance DetailsDocument7 pagesRepco Home Finance Ltd. (Repco) : Background Stock Performance DetailstsrupenNo ratings yet

- Investment AnalysisDocument11 pagesInvestment AnalysisFendi SamsudinNo ratings yet

- Udayshivakumar Infra Limited: All You Need To Know AboutDocument8 pagesUdayshivakumar Infra Limited: All You Need To Know AboutShreyclassNo ratings yet

- Divgi TorqTransfer Systems IPO Note Axis Capital PDFDocument12 pagesDivgi TorqTransfer Systems IPO Note Axis Capital PDFKyle KonjeNo ratings yet

- Proteanegovtechnologieslimitedrhp Ibcomments v2 2023Document11 pagesProteanegovtechnologieslimitedrhp Ibcomments v2 2023mohit_999No ratings yet

- Company Analysis of Unitech LimitedDocument21 pagesCompany Analysis of Unitech LimitedashwiniabhaykordeNo ratings yet

- ICICI Securities Sees 34% UPSIDE in Info Edge Green Shoots VisibleDocument6 pagesICICI Securities Sees 34% UPSIDE in Info Edge Green Shoots Visiblemanitjainm21No ratings yet

- Elecon Annual-Report-2009-2010Document75 pagesElecon Annual-Report-2009-2010satishmatadeNo ratings yet

- Date: 19: Ameya Masurkar Company Secretary and Compliance OfficerDocument233 pagesDate: 19: Ameya Masurkar Company Secretary and Compliance OfficerAaron AllenNo ratings yet

- Fra - Project - Group No.1 - Sec BDocument105 pagesFra - Project - Group No.1 - Sec BAkshita PaulNo ratings yet

- CEAT Limited Neeraj Cia 3Document9 pagesCEAT Limited Neeraj Cia 3Neeraj BalamNo ratings yet

- FM CiaDocument20 pagesFM CiaN SUDEEP 2120283No ratings yet

- TTLDRDocument8 pagesTTLDRSam KoshyNo ratings yet

- Project Report: IT & IT Enabled UnitDocument34 pagesProject Report: IT & IT Enabled UnitRishabh BalaniNo ratings yet

- Denso India Ltd. (Denso) : Background Stock Performance DetailsDocument7 pagesDenso India Ltd. (Denso) : Background Stock Performance DetailsVibhor GoswamiNo ratings yet

- Submitted To Chitkara Business School in Partial Fulfilment of The Requirements For The Award of Degree of Master of Business AdministrationDocument8 pagesSubmitted To Chitkara Business School in Partial Fulfilment of The Requirements For The Award of Degree of Master of Business AdministrationVishu GuptaNo ratings yet

- Question No.1: (3 Marks)Document25 pagesQuestion No.1: (3 Marks)Sudha SinghNo ratings yet

- ICICI Securities CAMS Company UpdateDocument9 pagesICICI Securities CAMS Company UpdatebeatthemarketdotnetNo ratings yet

- Financial ManagementDocument13 pagesFinancial Managementruchi sharmaNo ratings yet

- Muthoot Finance LTD.: Business OverviewDocument5 pagesMuthoot Finance LTD.: Business OverviewAvinash ThakurNo ratings yet

- BartronicsDocument7 pagesBartronicsAshish RathoreNo ratings yet

- An Tks 2019 EDocument192 pagesAn Tks 2019 EEric PhanNo ratings yet

- Home First Finance Company India Limited: Issue HighlightsDocument16 pagesHome First Finance Company India Limited: Issue HighlightstempvjNo ratings yet

- TLKM - MNCS Retail Flashnote - 15052024Document2 pagesTLKM - MNCS Retail Flashnote - 15052024win fortuneNo ratings yet

- IREDADocument8 pagesIREDAGorilla GondaNo ratings yet

- BP Equities Keystone Realtors LTD IPO Note Subscribe 13th Nov 2022Document4 pagesBP Equities Keystone Realtors LTD IPO Note Subscribe 13th Nov 2022al.ramasamyNo ratings yet

- Happiest Minds Technologies Limited: Axis CapitalDocument13 pagesHappiest Minds Technologies Limited: Axis Capitalhthn gfufNo ratings yet

- TCS Financial ModelDocument47 pagesTCS Financial ModelPrince PriyadarshiNo ratings yet

- D&B Indonesia Sample BIR 2023Document26 pagesD&B Indonesia Sample BIR 2023hermislexanderNo ratings yet

- TCS Financial ModelDocument47 pagesTCS Financial ModelAnshul NemaNo ratings yet

- Shlok Gupta - 73808 - Acc ProjectDocument9 pagesShlok Gupta - 73808 - Acc ProjectShlok GuptaNo ratings yet

- Finlatics ProjectDocument4 pagesFinlatics ProjectSecret AgentNo ratings yet

- CDSL-Stock RessearchDocument13 pagesCDSL-Stock RessearchSarah AliceNo ratings yet

- NCC LTD Investment AnalysisDocument11 pagesNCC LTD Investment AnalysisSeetanNo ratings yet

- Abridged-Annual-Report-2018-19 Airtel PDFDocument156 pagesAbridged-Annual-Report-2018-19 Airtel PDFChandrasekar ChandruNo ratings yet

- FY2022InvPresFY2022InvPresL&T Q4FY22 Investor PresentationDocument59 pagesFY2022InvPresFY2022InvPresL&T Q4FY22 Investor PresentationS MD SAMEERNo ratings yet

- Electrotherm (India) : Profit & Loss Consolidated in Rs. CroresDocument4 pagesElectrotherm (India) : Profit & Loss Consolidated in Rs. CroresTanmay AgnaniNo ratings yet

- Annual Report 2020Document160 pagesAnnual Report 2020SOBANAA SUNDARNo ratings yet

- Kec International LTDDocument13 pagesKec International LTDlala vickyNo ratings yet

- Diwali Dhamaka 2020Document25 pagesDiwali Dhamaka 2020Prachi PatwariNo ratings yet

- Final Project For Marketing PuneetDocument21 pagesFinal Project For Marketing PuneetSankalp KayathNo ratings yet

- Investors Guide To Ril: By: Miss - Pallavi Akole Roll No: 02Document19 pagesInvestors Guide To Ril: By: Miss - Pallavi Akole Roll No: 02miteshpathNo ratings yet

- Kotak Bank Edel 220118Document19 pagesKotak Bank Edel 220118suprabhattNo ratings yet

- Top Glove Corp: Company ReportDocument3 pagesTop Glove Corp: Company ReportBrian StanleyNo ratings yet

- A Study On Ratio Analysis of J.K Cement Limited CompanyDocument7 pagesA Study On Ratio Analysis of J.K Cement Limited Companyparika khannaNo ratings yet

- Research Paper Study On Comparative Analysis Between Infosys and Tata Consultancy ServicesDocument5 pagesResearch Paper Study On Comparative Analysis Between Infosys and Tata Consultancy ServicesSaakshi TripathiNo ratings yet

- Aditya Birla Sun Life Amc Limited: All You Need To Know AboutDocument7 pagesAditya Birla Sun Life Amc Limited: All You Need To Know AboutSarfarazNo ratings yet

- Tata Technologies Equity Research ReportDocument14 pagesTata Technologies Equity Research ReportPuneet GirdharNo ratings yet

- IPO Diary January'2021Document19 pagesIPO Diary January'2021Rakshan ShahNo ratings yet

- CSB Bank LTD - IPO Note - Nov'19Document10 pagesCSB Bank LTD - IPO Note - Nov'19puchooNo ratings yet

- Ar21 22Document164 pagesAr21 22abdulraheem18822No ratings yet

- Saintgits Institute of Management: Financial Management I Project Phase IiiDocument3 pagesSaintgits Institute of Management: Financial Management I Project Phase IiiKAILAS S NATH MBA19-21No ratings yet

- JT Express - Highlights of Draft IPO Prospectus - MW - June - 2023 c8jnqgDocument18 pagesJT Express - Highlights of Draft IPO Prospectus - MW - June - 2023 c8jnqgfkyqn9kp75No ratings yet

- Sansera Engineering Limited ReportDocument8 pagesSansera Engineering Limited Reportarjun aNo ratings yet

- L&T Financial Health AssessmentDocument12 pagesL&T Financial Health AssessmentSudhir SalunkeNo ratings yet

- P LTD Case Share ValuationDocument2 pagesP LTD Case Share Valuationpurva SikriNo ratings yet

- Exam Text BYG406 May 2021Document6 pagesExam Text BYG406 May 2021Andrej SørensenNo ratings yet

- Welded Beam CalculationDocument2 pagesWelded Beam CalculationVeenoyNo ratings yet

- ASBI-Construction Practices Handbook For Concrete Segmental and Cable Supported BridgesDocument454 pagesASBI-Construction Practices Handbook For Concrete Segmental and Cable Supported BridgesGanesh PersaudNo ratings yet

- Substation - Project List: SR - No. Project Title Customer Consultant End Client Scope of WorkDocument7 pagesSubstation - Project List: SR - No. Project Title Customer Consultant End Client Scope of WorksunjeyNo ratings yet

- ALMA - Method Statement For STP Water ProofingDocument7 pagesALMA - Method Statement For STP Water ProofingsubhaschandraNo ratings yet

- Ghost L1 Moving House ExtractDocument2 pagesGhost L1 Moving House ExtractSteven JamesNo ratings yet

- Earthmoving and Heavy Construction: Soil Volume-Change CharacteristicsDocument11 pagesEarthmoving and Heavy Construction: Soil Volume-Change Characteristicstrishia arcillaNo ratings yet

- Oj MD Celex 32021D1813 en TXTDocument10 pagesOj MD Celex 32021D1813 en TXT최재호No ratings yet

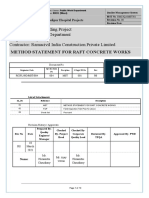

- MS For Raft Concrete Works (3 Files Merged)Document13 pagesMS For Raft Concrete Works (3 Files Merged)Himanshu KumarNo ratings yet

- Elevation A 1: Eave 610Document6 pagesElevation A 1: Eave 610Roy Bernard BasaNo ratings yet

- Hi Pon 90 08 Epoxy Ultra HB Ver 2.0 PDFDocument5 pagesHi Pon 90 08 Epoxy Ultra HB Ver 2.0 PDFPushpendraNo ratings yet

- Certificado Tuerca UnionDocument3 pagesCertificado Tuerca UnionCesarvervicNo ratings yet

- MS (Scaffolding)Document2 pagesMS (Scaffolding)Zubair Ahmed KhaskheliNo ratings yet

- Damp Proof WarrantyDocument11 pagesDamp Proof Warrantyiman.krisman2109No ratings yet

- Project Sand Repacement and Cement Replacement With Crusher DustDocument47 pagesProject Sand Repacement and Cement Replacement With Crusher DustAdusumalli Surendra BabuNo ratings yet

- Section 12 Bridge BearingsDocument38 pagesSection 12 Bridge BearingsComet AstroNo ratings yet

- Section 15155 - Sanitary & Drainage System (Exterior Works)Document2 pagesSection 15155 - Sanitary & Drainage System (Exterior Works)Kurt Darryl SabelloNo ratings yet

- CDOT Bridge Design Manual - Section - 11 - 2022Document50 pagesCDOT Bridge Design Manual - Section - 11 - 2022Liu ZhenguoNo ratings yet

- Lada Pulau Dayang Bunting G3 2023 (No 2)Document7 pagesLada Pulau Dayang Bunting G3 2023 (No 2)syariben mohdNo ratings yet

- 6.7X3 Weigh Bridge Civil Work B.O.MDocument16 pages6.7X3 Weigh Bridge Civil Work B.O.MArindam RoyNo ratings yet

- Od TK Fa LFT Top Steel Tower Rg.380-790: User ManualDocument21 pagesOd TK Fa LFT Top Steel Tower Rg.380-790: User ManualnguyenvantrucNo ratings yet

- 045 Tempest2009Document17 pages045 Tempest2009Manish ShashikantNo ratings yet

- Part AWC-CodesDocument33 pagesPart AWC-CodesBojan RoncevicNo ratings yet

- How To Write A Method StatementDocument15 pagesHow To Write A Method StatementA MakkiNo ratings yet

- Ark Samyak Brochure 12 (W) x11.5 (H) Inches RD14Document25 pagesArk Samyak Brochure 12 (W) x11.5 (H) Inches RD14keshavardhanreddy.kNo ratings yet

- Gravel and Sand SupplyDocument3 pagesGravel and Sand SupplyPhilip Dyaguit BaguhinNo ratings yet