Professional Documents

Culture Documents

DBS IDEAL Application Form-Oct2021

Uploaded by

zuoyefangaoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DBS IDEAL Application Form-Oct2021

Uploaded by

zuoyefangaoCopyright:

Available Formats

DBS IDEAL

APPLICATION PACK - REFERENCE (FOR CUSTOMER’S RETENTION)

Please read through thoroughly before submitting the form. We regret to inform you that incorrect applications may cause delays in processing.

Use this Application Form to sign up for DBS IDEAL if you:

Are an existing DBS Corporate Customer with no DBS IDEAL account

New IDEAL

Customer Wish to set up an authorisation policy for DBS IDEAL that differs from cheque signing mandate

Require user segregation between accounts (ie. some user can only access some accounts)

Existing IDEAL

Wish to upgrade your service package from Enquiry to Transaction

Customer

A SIGNUP PROCESS

1 2

• Decide IDEAL Services Mail the completed forms

Required and required documents to

• Complete the IDEAL

DBS Bank Ltd

Application Form and

Electronic Banking Board Channel Management

Newton Post Office PO

Resolution

Box 069 Singapore

912203

• Attach ID documents and

proof of residence

(Mandatory for Transaction OR submit to any DBS Branch

Authoriser* and

Customer Self Administrator*)

3 4

Receive acknowledgement Receive the Welcome

email that informs you Pack* upon successful

that your application is application (after 7

Inbox (1) business days)

being processed

* Welcome Pack includes:

Organisation ID, User ID,

and One Time Registration

Code

www.dbs.com/ideal

Please furnish us with the necessary documents to avoid any delay to setup your IDEAL access.

* For Singaporeans/PRs: Certified true copy of NRIC

For Foreigners: Certified true copy of either a) National ID with residential address, or b) passport and residential address proof (e.g. recent utility or phone bill,

bank statement or correspondence from a government agency)

Please submit the Electronic Banking Board Resolution (EBBR) when signing up for Loan or Customer Self Administration service. You may find it here.

B BENEFITS

Notes

DBS IDEAL Mobile • View Account Balances and Statements IDEAL Digital Token

• Approve transactions (for transaction authorisers only) will be used as the

• Create payments easily from your fingertips security token for

• Integrated with IDEAL digital token – you can perform 2-Factor Authentication authentications and

(2FA) via your registered smartphone for added convenience and ease of use authorisations.

IDEAL Mobile App IDEAL Mobile App

on the App Store on Google Play

DBS Bank Ltd Co. Reg. No: 196800306E . October 2021

DBS IDEAL

APPLICATION PACK - REFERENCE (FOR CUSTOMER’S RETENTION)

C SERVICE TYPES & USER ROLES

SERVICE TYPES

Enquiry Loan Enquiry

View account statements, trade transactions, remittance advices, subscribe to

View Loan accounts and Loan details.

alerts & trade notifications or enquire on Fixed Deposits.

Loan

Payment

Make payments locally & internationally via Bill Payment, DBS MAX, Send instructions on loan transactions including Loan Drawdown, Interest

Intra Company Transfer, Account Transfer, Bank Cheques, GIRO, MEPS, Rate Fixing, Loan Rollovers, Partial Repayment, Full Repayment, Enquire on

Fast Payments/Collections, Telegraphic Transfer or setup Direct Debit loan transaction details and history.

Authorisation. DealOnline (Foreign Exchange)

Payroll Convert your funds from one currency to another at competitive rates for

Make payroll transfers to multiple recipients on a regular basis Value Today, Value Tomorrow, Spot, Forward and Time Option

via GIRO Payroll. transactions for up to one year. Single Control Policy applies

(only single user is required to initiate and approve transactions).

Collection

Collect payments from customers via DBS MAX, GIRO collection. Other Specific Services

Specify other types of services not listed above (e.g. OCOE, EDS) or

Trade

selected products that the user requires (e.g. Telegraphic Transfers only).

Enquire on trade transaction details and history. Send new trade

applications including Documentary Credit, Documentary Collection, Security Token

Guarantees & Standby LC & Trade Loan; provide acceptance of Import • IDEAL Digital Token (Kindly ensure that your mobile device is not

Bills and settlement instructions. jailbroken or rooted)

• Physical Token (SGD$50.00 per token, at the point of registration)

USER ROLES

Transaction Maker Transaction Authoriser Contact Person

User who creates transactions. User who approves transactions. The bank will liaise directly with him/her on

matters relating to IDEAL sign up and services.

Customer Self Administrator

(at least 2 required)

Nominated Customer Self Administrator(s) will have the full power to administer and operate DBS IDEAL on behalf of the organisation, including:

• Add or remove a Transaction maker and • Requesting for a new Security Device

authoriser • Managing company profile in IDEAL

• Modify any user access to accounts and services • Manage company authorisation

• Suspending and re-activate a User’s IDEAL access policy

• Unlocking Security Device

IMPORTANT NOTES

Given the wide powers conferred on the appointed Customer Self Administrator(s), Customer Self Administrator(s) should be persons within the

organisation with sufficient executive power and authority to take on the role and the organisation is responsible for ensuring that it has appropriate and

adequate internal controls procedures and security measures in place to prevent any fraud, abuse or unauthorised acts/omissions by Customer Self

Administrators.

For security reasons, at least 2 Customer Self Administrators must be appointed and any action initiated by one Customer Self Administrator must be

approved by at least one other Customer Self Administrator. Hence,

a) Customer Self Administrator cannot act alone to add/modify any setup.

b) Dual control is always required for any actions performed. It is mandatory to provide a valid mobile number and submit a Certified True Copy

of identification document for all Customer Self Administrators together with this application.

Please submit the Electronic Banking Board Resolution (EBBR) when signing up for Loan or Customer Self Administration service. You may

find it here.

DBS Bank Ltd Co. Reg. No: 196800306E . October 2021

DBS IDEAL

APPLICATION PACK (FOR SUBMISSION TO BANK)

Please complete this form in BLOCK LETTERS.

*Mandatory Fields

1 COMPANY DETAILS

Company Name*

Company Registration No. (UEN)*

2 ACCOUNT(S) TO BE MANAGED UNDER IDEAL Tick where applicable

All DBS Accounts OR The Accounts Listed Below

3 AUTHORISE OWN TRANSACTIONS Tick where applicable

Note: For authorisers who are approving transactions that they created themselves and that require only one authoriser, transaction challenge will only be sent via

SMS to the registered mobile number.

All Transaction Authorisers can authorise own transactions (Single Control)

Risk Disclosure Statement

For all transactions made through DBS IDEAL, the system will have Dual Control in place such that no single person could create and

approve transactions that would result in fraudulent actions. Please note that Customer Self Administrators cannot act without a Dual

Control.

Dual Control

A procedure that involves two or more people to complete a transaction – one person to create a transaction and another of higher authority

to approve it in the system. This makes the system more secure as both persons would need to be in collusion to commit fraud.

Single Control

A procedure that needs only one person to complete a transaction, thus may incur higher risk compared with Dual Control.

Authorised signatories required

DBS Bank Ltd Co. Reg. No: 196800306E . October 2021

SIGN HERE SIGN HERE Page 1 of 7

DBS IDEAL

APPLICATION PACK (FOR SUBMISSION TO BANK)

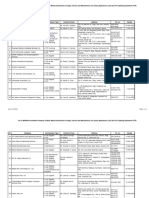

4 SERVICE(S) AND USER ROLE(S) Tick where applicable

Note: 2 Contact Persons must be provided.

*Mandatory Fields

As part of our enhanced security process, we require you to provide us with a valid mobile number & email address.

An invalid mobile number or email address may result in the inability to authenticate you and affect your login.

Your email address will be your login ID. Do not use address shared by multiple parties in your organization (e.g admin@company.com)

The 2FA mode will be the IDEAL digital token.

Name (as in NRIC/Passport)* NRIC/Passport No.* Name (as in NRIC/Passport)* NRIC/Passport No.*

Nationality* Date of Birth (DD/MM/YYYY)* Nationality* Date of Birth (DD/MM/YYYY)*

Preferred IDEAL User ID Mobile No.* Preferred IDEAL User ID Mobile No.*

(8-12 alphanumeric characters, ie. A-Z, 0-9) (8-12 alphanumeric characters, ie. A-Z, 0-9)

Email* Email*

Service(s) & Role(s) Service(s) & Role(s)

Please indicate authoriser Please indicate authoriser

Role(s) Transaction Transaction Role(s) Transaction Transaction

group for this user: group for this user:

Maker Authoriser (e.g. A, B, C, D, or E, if applicable Maker Authoriser (e.g. A, B, C, D, or E, if applicable

Service(s) to Authorisation Policy) Service(s) to Authorisation Policy)

Payment Payment

Payroll Payroll

Collection Collection

Trade Trade

Loan2,3 Loan2,3

Others Others

Enquiry Loan Enquiry Customer Self Administrator3 Enquiry Loan Enquiry Customer Self Administrator3

(at least 2 required) (at least 2 required)

Administrator(s) will have the ability to Administrator(s) will have the ability to

add or remove a Transaction maker and add or remove a Transaction maker and

DealOnline (Foreign Exchange)1 authoriser, modify any user access to authoriser, modify any user access to

accounts and services, unlock Security DealOnline (Foreign Exchange) 1

accounts and services, unlock Security

Device, manage company authorisation Device, manage company authorisation

policy, and more as listed in Section C - policy, and more as listed in Section C -

Service Types & User Roles. Service Types & User Roles.

Contact Person Contact Person

Additional Information Additional Information

Access to which Account(s)? Access to which Account(s)?

Note: If left blank, user will be given access to all accounts listed in Section 2 Note: If left blank, user will be given access to all accounts listed in Section 2

All Accounts from Section 2 OR The Accounts Listed Below All Accounts from Section 2 OR The Accounts Listed Below

1Separate control policy applies, refer to Reference Notes section C

2Authoriser groups are not available for Loan. Please fill section 7.

3 Please submit the Electronic Banking Board Resolution (EBBR) when signing up for Loan Authorised signatories required

or Customer Self Administration service. You may find it here.

DBS Bank Ltd Co. Reg. No: 196800306E . October 2021

SIGN HERE SIGN HERE Page 2 of 7

DBS IDEAL

APPLICATION PACK (FOR SUBMISSION TO BANK)

4 SERVICE(S) AND USER ROLE(S) Tick where applicable

Note: 2 Contact Persons must be provided.

*Mandatory Fields

As part of our enhanced security process, we require you to provide us with a valid mobile number & email address.

An invalid mobile number or email address may result in the inability to authenticate you and affect your login.

Your email address will be your login ID. Do not use address shared by multiple parties in your organization (e.g admin@company.com)

The 2FA mode will be the IDEAL digital token.

Name (as in NRIC/Passport)* NRIC/Passport No.* Name (as in NRIC/Passport)* NRIC/Passport No.*

Nationality* Date of Birth (DD/MM/YYYY)* Nationality* Date of Birth (DD/MM/YYYY)*

Preferred IDEAL User ID Mobile No.* Preferred IDEAL User ID Mobile No.*

(8-12 alphanumeric characters, ie. A-Z, 0-9) (8-12 alphanumeric characters, ie. A-Z, 0-9)

Email* Email*

Service(s) & Role(s) Service(s) & Role(s)

Please indicate authoriser Please indicate authoriser

Role(s) Transaction Transaction Role(s) Transaction Transaction

group for this user: group for this user:

Maker Authoriser (e.g. A, B, C, D, or E, if applicable Maker Authoriser (e.g. A, B, C, D, or E, if applicable

Service(s) to Authorisation Policy) Service(s) to Authorisation Policy)

Payment Payment

Payroll Payroll

Collection Collection

Trade Trade

Loan2,3 Loan2,3

Others Others

Enquiry Loan Enquiry Customer Self Administrator3 Enquiry Loan Enquiry Customer Self Administrator3

(at least 2 required) (at least 2 required)

Administrator(s) will have the ability to Administrator(s) will have the ability to

add or remove a Transaction maker and add or remove a Transaction maker and

DealOnline (Foreign Exchange) 1

authoriser, modify any user access to DealOnline (Foreign Exchange)1 authoriser, modify any user access to

accounts and services, unlock Security accounts and services, unlock Security

Device, manage company authorisation Device, manage company authorisation

policy, and more as listed in Section C - policy, and more as listed in Section C -

Service Types & User Roles. Contact Person Service Types & User Roles.

Contact Person

Additional Information Additional Information

Access to which Account(s)? Access to which Account(s)?

Note: If left blank, user will be given access to all accounts listed in Section 2 Note: If left blank, user will be given access to all accounts listed in Section 2

All Accounts from Section 2 OR The Accounts Listed Below All Accounts from Section 2 OR The Accounts Listed Below

1Separate control policy applies, refer to Reference Notes section C

2Authoriser groups are not available for Loan. Please fill section 7.

3 Please submit the Electronic Banking Board Resolution (EBBR) when signing up for Loan

or Customer Self Administration service. You may find it here. Authorised signatories required

DBS Bank Ltd Co. Reg. No: 196800306E . October 2021

SIGN HERE SIGN HERE Page 3 of 7

DBS IDEAL

APPLICATION PACK (FOR SUBMISSION TO BANK)

5 AUTHORISATION POLICY FOR CUSTOMER SELF ADMINISTRATION Tick where applicable

Please indicate the number of Customer Self Administrator(s) required to approve a set-up, administration and/or maintenance created

by a Customer Self Administrator.

If no option is given below, the default number of Customer Self Administrator(s) will be 1.

Any 1 Customer Self Administrator required to approve a request Any 2 Customer Self Administrators required to approve a request

Any 3 Customer Self Administrators required to approve a request Any 4 Customer Self Administrators required to approve a request

Any 5 Customer Self Administrators required to approve a request

Scenario of Customer Self Administrator creating a request

(with 3 Customer Self Administrator approvals)

Customer Customer Customer Customer

Self Administrator 1 Self Administrator 2 Self Administrator 3 Self Administrator 4

Creates a Request Approves Approves Approves Processed

You may have up to 5 Customer Self Administrator approvals required for a request.

6 AUTHORISATION POLICY Tick where applicable

From To Authorisation Requirement

No. of Authoriser required Required Combination of Authorised Signatories

Payment from S$0 to

0 50,000

L E

S$50,000 requires signatory Any 1 Authoriser Sequential

P

from Any 1 Authoriser. OR Authorisation

M

Any 2 Authorisers

Payment from S$50,000

to S$100,000 requires

1 signatory from Group A 50,000 100,000

EXA

No. of Authoriser required

Any 1 Authoriser

Required Combination of Authorised Signatories

Sequential

or 1 from Group B and OR 1A or 1B and 1C Authorisation

Any 2 Authorisers

1 from Group C.

Authorised signatories required

DBS Bank Ltd Co. Reg. No: 196800306E . October 2021

SIGN HERE SIGN HERE Page 4 of 7

DBS IDEAL

APPLICATION PACK (FOR SUBMISSION TO BANK)

6 AUTHORISATION POLICY - CONTINUED Tick where applicable

Note: If page is left blank or has missing information, the default setting of ‘All Debit Accounts’, ‘Payment currency in SGD’, ‘All Services’ and

‘Any 1 Authoriser for All Amounts’ will apply.

If ‘Payment currency in SGD’ is selected for this policy, it will apply to payments of any currency in its SGD equivalent.

If ‘Specific Payment Currency’ is selected for this policy, it will ONLY apply to payments in that said currency.

The total transaction value of the batch will be used to calculate the authorisation limit.

The upper limit of each level of authorisation policy will be the transaction limit for each transaction approved by the relevant

authoriser(s) per authorisation requirement(s) below and made from the applicable account.

1. ALL Debit Accounts OR Specific Debit Account

2. Payment currency in SGD OR Specific Payment Currency

3. All Services OR Payment Payroll Collection Trade Others

From To Authorisation Requirement

No. of Authoriser(s) required Required Combination of Authorised Signatories

0 Any 1 Authoriser

Any 2 Authorisers

OR

Sequential

Authorisation

No. of Authoriser(s) required Required Combination of Authorised Signatories

Any 1 Authoriser

Sequential

OR Authorisation

Any 2 Authorisers

No. of Authoriser(s) required Required Combination of Authorised Signatories

Any 1 Authoriser

Sequential

OR Authorisation

Any 2 Authorisers

No. of Authoriser(s) required Required Combination of Authorised Signatories

Any 1 Authoriser

Sequential

OR Authorisation

Any 2 Authorisers

No. of Authoriser(s) required Required Combination of Authorised Signatories

Any 1 Authoriser

Sequential

OR Authorisation

Any 2 Authorisers

Additional Information

Authorised signatories required

DBS Bank Ltd Co. Reg. No: 196800306E . October 2021

SIGN HERE SIGN HERE Page 5 of 7

DBS IDEAL

APPLICATION PACK (FOR SUBMISSION TO BANK)

7 LOAN AUTHORISATION POLICY Tick where applicable

This authorisation policy is for Loan only and would apply for the 5 main servicing transactions: Loan Drawdown, Interest Rate

Fixing, Loan Rollovers, Partial Repayment, Full Repayment. Any disbursements/repayments will be made to or from your DBS

loan servicing account and will be based on the number of authorisers you have selected below.

Any 1 Authoriser required to approve a request Any 2 Authorisers required to approve a request

Scenario of Loan Maker creating a request with 2 Authorisers' approval

Txn Maker Authoriser 1 Authoriser 2

Creates a Request Approves Approves Processed

You may have up to 2 Authorisers' approvals required for a request.

Authorised signatories required

DBS Bank Ltd Co. Reg. No: 196800306E . October 2021

SIGN HERE SIGN HERE Page 6 of 7

DBS IDEAL

APPLICATION PACK (FOR SUBMISSION TO BANK)

8 OTHER INSTRUCTIONS Tick where applicable

a. Parent/Subsidiary Companies Linkage

The relevant parent/subsidiary companies are required to submit a maintenance form to confirm linkage

Parent/Subsidiary Company Name Parent/Subsidiary Company Name

Parent Parent

Subsidiary Subsidiary

Company Registration No. (UEN) / IDEAL Organisation ID Company Registration No. (UEN) / IDEAL Organisation ID

b. File Transfer c. Other Specific Instructions

Access this service

File Transfer is a facility whereby you can generate a payment/payroll file

from your system into a DBS compatible format, to be uploaded directly in

IDEAL. It is recommended to send a test file to DBS for testing prior to

uploading actual payment/payroll file. You may send the test file to our DBS

BusinessCare at BusinessCareSG@dbs.com or contact us at 1800-222-2200

for any queries.

9 AGREEMENT, AUTHORISED SIGNATORIES AND STAMP

I/We hereby confirm that I/we have obtained copies of the DBS Electronic Banking Services Terms and Conditions ("EB Terms") and Fee Schedule, which I/we

have read, understood and accepted and I/we have also read and understood Section C of this form, including the Important Notes therein. In addition, I/we

acknowledge that there are other terms and conditions and agreement(s) intended or expressed to govern the use of other relevant banking products and

services offered by DBS Bank Ltd (the “Bank”) which may be used by me/us from time to time. By signing this application form, I/We hereby confirm that I/we

have read, understood and agree to be bound by the EB Terms (including the clause relating to the collection, processing, use and disclosure of personal

data) and such terms and conditions and agreement(s) intended or expressed to govern the use of other relevant banking products and services offered by

the Bank which may be used by me/us from time to time. In addition, the Bank may use and rely on any personal data to service providers, to communicate,

authenticate or otherwise deal with me/us and my/our office holders or employees in connection with the provision of banking products and services to me/

us. Copies of the Bank’s prevailing terms and conditions can be found at www.dbs.com.sg.

I/We also acknowledge that the Bank will be updating its records with the details provided in this form and/or in the Appendix (if applicable), which would

replace any existing details of any relevant persons (in their corporate capacities) which the Bank may have in its records.

I/We confirm that notwithstanding any other authorisation or instruction provided by the Organisation named in this form (“Organisation”) to the

Bank, the Bank is authorised to act on the authorisations or instructions provided in this form without further checks, even if the authorisations or

instructions may contradict any other instructions provided by the Organisation to the Bank. I/We also acknowledge that the Bank will be updating its

records with the details (including personal particulars) in this form and/or in the Appendix (if applicable), which would replace any existing details of me/us

which the Bank may have in its records.

Should any Customer Self Administrator cease to be employed by the Organisation, I/we undertake to inform the Bank and the Organisation will submit the

IDEAL Maintenance form to delete this Customer Self Administrator’s profile in IDEAL. I/We agree that the Organisation shall not hold the Bank liable for any

act or omission by an Customer Self Administrator who ceases to be employed by the Organisation for which the Bank is not informed.

For Partnerships, signatures of all partners are required. For companies, signatures of the authorised officers are required.

For Associations, Clubs & Societies, signatures of any two of existing/outgoing Chairman, Secretary or Treasurer are required.

I/We have read the Risk Disclosure Statement of Single Control in DBS IDEAL and where I/we authorise the Bank to proceed with Single Control setup in

DBS IDEAL, I/we fully understand and acknowledge the characteristics of Single Control and the risks with this authorisation, and agree to assume and be

responsible for all the risks associated with and losses arising out of or in connection with the application and use of Single Control in or through DBS IDEAL.

I/We undertake to keep the Bank fully indemnified from and against any loss, costs (including legal costs on a full indemnity basis), charges, damages,

claims, demands, actions, proceedings and all other liabilities of whatever nature and howsoever incurred or suffered by the Bank or which may

be brought or preferred against the Bank as a result of the Bank agreeing to act on our said authorisation. I/We also understand that the Bank may

terminate the provision of Single Control procedure by notice to us at any time.

Name: Name:

Date: Date:

Signature: Signature:

SIGN HERE SIGN HERE

DBS Bank Ltd Co. Reg. No: 196800306E . October 2021 Page 7 of 7

You might also like

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- 8 Legal Ethics Bar Questions and Answers (2007-2017)Document148 pages8 Legal Ethics Bar Questions and Answers (2007-2017)Angelica Fojas Rañola88% (26)

- R12 Advanced Global Intercompany System PresentationDocument67 pagesR12 Advanced Global Intercompany System Presentationmaumaju100% (2)

- The Journal of Historical Review - Volume 06Document542 pagesThe Journal of Historical Review - Volume 06Sam Sam100% (1)

- ERP - Withholding Tax OverviewDocument58 pagesERP - Withholding Tax Overviewrajesh gNo ratings yet

- SOP For Clients - 07022022 Final v1.9 - ADP TeamDocument17 pagesSOP For Clients - 07022022 Final v1.9 - ADP TeamPuvaneswary BalachandrenNo ratings yet

- Genting&PUC PartnerPresentationGuide ConvertDocument13 pagesGenting&PUC PartnerPresentationGuide ConvertsallyNo ratings yet

- Krishna Menon - DisarmamentDocument139 pagesKrishna Menon - DisarmamentEnuga S. Reddy100% (2)

- Backend Engineer at Revolut - Interview GuidelinesDocument16 pagesBackend Engineer at Revolut - Interview Guidelinesnucas0% (1)

- Statutory Cases Case Title: G.R. No. L-19650 (September 29, 1966)Document82 pagesStatutory Cases Case Title: G.R. No. L-19650 (September 29, 1966)Nong Mitra100% (6)

- Joint Arrangement UeueueuueDocument34 pagesJoint Arrangement UeueueuuechiNo ratings yet

- Sap IsuDocument36 pagesSap Isug.singh9634No ratings yet

- Executing The Digital StrategyDocument88 pagesExecuting The Digital Strategyabdesleme011577100% (2)

- Your Information: SIMPLE IRA Contribution Form Qualified Retirement Plan Loan Repayment Deposit SlipDocument1 pageYour Information: SIMPLE IRA Contribution Form Qualified Retirement Plan Loan Repayment Deposit SlipJitendra SharmaNo ratings yet

- Proposal CIMB Niaga For PERADIDocument14 pagesProposal CIMB Niaga For PERADIXq DesignNo ratings yet

- Enagic MY Registration Workflow - Ver3Document1 pageEnagic MY Registration Workflow - Ver3Aqwi AdhityaNo ratings yet

- Final Presentation - Group No 7Document19 pagesFinal Presentation - Group No 7Anmol ShuklaNo ratings yet

- Online Post Office Management SystemDocument20 pagesOnline Post Office Management SystemMamta SharmaNo ratings yet

- Trepend's Service LineDocument25 pagesTrepend's Service LineKavitha Manish JainNo ratings yet

- Company Profile: One Stop Solution For Industrial Tools and Office SupplyDocument4 pagesCompany Profile: One Stop Solution For Industrial Tools and Office SupplyERMIANUS SAMALEINo ratings yet

- ERP - What's New in Payables and Expenses 21CDocument23 pagesERP - What's New in Payables and Expenses 21CdavidjqNo ratings yet

- Ariba Standard Account Supplier Global Guide PDF DataDocument33 pagesAriba Standard Account Supplier Global Guide PDF DataPamela AngelaNo ratings yet

- Ease of Doing Business MoicsDocument2 pagesEase of Doing Business Moicsekadev adhikariNo ratings yet

- Performance AppraisalDocument22 pagesPerformance AppraisalJoel de MesaNo ratings yet

- Coca-Cola Beverages Philippines, Inc.: Project Tatak - GuideDocument46 pagesCoca-Cola Beverages Philippines, Inc.: Project Tatak - GuideEsnaida EsmaelNo ratings yet

- Edi SystemsDocument17 pagesEdi Systemstarek.sayd.23d983No ratings yet

- Natura InddustriesDocument15 pagesNatura InddustriesRahul ShuklaNo ratings yet

- 1.1 VSM Case StudyDocument4 pages1.1 VSM Case StudyericNo ratings yet

- 15.2 CJVImplementingReceivablesDocument66 pages15.2 CJVImplementingReceivablesJAN2909No ratings yet

- C02 Instr PPT Mowen4CeDocument73 pagesC02 Instr PPT Mowen4Cepiker.trance.0uNo ratings yet

- Ebiz Steps PDFDocument59 pagesEbiz Steps PDFBathina Srinivasa RaoNo ratings yet

- Soumyadeep Sengupta CVDocument2 pagesSoumyadeep Sengupta CVSoumyadeep SenguptaNo ratings yet

- EHS RFC 8000009498 Dunning by Email Estimate v.1.0Document9 pagesEHS RFC 8000009498 Dunning by Email Estimate v.1.0Govind kamtheNo ratings yet

- Tempelate Proposal X2 EnglishDocument5 pagesTempelate Proposal X2 EnglishPhitra SouvantanaNo ratings yet

- Komal Gaur: ProfileDocument2 pagesKomal Gaur: ProfileJaadi 786No ratings yet

- Customer Invoice To Receipt Flow ModelDocument1 pageCustomer Invoice To Receipt Flow ModelJavier ScribNo ratings yet

- Airtel Money Corporate Collections Solution ProposalDocument17 pagesAirtel Money Corporate Collections Solution Proposalotaala8171No ratings yet

- Fcubs Bills CollectionDocument100 pagesFcubs Bills CollectionNana Akua AseiduaNo ratings yet

- Accounting Process FlowDocument13 pagesAccounting Process FlowVENZON FERMINNo ratings yet

- Premier Integrator Requirements: Specialization Requirement Certified Role RequirementsDocument2 pagesPremier Integrator Requirements: Specialization Requirement Certified Role RequirementsSamir Ben Hassen0% (1)

- Team Singapore HDFC BankDocument14 pagesTeam Singapore HDFC BankRajeev KumarNo ratings yet

- Stages of Dtec Application - Jan 2019Document1 pageStages of Dtec Application - Jan 2019Sami AlasadNo ratings yet

- Progress Billing Data SheetDocument2 pagesProgress Billing Data Sheetss.harsha647No ratings yet

- Startup Current Account - Customer PresentationDocument8 pagesStartup Current Account - Customer PresentationalokNo ratings yet

- AEC - Tax Advisory and Training ProposalDocument4 pagesAEC - Tax Advisory and Training ProposalsefanitNo ratings yet

- 20D Subscription Management - Supremo - Amendments Flow - TrainingDocument85 pages20D Subscription Management - Supremo - Amendments Flow - Trainingrahul bansalNo ratings yet

- PDC Solution Functional DocumentDocument13 pagesPDC Solution Functional DocumentadnanykhanNo ratings yet

- User Manual ITProof SubmissionDocument9 pagesUser Manual ITProof SubmissionKumar GuduriNo ratings yet

- Citizen Charter: Registration and Incentives-Local IndustryDocument5 pagesCitizen Charter: Registration and Incentives-Local IndustryAnamul HasanNo ratings yet

- EBG Services - Beneficiary Workshop PresentationDocument35 pagesEBG Services - Beneficiary Workshop PresentationSabyasachi Naik (Zico)No ratings yet

- Inter-Organizational Commerce & Electronic Data Interchange (EDI)Document25 pagesInter-Organizational Commerce & Electronic Data Interchange (EDI)Asmit ShresthaNo ratings yet

- Company Profile Monotaroid 2019 v4 PDFDocument4 pagesCompany Profile Monotaroid 2019 v4 PDFdeskinielNo ratings yet

- In Priority Banking SoscDocument6 pagesIn Priority Banking Soscshekharsap284No ratings yet

- UBLFund 05 Jan 2022 012512 00079592-1Document1 pageUBLFund 05 Jan 2022 012512 00079592-1Sufia Mariyah ZamirNo ratings yet

- EdiDocument11 pagesEdiapi-3738703100% (3)

- APB Current Account - v2Document20 pagesAPB Current Account - v2Badsha SeikhNo ratings yet

- Central Public Works Department (CPWD) User Guide For E-Publishing Process For Auction Dated: 22 July 2022Document24 pagesCentral Public Works Department (CPWD) User Guide For E-Publishing Process For Auction Dated: 22 July 2022Abha CapsNo ratings yet

- Billing Services For Local and Access ServicesDocument5 pagesBilling Services For Local and Access Servicesgeorgebates1979No ratings yet

- Unit 3: Preliminary Billing Documents: Gain Experience With SAP S/4HANA - LogisticsDocument12 pagesUnit 3: Preliminary Billing Documents: Gain Experience With SAP S/4HANA - Logisticszulfiqar26No ratings yet

- An Analysis Pattern For Invoice ProcessingDocument13 pagesAn Analysis Pattern For Invoice ProcessingSushmaNo ratings yet

- Business Reg RequirementsDocument2 pagesBusiness Reg RequirementsCristine ChubiboNo ratings yet

- CORENET E-Submission System Training: DetailsDocument2 pagesCORENET E-Submission System Training: DetailsParthiban KarunanidhiNo ratings yet

- MetrobankDocument2 pagesMetrobankMeecy KimNo ratings yet

- Siebel Incentive Compensation Management ( ICM ) GuideFrom EverandSiebel Incentive Compensation Management ( ICM ) GuideNo ratings yet

- W2T - eBOOK - 30.03.2021 - Anglais Format Poche Version EssaiDocument71 pagesW2T - eBOOK - 30.03.2021 - Anglais Format Poche Version EssaizuoyefangaoNo ratings yet

- Attraction Guide Chongqing - enDocument2 pagesAttraction Guide Chongqing - enzuoyefangaoNo ratings yet

- Moscow, Russia Tour PresentationDocument22 pagesMoscow, Russia Tour PresentationzuoyefangaoNo ratings yet

- Walmart Key MessagesDocument8 pagesWalmart Key MessageszuoyefangaoNo ratings yet

- Andhra Pradesh Grama/Ward Sachivalayam Recruitment - 2020Document2 pagesAndhra Pradesh Grama/Ward Sachivalayam Recruitment - 2020vamsi karnaNo ratings yet

- GovernanceDocument33 pagesGovernanceAli HasanieNo ratings yet

- System EngineeringDocument11 pagesSystem EngineeringAzure MidoriyaNo ratings yet

- Abing Vs Waeyan, 497 SCRA 202, G.R. No. 146294, July 31, 2006Document2 pagesAbing Vs Waeyan, 497 SCRA 202, G.R. No. 146294, July 31, 2006Inday LibertyNo ratings yet

- Introduction To Income Tax-1Document20 pagesIntroduction To Income Tax-1Mehtab MalikNo ratings yet

- Accreditation Life Saving Appliances and Firefighting Equipment As of April 2023Document3 pagesAccreditation Life Saving Appliances and Firefighting Equipment As of April 2023eildrian22No ratings yet

- East Pakistan Provincial Elections in 1954 & The United FrontDocument16 pagesEast Pakistan Provincial Elections in 1954 & The United FrontTaef Hossain 1531416630No ratings yet

- NIS Compliance Guidelines For OESDocument68 pagesNIS Compliance Guidelines For OESAncutza RosuNo ratings yet

- Endgame Corner: Davies vs. Danish DynamiteDocument6 pagesEndgame Corner: Davies vs. Danish DynamitepiodasljkNo ratings yet

- 9-Riskiest Job in IraqDocument2 pages9-Riskiest Job in Iraqetimms5543No ratings yet

- Unit1 KCV PDFDocument110 pagesUnit1 KCV PDFsanjanaNo ratings yet

- Radiance RealtyDocument15 pagesRadiance RealtyRadiancerealtyNo ratings yet

- Singer v. NordstrongDocument12 pagesSinger v. NordstrongJustin TetreaultNo ratings yet

- ETHICS Means The Inner Guiding Moral PrinciplesDocument2 pagesETHICS Means The Inner Guiding Moral PrinciplesAkhil KhanNo ratings yet

- Complete List of Philippine PresidentsDocument81 pagesComplete List of Philippine PresidentsAl CuizonNo ratings yet

- An 7510Document15 pagesAn 7510MANOEL SAMPAIONo ratings yet

- Rem Juris Moot Court BrochureDocument9 pagesRem Juris Moot Court BrochureAkriti BhattNo ratings yet

- United States v. Figueroa-Rivera, 1st Cir. (2016)Document6 pagesUnited States v. Figueroa-Rivera, 1st Cir. (2016)Scribd Government DocsNo ratings yet

- 21Document7 pages21Jennifer AdvientoNo ratings yet

- SRWE Module 11Document48 pagesSRWE Module 11Frenchesca Darlene CaliwliwNo ratings yet

- People Vs Kalalom 559 Phil 715Document4 pagesPeople Vs Kalalom 559 Phil 715Anna Kristina Felichi ImportanteNo ratings yet

- Revision QuestionsDocument3 pagesRevision QuestionsKA Mufas100% (1)

- Shooting An ElephantDocument2 pagesShooting An ElephantShilpaDasNo ratings yet

- CFT Icao+na+proa+-+test+04Document9 pagesCFT Icao+na+proa+-+test+04Leandro Aquino dos SantosNo ratings yet

- University Malaysia Kelantan (UMK) : Course NameDocument18 pagesUniversity Malaysia Kelantan (UMK) : Course NameshobuzfeniNo ratings yet