Professional Documents

Culture Documents

LAMPIRAN

Uploaded by

Edo satria0 ratings0% found this document useful (0 votes)

2 views15 pagesLampiram Tugas Akhir

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLampiram Tugas Akhir

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views15 pagesLAMPIRAN

Uploaded by

Edo satriaLampiram Tugas Akhir

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 15

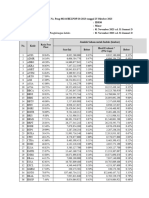

Lampiran 1.

Perhitungan Price to Book Value (PBV)

No. Book Value Price to Book Value

Tahun Ticker Code Market Price Total Equity Listed Shares

Data Per Share (PBV)

1 AGRO 525 3.111.284.877.000 17.912.537.958 174 3,02

2 ARTO 168 139.050.531.283 1.206.250.000 115 1,46

3 BABP 51 1.252.548.000.000 21.261.473.347 59 0,87

4 BACA 216 1.408.386.000.000 7.039.500.962 200 1,08

5 BANK belum listing 583.650.000.000 belum listing belum listing belum listing

6 2017 BBHI 113 440.333.456.571 4.015.000.000 110 1,03

7 BBKP 590 6.758.952.000.000 9.086.620.432 744 0,79

8 BBYB 400 676.191.287.257 4.699.158.088 144 2,78

9 BKSW 240 3.990.250.000.000 16.992.865.249 235 1,02

10 BTPN 2.460 17.200.797.000.000 5.840.287.257 2.945 0,84

11 NISP 1.875 21.784.354.000.000 11.472.648.486 1.899 0,99

12 AGRO 310 4.424.285.816.000 21.343.290.230 207 1,50

13 ARTO 184 115.559.450.886 1.206.250.000 96 1,92

14 BABP 50 1.429.990.000.000 21.785.053.618 66 0,76

15 BACA 300 1.484.963.000.000 7.070.128.427 210 1,43

16 BANK belum listing 530.263.000.000 belum listing belum listing belum listing

17 2018 BBHI 171 336.482.136.901 4.184.431.795 80 2,13

18 BBKP 272 8.594.437.000.000 11.651.908.748 738 0,37

19 BBYB 284 600.385.324.944 5.129.586.184 117 2,43

20 BKSW 182 4.672.060.000.000 20.436.685.984 229 0,80

21 BTPN 3.440 19.364.407.000.000 5.851.646.757 3.309 1,04

22 NISP 855 24.428.254.000.000 22.945.296.972 1.065 0,80

23 AGRO 198 4.481.704.219.000 21.343.290.230 210 0,94

24 ARTO 3.100 681.179.218.885 1.206.250.000 565 5,49

25 BABP 50 1.559.450.000.000 25.333.295.263 62 0,81

26 BACA 300 1.537.640.000.000 7.070.141.850 217 1,38

27 BANK belum listing 595.217.000.000 belum listing belum listing belum listing

28 2019 BBHI 125 299.765.877.648 4.184.431.795 72 1,74

29 BBKP 224 8.905.485.000.000 11.651.908.748 764 0,29

30 BBYB 284 945.783.595.296 6.161.782.101 153 1,85

31 BKSW 180 4.689.564.000.000 20.436.685.984 229 0,78

32 BTPN 3.250 31.471.928.000.000 8.148.928.869 3.862 0,84

33 NISP 845 27.664.803.000.000 22.945.296.972 1.206 0,70

34 AGRO 1.035 4.287.690.211.000 21.343.290.230 201 5,15

35 ARTO 4.300 1.232.333.000.000 10.747.687.500 115 37,50

36 BABP 50 1.551.237.000.000 25.333.296.313 61 0,82

37 BACA 376 1.640.391.000.000 7.070.141.850 232 1,62

38 BANK belum listing 641.274.000.000 belum listing belum listing belum listing

39 2020 BBHI 424 347.066.458.180 4.184.431.795 83 5,11

40 BBKP 575 8.466.442.000.000 32.673.251.194 259 2,22

41 BBYB 298 1.120.619.280.316 6.661.795.239 168 1,77

42 BKSW 106 4.112.442.000.000 20.436.685.984 201 0,53

43 BTPN 3.110 32.964.753.000.000 8.148.928.869 4.045 0,77

44 NISP 820 29.829.316.000.000 22.945.296.972 1.300 0,63

45 AGRO 1.810 2.457.663.179.000 22.520.054.593 109 16,59

46 ARTO 16.000 8.249.455.000.000 13.717.687.500 601 26,61

47 BABP 186 2.365.457.000.000 29.117.431.104 81 2,29

48 BACA 266 2.122.771.000.000 7.007.631.739 303 0,88

49 BANK 2.290 1.046.327.000.000 13.133.825.946 80 28,74

50 2021 BBHI 7.075 1.303.270.902.833 11.566.104.235 113 62,79

51 BBKP 270 13.205.904.000.000 67.019.885.160 197 1,37

52 BBYB 2.630 2.889.828.269.421 9.327.465.018 310 8,49

53 BKSW 192 4.026.548.000.000 20.232.319.124 199 0,96

54 BTPN 2.620 36.078.927.000.000 8.066.054.461 4.473 0,59

55 NISP 670 32.327.571.000.000 22.715.776.032 1.423 0,47

Lampiran 2.

Perhitungan Return On Asset (ROA)

No. Laba Bersih Total Asset Return On Asset

Tahun Ticker Code

Data (jutaan rupiah) (jutaan rupiah) (ROA)

1 AGRO 140.496 16.322.593 0,86%

2 ARTO -8.737 837.227 -1,04%

3 BABP -675.859 10.706.094 -6,31%

4 BACA 86.140 16.349.473 0,53%

5 BANK -9.785 1.275.648 -0,77%

6 2017 BBHI 10.362 2.458.824 0,42%

7 BBKP 135.901 106.442.999 0,13%

8 BBYB 14.420 5.004.795 0,29%

9 BKSW -789.803 24.635.233 -3,21%

10 BTPN 1.421.940 95.489.850 1,49%

11 NISP 2.175.824 153.773.957 1,41%

12 AGRO 204.213 23.313.671 0,88%

13 ARTO -23.288 664.673 -3,50%

14 BABP 57.021 10.854.855 0,53%

15 BACA 106.500 18.019.614 0,59%

16 BANK -64.720 661.912 -9,78%

17 2018 BBHI -123.143 2.264.173 -5,44%

18 BBKP 189.970 95.643.923 0,20%

19 BBYB -138.529 4.533.729 -3,06%

20 BKSW 14.568 20.486.926 0,07%

21 BTPN 2.257.884 101.919.301 2,22%

22 NISP 2.638.064 173.582.894 1,52%

23 AGRO 51.061 27.067.923 0,19%

24 ARTO -121.966 1.321.057 -9,23%

25 BABP 20.433 10.607.879 0,19%

26 BACA 15.964 18.959.622 0,08%

27 BANK 77.304 715.623 10,80%

28 2019 BBHI -36.550 2.527.173 -1,45%

29 BBKP 216.749 100.264.248 0,22%

30 BBYB 16.003 5.123.735 0,31%

31 BKSW 5.277 23.021.785 0,02%

32 BTPN 2.992.418 181.631.385 1,65%

33 NISP 2.939.243 180.706.987 1,63%

34 AGRO 31.261 28.015.492 0,11%

35 ARTO -189.567 2.179.873 -8,70%

36 BABP 10.414 11.652.904 0,09%

37 BACA 61.414 20.223.558 0,30%

38 BANK 44.868 721.397 6,22%

39 2020 BBHI 37.011 2.586.663 1,43%

40 BBKP -3.258.109 79.938.578 -4,08%

41 BBYB 15.872 5.421.324 0,29%

42 BKSW -422.168 18.297.700 -2,31%

43 BTPN 2.005.677 183.165.978 1,10%

44 NISP 2.101.671 206.297.200 1,02%

45 AGRO -3.045.701 16.866.523 -18,06%

46 ARTO 83.761 12.312.422 0,68%

47 BABP 12.868 14.015.360 0,09%

48 BACA 34.785 22.325.883 0,16%

49 BANK -121.275 2.173.162 -5,58%

50 2021 BBHI 192.475 4.649.357 4,14%

51 BBKP -2.302.279 89.215.674 -2,58%

52 BBYB -986.289 11.337.809 -8,70%

53 BKSW -1.578.777 17.701.527 -8,92%

54 BTPN 3.104.215 191.917.794 1,62%

55 NISP 2.519.619 214.395.608 1,18%

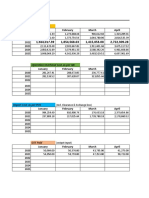

Lampiran 3.

Perhitungan Market Value of Book Value of Asset (MVBVA)

No.

Tahun Ticker Code Total Asset Total Equity Listed Shares Market Price MVBVA

Data

1 AGRO 16.322.593.372.000 3.111.284.877.000 17.912.537.958 525 1,39

2 ARTO 837.226.943.492 139.050.531.283 1.206.250.000 168 1,08

3 BABP 10.706.094.000.000 1.252.548.000.000 21.261.473.347 51 0,98

4 BACA 16.349.473.000.000 1.408.386.000.000 7.039.500.962 216 1,01

5 BANK 1.275.648.000.000 583.650.000.000 0 0 0,54

6 2017 BBHI 2.458.823.912.630 440.333.456.571 4.015.000.000 113 1,01

7 BBKP 106.442.999.000.000 6.758.952.000.000 9.086.620.432 590 0,99

8 BBYB 5.004.795.018.159 676.191.287.257 4.699.158.088 400 1,24

9 BKSW 24.635.233.000.000 3.990.250.000.000 16.992.865.249 240 1,00

10 BTPN 95.489.850.000.000 17.200.797.000.000 5.840.287.257 2.460 0,97

11 NISP 153.773.957.000.000 21.784.354.000.000 11.472.648.486 1.875 1,00

12 AGRO 23.313.671.252.000 4.424.285.816.000 21.343.290.230 310 1,09

13 ARTO 664.673.471.410 115.559.450.886 1.206.250.000 184 1,16

14 BABP 10.854.855.000.000 1.429.990.000.000 21.785.053.618 50 0,97

15 BACA 18.019.614.000.000 1.484.963.000.000 7.070.128.427 300 1,04

16 BANK 661.912.000.000 530.263.000.000 0 0 0,20

17 2018 BBHI 2.264.172.563.518 336.482.136.901 4.184.431.795 171 1,17

18 BBKP 95.643.923.000.000 8.594.437.000.000 11.651.908.748 272 0,94

19 BBYB 4.533.729.146.622 600.385.324.944 5.129.586.184 284 1,19

20 BKSW 20.486.926.000.000 4.672.060.000.000 20.436.685.984 182 0,95

21 BTPN 101.919.301.000.000 19.364.407.000.000 5.851.646.757 3.440 1,01

22 NISP 173.582.894.000.000 24.428.254.000.000 22.945.296.972 855 0,97

23 AGRO 27.067.922.912.000 4.481.704.219.000 21.343.290.230 198 0,99

24 ARTO 1.321.057.000.000 681.179.218.885 1.206.250.000 3.100 3,31

25 BABP 10.607.879.000.000 1.559.450.000.000 25.333.295.263 50 0,97

26 BACA 18.959.622.000.000 1.537.640.000.000 7.070.141.850 300 1,03

27 BANK 715.623.000.000 595.217.000.000 0 0 0,17

28 2019 BBHI 2.527.173.168.770 299.765.877.648 4.184.431.795 125 1,09

29 BBKP 100.264.248.000.000 8.905.485.000.000 11.651.908.748 224 0,94

30 BBYB 5.123.734.649.117 945.783.595.296 6.161.782.101 284 1,16

31 BKSW 23.021.785.000.000 4.689.564.000.000 20.436.685.984 180 0,96

32 BTPN 181.631.385.000.000 31.471.928.000.000 8.148.928.869 3.250 0,97

33 NISP 180.706.987.000.000 27.664.803.000.000 22.945.296.972 845 0,95

34 AGRO 28.015.492.262.000 4.287.690.211.000 21.343.290.230 1.035 1,64

35 ARTO 2.179.873.000.000 1.232.333.000.000 10.747.687.500 4.300 21,64

36 BABP 11.652.904.000.000 1.551.237.000.000 25.333.296.313 50 0,98

37 BACA 20.223.558.000.000 1.640.391.000.000 7.070.141.850 376 1,05

38 BANK 721.397.000.000 641.274.000.000 0 0 0,11

39 2020 BBHI 2.586.663.487.991 347.066.458.180 4.184.431.795 424 1,55

40 BBKP 79.938.578.000.000 8.466.442.000.000 32.673.251.194 575 1,13

41 BBYB 5.421.324.398.438 1.120.619.280.316 6.661.795.239 298 1,16

42 BKSW 18.297.700.000.000 4.112.442.000.000 20.436.685.984 106 0,89

43 BTPN 183.165.978.000.000 32.964.753.000.000 8.148.928.869 3.110 0,96

44 NISP 206.297.200.000.000 29.829.316.000.000 22.945.296.972 820 0,95

45 AGRO 16.866.522.655.000 2.457.663.179.000 22.520.054.593 1.810 3,27

46 ARTO 12.312.422.000.000 8.249.455.000.000 13.717.687.500 16.000 18,16

47 BABP 14.015.360.000.000 2.365.457.000.000 29.117.431.104 186 1,22

48 BACA 22.325.883.000.000 2.122.771.000.000 7.007.631.739 266 0,99

49 BANK 2.173.162.000.000 1.046.327.000.000 13.133.825.946 2.290 14,36

50 2021 BBHI 4.649.357.148.732 1.303.270.902.833 11.566.104.235 7.075 18,32

51 BBKP 89.215.674.000.000 13.205.904.000.000 67.019.885.160 270 1,05

52 BBYB 11.337.808.684.383 2.889.828.269.421 9.327.465.018 2.630 2,91

53 BKSW 17.701.527.000.000 4.026.548.000.000 20.232.319.124 192 0,99

54 BTPN 191.917.794.000.000 36.078.927.000.000 8.066.054.461 2.620 0,92

55 NISP 214.395.608.000.000 32.327.571.000.000 22.715.776.032 670 0,92

Lampiran 4.

Perhitungan Cummulative Abnormal Return (CAR)

Ticker Periode Harga Return Saham Return IHSG Cummulative Abnormal

IHSG

Code Pengamatan Saham (Ri,t) (Rm,t) Return (CAR)

H-5 372 5.905

H-4 352 5.683 -0,05376344 -0,03759526 -0,01616818

H-3 358 5.776 0,01704545 0,01636460 0,00068086

H-2 354 5.851 -0,01117318 0,01298476 -0,02415795

H-1 352 5.831 -0,00564972 -0,00341822 -0,00223150

AGRO

12-Sep-18 350 5.798 -0,00568182 -0,00565941 -0,00002241

HMETD 1

H+1 356 5.858 0,01714286 0,01034840 0,00679446

H+2 376 5.931 0,05617978 0,01246159 0,04371818

H+3 374 5.824 -0,00531915 -0,01804080 0,01272165

H+4 374 5.811 0,00000000 -0,00223214 0,00223214

H+5 376 5.873 0,00534759 0,01066942 -0,00532183

CAR HMETD 1 AGRO 0,01824543

H-5 2.080 6.691

H-4 2.100 6.651 0,00961538 -0,00597818 0,01559356

H-3 2.130 6.616 0,01428571 -0,00526237 0,01954808

H-2 2.240 6.651 0,05164319 0,00529021 0,04635299

H-1 2.240 6.675 0,00000000 0,00360848 -0,00360848

AGRO

18-Nov-21 2.260 6.636 0,00892857 -0,00584270 0,01477127

HMETD 2

H+1 2.150 6.720 -0,04867257 0,01265823 -0,06133079

H+2 2.100 6.723 -0,02325581 0,00044643 -0,02370224

H+3 2.030 6.677 -0,03333333 -0,00684218 -0,02649115

H+4 2.090 6.683 0,02955665 0,00089861 0,02865804

H+5 2.160 6.699 0,03349282 0,00239413 0,03109869

CAR HMETD 2 AGRO 0,04088997

H-5 2.870 3.989

H-4 3.580 3.937 0,24738676 -0,01303585 0,26042261

H-3 3.370 4.338 -0,05865922 0,10185420 -0,16051342

H-2 3.140 4.545 -0,06824926 0,04771784 -0,11596710

H-1 590 4.414 -0,81210191 -0,02882288 -0,78327903

ARTO

31-Mar-20 735 4.538 0,24576271 0,02809243 0,21767028

HMETD 1

H+1 915 4.466 0,24489796 -0,01586602 0,26076398

H+2 1.140 4.531 0,24590164 0,01455441 0,23134723

H+3 1.200 4.623 0,05263158 0,02030457 0,03232701

H+4 1.120 4.811 -0,06666667 0,04066623 -0,10733290

H+5 1.045 4.778 -0,06696429 -0,00685928 -0,06010500

CAR HMETD 1 ARTO -0,22466635

H-5 10.000 6.338

H-4 10.250 6.359 0,02500000 0,00331335 0,02168665

H-3 10.950 6.376 0,06829268 0,00267338 0,06561931

H-2 11.100 6.290 0,01369863 -0,01348808 0,02718671

H-1 9.500 6.258 -0,14414414 -0,00508744 -0,13905670

ARTO

08-Mar-21 9.700 6.248 0,02105263 -0,00159795 0,02265059

HMETD 2

H+1 10.225 6.199 0,05412371 -0,00784251 0,06196622

H+2 10.975 6.264 0,07334963 0,01048556 0,06286407

H+3 11.375 6.358 0,03644647 0,01500639 0,02144008

H+4 10.850 6.324 -0,04615385 -0,00534759 -0,04080625

H+5 10.100 6.309 -0,06912442 -0,00237192 -0,06675251

CAR HMETD 2 ARTO 0,03679817

Lampiran 4. Perhitungan Cummulative Abnormal Return (CAR) … lanjutan

Ticker Periode Harga Return Saham Return IHSG Cummulative Abnormal

IHSG

Code Pengamatan Saham (Ri,t) (Rm,t) Return (CAR)

H-5 57 6.014

H-4 55 6.088 -0,03508772 0,01230462 -0,04739234

H-3 55 6.069 0,00000000 -0,00312089 0,00312089

H-2 53 6.106 -0,03636364 0,00609656 -0,04246019

H-1 54 5.993 0,01886792 -0,01850639 0,03737431

BABP

20-Jun-18 53 5.884 -0,01851852 -0,01818789 -0,00033063

HMETD 1

H+1 53 5.822 0,00000000 -0,01053705 0,01053705

H+2 51 5.821 -0,03773585 -0,00017176 -0,03756409

H+3 52 5.859 0,01960784 0,00652809 0,01307976

H+4 52 5.825 0,00000000 -0,00580304 0,00580304

H+5 51 5.787 -0,01923077 -0,00652361 -0,01270716

CAR HMETD 1 BABP -0,07053937

H-5 50 6.026

H-4 50 6.023 0,00000000 -0,00049784 0,00049784

H-3 50 5.953 0,00000000 -0,01162212 0,01162212

H-2 50 6.011 0,00000000 0,00974299 -0,00974299

H-1 50 6.130 0,00000000 0,01979704 -0,01979704

BABP

03-Dec-19 50 6.133 0,00000000 0,00048940 -0,00048940

HMETD 2

H+1 50 6.112 0,00000000 -0,00342410 0,00342410

H+2 50 6.152 0,00000000 0,00654450 -0,00654450

H+3 50 6.186 0,00000000 0,00552666 -0,00552666

H+4 50 6.193 0,00000000 0,00113159 -0,00113159

H+5 50 6.183 0,00000000 -0,00161473 0,00161473

CAR HMETD 2 BABP -0,02607339

H-5 382 6.126

H-4 362 6.126 -0,05235602 0,00000000 -0,05235602

H-3 380 6.112 0,04972376 -0,00228534 0,05200910

H-2 354 6.026 -0,06842105 -0,01407068 -0,05435037

H-1 334 6.068 -0,05649718 0,00696980 -0,06346697

BABP

10-Sep-21 348 6.094 0,04191617 0,00428477 0,03763140

HMETD 3

H+1 352 6.088 0,01149425 -0,00098457 0,01247883

H+2 332 6.129 -0,05681818 0,00673456 -0,06355274

H+3 330 6.110 -0,00602410 -0,00310002 -0,00292408

H+4 330 6.109 0,00000000 -0,00016367 0,00016367

H+5 328 6.133 -0,00606061 0,00392863 -0,00998924

CAR HMETD 3 BABP -0,14435644

H-5 326 6.342

H-4 316 6.288 -0,03067485 -0,00851466 -0,02216018

H-3 326 6.417 0,03164557 0,02051527 0,01113030

H-2 338 6.416 0,03680982 -0,00015584 0,03696565

H-1 330 6.481 -0,02366864 0,01013092 -0,03379956

BACA

11-Oct-21 322 6.459 -0,02424242 -0,00339454 -0,02084789

HMETD 1

H+1 318 6.486 -0,01242236 0,00418021 -0,01660257

H+2 296 6.536 -0,06918239 0,00770891 -0,07689130

H+3 300 6.626 0,01351351 0,01376989 -0,00025638

H+4 312 6.633 0,04000000 0,00105644 0,03894356

H+5 328 6.658 0,05128205 0,00376903 0,04751302

CAR HMETD 1 BACA -0,03600535

Lampiran 4. Perhitungan Cummulative Abnormal Return (CAR) … lanjutan

Ticker Periode Harga Return Saham Return IHSG Cummulative Abnormal

IHSG

Code Pengamatan Saham (Ri,t) (Rm,t) Return (CAR)

H-5 2.620 6.636

H-4 2.570 6.720 -0,01908397 0,01265823 -0,03174220

H-3 2.740 6.723 0,06614786 0,00044643 0,06570143

H-2 2.670 6.677 -0,02554745 -0,00684218 -0,01870526

H-1 2.690 6.683 0,00749064 0,00089861 0,00659203

BANK

25-Nov-21 2.760 6.699 0,02602230 0,00239413 0,02362817

HMETD 1

H+1 2.630 6.561 -0,04710145 -0,02060009 -0,02650136

H+2 2.730 6.608 0,03802281 0,00716354 0,03085927

H+3 2.800 6.533 0,02564103 -0,01134988 0,03699090

H+4 2.610 6.507 -0,06785714 -0,00397979 -0,06387735

H+5 2.630 6.583 0,00766284 0,01167973 -0,00401689

CAR HMETD 1 BANK 0,01892875

H-5 165 5.934

H-4 163 6.001 -0,01212121 0,01129087 -0,02341208

H-3 164 6.088 0,00613497 0,01449758 -0,00836261

H-2 164 6.069 0,00000000 -0,00312089 0,00312089

H-1 168 6.106 0,02439024 0,00609656 0,01829369

BBHI

08-Jun-18 165 5.993 -0,01785714 -0,01850639 0,00064924

HMETD 1

H+1 160 5.884 -0,03030303 -0,01818789 -0,01211514

H+2 170 5.822 0,06250000 -0,01053705 0,07303705

H+3 174 5.821 0,02352941 -0,00017176 0,02370117

H+4 165 5.859 -0,05172414 0,00652809 -0,05825223

H+5 161 5.825 -0,02424242 -0,00580304 -0,01843939

CAR HMETD 1 BBHI -0,00177940

H-5 7.675 6.643

H-4 7.975 6.652 0,03908795 0,00135481 0,03773314

H-3 7.875 6.662 -0,01253918 0,00150331 -0,01404249

H-2 7.375 6.615 -0,06349206 -0,00705494 -0,05643713

H-1 6.950 6.626 -0,05762712 0,00166289 -0,05929001

BBHI

16-Dec-21 7.225 6.594 0,03956835 -0,00482946 0,04439781

HMETD 2

H+1 7.225 6.601 0,00000000 0,00106157 -0,00106157

H+2 6.850 6.547 -0,05190311 -0,00818058 -0,04372254

H+3 7.000 6.554 0,02189781 0,00106919 0,02082862

H+4 6.875 6.529 -0,01785714 -0,00381446 -0,01404268

H+5 6.675 6.555 -0,02909091 0,00398223 -0,03307314

CAR HMETD 2 BBHI -0,11870999

H-5 402 5.872

H-4 404 5.915 0,00497512 0,00732289 -0,00234776

H-3 406 5.931 0,00495050 0,00270499 0,00224551

H-2 408 5.933 0,00492611 0,00033721 0,00458890

H-1 404 5.946 -0,00980392 0,00219113 -0,01199506

BBKP

27-Jul-18 434 5.989 0,07425743 0,00723175 0,06702567

HMETD 1

H+1 440 6.027 0,01382488 0,00634497 0,00747992

H+2 424 5.936 -0,03636364 -0,01509872 -0,02126491

H+3 420 6.033 -0,00943396 0,01634097 -0,02577493

H+4 404 6.011 -0,03809524 -0,00364661 -0,03444863

H+5 400 6.007 -0,00990099 -0,00066545 -0,00923554

CAR HMETD 1 BBKP -0,02372684

Lampiran 4.

Perhitungan Cummulative Abnormal Return (CAR) … lanjutan

Ticker Periode Harga Return Saham Return IHSG Cummulative Abnormal

IHSG

Code Pengamatan Saham (Ri,t) (Rm,t) Return (CAR)

H-5 180 5.145

H-4 180 5.082 0,00000000 -0,01224490 0,01224490

H-3 185 5.116 0,02777778 0,00669028 0,02108750

H-2 179 5.097 -0,03243243 -0,00371384 -0,02871859

H-1 179 5.111 0,00000000 0,00274671 -0,00274671

BBKP

30-Jul-20 178 5.149 -0,00558659 0,00743494 -0,01302154

HMETD 2

H+1 171 5.006 -0,03932584 -0,02777238 -0,01155346

H+2 178 5.075 0,04093567 0,01378346 0,02715221

H+3 178 5.127 0,00000000 0,01024631 -0,01024631

H+4 182 5.178 0,02247191 0,00994734 0,01252457

H+5 193 5.143 0,06043956 -0,00675937 0,06719893

CAR HMETD 2 BBKP 0,07392150

H-5 310 6.699

H-4 314 6.561 0,01290323 -0,02060009 0,03350332

H-3 304 6.608 -0,03184713 0,00716354 -0,03901068

H-2 298 6.533 -0,01973684 -0,01134988 -0,00838696

H-1 286 6.507 -0,04026846 -0,00397979 -0,03628866

BBKP

02-Dec-21 296 6.583 0,03496503 0,01167973 0,02328531

HMETD 3

H+1 296 6.538 0,00000000 -0,00683579 0,00683579

H+2 304 6.547 0,02702703 0,00137657 0,02565046

H+3 300 6.602 -0,01315789 0,00840079 -0,02155869

H+4 298 6.603 -0,00666667 0,00015147 -0,00681814

H+5 312 6.643 0,04697987 0,00605785 0,04092201

CAR HMETD 3 BBKP 0,01813376

H-5 276 5.951

H-4 276 5.939 0,00000000 -0,00201647 0,00201647

H-3 274 6.032 -0,00724638 0,01565920 -0,02290558

H-2 274 6.057 0,00000000 0,00414456 -0,00414456

H-1 272 6.098 -0,00729927 0,00676903 -0,01406830

BBYB

28-May-19 272 6.033 0,00000000 -0,01065923 0,01065923

HMETD 1

H+1 272 6.104 0,00000000 0,01176861 -0,01176861

H+2 272 6.209 0,00000000 0,01720183 -0,01720183

H+3 278 6.289 0,02205882 0,01288452 0,00917430

H+4 276 6.305 -0,00719424 0,00254412 -0,00973837

H+5 270 6.276 -0,02173913 -0,00459952 -0,01713961

CAR HMETD 1 BBYB -0,07511685

H-5 230 4.925

H-4 248 4.942 0,07826087 0,00345178 0,07480909

H-3 252 4.918 0,01612903 -0,00485633 0,02098537

H-2 258 4.879 0,02380952 -0,00793005 0,03173958

H-1 244 4.964 -0,05426357 0,01742160 -0,07168517

BBYB

25-Jun-20 236 4.896 -0,03278689 -0,01369863 -0,01908826

HMETD 2

H+1 240 4.904 0,01694915 0,00163399 0,01531517

H+2 242 4.901 0,00833333 -0,00061175 0,00894508

H+3 238 4.905 -0,01652893 0,00081616 -0,01734509

H+4 244 4.914 0,02521008 0,00183486 0,02337522

H+5 256 4.966 0,04918033 0,01058201 0,03859832

CAR HMETD 2 BBYB 0,10564931

Lampiran 4.

Perhitungan Cummulative Abnormal Return (CAR) … lanjutan

Ticker Periode Harga Return Saham Return IHSG Cummulative Abnormal

IHSG

Code Pengamatan Saham (Ri,t) (Rm,t) Return (CAR)

H-5 442 6.043

H-4 426 6.050 -0,03619910 0,00115837 -0,03735746

H-3 420 5.999 -0,01408451 -0,00842975 -0,00565475

H-2 424 6.047 0,00952381 0,00800133 0,00152248

H-1 510 6.107 0,20283019 0,00992228 0,19290791

BBYB

11-Jun-21 476 6.095 -0,06666667 -0,00196496 -0,06470171

HMETD 3

H+1 458 6.080 -0,03781513 -0,00246103 -0,03535409

H+2 436 6.089 -0,04803493 0,00148026 -0,04951520

H+3 452 6.078 0,03669725 -0,00180654 0,03850378

H+4 440 6.068 -0,02654867 -0,00164528 -0,02490339

H+5 424 6.007 -0,03636364 -0,01005274 -0,02631090

CAR HMETD 3 BBYB -0,01086334

H-5 2.110 6.677

H-4 2.110 6.683 0,00000000 0,00089861 -0,00089861

H-3 2.220 6.699 0,05213270 0,00239413 0,04973857

H-2 2.170 6.561 -0,02252252 -0,02060009 -0,00192243

H-1 2.350 6.608 0,08294931 0,00716354 0,07578577

BBYB

30-Nov-21 2.280 6.533 -0,02978723 -0,01134988 -0,01843736

HMETD 4

H+1 2.310 6.507 0,01315789 -0,00397979 0,01713769

H+2 2.150 6.583 -0,06926407 0,01167973 -0,08094380

H+3 2.200 6.538 0,02325581 -0,00683579 0,03009160

H+4 2.750 6.547 0,25000000 0,00137657 0,24862343

H+5 2.700 6.602 -0,01818182 0,00840079 -0,02658261

CAR HMETD 4 BBYB 0,29259225

H-5 204 5.975

H-4 218 6.068 0,06862745 0,01556485 0,05306260

H-3 226 6.001 0,03669725 -0,01104153 0,04773878

H-2 228 5.983 0,00884956 -0,00299950 0,01184906

H-1 218 6.014 -0,04385965 0,00518135 -0,04904100

BKSW

05-Jun-18 220 6.088 0,00917431 0,01230462 -0,00313031

HMETD 1

H+1 220 6.069 0,00000000 -0,00312089 0,00312089

H+2 210 6.106 -0,04545455 0,00609656 -0,05155110

H+3 210 5.993 0,00000000 -0,01850639 0,01850639

H+4 216 5.884 0,02857143 -0,01818789 0,04675931

H+5 216 5.822 0,00000000 -0,01053705 0,01053705

CAR HMETD 1 BKSW 0,08785167

Lampiran 5.

Perhitungan Ukuran Perusahaan (Ln Total Asset)

No. Data Tahun Ticker Code Total Asset Ln (Total Asset)

1 AGRO 16.322.593.372.000 30,42

2 ARTO 837.226.943.492 27,45

3 BABP 10.706.094.000.000 30,00

4 BACA 16.349.473.000.000 30,43

5 BANK 1.275.648.000.000 27,87

6 2017 BBHI 2.458.823.912.630 28,53

7 BBKP 106.442.999.000.000 32,30

8 BBYB 5.004.795.018.159 29,24

9 BKSW 24.635.233.000.000 30,84

10 BTPN 95.489.850.000.000 32,19

11 NISP 153.773.957.000.000 32,67

12 AGRO 23.313.671.252.000 30,78

13 ARTO 664.673.471.410 27,22

14 BABP 10.854.855.000.000 30,02

15 BACA 18.019.614.000.000 30,52

16 BANK 661.912.000.000 27,22

17 2018 BBHI 2.264.172.563.518 28,45

18 BBKP 95.643.923.000.000 32,19

19 BBYB 4.533.729.146.622 29,14

20 BKSW 20.486.926.000.000 30,65

21 BTPN 101.919.301.000.000 32,26

22 NISP 173.582.894.000.000 32,79

23 AGRO 27.067.922.912.000 30,93

24 ARTO 1.321.057.000.000 27,91

25 BABP 10.607.879.000.000 29,99

26 BACA 18.959.622.000.000 30,57

27 BANK 715.623.000.000 27,30

28 2019 BBHI 2.527.173.168.770 28,56

29 BBKP 100.264.248.000.000 32,24

30 BBYB 5.123.734.649.117 29,26

31 BKSW 23.021.785.000.000 30,77

32 BTPN 181.631.385.000.000 32,83

33 NISP 180.706.987.000.000 32,83

34 AGRO 28.015.492.262.000 30,96

35 ARTO 2.179.873.000.000 28,41

36 BABP 11.652.904.000.000 30,09

37 BACA 20.223.558.000.000 30,64

38 BANK 721.397.000.000 27,30

39 2020 BBHI 2.586.663.487.991 28,58

40 BBKP 79.938.578.000.000 32,01

41 BBYB 5.421.324.398.438 29,32

42 BKSW 18.297.700.000.000 30,54

43 BTPN 183.165.978.000.000 32,84

44 NISP 206.297.200.000.000 32,96

45 AGRO 16.866.522.655.000 30,46

46 ARTO 12.312.422.000.000 30,14

47 BABP 14.015.360.000.000 30,27

48 BACA 22.325.883.000.000 30,74

49 BANK 2.173.162.000.000 28,41

50 2021 BBHI 4.649.357.148.732 29,17

51 BBKP 89.215.674.000.000 32,12

52 BBYB 11.337.808.684.383 30,06

53 BKSW 17.701.527.000.000 30,50

54 BTPN 191.917.794.000.000 32,89

55 NISP 214.395.608.000.000 33,00

Lampiran 6.

Sampel Laporan Keuangan Perusahaan Perbankan Digital

Lampiran 7.

Sampel Laporan Keuangan Perusahaan Perbankan Digital

Lampiran 8.

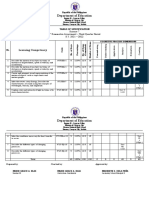

Hasil Pengujian Model EViews (Tahap 1)

Redundant Fixed Effects Tests

Equation: Untitled

Test cross-section fixed effects

Effects Test Statistic d.f. Prob.

Cross-section F 0.858397 (10,41) 0.5777

Cross-section Chi-square 10.455258 10 0.4015

Cross-section fixed effects test equation:

Dependent Variable: ROA

Method: Panel Least Squares

Date: 01/10/23 Time: 15:52

Sample: 2017 2021

Periods included: 5

Cross-sections included: 11

Total panel (balanced) observations: 55

Variable Coefficient Std. Error t-Statistic Prob.

C -0.168266 0.107745 -1.561713 0.1245

MVBVA 0.000155 6.74E-06 23.03869 0.0000

CAR -0.091765 0.117680 -0.779787 0.4391

SIZE 0.005149 0.003547 1.451987 0.1526

R-squared 0.924812 Mean dependent var 0.009649

Adjusted R-squared 0.920389 S.D. dependent var 0.158134

S.E. of regression 0.044618 Akaike info criterion -3.311404

Sum squared resid 0.101530 Schwarz criterion -3.165416

Log likelihood 95.06360 Hannan-Quinn criter. -3.254949

F-statistic 209.1002 Durbin-Watson stat 1.700268

Prob(F-statistic) 0.000000

Lampiran 9.

Hasil Uji Simultan EViews (Tahap 1)

Dependent Variable: ROA

Method: Panel Least Squares

Date: 01/10/23 Time: 16:18

Sample: 2017 2021

Periods included: 5

Cross-sections included: 11

Total panel (balanced) observations: 55

Variable Coefficient Std. Error t-Statistic Prob.

C -0.168266 0.107745 -1.561713 0.1245

MVBVA 0.000155 6.74E-06 23.03869 0.0000

CAR -0.091765 0.117680 -0.779787 0.4391

SIZE 0.005149 0.003547 1.451987 0.1526

R-squared 0.924812 Mean dependent var 0.009649

Adjusted R-squared 0.920389 S.D. dependent var 0.158134

S.E. of regression 0.044618 Akaike info criterion -3.311404

Sum squared resid 0.101530 Schwarz criterion -3.165416

Log likelihood 95.06360 Hannan-Quinn criter. -3.254949

F-statistic 209.1002 Durbin-Watson stat 1.700268

Prob(F-statistic) 0.000000

Lampiran 10.

Hasil Pengujian Model EViews (Tahap 2)

Redundant Fixed Effects Tests

Equation: Untitled

Test cross-section fixed effects

Effects Test Statistic d.f. Prob.

Cross-section F 3.640186 (10,40) 0.0016

Cross-section Chi-square 35.592014 10 0.0001

Cross-section fixed effects test equation:

Dependent Variable: PBV

Method: Panel Least Squares

Date: 01/10/23 Time: 16:16

Sample: 2017 2021

Periods included: 5

Cross-sections included: 11

Total panel (balanced) observations: 55

Variable Coefficient Std. Error t-Statistic Prob.

C 25.39166 23.99610 1.058158 0.2951

MVBVA 0.007212 0.004951 1.456524 0.1515

CAR -100.4186 25.75595 -3.898849 0.0003

SIZE -0.708298 0.787405 -0.899535 0.3727

ROA -50.42885 30.46607 -1.655246 0.1041

R-squared 0.284017 Mean dependent var 4.868402

Adjusted R-squared 0.226738 S.D. dependent var 11.03952

S.E. of regression 9.707635 Akaike info criterion 7.470210

Sum squared resid 4711.909 Schwarz criterion 7.652695

Log likelihood -200.4308 Hannan-Quinn criter. 7.540779

F-statistic 4.958506 Durbin-Watson stat 1.156922

Prob(F-statistic) 0.001910

Lampiran 11.

Hasil Uji Simultan EViews (Tahap 2)

Dependent Variable: PBV

Method: Panel Least Squares

Date: 01/10/23 Time: 16:22

Sample: 2017 2021

Periods included: 5

Cross-sections included: 11

Total panel (balanced) observations: 55

Variable Coefficient Std. Error t-Statistic Prob.

C -402.6368 80.19437 -5.020761 0.0000

MVBVA 0.018291 0.004934 3.707377 0.0006

CAR -101.3164 23.22599 -4.362199 0.0001

SIZE 13.41120 2.644380 5.071586 0.0000

ROA -43.04079 27.10368 -1.588005 0.1202

Effects Specification

Cross-section fixed (dummy variables)

R-squared 0.625149 Mean dependent var 4.868402

Adjusted R-squared 0.493951 S.D. dependent var 11.03952

S.E. of regression 7.853197 Akaike info criterion 7.186719

Sum squared resid 2466.908 Schwarz criterion 7.734174

Log likelihood -182.6348 Hannan-Quinn criter. 7.398424

F-statistic 4.764927 Durbin-Watson stat 1.487108

Prob(F-statistic) 0.000049

You might also like

- Thong Ke Giao Dich Tu DoanhDocument11 pagesThong Ke Giao Dich Tu DoanhĐức Anh NguyễnNo ratings yet

- Valuation StudyDocument68 pagesValuation Studykritcharin saoyaNo ratings yet

- Total ASSETS: BCA Bukopin BNI BRI Total Rata"Document1 pageTotal ASSETS: BCA Bukopin BNI BRI Total Rata"toekang printNo ratings yet

- Thong Ke Giao Dich Tu DoanhDocument10 pagesThong Ke Giao Dich Tu DoanhĐức Anh NguyễnNo ratings yet

- All Shares Index (08!08!17)Document6 pagesAll Shares Index (08!08!17)Marc AlamoNo ratings yet

- Zamboanga Peninsula Regional Development Investment Program 2017-2022Document544 pagesZamboanga Peninsula Regional Development Investment Program 2017-2022DONNAVEL ROSALESNo ratings yet

- Book128Document70 pagesBook128Welem IswanNo ratings yet

- Book 128Document54 pagesBook 128Welem IswanNo ratings yet

- Jute Cost 2020-21Document19 pagesJute Cost 2020-21Swastik MaheshwaryNo ratings yet

- 3 Lamp Peng-00244-BEI POP - IDX80 - Okt 2023 MinorDocument4 pages3 Lamp Peng-00244-BEI POP - IDX80 - Okt 2023 MinorkanayabilaaaNo ratings yet

- Non-Voting Depository ReceiptsDocument10 pagesNon-Voting Depository ReceiptsDestinNo ratings yet

- TemmetDocument2 pagesTemmetHalil AytaşNo ratings yet

- No Kode Saham Harga Saham Return Saham 2017 2018Document6 pagesNo Kode Saham Harga Saham Return Saham 2017 2018MahasidhiNo ratings yet

- Internally Generated Revenue at State Level: (2014) : October 2015Document3 pagesInternally Generated Revenue at State Level: (2014) : October 2015Kabir SinghNo ratings yet

- LC3 AnalysisDocument21 pagesLC3 AnalysistimothyNo ratings yet

- # Code Last Diff %CHG Prev ValueDocument2 pages# Code Last Diff %CHG Prev Valuechristologo manzano100% (1)

- Project Invest Last UpdateDocument10 pagesProject Invest Last Updateangel patrichiaNo ratings yet

- Top Sites CE CongestionDocument4 pagesTop Sites CE CongestionMark EmakhuNo ratings yet

- Additional InformationDocument1 pageAdditional InformationDaenarys VeranoNo ratings yet

- Conciliacion Bancaria AmbarDocument98 pagesConciliacion Bancaria AmbargerenciaservimosNo ratings yet

- 20220817-Room MarginDocument34 pages20220817-Room MarginBinh AnNo ratings yet

- Kelly Construction and Supply Co. 5% Withholding Tax Net Amount Gross AmountDocument5 pagesKelly Construction and Supply Co. 5% Withholding Tax Net Amount Gross AmountThelma PelaezNo ratings yet

- Kelly Construction and Supply Co. 5% Withholding Tax Net Amount Gross AmountDocument5 pagesKelly Construction and Supply Co. 5% Withholding Tax Net Amount Gross AmountJanaelaNo ratings yet

- DSPB Toko Kairatu (Tzs8) No Doc 2Document8 pagesDSPB Toko Kairatu (Tzs8) No Doc 2Mata JalanNo ratings yet

- No Kecamatan Anggaran Anggaran (Menu Kegiatan Sarpras)Document21 pagesNo Kecamatan Anggaran Anggaran (Menu Kegiatan Sarpras)Corla DapalaNo ratings yet

- Untitled 1Document2 pagesUntitled 1Oka ArtawanNo ratings yet

- Conciliacion Bancaria Sky BluDocument58 pagesConciliacion Bancaria Sky BlugerenciaservimosNo ratings yet

- ASJ Ponzi SchemeDocument2 pagesASJ Ponzi SchemeKim VisperasNo ratings yet

- 3 Lamp Peng-00133-BEI POP - JII70 - Mei 2023 MayorDocument5 pages3 Lamp Peng-00133-BEI POP - JII70 - Mei 2023 Mayorgendeludinasek100% (1)

- NO Kode Emiten HARGA SAHAM ROE (Bigger Better) DER (Less Better)Document17 pagesNO Kode Emiten HARGA SAHAM ROE (Bigger Better) DER (Less Better)Renggana Dimas Prayogi WiranataNo ratings yet

- File Excel TCDLDocument32 pagesFile Excel TCDLTrúc LinhNo ratings yet

- AccionesDocument4 pagesAccionesOlga María Flórez CastilloNo ratings yet

- 4 Lamp Peng-00244-Bei Pop - Kompas100 - Okt 2023 MinorDocument6 pages4 Lamp Peng-00244-Bei Pop - Kompas100 - Okt 2023 MinorkanayabilaaaNo ratings yet

- CalculationsDocument326 pagesCalculationsMaisamNo ratings yet

- B. Tabla SPDocument50 pagesB. Tabla SPKATTYA YAMILETH ENCISO QUISPENo ratings yet

- Agustus 2019Document94 pagesAgustus 2019jokoNo ratings yet

- Receipts Estimates and Spending CeilingDocument3 pagesReceipts Estimates and Spending CeilingrejieobsiomaNo ratings yet

- Portfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularDocument3 pagesPortfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularSumitNo ratings yet

- IGR Tables 2015 CompleteDocument4 pagesIGR Tables 2015 CompleteKabir SinghNo ratings yet

- Audit 1414Document3 pagesAudit 1414gocedelceva10No ratings yet

- P MamanDocument4 pagesP MamanDoody Joko SusiloNo ratings yet

- Nik FVA ResultsDocument18 pagesNik FVA ResultsSanjay PatelNo ratings yet

- Factores RETENCIONDocument11 pagesFactores RETENCIONasistentecontable2No ratings yet

- Client Query: Cumulative Insider Transactions CYTD19Document3 pagesClient Query: Cumulative Insider Transactions CYTD19qadir147No ratings yet

- BTST ScreenerDocument52 pagesBTST ScreenerAfiq SyahmiNo ratings yet

- Comportamiento Igbvc: Indice Valor Hoy Valor Ayer Variacion % Variacion Absoluta Variacion 12 Meses Variacion AÑODocument2 pagesComportamiento Igbvc: Indice Valor Hoy Valor Ayer Variacion % Variacion Absoluta Variacion 12 Meses Variacion AÑOAfiliaciones HuilaNo ratings yet

- 5 Year Challlenge Forex Trading: 20% Profit Per Month or 1% Per Day Versus Your Capital Initial CapitalDocument6 pages5 Year Challlenge Forex Trading: 20% Profit Per Month or 1% Per Day Versus Your Capital Initial CapitalMostNo ratings yet

- Assignment OF Sapm Submitted To, Submitted by Mr. Lovey Sir Name-Saurabh Arora Faculty of LIM Regd No - 10905517 Roll No - RT1903B40Document10 pagesAssignment OF Sapm Submitted To, Submitted by Mr. Lovey Sir Name-Saurabh Arora Faculty of LIM Regd No - 10905517 Roll No - RT1903B40Nipun BhardwajNo ratings yet

- Belajar Screening EmitenDocument33 pagesBelajar Screening EmitenMiftahul AriefNo ratings yet

- AnnuytasDocument4 pagesAnnuytasRandah rizki HazizahNo ratings yet

- MARKETING dINASDocument38 pagesMARKETING dINASAnwar ZeynNo ratings yet

- Punjab National Bank: Assets Summary: Mar 2009 - Mar 2018: Non-Annualised: Rs. MillionDocument4 pagesPunjab National Bank: Assets Summary: Mar 2009 - Mar 2018: Non-Annualised: Rs. MillionSaurabGhimireNo ratings yet

- Line 2 Passenger Ridership Report Eastbound Westbound CPL NgoDocument1 pageLine 2 Passenger Ridership Report Eastbound Westbound CPL NgoRalp GumilingNo ratings yet

- Pay RollDocument3 pagesPay RollValerie CorpuzNo ratings yet

- 2023 TargetDocument1,078 pages2023 TargetCris GapasNo ratings yet

- Founding Team: Sheet1Document6 pagesFounding Team: Sheet1aardg hytNo ratings yet

- 5X5Y - Business Plan: January February March AprilDocument7 pages5X5Y - Business Plan: January February March AprilZubairNo ratings yet

- My PortfolioDocument2 pagesMy PortfolioDinesh ShresthaNo ratings yet

- Nifty Mid Cap 50 - Google SheetsDocument3 pagesNifty Mid Cap 50 - Google SheetsrgautomobilesstockNo ratings yet

- Misel 2Document15 pagesMisel 2Undarma 1405No ratings yet

- Research Methodology and Biostatistics - Syllabus & Curriculum - M.D (Hom) - WBUHSDocument5 pagesResearch Methodology and Biostatistics - Syllabus & Curriculum - M.D (Hom) - WBUHSSumanta KamilaNo ratings yet

- Strategic Plan Executive SummaryDocument1 pageStrategic Plan Executive Summaryapi-532125110No ratings yet

- Proton-Halo Breakup DynamicsDocument7 pagesProton-Halo Breakup DynamicsBharat KashyapNo ratings yet

- Cars MasonryDocument1 pageCars MasonryAbdullah MundasNo ratings yet

- AaaaaDocument3 pagesAaaaaAnonymous C3BD7OdNo ratings yet

- SP Q4 Week 2 HandoutDocument10 pagesSP Q4 Week 2 HandoutLenard BelanoNo ratings yet

- Design of Deep Supported Excavations: Comparison Between Numerical and Empirical MethodsDocument7 pagesDesign of Deep Supported Excavations: Comparison Between Numerical and Empirical MethodsNajihaNo ratings yet

- Contact Inform 2002 OldDocument22 pagesContact Inform 2002 OldBelajar PurboNo ratings yet

- Filtergehà Use - Beutel Und - Kerzen - enDocument5 pagesFiltergehà Use - Beutel Und - Kerzen - ennabila OktavianiNo ratings yet

- Mathematics 9 DLPDocument10 pagesMathematics 9 DLPAljohaila GulamNo ratings yet

- AS Level Mathematics Statistics (New)Document49 pagesAS Level Mathematics Statistics (New)Alex GoldsmithNo ratings yet

- Participatory Irrigation ManagementDocument11 pagesParticipatory Irrigation ManagementSidNo ratings yet

- TanDocument8 pagesTanShourya RathodNo ratings yet

- Olimpiada de Limba Engleză - Liceu Etapa Locală - 15 Februarie 2020 Clasa A X-A, Secțiunea B Varianta 2Document4 pagesOlimpiada de Limba Engleză - Liceu Etapa Locală - 15 Februarie 2020 Clasa A X-A, Secțiunea B Varianta 2MidnightNo ratings yet

- EKJERP IPPF Document Eng v1.2 250819Document63 pagesEKJERP IPPF Document Eng v1.2 250819ahmad yaniNo ratings yet

- Final Exam For EappDocument2 pagesFinal Exam For EappReychel NecorNo ratings yet

- SM52 PDFDocument28 pagesSM52 PDFtaqigata75% (4)

- Ficha Tecnica: KN 95 (Non - Medical)Document13 pagesFicha Tecnica: KN 95 (Non - Medical)Luis Buitrón RamírezNo ratings yet

- OLET1139 - Essay - July 21 - InstructionDocument3 pagesOLET1139 - Essay - July 21 - InstructionPriscaNo ratings yet

- YR7 Revision Sheet - Working ScietificallyDocument6 pagesYR7 Revision Sheet - Working ScietificallyNisha zehra100% (1)

- Humanistic TheoryDocument28 pagesHumanistic TheoryNano KaNo ratings yet

- FNCPDocument3 pagesFNCPDarcey NicholeNo ratings yet

- Breathwork Fundamentals GuidebookDocument148 pagesBreathwork Fundamentals GuidebookJuliana RennerNo ratings yet

- Ministry of Health and Family Welfare Pregnancy GuidelinesDocument173 pagesMinistry of Health and Family Welfare Pregnancy GuidelinesKhushi GuptaNo ratings yet

- CulvertsDocument14 pagesCulvertsMatsobane LekalaksNo ratings yet

- Venkateshetal 2003Document56 pagesVenkateshetal 2003Gilang KemalNo ratings yet

- Grade Thresholds - November 2018: Cambridge International AS & A Level Mathematics (9709)Document3 pagesGrade Thresholds - November 2018: Cambridge International AS & A Level Mathematics (9709)redwanNo ratings yet

- Department of Education: Learning CompetencyDocument2 pagesDepartment of Education: Learning CompetencyShaira May Tangonan CaragNo ratings yet

- Classroom of The Elite Vol. 8Document244 pagesClassroom of The Elite Vol. 8Rahul Lakra85% (13)