Professional Documents

Culture Documents

June 2018

June 2018

Uploaded by

subham8555Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

June 2018

June 2018

Uploaded by

subham8555Copyright:

Available Formats

CAP I Paper 1: Fundamental of Accounting

CHARTERED ACCOUNTANCY PROFESSIONAL I

(CAP-I)

Suggested Answer

June 2018

The Institute of Chartered Accountants of Nepal

The Institute of Chartered Accountants of Nepal 1

Suggested Answer - June 2018

Paper 1: Fundamentals of Accounting

The Institute of Chartered Accountants of Nepal 2

CAP I Paper 1: Fundamental of Accounting

Roll No……………. Maximum Marks - 50

Total No. of Questions - 3 Total No. of Printed Pages -8

Time Allowed - 2 Hours

Marks

Attempt all questions. Working notes should form part of the answer.

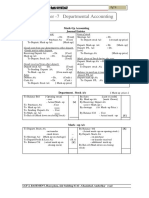

1. From the following Trial Balance and additional information, prepare the

Trading, Profit and Loss Account and Balance Sheet of Kathmandu

Suppliers as at Ashadh end, 2074: 15

Particulars Debit Amount Credit Amount

(Rs.) (Rs.)

Capital 5,000,000

Property, Plant and Equipment (at cost) 2,000,000

Accumulated Depreciation (opening balance) 700,000

Interest 120,000 70,000

Bank Balance 1,400,000

Cash on Hand 25,000

Sales 2,300,000

Purchases 1,800,000

Return Outward 200,000

Return Inward 150,000

Carriage Outward 15,000

Carriage Inward 25,000

Accrued Interest 75,000

Royalty 150,000

Sundry Debtors 1,500,000

Bad Debt 200,000

Account Payable 50,000

Creditors 51,000

Loan from Bank 1,200,000

Investment 1,325,000

Employee Loan 200,000

Retained Earning 95,000

Opening Stock 260,000

Discount 50,000 75,000

Salaries & Wages 156,000

Administrative Expenses 180,000

Selling and Distribution Expenses 280,000

Advance 15,000

Suspense Account 115,000

Total 9,891,000 9,891,000

Additional Information

1. Property, Plant and Equipment consist of the following assets:

Cost Accumulated Depreciation

a. Land purchased on

The Institute of Chartered Accountants of Nepal 3

Suggested Answer - June 2018

Bhadra 15, 2073 500,000

b. Plant & Machinery 900,000 500,000 (15% Depreciation rate)

c. Office Equipment 500,000 150,000 (25% Depreciation rate)

d. Furniture & Fixture 100,000 50,000 (20% Depreciation rate)

Company is applying WDV method to charge depreciation.

2. Company has a policy to provide 20% provision for doubtful debt on more than a

year aged debtors and 50% provision on more than two years aged debtors. Aging

report of the company shows the following:

a. Less than a year Rs. 1,100,000

b. More than a year Rs. 300,000

c. More than two years Rs. 100,000

3. Closing stock as on Ashadh end 2074 was Rs. 225,000 (market price Rs. 210,000).

4. Bad debt amount shown in Trial Balance is net of bad debt recovered amount of Rs.

120,000.

5. This year it is found that sales was overcast by Rs. 115,000 in previous year and

required adjustment need to reflect in current year.

6. Administrative expenses include Rs. 20,000 for the rent of Director’s residence.

7. Salary of Mr. Ram for Bhadra 2074 amounting Rs. 20,000 was unpaid in Bhadra

2074.

8. Salary and wages include wage amount Rs. 50,000.

You are required to prepare Trading and Profit and Loss Account for the year ended on

Ashadh end 2074 and Balance Sheet as on that date.

Answers:

Kathmandu Suppliers

Trading & Profit and Loss Account

For the year ended Ashadh end 2074

Dr. Cr.

Particulars Amount Particulars Amount

(Rs.) (Rs.)

To, Opening Stock 260,000 By, Sales 2,300,000

To, Purchase 1,800,000 Less: Return Inwards (150,000) 2,150,000

Less: Return (200,000) 1,600,000 By, Closing stock 210,000

Outwards (Note 1)

To, Wages 50,000

To, Carriage Inward 25,000

To, Gross Profit c/d 425,000

2,360,000 2,360,000

To, Carriage 15,000 By, Gross Profit b/d 425,000

Outward

To, Bad debt 320,000 By, Royalty 150,000

To, Discount 50,000 By, Bad debt recovered 120,000

To, Salaries & 106,000 By, Discount received 75,000

Wages

To, Administrative 160,000 By, Interest Income 70,000

expenses (Note 4)

To, Selling and 280,000 By, Net Loss 478,500

The Institute of Chartered Accountants of Nepal 4

CAP I Paper 1: Fundamental of Accounting

Distribution

expenses

To, Provision for 110,000

doubtful debt (Note

2)

To, Depreciation 157,500

(Note 3)

To, Interest 120,000

1,318,500 1,318,500

Kathmandu Suppliers

Balance Sheet

As on Ashadh end 2074

Capital & Liabilities Amount Assets Amount

(Rs.) (Rs.)

Share Capital 5,000,000 Property, Plant and Equipment

Less: Drawing (20,000) 4,980,000 Gross 2,000,000

Retained Earnings 95,000 Less: Accumulated dep. (857,500) 1,142,500

Less: Net Loss (478,500) Accrued Interest 75,000

Less: Adjustment (Note 5) (115,000) (498,500) Book Debtors 1,500,000

Account Payable 50,000 Less: Provision for

1,390,000

doubtful debt (110,000)

Loan from Bank 1,200,000 Investment 1,325,000

Creditor 51,000 Inventory (Note 1) 210,000

Employee Loan 200,000

Advance 15,000

Bank Balance 1,400,000

Cash on Hand 25,000

Total 5,782,500 Total 5,782,500

Working Notes

1. Closing stock is valued at cost or Net realizable value which ever is lower;

a. Cost amount of stock 225,000

b. Net realizable value 210,000

Hence closing stock as on Ashadh end 2074 is value at NPR 210,000

2. Calculation of provision for doubtful debt;

Aging Debtor Rate Provision for doubtful debt

Less than a year 1,100,000 0% -

More than a year 300,000 20% 60,000

More than two years 100,000 50% 50,000

Total Provisioning for doubtful debt 110,000

3. Calculation of depreciation

Assets Cost Accumulated Written Rate of Depreciation

Depreciation Down Value Depreciation for the year

Land 500,000

Plant & Machinery 900,000 500,000 400,000 15% 60,000

The Institute of Chartered Accountants of Nepal 5

Suggested Answer - June 2018

Office Equipment 500,000 150,000 350,000 25% 87,500

Furniture & Fixture 100,000 50,000 50,000 20% 10,000

Total 157,500

4. Administrative Expenses

Administrative expenses 180,000

Drawing (20,000)

Net amount 160,000

5. Overcast of sales by 115,000 which was treated as suspense account should be

adjusted through retained earnings of the company.

2.

a) Sita, Tara and Rita were partners sharing profits and losses at the ratio

of 2:2:1. Rita wants to retire on Ashadh 31, 2074. Following are the

information of the firm:

Balance Sheet as on Ashadh 31, 2074

Liabilities Amount Rs. Assets Amount Rs.

Partners’ Capital Property, Plant & Equipment 300,000

Sita 240,000 Bills Receivable 40,000

Tara 160,000 Stock 100,000

Rita 120,000 Sundry Debtors 100,000

Reserve 20,000 Bank Balance 100,000

Sundry Creditors 100,000

Total 640,000 Total 640,000

i) Sita and Tara agree to share profit and losses at the ratio of 3:2 in future.

ii) Value of goodwill is taken to be Rs. 100,000 but Sita and Tara do not want to

show goodwill in their books of accounts.

iii) Fixed assets are revalued upward by Rs. 60,000 and stock by Rs. 20,000. Bills

receivable dishonored Rs. 10,000 on 31.03.2074 but not recorded in the books.

Dishonor of bills was due to insolvency of the customer.

iv) Sita and Tara agree to bring sufficient cash to discharge claim of Rita and to

make their capital proportionate with maintaining bank balance of Rs. 150,000.

b) You are required to prepare the Balance Sheet as on Ashadh 31, 2074 after

retirement of Rita and Partners’ Capital Account. 10

c) Mr. Gupta of Birgunj purchased 1,000 meters of cloth for Rs. 200,000. Out of total

purchase he sends 500 meters of cloth on consignment to Mr. Prakash of Pokhara at

the selling price of Rs. 300 per meter. Mr. Gupta paid Rs. 5,000 for freight and Rs.

500 as loading expenses. Mr. Prakash sold 400 meters of cloth at Rs. 400 per meter.

Mr. Prakash incurred Rs. 2,000 as selling expenses. Mr. Prakash is entitled to a

commission of 5% on total sale proceeds plus a further 20% on any surplus price

realized over Rs. 300 per meter. Owing to fall in the market price, the stock of cloth

The Institute of Chartered Accountants of Nepal 6

CAP I Paper 1: Fundamental of Accounting

in hand is to be reduced by 10%. You are required to prepare Consignment Account

in the Books of the Mr. Gupta and Mr. Gupta’s Account in the books of Mr. Prakash. 10

Answers:

a)

Balance Sheet after Rita's Retirement as at 31st Ashadh, 2074

Amount

Capital & Liabilities Rs. Assets Amount Rs.

Partners' Capital Property, Plant & Equipment 360,000

Sita's 396,000 Stocks 120,000

Tara's 264,000 Sudry Debtors 100,000

Sundry Creditors 100,000 Bills Receivable 30,000

Bank Balance 150,000

Total 760,000 Total 760,000

Working Notes:

Calculation of New capital and its

proportion

Total Capital

Property, Plant Equipment (Rs. 300,000+Rs. 60,000) 360,000

Stock (Rs. 100,000+ Rs.

20,000) 120,000

Debtors 100,000

Bills Receivabe (Rs. 40,000- Rs. 10,000) 30,000

Bank Balance 150,000

760,000

Less:

Sundry Creditors' (100,000)

Total Capital 660,000

Sita Portion of Capital (3/5 of total capital) 396,000

Tara's Portion of Capital (2/5 of total

capital) 264,000

Revaluation Account

Dr. Cr.

Amount

Particulars Rs. Particulars Amount Rs.

To Bills Receivable A/C 10,000 By Property, Plant & Equipment A/C 60,000

To Partner's Capital A/C By Stock 20,000

Sita 28,000

Tara 28,000

Rita 14,000

Total 80,000 Total 80,000

The Institute of Chartered Accountants of Nepal 7

Suggested Answer - June 2018

Bank Account

Dr. Cr.

Amount

Particulars Rs. Particulars Amount Rs.

To Balance b/d 100,000 By Rita's Capital A/C 158,000

To Sita's Capital A/C 140,000 By Balance c/d 150,000

To Tara's Capital A/C 68,000

Total 308,000 Total 308,000

On Rita's retirement, she is entitled for the share of goodwill of the firm equivalent to Rs. 20,000 (Rs.

100,000X 1/5)

It has to be borne by Sita only because she has gained in the profit sharing ratio on Rita's retirement

Partners' Capital Account

Dr. Cr.

Particulars Sita Tara Rita Total Particulars Sita Tara Rita Total

To Rita's

Capital By Balance

A/C 20,000 - - 20,000 b/d 240,000 160,000 120,000 520,000

By Reserve

A/C 8,000 8,000 4,000 20,000

By

Revaluation

A/C 28,000 28,000 14,000 70,000

To

Balance By Sita's

c/d 256,000 196,000 158,000 610,000 Capital A/C - - 20,000 20,000

276,000 196,000 158,000 630,000 276,000 196,000 158,000 630,000

To Bank By Balance

A/C - - 158,000 158,000 b/d 256,000 196,000 158,000 610,000

To

Balance By Bank

c/d 396,000 264,000 - 660,000 A/C 140,000 68,000 - 208,000

Total 396,000 264,000 158,000 818,000 Total 396,000 264,000 158,000 818,000

b)

In the Books of Mr. Gupta

Consignment to Pokhara Account

Dr. Cr.

Amount Amount

Particulars Rs. Particulars Rs.

To Goods sent on

consignment A/C By Prakash's A/C (Sales) 160,000

The Institute of Chartered Accountants of Nepal 8

CAP I Paper 1: Fundamental of Accounting

(500x Rs. 300) 150,000 (400x Rs.400)

To Cash A/C By Goods sent on

(Expenses) 5,500 consignment A/C

To Prakash's A/C

(Expenses) 2,000 (500x Rs. 100) 50,000

To Prakash's A/C

(Commission Expenses) 16,000 By Consignment Stock

To Profit & Loss A/C

(Profit on Consignment

A/C) 55,490 (100x Rs. 200) 20,000

Add: Proportionate

Expenses 1,100

(5000+500=5500x100/500)

Less: 10% (Owing to Fall in

price) (2,110) 18,990

Total 228,990 Total 228,990

In the Books of Mr. Prakash

Mr. Gupta's A/C

Dr. Cr.

Particulars Amount Rs. Particulars Amount Rs.

To Cash A/C (selling

Expenses) 2,000 By Cash A/C (Sales) 160,000

To Commission A/C 16,000

To Balance c/d 142,000

Total 160,000 Total 160,000

3.

a) From the following information, prepare Bank Reconciliation

Statement of XYZ Pvt. Ltd. for the year ended Ashadh 31, 2074: 7

i) Bank statement of the company shows overdrawn balance of Rs.

12,000.

ii) A cheque of Rs. 1,560 in favor of Mr. Ram has been issued in

Ashadh 27, 2074 but only encashed at bank on Shrawan 5, 2074.

iii) A cheque of Rs. 1,500 issued and cleared on Ashadh 24, 2074 to NEA for electricity

charges has been entered as Rs. 1,800 by the company.

iv) Interest amount has been credited by the bank of Rs. 2,500 on Ashadh 31, 2074 but no

advice received by the company.

v) The company has issued standing order to pay telephone expenses of Rs. 1,000 to

Telecom on Ashadh 15 every month but bank has not made any payment yet.

vi) A party paid amount directly to the bank on Ashadh 25 of Rs. 2,000 but the company

has received advice of credit on Shrawan 3, 2074.

The Institute of Chartered Accountants of Nepal 9

Suggested Answer - June 2018

vii) Bank has deducted monthly installment of loan amounting Rs. 27,000 from the account

on Ashadh 27, 2074 and advice was received from the bank on Ashadh 28, 2074;

however, no transaction is recorded by the company.

viii) A Cheque was sent for collection Rs. 15,000 on Ashadh 27, 2074, which was

dishonored and return back by bank with advice on Ashadh 29, 2074 and new cheque

was given by the customer on Shrawan 1, 2074 which was cleared on Shrawan 2, 2074

by the bank.

ix) Bank has charged Rs. 200 as annual fee but advice of charge was received on Shrawan

3, 2074.

x) Dividend of Rs. 1,500 directly deposited into bank Account on Ashadh 14, 2074 and

the company only knows about it after obtaining bank statement on Shrawan 7, 2074.

b) Answer the followings: (4×2=8)

i) What is recouping of shortworkings?

ii) What are the consideration determining capital and revenue

transactions?

Answers:

a)

Bank Reconciliation Statement of XYZ Pvt. Ltd.

As at Ashadh end 2074

S.N. Particulars Amount (Rs.) Total Amount

(Rs.)

1 Balance as per Bank Statement (Overdrawn) -12,000

Adjustments

Add: Repayment of loan not recorded by the company 27,000

Add: Bank Charge deducted by bank but not recorded by 200

the company

Sub-total 27,200 27,200

Less: Cheque issued but not presented in bank 1,560

Less: Over charged payment of Electricity expenses 300

Less: Amount directly deposited into bank account but 2,000

not accounted by the company

Less: Payment not made by the bank 1,000

Less: Dividend deposited into bank but not recorded by 1,500

the company

Less: Interest income not recorded by the company 2,500

Sub-total 8,860 -8,860

2 Balance as per Bank Ledger 6,340

b)

i) In simple, recoupment means adjustments. Usually in the first few years of the royalty

agreement, the work does not gather the required momentum because of the time taken

in the preparation for starting the production or pushing up the sales, so shortworkings

arising in the first few years may not be due to inefficiency of the lessee. Keeping this

in view, royalty agreements may contain a clause that shortworkings (i.e. excess

amount paid in earlier years) are recoverable by the lessee in subsequent years when

royalties are in excess of the minimum rent. The right of getting back the excess

The Institute of Chartered Accountants of Nepal 10

CAP I Paper 1: Fundamental of Accounting

payment made by the lessee in earlier years is called the right of recoupment of

shortworkings. A time is usually set upon the number of years for which such

shortworkings can be recouped. This time limit for recoupment of shortworkings may

be fixed or fluctuating. If the shortworkings (partly of wholly) cannot be recouped

within the specified time, they lapse and are charged to profit and loss account in the

period when such specified time limit for recoupment expires. Therefore,

shortworkings are the losses of the lessee, no in the year of their occurrence, but in the

year, they lapse.

ii) The basic consideration in distinction between capital and revenue expenditure are;

Nature of business: For a trader dealing in furniture, purchase of furniture is revenue

expenditure but for any other trader, the purchase of furniture should be treated as

capital expenditure and shown in the statement of financial position as an asset.

Therefore, the nature of business is a very important criterion in separating expenditure

between capital and revenue.

Nature of expenditure: If the frequency of an expense is quite often in an accounting

year then it is said to be a revenue expenditure like; salary, rent etc. while non-recurring

expenditure is infrequent in nature and do not incur often in an accounting year like;

purchase of vehicle, computer etc.

Purpose of expenditure: Expense for repairs of machine may be incurred in course of

normal maintenance of the asset. Such expenses are revenue in nature. On the other

hand expenditure incurred for major repair of the asset so as to increase its productive

capacity is capital in nature.

Effect in revenue earning capacity: The expenses which help to generate revenue in the

current period are revenue in nature and should be matched against the revenue earned

in the current period. On the other hand, if expenditure helps to generate revenue over

more than one accounting period, it is generally called capital expenditure.

Materiality of the amount involved: Nepal Accounting Standard on presentation of

financial statements defines the term material. It states that omission or misstatements

of item are material if they could, individually or collectively; influence the economic

decisions of users taken on the basis of financial statements. Materiality depends on the

size and nature of the omission or misstatement judged in the surrounding

circumstances. The size or nature of the item or a combination of both could be the

determining factor. So the relative proportion of the amount involved is another

important consideration in distinction between revenue and capital transaction. Even if

expenditure does not increase the productive capacity of an asset, it may be capitalized

because the amount is material or expenditure may increase the asset value or yet to be

expensed because the amount is material in value.

The Institute of Chartered Accountants of Nepal 11

Suggested Answer - June 2018

Specific Comments on the performance of the students

Batch: - JUNE 2018

Level: - CAP-I (New)

Subject: Fundamental of Accounting

Question No. 1

Lack of Conceptual knowledge and preparation is poor. Many students failed to effect the all

transaction method in trading PL and balance sheet. Student has satisfactory performance on it but

most of students could not do the effect of prior year adjustment. Almost all students have attempted

this question. Majority of the candidate scored at least 50% mark. Majority of the candidate treated

the previous year sales overcast wrongly. Overall Performance is good but students are confused

with calculation of depreciation adjustment of prior period error & other assets items. Candidates

need to do more practice on segregation of items of profit & loss and balance sheet. Maximum

students does not proper knowledge of provision for bad debts & its treatment due to lack of

conceptual knowledge & also for treatment of suspense a/c. Students did not possess specific

knowledge in treating capital and revenue transaction. They have committed mistakes in calculating

depreciation and doubtful debts.

Question No. 2

No conceptual clarity and lack of practice. In part (a) the capital requires from remaining rather is not

largely calculated. Most of the students have correct it. Some students have not done working

properly which is very essential. Most of the student attempted both part a & b of the question while

consignment a/c was correctly presented. Most of the student confused in preparing Mr. Gupta’s A/C

in the books of Mr. Prakash and done opposite in partnership A/C. Most of the student did not

prepare bank A/C and did mistake in bank balance. Only few students were able to derive the correct

answer and most of the answers were not supported by clear working. Calculation of goodwill and

adjustment is major mistake from the candidate. Candidate need to improve in final posting of

partnership A/C. Improvement needed in calculation of closing stock & stock reserve. Does not read

the question regarding closing stock calculation. Most of the students failed in computing total

capital of the firm and partner’s proportionate capital. Most of the students committed mistakes in

computing closing stock in consignment and preparing consignor’s a/c. Many students have

confused in taking balance of passbook. Some confused overdraft as balance.

Question No. 3

Little preparation, lack of conceptual knowledge and did not understand the question properly. It is

generally good. Theory writing shall be improved. Most of the student attempted Bank reconciliation

as well as theoretical part. While majority of student scored at least 5 out of 7 in BRS, they were

failed to reach the correct account balance. Majority of student lack the conceptual part in explaining

recouping of short working & consideration determining capital & revenue transactions. Few students

have wrongly done the reconciliation of overdrawn balance. No clear concept of capital & revenue

expenditure were found in few cases. Bank reconciliation concept is clear among all students but

calculation of total balance is mistake due to overdraft has been wrongly post. Student does not need

properly specially part 3 b ii question. Some students even lack some English language.

The Institute of Chartered Accountants of Nepal 12

CAP I Paper 2: Mercantile Law and Fundamental of Economics

Paper 2:

Part A: Mercantile Law

Part B: Fundamentals of Economics

The Institute of Chartered Accountants of Nepal 13

Suggested Answer - June 2018

Part A: Mercantile Law

The Institute of Chartered Accountants of Nepal 14

CAP I Paper 2: Mercantile Law and Fundamental of Economics

Maximum Marks - 25

Total No. of Questions - 2 Total No. of Printed Pages -3

Time Allowed - 1 Hour

Marks

Attempt all questions.

1. Answer the following questions:

a) How accounts are settled at the time of dissolution of Partnership firm? 5

b) Mention the criteria for the registration of a firm as per Partnership

Act, 2020. 5

Answers:

a) Settlement of accounts shall be carried out in following manner and

order:

Debts of third party;

Debt of the partner as distinguished from capital on proportionately basis;

Capital of the Partner on proportionately basis;

Residue, if any, divided between partners in the proportion of profit sharing ratio.

Assets of the partnership firm shall not be divided between/among partners without

paying the debt obligation of third party despite the partnership agreement states any

matter.

b) Criteria of the Firm Registration

Firm to be registered to the concerned department within 6 months from the entering

into the partnership deed. Partnership which is not registered to the concerned

department shall not get legal validity.

To register a partnership firm, an application shall be made along with partnership

agreement and prescribed fees and the following documents:

Full Name of the Firm;

Registered address of the business;

Objectives of the firm including nature of goods/ services to be dealt;

Name, surname and address of partners;

Restrictions, if any on partners;

Types of partnership and capital subscribed by each partner;

Partners representing the firm;

Mode of settlement of profit /loss of among partners and mode to calculate profit;

Other matters, if any.

Firm registered under the Private Firm Registration Act, 2014 shall not be required to

register under partnership Act, 2020. However, certain documents may be asked by

concerned department.

Name of the firm shall not be:

Which resembles the already registered firm

The Institute of Chartered Accountants of Nepal 15

Suggested Answer - June 2018

Any limited company which has already registered under Companies Act.

Approval of Concerned department required to change the documents submitted along

with partnership deed

Documents submitted along with application, and

Partnership agreement

2. Answer the following questions:

a) State any five duties of Bailee in a contract of Bailment. 5

b) Differentiate between Contract of Indemnity and Contract of

Guarantee. 5

c) Who can perform the contract as per Contract Act, 2056? 5

Answers:

a)

a. Duty to take reasonable care.

b. Duty not to make any unauthorized use.

c. Duty not to mix or part with the goods.

d. Duty to return goods.

e. Duty to deliver increase or profit accrued from bailment.

b) The differences between Contract of Indemnity and Contract of

Guarantee are as follows:-

Contract of Indemnity Contract of Guarantee

It refers to a Contract by which one party

It refers to a Contract to perform the

promises to save the other from loss caused

promise or discharge the liability of a

by conduct of the promisor or another

third person in case of his default.

person.

In contract of guarantee, the primary

In contract of indemnity, the liability of the

liability is of principal debtor and the

promisor is primary.

liability of surety is secondary.

Contract between surety and principal

Contract between the indemnifier and the

debtor is implied and between creditor

indemnity holder is express and specific.

and principal debtor is express.

In contract of guarantee there are three

In contract of indemnity there are two parties

parties i.e. creditor, the principal debtor

indemnifier and the indemnity holder.

and surety.

In contract of guarantee there are three

In Contract of indemnity there is only one agreements i.e. agreement between the

agreement i.e. the agreement between creditor and principal debtor, the creditor

indemnifier and indemnity holder. and surety and surety and principal

debtor.

Contract of indemnity protects the promise Contract of guarantee is for the surety of

The Institute of Chartered Accountants of Nepal 16

CAP I Paper 2: Mercantile Law and Fundamental of Economics

from loss. the creditor.

In contract of guarantee, the surety does

In Contract if indemnity, the promisor

not require any relinquishment for filing

cannot file the suit against third person until

of suit. The surety gets the right to file

and unless the promisee relinquishes his

suit against the principal debtor as and

right in favour of the promisor.

when the surety pays the debt.

c) By whom contract may be performed:

The promise under a contract may be performed, as the circumstances may permit, by

the promisor himself, or by his agent or his legal representative.

a. Promisor himself: If there is something in the contract to show that it was the

intention of the parties that the promise should be performed by the promisor

himself, such promise must be performed by the promisor. This means contracts

which involve the exercise of personal skill or diligence, or which are founded on

personal confidence between the parties must be performed by the promisor

himself.

b. Agent: Where personal consideration is not the foundation of a contract, the

promisor or his representative may employ a competent person to perform it.

c. Representatives: A contract which involves the use of personal skill or is founded

on personal consideration comes to an end on the death of the promisor. As

regards any other contract the legal representatives of the deceased promisor are

bound to perform it unless a contrary intention appears from the contract. (But

their liability under a contract is limited to the value of the property they inherit

from the deceased).

d. Third persons: When a promisee accepts performance of the promise from a third

person, he cannot afterwards enforce it against the promisor. That is, performance

by a stranger, accepted by the promisee, produces the result of discharging the

promisor, although the latter has neither authorized not ratified the act of the third

party.

e. Joint promisors: When two or more persons have made a joint promise, then

unless a contrary intention appears from the contract, all such persons must jointly

fulfill the promise. If any of them dies, his legal representatives must, jointly with

the surviving promisors, fulfill the promise. If all of them die, the legal

representatives of all of them must fulfill the promise jointly.

The Institute of Chartered Accountants of Nepal 17

Suggested Answer - June 2018

Part B: Fundamentals of Economics

The Institute of Chartered Accountants of Nepal 18

CAP I Paper 2: Mercantile Law and Fundamental of Economics

Maximum Marks - 25

Total No. of Questions - 2 Total No. of Printed Pages -6

Time Allowed –1 Hour

Marks

Attempt all questions.

1. Long Answer Questions:

a) Define monopolistic competition. Explain how price and output are

determined under it in the short-run with suitable diagrammatic

illustration. (1+4=5)

b) Explain the major problems of agriculture sector development in Nepal. 5

Answers:

a) Monopolistic competition is a blend of monopoly and perfect competition. It is a

market structure characterized by large number of sellers (firms) selling differentiated

products which are close substitutes to each other, and there is free entry and exit of

firms.

The price and output determination under monopolistic competition in the short run

can be presented below:

In the short run equilibrium, there arises three cases:

a. Abnormal profit (AR > AC)

b. Normal profit (AR = AC)

c. Losses (AR < AC)

The fact that a firm is in (short–run) equilibrium does not necessarily mean that it

makes abnormal (excess) profits. Whether a firm makes abnormal profit or losses

depends on the level of AC in the short-run equilibrium. Thus, it is important to

analyze the above mentioned 3 cases as per the level of AC.

Graphical Analysis

The Institute of Chartered Accountants of Nepal 19

Suggested Answer - June 2018

C,R,P C,R,P C,R,P

MC MC

AC

AC

B

MC C

Pe A

A

A Pe

Pe AC

B e

C e

e

AR (=D) AR (=D)

AR (=D)

MR MR MR

O Qe Output O Qe Output O Qe Output

Abnormal Profit Loss Normal Profit

(AR>AC) (AR<AC) (AR=AC)

1.

In the given figures, we have drawn downward sloping AR (=D) and MR curves. At

e, the firm is in equilibrium as the two conditions for equilibrium are met. In case of

abnormal profits, Average Cost (AC) curve lies below AR curve at A so that AR >

AC, and the shaded region PeABC is abnormal profit enjoyed by the firm which is

shown by the first figure. In case of losses, AC curve lies above the AR curve at A so

that AR < AC, and the shaded region PeABC is the loss faced by the firm shown by

the second figure. In case of normal profit, average cost curve (AC) is tangent to AR

curve at A so that AR = AC. It is shown by the third figure. Thus we can conclude

that it is the level of AC that forces a firm to bear losses or enjoy abnormal profit or

just stay with normal profits at equilibrium. In this way, a firm is in equilibrium with

price Pe and output Qe as shown by the figures.

b) Agriculture sector is the dominant sector of Nepal since it contributes the majority of

the gross domestic product of the economy. Even though, more than 60 percent of the

population of Nepal are involved in agricultural sector but the contribution of this

sector in national income is not satisfactory because agriculture sector of Nepal is

facing many problems.

The main problems of Nepalese agriculture sector can be explained as following:

1. lack of industrial farming:

Nepalese agricultural system is following subsistence farming system. Farmers

produce crops for their self-consumption rather than sale and generate income.

Due to which they are producing all those commodities whether their productivity

is satisfactory or not.

2. lack of agriculture research:

It is one of the main problems of Nepalese agriculture sector. Due to lack of

research on agricultural productivity and fitness, the productivity of the

agricultural is very low. The farmers don’t know about the product which is best

fit in their soil and environment.

3. lack of technical education:

The Institute of Chartered Accountants of Nepal 20

CAP I Paper 2: Mercantile Law and Fundamental of Economics

Even though Nepal is called as agro-based economy, but the technical education

agriculture sector is not supporting it. The farmers have no knowledge about the

modern technologies and process of farming.

4. lack of appropriate policy:

Since, government of Nepal had adopted agriculture policy to support and develop

agricultural sector, but the policy itself is not being able to produce the result as

desired. It is because the policy is not consistent with the current features,

problems and their measures to solve those problems.

5. Lack of agricultural subsidy:

Lack of agricultural finance is one of the major hurdles of Nepalese agriculture

sector. Most of the Nepalese farmers are poor, they can’t invest money in

fertilizers and modern agricultural equipment. Therefore the government should

provide subsidy to the farmers in such activities.

If those problems of Nepalese agriculture sector are solved, it surely increases the

productivity of the sector which in turn increases the contribution in the national

income and employment generation in the economy along with increases in export of

agricultural goods.

2. Short Answer Questions (Any Five):

a) Explain the concept of short run and long run production functions. 3

b) Define average and marginal costs. Illustrate their relationship. 3

c) What is supply? Explain the extension in supply with the help of

appropriate example. (1+2=3)

d) Microeconomics concerns about the optimum allocation of resources

rather than full employment and growth of resources. Justify the statement

with proper example. 3

e) Define BOP. Explain any four items of current account of BOP 3

f) "Utility derived from consumption of additional unit of a commodity

diminishes at every additional unit of consumption of the commodity."

Elaborate by using numerical table. 3

Answers:

a) There are generally two types of production function: Short-run and Long-run

production functions.

i. Short-run Production Function

A production function in which some factors are fixed and some factors are variable

is known as short-run production function. A short-run production function can be

expressed as:

—

Q = f( K , L)

Where,

The Institute of Chartered Accountants of Nepal 21

Suggested Answer - June 2018

—

K = Fixed factor capital

L = Variable factor labour

The ‘Law of variable proportions' deals with the nature of short-run production

function.

ii. Long-run Production Function

Long run production function implies a production function with all factors variable,

i.e.

Q = f(K, L)

Where,

K and L both are variable inputs

The ‘Law of returns to scale' deals with the nature of long-run production function.

The distinction between short-run and long-run production functions is related to the

capacity of the firm to change inputs. It is not related to the calendar date.

b) Average Cost (AC) is defined as the total cost divided by level of output,

i.e.,

TC

AC = Q

Marginal cost (MC) is defined as the change in TC due to change in level of output,

i.e.

TC

MC =

Q

We can present both AC and MC in the following figure.

AC, MC

MC AC

a

Minimum

point of AC

b

O Q

With the help of the figure above, we can derive the following relationships between

AC and MC:

a. Both AC and MC are derived from same sources Total Cost (TC) and level of

output (Q) with the difference that MC needs change in TC and Q.

b. Both are U-shaped due to law of variable proportions.

The Institute of Chartered Accountants of Nepal 22

CAP I Paper 2: Mercantile Law and Fundamental of Economics

c. When AC falls, MC also falls but rapidly. Thus to the left of minimum point of

AC, AC > MC.

d. When AC increases, MC also increases but rapidly. To the right of minimum

point of AC, AC < MC.

e. MC always cuts AC at its minimum point. At minimum point of AC i.e. at a, AC

= MC.

c) Supply can be defined as the quantity of a commodity which the seller is ready to sell

and buyer are also ready to purchase at given price and given period of time. In fact,

supply is a part of stock with given price and time. As we know, there exists direct

relationship between price and quantity supplied of a commodity. It means when

price of the commodity increases, quantity supplied of the commodity also increases.

Due to which, suppliers equilibrium point will move upwards within the same supply

curve. It is called as extension in supply. It can be explained with the help of

following example.

Let us suppose the price of apple, initially the price of apple was Rs. 150 per Kg. at

which the supply was 5 Kg which is described by point A in the following diagram.

When price of the commodity increases to Rs. 160 per Kg. quantity supplied of apple

increases to 8 Kg which is described by point B on the diagram. Here with increase in

price of apple by Rs. 10 Per Kg. the equilibrium point move upward within the same

supply curve which is extension in supply.

Point Price (Per Kg) Quantity Supplied (Kg)

A 150 2 Kg

B 160 4 Kg

Price (Rs)

160 B

150 Extension in supply

A

O

Quantity Supplied (kg)

1

d) Microeconomics is a branch of economics which deals with the relationship between

the small or individual variables such as individual consumer, household, firm,

industry etc. it also helps in making decisions on the allocation of available limited

resources. Microeconomics can also be defined as the worm’s eye view analysis of

microeconomic variables.

One of the goals of microeconomics is to analyze market mechanisms that

establish relative prices amongst goods and services and allocation of limited

The Institute of Chartered Accountants of Nepal 23

Suggested Answer - June 2018

resources amongst many alternative uses. Microeconomics analyzes market failure,

where markets fail to produce efficient results, and describes the theoretical

conditions needed for perfect competition.

The main objective of microeconomics is to study principles, problems and policies

related to optimal allocation of resources. Microeconomics don’t deal with the growth

of resources rather allocates the available limited resources to its best use. As for

example, when the consumer has limited budget to spend on various goods and

maximize the utility in such case microeconomics can be the useful tool to solve that

problem. Similarly, if the producer has limited cost to employ inputs used in the

production process microeconomics teaches in optimal employment of inputs as well.

e) Balance of payment (BOP) is a summary statement of systematic record of all

economic transactions between one country and the rest of the world. It includes all

transactions, visible as well as invisible items. A balance of payments statement

consists of two components: (a) current account and (b) capital account.

Current Account

The current account of the balance of payments statement relates to real and short

term transactions which are concerned with actual transfer of goods and services. It

contains receipts and payments on account of exports of visible and invisible items.

The current account of the balance of payments includes the following items:

(Consider any four)

1. Merchandise. Exports and imports of goods from the visible account have a

dominant position in the current account of balance of payments. Exports are

entered in the credit side and imports are entered in debit side.

2. Travel. Travel is an invisible item in the balance of payments. Travel may be for

reasons of business, education, health, international conventions or pleasures.

Expenditure by the foreign tourists in our country forms the credit item and the

expenditure by our tourists abroad constitutes the debit item in our balance of

payments.

3. Transportation. International transportation of goods is another invisible

transaction. It includes warehousing (while in transit) and other transit expenses.

Use of domestic transport services by the foreigners is the credit item and the use

of foreign transport services by domestic traders is the debit item.

4. Insurance. Insurance premium and payments of claims is also an invisible

transaction in a country's balance of payments account. Insurance policies sold to

foreigners are a credit item and the insurance policies purchased by domestic users

from the foreigners purchased are a debit item.

5. Investment Income. Another invisible item in the current account of the balance of

payment is the investment income which includes interest, capital, dividends and

profits.

6. Government Transactions. Government transactions refer to the expenditure

incurred by a government for the upkeep of its organizations abroad (e.g., payment

of salaries to the ambassadors, high commissioners, etc.). Such amounts received

by a government from abroad constitute the credit item and made to the foreign

governments form the debt item.

The Institute of Chartered Accountants of Nepal 24

CAP I Paper 2: Mercantile Law and Fundamental of Economics

7. Donations and Gifts. Donations, gifts, etc. received by a country from abroad are

the credit item and sent to the foreign countries are the debit item in the balance of

payments account. Donations and gifts are 'unilateral transfers' or 'unrequited

payments' because nothing is given in return for them.

8. Miscellaneous. Miscellaneous invisible items include expenditure incurred on

services like advertisement, commissions, film rental, patent fees, royalties,

subscriptions to the periodicals, membership fees, etc. Such payments received by

a country from abroad are a credit item and made by a country to foreign countries

are a debt item.

f) Other things remaining the same when a consumer consumes additional unit of a

commodity, utility obtained from every additional unit of commodity decreases. In

other words, if consumer consumes more and more unit of same commodity marginal

utility obtained from that commodity decreases. This law of consumer's behaviour is

known as law of diminishing marginal utility.

When consumer consumes more units of a commodity at the same time consumer

reaches to the point of satisfaction. In this situation, marginal utility obtained from

that commodity is zero. If the consumer consumes more unit of a commodity than

this level, consumer obtains negative marginal utility. This is explained with the help

of following table:

Units of a commodity Total utility Marginal utility

1 10 10

2 18 8

3 24 6

4 28 4

5 30 2

6 30 0

7 28 -2

When a consumer consumes 1st unit of a commodity, he obtains 10 of total and

marginal utility. Again if he consumes 2nd unit, he gets 18 total utility but marginal

utility decreases to 8. Similarly, if he consumes successive unit up to 5th unit, total

utility increases continuously but marginal utility decreases. Total utility becomes

maximum when the consumer consumes 6th unit of the commodity but marginal

utility at this unit is zero. When a consumer consumes 7th unit he gets negative

marginal utility and total utility decreases to 28.

The Institute of Chartered Accountants of Nepal 25

Suggested Answer - June 2018

Specific Comments on the performance of the students

Batch: - JUNE 2018

Level: - CAP-I (New)

Subject: Mercantile laws

Question No. 1

I think some candidates are confused on question. Average performance in both questions.

Conceptual and meanings are found clear in generally question No. 1 (a) & (b). Some extend

difficult to find the answer sheet as per the standard of suggested answer. Frequently asked

question. Adequate knowledge. Students are confused for dissolution partnership rather settlement

of account at the time of dissolution of partnership.

Question No. 2

Nothing and in Q no. 2 (c) most of the candidates are failed to give answer correctly. Average

performance in (a) & (b) questions but more than 95% students did not understand the question

and hence provided wrong answers. The students could not give proper answer in 2 (c) of

incompetent party of the contract. Q no. 2 c has not been properly understand by student so could

not answer appropriately. Confusion about parties of contract. No specific answer by most of the

students. 2 (b) Understand however all points of difference not concerned. Did not covered all

elements to be covered. Confused performance of contract.

Subject: Fundamentals of Economics

Question No. 1

Most of the students have made mistakes in diagrammatic illustration for part (a) and they were

confused with monopoly market. Satisfactory. Most of the students are unable to answer the

question as it is slightly twisted question. Students have done well in this question. Problems in

constructing correct figure and unable to write logical answer. Problem in finding equilibrium and

limiting answer.

Question No. 2

Students were confused in solving the relationship between AC and MC. Answers of question no.

2 d & 2 e are not satisfactory. In this question 2 (e) has not explained properly by the students rest

is ok. Lack of conceptual knowledge and confidence. Too long answer of theoretical questions

and less apply of mathematical tools.

The Institute of Chartered Accountants of Nepal 26

CAP I Paper 3: Fundamental of Management and Commercial Mathematics & Statistic

Paper 3:

Part A: Fundamentals of Management

Part B: Commercial Mathematics &

Statistics

The Institute of Chartered Accountants of Nepal 27

Suggested Answer - June 2018

Part A: Fundamentals of Management

The Institute of Chartered Accountants of Nepal 28

CAP I Paper 3: Fundamental of Management and Commercial Mathematics & Statistic

Maximum Marks - 25

Total No. of Questions - 2 Total No. of Printed Pages -4

Time Allowed –1 Hour

Marks

Attempt all questions.

2. Long Answer Questions: (2×5=10)

a) Define management. Describe four management functions.

b) What is organization? What are the resources mobilized by an organization to achieve

the pre-determined goals?

Answer:

a)

Meaning of Management

Management is the science and art of getting things done properly through the mobilization

of human and other physical resources in the pursuit of certain common goals. Managers

have to plan, to organize, to lead and to control the resources for optimum results. It takes

business functions and management functions as the means to reach its goals, missions and

objectives.

Management is a conscious effort to mobilize men, materials, machines, methods, etc.

through planning, organizing, leading and controlling processes to attain organizational

objectives efficiently and effectively satisfying all its constituents.

Functions of Management

Planning

Planning sets missions, goals, objectives, strategies and the programmes, schedules,

standards and budgets to achieve the objectives. Every manager in organizations have to plan

on what to do, how to do, when to do, who is to do and what resources to use and from where

to get these resources

Organizing

Organizing is the differentiation and integration of work activities to be performed to reach

the objectives. It involves work division, setting hierarchy, and departmentalization,

delegation of power and work, and provision of committed and competent human resources

for various jobs being set.

Leading

Leading consists of different work activities such as supervising, directing, influencing,

communicating, motivating and coordinating the activities of the subordinates. Under

leading, subordinates are made to work as planned, programmed, schedule and standards set.

Controlling

Controlling is about monitoring work activities and compares with standards to find if there

appears any deviation between these two. It aims to get the things done properly and yield

The Institute of Chartered Accountants of Nepal 29

Suggested Answer - June 2018

desired results. It also checks if any deviation exists. If there is any gap, necessary corrective

steps are taken.

b) The term organization represents the company, firm, concern, corporation, group, agency

association etc. that combined people, technology and structure to achieve predetermined

goals.

It is social unit of people that is structured and managed to meet a need or to pursue

collective goals. All organizations have a management structure that determines relationships

between the different activities and the members, and subdivides and assigns roles,

responsibilities, and authority to carry out different tasks. Organizations are open systems--

they affect and are affected by their environment.

All organizations, regarding of whether they are large or small, profit making or not for

profit, domestic or multinational, use some resources to achieve their goals. The basic four

resources that organization used are:

i) Human resources

ii) Financial resources

iii) Physical resources, and

iv) Information resources.

Human resource is the combination of skills, efforts, abilities and knowledge of a

company’s workforce/employee. It is also called human capital. They have the capabilities to

transform raw materials into valuable products, or knowledge and skills into services. The

human capital controls day-to-day operations, including managerial decisions and customer

service, knowledge or business know-how gained from research and development or

innovation and therefore the growth of any business.

Physical resources are the tangible resource used to operate the organization, such as Land,

building, production machinery, supplies for final product, transportation, and overhead such

as Internet and electricity.

Financial resources encompass any source of revenue a company has including sales, loans,

and investments.

Information resources wealth of informational and educational resources that helps to make

right decision at right time for the achievement of organizational goals.

2. Short Answer Questions (Any Five): (5×3=15)

a) Contingency theory of management.

b) Importance of planning.

c) Define the term Hiring and Firing.

d) Importance of motivation.

The Institute of Chartered Accountants of Nepal 30

CAP I Paper 3: Fundamental of Management and Commercial Mathematics & Statistic

e) Define leadership and list out the qualities that must be possess in a successful leader.

f) Motivation-hygiene theory.

Answer:

a) The Contingency Theory

This theory is the result of efforts by Lawrence, Lorch, Thompson, Cast and Rosenberg.

This theory explains the situations quite changeable and managerial behaviours must be

influenced by unique elements in the situation. They must apply situation-specific

solutions to issues. A solution to same problem in the past may be unsuitable if the

elements in the environment have changed. So ‘if…… then….”strategy is suitable. Here,

if…. describes problem-related situation and then…. suggests applicable solution. This

theory has explained decision making as the major job for managers.

According to this approach, managers should be clear on which in a particular case and

time will be suitable to the attainment of organizational goals.

b) Importance of planning

Planning is looking ahead in a systematic way. It is important because it reduces

uncertainty and encourages creativity. Forecasting and environmental scanning help

anticipate future uncertainties. It forces managers to think ahead, anticipate change,

consider the impact of change and develop appropriate responses.

Planning helps managers to focus on goals. It defines goals and determines courses of

action to achieve them. Planning facilitates better mobilization, allocation and

coordination of resources. Planning identifies environmental opportunities and threats.

Planning ensures commitment of managers and employees to goals and courses of

actions. Actual performance is compared with planned targets to find deviations and

make corrections. Control is only possible through planning.

c) Define the term Hiring and Firing

Hiring refers to recruitment of personnel. It includes the overall process of attracting,

selecting and appointing suitable candidates for job within an organization, either

permanent or temporary. Recruitment can also refer to processes involved in choosing

individuals for unpaid positions, such as voluntary roles or training programs.

Dismissal of employee from the job refers firing. It means termination of employment by

an employer against the will of the employee. Such kind of decision can be made by an

employer for a variety of reasons, ranging from an economic downturn to performance

related problems on the part of employee.

d) Importance of Motivation

Motivation is the human resource management policy and practice to generate employees’

internal willingness & readiness to contribute and accomplish. Its importance is explained

under the following points:

The Institute of Chartered Accountants of Nepal 31

Suggested Answer - June 2018

Understand employee behavior: Motivation analyzes how and why employees behave,

what attracts and makes them happy or unhappy. Then management can find suitable way

out to change their behaviours.

Productivity improvement: Motivated employees are more productive and creative. Their

performance rating is comparatively high. Management can make better utilization of their

competence.

Work Quality: Motivation increases quality consciousness in the employees. They explore

better work methods. Scrap, rejects, and defects can be minimized.

Employees’ tenure: Motivated employees love the organization and their present work.

They do not think about changing their employer. Long service supports strategic HR

planning.

Innovativeness: Motivated employees always are conscious about how to accomplish fast

without any flaws at work. They may develop new ideas and methods for doing things.

Commitment: Employees are committed as a result of motivation in various forms: low

employee turnover, reduced absenteeism, reduced accident rates, improved discipline,

reduction in grievances, and higher employees’ loyalty and morale, etc.

e) Leadership is the art of influencing and inspiring the behavior of others in accordance with

requirement. It is the ability to influence and motivate a group towards achievement of

objectives. In fact organizational performance totally depends up on the ability of the

leader of organization. Generally leadership qualities includes;

a) Personal qualities

* Physical fitness

*Self confidence

*Intelligence

*Vision and foresight

*Sense of Personality etc.

b) Managerial qualities

*Technical knowledge

*Organizing ability

*Motivation and communication skill

*Wider perspective etc.

f) Motivation- hygiene theory is also known as Herzberg’s two-factor theory. Fredrick

Herzberg made the proposition that two separate sets of factors are relevant in any

motivational setting.

One set of factors is called satisfiers or motivation factors. Satisfiers consist of interesting

job, opportunities for growth, recognition, advancement and obligation. Maximizing

motivation factors can increase motivation.

The second set of factors is called hygiene factors or maintenance factors. Hygiene factors

include working condition, job security, salary, warm interpersonal relations, status and

fairness of organizational policies. These factors are necessary to avoid dissatisfaction.

Herzberg has suggested two steps application of this theory. The first step is to avoid

stumbling blocks for motivation. Supervisor should eliminate hygiene factors that cause

The Institute of Chartered Accountants of Nepal 32

CAP I Paper 3: Fundamental of Management and Commercial Mathematics & Statistic

dissatisfaction. The second step is to enrich the jobs for motivation. Supervise should

maximize motivating factors.

The Institute of Chartered Accountants of Nepal 33

Suggested Answer - June 2018

Part B: Commercial Mathematics & Statistics

The Institute of Chartered Accountants of Nepal 34

CAP I Paper 3: Fundamental of Management and Commercial Mathematics & Statistic

Roll No........................ Maximum Marks - 25

Total No. of Questions - 2 Total No. of Printed Pages -4

Time Allowed – 1 Hour Marks

Attempt all questions.

1.

a) An enquiry into the budget of the middle class families in a

certain city gave the following information.

Expenses on Food Rent Clothing Fuel Misc.

35 % 15 % 20 % 10 % 20 %

Price in 2015 150 50 100 20 60

Price in 2016 174 60 125 25 90

What changes in the cost of living figures of 2016 have

taken place as compared to 2015? 4

b) The price of a certain commodity in 90 different days are

given below:

Price ( in Rs.) 10 12 15 18 20 23 25

No. of days 8 11 22 20 15 9 5

Find the Percentile coefficient of kurtosis and comment on

the normality of the distribution. (3+1=4)

c) From the data given below, calculate the trend values and

estimate the production for the year 2019. What is the

monthly increase in the production? (3+0.5+0.5=4)

Year: 2010 2011 2012 2013 2014 2015 2016 2017

Production

(000 tons): 15 18 17 20 22 25 24 28

d) A company, which is making 200 mobile phones each week,

plans to increase its production.

The number of mobile phones produced is to be increased by

20 each week from 200 in week 1 to 220 in week 2, to 240 in

week 3 and so on, until it is producing 600 in week N. (2+2=4)

i) Find the value of N.

The company then plans to continue to make 600 mobile

phones each week.

ii) Find the total number of mobile phones that will be made

in the first 52 weeks starting from and including week 1.

Answer:

a) Calculation of cost of living index number.

Items Po ( 2015 ) P1 ( 2016 ) W P= P.W

The Institute of Chartered Accountants of Nepal 35

Suggested Answer - June 2018

Food 150 174 35 116 4060

Rent 50 60 15 120 1800

Cloth 100 125 20 125 2500

Fuel 20 25 10 125 1250

Misc. 60 90 20 150 3000

100 12610

Cost of Living Index = P0 1 = = = 126.10 %

Hence , Reqd. Change = (126.10 – 100 ) = 26.10 %

b)

Price( in Rs) No of days(f) C.f.

10 8 8

12 11 19

15 22 41

18 20 61

20 15 76

23 9 85

25 5 90

N=∑f=90

For Q1, 1 ( N 1) 1 (90 1) 22.75 Hence c.f. just greater than

4 4

22.75 is 41 and corresponding price is 15. Q1 = 15.

For Q3, 3 ( N 1) 3 (90 1) 68.25 Hence c.f. just greater than

4 4

68.25 is 76 and corresponding price is 20. Q3 = 20.

For P10, 10 ( N 1) 10 (90 1) 9.1 Hence c.f. just greater than

100 100

9.1 is 19 and corresponding price is 12. P10 = 12.

For P90, 90 ( N 1) 90 (90 1) 81.9 Hence c.f. just greater than

100 100

81.9 is 85 and corresponding price is 23. P90 = 23.

Percentile coefficient of kurtosis is given by

Q3 Q1

K 20 15 5 0.227

2P90 P10 223 12 22

Since the value of K is less than 0.263, the given distribution is platy-

kurtic.

c) Let Year = t, Production ( 000 tones) = Y and X = (t-

2013.5)×2

The Institute of Chartered Accountants of Nepal 36

CAP I Paper 3: Fundamental of Management and Commercial Mathematics & Statistic

Trend

t X Y XY X2 values

2010 -7 15 -105 49 15

2011 -5 18 -90 25 16.75

2012 -3 17 -51 9 18.5

2013 -1 20 -20 1 20.25

2014 1 22 22 1 22

2015 3 25 75 9 23.75

2016 5 24 120 25 25.5

2017 7 28 196 49 27.25

Total 0 169 147 168 169

Here ∑X = 0,

Therefore, b

XY 147 0.875 and a Y Y 169 21.125

X 2

168 N 8

Trend line is Yˆ = a + b X i. e Yˆ = 21.125 + 0.875 X

Trend values are

Yˆ (2010) = 21.125+0.875×(-7) = 15

Yˆ (2011) = 21.125+0.875×(-5) = 16.75 and so on.

Estimated production for the year 2019 (i.e. X=11) = 21.125+0.875×(11) = 30.75

Here b is 1/2 yearly increment

Monthly increment = 1/2 Yearly increment /6 = b/6 = 0.875/6 =

0.1458 thousand = 145.83 Tons

d) i) 200, 220, 240,……….,600

1 2 3 N

We know that

( )

( )( )

N= 21

ii) We have to calculate total production till 21is week plus 22nd week to 52nd week

Total = [21+31=52 weeks]

We know that ( )+600(31)

= ( )

= 27000

2. (3×3=9)

a) In how many ways can the letters of the word

‘MARKETING ‘ be arrange

i) if three letters are taken at a time?

ii) if all of them are taken at a time?

The Institute of Chartered Accountants of Nepal 37

Suggested Answer - June 2018

b) Find the amount of Rs. 50,000 after 10 years if invested at

6% p.a. compounded semiannually for the first three years,

at 8% p.a. compounded quarterly for the next 5 years and at

7% p.a. compounded annually thereafter.

c) In two factories A and B engaged in the same industry in an

area, the average weekly wages in Rs. and the standard

deviations are as follows:

Factory Average weekly wages S.D. No. of wage earners

A 34.5 5 476

B 28.5 4.5 524

What is the average wages of all the workers in two factories taken together?

Answer:

a) In the word ‘MARKETING’ , no. of letters , n = 9

(i) Here , r = 3

Reqd. No. of ways = = = ( )

= = = 504

ways.

(ii) Here , n = 9 , r = 9

Reqd. no. of ways = = ( )

= 362880 ways.

b) Here P=Rs. 50,000

R1= 6% m1= 2 n1= 3

R2= 8% m2= 4 n2= 5

R3= 7% n3 = 2

Now compound amount after 10 years (A)

mn m n n

R1 1 1 R2 2 2 R3 3

= P 1 1 1

100m1 100m2 100

2 3 4 5 2

= 50000 1 6 1 8 1 7

100 2 100 4 100

= 50000(1+6/200) × (1+8/400) × (1+7/100)2

6 20

= 50000(1+0.03)6 × (1+0.02)20 × (1+0.07)2

= 50000(1.03)6 × (1.02)20 × (1.07)2

= 50000×1.194×1.486×1.145

= Rs. 101,578

c) The average wage of all the workers in the two factories is

n1 x1 n2 x2 476 x34.5 524 x28.5

x 31.36

n1 n2 476 524

The Institute of Chartered Accountants of Nepal 38

CAP I Paper 3: Fundamental of Management and Commercial Mathematics & Statistic

Specific Comments on the performance of the students

Batch: - JUNE 2018

Level: - CAP-I (New)

Subject: Fundamentals of management

Question No. 1

Most of the students did not answer sub parts of the question proportionately emphasis was only

on a part. Students are trying to give long answer question but preparation are too low. They could

not prefer to the time division of the questions.

a) The Students have average performance. Overall answer is satisfactory.

b) Students have lack of conceptual knowledge on sub parts of the question. The students are

confused to answer. Having good concept about organization but some confusion about its

resources.

Question No. 2

Students given answer is not fully clear about the concept that is lack of concepts of the contexts.

Students preparation are not satisfactory they are attempting the examination without given prior

to this subject.

a) They lack clear understanding of the topic. Not clear about concept.

b) Answers are found too sketchy. Adequate.

c) Unsatisfactory preparation and performance. Confused about hiring and firing as well as very

sketchy answer.

d) Below average performance

e) Quality is ignored, function of leadership is focused

f) Almost 50% of the students are not clear about the topic

Subject: Commercial Mathematics and Statistics

Question No. 1

Preparation is not adequate, lack of knowledge about the subject matter of questions. Many

students did not write unit % in answer. Unsatisfactory though questions are easy 1 (a,b&d)

a) Many Students do not use P=p1/p0×100 which makes the Q no. 1 (a) wrong. This question is

not suitable to maintain standard of level.

b) Ok. Satisfactory. Some of the students do not calculate exactly.

c) Most of the students left to calculate the annual increment and many have incomplete. This

question is suitable.

d) 2nd part question has left by many students and are confused.

Question No. 2

Questions are not understand properly, practice not sufficient.

Many students did not understand question.

a) Instead of permutation some of the students have used "combination". Not perform well.

b) Confusion to multiply by quarterly & half yearly period in formula.

c) This question is very easy to understand and calculate.

The Institute of Chartered Accountants of Nepal 39

Suggested Answer - June 2018

The End

The Institute of Chartered Accountants of Nepal 40

You might also like

- Jane Lazar CGFR 8th Ed Solutions AfaDocument228 pagesJane Lazar CGFR 8th Ed Solutions Afasharmitraa100% (16)

- Journal To Final AccountsDocument38 pagesJournal To Final Accountsguptagaurav131166100% (5)

- Worksheet On Accounting For Partnership - Admission of A Partner Board QuestionsDocument16 pagesWorksheet On Accounting For Partnership - Admission of A Partner Board QuestionsCfa Deepti Bindal100% (1)

- Mercantile Laws MCQDocument69 pagesMercantile Laws MCQalchemist100% (8)

- Tally Accounting EntriesDocument16 pagesTally Accounting EntriesvishnuNo ratings yet

- Holding Companies ProblemsDocument11 pagesHolding Companies ProblemsMr. 360No ratings yet

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesDocument17 pagesChapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesAyush AcharyaNo ratings yet

- Account Past Questions Compilation (2009june - 2020 Dec.)Document246 pagesAccount Past Questions Compilation (2009june - 2020 Dec.)Prashant Sagar Gautam100% (2)

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- CA Inter Accounting - Chapter 1Document37 pagesCA Inter Accounting - Chapter 1Gokarakonda Sandeep100% (1)

- Notes On ObliCon by Prof. Ruben BalaneDocument125 pagesNotes On ObliCon by Prof. Ruben BalaneKezia Escario100% (1)

- 47 Branch AccountsDocument53 pages47 Branch AccountsShivaram Krishnan70% (10)

- Environment of Financial Accounting and Reporting: FalseDocument6 pagesEnvironment of Financial Accounting and Reporting: Falsekris mNo ratings yet

- Consignment - SolutionDocument18 pagesConsignment - Solution203 596 Reuben RoyNo ratings yet

- (Holy Balance Sheet) Jones Electrical DistributionDocument29 pages(Holy Balance Sheet) Jones Electrical DistributionVera Lúcia Batista SantosNo ratings yet

- Unit - 4: Amalgamation and ReconstructionDocument54 pagesUnit - 4: Amalgamation and ReconstructionAzad AboobackerNo ratings yet

- CCC INSURANCE CORPORATION v. KAWASAKIDocument2 pagesCCC INSURANCE CORPORATION v. KAWASAKIEmmanuel Princess Zia SalomonNo ratings yet

- Dino VS CaDocument2 pagesDino VS CaJulioNo ratings yet

- Compiler CAP II Cost AccountingDocument187 pagesCompiler CAP II Cost AccountingEdtech NepalNo ratings yet

- Bank of The Philippine Islands vs. Sarabia Manor Hotel Corporation, G.R. No. 175844, 29 July 2013Document3 pagesBank of The Philippine Islands vs. Sarabia Manor Hotel Corporation, G.R. No. 175844, 29 July 2013Hannika SantosNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Accounting From Incomplete Records For BookDocument21 pagesAccounting From Incomplete Records For BookbinuNo ratings yet

- CAP I - Paper 2B - MCQDocument41 pagesCAP I - Paper 2B - MCQalchemist100% (3)

- Study Note 3, Page 114-142Document29 pagesStudy Note 3, Page 114-142s4sahithNo ratings yet

- Suggested Answer CAP II June 2018Document128 pagesSuggested Answer CAP II June 2018Pradeep Bhattarai67% (3)

- Suggested Answer CAP II June 2017rDocument104 pagesSuggested Answer CAP II June 2017rBAZINGANo ratings yet

- Branch: ? AccountingDocument36 pagesBranch: ? AccountingbinuNo ratings yet

- June 2019 All Paper SuggestedDocument120 pagesJune 2019 All Paper SuggestedEdtech NepalNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (2)

- Partnership Dec 2020 UpdatedDocument46 pagesPartnership Dec 2020 Updatedbinu100% (4)

- Study Note 5.2 (353-378)Document26 pagesStudy Note 5.2 (353-378)s4sahith100% (1)

- PartnershipDocument28 pagesPartnershipAdi Murthy100% (2)

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NNo ratings yet

- Bos 28432 CP 14Document53 pagesBos 28432 CP 14Basant Ojha100% (1)

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Capinew Account June13Document7 pagesCapinew Account June13ashwinNo ratings yet

- Chapter 9 Accounting For Branches Including Foreign Branches PDFDocument61 pagesChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh MahajanNo ratings yet

- Chapter 9 Accounting For Branches Including Foreign Branches PMDocument48 pagesChapter 9 Accounting For Branches Including Foreign Branches PMviji88mba60% (5)

- 5 Debenture Material3619080524732228932Document14 pages5 Debenture Material3619080524732228932Prabin stha100% (1)

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- PCC 2008 NPO QuestionDocument10 pagesPCC 2008 NPO QuestionVaibhav MaheshwariNo ratings yet

- Branch AccountingDocument44 pagesBranch Accountingaruna2707100% (1)

- DepartmentalDocument17 pagesDepartmentalPapiya DeyNo ratings yet

- Amalgamation Accounting Cp6 3Document28 pagesAmalgamation Accounting Cp6 3Divakara ReddyNo ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsDocument53 pagesChapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsMercy GamingNo ratings yet

- Introduction To Cost and Management Accounting: Question-1Document32 pagesIntroduction To Cost and Management Accounting: Question-1Alvarez StarNo ratings yet

- Bos 24780 CP 5Document114 pagesBos 24780 CP 5NmNo ratings yet

- Chap 12 PDFDocument15 pagesChap 12 PDFTrishna Upadhyay50% (2)

- Coc Departmental Accounting Ca/Cma Santosh KumarDocument11 pagesCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaNo ratings yet

- 3246accounting - CA IPCCDocument116 pages3246accounting - CA IPCCPrashant Pandey100% (1)

- RTP Dec2023 p1Document32 pagesRTP Dec2023 p1Vaibhav M S100% (1)

- Chapter - 6 JournalDocument4 pagesChapter - 6 JournalRitaNo ratings yet

- 18 Chapter4 Unit 1 2 Hire Purchase and Instalment PaymentDocument17 pages18 Chapter4 Unit 1 2 Hire Purchase and Instalment Paymentnarasimha_gudiNo ratings yet

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Royalty AccountsDocument11 pagesRoyalty AccountsVipin Mandyam Kadubi0% (1)

- 15-Mca-Nr-Accounting and Financial ManagementDocument4 pages15-Mca-Nr-Accounting and Financial ManagementSRINIVASA RAO GANTA0% (2)

- Paper 1 Advanced AccountingDocument576 pagesPaper 1 Advanced AccountingExcel Champ60% (5)

- Scanner CAP II Income Tax VATDocument162 pagesScanner CAP II Income Tax VATEdtech NepalNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- National Law Institute University: BhopalDocument3 pagesNational Law Institute University: BhopalMranal MeshramNo ratings yet

- 286practice Questions - AnswerDocument17 pages286practice Questions - Answerma sthaNo ratings yet

- Principles of ManagementDocument107 pagesPrinciples of ManagementalchemistNo ratings yet

- Community Forest Management: An Assessment and Explanation of Its Performance Through QCADocument12 pagesCommunity Forest Management: An Assessment and Explanation of Its Performance Through QCAalchemistNo ratings yet

- Suggested Answer CAP I June 2012Document77 pagesSuggested Answer CAP I June 2012alchemistNo ratings yet

- Suggested Answer CAP I June 2011Document83 pagesSuggested Answer CAP I June 2011alchemistNo ratings yet

- Fundamentals of Accounting Suggested Answer Attempt All Questions. Working Notes Should Form Part of The AnswerDocument28 pagesFundamentals of Accounting Suggested Answer Attempt All Questions. Working Notes Should Form Part of The AnsweralchemistNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested AnswersDocument34 pagesThe Institute of Chartered Accountants of Nepal: Suggested AnswersalchemistNo ratings yet

- Individual Project of IMOTDocument8 pagesIndividual Project of IMOTalchemistNo ratings yet

- CAP I - Paper 2B - MCQDocument41 pagesCAP I - Paper 2B - MCQalchemist100% (3)

- Event and Activity Record: Self ReflectionDocument2 pagesEvent and Activity Record: Self ReflectionalchemistNo ratings yet