Professional Documents

Culture Documents

Bharat Star General Insurance Co LTD Excel

Uploaded by

Subham Jain0 ratings0% found this document useful (0 votes)

2 views6 pagesOriginal Title

Bharat Star General Insurance Co Ltd Excel

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views6 pagesBharat Star General Insurance Co LTD Excel

Uploaded by

Subham JainCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 6

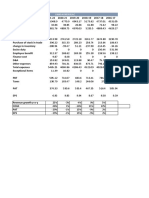

Profit & Loss

Figures in Rs. Crores

Mar-19 Mar-20 Mar-21 Mar-22 Mar-23

Sales - 10604.85 10941.15 11573.85 15224.7 16982.2

Sales Growth % 58% 3% 5% 30% 11%

Expenses - 9019.3 9257.75 10064.3 14259.5 15781.4

Manufacturing Cost % 64% 60% 58% 62% 60%

Employee Cost % 5% 6% 6% 6% 6%

Other Cost % 12% 15% 18% 22% 23%

Operating Profit 1585.55 1683.4 1509.55 965.2 1200.8

OPM % 14% 14% 12% 6% 7%

Other Income - -1.9 14.25 470.25 768.55 941.45

Exceptional items -1.9 -0.95 0 -0.95 -3.8

Other income normal 0 14.25 470.25 769.5 945.25

Interest 66.5 0 0 0 0

Depreciation 0 85.5 123.5 133.95 134.9

Profit before tax 1518.1 1612.15 1856.3 1599.8 2007.35

Tax % 32% 28% 24% 23% 17%

Net Profit + 996.55 1134.3 1399.35 1207.45 1642.55

EPS in Rs 21.945 24.9565 30.78 24.5955 33.4495

Dividend Payout % 25% 12% 24% 33% 27%

OPM 14.21% 14.62% 12.39% 6.02% 6.72%

Balance Sheet

Figures in Rs. Crores

Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Sep-23

Equity Capital 431.3 431.3 432.25 466.45 466.45 466.45

Reserves 4698.7 5396 6786.8 8266.9 9455.35 10278.05

Borrowings + 460.75 460.75 460.75 242.25 33.25 33.25

Other Liabilities - 26141.15 28901.85 29653.3 39330.95 42376.65 46133.9

Trade Payables 17265.3 404.7 0 1067.8 1337.6 0

Other liability items 8875.85 28496.2 29653.3 38262.2 41040 46133.9

Total Liabilities 31732.85 35189.9 37333.1 48305.6 52331.7 56912.6

Fixed Assets + 1866.75 630.8 681.15 893.95 838.85 547.2

CWIP 16.15 11.4 13.3 10.45 23.75 0

Investments 19678.3 25010.65 29248.6 36491.4 40694.2 43046.4

Other Assets - 10171.65 9537.05 7390.05 10910.75 10774.9 13318.05

Trade receivables 8484.45 0 0 0 0 0

Cash Equivalents 381.9 31.35 216.6 278.35 192.85 66.5

Short term loans 181.45 0 0 0 0 12921.9

Other asset items 1123.85 9505.7 7173.45 10632.4 10582.05 329.65

Total Assets 31732.85 35189.9 37333.1 48305.6 52331.7 56912.6

ROE 19.43% 19.46% 19.39% 13.83% 16.56%

ROCE 30.57% 27.14% 26.58% 19.21% 21.20%

Cash Flow Statement

Figures in Rs. Crores

Mar-20 Mar-21 Mar-22 Mar-23

Cash from Operating Activity - 3261.35 1685.3 768.55 2175.5

Profit from operations 3731.6 2020.65 1126.7 2472.85

Other WC items 0 0 0 0

Working capital changes 0 0 0 0

Direct taxes -470.25 -335.35 -358.15 -297.35

Other operating items 0 0 0 0

Cash from Investing Activity - -3212.9 -1298.65 128.25 -1600.75

Fixed assets purchased -287.85 -75.05 -72.2 -114.95

Fixed assets sold 0.95 0 3.8 0.95

Investments purchased -13215.45 -12761.35 -11451.3 -13775

Investments sold 8847.35 9799.25 9356.55 9893.3

Investment income 1445.9 1742.3 2274.3 2400.65

Interest received 0 0 0 0

Other investing items -3.8 -4.75 16.15 -5.7

Cash from Financing Activity - -399 -201.4 -835.05 -660.25

Proceeds from shares 3.8 9.5 38.95 19.95

Repayment of borrowings 0 0 -460.75 -209

Interest paid fin -401.85 -210.9 -414.2 -470.25

Other financing items 0 0 0 0

Net Cash Flow -350.55 185.25 61.75 -85.5

TRENDS: 10 YEARS 7 YEARS 5 YEARS 3 YEARS

Sales Growth 17% 17% 21% 16%

OPM 9% 10% 11% 8%

Price to Earning 42.3 42.3 42.4 42.0

Shareholding Pattern

(Numbers in percentages)

Mar-18 Mar-19 Mar-20 Mar-21 Mar-22

Promoters + 55.92% 55.87% 55.86% 51.88% 48.05%

FIIs + 6.42% 13.24% 23.39% 29.08% 26.88%

DIIs + 9.16% 7.95% 13.18% 11.96% 13.73%

Government + 0.00% 0.00% 0.00% 0.00% 0.00%

Public + 28.50% 22.94% 7.57% 7.08% 11.34%

No. of Shareholders 283,706 230,419 241,934 258,816 287,701

Stock Price CAGR Rate

10 Years: NA

5 Years: 13%

3 Years: 7%

1 Year: 57%

Mar-23 Dec-23

48.03% 47.91%

22.85% 23.04%

17.23% 17.86%

0.10% 0.10%

11.79% 11.09%

287,023 252,680

You might also like

- IM ProjectDocument24 pagesIM ProjectDäzzlîñg HärîshNo ratings yet

- Hathway CableDocument12 pagesHathway CableFIN GYAANNo ratings yet

- Radico KhaitanDocument38 pagesRadico Khaitantapasya khanijouNo ratings yet

- Working Capital Management - docx.PDF 20231102 130330 0000Document3 pagesWorking Capital Management - docx.PDF 20231102 130330 0000Aarti SharmaNo ratings yet

- JODY2 - 0 - Financial Statement Analysis - MC - CorrectedDocument6 pagesJODY2 - 0 - Financial Statement Analysis - MC - Correctedkunal bajajNo ratings yet

- TAMO Common Size StatementsDocument6 pagesTAMO Common Size Statementsanuda29102000No ratings yet

- Institute Program Year Subject Project Name Company Competitor CompanyDocument37 pagesInstitute Program Year Subject Project Name Company Competitor CompanyEashaa SaraogiNo ratings yet

- Balance Sheet - Subros: Optimistic Senario Normal ScenarioDocument9 pagesBalance Sheet - Subros: Optimistic Senario Normal ScenarioAnonymous tgYyno0w6No ratings yet

- Shree Cement Financial Model Projections BlankDocument10 pagesShree Cement Financial Model Projections Blankrakhi narulaNo ratings yet

- SUNDARAM CLAYTONDocument19 pagesSUNDARAM CLAYTONELIF KOTADIYANo ratings yet

- HUL FinancialsDocument5 pagesHUL FinancialstheNo ratings yet

- Investment Management Homework - Quarterly - HULDocument9 pagesInvestment Management Homework - Quarterly - HULNaina BakshiNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Hathway CableDocument10 pagesHathway CableFIN GYAANNo ratings yet

- Common Size Income Statement - TATA MOTORS LTDDocument6 pagesCommon Size Income Statement - TATA MOTORS LTDSubrat BiswalNo ratings yet

- Comparative Balance SheetDocument14 pagesComparative Balance SheetsweetdipudeepmalaNo ratings yet

- Britannia IndustriesDocument12 pagesBritannia Industriesmundadaharsh1No ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- Standalone Consolidated KRBL LT Food KRBL LT Food: Mar 19 YOY Mar 19 YOY Mar 19 YOY Mar 19 YOYDocument31 pagesStandalone Consolidated KRBL LT Food KRBL LT Food: Mar 19 YOY Mar 19 YOY Mar 19 YOY Mar 19 YOYAbhi BhatNo ratings yet

- HDFC BankDocument10 pagesHDFC Bankvishnu chandNo ratings yet

- Hotel Sector AnalysisDocument39 pagesHotel Sector AnalysisNishant DhakalNo ratings yet

- JSW Energy: Horizontal Analysis Vertical AnalysisDocument15 pagesJSW Energy: Horizontal Analysis Vertical Analysissuyash gargNo ratings yet

- Mindtree ValuationDocument7 pagesMindtree ValuationAman Khosla A-manNo ratings yet

- Ashok Leyland DCF TempletDocument9 pagesAshok Leyland DCF TempletSourabh ChiprikarNo ratings yet

- Engineers IndiaDocument10 pagesEngineers IndianikhilNo ratings yet

- Infosys - Veritcal AnalysisDocument2 pagesInfosys - Veritcal AnalysisGhritachi PaulNo ratings yet

- Amount in Rupees CroreDocument40 pagesAmount in Rupees CrorePradeep MulaniNo ratings yet

- Company Analysis - Format Basic - VardhamanDocument8 pagesCompany Analysis - Format Basic - VardhamanSuyashi BansalNo ratings yet

- 1Document1 page1Saray MorenoNo ratings yet

- CAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Document22 pagesCAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Garima GulatiNo ratings yet

- Class Work Outs - FSA - MBF2Document67 pagesClass Work Outs - FSA - MBF2Shubham MukherjeeNo ratings yet

- Revenue 3. Net Revenue 5. Gross ProfitDocument3 pagesRevenue 3. Net Revenue 5. Gross ProfitPhuong Anh NguyenNo ratings yet

- Invesment LabDocument16 pagesInvesment Labtapasya khanijouNo ratings yet

- TCS Financial AnalysisDocument5 pagesTCS Financial AnalysisREVATHI NAIRNo ratings yet

- Income Statement (Horizontal Analysis)Document1 pageIncome Statement (Horizontal Analysis)gimbaoadulorNo ratings yet

- Icici Bank CMP: Rs. 956.05: Result UpdateDocument6 pagesIcici Bank CMP: Rs. 956.05: Result UpdatemahasagarNo ratings yet

- Financial Model of Dmart - 5Document4 pagesFinancial Model of Dmart - 5Shivam DubeyNo ratings yet

- Book 1Document2 pagesBook 1justingordanNo ratings yet

- FM 2 AssignmentDocument337 pagesFM 2 AssignmentAvradeep DasNo ratings yet

- CEAT Financial Model - ProjectionsDocument10 pagesCEAT Financial Model - ProjectionsClasherNo ratings yet

- Book 1Document4 pagesBook 1vineetchahar0210No ratings yet

- CEAT Financial Model - ProjectionsDocument10 pagesCEAT Financial Model - ProjectionsYugant NNo ratings yet

- thu-BAV VNMDocument45 pagesthu-BAV VNMLan YenNo ratings yet

- Titan Co Financial ModelDocument15 pagesTitan Co Financial ModelAtharva OrpeNo ratings yet

- DCF TVSDocument17 pagesDCF TVSSunilNo ratings yet

- CAGRDocument7 pagesCAGRAsis NayakNo ratings yet

- Group 14 - Bata ValuationDocument43 pagesGroup 14 - Bata ValuationSUBHADEEP GUHA-DM 20DM218No ratings yet

- Dion Global Solutions LimitedDocument10 pagesDion Global Solutions LimitedArthurNo ratings yet

- Monte Carlo Fashions Ltd. Forecast - UPDATEDDocument26 pagesMonte Carlo Fashions Ltd. Forecast - UPDATEDsanket patilNo ratings yet

- Narration Dec-99 Dec-99 Dec-99 Dec-99 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst CaseDocument10 pagesNarration Dec-99 Dec-99 Dec-99 Dec-99 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best Case Worst Casechandrajit ghoshNo ratings yet

- Business Valuation: Cia 1 Component 1Document7 pagesBusiness Valuation: Cia 1 Component 1Shubh SavaliaNo ratings yet

- Excel Bav Vinamilk C A 3 Chúng TaDocument47 pagesExcel Bav Vinamilk C A 3 Chúng TaThu ThuNo ratings yet

- DCF Trident 2Document20 pagesDCF Trident 2Jayant JainNo ratings yet

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- NilkamalDocument14 pagesNilkamalNandish KothariNo ratings yet

- ColgateDocument32 pagesColgateapi-3702531No ratings yet

- Abbott Laboratories (Pakistan) Limited-1Document9 pagesAbbott Laboratories (Pakistan) Limited-1Shahrukh1994007No ratings yet

- Income Statement For AAPLDocument1 pageIncome Statement For AAPLEzequiel FriossoNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet

- Saraswati CommerDocument37 pagesSaraswati CommerAxisNo ratings yet

- Profit Booking SheetDocument7 pagesProfit Booking SheetSubham JainNo ratings yet

- Average Market Capitalization of List Companies During Jan JuneDocument45 pagesAverage Market Capitalization of List Companies During Jan JuneSubham JainNo ratings yet

- Saraswati CommerDocument37 pagesSaraswati CommerAxisNo ratings yet

- Ester IndustriesDocument37 pagesEster Industriesprabhusp7No ratings yet

- Technofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialDocument37 pagesTechnofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialVipulNo ratings yet

- App A1 Question Number 6Document4 pagesApp A1 Question Number 6Subham JainNo ratings yet

- IndusInd Bank Limited EP 2023-07-18 EnglishDocument39 pagesIndusInd Bank Limited EP 2023-07-18 EnglishSubham JainNo ratings yet

- Man I ChandanDocument217 pagesMan I ChandanSubham JainNo ratings yet

- Chapter 11Document4 pagesChapter 11Subham JainNo ratings yet

- Chapter 9 HKKDocument5 pagesChapter 9 HKKSubham JainNo ratings yet

- Ashok Gantt ChartDocument3 pagesAshok Gantt ChartSubham JainNo ratings yet

- Homework 4Document11 pagesHomework 4Subham JainNo ratings yet

- Homework 1Document11 pagesHomework 1Subham JainNo ratings yet

- Amazon Vs WalmartDocument13 pagesAmazon Vs WalmartSubham JainNo ratings yet

- Ashok PCC PresentationDocument3 pagesAshok PCC PresentationSubham JainNo ratings yet

- BrushDocument1 pageBrushBagus MirizNo ratings yet

- SOIC-Result Update Q1FY22 VideoDocument32 pagesSOIC-Result Update Q1FY22 VideoSubham JainNo ratings yet

- 1 Year Plan For CSE 2024Document36 pages1 Year Plan For CSE 2024Subham JainNo ratings yet

- QT License LGPLv2.1Document11 pagesQT License LGPLv2.1bwxsmjxkkkschdvgxiNo ratings yet

- ReslisttxtDocument2 pagesReslisttxtfgdfgdfgNo ratings yet

- 1 Year Plan For CSE 2024Document36 pages1 Year Plan For CSE 2024Subham JainNo ratings yet

- Dissertation PrelimnariesreportDocument5 pagesDissertation PrelimnariesreportHarshita BhanawatNo ratings yet

- Hanoi, 19 October 2015: Translation Update Service Since 1 April, 1999Document3 pagesHanoi, 19 October 2015: Translation Update Service Since 1 April, 1999Nguyen Van ThanhNo ratings yet

- 10.3.11 Packet Tracer - Configure A ZPFDocument4 pages10.3.11 Packet Tracer - Configure A ZPFFerrari 5432No ratings yet

- The Life God Has Called Me To LiveDocument3 pagesThe Life God Has Called Me To LiveOluwafunsho RaiyemoNo ratings yet

- SH INDUSTRIAL 1 2023.02.03 Contract of Service vs. Contract For Service ENGDocument5 pagesSH INDUSTRIAL 1 2023.02.03 Contract of Service vs. Contract For Service ENGthe advantis lkNo ratings yet

- Comprehensive Review For CorporationDocument14 pagesComprehensive Review For CorporationJoemar Santos Torres33% (3)

- Code of Virginia Code - Chapter 3. Actions - See Article 7 - Motor Vehicle AccidentsDocument15 pagesCode of Virginia Code - Chapter 3. Actions - See Article 7 - Motor Vehicle AccidentsCK in DCNo ratings yet

- Philipsek Part 5Document10 pagesPhilipsek Part 5HoldingfordNo ratings yet

- Economics 9708 A Level P3 NotesDocument12 pagesEconomics 9708 A Level P3 NotesFatima Rehan86% (7)

- Shilp - Aaron Retail Office Ahmedabad India Floor PlansDocument24 pagesShilp - Aaron Retail Office Ahmedabad India Floor Planskatzan jammerNo ratings yet

- NigeriaDocument26 pagesNigeriaJonathan J Jackson ONo ratings yet

- Share Capital TransactionsDocument65 pagesShare Capital Transactionsm_kobayashiNo ratings yet

- Tyre Air Pressure 2010 enDocument172 pagesTyre Air Pressure 2010 enbruteforce2000No ratings yet

- Modul 1 - Let - S ExploreDocument48 pagesModul 1 - Let - S ExploreJo NienieNo ratings yet

- IMNPD AssignmentDocument49 pagesIMNPD AssignmentSreePrakash100% (3)

- A Project Report On: A Study On Service Quality of Hotel Industry in RourkelaDocument58 pagesA Project Report On: A Study On Service Quality of Hotel Industry in RourkelaKapilYadavNo ratings yet

- Hard Rock CafeDocument6 pagesHard Rock CafeNove Jane Zurita100% (2)

- SimulcryptPrimer PDFDocument5 pagesSimulcryptPrimer PDFTechy GuyNo ratings yet

- Week 2 - ObliconDocument6 pagesWeek 2 - ObliconJazmin Ace PrepotenteNo ratings yet

- Filipino-Social ThinkersDocument2 pagesFilipino-Social ThinkersadhrianneNo ratings yet

- Marsden Victor Emile - The Protocols of ZionDocument156 pagesMarsden Victor Emile - The Protocols of ZionPeter100% (4)

- Book of Mormon: Scripture Stories Coloring BookDocument22 pagesBook of Mormon: Scripture Stories Coloring BookJEJESILZANo ratings yet

- AtsikhataDocument6 pagesAtsikhataKaran Upadhyay100% (1)

- Jack Ma BiographyDocument2 pagesJack Ma BiographyAlena Joseph100% (1)

- The Legal Environment of Business: A Managerial Approach: Theory To PracticeDocument15 pagesThe Legal Environment of Business: A Managerial Approach: Theory To PracticeSebastian FigueroaNo ratings yet

- Ethics A Basic FrameworkDocument14 pagesEthics A Basic FrameworkA Roy TantonoNo ratings yet

- A Brief History of AntiDocument2 pagesA Brief History of AntiHoa ThanhNo ratings yet

- Only Daughter: Sandra CisnerosDocument2 pagesOnly Daughter: Sandra CisnerosUzhe ChávezNo ratings yet

- PHN6WKI7 UPI Error and Response Codes V 2 3 1Document38 pagesPHN6WKI7 UPI Error and Response Codes V 2 3 1nikhil0000No ratings yet

- AWR160 WMD AnswersDocument32 pagesAWR160 WMD Answersthatguy8950% (4)