Professional Documents

Culture Documents

Adobe Scan 04-Mar-2024

Adobe Scan 04-Mar-2024

Uploaded by

AKSHAYKUMAR PATIL0 ratings0% found this document useful (0 votes)

5 views9 pagesOriginal Title

Adobe Scan 04-Mar-2024 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views9 pagesAdobe Scan 04-Mar-2024

Adobe Scan 04-Mar-2024

Uploaded by

AKSHAYKUMAR PATILCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 9

Name : paki Akshaykurno Dattapwosd.

Roll NO DSJ0

Sub i: inorcial Monoqenent Dote

QLDeline Capitalisaboh 9 Eploin Hhe Causes Ghd eltecds o

Ovekcapilalsabion,

"CopiBalistion is the Surn oP Hhe pa Value o} slocks

and bonds outslondinq

Causes ooNeKapilalisaloh

Thee ave many acBoks hich acCOun he sitaio

o Oveh-Ca poial saioh. o a

Aont Causes. Company ollooihg Ore Some impok

Heavyplonotioh Gpehses Beocham is o the vielo that

"A Cevtoin deqsee of ovekCapiBahsazioh may be Caused by

heovy iSsue expehses" HeoNy plarokoh ond esloblish ment

expenses inCEQse the amouh o Cap1Bohsaioh kithout cddlin

o he ea hin¢s Capacity of he Conpohy.

siAcquihing Asseks ak an Thlaked puce i- Asels nay be acqed

at an ihtlated ohice o dukibg boun pekiod heh Ehe pices

of the asseks are ails peak Asoa Compahy moy

acquie

he asset (o a goinyCanceh by playing unduly hifhphite ol"

Hhe yehdo kqoodul

)Ponoioh/ fenoibh_ dnin Bootpaiod

n - ta CoinponyiS

oaled duing an inoionaypeiod, a ahy daelopment achvity

(epaisadion because it has to spehd huge amcuht

Date :

iyloveseglimaioh of fuhue Eaun ingso.undueskmalion

o} Capilolisalioh Rake i Eaynin4s theoy o Cnpitalisalah

|equibes estmoioh to be cone as bedopds the tukue

eathings and the Copitolisotion Hate.tf Hhis esbimatith

phoper Chpichsa Loh.

y-ovek issue oP Capilol: Deecive nan Cia) planning lWillnay

leod to exCesSive Sue_of shases ot debehties. his

put a Conslont buwdenon theeasnings of the Company

as the CopiBo) Canho be paobly uilk sed and the dhdd,

inlevesk needsto be pmd oh the Capilol hal is. bih

Aoised

)Libesal Dividend pahcy ie A Cotnpohy alloolnga kberal

dhàdehd poley nay hok velain sulleieb fuhds o safe

|inohCihghig may aclva.sely afect the eanihgs o} dhe

Company in utuse kesulin in ovet- Capikalksolioh: t is

also_ obse-ved that bera) chividehd's are paic o the Cost

o! Snadequolepovisioh to depeca ioh.

wiLack_o Reseves - Lowe, amouh o seseAYes bouie

en kaul boolaihg ok bigh ales or futuLe equilem ents. sch

aapolcy. Jedluce s._Hhe ealpro} oF the Canpahy Ghd.

ledds to ce Capibolsaio..

Date:

Bonowinat Highe InBevest Rales ove CapiBalisatioh.

may also aMiSe klheh the Company bo:xols Yuhds at exosbia:

n ote o! inleest I he toteof inteves (s mobe theh.

the tate o eanibgs,the kale o tesh on Shase may

An belclw_hormal.

Toxatioh gohty z Hiyh ales of lanalioh may leoyeJle ih.

Hhe handso the Company to povide b depueciakon , keplatemeh

ol assels and paying divident to the shaehaldes - this moy

advessely aeck iks eohing Capaciky ohd lecg to oveL

|Caplaisaion,.

Tadeduak Demahd b pioclucds it? a Companys pladucks

eiskL a lonslan decline,it LHL bing douh the proFidabi iky

o Hhe Comoahy this lail. kesulinlowes eBukh oh Capiba)

emplayedahd thaly a Sialion o! ovek- Capilaisahion

Date:

Q01hol 1s unde Capilclisalion Explain the Casuse abd

elecds of undevcapilolisation..

An excess_o? bue agset Malues_OVe the_04gke

4ake o sBocks ohd bonds. ou sBahdln'

J| Unde esimotion o Cooito! QecvimehLs The promaies

|may uhde eslimole Hhe Capila)_hecdg_of the Compchy

H he eahings. plove fo be highe Lhen the Coh Cen Shall

beCone undes Copitalised.

i EHdebey ond Belte Donogemen ACohpony nay have

optimally ulised the asels ond ehhanced iHs clciehey

by exploiting -eYely poSSible oppouhity auailable in he

noke hee is a plopek Cortsol ore the expehchkue o}

Hhe Compony- As Such mahage meh o Such a CompahyiS

highly efteht Which wesulks in hyh ea}hihys

i) ovek- estimaiah ol apilalisaBioh ale o Under- esimadion

Hegukes esinatoh to be done as kejasds the We

eakhlys ahd the Capilalisalioh kode t! his esbmolioh ploCe

Lss IS bulty or biased, theh it boill hoB sesut papr Capekali.

scLiohAs_Such ovek eshimaioh of Copitalisaton tale OA

under esimaioh o utue eothings sosuls in uhder

Capitalisakioh.

Date

Aonoion Duing Dapyessioh ACompany foabed dusin!

Capital:sed

la ohase o} dephession kEIN And itsel uhde-

duind the bootn peliod hen plices hise the book Value LhM be

he lwer igue o oxgihol 0ice Jess depiecialonthe eanins

laL Such Bime may ineage opostanately hghe heh an

ncvease in Hhe amoun o Capikal mployed.

Cinsevakive Dividehd polcy i If he mahogenen follouas a

CohSeabye diudehd polkcy ie. diseibuing Jes dlividehd and

reloinihg moe Yo sel Anancing, ik elies Jess oh oltside

puhds lhich ae Cosly

yScessive Depeciaioh I aCompony bliaS CQ0licy o} Choy

in excesSiYe dep-eciatioh, j tesults in loweL book lalue o

he asses theh the heal Value

Vi) dihd all Gains i Some Conpahies Conihueto opeLOle SLCCess

Auily cluing the phose o depiessioh. they may Ands Hhat

thei. earnihgs ave uuolly high hen they ehtes theboon

peuiod.

v Desie Carbal and TEadingoh. Equty Someimes due to

Be Cangeiwobve_appiocch of He pomokes, thay scise lasseL

amouh af Capila). in gh_eftorts no to dilue HheCohtol

Date :

G3lhak is Copita Budgeing 9 bploin in delai!" Dsoyhdel

Cash. iouw. method / Tinne Adlusted melhods" hd e CapitoL

BudyelinCapilal

g. Audebing is JhepoceSsofdelesmi binf

ahelhe a. long term ihveslmehOL DoJecE is larthbile.

|this inlolves. assessing the pokenla p»okobility a the

vestmeht abd CompaLihg i to aiBesnolive uses a

CapiBal.

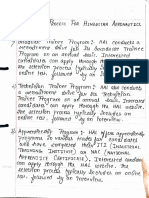

DisCouhled Cash polw methodls, alsoknoleA as

Tine adiusle methods, ne populaL techniques Secd in.

Capilal Bucgeing hey Consdes the bme Value o} nongy

hich meansthat dolla veCeived

Distounte Cash olo mehod.

DNet puesh Vollye CP) NPy Calcu laBes the pieseht

Malué of qll_ futuse Cosh inlous ond out tlous of a

paject and subitachs the inital inYeskmehtÊthepy

is posiive, the piajeckis Cohsidecd fnancially MiGble.

Intenal lale o Return IRR is the cscoluh ade

hat makes HheNPYo a ploleck Zeso.Ih keplsends

Ihe ate oP KkAh hakch inyestmeh is expecled to

gehelole oyeL its elime If the IRRSgea kee then.

he leguived kok of sekush (Costo Capibol), Ee. pkaleck

is Considere nghcollyvicble.

Date:

l o00 tablty Index i PI is the vaio oP the pieseht

olue of utve Cash lows to the initial investm eht I

indiCotes the Value eated pes dolla o? ihvestmeh. A

D iS qhoke than ohe means the pojeckis Hnancialy

Viable

Payback pesiod i payback peuiod Calu lades Ehe tne i

Tara poect to \ecoVes iAs jnilial investntht. Shorte pay

kaks.

back peuiod. ae genesolly prelened, as they ihdi Cates Resle

Hetuvnse

Each melhod has its stiehdths ahd Heaknesses

ANPY iS gene%olly peened as it Consides .a Cush îeus

and piouides a diiecl mensune of valye. rRR IS use lu foe

Coppoing praiecds With chPeen Cash rous. but Can lead

t0 mutiple IRRs in Conplex plaiecds. Pr is useal os anking

galeChs, butitCon baised tosavds Stnalle poeCBs payback

peiod is eosy to Unde sBahd but daes hot Consid e Lhe bine

a value o! mohey.

Date

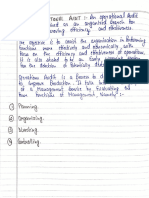

@,|hite Shot hote oh.

o) Net peseht Valye Tie hel peseh Volie is e

dieehce beloen Hhe tolal preseht Value o praleckel

Cash in}'ouS avisihs_ton. a_ploposal and the inikial

hvestmeh nade in the plopo Sa<_ f Compuing Ehe net

present Value, he falouihg sleps ave lokeh

peash inlou Ohiaing ouk of a Gapilal budeking pioposa!

ave praieched for the ehe he tine of opasal.

) AtaBe of distount aA LJhich the Cash inlowS ae o

be cs touhted shoud be red the. ale of discoluhh depehds

oh the Cost oP funds Hequiteg o Ehe ploposG) ahd the

inloioh kaLe in the eo hormy

si). peseb Value o poecked) Cash inlo is lon pukec hy

applying the ate of d;sCouht Salecded.

)_Net pLeSeh value is Coimpubed by dlelucth g the

mitrG investmeh amcuh (eash outlo) rom he lsta

peser Valle of He Cosh ihlou t? he nel pies th&

value is psi Eive, the plopaSa| may_be acepkel and

mttelly. erclsve plopasals., a pkapnsal 4N24 higher hek

pieseht Valye kil! be Selechedl

Date

Aocbilhty Ihdex -This is also tesmed_as Cost beheßt

atio ahd Is Computec) _by clircing the toBal pesth Volae

Cash inoos by the initia) investnent the potability

index indicoles Ahe +eush availoble pes upee inves ked in

a ploposal and is te uselu Hheh dlecisioh making_is to be

made om mutually exclusive popasals innoaihg die eht

anoun o! inyestmeht

poikabildy Ihder is de!ned as the lale of

Deseht lue of the Aue cash behels at te seguised

ade of sen to the hiial Cosh_ oul? bw of the investment.

this is_yeB ahcther method o eraluohing khe nvestment

0opoSalsIalso khdJh as the Rene?rt Cost atio

Jhe DI approach mgaSuYs preseh Value c

kelrns pel kypee ihvested his iS Simila to NPN gpp»oach.

hese piaiect shth olifereht initial inyestments ae to be

evaluaBecl., the I method poyes t be Hhe besk techhigue.

You might also like

- 0151 - HAZMAT - IMDG Code - Advanced-2020!12!24Document1 page0151 - HAZMAT - IMDG Code - Advanced-2020!12!24Dragos M.0% (3)

- Difference Between Service and Product QualityDocument3 pagesDifference Between Service and Product Qualityferreirae100% (3)

- Bidding For Hertz - Leveraged BuyoutDocument5 pagesBidding For Hertz - Leveraged Buyoutrishabh jainNo ratings yet

- Adobe Scan 04-Mar-2024Document12 pagesAdobe Scan 04-Mar-2024AKSHAYKUMAR PATILNo ratings yet

- Research MethodologyDocument15 pagesResearch MethodologyAKSHAYKUMAR PATILNo ratings yet

- BST Unit Test 3Document4 pagesBST Unit Test 3Komal JainNo ratings yet

- Uslons: Name9onoyaghuwaunt DataceDocument15 pagesUslons: Name9onoyaghuwaunt Datacesagar dafareNo ratings yet

- Ignou: 22-Ie QmalDocument15 pagesIgnou: 22-Ie QmalVarun MandalNo ratings yet

- Government Budget Notes Class 12Document10 pagesGovernment Budget Notes Class 12xhaviNo ratings yet

- EVS Unit 1Document13 pagesEVS Unit 1Kksia AroraNo ratings yet

- Herbert Simon + Fred RiggsDocument20 pagesHerbert Simon + Fred RiggsKritika MalikNo ratings yet

- Kamalamokumda Hed: Ealucoional Bsychala94Document8 pagesKamalamokumda Hed: Ealucoional Bsychala94Vikas KumarNo ratings yet

- Aulpil Menta: Mspania Shama Lsubject Teachex) Cluring HeDocument13 pagesAulpil Menta: Mspania Shama Lsubject Teachex) Cluring Hevijay prakashNo ratings yet

- MEFA (Assignment 1)Document10 pagesMEFA (Assignment 1)gkeerthana1108No ratings yet

- Economic Stability Is Not Possible Without Political StabilityDocument7 pagesEconomic Stability Is Not Possible Without Political StabilityAdv Nayyar HassanNo ratings yet

- Financial Literacy and Banking AssignmentDocument11 pagesFinancial Literacy and Banking AssignmentKrishnansh PandeyNo ratings yet

- Physical Unit 01Document4 pagesPhysical Unit 01Cube TechNo ratings yet

- Safa Rizny (11ssc)Document4 pagesSafa Rizny (11ssc)SowmiyaNo ratings yet

- CBRM Note 1Document25 pagesCBRM Note 1Rajas G GanjaveNo ratings yet

- Adobe Scan 22 Jul 2022Document5 pagesAdobe Scan 22 Jul 2022SHIVAM AGRAWAL 9 ANo ratings yet

- GST RegistrationDocument6 pagesGST RegistrationJigar PitrodaNo ratings yet

- Adobe Scan 17 Mar 2022Document22 pagesAdobe Scan 17 Mar 2022TusharNo ratings yet

- Adobe Scan 29 Jan 2022Document9 pagesAdobe Scan 29 Jan 2022Sayali SatkarNo ratings yet

- Acc. Assignment - 1Document14 pagesAcc. Assignment - 1Pulkit KaushikNo ratings yet

- Accounts MHA 212803005Document9 pagesAccounts MHA 212803005kaashvi dubeyNo ratings yet

- Operational AuditDocument19 pagesOperational AuditaleeshaNo ratings yet

- Adobe Scan 28-Feb-2022Document3 pagesAdobe Scan 28-Feb-2022Sachin Anand Roll No. 48No ratings yet

- CapitalismDocument5 pagesCapitalismRomeo ShyamNo ratings yet

- Adobe Scan 27 May 2021Document8 pagesAdobe Scan 27 May 2021ALVINo ratings yet

- Eco ProjectDocument20 pagesEco ProjectIshu RaiNo ratings yet

- Size ReductionDocument3 pagesSize ReductionmaitisafalNo ratings yet

- PHRM-Assignment 1Document8 pagesPHRM-Assignment 1Tushar NairNo ratings yet

- Consumwr Motivation 2Document20 pagesConsumwr Motivation 2SAPNA MAHINo ratings yet

- NishiDocument14 pagesNishiNishi ShahNo ratings yet

- Files 1 2020 November NotesHubDocument 1605715167Document13 pagesFiles 1 2020 November NotesHubDocument 1605715167Varinder KumarNo ratings yet

- Asherentiatmdiljorentiatim A TheDocument22 pagesAsherentiatmdiljorentiatim A TheV ANo ratings yet

- HCJC - Comprehension Skills Handbook Volume 2Document9 pagesHCJC - Comprehension Skills Handbook Volume 2jcguru2013No ratings yet

- Split 5968378065244504048Document28 pagesSplit 5968378065244504048Sarthak BansalNo ratings yet

- Bhavya Lall - MACR MinorDocument6 pagesBhavya Lall - MACR MinorBhavya LallNo ratings yet

- Ed 1 To 4 UnitsDocument16 pagesEd 1 To 4 UnitsPallavii PalluNo ratings yet

- Ch-2 Federalism Weekly Assignment 1Document4 pagesCh-2 Federalism Weekly Assignment 1anumitasawhney777No ratings yet

- PDD5Document22 pagesPDD5Vaibhav JadhavNo ratings yet

- CosmeticDocument20 pagesCosmetickhushi kumarNo ratings yet

- Adobe Scan 02 Mar 2022Document3 pagesAdobe Scan 02 Mar 2022Prem anandNo ratings yet

- Iclassicaho6Yancho-: Clossilicalio by NahreDocument15 pagesIclassicaho6Yancho-: Clossilicalio by NahreAryan KumarNo ratings yet

- Organisational BehaviourDocument18 pagesOrganisational Behaviourvarun rajNo ratings yet

- Managerial Communication 2nd SemDocument10 pagesManagerial Communication 2nd SemAs PrashanthNo ratings yet

- Aduandag: SesoloDocument7 pagesAduandag: SesoloVeena PillaiNo ratings yet

- Industrial Pharmacy I Unit IDocument13 pagesIndustrial Pharmacy I Unit IAnuragNo ratings yet

- Translation Studies Unit-1Document12 pagesTranslation Studies Unit-1Sozain RomiNo ratings yet

- DM Class Test AnswersDocument5 pagesDM Class Test AnswersNishiket KhadkeNo ratings yet

- MacroeconomicsDocument7 pagesMacroeconomicsYäshwänt ShärmäNo ratings yet

- CHP 2 Price MechanismDocument17 pagesCHP 2 Price MechanismmuhammadNo ratings yet

- Mha (N) 306Document5 pagesMha (N) 306R SheeNo ratings yet

- P41248 - CBRM Assignment 1Document3 pagesP41248 - CBRM Assignment 1Vishnu PrajapatNo ratings yet

- Ade - Epicin4-: Edn E0Ajeaent Ena ChaDocument4 pagesAde - Epicin4-: Edn E0Ajeaent Ena ChaHenil MehtaNo ratings yet

- Uence o 1he Poweexekkd By: LauwtenceDocument3 pagesUence o 1he Poweexekkd By: Lauwtence352Sushant ShuklaNo ratings yet

- Tanya GargDocument10 pagesTanya Gargarchit jainNo ratings yet

- Haagmm Ent 2: Cumit-9Document15 pagesHaagmm Ent 2: Cumit-9Udit kothiwalaNo ratings yet

- Camination Oslo8 - 2021 Signatint D Skdent H S: Cution Papeu Ib Dah ofDocument17 pagesCamination Oslo8 - 2021 Signatint D Skdent H S: Cution Papeu Ib Dah ofShivam MishraNo ratings yet

- Theories of EntrepreneurshipDocument5 pagesTheories of Entrepreneurshipshreyasingh14032000No ratings yet

- Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsFrom EverandCredit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsNo ratings yet

- Types of CostsDocument9 pagesTypes of CostsSneha DhakanNo ratings yet

- College Course 28349Document6 pagesCollege Course 28349Hirenya ANo ratings yet

- Acrev 422 AfarDocument19 pagesAcrev 422 AfarAira Mugal OwarNo ratings yet

- 1st Assingment - MBA 650 - Md. Iftekhar Abid-20251037Document20 pages1st Assingment - MBA 650 - Md. Iftekhar Abid-20251037Sara DilshadNo ratings yet

- SAP SD Tables Field Mapping DataDocument229 pagesSAP SD Tables Field Mapping DataNoopur Rai100% (1)

- Dole Ro 8: Key Frontline Services:: KFS PCT Within PCT Per Validation RemarksDocument3 pagesDole Ro 8: Key Frontline Services:: KFS PCT Within PCT Per Validation RemarksDOLE West Leyte Field OfficeNo ratings yet

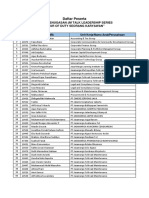

- Daftar Peserta JM Talk Leadership Series2Document8 pagesDaftar Peserta JM Talk Leadership Series2Doddy LombardoNo ratings yet

- Unit 1 - Public AdministrationDocument9 pagesUnit 1 - Public AdministrationashusinghNo ratings yet

- MBA 5004 - Assessment Guide-3Document13 pagesMBA 5004 - Assessment Guide-3vzu53350No ratings yet

- Warehouse Management: CARE Supply Chain Management Manual 2008Document46 pagesWarehouse Management: CARE Supply Chain Management Manual 2008May Salvi Rosa DNo ratings yet

- 104 2022 221 GTDocument25 pages104 2022 221 GTJason BramwellNo ratings yet

- Exploring Scrum of Scrums: As A Scaling VehicleDocument39 pagesExploring Scrum of Scrums: As A Scaling VehicleSai Sunil Chandraa100% (1)

- DreamFolks-Annual Report 2023Document140 pagesDreamFolks-Annual Report 2023velusunilNo ratings yet

- Takt Time, Cycle Time, and Lead Time Explained (+ Calculators)Document22 pagesTakt Time, Cycle Time, and Lead Time Explained (+ Calculators)HARSHA P100% (1)

- 2010 Cross BikesDocument541 pages2010 Cross BikesRon RobichaudNo ratings yet

- Gender Diversity IndexDocument9 pagesGender Diversity IndexLalit JainNo ratings yet

- 2010-Principles of Accounting Main EQP and Commentaries 2010-Principles of Accounting Main EQP and CommentariesDocument59 pages2010-Principles of Accounting Main EQP and Commentaries 2010-Principles of Accounting Main EQP and Commentaries전민건No ratings yet

- A Staffing Agency For Events, Exhibitions & Promotional ActivitiesDocument2 pagesA Staffing Agency For Events, Exhibitions & Promotional Activitiessaurabh rajNo ratings yet

- Integrity LicDocument9 pagesIntegrity LicPiyush VirmaniNo ratings yet

- Project Management Manual Part II RequirementsDocument120 pagesProject Management Manual Part II RequirementsKyawt Kay Khine Oo100% (1)

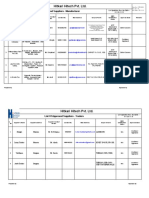

- Hitkari Hitech Pvt. LTD.: List of Approved Suppliers - ManufacturerDocument3 pagesHitkari Hitech Pvt. LTD.: List of Approved Suppliers - ManufacturerRakesh ChauhanNo ratings yet

- WH006-02 Sop For Receipt of Raw and Packing MaterialDocument6 pagesWH006-02 Sop For Receipt of Raw and Packing MaterialBRIJENDRA KUMAR SINGHNo ratings yet

- BT 0210-Si 0211. Lecture 1Document28 pagesBT 0210-Si 0211. Lecture 1richpath00No ratings yet

- Chapter 01: An Overview of Project Management Quiz1: (Ii) TemporaryDocument19 pagesChapter 01: An Overview of Project Management Quiz1: (Ii) TemporarySujit DoneraoNo ratings yet

- CV Daud Zakaria LinkedInDocument4 pagesCV Daud Zakaria LinkedInGIEL UTAMI PUTRI SIREGARNo ratings yet

- 5 3+Segregation+of+DutiesDocument2 pages5 3+Segregation+of+Dutiespomowoh476No ratings yet

- Process Costing 1 PDF FreeDocument68 pagesProcess Costing 1 PDF Freeoliver eronicoNo ratings yet